TIDMALK

RNS Number : 4488J

Alkemy Capital Investments PLC

27 April 2022

27 April 2022

Alkemy Capital Investments Plc

Tees Valley Lithium announces plans to establish world class

Lithium Hydroxide production at Wilton International Chemical Park,

UK

Alkemy Capital Investments plc ("Alkemy") is pleased to announce

the completion of a Feasibility Study for a world class lithium

hydroxide processing facility at the Wilton International Chemical

Park located in the Teesside Freeport, UK.

Alkemy, through its wholly owned subsidiary Tees Valley Lithium,

is seeking to develop an independent and sustainable supply of

lithium hydroxide to meet the burgeoning demand from UK and

European giga factories.

The facility will process feedstock imported from various

sources to produce 96,000 tonnes of a premium, low-carbon lithium

hydroxide annually, representing around 15% of Europe's projected

demand.

The proposed facility is located at the "plug and play" Wilton

International Chemical Park located in the Teesside Freeport with

connections to low carbon offshore wind and 100% certified

renewable energy.

The project is the first of its kind in the UK, the biggest in

Europe and will when completed be a key supplier to UK and European

giga factories, electrical vehicle and battery storage

industries.

The study has been prepared by Wave International, a leading

engineering consultancy firm with significant experience in

developing lithium hydroxide projects worldwide.

HIGHLIGHTS:

-- 96,000 tonnes annual production of battery grade lithium

hydroxide representing approximately 15% of projected UK and EU

demand;

-- Plant has been designed to process a range of imported

low-carbon, high value feed sources including lithium sulphate and

lithium carbonate;

-- Pre-tax net present value (NPV) of GBP2.8 (US$3.9) billion

based on long-term lithium hydroxide price of US$25,000 per

tonne;

-- Initial capital cost of GBP216 (US$300) million;

-- Gross revenues of GBP49.2 (US$68.4) billion;

-- Internal rate of return (IRR) of 35.6%;

-- Significant potential to capture by-product value streams.

The results of the Feasibility Study demonstrate the viability

of developing a robust battery-grade lithium hydroxide project with

low capital and processing costs, a low carbon footprint, strong

cash flow generation capacity and significant upside potential by

capturing by-product credits.

The Feasibility Study has evaluated the project economics using

the following assumptions:

-- A merchant lithium hydroxide plant comprising four trains

each with a 24,000tpa capacity, to produce up to 96,000tpa of

battery-grade lithium hydroxide.

-- Train 1 will follow the conventional Glauber's Salt process

route with trains 2 to 4 following an Electrochemical route.

-- Purpose built facility to be constructed on a 9.6 ha plot at

the Wilton International Chemical Park in the Teesside

Freeport.

-- Plug and play infrastructure with a connection to reliable

and cheap offshore wind and 100% certified renewable energy.

-- Production of a premium, low carbon product for sale to Tier

1 customers in the UK and Europe.

The Feasibility Study identifies target production over a

30-year life to be the most appropriate option. The preliminary

economics of the project are set out below:

Table 1 - Project Economics

Tees Valley Lithium - Economic Summary Unit Value

Life of Project Years 30

----- ---------

Lithium Hydroxide Sold MT 2.7

----- ---------

Gross Revenue GBP 49.2bn

----- ---------

Initial Capital Cost Train 1 (including a 17.5% Contingency) GBP 216M

----- ---------

Life of Project Capital Cost (including initial capital) GBP 1.49bn

----- ---------

Taxes GBP 2.2bn

----- ---------

NPV and IRR

----- ---------

Discount Rate % 8

----- ---------

Pre-Tax NPV GBP 2.8bn

----- ---------

Pre-Tax IRR % 35.6

----- ---------

Pre-Tax Payback Period (Train 1) Years 2.9 years

----- ---------

After-Tax NPV GBP 2.2bn

------------------------------------------------------------- ----- ---------

After-Tax IRR % 32.9

----- ---------

Peak Funding Requirement GBP 336

----- ---------

EBITDA Margin % 26%

----- ---------

Notes:

