TIDMAML

RNS Number : 5867S

Aston Martin Lagonda Global Hld PLC

15 July 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, CHINA OR

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH ACTIVITY WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION. THE INFORMATION CONTAINED

HEREIN DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER TO ISSUE OR

SELL, OR ANY SOLICITATION OF ANY OFFER TO SUBSCRIBE OR PURCHASE,

ANY INVESTMENTS IN ANY JURISDICTION.

15 July 2022

Aston Martin Lagonda Global Holdings plc

Proposed New Equity Financing and Strategic Investment by the

Public Investment Fund ("PIF")

Aston Martin Lagonda Global Holdings plc (" Aston Martin ", "

Aston Martin Lagonda " or the " Company ") today provides the

following market update

-- GBP653m. proposed equity capital raise with the proceeds used

to meaningfully de-leverage the balance sheet, strengthen and

accelerate long-term growth

-- Leading global investment fund, PIF, to become a new anchor

investor and the second largest shareholder

-- PIF, the Yew Tree Consortium and Mercedes-Benz AG to invest c. GBP335m in total

-- Proposed equity capital raise provides clear pathway for

significant shareholder value creation with pro-forma cash of

GBP500 - 600m post debt pay down, driving Aston Martin's growth

ambitions and supporting positive free cash flow generation from

2024

-- FY 2022 outlook reaffirmed in H1 trading update with strong demand trends continuing

-- Company also announces the Board's rejection of Atlas Consortium Proposal

Proposed Equity Capital Raise

The Company announces its intention to undertake a proposed

equity capital raise (the "Capital Raise") to meaningfully

deleverage the balance sheet, strengthen and accelerate its

long-term growth. The Company confirms the following plans for a

linked primary issuance of shares, subject to shareholder and

regulatory approvals:

-- a proposed placing of approximately 23.3 million new ordinary

shares at a price of GBP3.35 per ordinary share in the capital of

the Company to PIF (the "Placing Shares"), conditional upon the

subsequent underwritten rights issue, to raise approximately GBP

78.0 million (the "Placing"), representing approximately 16.7% of

the post-placing share capital of the Company; and

-- a subsequent underwritten rights issue to raise approximately

GBP 575 million (the "Rights Issue" and, together with the Placing,

the "Capital Raise").

The Company intends to use the net proceeds from the Capital

Raise for the following purposes:

-- up to half to repay existing debt, strengthening financial

resilience and improving the company's cash flow generation by

reducing its interest costs;

-- the balance to maintain a substantial liquidity cushion to

underpin and accelerate future capital expenditure, and to support

execution of its targets in what remains a challenging operating

environment, impacted by the war in Ukraine, COVID-19 lockdowns in

China, as well as continued supply chain and logistics

disruptions

The Capital Raise has been in development for some time, and

follows a comprehensive Board review of the Company's optimal

capital structure and growth capital requirements over the

medium-term and beyond, as well as the debt reduction required in

order to achieve a net debt leverage ratio of c. 1-1.5x by

2024/25.

Over the coming years, Aston Martin's capital expenditure

profile, enhanced by this Capital Raise, will focus on:

-- next year's next-generation front-engine sports cars, and furthering the DBX offering,

-- the development of the Group's high margin mid-engine

vehicles, including the Valhalla special edition,

-- its electric platform for future sports cars/GTs and SUVs,

working towards the following timelines:

o 2024: First PHEV targeted for delivery

o 2025: First BEV targeted for launch

o 2030: Fully electrified GT/Sport and SUV portfolio

The Board believes the proposed Capital Raise will serve to

further support the Company's re-affirmed medium-term targets of c.

10,000 wholesales, c. GBP2bn revenue and c. GBP500m adjusted EBITDA

by 2024/25, and strongly positions it for positive FCF generation

from 2024.

The specific terms and conditions of the Capital Raise will be

announced by the Company in due course. The Company expects to

separately publish a circular (the "Circular") in mid-August, which

will contain notice of the General Meeting of the Company (the

"General Meeting") required in connection with the Capital Raise,

which it is expected will take place in early September and at

which the Company will seek approval from its shareholders. It is

expected that a prospectus, (the "Prospectus") containing further

information on the Capital Raise will also be published in early

September and in any event before the General Meeting and that

completion of the Capital Raise will take place by the end of

September.

