TIDMALTN

AltynGold Plc

("Altyn" or the "Company")

Results for the year ended 31 December 2020

AltynGold Plc (LSE:ALTN) an exploration and development company,

is pleased to announce its results for the year ended 31 December

2020.

Highlights

Financial highlights

-- Turnover increased in the year to US$30m (2019:

US$14.9m).

-- 16,535oz of gold sold (2019: 10,500oz), an increase of

57%.

-- Average gold price achieved (including silver), US$1,816oz,

(2019: US$1,390oz).

-- The Company made a profit before tax of US$3.3m (2019: loss

US$1.04m).

-- Adjusted EBITDA (Earnings before interest, tax, depreciation

and amortisation) of US$13.5m (2019: US$3.3m).

-- The Company finalised the listing of the balance of the

US$10m 9% bonds on the Astana International Exchange (AIX).

-- The balance of the facility with JSC Bank Center Credit of

US$8m was drawn down during the year.

-- A share placing with JSC Freedom Finance raised US$1.5m in

the year.

-- New facility taken out in December 2020 with Bank Center

Credit of US$5.5m, (2.3bln Tenge), of this US$973,000 was drawn

down before the year end.

Operational highlights

-- Gold poured 17,028oz, (2019: 10,537oz) a 61% increase

year-on- year.

-- Mined gold grade 1.57g/t, (2019: 1.92g/t), decreased due to

ore dilution - new equipment is now increasing to the target

grade.

-- Operating cash cost US$800/oz, (2019: US$854/oz).

-- Gold recovery rate 80.44% (2019: 82.31%).

Underground development & exploration

-- Subsoil use contract at Sekisovskoye extended to July

2029.

-- Production of test ore at Teren-Sai, average grade 1.8g/t at

81% recovery.

-- Total 5,657 linear metres developed at Sekisovskoye.

-- Transport declines further developed, decline No.1 352 linear

metres, decline No. 2 353 linear metres.

-- 750,000t of ore made accessible from declines 1 and 2.

-- Areas No.1, 2 and new Area 5 developed in Teren-Sai - drill

holes and core samples extracted,

Annual General Meeting

The Annual General Meeting of the Company will be held at

Langham Court Hotel, 31-35 Langham Street, London W1W 6BU, United

Kingdom on Thursday 24 June 2021 at 11.00am. Due to the current

COVID-19 situation if the timing location or other details change

the Company will notify shareholders as appropriate.

The details of the resolutions are given in the Annual Report

which will be available on the website in due course.

For further information please contact:

AltynGold Plc

Rajinder Basra, CFO +44 (0) 207 932 2456

AltynGold Plc (LSE: ALTN) is an exploration and development

company, which listed on the main market segment of the London

Stock Exchange in December 2014. To read more about AltynGold Plc

please visit our website www.altyngold.uk

CHAIRMAN'S STATEMENT

This year has been very different for many reasons, the effects

of the COVID-19 pandemic have been felt around the world, causing

economic and social havoc. One year later the crisis is still

ongoing, with governments, companies and individuals still facing

uncertainty on how the pandemic will evolve and its aftermath.

From our perspective as a mining Company focused on mining

operations in Kazakhstan, we have been insulated to a large extent

from the fallout of the pandemic, as mining operations were a

protected industry and the Company has been able to continue to

operate throughout the pandemic. While cooperating with the

authorities, the Company has quickly adapted its new operational

working practices to ensure that the staff were able to continue

working in a safe environment at the mine site, organising special

shift patterns for production. Office workers at both the mine site

and head office were largely able to work remotely, as the lock

down has eased the staff were able to resume their duties at the

offices during March 2021. The country is still organising measures

to contain the transmission of COVID-19, and in April 2021 a

limited lockdown was introduced in the country. The imposition of

the most recent lockdown has not resulted in any issues in relation

to the current operations of the Company.

Supply chains and the important sale of dore to the refinery

were carefully monitored and potential issues resolved as soon as

they arose.

Against this background the Company managed to grow, attracting

funding from a range of sources and delivering on its capital

investment plan. The resultant increase in production combined with

the favorable gold price led to a substantially higher revenue

stream.

