TIDMAMC

RNS Number : 4493N

Amur Minerals Corporation

30 September 2021

30 September 2021

AMUR MINERALS CORPORATION

(AIM: AMC)

Interim Results 2021

Chairman's Statement

It is with pleasure that I take this opportunity to update

shareholders of Amur Minerals Corporation (the "Company") on the

Company's successful performance during the first six months of

2021.

In August 2021, the Company submitted the Permanent Conditions

Report ("TEO") on its far east Russia Kun-Manie nickel copper

sulphide project to the Russian Government Commission for Natural

Resources Reserves ("GKZ"). The TEO was completed by Moscow based

and certified Oreall LLC ("Oreall"), who have compiled Russian

based project specific operating and capital cost estimates using a

team of industry recognised specialists and experts. The completion

of the GKZ review will establish the reserves available for open

pit mining at its "Detailed Exploration and Mining Production"

licence (BLG 15883 TE) located in Amur Oblast. Subsequent to GKZ

registration of the reserves, the results will be utilised to

establish the Russian approved mine plan for Kun-Manie.

TEO Highlights:

-- Revenue is based on a conservative nickel price of US$

13,300/t (US$ 18,600/t today) and a copper price of US$5,960/t (US$

9,260/t today). Metal recoveries derived by Gipronickel Institute

(a wholly owned subsidiary of Norilsk Nickel) are anticipated to be

73.5% for nickel and 52.3% for copper based on a nickel cut-off

grade of 0.3% nickel.

-- Russian B + C1 reserve inclusive of in-balance and

off-balance totals 144.2 million ore tonnes containing 1.10 million

nickel tonnes and 304 thousand copper tonnes. This inventory

approximates the JORC resource categories of Measured and

Indicated.

-- Potential mine life estimated to be 25 years, sustaining an

11.2 million tonne per year throughput.

-- Open pit mining operating costs per ore tonne US$ 14.79 (ore

plus waste cost). All other costs total $33.25 per ore tonne FOB

Vladivostok, Russia.

-- Total initial capital costs are projected to be approximately

US$ 1.0 billion including the construction of a power line and a

dual carriageway gravel surface road. Working capital expenditures

projected to be US$ 83 million.

On 30 June 2021, the Company announced that RPM Global had

completed an update to the JORC resource estimates including all

drilling and trenching. Based on a 0.3% nickel equivalent cut-off

grade ("COG"), the global JORC ore tonnage has increased by 19.2

million tonnes ("Mt") (12.4%) to 174.3 Mt, by 156,000 nickel tonnes

(13.5%) to 1.31 Mt of nickel (averaging 0.75% nickel) and by 53,000

copper tonnes (16.6%) to 372,000 copper tonnes (averaging 0.21%

copper). A 0.3% nickel cut-off grade was used to calculate the JORC

Resource compared to previously reported resources at a 0.4% Nickel

cut off-grade. The reduction in the COG is primarily due to the

metallurgical test results by Gipronickel Institute which confirmed

that two revenue generating concentrate products (Ni and Cu) could

be produced. Previous resource estimates were based on a single

nickel only payable concentrate being produced with zero revenue

contribution being derived from the copper.

NRR Investment

On 05 July 2021, the Company sold its wholly owned subsidiary

Carlo Holdings Ltd ("CHL") which held an investment of US$4.67

million in a Convertible Loan Note ("CLN") on Nathan River

Resources Pte Limited ("NRR"). NRR owns the Roper Bar Iron Ore

Project located in the Northern Territory in Australia. Amur

acquired CHL on 28 August 2020 for a cash consideration of GBP1,

and immediately provided the funding whereby CHL subscribed for the

CLNs provided by NRR.

A share sale agreement was entered into with Hamilton

Investments Pte. Ltd., a subsidiary of Britmar (Asia) Pte Ltd for

cash consideration of US$6,137,019. This represents a profit of

US$1.47 million when set against its original investment, albeit

foregoing the interest that would otherwise be payable over the

lifetime of the CLNs at a coupon rate of 14%. During the 6 month

period to 30 June 2021, the Company received US$326,900 in interest

payments.

Financial Overview

As at 30 June 2021 the Company had cash reserves of

US$1,846,000, down from US$2,790,000 at the start of 2021. Shortly

after the period end, the Company received US$6,137,019 in cash

from Hamilton Investments Pte. Ltd in respect of the sale of CHL.

The Company remains debt free.

