TIDMAMRQ

RNS Number : 1433X

Amaroq Minerals Ltd

25 August 2022

AMAROQ Minerals - Q2 Financial Results and Operational

Update

TORONTO, ONTARIO - August 25(th) - 2022 - Amaroq Minerals Ltd.

("Amaroq" or the "Company" or the "Corporation") (AIM, TSXV: AMRQ),

the independent mining company with an unrivalled land package of

gold and strategic mineral assets covering an area of 7,866.85

km(2) in Southern Greenland, is pleased to provide an update on its

Q2 financials and operational activities in the first half of

2022.

H1 2022 highlights

Precious Metals targets

-- Nalunaq: Construction of mountain access roads required to

facilitate the 2022 core drilling programme completed ahead of

schedule and under budget.

-- Nalunaq: Drilling ahead of schedule with 7,300m of core

drilling out of a scheduled 9,100m completed across the Valley

Block with geological logging and sampling now underway. 2022

drilling focused on providing further resource confidence with a

view to increasing the Mineral Resource Estimate (MRE) in due

course.

-- Nalunaq: Preliminary Economic Assessment (PEA) commenced to

assess bulk sample and eventual mine re-opening optionality.

-- Vagar Ridge: Exploration aimed at understanding the styles

and geological controls on mineralisation continues, with 65% of

planned core drilling now complete despite unseasonal weather

during the period, targeting both Orogenic gold and Intrusion

Related Gold mineralisation.

-- Vagar Licence: Further geological mapping and sampling across

new targets identified by the 2021 exploration programme scheduled

for later in the season.

-- Nanoq: Contractors are mobilising to conduct an airborne

geophysical survey across the target, and along an interpreted 20km

structural corridor linking the discovery to the Jokum's Shear

gold/copper occurrence. This area is now held by Amaroq under the

newly acquired Siku licence securing access to multiple potential

Orogenic gold targets.

Strategic Mineral Targets

-- Sava: A 320m maiden scout core drilling programme to test

Iron Oxide, Copper, Gold (IOCG) mineralisation has targeted two

areas and samples are due to be dispatched to ALS Geochemistry

imminently.

-- North Sava: Contractors are mobilising to conduct an airborne

geophysical survey across North Sava to extend geological

understanding from Sava into the former Orano licence.

-- Stendalen: Amaroq is in negotiations to conduct an MT geophysical survey across this Iron-Vanadium-Titanium layered intrusive with additional Nickel and Copper potential.

-- Regional: Further geological reconnaissance and sampling

across the Eagle's Nest gold target, Kobbermineburgt copper targets

and the Paatusoq Rare Earth target are scheduled for later in the

2022 season.

Operational Update

-- Further investment in operational infrastructure and

equipment upgrades. With the 50 person all-weather camp in place at

Nalunaq and a satellite field camp in situ at Vagar Ridge, the

Company is now able to function more efficiently and to shorter

operational lead-times. The ALS on-site Containerised Preparation

Laboratory (CPL) has been installed and commissioned with the first

samples being dispatched.

-- Operational efficiency across all aspects of the Company's

Greenland assets significantly increased through key longer term

contracts with carefully selected service providers.

Corporate Update

-- Significant 3,527.75 km(2) mineral licence area has been

acquired from Orano substantially increasing the Company's exposure

to Base and Strategic Minerals. When coupled with the newly awarded

251 km(2) Siku licence, takes Amaroq's total land package in South

Greenland to 7,866.85km(2) .

-- Establishment of non-binding Joint Venture agreement with

ACAM LP for the exploration and development of Amaroq's Strategic

Mineral assets for a combined contribution of GBP36.7 million with

initial equity funding of GBP18 million following completion.

-- Cash balance of $19.5 at June 30, 2022.

-- Approval of special resolution to change the name of the Company to Amaroq Minerals Ltd.

Eldur Olafsson, CEO of Amaroq Minerals, commented:

"I am pleased to present an update on our activities for Q2

2022. Our field season for 2022 is well underway and we are making

solid progress with our drilling programmes at Nalunaq, Vagar Ridge

and Sava. We expect to share the results from this programme with

the market in late Q3 to Q4.

We are progressing with our strategic mineral exploration

programme in Southern Greenland with the support of our partners.

We remain focused on accelerating Greenland's contribution to the

energy transition as a frontier jurisdiction at a time when access

to these critical minerals for Western Governments and companies is

limited by Chinese and Russian control of supply.

