0OIR Three-month Interim Report (Q1) 2022

12 May 2022 - 3:30PM

UK Regulatory

TIDMALK TIDMB

Bemærk venligst, at rapporten udelukkende findes på engelsk

ALK reports Q1 revenue growth of 11% with tablet sales up 24%

and earnings up 20% (unaudited)

ALK delivered strong financial performance in Q1, with revenue

up 11% and tablets as the primary driver of growth with sales up

24%. Sales growth and efficiencies led to a further improvement in

gross margin, and operating profit (EBITDA) increased by 20%. ALK's

financial outlook for 2022 is maintained.

Q1 2022 financial highlights

-- Total revenue increased 11% organically in local currencies to DKK 1,155

million (1,021).

-- Currencies had a positive effect of 2 percentage points, resulting in

reported growth of 13%.

-- Tablet sales increased by 24% to DKK 583 million (466) on broad-based

growth, particularly from Japan, and tablets now account for 50% of

overall revenue.

-- Combined SCIT and SLIT-drops sales increased 2% on strong growth from

International markets, especially China, while sales of other products

were down 5%.

-- Gross margin improved by 2 percentage points to 64% on sales growth and

efficiencies.

-- Operating profit (EBITDA) increased 20% in reported currency to DKK 272

million (226), largely on the strong sales growth and improved gross

margin, while R&D and sales and marketing expenses increased as planned.

-- Free cash flow was DKK 38 million (86) impacted by changes in working

capital.

Key events and strategic progress

ALK continued to make good progress on its strategic priorities

and remained robust in the face of other challenges. In Q1:

-- ALK received a clinical trial waiver from China's authorities, permitting

ALK to submit a registration filing for its house dust mite allergy

tablet in 2022, without finalising the paused, local Phase III trial.

-- ALK is finalising plans for the early clinical development of its peanut

allergy tablet and expects to initiate a Phase I trial soon.

-- ALK has established an exclusive licensing agreement with Dr Reddy's

Laboratories that will lead to the future introduction of ALK's house

dust mite tablet in India.

-- As expected, COVID continued to somewhat distort allergy markets in Q1,

with infections once again restricting allergy patients' ability and

willingness to seek treatment to varying degrees, especially in certain

European markets.

2022 financial outlook maintained

Based on performance in the first three months and forecasts for

the remainder of the year, ALK is maintaining its full-year

outlook:

-- Revenue is still expected to grow 8-12% in local currencies with tablet

sales up by 20%.

-- EBITDA is still expected to increase to DKK 625-725 million (2021: DKK

534 million) on sales growth, improved gross margin and efficiencies.

Hørsholm, 12 May 2022

ALK-Abelló A/S

Comparative figures for 2021 are shown in brackets. Revenue

growth rates are stated in local currencies, unless otherwise

indicated

For further information, contact:

Investor Relations: Per Plotnikof, tel. +45 4574 7527, mobile

+45 2261 2525

Media: Jeppe Ilkjær, mobile +45 3050 2014

Today, ALK is hosting a conference call for analysts and

investors at 1.30 p.m. (CEST) at which Management will review the

financial results and the outlook. The conference call will be

audio cast on

https://www.globenewswire.com/Tracker?data=ZbscKoFw4LjiZ3muEZ3yV408XYhH2_4-Z3K1k45C97Z8Of7vYC_tO2-WekdyA3o-qZ6jABhgD_pkIHOdM8EE-g==

https://ir.alk.net where the relevant presentation is available

shortly before the call begins. Please call in before 1.25 p.m.

(CEST). Danish participants should call in on tel. +45 3544 5577

and international participants should call in on tel. +44 333 300

0804 or +1 631 913 1422. Please use the Participant Pin Code:

67379541#.

Vedhæftet fil

-- FM_09_22UK_12052022

https://ml-eu.globenewswire.com/Resource/Download/542dddf2-7e91-4bc1-9d42-2ee8b3e9e652

(END) Dow Jones Newswires

May 12, 2022 01:30 ET (05:30 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

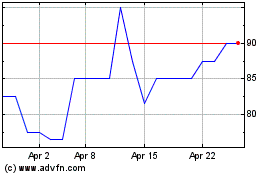

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024