Administration expenses for the first half of 2021 totalled

US$1.04 million (H1 2020: US$1.3 million), a reduction caused by

the departure of two board members. There was a currency

translation gain of US$0.4 million (H1 2020: translation loss of

US$3.0 million) was due to the strengthening of the Russian rouble

to the US dollar. Expenditure on exploration was US$0.4 million (H1

2020: US$210,000) as the Company remained focused on the completion

of the TEO. The exploration asset saw an exchange gain of US$0.4

million (H1 2019: exchange loss US$2.9 million) also due to the

strengthening of the Russian rouble to the US dollar.

Covid-19

Since the start of January 2020, Covid-19 has created

significant disruption to the global markets and economies,

including Russia. In order to keep safe its personnel, the Company

has put in place special measures to protect its workforce while at

the same time ensuring business continuity. Prior to the outbreak,

the Company had the facilities in place to allow remote working for

most members of staff. This capability has been enhanced to ensure

that the Company can continue to operate effectively over an

extended period of time without requiring regular access to

physical offices. The Company maintained close contact with its

contractors working on the Permanent Conditions TEO as they also

put in place procedures to work effectively over the period in

order to ensure that these TEO was completed and delivered.

As of the date of this report, Covid-19 has created a lot of

uncertainty and disruption in the financial markets. The Company

has not seen any negative impact of Covid-19 on its ability to

raise funds, having completed multiple equity placements throughout

2020.

Outlook

The Company's principal objective is to work towards the full

registration of its reserve, compilation of its operational design

and the conversion of the Russian based work for incorporation in a

western Bankable Feasibility Study ("BFS"). The BFS provides the

necessary technical, environmental and economic detail for

institutional investors to advance funding for construction and

production. The BFS is itself a considerable undertaking and the

Amur team has been working on the detailed planning and costing of

the BFS programme. This has required considerable interaction with

both Russian and international organisations qualified in compiling

both Russian and western BFS level work.

In conjunction with the development of the BFS work programme,

the Company has also been keeping discussions open with potential

offtake partners, funding sources and governmental infrastructure

support agencies. It is the Company's belief that the successful

completion of a binding offtake agreements will provide access to

institutional investors providing financing options for BFS

programme and any associated work. Downline metallurgical processes

are also being investigated to determine if battery ready sulphate

products can be generated. We envisage that this funding will be

principally through funding at the asset level and would be

sufficient to fund the BFS programme and sustain the Company's

activity through to the completion of the BFS.

On behalf of the Board of Directors, I would like to thank all

the staff, consultants and Russian agencies for their dedication

and hard work throughout this period in successfully delivering the

TEO for its subsequent use in the registration of reserves in

accordance with Russian Federation regulatory standards.

Mr. Robert W. Schafer

Non Executive Chairman

29 September 2021

AMUR MINERALS CORPORATION

consolidated STATEMENT OF FINANCIAL POSITION

AS AT 30 June 2021

(Amounts in thousands of US Dollars)

Unaudited Unaudited Audited

30 June 2021 30 June 31 December

Note 2020 2020

Non-current assets

Exploration and evaluation

assets 5 24,364 24,413 23,542

Property, plant and equipment 266 734 452

Financial assets at fair value

through profit and loss 6,137 - 5,255

30,767 25,147 29,249

-------------- ------------ -------------

Current assets

Inventories 209 238 207

Other receivables 234 146 158

Cash and cash equivalents 1,846 831 2,790

------------ -------------

2,289 1,215 3,155

-------------- ------------ -------------

Total assets 33,056 26,362 32,404

-------------- ------------ -------------

Current liabilities

Trade and other payables 836 1,191 913

Rehabilitation provision - - -

836 1,191 913

-------------- ------------ -------------

Net current assets 1,453 24 2,242

-------------- ------------ -------------

Non-Current Liabilities

Rehabilitation provision 145 144 141

Total non-current liabilities 145 144 141

-------------- ------------ -------------

Net assets 32,075 25,027 31,350

============== ============ =============

Equity

Share capital 7 80,449 71,012 80,449

Share premium 4,278 4,748 4,278

Foreign currency translation

reserve (17,091) (15,902) ( (17,474)

Share options reserve 683 1,534 577

Warrant Reserve - 93 -

Accumulated deficit (36,244) (36,458) (36,480)

Total equity 32,075 25,027 31,350

============== ============ =============

Approved on behalf of the Board on 29 September 2021

Robin Young

The accompanying notes on pages 7 to 11 form an integral part of

the financial information

AMUR MINERALS CORPORATION

CONSOLIDATED STATEMENT of COMPREHENSIVE INCOME

FOR THE six monthsED 30 June 2021

(Amounts in thousands of US Dollars)

