Assura PLC Scrip calculation price (5119Z)

15 September 2022 - 4:00PM

UK Regulatory

TIDMAGR

RNS Number : 5119Z

Assura PLC

15 September 2022

15 September 2022

Assura plc

Scrip Calculation Price

Assura plc ("the Company") announces, in accordance with the

terms and conditions of the Company's Scrip Dividend Scheme ("the

Scheme"), that the Scrip Calculation Price in respect of the

quarterly interim dividend proposed to be paid on 12 October 2022,

is 63.73 pence. This is the average closing mid-market price of an

ordinary share in the Company for the five dealing days commencing

with, and including, the ex-dividend date of 8 September 2022.

If you wish to receive this quarterly interim dividend in cash,

you do not need to take any action.

If you wish to participate in the Scheme and receive New Shares

instead of your cash dividend, you should complete a Mandate, as

follows:

-- If you hold your Ordinary Shares in certificated form, and if

you have not already done so, you should complete the Mandate Form

(which is available to download from Assura's website

www.assuraplc.com) in accordance with the instructions printed

thereon and return it to Link Group at 10(th) Floor, Central

Square, 29 Wellington Street, Leeds, LS1 4DL by no later than 4.30

p.m. (London time) on 29 September 2022. The Mandate Form will

remain in force for any future dividends in respect of which a

Scrip Dividend Alternative is offered, until such time as the

Mandate Form is cancelled.

-- If you hold your Ordinary Shares in uncertificated form via

the CREST System, you can only elect to receive dividends in the

form of New Shares by submitting a CREST Dividend Election Input

Message via the CREST System. Evergreen elections will not be

permitted. This means that if you wish to receive New Shares

instead of cash as a matter of routine whenever a Scrip Dividend

Alternative is offered, you must complete and submit a CREST

Dividend Election Input Message on each occasion, otherwise you

will receive the relevant dividend in cash.

If you have any questions about the Scheme or how it operates,

you can contact our Registrar, Link Group, at the address above or

by telephone on 0371 664 0321. Lines are open between 9.00am and

5.30pm Monday to Friday, excluding public holidays.

Based upon the above Scrip Calculation Price, if all eligible

Shareholders were to elect to take up their full entitlement to New

Shares in respect of this quarterly interim dividend, approximately

36,218,029 New Shares would be issued. This would represent

approximately 1 per cent. of the Company's issued share capital as

at today's date. The total cash cost of this quarterly interim

dividend if no Shareholders were to elect to take up their

entitlement (and therefore no New Shares were to be issued) would

be approximately GBP23.1 million.

Words and expressions defined in the circular dated 9 December

2015 in relation to the Scheme bear the same meanings in this

announcement.

This interim dividend will be paid as 100% Property Income

Distribution ("PID"). F orms to register for gross PIDs are

available on the Company's website. Please click here for PID Forms

.

- Ends -

For more information, please contact:

Assura plc Tel: 01925 945354

Orla Ball, Company Secretary E mail: Investor@assura.co.uk

David Purcell, Investor Relations

Director

FGS Global Tel: 0207 251 3801

Gordon Simpson Email: Assura@fgsglobal.com

James Thompson

Notes to Editors

Assura plc is a national healthcare premises specialist and UK

REIT based in Warrington, UK - caring for more than 600 primary

healthcare buildings, from which almost seven million patients are

served.

A constituent of the FTSE 250 and the EPRA* indices, as at 31

March 2022, Assura's portfolio was valued at GBP2,752 million.

At Assura, we BUILD for health. Assura builds better spaces for

people and places, invests in skills and inspires new ways of

working, and unlocks the power of design and innovation to deliver

lasting impact for communities - aiming for six million people to

have benefitted from improvements to and through its healthcare

buildings by 2026.

Assura is leading for a sustainable future, targeting net zero

carbon across its portfolio by 2040.

Further information is available at www.assuraplc.com

*EPRA is a registered trademark of the European Public Real

Estate Association.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVSFMFWLEESEIU

(END) Dow Jones Newswires

September 15, 2022 02:00 ET (06:00 GMT)

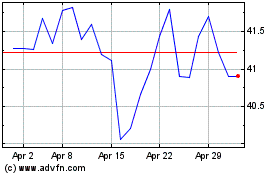

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024