TIDMALK

RNS Number : 2389K

Alkemy Capital Investments PLC

20 December 2022

20 December 2022

Alkemy Capital Investments Plc

Long Term Lease Agreed for TVL's lithium processing facility at

Wilton International

Alkemy Capital Investments plc ("Alkemy") (ALK:LSE) (JV2:FRA) is

pleased to announce that its wholly owned subsidiary Tees Valley

Lithium Ltd (" TVL ") has agreed the terms of a Long Term Lease in

respect of its lithium hydroxide processing facility in

Teesside.

HIGHLIGHTS

-- TVL and Sembcorp Energy UK agree the terms of a 30 year Lease

for TVL's lithium processing facility at Wilton International,

Teesside.

-- Sembcorp Energy UK's site at Wilton International, within the

Teesside Freeport, sits amongst a hub of decarbonisation

innovation, and is ready for investing energy-intensive industrial

businesses with it's 'plug and play' approach to available

development land.

-- Agreeing terms for a long term Lease follows the granting of

full planning permission in November and represents another

significant milestone for TVL.

TVL announces that further to its RNS on 8 November 2022, it has

now formally agreed the terms of a 30 year Lease with Sembcorp

Energy UK in respect of its site at Wilton International in

Teesside.

Under the terms of an Agreement for Lease, which was signed

today, TVL has an option for up to a year to enter into the agreed

long term Lease, during which time it will conclude formalities

with respect to financing and utilities and services, although it

is anticipated that these should be completed well in advance of

the expiry of the option period.

A key driver for TVL's site selection at Wilton International,

which sits within the Teesside Freeport amongst a hub of

decarbonisation innovation, is Sembcorp Energy UK's 'plug &

play' infrastructure, and readily-accessible utilities including

water, gas, steam and electricity.

The refinery will be capable of producing both lithium hydroxide

and lithium carbonate sourced from imported high grade feedstock

from South America and lithium producers located in Australia and

elsewhere. The refinery is expected to produce enough lithium

hydroxide to supply 100% of the forecasted automotive demand in the

UK by 2030, with a further 35% of its total production available

for export to other countries in Europe and elsewhere.

Utilising state-of-the-art electrochemical processing, TVL's

zero waste lithium refinery will be the largest in Europe -

producing 96,000tpa of low-carbon battery-grade lithium hydroxide

once in full production - equivalent to 15% of projected European

demand.

Andy Koss,CEO UK & Middle East, Sembcorp Industries,

commented:

"It's great to see Tees Valley Lithium committed to Teesside and

further supporting the net zero supply chain. At Wilton

International, Sembcorp Energy UK is ready to welcome new

businesses and jobs that will help enable the transition to a

low-carbon economy."

Sam Quinn, Director of Alkemy commented:

"We are delighted to have agreed the terms of a Long Term Lease

at the world-class Wilton International site in Teesside.

This represents another significant milestone for Tees Valley

Lithium as we seek to become Europe's first and largest independent

and sustainable lithium hydroxide processing hub.

We would like to thank the highly supportive team at Sembcorp

Energy UK and look forward to working together with them as we

develop and construct our refinery."

Further information

For further information, please visit Alkemy's website:

www.alkemycapital.co.uk or TVL's website

www.teesvalleylithium.co.uk .

-Ends-

Alkemy Capital Investments Plc Tel: 0207 317 0636

Sam Quinn info@alkemycapital.co.uk

Buchanan Tel: +44 (0)20 7466 5000

Oonagh Reidy/Abigail Gilchrist TVL@buchanan.uk.com

VSA Capital Limited Tel: 0203 005 5000

Andrew Monk (Corporate Broking)

Andrew Raca (Corporate Finance)

Shard Capital Partners LLP Tel: 0207 186 9952

Damon Heath damon.heath@shardcapital.com

Tel: 0207 186 9927

Isabella Pierre isabella.pierre@shardcapital.com

NOTES TO EDITORS

Alkemy is seeking to establish the world's leading independent

and sustainable lithium hydroxide production by developing

state-of-the-art Lithium Sulphate and Lithium Hydroxide facilities

in Australia and the UK.

Alkemy, through its wholly-owned subsidiary Tees Valley Lithium,

has secured a 9.6 ha brownfields site with full planning permission

at the Wilton International Chemicals Park located in Teesside, a

major UK Freeport to build Europe's first and largest Lithium

Hydroxide processing facility.

Alkemy has completed a Class 4 Feasibility Study for its

proposed lithium hydroxide facility which will process feedstock

imported from various sources to produce 96,000 tonnes of premium,

low-carbon lithium hydroxide annually, representing around 15% of

Europe's projected demand.

The company has identified a site at Port Hedland, Western

Australia to build a world-class sustainable Lithium Sulphate

refinery that will provide reliable feedstock for Tees Valley

Lithium.

Forward Looking Statements

This news release contains forward--looking information. The

statements are based on reasonable assumptions and expectations of

management and Alkemy provides no assurance that actual events will

meet management's expectations. In certain cases, forward--looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Alkemy believes the expectations

expressed in such forward--looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Alkemy will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the

forward--looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEANFEKAFAA

(END) Dow Jones Newswires

December 20, 2022 02:00 ET (07:00 GMT)

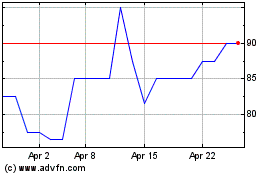

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024