Unaudited Unaudited

6 Months 6 Months Audited

ended ended Year ended

30 June 30 June 31 December

Note 2021 2020 2020

Administrative expenses (1,154) (1,297) (3,083)

Operating loss (1,154) (1,297) (3,083)

Finance income 327 - 205

Finance expense - (104) (104)

Fair value movements on derivative

financial instruments and loans - (109) -

Gain on revaluation of assets

held at fair value through profit

and loss 1,046 - 423

Loss on early redemption - - (109)

Foreign exchange 17 - -

Profit/(Loss) before tax 236 (1,510) (2,668)

Tax expense - - -

Profit/ (Loss) for the period

/ year attributable to owners

of the parent 236 (1,510) (2,668)

=========== ========= ============

Other Comprehensive (loss) / income:

Items that could be reclassified

to profit or loss

Exchange differences on translation

of foreign operations 383 (3,037) (4,123)

Total comprehensive (loss) / income

for the period / year attributable

to owners of the parent 619 (4,547) (6,791)

=========== ========= ============

(Loss) per share: basic & diluted 4 US 0.02 US (0.17) US (0.25)

(expressed in cents)

The accompanying notes on pages 7 to 11 form an integral part of

the financial information.

AMUR MINERALS CORPORATION

CONSOLIDATED STATEMENT OF cash flowS

FOR THE SIX MONTHSED 30 JUNE 2021

(Amounts in thousands of US Dollars)

Unaudited Unaudited

6 Months 6 Months Audited

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Cash flows used in operating

activities:

Payments to suppliers and employees (1,040) (655) (2,196)

Interest paid - - -

Net cash outflow from operating

activities (1,040) (655) (2,196)

---------- ---------- -------------

Cash flow used in investing activities:

Payments for exploration expenditure (428) (210) (564)

Loans granted - - (4,658)

Payment for property, plant and - - -

equipment

Interest received 326 - 43

Net cash used in investing activities (102) (210) (5,179)

---------- ---------- -------------

Cash flow from financing activities:

Cash received on issue of shares,

net of issue costs - 1,460 10,005

Issue of convertible loan (net

of issue costs) - - 607

Loans received - 595 -

Loans repaid - (720) -

Repayment of convertible loan - - (720)

Net cash generated from financing

activities - 1,335 9,892

---------- ---------- -------------

Net (decrease)/increase in cash

and cash equivalents (1,142) 470 2,517

Cash and cash equivalents at

beginning of period / year 2,790 398 398

Effect of foreign exchange rates 198 (37) (125)

Cash and cash equivalents at

end of period / year 1,846 831 2,790

========== ========== =============

The accompanying notes on pages 7 to 11 form an integral part of

the financial information.

AMUR MINERALS CORPORATION

CONSOLIDATED Statement of changes in equity

FOR THE SIX MONTHSED 30 JUNE 2021

(Amounts in thousands of US Dollars)

Foreign

currency Share

Share translation options Warrant Accumulated

Share capital premium reserve reserve Reserve deficit Total

------------- -------- --------------- --------------- --------------- --------------- -------

At 1 January

2021 80,449 4,278 (17,474) 577 - (36,480) 31,350

Profit of the

period - - - - - 236 236

Exchange

differences on

translation of

foreign

operations - - 383 - - - 383

Total

comprehensive

income for the

period - - 383 - - 236 619

Issue of share - - - - - - -

capital

Costs of issue - - - - - - -

Options granted - - 106 - - 106

At 30 June 2021

(unaudited) 80,449 4,278 (17,091) 683 - (36,244) 32,075

============= ======== =============== =============== =============== =============== =======

At 1 January

2020 69,510 4,790 (12,865) 1,136 - (34,948) 27,623

Loss of the

period - - - - - (1,510) (1,510)

Other

comprehensive

income for the

period - - (3,037) - - - (3,037)

------------- -------- --------------- --------------- --------------- --------------- -------

Total

comprehensive

income for the

period - - (3,037) - - (1,510) (4,547)

Issue of share

capital 1,502 - - - - - 1,502

Costs of issue - (42) - - - - (42)

Options granted - - - 398 - - 398

Warrants granted - - - - 93 - 93

At 30 June 2020

(unaudited) 71,012 4,748 (15,902) 1,534 93 (36,458) 25,027

============= ======== =============== =============== =============== =============== =======

At 1 January

2020 69,510 4,790 (13,351) 1,136 - (34,948) 27,137

Loss for the

year - - - - - (2,668) (2,668)

Exchange

differences on

translation of

foreign

operations - - (4,123) - - - (4,123)

Total

comprehensive

loss for the

period - - (4,123) - - (2,668) (6,791)

Issue of share

capital 10,063 (512) - - - - 9,551

Conversion of

warrants 876 - - - - - 876

Options charge

for the year - - - 577 - - 577

Options expired - - - (1,136) - 1,136 -

At 31 December

2020 (audited) 80,449 4,278 (17,474) 577 - (36,480) 31,350

============= ======== =============== =============== =============== =============== =======

The accompanying notes on pages 7 to 11 form an integral part of

the financial information.