We continue to invest in our highly qualified senior management

team, as well as selecting strong and reliable partners for

contract appointments. In addition, we are now benefitting from

considerably upgraded corporate governance systems and a

strengthened Board, which continues to guide the strategic vision

of our business."

Precious Metals 2022 Exploration Programme:

Nalunaq

-- The 2022 exploration programme is targeting further resource

development through both infill and strike extension drilling

across the Valley Block, informed by the Dolerite Dyke Model

developed and tested in 2021.

-- Two new mountain access roads to facilitate the extension

drilling have been completed ahead of schedule and under budget

(totalling $0.74m) and now are being utilised by two core drill

rigs.

-- To date approximately 7,300m of core (2,600m infill and

4,700m extension) drilling has been completed and geological

logging and sampling is now underway. A further 1,800m of core

drilling is scheduled for 2022.

-- ALS has completed the construction and commissioned an

on-site Containerised Preparation Laboratory (CPL) at Nalunaq to

oversee the preparation of all samples ahead of shipment to Ireland

for chemical assaying.

-- Amaroq geological teams have re-entered the historic mine to

assess the extension opportunities within the Mountain Block and

have identified further surface outcrops of the Main Vein, which

they intend to channel sample during this season to further define

this extension area.

-- Amaroq has continued to work with SRK to adapt the MRE

procedures to account for the Dolerite Dyke Model and the 2020 and

2021 drilling results with the aim of providing a further update to

the contained resources later in 2022.

-- A PEA for the project to assess bulk sample and eventual mine

re-opening optionality has been commenced.

-- Subject to results from the 2022 exploration programme,

Amaroq will continue to assess additional underground

infrastructure and underground bulk sample options for 2023, which

may include off-site toll treatment, subject to discussions with

the Government of Greenland. This would be used as a development

step to increase resource confidence and de-risk the resource ahead

of potential mine construction in 2024/2025.

-- The Corporation remains in discussion with mine development

contractors in order to mitigate programme delays, as the industry

average lead time today is 12 months.

-- The Company is in the process of updating its Environmental

Impact Assessment (EIA) and Social Impact Assessment (SIA), which

as previously announced it expects to complete over the course of

the next year.

Vagar Ridge

-- Following the exploration conducted in 2021, which

significantly increased the Vagar Ridge footprint, Amaroq have

commenced an approximately 2,000m core drilling programme across

the target to further understand its scale and geological controls

on mineralisation as a necessary step towards defining potential

resources.

-- At the time of reporting, approximately 1,300m has been

drilled across four drillholes with geological logging and sampling

in progress.

-- Geological reconnaissance and mapping is also underway over

the area, and Amaroq aims to supplement the drilling with a chip

channel sampling programme across the southern low grade granite

hosted areas of Vagar Ridge.

-- Unseasonal low cloud and sea fog in the last month has

hampered helicopter availability, a supply and health and safety

requirement for drilling in this remote location. This has slowed

drilling and delayed completion of the programme. Amaroq is looking

to reduce the impact of this by deploying a remote tented camp on

site.

-- Amaroq is utilising its experience and strong regional

understanding of South Greenland to progress with drilling and gain

a fuller understanding of the targets, and intends to update the

market on developments in due course.

Vagar Licence Targets

-- Due to the unseasonal weather, Amaroq has not yet commenced

the planned regional investigation of the target areas developed

following the interpretation of the 2021 geophysical programme,

which defined a significant deformation zone that extends for more

than 50km across the Vagar licence and into Amaroq's neighbouring

licences. This is currently scheduled for later in September.

Nanoq Gold

-- Amaroq's geophysical contractor New Resolution Geophysics

(NRG) began mobilising helicopter and equipment to Southern

Greenland on 22(nd) August and plans to commence an approximately

4,500 line km magnetic, radiometric and gravity survey over the

Nanoq target and the area connecting this target to Jokum's Shear

in the Nanortalik gold belt.

-- This area (located within the Corporation's newly awarded

251km(2) Siku mineral licence) hosts an interpreted 20km long

regional structure that could host multiple Orogenic gold

targets.

Eagle's Nest

-- Following an assessment of the 2021 exploration results in

the area, which are still being analysed, the Company intends to

continue its early stage geological reconnaissance mapping and

sampling aimed at making further Orogenic gold discoveries north of

Nalunaq.

-- This field work is provisionally scheduled for mid-September.