-The model uses a long-term lithium sulphate price of

US$10,000/t and a long-term lithium hydroxide price of

$25,000/t

-Peak funding for Train 1 is GBP218m

-Long term GBP/US$ exchange rate is 1.39

Sam Quinn, Director of Alkemy and Tees Valley Lithium,

commented:

"This Feasibility Study is a major milestone for Alkemy and its

100% owned subsidiary Tees Valley Lithium. We are moving quickly to

establish a major independent and sustainable lithium hydroxide

producer at the Wilton International Chemical Park in the Teesside

Freeport and are pleased with the validation that this independent

feasibility study brings to our project.

At full production, Tees Valley Lithium will produce 96,000

tonnes of battery-grade lithium hydroxide per annum and will be a

major supplier to the UK and European electric vehicle

industry."

APPIX - CLASS 4 FEASIBILITY STUDY SUMMARY

PROJECT BACKGROUND

Tees Valley Lithium's strategy is to become a leading producer

of lithium products, and a key supplier to the battery supply chain

for the expanding electric vehicle ("EV") and stationary energy

storage markets.

A merchant Lithium Hydroxide Monohydrate (" LHM") plant

consisting of four trains is proposed to be developed at Teesside

with the following key advantages:

-- Direct access to cheap, renewable (wind) power and certified renewable electricity;

-- Location within a Freeport zone providing economic benefits and frictionless trade;

-- Location close to the fifth biggest port in the UK for the

import of raw materials and export of products;

-- Location within an established industrial chemicals park, with "plug and play" services and infrastructure;

-- Proximity to the UK and EU's Cathode Active Material and automotive industry;

-- Experienced management team specialising in mining, mineral

processing, lithium hydroxide projects and battery supply

chain;

-- Pioneering the world's first successful low-carbon

electrochemical route by partnering with global expertise and

generating proven lab results.

Train 1 is anticipated to have a production capacity of 24,000

tpa LHM and will be designed to process Lithium Sulphate

Monohydrate ("LSM") and lithium carbonate from multiple sources

with initial supply via third party feedstock contracts.

Train 1 will be based on a conventional Glauber's Salt

processing route, producing LHM and Anhydrous Sodium Sulphate. This

process is currently utilised extensively in LHM production in

China and Australia.

Trains 2 to 4 are anticipated to have a combined production

capacity of 72,000 tpa LHM and will also be designed to process LSM

and lithium carbonate from multiple sources. Train 2 will likely be

based on the Electrochemical processing route, producing LHM and a

dilute Sulphuric Acid stream (which in turn will be converted into

a saleable by- product).

Tees Valley Lithium ("TVL") has developed its own IP on the

Electrochemical processing route, which utilises equipment

available from reputable, global vendors who have completed

extensive testwork on lithium extraction. The Electrochemical route

is ideally suited to sites with low cost, renewable power

sources.

The target product will be Battery Grade LHM meeting the

specifications of tier 1 European automotive Original Equipment

Manufacturers, TVL's target customers. With the EV ambitions of its

customers in mind, TVL aims to be an early full-scale manufacturer

of Battery grade LHM in the UK and Europe.

A key strategic consideration for the plant design is the

ability to process multiple sources of LSM, including LSM derived

from spodumene, mica, brine and recycling of used batteries as well

as lithium carbonate. The test work undertaken to date, along with

resulting engineering development, has considered variability of

both LSM and lithium carbonate sources.

To achieve its strategic goals, TVL has aligned with a key

strategic shareholder base as well as appointing a highly

experienced management team with experience in the chemicals and

lithium sectors.

METALLURGICAL TESTWORK

To date, a considerable amount of metallurgical test-work has

been carried out by a number of leading laboratories in the field

of lithium and speciality minerals processing and treatment.

The test-work has formed the basis for the process flowsheet in

the Feasibility Study. The metallurgical test work yielded an

ultra-pure battery grade lithium hydroxide, exceeding the

industry-recognised Chinese standard GB/T 26008-2020 D1.