While the gold price has increased given its hedge

characteristic against the downturn in the global outlook for

economies, a higher gold price level should be sustained by the

expectation of increased inflation levels resulting from global

monetary policies that are increasing the money supply, and a

deteriorating fiscal outlook. With the production levels budgeted

to increase, the management is upbeat about the Company's future

growth outlook.

With its strong financial position and additional funding

raised, the Company has also continued its exploration program at

Teren-Sai. The test production run as reported in the RNS news

release in 2021 yielded good results in terms of grade, and the

expected low cash cost of production will have a positive impact on

the results of the Company in the future.

In summary against the backdrop of uncertainty caused by the

COVID-19 crisis the Company has managed to emerge in a much

stronger position at the end of the year. It has secured its

required level of funding, utilising it to good effect as

demonstrated by the increased production levels. The Board has also

been strengthened by the appointment of a new non-executive

director Thomas Gallagher who will bring important qualities and

experience to the team, and we welcome him to the Company.

I would like to conclude with a heartfelt thank you to all the

staff from the top management and to those who only work on a

part-time basis for their dedication to the Company and support in

minimising the effect of the pandemic on our business.

Kanat Assaubayev

Chairman

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The Company has been able to implement its medium term plan,

following successful rounds of financing completed in late 2019 and

2020. As such, a significant amount of underground plant and

equipment (details below) has been purchased leading to a 98%

increase in ore extraction in the year to 505,000t. Timely

maintenance of the processing plant and the overhaul of other

equipment allowed a swift increase in processed ore which grew 82%

from 231,000t to 420,000t leading to a 61% increase in gold

produced from 10,537oz to 17,028oz. With the introduction of more

specialised drilling rigs in 2021, the Company is also targeting a

lower level of dilution of extracted ore which should result in a

noticeable improvement of grades in Q2 2021.

Due to careful planning and co-operation with the relevant

authorities there was little impact on the operations of the

Company from COVID-19. Indeed, the trend and momentum of production

at Sekisovskoye continue to be very encouraging. These positive

developments set the stage for the company to achieve its first

major target of 850,000t ore extraction per annum.

The Company has also invested additional funds to expand the

exploration program at Teren-Sai. The Teren-Sai area is large,

covering in excess of 198km which the Company has split this into a

number of areas. After initially concentrating on Area No.2 the

Company has now expanded its exploration programs into Areas No. 1

and 5.

Commentary on results

Sekisovskoye underground mine

Plant and equipment

There was a significant investment in plant and machinery during

2020 and to date in 2021, these are summarised below:

-- Front-end loader ZL 50G

-- Dump truck 25t Chaicman

-- Material handling trucks CAT R1300 - 3 units

-- Underground haulers CAT AD30 - 3 units

-- Face drilling rig Atlas Copco T1D

-- Ring drilling rig Atlas Copco T1D

-- Exploration drilling rig Atlas Copco Diamec U4

-- Boomer T1D drilling rig with a capacity of 400m/month

-- Boomer T1D long-hole production drill

-- Diamec U4 Smart exploration drill rig

-- JSB Crawler with a capacity of 1.8cu.m

-- Korfmann AL18-2500 ventilator with a capacity of 100m3/s

-- Lupamit LKV 250 compressors, each compressor with a capacity

of 45m3/min

-- 100 CFO flower heaters

The following was achieved with regards to the underground mine

in the year:

-- There was a substantial development of tunneling amounting to

5,657 linear metres, including 353 metres on transport decline No 2

allowing access to 640,000 tons of reserves at levels +161, +164

and +178; and 352 metres on transport decline No 1 allowing access

to 110,000 tons at levels +150 and +163.

-- With the purchase of heaters, compressors and a Korfman

AL18-2500 ventilator, the company was able to complete necessary

works on the main ventilation shaft required for the continuation

of operations until 2029 in line with the mine plan.

-- Thanks to additional equipment, ore stockpiles were increased

substantially at portal No 2, allowing for an increase in the daily

ore production to 1,800t/day.

-- In addition to 48,000m3 of back and cavity filling, works are

ongoing for the development of the general site including

renovation and expansion of the offices and other amenities.

-- Ore mined at Sekisovskoye during 2020 was 506,000t (2019:

255,000t), with the new equipment on site this is budgeted to

increase.

