TIDMAML

RNS Number : 0226B

Aston Martin Lagonda Glob.Hldgs PLC

28 September 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, CHINA OR

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH ACTIVITY WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION. THE INFORMATION CONTAINED

HEREIN DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER TO ISSUE OR

SELL, OR ANY SOLICITATION OF ANY OFFER TO SUBSCRIBE OR PURCHASE,

ANY INVESTMENTS IN ANY JURISDICTION.

28 September 2022

Aston Martin Lagonda Global Holdings plc

("Aston Martin Lagonda", the "Company" or the "Group")

Results of the Rump Placing

Following the announcement on 28 September 2022 regarding valid

acceptances under the fully underwritten Rights Issue announced by

Aston Martin Lagonda on 5 September 2022, the Company confirms that

J.P. Morgan Securities plc, Barclays Bank PLC, Credit Suisse

International and Deutsche Bank AG, London Branch, in their

capacity as Underwriters, have procured subscribers for all of the

31,737,331 New Ordinary Shares for which valid acceptances were not

received, representing approximately 5.7 per cent. of the New

Ordinary Shares, at a price of 132 pence per New Ordinary Share

(the "Placing Price"). Capitalised terms used but not defined

herein have the meanings assigned to them in the prospectus

published on 5 September 2022 (the "Prospectus").

The net proceeds from the placing of such New Ordinary Shares

(after the deduction of the Issue Price of 103 pence per New

Ordinary Share and the expenses of procuring subscribers including

any applicable brokerage and commissions and amounts in respect of

VAT which are not recoverable) will be paid (without interest) to

those persons whose rights have lapsed in accordance with the terms

of the Rights Issue, pro rata to their lapsed provisional

allotments, save that individual amounts of less than GBP5.00 will

not be paid to such persons but will be aggregated and paid to the

Company.

The Company also notes that: (i) The Public Investment Fund has

subscribed for 14,000,000 New Ordinary Shares at the Placing Price,

for an aggregate consideration of GBP18,480,000; and (ii) Yew Tree

Overseas Limited has subscribed for 4,860,469 New Ordinary Shares

at the Placing Price, for an aggregate consideration of

GBP6,415,819. The Public Investment Fund and Yew Tree Overseas

Limited are both related parties of the Company and these

transactions constitute smaller related party transactions for the

Company under Listing Rule 11.1.10R.

Enquiries

Investors and Analysts

Sherief Bakr Director of Investor Relations +44 (0)7789 177547

sherief.bakr@astonmartin.com

Holly Grainger Deputy Head, Investor Relations +44 (0)7442 989551

holly.grainger@astonmartin.com

Media

Kevin Watters Director of Communications +44 (0)7764 386683

kevin.watters@astonmartin.com

Paul Garbett Head of Corporate and Brand +44 (0)7501 380799

Communications paul.garbett@astonmartin.com

Grace Barnie Corporate Communications +44 (0)7880 903490

Manager grace.barnie@astonmartin.com

Tulchan Communications

Harry Cameron and Simon Pilkington +44 (0)20 7353 4200

J.P. Morgan Cazenove (Joint Global

Coordinator, Joint Bookrunner, Sole

Sponsor and Corporate Broker)

Robert Constant

James A. Kelly

Will Holyoak

Charles Oakes +44 (0)20 7742 4000

Barclays (Joint Global Coordinator,

Joint Bookrunner and Corporate Broker)

Enrico Chiapparoli

Lawrence Jamieson

Alastair Blackman

Arthur Schuetz +44 (0) 20 7623 2323

Credit Suisse International (Joint

Bookrunner)

Matt Hall

Nick Koemtzopoulos

Omri Lumbroso

Sebastian Barleben +44 (0) 20 7888 8888

Deutsche Bank AG, London Branch (Joint

Bookrunner)

Derek Shakespeare

Mark Hankinson

Jochen Gehrke

Paul Frankfurt +44 (0) 20 7545 8000

IMPORTANT NOTICES

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy or completeness. The

information in this announcement is subject to change.

