ALTYNGOLD PLC: 4th Quarter results

31 January 2022 - 6:00PM

UK Regulatory

TIDMALTN

AltynGold Plc

("AltynGold" or the "Company")

Fourth quarter production results

AltynGold is pleased to announce its 4Q21 production results

Highlights:

-- Revenues increased 12.8% QoQ to 14.44 USD million. Growth was mainly

driven by operational improvements given stable average gold price

dynamic compared to the previous quarter.

-- The Company maintained positive growth momentum in production with milled

ore, mined ore and contained gold production increasing 9.2%, 2.9% and

2.2% QoQ respectively. 4Q21 annualized production run rate reached

618kt/year.

-- Average grade was 2.02g/t versus 2.07g/t in 3Q21 given increased share of

developmental ore mined during the quarter. The Company is on track to

achieve 2.2g/t grade over the coming quarters.

-- The Company had no interruptions on its production operations due to

COVID-19 or any other negative effect during the quarter. All operational

processes continued at a regular pace and the Company provides

comprehensive assistance in the voluntary vaccination of its employees.

The health and safety of our employees remains our top priority.

1Q21 2Q21 3Q21 4Q21

Ore mined Tons 131,733 134,874 149,998 154,430

Contained gold Ounces 7,462 8,442 9,732 9,944

Ore milled Tons 132,834 129,910 133,291 145,541

Average gold grade gr/tone 1.78 1.98 2.07 2.02

Gold poured Ounces 6,272 6,794 7,440 7,944

Revenue USD m 10.06 12.72 12.80 14.44

Aidar Assaubayev, CEO of the Company commented:

"We are pleased with our latest set of results. The steady

increase in ore milled, ore mined and contained gold production

highlight the quality of our Sekisovskoye deposit and confirm

progress towards our medium term goal of producing 100 thousand

ounces of gold annually.

"The Company posted record revenue of $14.4 million for the

quarter, during which time gold prices were stable. This record was

primarily supported by our efficiency and low-cost production base.

It's worth noting that our annual revenue for 2021 is substantially

higher than our company's current market valuation, making us one

of the most undervalued gold mining stocks on the London Stock

Exchange. With gold prices now on the rise and our improving

operational excellence, I am positive that we will deliver even

better numbers in the coming year."

Further Information:

For further information please contact:

AltynGold Plc

Rajinder Basra

+44 (0) 203 432 3198

For media inquiries please contact:

Maria Ermakova

ermakova@em-comms.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

Information on the Company

AltynGold Plc is a leading gold miner in Kazakhstan, a

resource-rich country where the mining sector has always been a key

driver of economic growth. AltynGold has a high-quality resource

base at its two primary assets, Sekisovskoye and Teren-sai. For the

year ended 31 December 2020 AltynGold had gold sales of 16,535 oz.,

revenue of USD 30.0 mln and EBITDA of USD 13.5 mln, with an EBITDA

margin of 45.0%.

Shares of AltynGold Plc are traded on the London Stock Exchange

and are listed on the Main Market under the ticker "ALTN".

For more information: www.altyngold.uk

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220130005034/en/

CONTACT:

AltynGold Plc

SOURCE: AltynGold Plc

Copyright Business Wire 2022

(END) Dow Jones Newswires

January 31, 2022 02:00 ET (07:00 GMT)

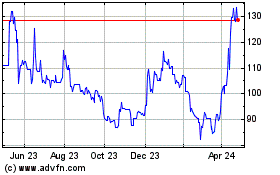

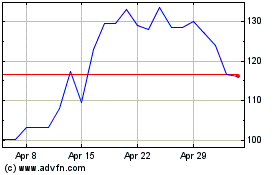

Altyngold (LSE:ALTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Apr 2023 to Apr 2024