TIDMALBA

RNS Number : 8923W

Alba Mineral Resources PLC

23 August 2022

Alba Mineral Resources plc

("Alba" or the "Company")

Alba Moves to 100% Ownership of Clogau Gold Mine

& Operational Update

Alba Mineral Resources plc (AIM: ALBA) is pleased to announce

that it has agreed to acquire the remaining 10% interest in Gold

Mines of Wales Limited ("GMOW") to take 100% ownership of the

Clogau Gold Project (the "Project"). Situated within the Dolgellau

Gold Belt in Wales, United Kingdom, the Project comprises the

Clogau Gold Mine (the "Mine"), where Alba has identified a number

of highly prospective gold targets through extensive exploratory

drilling in 2020-21, as well as a large number of gold targets and

former gold workings outside of the footprint of the Mine within a

total option area of 106.94 km (2) .

Alba is also pleased to provide an operational update which

covers the dewatering of the Llechfraith Shaft, one of the priority

targets within the Mine, as well as confirmation of the renewal of

the licence to the Limerick Base Metals Project.

Highlights

-- Alba to acquire remaining 10% of the Clogau Gold Project,

taking its total ownership of the Project to 100%.

-- Alba to buy back a 3% net smelter return royalty owned by the

vendor, reducing the royalty to 1%, as well as a residual GBP72,000

of loans held by the vendor.

-- Total consideration payable is GBP400,000

o Payable by the issue of 200 million Alba ordinary shares at a

price per share of 0.2p (the "Consideration Shares"), being a

premium of 25 per cent to the closing share price of 0.16p on 22

August 2022, plus 81,930,830 two-year share warrants with an

exercise price of 0.4p per share.

o Consideration Shares to be subject to a 12-month

lock-up/orderly marketing restriction.

-- Good progress made in further ecological surveying/data

generation in support of plan to dewater Llechfraith Shaft at

Clogau Gold Mine.

o Alba expects to submit updated ecological/technical report and

renewed permit applications in first half of September.

-- Alba's Limerick Base Metals Project licence renewed for two further years.

George Frangeskides, Alba's Executive Chairman, commented:

"It is a measure of our confidence in the long-term prospects

for the Clogau Gold Project that we have taken the opportunity to

move to 100% ownership of the Project. The 10% minority stake was

free carried to commercial production and the vendors also held a

4% net smelter return royalty over the Project, so acquiring both

the free carried interest as well as 75% of the royalty greatly

improves the economic viability of the Project for Alba. At the

same time, any concerns regarding the market impact of the issue of

Alba shares has been addressed by a lock-up of the consideration

shares for six months plus a further six-month orderly marketing

restriction. We have also negotiated to issue the consideration

shares at a significant premium to the last closing price, reducing

the dilutive effect of the transaction.

"On the matter of the dewatering of the Llechfraith Shaft, over

the past few months we have carried out supplementary ecological

surveying to generate further supporting data as well as adding to

our proposed mitigation scheme for the dewatering, all of which

elements are being incorporated within a revised ecological and

technical report for submission to NRW in the first half of

September. We remain confident that our application for dewatering

will ultimately be successful.

"Finally, we have renewed the licence to our Limerick Base

Metals Project in advance of the drilling which we intend to

undertake there this year, as soon as we have the permits in

hand."

Acquisition Terms

Alba has agreed to acquire the remaining 10% of the Clogau Gold

Project, taking its total ownership of the Project to 100%. The 10%

stake being acquired by Alba's 100%-owned subsidiary, Dragonfire

Mining Limited, was free carried to commercial production, meaning

that the owner, Victorian Gold Limited, did not have to contribute

to any of the exploration and development costs being incurred by

Alba.

At the same time, Alba has agreed to buy back a 3% net smelter

return royalty owned by the vendor, reducing its royalty to 1%, as

well as acquiring the residual GBP72,000 of loans held by the

vendor.

An estimated value of GBP214,000 was attributed to the 10%

interest in the Group accounts for the year ended 30 November 2021,

however this did not include any value for the future free carry

benefit, which the Directors consider to be material. The Group had

not attributed a value to the royalty in the Group accounts as at

30 November 2021.

The total consideration for these acquisitions is GBP400,000,

payable by the issue of 200 million Alba ordinary shares at a price

per share of 0.2p, being a premium of 25 per cent to the closing

share price of 0.16p on 22 August 2022, plus 81,930,830 share

warrants with an exercise price of 0.4p per share and an expiration

date of two years from the date of issue.