-- The average gold grade was 1.58g/t (2019: 1.76 g/t) in line

with the Company budget. The average grade for the year was

affected by lower grades during Q1 at 1.49g/t (1.43g/t budgeted)

due to high level of developmental ore. The introduction of

additional equipment in particular the Boomer T1D LHD drilling rigs

has led to a steady improvement in grades to its current level of

1.75g/t. Further improvement expected in the future as more ore

bodies become accessible.

Exploration -- Teren-Sai

The Teren-sai exploration program has been expanded and

accelerated during 2020. The Company views the site as a very

valuable asset that will add substantially to the production

capacity of the Company once it is fully functional.

In area No.2 the Company continued pneumatic drilling conducting

16 profiles for verification analysis against existing data.

Additional drilling was also carried out to fully delineate the

extent and boundaries of the ore body resulting in 14 completed

drill holes and 4,183m drilled meterage.

Mining results ore extraction

2020 2019

Ore mined T 506,050 255,134

Gold grade g/t 1.57 1.92

S ilver grade g/t 1.08 1.37

Contained gold oz 25,555 15,760

Contained silver oz 17,525 11,239

Mining results processing

2020 2019

Crushing T 421,040 239,046

Mining T 420,256 230,966

G old grade g/t 1.58 1.76

Silver grade g/t 1.13 1.37

Gold recovery % 80.44 82.31

S ilver recovery % 72.81 69.88

Contained gold oz 21,355 12,981

C ontained silver oz 15,253 9,819

Gold Poured oz 17,028 10,537

Silver poured oz 11,180 6,760

Projected capital expenditure - Sekisovskoye

Total 2021 2022

US$m US$m US$m

Prospect drilling 1.7 0.9 0.8

Underground development 6.8 4.5 2.3

Infrastructure 0.1 -- 0.1

Ore handling facilities 3.7 3.4 0.3

Process plant incremental expansion 3.4 2.6 0.8

Total 15.7 11.4 4.3

In order to build up a reliable profile of the site,

verification results are being constantly mapped against existing

data. During 2020 the Company successfully processed the first

batch of test ore amounting to 1,794t, resulting in an average

grade of 1.8g/t and a recovery rate of 81%. These were very

encouraging results and a significant step in moving forward with

the project. It is expected that the initial extraction of ore will

be via open pit workings, with the use of some of the existing open

pit equipment which has been mothballed at Sekisovskoye, and

further equipment being purchased as necessary. The ore extracted

is expected to be processed by a separate plant to be built at

Teren-Sai, thus avoiding transport costs to Sekisovskoye and

keeping the unit cost of production at a reasonable level.

In addition to Area No.2 exploration work was expanded to Area

No.1 and new zone identified as Area No.5. In Area No.1, 13

prospective drilling profiles were conducted, the analysis of the

results was encouraging and further core drilling is to be

undertaken in 2021. In relation to Area No. 5, the meterage drilled

was 3,886m with 17 drill holes which identified 11 ore

intersections. Sampled grades over four of the holes ranged from

1.4g/t to 2.4g/t and further work is planned in this area in

2021.

The Company also commenced topographic work over 50km2 to gain a

better understanding of the site and the potential to develop the

area, the work will be completed during 2021.

Capital requirements

The capex requirements for the next two years are detailed in

the table below. The budgeted plans foresee the Company expanding

ore extraction and production to 850,000t to per annum for

Sekisovskoye, and the development of its prospective resource at

Teren-Sai. The Company is constantly reviewing and refining its

plans to adapt to changing circumstances.

Longer term plan

The long term plan still consists in operating the Sekisovskoye

Mine at 850kt annual capacity for three years then ramping up

production to 2Mtpa over a six year period. The initial target is

an important milestone and with the purchase of the new equipment

this is now progressing as planned. The longer term plan involves

obtaining further funding and the Board is constantly looking at

the best way to finance the business going forward. In this regard,

the Company has recently appointed Renaissance Capital to operate

as a Corporate Broker as well as produce independent research on

the Company in order to increase its profile with potential

investors. In order to achieve the longer term goal outlined, the

Company has estimated that it will require an initial funding of

US$40m-US$50m to attain 1Mpta target. Further funding will be

required for the secondary 2Mpta target.

