TIDMAGR

RNS Number : 7831B

Assura PLC

05 October 2022

5 October 2022

Assura plc

Trading Update

For the first half ending 30 September 2022

Assura plc ("Assura"), the leading primary care property

investor and developer, today announces its Trading Update for the

first half of the year to 30 September 2022.

Jonathan Murphy, CEO, said:

"Following another period of good progress, Assura continues to

be well positioned to meet the UK's strong underlying demand for

quality primary care and community health buildings as a partner of

choice for the NHS.

"Highly targeted and selective acquisitions and developments

during the first half of the year, along with the disposal of 61

properties for GBP73 million, have further strengthened the quality

of our portfolio, which now stands at 603 properties with an annual

rent roll of GBP139 million and a weighted average unexpired lease

term of 11.4 years.

"Our financial position remains very strong. Our debt book is

fixed at an average interest rate of 2.3% with a long-term average

maturity of 7.5 years, and we have cash and committed undrawn

facilities totalling GBP284 million.

"Together with the strength of our portfolio and expertise of

our teams, we are well placed to take advantage of the

opportunities ahead. That said, we recognise the current

macro-economic uncertainty and industry-wide inflationary pressure

and will continue to monitor and take a cautious approach to

capital investment to ensure long-term success."

Strong track record of disciplined investment alongside ongoing

capital recycling

-- Portfolio currently stands at 603 properties with an annualised rent roll of GBP139.3 million

-- Invested GBP141 million on additions during the half at an

average yield on cost of 5.0%; six development completions, 13

acquisitions and three assets in co-investment arrangements,

largely in the first quarter

-- Three developments started on site, including our first net zero carbon project in Fareham

-- Completed disposal of portfolio of 61 properties for GBP73

million at a small premium to book value

-- Seven lease regears completed (GBP1.1 million of existing rent)

-- Completed five asset enhancement capital projects (total

spend GBP2.2 million); on site with a further six (total spend

GBP8.8 million)

Development and acquisition pipelines provide growth

opportunities

-- Currently on site with 13 developments; total cost of GBP153

million (March 2022: 17, GBP166 million) of which GBP65 million has

been spent to date

-- Immediate development pipeline of 10 schemes, where we would

normally expect to be on site within 12 months; total cost of GBP83

million (March 2022: 20, GBP158 million). We continue to experience

some delays to construction timetables and start dates

-- Monitoring the extended development and acquisition pipelines

as well as the immediate development pipeline in light of the

current macro-economic environment

-- 35 lease re-gears covering GBP6.4 million of existing rent roll in the current pipeline

-- Pipeline of 18 capital asset enhancement projects (projected

spend GBP10.5 million) over the next two years

Strong and sustainable financial position

-- At 30 September 2022 net debt stood at GBP1,092 million with

cash and undrawn facilities of GBP284 million

-- All drawn facilities are unsecured with fixed interest

(weighted average interest rate of 2.3%) and weighted average

maturity 7.5 years

- ENDS -

Assura plc Tel: 01925 945354

Jayne Cottam, CFO E mail: Investor@assura.co.uk

David Purcell, Investor Relations

Director

FGS Global Tel: 0207 251 3801

Gordon Simpson Email: Assura@fgsglobal.com

James Thompson

Notes to Editors

Assura plc is a national healthcare premises specialist and UK

REIT based in Warrington, UK - caring for more than 600 primary

healthcare buildings, from which almost seven million patients are

served.

A constituent of the FTSE 250 and the EPRA* indices, as at 31

March 2022, Assura's portfolio was valued at GBP2,752 million.

At Assura, we BUILD for health. Assura builds better spaces for

people and places, invests in skills and inspires new ways of

working, and unlocks the power of design and innovation to deliver

lasting impact for communities - aiming for six million people to

have benefitted from improvements to and through its healthcare

buildings by 2026.

Assura is leading for a sustainable future, targeting net zero

carbon across its portfolio by 2040.

Further information is available at www.assuraplc.com

Assura plc LEI code: 21380026T19N2Y52XF72

*EPRA is a registered trademark of the European Public Real

Estate Association.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIDIVLSIIF

(END) Dow Jones Newswires

October 05, 2022 02:00 ET (06:00 GMT)

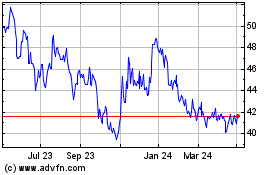

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

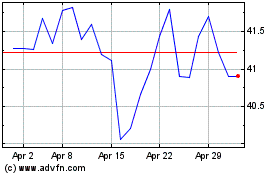

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024