In connection with the Capital Raise, the Company confirms

that:

-- PIF has entered into a binding transaction agreement with the

Company on the date of this announcement. Pursuant to this

agreement, PIF and the Company agree to use reasonable endeavours

to negotiate in good faith and finalise all definitive documents in

relation to PIF's participation in the Capital Raise, and to enter

into such definitive documents immediately prior to announcement of

the Capital Raise. PIF's participation in the Placing remains

subject to customary conditions, in addition to the Rights Issue

being fully underwritten ahead of launch;

-- PIF will also have the right, subject to owning more than 7%

of the Company's voting rights, to a Non-Executive Director seat as

a Shareholder Representative on the Aston Martin Board of

Directors, and the right to a second Non-Executive Director seat

provided that PIF owns more than 10% of the Company's voting

rights;

-- Goldman Sachs International acted as sole Financial Adviser to PIF;

-- Yew Tree Overseas Limited (on its own behalf and in its

capacity as Representative Shareholder on behalf of the members of

the Yew Tree Consortium, being Yew Tree Overseas Limited, Saint

James Invest SA, J.C.B. Research, RRRR Investments LLC, John Idol,

Francinvest Holding Corporation, ErsteAM Ltd and Omega Funds I

Limited) which owns approximately 22.0% of the issued share capital

of the Company as at the date of this announcement and which is

expected to own approximately 18.3% following the proposed Placing,

has irrevocably agreed to: (a) vote in favour of the Capital Raise

at the General Meeting; and (b) take up in full its entitlement to

shares to be issued in the Rights Issue for a total equity

investment of GBP105.3 million;

-- Mercedes-Benz AG which owns approximately 11.7% of the issued

share capital of the Company as at the date of this announcement

and which is expected to own approximately 9.7% following the

proposed Placing has irrevocably agreed to: (a) vote in favour of

the Capital Raise at the General Meeting; and (b) take up in full

its entitlement to shares to be issued in the Rights Issue for a

total equity investment of GBP56.0 million ;

-- The Company continues to enjoy a long-term strategic

relationship with MBAG as evidenced by their proposed investment

and our planned deployment of MBAG technologies, accessed via

tranche 1 of the Strategic Cooperation Agreement (the "SCA"), in

new product ranges delivered 2022 through 2025. The strength of

relationship makes it natural that the Company is exploring a BEV

partnership with them, as it has the option to via tranche 2 of the

SCA, subject to reaching a commercial agreement, which would be

targeted for the benefit of financial year 2026 and onwards. The

Company would note that the structure and terms of the SCA may be

amended in due course, having regards to the best interests of the

Company, to better reflect Aston Martin's planned BEV time horizons

and the impact of the Capital Raise.

-- In addition, the Company has entered into a standby

underwriting letter on the date of this announcement with J.P.

Morgan Securities plc (which conducts its UK investment banking

business as J.P. Morgan Cazenove) and Barclays Bank PLC (the

"Banks"), pursuant to which the Banks have agreed to underwrite on

a standby basis the Rights Issue up to GBP318 million, which

excludes the shares undertaken to be taken up by PIF, Yew Tree

Overseas Limited and Mercedes-Benz AG. The standby underwriting

letter contains customary representations and warranties,

conditions and termination rights, and the Rights Issue will be

subject to customary conditions.

H1 2022 trading update

Aston Martin is pleased to reaffirm its 2022 outlook with strong

demand trends continuing:

-- The Company continued to benefit from strong demand across

its product lines, with GT/Sports cars fully sold out into 2023 and

order intake for DBX more than 40% higher year-on-year

-- Despite supply chain disruption impacting the timing of early

DBX 707 deliveries in Q2, order intake remains robust and in-line

with expectations

-- As noted above, supply chain and logistics disruptions,

including COVID-19 lockdowns in China, impacted wholesale volumes,

most notably DBX deliveries in Q2

- H1 wholesale volumes of 2,676 (H1 2021: 2,901)

-- Wholesale ASP continued to increase year-on-year, supported

by strong pricing dynamics throughout the core portfolio, as well

as FX tailwinds

-- Initial deliveries of the fully sold out V12 Vantage run of

333 cars commenced in Q2, with expected H2 ramp supportive of gross

margin progression

-- 27 Aston Martin Valkyrie deliveries in H1 2022. Production

rates continued to increase with 38 vehicles assembled in H1 and

the Company remains on track to achieve its full year target range

(75-90)