Strategic Mineral Targets 2022 Exploration Work Programme :

General

-- Significant 3,527.75 km (2) mineral licence area has been

acquired from Orano, which, with the newly awarded Siku licences,

takes Amaroq's total land package in South Greenland to 7,866.85km

(2) and substantially increasing the Company's exposure to Base and

Strategic Minerals. The acquisition means the Company will become

the largest licence holder in South Greenland, and the third

largest in Greenland, after Anglo American and Greenfields

Exploration.

-- Amaroq's ongoing Mineral System Modelling highlights the

potential of Southern Greenland to host significant strategic metal

deposits. These new licences sit within a n interpreted Laurasian

Mineral Belt connecting Eastern Canada through Greenland to

Scandinavia that hosts World Class mineral deposits such as

Voisey's Bay (Canada), Gardar Province (Greenland), and the Kiruna

IOCG belt (Scandinavia). Work programmes at Sava have illustrated

Iron Ore, Copper, Gold ("IOCG") style signatures across three

target areas.

Sava and North Sava

-- Following the successful 2021 season, which identified three

initial priority targets across the Sava IOCG and Porphyry Copper

licence, Amaroq has completed a 320m scout core drilling programme

over two drillholes on Targets West and Target South.

-- These samples have subsequently been prepared in the ALS CPL

at Nalunaq and are awaiting dispatch to Ireland for chemical

assaying.

-- A further sample has been sent to Durham University for

geological age dating to assess if the observed mineralisation is

related to the Gardar Intrusion suite that host the significant

deposits at Kavanefjeld and Tanbreez.

-- The Amaroq geological team has also conducted further surface

exploration and sampling aimed at expanding the current targets and

defining further targets for future investigation.

-- Building upon previous Orano geological interpretations,

Amaroq intends to conduct a similar geophysical survey to that

completed over Sava across the newly acquired North Sava licence.

This approximately 5,000 line km programme will be conducted by NRG

following completion of the Nanoq survey.

-- Multiple zones of veining and brecciation have been

discovered containing Copper Iron Sulphide mineralisation including

chalcopyrite and bornite mapped at surface at Sava, giving further

evidence of IOCG occurrence.

The Stendalen Iron-Vanadium-Titanium layered intrusive

-- Previously explored by GEUS, Softrock Mineral and NunaMineral

A/S. This intrusive is 8km in diameter and hosts a magnetic layer

up to 20m thick which has provided historical samples yielding

between 1-10.5% Titanium Dioxide (TiO (2) (average of 4.8%) and

226-5,753ppm Vanadium (V) (average 2,335ppm).

-- Stendalen also hosts potential for Nickel (Ni), Copper (Cu)

and Platinum Group Element (PGE) mineralisation with grab samples

proving grades of 0.8% Copper (Cu), 0.5% Nickel (Ni) and 0.1%

Cobalt (Co).

-- The Company is in negotiations to conduct an airborne

geophysical (MT) survey over the intrusion in order to understand

its scale, structure and potential for deep sulphide mineralisation

signatures. This survey will be coupled with a ground assessment of

the reported Ni/Cu sulphide mineralisation in the contact areas of

the intrusion. Finally, the Company will assess drill locations and

site logistics ahead of a core drilling programme in 2023 subject

to results.

The Paatusoq Rare Earth Element, Niobium, Tantalum, Zirconium

project

-- This syenite complex is 20 km in diameter covering an area of

240 km (2) within an unexplored section of the Gardar Province.

-- Amaroq plans to visit this new critical metals target within

the licences acquired from Orano during a regional exploration

programme in September. The aim of this will be to conduct

additional geochemical sampling to test the styles of

mineralisation and its relationship to the wider Gardar Province

that also hosts the Kvanefjeld and Tanbreez rare earth

projects.

Amaroq Minerals Infrastructure support

-- Amaroq has successfully continued the use of its all-weather

50-person camp as well as operating a small satellite tented camp

at Vagar Ridge to facilitate drilling there.

-- Since June, Amaroq has been operating with four drill rigs

across three sites and the Company is now assessing rig

requirements for 2023.

-- The Company has also finalised contracts with ALS

Geochemistry to install the Containerised Preparation Laboratory

(CPL) at Nalunaq, which has been fully installed and

commissioned.

-- Amaroq is experiencing material increases in its operational

efficiency during the 2022 season as a result of partnering with

key, carefully selected, contractors across its Greenland business.

This has resulted in programme objectives being meet ahead of

schedule, increased drilling rates, greater logistical flexibility

and aims to result in quicker return on sample results through the

second half of 2022.

Amaroq Minerals Financial Results

-- The Corporation had a cash balance of $19.5 million at June

30, 2022 ($23.8 million at March 31, 2022), with no debt, and total

working capital of $16.8 million ($22.6 million at March 31,

2022).