The studies and laboratories are listed below.

Table 2 - Testwork Programmes

TESTWORK PROGRAM LABORATORY SCOPE STATUS

Impurity removal Nagrom laboratories, Impurity removal from Varying reagent

Australia assumed LSM feedstock, regimes being

to achieve purified trialled examining

LS solution requirements impact on

for both Electrochemical liquor purity.

and Glauber's Salt Program ongoing.

routes.

--------------------- ------------------------------ --------------------

Glauber's Salt Jord Proxa, Production of battery Complete.

crystallisation South Africa grade LHM from synthetic

purified LS solution,

including Zero Liquid

Discharge.

Confirm flowsheet for

crystallisation circuit.

--------------------- ------------------------------ --------------------

Electrochemical Electrosynthesis, Bench scale proof of Complete.

bench scale United States concept of Electrochemica

l route from synthetic

purified LS solution.

Initial process optimisation

work, assessment of

different membranes

suppliers.

--------------------- ------------------------------ --------------------

Electrochemical Dorfner Anzaplan, Bench scale proof of Complete.

bench scale Germany concept of Electrochemical

route from synthetic

purified LS solution.

Desktop study into

impact of impurities

from different feed

sources.

Production of crude

LHM.

--------------------- ------------------------------ --------------------

The process route for each process route is set out in the

Figure 1, along with the scope of each programme. It is noted that

Anzaplan's scope included a single stage crystallisation only to a

crude LHM and that Electrosynthesis did not perform LHM

crystallisation.

Figure 1 - Proposed flowsheet (left Glauber's Salt route, right

Electrochemical route) To view the image, please click on the

following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_1_.jpg

Results - Impurity Removal Programme at Nagrom

The impurity removal programme was designed to produce a

purified lithium sulphate liquor from a low-grade lithium sulphate

input, to levels acceptable to both the Glauber's Salt and

Electrochemical process routes. It is noted that the purity

requirements differ between the two routes.

The flowsheet is based on process widely used commercially in

industry, and as such the ongoing testwork is focused on examining

varying reagent regimes and the impact on liquor purity ahead of

either downstream process (Glauber's Salt or Electrochemical). The

regimes and specific results are considered confidential, and this

testwork is ongoing.

Results - Glauber's Salt crystallisation work at JordProxa

The crystallisation testwork programme was designed to prove the

causticisation and crystallisation process to a final ultra-pure

LHM project. This involved causticisation, Glauber's Salt

crystallisation, and three stage lithium hydroxide

crystallisation.

After three stages of crystallisation, an ultra-pure battery

grade LHM product was produced, exceeding the Chinese Standard GB/T

26008-2020 D1 as well as TVL's target specification. TVL considers

the actual values confidential at this stage, but all analyte

requirements were exceeded easily, demonstrating the premium

product to be produced by TVL.

Figure 2 - Crystallisation testwork at JordProxa. Top left:

glass jar crystallisers. Top right: crystallisers. Bottom left:

centrifuge. Bottom right: LHM crystals. To view the image, please

click on the following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_2.jpg

The Zero Liquid Discharge testwork was also completed, providing

relevant process parameters for equipment sizing which has been

used in the capital cost estimates.

Results - Electrochemical Testwork at Anzaplan

The Anzaplan testwork programme was design to examine two

different electrochemical cell configurations, and to produce a

crude LHM product through single stage crystallisation. The

testwork reported specific energy consumption and current

efficiency for the two configurations, as well as impurity profiles

for crude LHM. The details of the configurations and outputs are

considered confidential.

The results from Anzaplan provide excellent justification for

the proposed Electrochemical flowsheet, proving that key purity and

a number of impurity targets can be met with only a single stage

crystallisation. Future testwork will combine the results from both

Anzaplan and Electrosynthesis (see below) into an optimised

Electrochemical cell configuration, taken all the way through to

final ultra-pure battery grade LHM.

Results - Electrochemical Testwork at Electrosynthesis

The Electrosynthesis testwork programme was designed to test

various process parameters against cell performance, and also to

evaluate two different commercially available membrane

technologies.