Mining operations at Teren- Sai are planned to run in parallel

to Sekisovskoye development and will initially include surface

mining at Area No.2 before moving underground at a later stage. It

is envisaged that at the initial costs of open pit operations can

be kept low by making use of the existing equipment as far as

possible. The significant expenditure relates to the planned

Teren-Sai processing plant which will be a conventional

carbon-in-leach ("CIL") gold recovery plant, similar to the

existing one at the neighbouring Sekisovskoye Mine.

FINANCIAL PERFORMANCE

Key performance indicators (KPIs)

Annual gold sales (oz)

16,535oz

2020 16,535

2019 10,500

2018 14,990

Annual gold poured (oz)

17,028oz

2020 17,028

2019 10,537

2018 15,282

Reveune (US$m)

US$30m

2020 30.0

2019 14.9

2018 19.4

Operating cash cost of production (US$oz)

US$800oz

2020 800

2019 854

2018 865

Adjusted EBITDA (US$m)

US$13.5m

2020 13.5

2019 3.3

2018 0.9

Net assets (US$m)

US$35.3m

2020 35.3

2019 33.3

2018 34.9

The Company raised significant funds in the year, mainly bank

borrowings and a bond placement on the Astana International

Exchange. The raised funds have mainly been used for the purchase

of new underground equipment, infrastructure and capital

development at Sekisovskoye, exploration drilling at Teren-Sai and

funding expanded working capital requirements.

In terms of output, the investment in the new equipment and the

refurbishment of plant and machinery has had a direct and immediate

effect on production levels in the year. Gold poured has increased

by 61.6% from the prior year to 17,028oz the highest it has been

for a number of years. Budgeted levels in the forthcoming periods

are set to increase further as the full effect of the investments

made flow through.

During 2020, the Company sold 16,535oz of gold (2019: 10,500oz).

The average price achieved per oz in 2020 was US$1,816 (2019:

US$1,390) a significant uplift from the prior year. While consensus

analysts' forecasts expect the gold price to remain in the region

of US$1,800 the Company conservatively uses a lower price of gold

in its forward modelling. Further, the outlook for the business is

expected to remain positive given the anticipation of dollar

strength against the local currency in which a significant level of

expenses are payable.

There were no changes to the sales off-take agreement currently

in place with the Kazakh national refinery, which continues to take

all of the Company's output. As in the prior year, sales are

translated at the spot US$ market rate at the point the gold is

sold.

The total cash cost of production, which includes administrative

costs but excludes depreciation and provisions, amounted to

US$970/oz, (2019: S$1,104oz). The operating cash cost excluding

administrative costs amounted to US$800/oz (2019: US$854/oz). The

cash cost of production is expected to fall in future periods with

expanded economies of scale and improved grades. The administrative

costs are being closely monitored and there has only been a small

increase from the prior year, which is expected to be maintained in

future periods.

The Group has reported a net profit of US$3.3m before tax (2019:

loss US$1.04m) with a gross profit of US$11.9m (2019: US$2.5m),

this was after a one off charge in the year relating to a share

based payment of US$2.4m in connection with share options issued.

While the increase in gold price of 30% had a positive effect, the

principal driving factor for the increase in profitability was the

57% increase in output. The adjusted EBITDA increased to US$13.5m

(2019: US$3.3m) after adjusting for depreciation of US$3.9m (2019:

US$3.4m), and the share based payment noted above. The operating

profit as a consequence rose to US$7.2m (2019: US$0.0 Statement by

the directors in performance of their statutory duties in

accordance with s172 (1) Companies Act 2006.25m). Net profit has

been reduced by the effect of the borrowing costs which increased

from US$1.2m to US$2.3m. The effect of foreign exchange losses in

the subsidiaries also had the effect of decreasing profits, in 2020

this is US$1.5m (2019:US$116,000 gain), principally as a result of

the revaluation of the borrowings.

Management are keenly aware that funding should be on the most

attractive terms and are exploring new avenues to achieve this.

Cash at year-end was US$7.2m (2019: US$1.9m), the increase was

driven by fund raising, including the issue of shares for a

consideration of US$1.5m in the year. Current resources are

sufficient to meet the current working capital requirements and

purchase of capital equipment in the current budget. In December

2020 the Company agreed additional bank facilities with Bank Center

Credit of US$5.5m, of this amount US$1.9m is available to fund

working capital and the balance will be used for investment into

new machinery. Of this facility US$1.0m was drawn down in December

2020.