A copy of the Prospectus is available on the Company's website

at

https://www.astonmartinlagonda.com/investors/funding/september-2022-capital-raise

. Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement. The Prospectus provides

further details of the securities being offered pursuant to the

Rights Issue.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement does not contain or constitute an offer for sale

or the solicitation of an offer to purchase securities in the

United States. No securities referred to herein have been or will

be registered under the US Securities Act of 1933 (the "Securities

Act") or under any securities laws of any state or other

jurisdiction of the United States and such securities may not be

offered, sold, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States

except pursuant to an applicable exemption from or in a transaction

not subject to the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. No public offering of

securities is being made in the United States. No securities

referred to herein, nor this announcement nor any other document

connected with the proposed transactions referred to herein has

been or will be approved or disapproved by the United States

Securities and Exchange Commission or by the securities commissions

of any state or other jurisdiction of the United States or any

other regulatory authority, and none of the foregoing authorities

or any securities commission has passed upon or endorsed the merits

of the proposed transactions or the securities referred to herein

or the adequacy of this announcement or any other document

connected with the proposed transactions referred to herein. Any

representation to the contrary is a criminal offence in the United

States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for any securities in any jurisdiction. No

offer or invitation to purchase or subscribe for, or any

solicitation to purchase or subscribe for, any securities will be

made in any jurisdiction in which such an offer or solicitation is

unlawful. The information contained in this announcement is not for

release, publication or distribution to persons in the United

States or Australia, Canada, Japan, the People's Republic of China

or the Republic of South Africa, and should not be distributed,

forwarded to or transmitted in or into any jurisdiction, where to

do so might constitute a violation of local securities laws or

regulations.

No representations or warranties, express or implied, are made

as to, and no reliance should be placed on, the accuracy, fairness

or completeness of the information presented or contained in this

release. This release contains certain forward-looking statements,

which are based on current assumptions and estimates by the

management of the Company. Past performance cannot be relied upon

as a guide to future performance and should not be taken as a

representation that trends or activities underlying past

performance will continue in the future. Such statements are

subject to numerous risks and uncertainties that could cause actual

results to differ materially from any expected future results in

forward-looking statements. These risks may include, for example,

changes in the global economic situation, and changes affecting

individual markets and exchange rates.

The Company provides no guarantee that future development and

future results achieved will correspond to the forward-looking

statements included here and accepts no liability if they should

fail to do so. The Company undertakes no obligation to update these

forward-looking statements and will not publicly release any

revisions that may be made to these forward-looking statements,

which may result from events or circumstances arising after the

date of this release.

This release is for informational purposes only and does not

constitute or form part of any invitation or inducement to engage

in investment activity, nor does it constitute an offer or

invitation to buy any securities, in any jurisdiction including the

United States, or a recommendation in respect of buying, holding or

selling any securities.

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the Financial Conduct Authority

("FCA") and not a prospectus and not an offer to sell, or a

solicitation of an offer to subscribe for or to acquire securities.

Neither this announcement nor anything contained herein shall form

the basis of, or be relied upon in connection with, any offer or

commitment whatsoever in any jurisdiction. Investors should not

purchase or subscribe for any transferable securities referred to

in this announcement except on the basis of information contained

in the Prospectus published by the Company.

J.P. Morgan Securities plc (which conducts its UK investment

banking business as J.P. Morgan Cazenove) is authorised by the

Prudential Regulation Authority (the "PRA") and regulated by the

PRA and FCA. J.P. Morgan Cazenove is acting for the Company and no

other person in connection with this announcement and the proposed

transactions described herein and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of J.P. Morgan Cazenove nor for providing advice to any

person in relation to the proposed transactions described herein or

any other matter referred to in this announcement.

Barclays Bank PLC, acting through its investment bank

("Barclays"), which is authorised by the PRA and regulated in the

United Kingdom by the FCA and the PRA, is acting for the Company

and no other person in connection with this announcement and the

proposed transactions described herein and will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Barclays nor for providing advice to any

person in relation to the proposed transactions described herein or

any other matter referred to in this announcement.

Credit Suisse International is authorised in the United Kingdom

by the PRA and regulated in the United Kingdom by the FCA and the

PRA. Credit Suisse International is acting for the Company and no

other person in connection with this announcement and the proposed

transactions described herein and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of Credit Suisse International nor for providing advice to

any person in relation to the proposed transactions described

herein or any other matter referred to in this announcement.