The process parameters and membrane details are considered

confidential, but included acid and base concentrations, lithium

sulphate concentration, cell configuration and batch vs. continuous

operation. Specific energy consumption, production rate, base

impurity and acid impurity were included in reported details.

Approximately 3kg of LHM equivalent was produced in product

liquor, which is available for future crystallisation testwork

along with dilute acid which is available for future valorisation

testwork.

ENGINEERING

Process Description - Glauber's Salt Route

The LSM feedstock is received and dissolved in water. The crude

lithium sulphate solution is transferred to impurity removal.

Impurity removal consists of two stages, where caustic and

sodium carbonate solution are respectively added as pH modifiers to

precipitate out key impurities of calcium, magnesium, iron, and

aluminium by forming insoluble hydroxides. Precipitates are removed

via filtration, prior to a final impurity removal stage using ion

exchange.

The purified LSM solution is transferred to ion exchange

columns, which facilitate the removal of the remaining impurities

from the liquor by adsorption onto the ion exchange resin. The

purified pregnant liquor solution from the IX package is sent to

the causticisation stage.

The purified liquor is pumped to the Lithium Hydroxide reactor

where caustic is added to convert Li SO to LiOH and Na(2) SO(4) .

Glauber's Salt is removed from the solution by exploiting its poor

solubility in water at low temperatures and transferred to the

sodium sulphate anhydrous crystallization circuit.

The LHM product circuit is a three-stage Lithium crystallization

circuit where the first stage is crude stage crystallization, the

second is pure stage crystallization and the third is ultra-pure

stage crystallization. The wet precipitated crystals from the third

stage are then transported into the LHM drying stage with the

cooled and dried LHM product bagged and dispatched to

customers.

The Glauber Salt crystals that were removed report to the

Glauber Salt Melter, which dissolves the Glauber Salt crystals back

into the recirculating solution. This liquor is pumped to the

Sodium Sulphate Anhydrous (SSA) Crystallizer, which precipitates

out anhydrous Na2SO4 (or SSA) crystals. The SSA crystals are

transferred to the SSA Dryer to remove all moisture and generate

the final SSA product. The SSA product is then bagged and

dispatched to customers.

A Zero Liquid Discharge system is incorporated to capture water

excess and return it to the processes (resulting in zero

environmental liquid discharge).

Electrochemical Route

The LSM feedstock is received and dissolved in Calcium rich

water. The Crude Lithium Sulphate solution is transferred to

impurity removal.

Impurity removal consists of two stages, where a mixture of

NaOH, LiOH and Na2SO4 and a mixture of NaOH, LiOH, Na2SO4 and

lithium carbonate solutions are respectively added as pH modifiers

to precipitate out key impurities of Magnesium, Manganese, Iron,

and Aluminium into insoluble hydroxides and silicates as Magnesium

or Calcium silicates.

Precipitates are removed via filtration, prior to a final

impurity removal stage using ion exchange. Target impurity levels

for the Electrochemical route are different to the Glauber's Salt

route, and the specifics of the process are modified for this

route.

The purified LSM solution is prepared prior to ion exchange,

which facilitate the removal of the remaining impurities from the

liquor by adsorption onto the ion exchange resin.

The polished Lithium Sulphate solution from IX is mixed prepared

and pH adjusted ahead of the Electrochemical cell feed. This

solution is then pumped to the Electrochemical cells, whereupon

with the application of an electric current, lithium sulphate is

converted to

lithium hydroxide which is transferred to Lithium Hydroxide

Evaporation, Salt which is transferred to Salt Concentration, and

Sulphuric Acid.

The Lithium Hydroxide is evaporated to increase the overall

concentration of the solution. The concentrated LiOH is pumped to

Crude Crystallization, where it exploits the saturated solubility

of LiOH in the water against that of the remaining impurities.

The LiOH crystallizes out of the solution, forming LiOH crystals

that can be removed and

reprocessed through an additional crystallization stage until

the desired grade specifications are achieved. The wet precipitated

crystals from the second stage are then transported into LHM Drying

where the cooled and dried lithium hydroxide product will be bagged

and dispatched to customers.

