TIDMAIBG

RNS Number : 1336R

AIB Group PLC

03 November 2021

EMBARGO 07:00 3 November 2021

AIB Group pLC - Nine Months to September 2021 Trading update

(UNAUDITED)

Strong performance in Q3 with positive momentum

"I am pleased to report that the Group had a strong third

quarter and is performing in line with our 2021 full year guidance.

Looking to the fourth quarter and beyond, we expect the steady

economic recovery to continue as our customers return to

pre-pandemic levels of activity.

We are making meaningful progress towards achieving our

medium-term targets as we deliver at pace on our strategy. Our

robust balance sheet, leading digital capability and the strength

and breadth of our franchise enable us to support our 2.8 million

customers and the communities we serve.

The doubling of our Climate Action Fund to EUR10 billion will

play a leading role in Ireland's transition to a low-carbon

economy. The Group is also focused on continuing to fund the

construction of much needed new homes and to provide mortgages to

our customers and their families.

We are increasingly confident about the economic outlook and our

ability to generate sustainable shareholder returns, and in this

regard the Board will consider the resumption of dividends for

2021, subject to regulatory approval."

- Colin Hunt, Chief Executive Officer

Highlights: (all comparisons nine months to Sept 21 versus

equivalent period 2020 unless otherwise stated)

-- Strong profitability in Q3 with current trading in line with expectations

-- Confident in our delivery for 2021; full year guidance reiterated(1)

-- Strong capital position continues; CET1 16.6%; significantly ahead of >13.5% target

-- Total income broadly stable

o Net interest income (NII) decreased 8%; on track for moderate

full year decline

o Other income increased 26%

-- Costs in line with expectations; strategic cost initiatives on track

-- Net credit impairment writeback in Q3; Asset quality remains resilient

-- Performing loans stable at EUR55.1bn; new lending increased 7% to EUR7.2bn

o ROI new mortgage lending increased 17% with green mortgages

representing 18%

o 31% mortgage market share in month of September, 27% YTD

-- September pro-forma NPEs of c.EUR3.1bn (c. 5.3%) following c.

EUR0.4bn agreed NPE portfolio sale

-- Customer deposits of EUR90.7bn; increased 11% from Dec 20 as savings continue to accumulate

-- Ireland's leading digital bank with 1.8m customers digitally active

-- Doubled our Climate Action Fund to EUR10bn; first Irish bank to adopt the Equator Principles

Financial Performance

The Group is trading well and is on track to meet earnings

expectations for the full year.

We reiterate our guidance that we expect a moderate decline in

NII in 2021(1) . In the first nine months NII decreased 8%

reflecting the impact of the lower interest rate environment, lower

loan volumes and excess liquidity partially offset by momentum in

our negative interest rate strategy. As at September 2021 c.

EUR12bn deposits were at negative rates, up from EUR4.7bn at

December 2020. The continued distortionary impact from c. 14bps

excess liquidity grossing up the balance sheet contributed to a

decline in NIM to 1.58% from 1.70% Q4 exit. NII in H1 2021 included

EUR15m of TLTRO (2) III funding benefit as the relevant March 2021

lending benchmark target was achieved. We expect to recognise c.

EUR 5 0m TL TRO funding benefit in Q4 on TLTRO III borrowings of

EUR10bn, subject to the achievement of the relevant December 2021

lending benchmark targets.

Interest rate sensitivity (3)

The structure of our balance sheet is geared towards higher

rates in our core markets of ROI and UK. The table below shows the

sensitivity of the Group's banking book to a 100 basis point

parallel movement in interest rates in terms of the impact on NII

on a forward looking basis over a twelve month period assuming no

change in the balance sheet:

Sensitivity of projected NII to interest 2020

rate movements EURm

+ 100 basis point parallel move in all

interest rates 219

------

- 100 basis point parallel move in all

interest rates (202)

------

Other income increased 26% (+24% excluding Goodbody) and within

this net fee and commission income increased 15%. We expect full

year 2021 other income to be ahead of 2020 due to a better than

expected performance as net fees and commissions return to more

normalised levels and the inclusion of Goodbody.