-- Given FX movements during the period, the Company anticipates

a further FX revaluation impact (mostly non-cash) on its dollar

denominated debt

-- In addition to its planned capital expenditure in H1 2022 and

cash interest payment in Q2 2022, the Company's H1 free cash flow

and cash balance was highly impacted by elevated working capital

outflows related to supply chain and logistics disruptions, as well

as movements in the level of usage of the revolving credit facility

at the end of the period. The Company expects cashflows from

working capital to significantly improve in the second half of the

year

-- The Company continues to trade in line with expectations for

full year 2022 and reaffirms its operational financial guidance for

the year as follows:

- Wholesales: growth to > 6,600 units

- Adjusted EBITDA margin: c.350-450bps expansion

- Capex and R&D: c.GBP300m

- Depreciation and amortisation: c.GBP315m-GBP330m

The Company's Interim Results for the six months to 30 June 2022

will be announced on 29 July 2022

Atlas Consortium Proposal

On 8 July 2022, the Company received a proposal (the "Proposal")

from Investindustrial Group Holdings S.à r.l. ("InvestIndustrial")

and Geely International (Hong Kong) Limited ("GIHK")

(Investindustrial and GIHK together being referred to the "Atlas

Consortium") for an equity investment of up to GBP1.3 billion in

aggregate into the Company comprising of a GBP203 million firm

placing and subsequent GBP1,105 million underwritten rights issue

(pursuant to which the Atlas Consortium would take up its pro rata

rights for approximately GBP300 million and underwrite, subject to

relevant regulatory and shareholder approvals, any residual shares

not taken up by existing shareholders.)

The Board of Aston Martin considered the Proposal carefully in

the light of the Company's current financial performance and future

capital requirements. Having done so, the Board does not believe

that the Proposal presented an attractive funding option or value

creation opportunity for existing shareholders. Accordingly, the

Board unanimously rejected the Proposal and believes there is no

basis for further discussion.

The Board of Aston Martin believes that the Proposal markedly

overestimated the Company's new equity capital requirements, would

have been heavily dilutive for existing shareholders, and comprised

a number of execution obstacles.

Furthermore, the structure of the Proposal and the nature of its

delivery are such that the Board of Aston Martin considered this an

attempt by the Atlas Consortium to acquire a controlling and

prospectively majority ownership position without any premium paid

to existing shareholders.

Commenting on this announcement, Lawrence Stroll, Executive

Chairman of the Board, said:

"Today's announcement marks the latest success in the evolution

of Aston Martin, the restoration of the business and balance sheet

we inherited, and the acceleration of our long-term growth

potential. Since I became Executive Chairman in 2020, we have made

significant progress on our journey to become the world's most

desirable, ultra-luxury British performance brand.

We started by fixing the core fundamentals of the Company,

successfully de-stocking the dealer network to rebalance supply to

demand, optimising inventory levels aligned for an ultra-luxury

business, and now benefit from the strongest order book we have

seen in many years. We also signed a strategic co-operation

agreement with Mercedes-Benz and have developed a breathtaking

pipeline of products, starting with the DBX707 and V12 Vantage, all

of which are aligned with our 40%+ contribution margin targets - a

significant increase from the past.

Aston Martin's return to the pinnacle of motorsport with the

Aston Martin Aramco Cognizant Formula One(TM) team, has also

ushered in a new era for our iconic British brand. Our focus on

building brand equity and unleashing the potential of Aston Martin

is already delivering growing demand from a new generation of

customers, with more than 60% new to the brand in 2021.

I am delighted to welcome the Public Investment Fund as a new

anchor shareholder in the Company, alongside my consortium. We have

a shared vision and our joint participation in this important

strategic financing demonstrates both our confidence in the

prospects for the Company and our commitment to the future success

of Aston Martin.

I would also like to thank Mercedes-Benz for their continued

support and investment as well as the strong long-term partnership

we have created.

Overall, this is a game changing event for Aston Martin,

supporting the delivery of our strategic plans and accelerating our

long-term growth potential. It transforms our balance sheet,

liquidity and cashflow profile and provides greater clarity on our

pathway to become sustainably free cash flow positive and create

significant shareholder value. With the new leadership team in

place, led by Amedeo Felisa, we have the right team and the right

strategy to fully realise the long-term potential of Aston

Martin."