-- Exploration and evaluation expenses during the period were

$5.4 million (Q2 2021: $3.2 million), predominantly on the Nalunaq

Property.

-- General and administrative expenses during the period were

$5.1 million (Q2 2021: $4.0 million).

Selected Financial Information

The following selected financial data is extracted from the

Financial Statements for the six months ended June 30, 2022.

Financial Results

Six months

ended June 30,

2022 2021

------------

$ $

------------ -----------

Exploration and evaluation

expenses 5,435,831 3,245,196

General and administrative 5,086,708 4,038,649

Net loss and comprehensive

loss (10,460,137) (7,866,015)

Basic and diluted loss per

common share (0.06) (0.04)

------------ -----------

Financial Position

As at June 30, 2022 As at December 31,

2021

$ $

------------------- ------------------

Cash on hand 19,494,000 27,324,459

Total assets 34,618,121 42,781,664

Total current liabilities 2,880,555 2,100,084

Shareholders' equity 31,043,925 39,968,502

Working capital 16,678,108 25,542,242

------------------- ------------------

Enquiries:

Amaroq Minerals ltd.

Eldur Olafsson, Director and CEO

+354 665 2003

eo@amaroqminerals.com

Eddie Wyvill, Investor Relations

+44 (0) 7713 126727

ew@amaroqminerals.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Broker)

Callum Stewart

Simon Mensley

Ashton Clanfield

+44 (0) 20 7710 7600

Panmure Gordon (UK) Limited (Joint Broker)

John Prior

Hugh Rich

Dougie Mcleod

+44 (0) 20 7886 2500

SI Capital Limited (Joint Broker)

Nick Emerson

Charlie Stephenson

+44 (0) 1483 413500

Camarco (Financial PR)

Billy Clegg

Elfie Kent

Charlie Dingwall

+44 (0) 20 3757 4980

For Company updates:

Follow @Amaroqminerals on Twitter

Follow Amaroq Minerals Inc. on LinkedIn

Amaroq Minerals Ltd: Unaudited Condensed Interim Consolidated

Financial Statements for the Three Months Ended June 30, 2022

Consolidated Statements of Financial Position

(Unaudited, in Canadian Dollars)

As at As at December

June 30, 31,

Notes 2022 2021

--------------------------------------------------- ------------ ---------------

$ $

ASSETS

Current assets

Cash 19,494,000 27,324,459

Sales tax receivable 84,429 51,250

Prepaid expenses and others 84,234 266,617

Total current assets 19,662,663 27,642,326

Non-current assets

Deposit 27,944 9,805

Escrow account for environmental monitoring 397,115 424,637

Mineral properties 3 62,244 62,244

Capital assets 4 14,468,155 14,642,652

Total non-current assets 14,955,458 15,139,338

---------------------------------------------------- ------------ ---------------

TOTAL ASSETS 34,618,121 42,781,664

---------------------------------------------------- ------------ ---------------

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 2,810,526 2,049,249

Lease liabilities - current portion 5 70,029 50,835

-------------------------------------------- ------ ------------ ---------------

Total current liabilities 2,880,555 2,100,084

Non-current liabilities

Lease liabilities 5 693,641 713,078

Total non-current liabilities 693,641 713,078

Total liabilities 3,574,196 2,813,162

Equity

Capital stock 88,595,905 88,500,205

Contributed surplus 4,740,583 3,300,723

Accumulated other comprehensive loss (36,772) (36,772)

Deficit (62,255,791) (51,795,654)

---------------------------------------------------- ------------ ---------------

Total equity 31,043,925 39,968,502

---------------------------------------------------- ------------ ---------------

TOTAL LIABILITIES AND EQUITY 34,618,121 42,781,664

---------------------------------------------------- ------------ ---------------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

Consolidated Statements of Comprehensive Loss

(Unaudited, in Canadian Dollars)

Three months Six months

ended June 30, ended June 30,

----------------------------- ------ ------------------------ -------------------------

Notes 2022 2021 2022 2021

------------------------------------ ----------- ----------- ------------ -----------

Expenses

Exploration and evaluation

expenses 7 4,425,501 1,998,049 5,435,831 3,245,196

General and administrative 8 2,097,937 2,453,578 5,086,708 4,038,649

Foreign exchange loss (gain) (173,880) 157,092 (26,693) 647,691

----------- ----------- ------------ -----------

Operating loss 6,349,558 4,608,719 10,495,846 7,931,536

Other expenses (income)