The dilute Sulphuric Acid produced by the Electrochemical

process is converted into Gypsum using Limestone or quick lime. The

precipitated slurry is then transferred to Gypsum Filtration. The

washed cake discharge from filtration is transported onto a

stockpile where it is ready for transport off-site and sale to the

market.

Engineering Development

The engineering has been developed to a sufficient level to

support the Feasibility Study economics which includes:

1. Block flow diagrams

2. Preliminary Process flow diagrams

3. Preliminary mass and water balance

4. Preliminary mechanical equipment list

5. Preliminary layouts

These deliverables were completed for each process route, based

on Wave International's experience and the outcomes of the

metallurgical testwork.

The figure below provides for a representation of the proposed

facility location on TVL's selected site at Wilton

International.

Figure 3 - image of the proposed processing facility. To view

the image, please click on the following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_3.jpg

LOCATION

The location of the process facility is strategically proposed

in the Teesside Freeport, in close proximity to TVL's customers and

to provide for fast development and efficient operations leveraging

the established "plug and play" infrastructure at Wilton

International.

The process plant benefits from excellent transport links as it

is located adjacent to the UK's fifth largest port, enabling ease

of supply as well as providing direct access to the European Market

which is of particular interest due to the size and growth rate of

the EV market. TVL has been in discussions with local transport

logistics companies for the LSM feedstock and LHM offtake.

The local skilled workforce both in the engineering and chemical

processing domains are further upsides of this location as well as

the proximity to potential future lithium mines currently under

assessment in Europe.

NON-PROCESS INFRASTRUCTURE

During the process of site selection, the non-process related

infrastructure has been evaluated for the project. This includes

the facilities, and logistics requirements for material movements.

The non process related infrastructure includes the following:

1. Site access and security

2. Potable and demineralised water

3. Steam

4. Power

5. Medical Facilities

6. Fire services

The site is adjacent to PD Ports, the 5(th) largest container

port in the UK. PD Ports boasts large scale Roll-On-Roll-Off and

Lift-On-Lift-Off container handling facilities, as well as bulk

materials handling capability.

TVL's logistics requirements can be easily met by existing port

capacity and TVL will not need to handle any bulk materials (and

hence avoids issues associated with dust management of

concentrates, as well as reduced carbon footprint from large volume

international logistics).

ENVIRONMENT, PERMITTING AND APPROVALS

The Company anticipates receiving planning approval in July

2022. The table below list the submission dates.

Table 3 - Environmental Impact Assessment Milestones

Heads of agreement for lease COMPLETE March

EIA Scoping Study COMPLETE March

--------- ------

Submission for Council Opinion COMPLETE April

--------- ------

Planning Application Preparation ON TRACK May

--------- ------

Submission final EIA ON TRACK June

--------- ------

Due Date for Planning Approval ON TRACK July

--------- ------

OPERATING COSTS

An operating cost estimate has been prepared for the individual

Glauber's Salt and Electrochemical routes, both of which have a

nameplate capacity of 24,000 tpa of LHM per train.

The operating cost estimate was developed as a bottom-up

estimate with key values taken from the Feasibility Study's

economic evaluation report, namely the process design criteria,

mass and water balance, and the mechanical equipment list.

All significant and measurable items have been calculated;

however, smaller items are factored as per industry practice. The

level of effort for each of the line items meets the requirements

for a Class 4 Feasibility Study estimate.

CAPITAL COST

Based on the engineering development and operational management

work progressed, a Capital Cost Estimate has been prepared for the

Glauber's Salt and Electrochemical routes.

The Capital Cost Estimate was developed to meet the requirements

of a Class 4 estimate as defined by the American Association of

Cost Engineers' Cost Estimation and Classification System (as

applied for mining and minerals processing industries) and

represents a nominal accuracy range of +/-25%, with a contingency

of 17.5%. All cost data is in GBP (GBP).