Costs were stable in the first nine months and on a full year

basis are expected to decline marginally (excluding c. EUR25m for

Goodbody). We remain focused and on track to achieve our

medium-term target of <EUR1.475bn(4) by 2023 which includes a

commitment to generate EUR230m cost-savings.

Regulatory costs and levies for 2021 are expected to be c.

EUR125m for the full year.

A further net credit impairment writeback was recorded in Q3

reflecting continued repayments, recoveries and a stronger macro

environment, we expect this trend to continue in the fourth

quarter. Macroeconomic scenarios will be updated as part of the

full-year credit impairment process reflecting the strengthening

environment.

Exceptional costs are expected to be c. EUR350m in 2021 as

guided.

Balance sheet

Gross loans of EUR58.5bn were broadly stable from EUR58.7bn in

June 21. New lending of EUR7.2bn for the nine months to September

represented 7% growth versus the equivalent prior year period with

a pick-up in momentum in Q3 to EUR2.7bn (Q1: EUR2.3bn, Q2:

EUR2.2bn). We expect this trend to continue in Q4 as H2 new lending

is on track to outperform H1 with a strong performance expected in

mortgages and corporate banking.

The Irish mortgage market continued to perform strongly in Q3

with nine months drawdowns up 32% on the prior year period. Market

estimates have been revised upwards to >EUR10bn for 2021.

YTD ROI new mortgage lending increased 17% versus the prior year

with 36% increase in Q3 versus Q2. Our mortgage market share of

drawdowns in the month of September was 31% (Sept YTD 27%) as the

strong pipeline of applications and approvals that we have seen

throughout 2021 is converting to drawdowns.

New lending in AIB Capital Markets(5) increased 20% with strong

performances particularly in renewable energy and property. SME new

lending to September was up 3% and the pipeline is robust across a

number of sectors. New consumer lending remains sluggish reflecting

subdued credit demand.

Our commitment to the sustainability agenda and support for

customers transitioning to a lower-carbon economy is reflected in

EUR1.4bn of new green lending recorded in the first nine months of

the year. Within this our green mortgage product represented 18% of

new ROI mortgage lending.

NPEs decreased to EUR3.5bn or 5.9% of gross loans at end

September (Dec 20: EUR4.3bn or 7.3%). Including the recently

announced long-term default c. EUR0.4bn portfolio sale, NPEs are c.

EUR3.1bn or c. 5.3% on a pro-forma basis. Asset quality remains

resilient with minimal net flow to Stage 3. We are well progressed

towards our medium-term target of c.3%.

Funding & Capital

The loan to deposit ratio was 62% at the end of Q3 2021. The

strong trend in customer deposits continued in the third quarter

with EUR90.7bn at the end of September compared to EUR88.3bn in

June (Dec 20: EUR82.0bn). Cash held at the CBI (inclusive of

EUR10bn TLTRO) amounted to EUR33.5bn at the end of Sept (Dec 20:

EUR19.3bn).

The fully loaded CET1 at the end of Q3 was 16.6% (Dec 20: 15.6%)

which is well ahead of our medium-term target of >13.5% and

regulatory requirements. The main movements since June (CET1:

16.4%) are organic capital generation and lower RWAs partially

offset by the impact of Goodbody c. 16bps. Additionally we expect a

further c. 25bps CET1 benefit as a result of the recently announced

NPE portfolio sale.

Following the easing of regulatory guidelines in relation to

capital distributions for European banks, the Board will consider

the resumption of dividends for 2021, subject to regulatory

approval.

Strategic progress & Sustainability

Implementation of our strategic plan continues and we are making

good progress in advancing our digitalisation and ways of working

programmes.

Following receipt of all regulatory approvals, on 1 September we

announced the completion of the acquisition of Goodbody.

Competition and Consumer Protection Commission (CCPC) approval has

been received for our joint venture proposition with Great-West

LifeCo with the regulatory approval process progressing well.

Commercial negotiations with NatWest Holdings Limited, for the

acquisition of a c. EUR4bn performing corporate and commercial loan

portfolio, have completed and the CCPC approval process is now

underway. Our plans to exit the GB SME market are progressing well

with a sales process significantly advanced and we have moved to

preferred bidder stage.