Interest income (34,392) (41,859) (54,717) (85,929)

Finance costs 9,473 10,103 19,008 20,408

------------------------------------- ----------- ----------- ------------ -----------

Net loss and comprehensive

loss (6,324,639) (4,576,963) (10,460,137) (7,866,015)

------------------------------------- ----------- ----------- ------------ -----------

Weighted average number of

common shares outstanding

- basic and diluted 177,109,616 177,098,737 177,104,206 177,098,737

Basic and diluted loss per

common share (0.04) (0.03) (0.06) (0.04)

------------------------------------- ----------- ----------- ------------ -----------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

Consolidated Statements of Changes in Equity

(Unaudited, in Canadian Dollars)

Number of Accumulated

common shares Capital Contributed other comprehensive Total

outstanding Stock surplus loss Deficit Equity

------------------------ -------------- ---------- ----------- -------------------- ------------ ------------

$ $ $ $ $

Balance at January 1,

2021 177,098,737 88,500,205 2,925,952 (36,772) (27,106,415) 64,282,970

Net loss and

comprehensive

loss - - - - (7,866,015) (7,866,015)

Stock-based compensation - - 360,000 - - 360,000

------------------------- -------------- ---------- ----------- -------------------- ------------ ------------

Balance at June 30, 2021 177,098,737 88,500,205 3,285,952 (36,772) (34,972,430) 56,776,955

------------------------- -------------- ---------- ----------- -------------------- ------------ ------------

Balance at January 1,

2022 177,098,737 88,500,205 3,300,723 (36,772) (51,795,654) 39,968,502

Net loss and

comprehensive

loss - - - - (10,460,137) (10,460,137)

Options exercised 110,000 95,700 (40,700) - - 55,000

Stock-based compensation - - 1,480,560 - - 1, 480,560

------------------------- -------------- ---------- ----------- -------------------- ------------ ------------

Balance at June 30, 2022 177,208,737 88,595,905 4,740,583 (36,772) (62,255,791) 31,043,925

------------------------- -------------- ---------- ----------- -------------------- ------------ ------------

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

Consolidated Statements of Cash Flows

(Unaudited, in Canadian Dollars)

Six months

Notes ended June 30,

---------------------------------------------- ------ --------------------------

2022 2021

----------------------------------------------------- ------------ ------------

$ $

Operating activities

Net loss for the period (10,460,137) (7,866,015)

Adjustments for:

Depreciation 4 418,075 143,723

Stock-based compensation 1,480,560 360,000

Other expenses (income) 9,048 -

Foreign exchange (13,571) 644,430

------------------------------------------------------ ------------ ------------

(8,566,025) (6,717,862)

Changes in non-cash working capital items:

Sales tax receivable (33,179) (1,732)

Prepaid expenses and others 182,383 280,536

Trade and other payables 815,210 231,188

------------------------------------------------------ ------------ ------------

964,414 509,992

----------------------------------------------------- ------------ ------------

Cash flow used in operating activities (7,601,611) (6,207,870)

------------------------------------------------------ ------------ ------------

Investing activities

Acquisition of capital assets 4 (301,958) (2,084,161)

Deposit on order - (3,474,030)

Cash flow used in investing activities (301,958) (5,558,191)

------------------------------------------------------ ------------ ------------

Financing activities

Principal repayment - lease liabilities 5 (22,551) (32,539)

Exercise of stock options 55,000 -

Cash flow from financing activities 32,449 (32,539)

------------------------------------------------------ ------------ ------------

Net change in cash before effects of exchange

rate changes on cash during the period (7,871,120) (11,798,600)

Effects of exchange rate changes on cash 40,661 (482,763)

------------------------------------------------------ ------------ ------------

Net change in cash during the period (7,830,459) (12,281,363)

Cash, beginning of period 27,324,459 61,874,999

------------------------------------------------------ ------------ ------------

Cash, end of period 19,494,000 49,593,636

------------------------------------------------------ ------------ ------------

Supplemental cash flow information

Interest received 54,717 85,929

Exercise of stock options credited to capital

stock 40,700 -

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

Condensed Notes to the interim Consolidated Financial

Statements

Three and six months ended June 30, 2022 and 2021

(Unaudited, in Canadian Dollars)

NATURE OF OPERATIONS, BASIS OF PRESENTATION

Amaroq Minerals Ltd. (the "Corporation") (previously known as

AEX Gold Inc.) was incorporated on February 22, 2017, under the

Canada Business Corporations Act. The Corporation's head office is

situated at 3400, One First Canadian Place, P.O. Box 130, Toronto,

Ontario, M5X 1A4, Canada. The Corporation operates in one industry

segment, being the acquisition, exploration and development of

mineral properties. It owns interests in properties located in

Greenland. The Corporation's financial year ends on December 31.