Appointment of Corporate Broker

Aston Martin also announces the appointment of Barclays Bank PLC

("Barclays") as its joint Corporate Broker, alongside J. P. Morgan

Securities PLC, with immediate effect.

Other information

This announcement includes inside information as defined in

Article 7 of the UK Market Abuse Regulation No. 596/2014 as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018 and is being released on behalf of the

Company by Liz Miles, Company Secretary.

The financial information contained herein is unaudited.

All metrics and commentary in this announcement exclude

adjusting items unless stated otherwise and certain financial data

within this announcement have been rounded.

Conference Call

-- There will be a call for investors and analysts today at 08:30am

-- The conference call can be accessed live via the corporate website https://www.astonmartinlagonda.com/investors/calendar

-- A replay facility will be available on the website later in the day

-- Interim Results for the six months to 30 June 2022 will be announced on 29 July 2022

Enquiries

Investors and Analysts

Sherief Bakr Director of Investor Relations +44 (0)7789 177547

sherief.bakr@astonmartin.com

Holly Grainger Deputy Head, Investor Relations +44 (0)7442 989551

holly.grainger@astonmartin.com

Media

Kevin Watters Director of Communications +44 (0)7764 386683

kevin.watters@astonmartin.com

Paul Garbett Head of Corporate and Brand +44 (0)7501 380799

Communications paul.garbett@astonmartin.com

Grace Barnie Corporate Communications +44 (0)7880 903490

Manager grace.barnie@astonmartin.com

Tulchan Communications

Harry Cameron and Simon Pilkington +44 (0)20 7353 4200

J.P. Morgan Cazenove (Lead Financial

Adviser, Joint Global Coordinator,

Joint Bookrunner, Sole Sponsor and

Corporate Broker)

Robert Constant

James A. Kelly

Will Holyoak +44 (0)20 7742 4000

Barclays (Financial Adviser, Joint

Global Coordinator, Joint Bookrunner

and Corporate Broker)

Enrico Chiapparoli

Lawrence Jamieson

Alastair Blackman

Arthur Schuetz +44 (0) 20 7623 2323

Notes to editors

About PIF

The Public Investment Fund ("PIF") is one of the largest and

most impactful sovereign wealth funds in the world. Since 2015,

when the Board was reconstituted and oversight transferred to the

Council of Economic and Development Affairs, the Fund's board of

directors has been chaired by HRH Prince Mohammed bin Salman Al

Saud, Crown Prince, Deputy Prime Minister and Chairman of the

Council for Economic and Development Affairs. As of April 2022,

PIF's Assets Under Management have reached more than $620 billion

(over 2.3 trillion Saudi Riyals). The Fund plays a leading role in

advancing Saudi Arabia's economic transformation and

diversification, as well as contributing to shaping the future of

the global economy. Since 2017, the Fund has established 54

companies and created, directly and indirectly, more than 500,000

jobs as at the end of 2021.

PIF is building a diversified portfolio by entering into

attractive and long-term investment opportunities in 13 strategic

sectors in Saudi Arabia and globally. The Fund's strategy, as set

out in the PIF Program 2021-2025 - one of the Vision 2030

realization programs - aims to enable many promising sectors and

contribute to increasing local content by creating partnerships

with the private sector, in addition to injecting at least 150

billion riyals annually into the local economy. PIF works to

transfer technologies and localize knowledge to build a prosperous

and sustainable economy in Saudia Arabia. As the investment arm of

Saudi Arabia, the Fund looks to make unique investments, and is

building strategic alliances and partnerships with prestigious

international institutions and organizations, which contribute to

achieving real long-term value for the Kingdom in line with the

objectives of Vision 2030. PIF has also created an operational

governance model that reflects its main tasks and objectives, in

line with best international practices. Applying this model of

governance enhances the level of transparency and effectiveness in

decision-making and future progress.