AIB became the first Irish bank to adopt the Equator Principles,

a globally recognised risk management framework used by financial

institutions for determining, assessing and managing environmental

and social risk in projects. Additionally in October we doubled our

Climate Action Fund to EUR10bn due to strong customer demand.

Following a strong performance in Q3 with an economy that has

effectively fully re-opened we are confident for the remainder of

the year and we continue to focus on embedding our strategy and

supporting our customers.

-S-

Analyst conference call

There will be a conference call for analysts at 08:30 GMT today

3 November, hosted by Colin Hunt, CEO, and Donal Galvin, CFO.

Dial in details for this event are as follows:

Ireland: 01 5060650

International: +44 (0) 2071 928338

USA +1 646 741-3167

Conference ID 8089418

(1) Guidance excludes impact of inorganic opportunities

(2) TLTRO: Targeted Longer-Term Refinancing Operations

(3) For further information please see page 159 of Annual Report 2020

(4) Costs before bank levies and regulatory fees and exceptional items

(5) AIB Capital Markets formerly Corporate, Institutional and Business Banking (CIB)

For further information, please contact:

Niamh Hore / Siobhain Walsh Paddy McDonnell / Graham Union

Investor Relations Media Relations

AIB Group AIB Group

Dublin Dublin

Tel: +353-86-3135647 / +353-87-3956864 Tel: +353-87-7390743 / +353-1-6412430

email: niamh.a.hore@aib.ie Email : paddy.x.mcdonnell@aib.ie

siobhain.m.walsh@aib.ie graham.x.union@aib.ie

Forward Looking Statements

This document contains certain forward looking statements with

respect to the financial condition, results of operations and

business of AIB Group and certain of the plans and objectives of

the Group. These forward looking statements can be identified by

the fact that they do not relate only to historical or current

facts. Forward looking statements sometimes use words such as

'aim', 'anticipate', 'target', 'expect', 'estimate', 'intend',

'plan', 'goal', 'believe', 'may', 'could', 'will', 'seek',

'continue', 'should', 'assume', or other words of similar meaning.

Examples of forward looking statements include, among others,

statements regarding the Group's future financial position, capital

structure, Government shareholding in the Group, income growth,

loan losses, business strategy, projected costs, capital ratios,

estimates of capital expenditures, and plans and objectives for

future operations. Because such statements are inherently subject

to risks and uncertainties, actual results may differ materially

from those expressed or implied by such forward looking

information. By their nature, forward looking statements involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. There are a number of

factors that could cause actual results and developments to differ

materially from those expressed or implied by these forward looking

statements. These are set out in the Principal risks on pages 50 to

53 in the Annual Financial Report 2020 and updated on page 36 of

the Half-Yearly Financial Report 2021. In addition to matters

relating to the Group's business, future performance will be

impacted by direct and indirect impacts of the COVID-19 pandemic

and by Irish, UK and wider European and global economic and

financial market considerations. Any forward looking statements

made by or on behalf of the Group speak only as of the date they

are made. The Group cautions that the list of important factors on

pages 50 to 53 of the Annual Financial Report 2020 is not

exhaustive. Investors and others should carefully consider the

foregoing factors and other uncertainties and events when making an

investment decision based on any forward looking statement.

Figures presented may be subject to rounding.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUOSNRAAUARRA

(END) Dow Jones Newswires

November 03, 2021 03:00 ET (07:00 GMT)

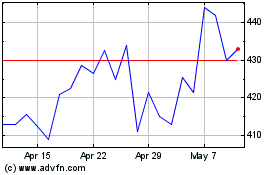

Aib (LSE:AIBG)

Historical Stock Chart

From Mar 2024 to Apr 2024

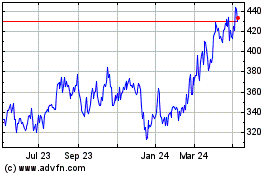

Aib (LSE:AIBG)

Historical Stock Chart

From Apr 2023 to Apr 2024