Since July 2017, the Corporation's shares are listed on the TSX

Venture Exchange (the "TSX-V") under the AMRQ ticker and since July

2020, the Corporation's shares are also listed on the AIM market of

the London Stock Exchange ("AIM") under the AMRQ ticker.

These unaudited condensed interim consolidated financial

statements for the three and six months ended June 30, 2022

("Financial Statements") were approved by the Board of Directors on

August 24, 2022.

1.1 Basis of presentation

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board ("IASB") including

International Accounting Standard ("IAS") 34, Interim Financial

Reporting. The Financial Statements have been prepared under the

historical cost convention.

The Financial Statements should be read in conjunction with the

annual financial statements for the year ended December 31, 2021

which have been prepared in accordance with IFRS as issued by the

IASB. The accounting policies, methods of computation and

presentation applied in these Financial Statements are consistent

with those of the previous financial year ended December 31,

2021.

2. CRITICAL ACCOUNTING JUDGMENTS AND ASSUMPTIONS

The preparation of the Financial Statements requires Management

to make judgments and form assumptions that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and reported amounts of expenses during the reporting

period. On an ongoing basis, Management evaluates its judgments in

relation to assets, liabilities and expenses. Management uses past

experience and various other factors it believes to be reasonable

under the given circumstances as the basis for its judgments.

Actual outcomes may differ from these estimates under different

assumptions and conditions.

In preparing the Financial Statements, the significant

judgements made by Management in applying the Corporation

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the Corporation's audited

annual financial statements for the year ended December 31, 2021.

Estimates and assumptions are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

3. MINERAL PROPERTIES

As at December

31, 2021 As at

June 30,

Additions 2022

------------------------- --------------- ---------- ----------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq 7,348 - 7,348

Anoritooq 6,389 - 6,389

Sava 6,562 - 6,562

Total mineral properties 62,244 - 62,244

------------------------- --------------- ---------- ----------

As at December

31, 2020 As at

December 31,

Additions 2021

------------------------- --------------- ---------- --------------

$ $ $

Nalunaq 1 - 1

Tartoq 18,431 - 18,431

Vagar 11,103 - 11,103

Naalagaaffiup Portornga 6,334 - 6,334

Nuna Nutaaq 6,076 - 6,076

Saarloq 7,348 - 7,348

Anoritooq 6,389 - 6,389

Sava 6,562 - 6,562

Total mineral properties 62,244 - 62,244

------------------------- --------------- ---------- --------------

4. CAPITAL ASSETS

Field Vehicles Equipment Construc-tion Right-of-use Total

equipment and rolling (including In Progress assets

and infrastruc- stock software)

ture

$ $ $ $ $ $

------------------------- ----------------- ------------- ------------ -------------- ------------- ------------

Six months ended

June 30, 2022

Opening net book

value 1,989,114 4,304,709 156,011 7,452,668 740,150 14,642,652

Additions - - 179,041 69,417 - 248,458

Adjustment - - - - (4,880) (4,880)

Depreciation (129,183) (219,223) (29,895) - (39,774) (418,075)

------------------------- ----------------- ------------- ------------ -------------- ------------- ------------

Closing net book

value 1,859,931 4,085,486 305,157 7,522,085 695,496 14,468,155

------------------------- ----------------- ------------- ------------ -------------- ------------- ------------

As at June 30,

2022

Cost 2,351,041 4,605,320 364,919 7,522,085 836,200 15,679,565

Accumulated depreciation (491,110) (519,834) (59,762) - (140,704) (1,211,410)

------------------------- ----------------- ------------- ------------ -------------- ------------- ------------

Closing net book

value 1,859,931 4,085,486 305,157 7,522,085 695,496 14,468,155

------------------------- ----------------- ------------- ------------ -------------- ------------- ------------

4. CAPITAL ASSETS (CONT'D)

Depreciation of capital assets related to exploration and

evaluation properties is being recorded in exploration and

evaluation expenses in the consolidated statement of comprehensive

loss, under depreciation. Depreciation of $363,461 ($98,632 for the

six months ended June 30, 2021) was expensed as exploration and

evaluation expenses during the six months ended June 30, 2022.