1. Reporting Entity

Amur Minerals Corporation (the "Company" or the "Group") is a

company domiciled in the British Virgin Islands. The consolidated

interim financial information as at and for the six months ended 30

June 2021 comprise the results of the Company and its subsidiaries

(together referred to as the "Group").

The consolidated financial statements of the Group as at and for

the year ended 31 December 2020 are available upon request from the

Company's registered office at Kingston Chambers, P.O. Box 173,

Road Town, Tortola, British Virgin Islands or at

www.amurminerals.com.

2. BASIS OF PREPARATION

The financial information set out in this report is based on the

consolidated financial information of Amur Minerals Corporation and

its subsidiary companies. The financial information of the Group

for the 6 months ended 30 June 2021 was approved and authorised for

issue by the Board on 29 September 2021. The interim results have

not been audited. This financial information has been prepared in

accordance with the accounting policies that are expected to be

applied in the Report and Accounts of Amur Minerals Corporation for

the year ended 31 December 2021 and are consistent with the

recognition and measurement requirements of IFRS as adopted by the

European Union. The auditor's report on the Group accounts to 31

December 2020 whilst unqualified raised a material uncertainty

relating to going concern due to the lack of certainty over future

funding. The comparative information for the full year ended 31

December 2020 is not the Group's full annual accounts for that

period but has been derived from the annual financial statements

for that period.

The consolidated financial information incorporates the results

of Amur Minerals Corporation and its subsidiaries undertakings as

at 30 June 2021. The corresponding amounts are for the year ended

31 December 2020 and for the 6 month period ended 30 June 2020.

The Group financial information is presented in US Dollars

('US$') and values are rounded to the nearest thousand Dollars.

The same accounting policies, presentation and methods of

computation are followed in the interim consolidated financial

information as were applied in the Group's latest annual audited

financial statements except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 January 2021, and will be adopted in the

2021 annual financial statements.

A number of new standards, amendments and became effective on 1

January 2021 and have been adopted by the Group. None of these

standards have materially affected the Group.

3. GOING CONCERN

The Group operates as a natural resources exploration and

development group. To date, the Group has not earned significant

revenues and is considered to be in the exploration stage.

The Directors have reviewed the Group's cash flow forecast for

the period to 31 December 2022 and plan to continue advancing the

project in 2021 - 2022. Post 30 June 2021, the Company completed

the sale of Carlo Holdings Limited for cash consideration of US$6.1

million, which was received in full.

As the Group approaches bankable feasibility, an alternative

funding option will need to be secured in order to adequately fund

this step. The Directors are currently in negotiations with a

number of parties in respect of raising further funds. Whilst

progress is being made on a number of potential transactions which

would provide adequate funding to the Group, there are no binding

agreements in place. The Company was successful in completing three

equity placements in 2020 and while the Directors are confident of

raising additional funding should it be required, their ability to

do this is not completely within in their control.

Based on the current progress of the negotiations with potential

investors and providers of finance the Directors believe that the

necessary funds to provide adequate financing to continue with the

current work program on its Kun-Manie project will be raised as

required and accordingly they are confident that the Group will

continue as a going concern and have prepared the financial

statements on that basis.

The financial statements do not include the adjustments that

would result if the Group was not able to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

4. PROFIT/(LOSS) PER SHARE

Basic and diluted profit/(loss) per share is calculated and set

out below. The effects of warrants and share options outstanding at

the period end are anti-dilutive as they will serve to reduce the

profit/(loss) per share. A total of 90.1 million of potential

ordinary shares have therefore been excluded from the following

calculations:

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Net profit/(loss) for the

period / year 236 (1,510) (2,688)

Weighted average number

of shares for the period/year 1,379,872,315 878,022,210 1,071,175,000

Basic profit/(loss) per

share (expressed in cents) US 0.02 US (0.17) US (0.25)

-------------- -------------- --------------

5. Exploration and evaluation assets

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

At start of the period

/ year 23,542 26,713 26,713

Additions 428 557 1,154

Foreign exchange differences 394 (2,857) (4,325)

At end of the period /

year 24,364 24,413 23,542

=================== ============== =============

The Group did not recognise any impairment in respect of its

exploration and evaluation assets during the period (H1 2020: nil)

(2020: nil).