The main financing commitments during the year were payment of

interest on the bonds and repayment of principal and interest on

the bank borrowings, in total these amounted to US$4.1m in 2020

(2019: US$1.4m).

The consolidated net assets of the Group are US$35.3m (2019:

US$33.3m).

During the year the Company operated successfully through the

restrictions and lock downs as stipulated by the Kazakh authorities

and is pleased to confirm it safely guarded the wellbeing of its

staff. The Government imposed a number of lockdowns beginning in

March 2020 ranging from a full national lockdown and containment of

the major cities to less stringent limited ones that are currently

operating. The Company experienced minimal operational disruption

from the COVID-19 pandemic that commenced in 2020 and expects

operations to continue uninterrupted.

CONSOLIDATED INCOME STATEMENT

for the year ended 31 December 2020

2020 2019

Note $000 $000

Revenue 3 30,032 14,908

Cost of sales (17,610) (12,390)

Gross profit 12,422 2,518

Administrative expenses (2,826) (2,600)

Share based payment (2,400) --

Impairments (34) 107

Operating profit 7,162 25

Foreign exchange (1,508) 116

Finance expense (2,324) (1,183)

Total finance cost (3,832) (1,067)

Profit/(loss) before tax 3,330 (1,042)

Taxation expense (392) (214)

Profit/(loss) for the year attributable to the

equity holders of the parent 2,938 (1,256)

Profit/(loss) per ordinary share

Basic 4 11.27c (5.00c)*

Diluted 4 10.97c --

*The earnings per share calculation for 2019 has been restated

to reflect the 100:1 consolidation of shares in 2020.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2020

2020 2019

$000 $000

Profit/(loss) for the year 2,938 (1,256)

Items that may be reclassified subsequently to the income

statement

Currency translation differences arising on translations

of foreign operations (3,846) 129

Currency translation differences on translation of foreign

operations relating to tax (1,011) (461)

(4,857) (332)

Total comprehensive loss for the year (1,919) (1,588)

Total comprehensive loss attributable to:

Equity holders of the parent (1,919) (1,588)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 December 2020

2020 2019

Registration number: 05048549 Note $000 $000

Assets

Non-current assets

Intangible assets 5 12,849 12,943

Property, plant and equipment 6 32,092 30,316

Deferred tax assets 5,311 7,356

Trade and other receivables 6,700 6,048

Restricted cash 13 --

56,965 56,663

Current assets

Inventories 5,468 3,631

Trade and other receivables 7,182 3,615

Cash and cash equivalents 7,154 1,934

19,804 9,180

Total assets 76,769 65,843

Equity and liabilities

Current liabilities

Trade and other payables (6,705) (7,553)

Provisions (151) (130)

Loans and borrowings (5,833) (2,550)

(12,689) (10,233)

Non-current liabilities

Vat payable (230) (964)

Other payables (492) (1,333)

Provisions (4,763) (5,007)

Loans and borrowings (23,260) (15,027)

(28,745) (22,331)

Total liabilities (41,434) (32,564)

Equity

Share capital (4,267) (4,055)

Share premium (152,839) (151,476)

Merger reserve 282 282

Other reserves (333) (333)

Foreign currency translation reserve 52,959 48,102

Accumulated losses 68,863 74,201

Equity attributable to owners of the company (35,335) (33,279)

Total equity and liabilities (76,769) (65,843)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 December 2020

Share

Currency based

Share Share Merger translation payment Other Accumulated Total

capital premium reserve reserve reserve reserves losses equity

$000 $000 $000 $000 $000 $000 $000 $000

At 1 January

2019 4,054 151,470 (282) (47,770) -- 333 (72,945) 34,860

Loss for the

year -- -- -- -- -- -- (1,256) (1,256)

Other

comprehensive

loss -- -- -- (332) -- -- -- (332)

Total

comprehensive

loss -- -- -- (332) -- -- (1,256) (1,588)

New share

capital

subscribed 1 6 -- -- -- -- -- 7

At 31 December

2019 4,055 151,476 (282) (48,102) -- 333 (74,201) 33,279

At 1 January

2020 4,055 151,476 (282) (48,102) -- 333 (74,201) 33,279

Profit for the

year -- -- -- -- -- -- 2,938 2,938

Other

comprehensive

income -- -- -- (4,857) -- -- -- (4,857)