The Capital Cost Estimate presents the capital requirements to

engineer, procure, construct and commission TVL as defined with a

throughput of 24,000 tpa. The Capital Cost Estimate covers project

implementation costs for the period between Financial Investment

Decision and commissioning completion. It also includes long-lead

items brought forward from Financial Investment Decision.

The following table provides a summary of capital costs for the

Glauber's Salt and Electrochemical routes.

Table 4 - Capital Cost (in GBP)

Capital Costs (in GBP) Glauber's Salt Electrochemical

Route Route

Installation 15,680,643 20,861,939

---------------------------- ----------------

Earthworks 1,960,080 1,960,080

---------------------------- ----------------

Civil/concrete 5,880,241 7,823,227

---------------------------- ----------------

Structural 9,800,402 13,038,712

---------------------------- ----------------

Architectural 9,800,402 9,800,402

---------------------------- ----------------

Mechanical/Platework 47,041,929 62,585,816

---------------------------- ----------------

Piping & Valves 9,800,402 13,038,712

---------------------------- ----------------

Electrical 9,800,402 13,038,712

---------------------------- ----------------

Controls & Instrumentation 7,840,322 10,430,969

---------------------------- ----------------

Total Direct Cost 117,604,823 152,578,569

---------------------------- ----------------

Indirect Cost 66,485,927 86,465,003

---------------------------- ----------------

Sub-total 184,090,750 239,043,572

---------------------------- ----------------

Contingency (17.5%) 32,215,881 41,832,625

---------------------------- ----------------

Total Capital Cost 216,306,631 280,876,198

---------------------------- ----------------

SUSTAINING CAPITAL

Sustaining capital of 2% of direct capital costs (excluding

earthworks) has been included in the financial model for the first

25 years, increasing to 3% for the last 5 years.

PRE-FINANCING ANALYSIS

The project has been evaluated on both a pre-tax basis and after

UK taxes. Modelling incorporates fiscal aspects of the UK tax law,

including a 19% UK corporate tax rate.

The financial model was developed for a Base Case scenario using

a long-term LSM price forecast of US$10,000/t and long-term LHM

price of US$25,000t.

WORKFORCE

At a steady state of production the Company anticipates to

employ up to 100 people per train totaling 400 people for the plant

at its design rate.

During the construction phase it is anticipated that around 250

direct jobs will be created for train 1 alone.

UPSIDE OPPORTUNITES

The Feasibility Study has also identified a number of

opportunities to further improve the project and a work programme

is planned to investigate these opportunities. In additional to

TVL's ultra-pure LHM product, the project will produce two

additional non lithium products:

1. Anhydrous Sodium Sulphate from the Glauber's Salt route.

2. Gypsum from the Electrochemical route.

An existing market exists for Anhydrous Sodium Sulphate within

Europe, and as a first mover TVL expects to place this material

from train 1 into existing markets.

For train 2, gypsum is proposed to be produced as it is noted

the region is a net importer of gypsum. It is anticipated that this

product can be sold locally.

Zero revenue has been attributed to these products in the

economics.

FEEDSTOCK

The plant is set up to accommodate multiple feed sources of

lithium sulphate and lithium carbonate to maximise the number of

potential suppliers. This diversity will provide flexibility of

supply and de-risks the project.

TVL is in advanced discussion with a number of feedstock

suppliers including some of the world's largest groups and is

confident to be able to secure sufficient LSM for all 4 trains.

The Feasibility Study will be utilised for completion of due

diligence activities with various suppliers as a planned next step

to finalising binding offtake.

CLIENTS

TVL is also in discussions for long-term supply agreements with

Original Equipment Manufacturers and battery manufacturers and is

confident that it will secure customers for 100% of its

production.

TIMELINE

TVL anticipates first production during Q4 2024. Figure 4 lists

the various milestones including:

-- Permitting - Q2 to Q3 2022

-- Long lead time procurement - Q3 2022 to Q2 2023

-- Financing - Q4 2022

-- Main Construction, subject to financing - Q4 2022 to Q4 2023.