6. SHARE BASED PAYmENTS

Options:

No options were granted during the period ended 30 June 2021. In

the period ended 30 June 2020, 55,619,260 new options were granted

to Directors, management and Russian employees.

At 30 June 2021 the following options were outstanding at the

beginning and end of the period:

Outstanding at 1 January

2021 55,619,260

Granted -

Exercised -

Expired (20,309,630)

Vesting 7,500,000

-------------

Outstanding at 30 June

2021 42,809,630

=============

The fair value of the options is estimated at the grant date

using a Black-Scholes model, taking into account the terms and

conditions on which the options were granted. This uses inputs for

share price, exercise price, expected volatility, option life,

expected dividends and risk-free rate.

The share price is the price at which the shares can be sold in

an arm's length transaction between knowledgeable, willing parties

and is based on the mid-market price on the grant date. The

expected volatility is based on the historic performance of Amur

Minerals shares on the Alternative Investment Market of the London

Stock Exchange. The option life represents the period over which

the options granted are expected to be outstanding and is equal to

the contractual life of the options. The risk-free interest rate

used is equal to the yield available on the principal portion of US

Treasury Bills with a life similar to the expected term of the

options at the date of measurement.

The total charge arising from outstanding options for the period

was US$105,527 (H1 2020: US$398,000; December 2020:

US$484,546).

Warrants:

No warrants were granted during the period ended 30 June 2021.

In the period ended 30 June 2020, 13,000,000 new warrants were

granted to participants of the equity placing completed on 4

November 2019. In conjunction with the Loan Note Instrument entered

into by the Company on 13 March 2020, 52,447,552 new warrants were

granted and are treated as equity instruments. The loan was fully

repaid on 4 May 2020. On 25 August 2020, 4,105,495 warrants were

awarded to consultants.

At 30 June 2021 the following warrants were outstanding at the

beginning and end of the period:

Outstanding at 1 January

2021 42,022,550

Granted -

Exercised -

Expired -

Outstanding at 30 June

2021 42,022,550

===========

There was no charge arising from outstanding warrants for the

period (H1 2020: nil; December 2020: nil).

7. share Capital

Audited

Unaudited Unaudited 31 December

30 June 2021 30 June 2020 2020

--------------- --------------- --------------

Number of Shares (no

par value):

Authorised 2,000,000,000 2,000,000,000 2,000,000,000

=============== =============== ==============

Total issued 1,379,872,315 968,060,149 1,379,872,315

=============== =============== ==============

8. RELATED PARTIES

For the purposes of these financial statements, entities are

considered to be related if one party has the ability to control

the other party or exercise significant influence over the other

party in making financial or operational decisions as defined by

IAS 24 "Related Party Disclosures". In addition, other parties are

considered to be related if they are under common control. In

considering each possible related party relationship, attention is

directed to the substance of the relationship, not merely the legal

form.

Details of transactions between the Group and related parties

are disclosed below.

Compensation of Key Management Personnel

Key management personnel are considered to be the Directors and

senior management of the Group

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Salaries and fees 501 469 830

Share-based payments 89 398 434

501 867 1,264

============== ============== =============

9. EVENTS AFTER THE REPORTING DATE

On 5 July 2021, the Company sold its wholly owned subsidiary

Carlo Holdings Limited for a cash consideration of US$6,137,019

pursuant to a share sale agreement entered into on 3 July 2021 with

Hamilton Investments Pte. Ltd., a subsidiary of Britmar (Asia) Pte

Ltd.

On 20 August 2021, the Company announced that Oreall LLC

completed the Permanent Conditions Report ("TEO") on its far east

Russia Kun-Manie nickel copper sulphide project and it was

submitted for review by the Russian Government Commission for

Natural Resources Reserves.

10. INTERIM REPORT

Copies of this interim report for the six months ended 30 June

2021 will be available from the Company's website

www.amurminerals.com .

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Company Nomad and Broker Public Relations

Amur Minerals Corp. S.P. Angel Corporate Finance Blytheweigh

LLP

Robin Young CEO Richard Morrison Megan Ray

Adam Cowl Tim Blythe

+44 (0) 20 7138

+7(4212)755615 +44(0)20 3470 0470 3203

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNNASFFEFA

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

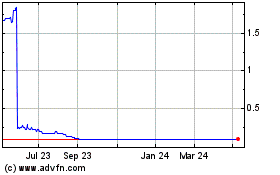

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024