Total

comprehensive

loss -- -- -- (4,857) -- -- 2,938 (1,919)

New share

capital

subscribed 13 62 -- -- -- -- -- 75

Share based

payment

charge -- -- -- -- 2,400 -- -- 2,400

Share options

exercised 199 1,301 -- -- (2,400) -- 2,400 1,500

At 31 December

2020 4,267 152,839 (282) (52,959) -- 333 (68,863) 35,335

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 December 2020

2020 2019

Note $000 $000

Cash flows from operating activities

Net cash flow from operating activities 4,245 (2,832)

Cash flows from investing activities

Acquisitions of property plant and equipment (8,559) (7,180)

Proceeds from sale of property plant and equipment -- 20

Acquisition of intangible assets (1,271) (552)

Proceeds from test production 165 --

Net cash flows from investing activities (9,665) (7,712)

Cash flows from financing activities

Loans received 16,903 14,089

Proceeds of share issue 1,500 --

Interest paid (3,740) (193)

Loans repaid (3,431) (1,523)

Commission charge (588) --

Net cash flows from financing activities 10,644 12,373

Net increase in cash and cash equivalents 5,224 1,829

Cash and cash equivalents at 1 January 1,934 105

Effect of exchange rate fluctuations on cash held (4) --

Cash and cash equivalents at 31 December 7,154 1,934

NOTES TO THE FINANCIAL STATEMENTS

for the year ended 31 December 2020

1 General information

AltynGold Plc (the "Company") is a Company incorporated in

England and Wales under the Companies Act 2006. The financial

information set out above for the years ended 31 December 2020 and

31 December 2019 does not constitute statutory accounts as defined

in Section 434 of the Companies Act 2006, but is derived from those

accounts. Whilst the financial information included in this

announcement has been compiled in accordance with international

financial reporting standards (IFRS), adopted pursuant to

Regulation (EC) in conformity with the requirements of the

Companies Act 2006, this announcement itself does not contain

sufficient financial information to comply with International IFRS.

A copy of the statutory accounts for 2019 has been delivered to the

Registrar of Companies and those for 2020 will be submitted for

approval by shareholders at the Annual General Meeting. The full

audited financial statements for the years end 31 December 2020 and

31 December 2019 do comply with IFRS.

2 Going concern

During the year the Group obtained additional funding

principally from a mixture of placing bonds on the Astana

International Exchange, an additional US$7.4m and obtaining further

funds from the term loans from a Kazakhstan based bank that were

agreed in 2019 of US$8.3m. In total these increased the loans and

borrowings from US$17.6m in 2019 to the current level of US$29.1m.

The funds were utilised to purchase equipment and to provide

working capital to expand and develop the mining site at

Sekisovskoye. The Group increased sales from US$14.9m to US$30.0m

during 2020, resulting in an increase in adjusted EBITDA from

US$3.4m to US$13.5m. This provided positive funding to the Group in

the year, and is expected to continue at increasing levels in the

future.

At the year-end the Group had cash resources of US$7.2m (2019:

US$1.9m) available. In December 2020 the Company agreed additional

bank facilities with Bank Center Credit in the amount of US$5.5m,

of which US$1.9m is available to fund working capital and the

balance is required to be used for investment into new machinery.

Of this facility US$1.0m was drawn down in December 2020.

The Board have reviewed the Group's forecast cash flows for the

period to June 2022, which include the capital and interest

repayments to be made in relation to the Group's borrowings.

Capital and operating costs are based on approved budgets and

latest forecasts in the case of 2021 and current development plans

in the case of 2022. Based on the Group's cash flow forecasts, the

Directors believe that the combination of its current cash

balances, net cash flows from operations, and increased production

based on projections of future growth, are sufficient for the

Company to achieve its current plans and meet its cash flow

requirements.

The Group has operated in the most difficult time of the

COVID-19 pandemic, and experienced little impact on its ability to

trade and grow the business. However management are keenly aware

that the situation may change and have factored any potential

impacts into its future business plans. The initial impact of

COVID-19 was felt in March 2020 when Kazakhstan and the UK went

into lockdown. The Group was quick to adapt and allowed office

workers to use remote technology to perform their duties. In

relation to the mine, mining operations were designated by the

government to be a key industry. This ensured that production and

transport of dore to the refinery could continue as normal. The

Group adapted working conditions and patterns of working, to ensure

that production continued in a safe working environment. The Group

has also ensured that adequate stocks are being maintained of parts

and consumables in order to prevent any disruption to production.