The Consideration Shares will be subject to restrictions on

disposals comprising a six-month lock-up (no disposals to be

undertaken without Alba's prior consent) and a further six-month

orderly marketing restriction (disposals only to be permitted in

consultation with Alba so as to maintain an orderly market in Alba

shares).

Alba has also agreed that if at any time in the five years

following Completion it should acquire the exclusive right to

explore for and/or exploit the Clogau Project licence area or any

part of it for copper, the vendor shall have the right to a 10%

working interest in those copper rights, to be enshrined in a

formal joint venture agreement. The prospectivity of the Dolgellau

Gold Belt for copper has been long known. In the first half of the

nineteenth century, the most important mines in the Mawddach Valley

included the Vigra and Old Clogau copper mines, both of which are

situated within the area covered by Alba's Clogau exploration

licence (which only covers gold and silver). It is believed that

the two decades from 1825 to 1845 covered the principal era of

copper working.

Completion of the acquisition is scheduled to occur in the next

few days and a further announcement will be made in due course.

Clogau Operational Update

In November 2021, the regulator, Natural Resources Wales

("NRW"), refused the Company's permit application to dewater the

Llechfraith Shaft, situated below the Llechfraith Adit level. The

dewatering exercise is a necessary first step in gaining access to

the Llechfraith Payshoot, one of Alba's primary in-mine targets. In

March 2022, Alba submitted additional data and analysis to the

regulator. Following the receipt of its feedback in respect of

those submissions, the Company and its professional consultants

have in the past few months implemented an extension to the

programme of ecological and species surveys in order to expand the

ecological dataset generated by the Company during the past 3-4

years.

The Company's ecological consultants are in the process of

updating the previously submitted ecological and technical report.

Once the survey data for August is incorporated, the Company

intends to submit the revised report and renewed dewatering

applications in the first half of September. The Company remains

confident that it will ultimately be successful in its bid to

dewater the shaft.

Limerick Update

The mineral exploration licence for the Company's 100% owned

Limerick Base Metals Project, PL 3824, has been renewed until 26

May 2024. The Project is situated in the world-class Irish Zinc Ore

Field, the location of a number of high-grade zinc-lead

deposits.

The expenditure conditions attaching to the renewal of PL 3824

require the Company to incur expenditure of EUR38,087 by 31

December 2022 with a further EUR62,500 to be spent by 26 May

2024.

As previously announced, the Company has identified three

principal exploration target areas for follow-up drilling at

Limerick. Accordingly, applications for the necessary drill permits

have been submitted with the aim of commencing drilling before the

end of 2022.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

**S**

For further information, please visit

www.albamineralresources.com or contact:

Alba Mineral Resources plc

George Frangeskides, Executive Chairman +44 20 3950 0725

SPARK Advisory Partners Limited (Nomad)

Andrew Emmott +44 20 3368 3555

OvalX (Broker)

Thomas Smith +44 20 7392 1494

St Brides Partners (Financial PR)

Isabel de Salis / Catherine Leftley alba@stbridespartners.co.uk

Alba's Projects and Investments

Mining Projects Operated Location Ownership

by Alba

Clogau (gold) Wales 100%

----------- ----------

Dolgellau Gold Exploration

(gold) Wales 100%

----------- ----------

Gwynfynydd (gold) Wales 100%

----------- ----------

Limerick (zinc-lead) Ireland 100%

----------- ----------

Investments Held by Alba Location Ownership

----------- ----------

GreenRoc Mining Plc (mining) Greenland 54%

----------- ----------

Horse Hill (oil) England 11.765%

----------- ----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPJMFTMTMTMRT

(END) Dow Jones Newswires

August 23, 2022 02:30 ET (06:30 GMT)

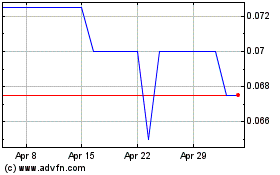

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Apr 2023 to Apr 2024