As at June 30, 2022, the Corporation had capital asset purchase

commitments, net of deposit on order, of $nil ($6,030,167 as at

June 30, 2021). These commitments related to purchases of

equipment, infrastructure and vehicles.

As of June 30, 2022, the amount of $7,522,085 of construction in

progress is related to equipment and infrastructure received or in

storage and which will be installed at the appropriate time.

Equipment and infrastructure include process plant components that

are not yet available for use.

5. LEASE LIABILITIES

As at

June 30

2022

---------------------------------------- ------------

$

Balance beginning 763,913

Principal repayment (22,551)

Adjustment 22,308

---------------------------------------- ------------

Balance ending 763,670

Non-current portion - lease liabilities (693,641)

Current portion - lease liabilities 70,029

---------------------------------------- ------------

6. STOCK OPTIONS

An incentive stock option plan (the "Plan") was approved

initially in 2017 and renewed by shareholders on June 16, 2022. The

Plan is a "rolling" plan whereby a maximum of 10% of the issued

shares at the time of the grant are reserved for issue under the

Plan to executive officers, directors, employees and consultants.

The Board of directors grants the stock options and the exercise

price of the options shall not be less than the closing price on

the last trading day, preceding the grant date. The options have a

maximum term of ten years. Options granted pursuant to the Plan

shall vest and become exercisable at such time or times as may be

determined by the Board, except options granted to consultants

providing investor relations activities shall vest in stages over a

12-month period with a maximum of one-quarter of the options

vesting in any three-month period. The Corporation has no legal or

constructive obligation to repurchase or settle the options in

cash.

On January 17, 2022, the Corporation granted its officers,

employees and consultant 4,100,000 stock options with an exercise

price of $0.60 and expiry date of January 17, 2027. The stock

options vested 100% at the grant date. The options were granted at

an exercise price equal to the closing market price of the shares

the day prior to the grant. Total stock-based compensation costs

amount to $1,435,000 for an estimated fair value of $0.35 per

option. The fair value of the options granted was estimated using

the Black-Scholes model with no expected dividend yield, 69.38%

expected volatility, 1.51% risk-free interest rate and a 5-year

term. The expected life and expected volatility were estimated by

benchmarking comparable companies to the Corporation.

6. STOCK OPTIONS (CONT'D)

On April 20, 2022, the Corporation granted a senior employee

73,333 stock options with an exercise price of $0.75 and expiry

date of April 20, 2027. The stock options vested 100% at the grant

date. The options were granted with an exercise price equal to the

closing market price of the shares the day prior to the grant.

Total stock-based compensation costs amount to $32,267 for an

estimated fair value of $0.44 per option. The fair value of the

options granted was estimated using the Black-Scholes model with no

expected dividend yield, 68.9% expected volatility, 2.7% risk-free

interest rate and a 5-year term. The expected life and expected

volatility were estimated by benchmarking comparable companies to

the Corporation.

Changes in stock options are as follows:

Six months ended

June 30, 2022

------------------------- -----------------------------

Weighted

Number of average exercise

options price

------------------------- ---------- -----------------

$

Balance, beginning 6,935,000 0.51

Granted 4,173,333 0.60

Exercised (110,000) 0.50

Balance, end 10,998,333 0.55

------------------------- ---------- -----------------

Balance, end exercisable 10,865,000 0.55

------------------------- ---------- -----------------

Stock options outstanding and exercisable as at June 30, 2022

are as follows:

Number of options Number of options Exercise

outstanding exercisable price Expiry date

----------------- ----------------- -------- -----------------------

$

1,050,000 1,050,000 0.50 July 13, 2022 (expired)