COVID-19 is still an ongoing issue in Kazakhstan and indeed in many

countries, however the Management believe the procedures they have

in place, such as shift working at the mine, remote working,

advance ordering of supplies and consumables, together with the

support of the government will ensure that future production will

continue.

The Board have considered possible stress case scenarios that

they consider may be likely to impact on the Group's operations,

financial position and forecasts. Factors considered are

operational disruptions, such as illness amongst the workforce,

disruption to supply chain and possible impact on the price of gold

if this was to fall to pre COVID-19 levels. From the analysis

undertaken the Board have concluded that Group will be able to

continue to trade by the careful management of its existing

resources. The stress tests included the following scenarios

amongst others, a fall in the gold price by 18% from current

levels, a drop in budgeted production by 20% or a combination of

both factors together. In each case the Group would not experience

a cash shortfall in either scenario. If required the Group would

manage its resources, reducing investment and managing its payables

in order to maintain liquidity.

The Board therefore considers it is appropriate to adopt the

going concern basis of accounting in preparing these financial

statements.

3 Revenue

The analysis of the group's revenue for the year from continuing

operations is as follows:

2020 2019

$000 $000

Sale of gold and silver 29,790 14,623

Other sales 242 285

30,032 14,908

Included in revenues from sale of gold and silver are revenues

of US$29,790,000 (2019: US$14,623,000) which arose from sales of

precious metals to one customer based Kazakhstan. Other sales

amounted to US$242,000 (2019: US$285,000) and related to lease and

rental income.

4 Profit/(loss) per ordinary share

The calculation of basic and diluted earnings per share from

continuing operations is based upon the retained profit from

continuing operations for the financial year of US$2.9m (2019: loss

of US$1.3m).

The weighted average number of ordinary shares for calculating

the basic loss in 2020 and 2019 is shown below. The company

consolidated its shares on a 100:1 basis during the year, the

comparative figure of the number of shares has been adjusted

accordingly.

The diluted earnings per share in 2020 arises as the convertible

loan notes have conversion rights, which would result in an

additional 702,650 shares being issued.

As the Company was loss making in 2019, the impact of the

potential ordinary shares outstanding from the conversion of the

convertible loan notes would be anti-dilutive, and as such the

basic and diluted earnings per share are the same.

2020 2019

No. No.

Basic 26,070,079 25,677,720

Diluted 26,772,729 n/a

5 Intangible assets

Teren-Sai Exploration and

geological data evaluation costs Total

Group US$000 US$000 US$000

Cost or valuation

At 1 January 2019 9,889 5,919 15,808

Additions -- 552 552

Amortisation capitalised -- 992 992

Currency translation 42 25 67

At 31 December 2019 9,931 7,488 17,419

At 1 January 2020 9,931 7,488 17,419

Additions -- 1,271 1,271

Amortisation capitalised -- 608 608

Currency translation (905) (717) (1,622)

At 31 December 2020 9,026 8,650 17,676

Amortisation

At 1 January 2019 3,470 -- 3,470

Amortisation charge 992 -- 992

Currency translation 14 -- 14

At 31 December 2019 4,476 -- 4,476

At 1 January 2020 4,476 -- 4,476

Amortisation charge 608 -- 608

Currency translation (422) -- (422)

Revenue relating to test

production -- 165 165

At 31 December 2020 4,662 165 4,827

Carrying amount

At 31 December 2020 4,364 8,485 12,849

At 31 December 2019 5,455 7,488 12,943

At 1 January 2019 6,419 5,919 12,338

The intangible assets relate to the historic geological

information pertaining to the Teren-Sai ore fields. The ore fields

are located in close proximity to the current open pit and

underground mining operations of Sekisovskoye. The Company obtained

a contract for exploration and evaluation on the site in May 2016

from the Kazakh authorities. The contract is valid for a period of

6 years, with a right to extend over a further 5 years.

The value of the geological data purchased is in the opinion of

the Directors the value that would have been incurred if the

drilling had been undertaken by a third party (or internally). The

Company has continued to develop the site with a CPR completed in

2019, and confirmatory drilling and further exploration work

continuing on the site.. Full details are given in the mineral

resources statement included as part of the Annual Report.