Deutsche Bank AG is a joint stock corporation incorporated with

limited liability in the Federal Republic of Germany, with its head

office in Frankfurt am Main where it is registered in the

Commercial Register of the District Court under number HRB 30 000.

Deutsche Bank AG is authorised under German banking law. The London

branch of Deutsche Bank AG is registered in the register of

companies for England and Wales (registration number BR000005) with

its registered address and principal place of business at

Winchester House, 1 Great Winchester Street, London EC2N 2DB.

Deutsche Bank AG is authorised and regulated by the European

Central Bank and the German Federal Financial Supervisory Authority

(BaFin). With respect to activities undertaken in the UK, Deutsche

Bank AG is authorised by the PRA with deemed variation of

permission. It is subject to regulation by the FCA and limited

regulation by the PRA. The nature and extent of client protections

may differ from those for firms based in the UK. Details about the

Temporary Permissions Regime, which allows EEA-based firms to

operate in the UK for a limited period while seeking full

authorisation, are available on the FCA's website. Deutsche Bank

AG, London Branch, is acting for the Company and no other person in

connection with the Capital Raise. Neither Deutsche Bank AG, London

Branch nor any of its subsidiaries, branches or affiliates will be

responsible to any person other than the Company for providing any

of the protections afforded to clients of Deutsche Bank AG, London

Branch nor for providing advice in relation to the Capital Raise or

any matters referred to in this announcement.

None of J.P. Morgan Cazenove, Barclays, Credit Suisse

International nor Deutsche Bank AG, London Branch, nor any of their

respective subsidiaries, branches or affiliates, nor any of their

respective directors, officers or employees owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of J.P. Morgan Cazenove,

Barclays, Credit Suisse International or Deutsche Bank AG, London

Branch in connection with this announcement, any statement

contained herein, or otherwise.

Cautionary statement regarding forward-looking statements

This announcement contains forward-looking statements, including

with respect to financial information, that are based on current

expectations or beliefs, as well as assumptions about future

events. These forward-looking statements can be identified by the

fact that they do not relate only to historical or current facts.

Forward-looking statements often use words such as "anticipate",

"target", "expect", "estimate", "intend", "plan", "goal",

"believe", "will", "may", "should", "would", "could", "is

confident", or other words of similar meaning. Undue reliance

should not be placed on any such statements because they speak only

as at the date of this announcement and, by their very nature, they

are subject to known and unknown risks and uncertainties and can be

affected by other factors that could cause actual results, and the

Company's plans and objectives, to differ materially from those

expressed or implied in the forward-looking statements. No

representation or warranty is made that any forward-looking

statement will come to pass.

You are advised to read the Prospectus in its entirety, and, in

particular, the section of the Prospectus headed "Risk Factors",

for a further discussion of the factors that could affect the

Group's future performance and the industry in which it operates.

In light of these risks, uncertainties and assumptions, the events

described in the forward-looking statements, including statements

regarding prospective financial information, in this announcement

may not occur. These statements are not fact and should not be

relied upon as being necessarily indicative of future results, and

readers of this announcement are cautioned not to place undue

reliance on the forward-looking statements, including those

regarding prospective financial information.

No statement in this announcement is intended as a profit

forecast, and no statement in this announcement should be

interpreted to mean that underlying operating profit for the

current or future financial years would necessarily be above a

minimum level, or match or exceed the historical published

operating profit or set a minimum level of operating profit.

Neither the Company nor any of the Underwriters is under any

obligation to update or revise publicly any forward-looking

statement contained within this announcement, whether as a result

of new information, future events or otherwise, other than in

accordance with their legal or regulatory obligations (including,

for the avoidance of doubt, the Prospectus Regulation Rules, the

Listing Rules and Disclosure Guidance and Transparency Rules).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ARIBVLFLLKLEBBV

(END) Dow Jones Newswires

September 28, 2022 07:01 ET (11:01 GMT)

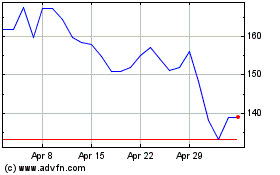

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024