-- Commercial production - Q4 2024

Figure 4 - Timeline of the development Milestones To view the

image, please click on the following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_4.jpg

EV REVOLUTION

The UK / EU have announced a ban on petrol and diesel car

production from 2030 onwards. This means that the automotive

industry are obligated to switch to EVs. A typical NMC EV battery

requires approximately 1.15kg of lithium hydroxide per kWhr of

energy storage. Typically NMC EV's have 40kWhr batteries.

The UK is forecast to produce 1.5M EVs in 2030, with the EU

producing a further 15M. This implies a UK market of approximately

43kt and a European market of 434kt of lithium hydroxide. Consumer

sentiment driven by concern over climate change and more recently

high petrol prices, has shown a very aggressive adoption rate for

EV's with most manufacturers quoting 9 to 12 month lead times.

These two points are what is driving the EV revolution.

By 2027 it is forecast that an EV will cost less than an

internal combustion engine vehicle, so with energy costs of EV's at

1/10 of an internal combustion engine, it will be an overwhelming

economic choice to buy and EV, ensuring the complete transition to

EV's by 2030.

The rapid changes in consumer demand is attracting significant

investment in battery cell manufacturing. The figure below provides

an estimate of battery manufacturing capacity globally between 2021

and 2031.

Figure 5 - Battery manufacturing forecast (source: Benchmark

Minerals Intelligence, Battery Gigafactories 2021) To view the

image, please click on the following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_5_.jpg

The mid and upstream supply chains to support this capacity

however, is considered constrained within the UK / EU region with

respect of access to raw materials, access to mid-stream refining

and rising cost pressures. In addition, there is tight supply of

primary lithium units from brine, hard rock (and other minerals)

and recycled lithium is not yet available in material quantities.

The figure below provides a LHM market balance forecast to

2040.

Figure 6 - LHM market balance forecasts (source: Benchmark

Minerals Intelligence, Wave International) To view the image,

please click on the following link

https://www.alkemycapital.co.uk/images/2022/April/Figure_6_.jpg

Whilst hard rock primary lithium supply is proving to be a

dominant source of lithium units for LHM, key challenges present

themselves within the supply chain.

Further information

For further information, please visit the Company's website:

www.alkemycapital.co.uk or www.teesvalleylithium.co.uk

-Ends-

Alkemy Capital Investments Plc Tel: 0207 317 0636

Sam Quinn info@alkemycapital.co.uk

VSA Capital Limited Tel: 0203 005 5000

Andrew Monk (corporate broking) amonk@vsacapital.com

Andrew Raca (corporate finance) araca@vsacapital.com

Shard Capital Partners LLP

Damon Heath Tel: 0207 186 9952

damon.heath@shardcapital.com

Isabella Pierre Tel: 0207 186 9927

isabella.pierre@shardcapital.com

NOTES TO EDITORS

Alkemy is seeking to develop, construct and operate the world's

leading independent and sustainable lithium hydroxide production

facility.

Alkemy, through its wholly-owned subsidiary Tees Valley Lithium,

has secured a 9.6ha brownfields site at the Wilton International

Chemical Park located in Teesside, a major UK Freeport.

Alkemy has completed a Class 4 Feasibility Study for its

proposed lithium hydroxide facility which will process feedstock

imported from various sources to produce 96,000 tonnes of a

premium, low-carbon lithium hydroxide annually, representing around

15% of Europe's projected demand.

Forward Looking Statements

This news release contains forward--looking information. The

statements are based on reasonable assumptions and expectations of

management and Alkemy provides no assurance that actual events will

meet management's expectations. In certain cases, forward--looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Alkemy believes the expectations

expressed in such forward--looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Alkemy will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the

forward--looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDIFMMTMTTTTTT

(END) Dow Jones Newswires

April 27, 2022 02:01 ET (06:01 GMT)

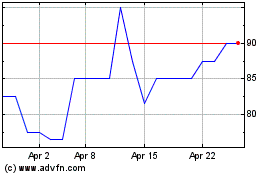

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024