The directors consider that no impairment is required taking

into account the CPR results, exploration and planned production in

the future. The write off of the geological data over the period of

the licence to the end of the extended licence period in 2027 is

appropriate. After that period the costs amortised are capitalised

in line with the Company's accounting policy within the subsidiary

TOO GMK Altyn MM LLP, there are no impairment indicators.

6 Property, plant and equipment

Equipment, Plant,

Freehold fixtures machinery

Mining Land and and and Assets under

properties buildings fittings buildings construction Total

Group US$000 US$000 US$000 US$000 US$000 US$000

Cost or

valuation

At 1 January

2019 11,730 24,481 9,701 5,047 978 51,937

Additions 2,140 71 239 2,469 301 5,220

Disposals -- (4) (34) (41) -- (79)

Transfers -- 134 -- -- (134) --

Currency

translation 79 104 39 26 (78) 170

At 31

December

2019 13,949 24,786 9,945 7,501 1,067 57,248

At 1 January

2020 13,949 24,786 9,945 7,501 1,067 57,248

Additions 1,622 166 2,838 2,717 1,246 8,589

Disposals -- -- (70) (180) -- (250)

Transfers (764) 1,383 (26) 18 (471) 140

Transfer from

inventories -- -- -- -- 241 241

Currency

translation (1,543) (2,285) (907) (734) (110) (5,579)

At 31

December

2020 13,264 24,050 11,780 9,322 1,973 60,389

Depreciation

At 1 January

2019 2,220 8,291 8,501 4,534 -- 23,546

Charge for

year 209 2,133 794 217 -- 3,353

Eliminated on

disposal -- (3) (30) (40) -- (73)

Currency

translation 12 35 40 19 -- 106

Transfers -- 107 (101) (6) -- --

At 31

December

2019 2,441 10,563 9,204 4,724 -- 26,932

At 1 January

2020 2,441 10,563 9,204 4,724 -- 26,932

Charge for

the year 520 1,885 773 772 -- 3,950

Eliminated on

disposal -- -- (70) (180) -- (250)

Currency

translation (232) (997) (805) (441) -- (2,475)

Transfers 140 (80) 80 -- -- 140

At 31

December

2020 2,869 11,371 9,182 4,875 -- 28,297

Carrying

amount

At 31

December

2020 10,395 12,679 2,598 4,447 1,973 32,092

At 31

December

2019 11,508 14,223 741 2,777 1,067 30,316

At 1 January

2019 9,510 16,190 1,200 513 978 28,391

Capitalised cost of mining property are amortised over the life

of the licence from commencement of production on a unit of

production basis. This basis uses the ratio of production in the

period compared to the mineral reserves at the end of the period.

Mineral reserves estimates are based on a number of underlying

assumptions, which are inherently uncertain. Mineral reserves

estimates take into consideration estimates by independent

geological consultants. However, the amount of mineral that will

ultimately be recovered cannot be known until the end of the life

of the mine.

Any changes in reserve estimates are, for amortisation purposes,

treated on a prospective basis. The recovery of the capitalised

cost of the Company's property, plant and equipment is dependent on

the development of the underground mine.

The Directors are required to consider whether the non-current

assets comprising, mineral properties, plant and equipment have

suffered any impairment. The recoverable amount is determined based

on value in use calculations. The use of this method requires the

estimation of future cash flows and the choice of a discount rate

in order to calculate the present value of the cash flows. The

directors considered entity specific factors such as available

finance, cost of production, grades achievable, and sales price.

The directors have concluded that no adjustment is required for

impairment.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210430005508/en/

CONTACT:

Altyn Plc

SOURCE: Altyn Plc

Copyright Business Wire 2021

(END) Dow Jones Newswires

April 30, 2021 13:21 ET (17:21 GMT)

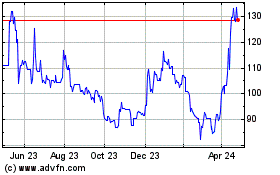

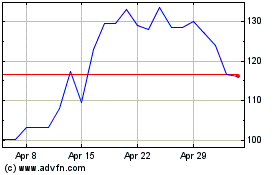

Altyngold (LSE:ALTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Apr 2023 to Apr 2024