More information about PIF can be found at www.pif.gov.sa

Media Contact: media@pif.gov.sa

IMPORTANT NOTICES

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement does not contain or constitute an offer for sale

or the solicitation of an offer to purchase securities in the

United States. No securities referred to herein have been or will

be registered under the US Securities Act of 1933 (the "Securities

Act") or under any securities laws of any state or other

jurisdiction of the United States and such securities may not be

offered, sold, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States

except pursuant to an applicable exemption from or in a transaction

not subject to the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. No public offering of

securities is being made in the United States. No securities

referred to herein, nor this announcement nor any other document

connected with the proposed transactions referred to herein has

been or will be approved or disapproved by the United States

Securities and Exchange Commission or by the securities commissions

of any state or other jurisdiction of the United States or any

other regulatory authority, and none of the foregoing authorities

or any securities commission has passed upon or endorsed the merits

of the proposed transactions or the securities referred to herein

or the adequacy of this announcement or any other document

connected with the proposed transactions referred to herein. Any

representation to the contrary is a criminal offence in the United

States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for any securities in any jurisdiction. No

offer or invitation to purchase or subscribe for, or any

solicitation to purchase or subscribe for, any securities will be

made in any jurisdiction in which such an offer or solicitation is

unlawful. The information contained in this announcement is not for

release, publication or distribution to persons in the United

States or Australia, Canada, Japan, the People's Republic of China

or the Republic of South Africa, and should not be distributed,

forwarded to or transmitted in or into any jurisdiction, where to

do so might constitute a violation of local securities laws or

regulations.

No representations or warranties, express or implied, are made

as to, and no reliance should be placed on, the accuracy, fairness

or completeness of the information presented or contained in this

release. This release contains certain forward-looking statements,

which are based on current assumptions and estimates by the

management of the Company. Past performance cannot be relied upon

as a guide to future performance and should not be taken as a

representation that trends or activities underlying past

performance will continue in the future. Such statements are

subject to numerous risks and uncertainties that could cause actual

results to differ materially from any expected future results in

forward-looking statements. These risks may include, for example,

changes in the global economic situation, and changes affecting

individual markets and exchange rates.

The Company provides no guarantee that future development and

future results achieved will correspond to the forward-looking

statements included here and accepts no liability if they should

fail to do so. The Company undertakes no obligation to update these

forward-looking statements and will not publicly release any

revisions that may be made to these forward-looking statements,

which may result from events or circumstances arising after the

date of this release.

This release is for informational purposes only and does not

constitute or form part of any invitation or inducement to engage

in investment activity, nor does it constitute an offer or

invitation to buy any securities, in any jurisdiction including the

United States, or a recommendation in respect of buying, holding or

selling any securities.

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the Financial Conduct Authority

("FCA") and not a prospectus and not an offer to sell, or a

solicitation of an offer to subscribe for or to acquire securities.

Neither this announcement nor anything contained herein shall form

the basis of, or be relied upon in connection with, any offer or

commitment whatsoever in any jurisdiction. Investors should not

purchase or subscribe for any transferable securities referred to

in this announcement except on the basis of information contained

in the Prospectus to be published by the Company in due course.

J.P. Morgan Securities plc (which conducts its UK investment

banking business as J.P. Morgan Cazenove) is authorised by the

Prudential Regulation Authority (the "PRA") and regulated by the

PRA and FCA. J.P. Morgan Cazenove is acting for the Company and no

other person in connection with this announcement and the proposed

transactions described herein and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of J.P. Morgan Cazenove nor for providing advice to any

person in relation to the proposed transactions described herein or

any other matter referred to in this announcement.

Barclays Bank PLC, acting through its investment bank

("Barclays"), which is authorised by the PRA and regulated in the

United Kingdom by the FCA and the PRA, is acting for the Company

and no other person in connection with this announcement and the

proposed transactions described herein and will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Barclays nor for providing advice to any

person in relation to the proposed transactions described herein or

any other matter referred to in this announcement.

None of J.P. Morgan Cazenove nor Barclays, nor any of their

respective subsidiaries, branches or affiliates, nor any of their

respective directors, officers or employees owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of J.P. Morgan Cazenove or

Barclays in connection with this announcement, any statement

contained herein, or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEGGGDRGXBDGDU

(END) Dow Jones Newswires

July 15, 2022 02:00 ET (06:00 GMT)

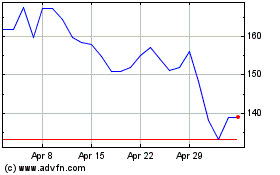

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024