1,360,000 1,360,000 0.45 August 22, 2023

1,820,000 1,820,000 0.38 December 31, 2025

100,000 33,333 0.50 July 5, 2026

100,000 33,333 0.50 September 13 , 2026

1,495,000 1,495,000 0.70 December 31, 2026

4,100,000 4,100,000 0.60 January 17, 2027

900,000 900,000 0.59 December 31, 2027

73,333 73,333 0.75 April 20, 2027

10,998,333 10,864,999

----------------- ----------------- -------- -----------------------

7. EXPLORATION AND EVALUATION EXPENSES

Three months Six months

ended June 30, ended June 30,

---------------------------- -------------------- --------------------

2022 2021 2022 2021

---------------------------- --------- --------- --------- ---------

$ $ $ $

Geology 651,211 562,416 805.632 705,954

Lodging and on-site support 35,255 64,523 35,255 64,523

Underground work - 18,588 - 18,589

Drilling 1,250,066 287,760 1,290,527 287,760

Analysis - 5,362 141,382 84,581

Transport 54,076 21,455 143,215 22,413

Supplies and equipment 360,158 - 360,158 -

Helicopter charter 442,824 109,024 442,824 109,024

Logistic support 90,356 64,913 102,108 86,114

Insurance (13,200) 45 - 8,707

Maintenance infrastructure 1,373,127 - 1,743,375 -

Project Engineering costs - 804,267 - 1,736,133

Government fees - 10,380 7,894 22,766

Depreciation 181,628 49,316 363,461 98,632

---------------------------- --------- --------- --------- ---------

Exploration and evaluation

expenses 4,425,501 1,998,049 5,435,831 3,245,196

---------------------------- --------- --------- --------- ---------

8. GENERAL AND ADMINISTRATION

Three months Six months

ended June 30, ended June 30,

----------------------------------- -------------------- --------------------

2022 2021 2022 2021

----------------------------------- --------- --------- --------- ---------

$ $ $ $

Salaries and benefits 601,769 667,453 1,241,768 1,054,961

Stock-based compensation 36,698 360,000 1,480,560 360,000

Director's fees 157,000 116,879 314,000 236,379

Professional fees 748,904 690,594 1,024,612 1,246,949

Marketing and industry involvement 133,811 190,609 302,678 356,332

Insurance 104,651 148,377 205,670 266,342

Travel and other expenses 238,656 172,156 384,571 302,365

Regulatory fees 43,971 84,965 78,235 170,230

Depreciation 32,477 22,545 54,614 45,091

General and administration 2,097,937 2,453,578 5,086,708 4,038,649

----------------------------------- --------- --------- --------- ---------

9. SUBSEQUENT EVENTS

9.1 Options granted

On July 14, 2022, the Corporation granted an employee 39,062

stock options with an exercise price of $0.64 and expiry date of

July 14, 2027. The stock options vested 100% at the grant date. The

options were granted with an exercise price equal to the closing

market price of the shares the day prior to the grant.

9.2 Acquisition of Significant Strategic Mineral Land Package in South Greenland

On May 12, 2022, the Corporation announced that it has acquired

mineral exploration licences No. 2020-41 and 2021-11 (the

"Licences") covering areas in South Greenland from Orano Group

("Orano") for zero upfront consideration but in exchange for a 0.5%

contractual, gross revenue royalty (GRR), based on potential future

sales of minerals exploited on the licences. The GRR is paid

annually and capped at US$10 million ("Royalties Cap"). The

Royalties Cap is subject to an annual inflation adjustment, with an

ultimate cap limited to the current market capitalisation of the

Corporation. Orano has a right of first refusal on any sales or

transfer of licenses. The acquisition is subject to approval from

the Greenland Government.

9.3 ACAM LP To Invest Upfront Capital in Strategic Mineral Asset Joint Venture with Amaroq

On June 10, 2022, the Corporation announced that it has now

signed a non-binding head of terms with ACAM LP ("ACAM") to

establish a special purpose vehicle (the "SPV") and create a joint

venture (the "JV") for the exploration and development of its

Strategic Mineral assets for a combined contribution of GBP36.7

million (circa $58.0 million). Subject to negotiation of the final

terms of the JV, ACAM will invest GBP18.0 million (circa $28.5

million) in exchange for a 49% shareholding in the SPV, with Amaroq

holding 51%. Amaroq is expected to contribute its Strategic

non-precious Mineral (i.e. non-gold) licences as well as a

contribution in kind, valued, in aggregate, at GBP18.7 million

(circa $29.5 million) in the form of site support, logistics and

overhead costs associated with utilizing its existing

infrastructure in Southern Greenland to support the JV's

activities. The transfer of these licences is subject to approval

from the Greenland Government. An option for further future funding

of GBP10.0 million (circa $16.0 million) is to be available on the

achievement of agreed milestones.

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business objectives are the

identification, acquisition, exploration, and development of gold

and strategic metal properties in Greenland. The Company's

principal asset is a 100% interest in the Nalunaq Project, an

advanced exploration stage property with an exploitation license

including the previously operating Nalunaq gold mine. The

Corporation has a portfolio of gold and strategic metal assets

covering 7,615.85km(2) , the largest mineral portfolio in Southern

Greenland covering the two known gold belts in the region. Amaroq

Minerals is incorporated under the Canada Business Corporations Act

and wholly owns Nalunaq A/S, incorporated under the Greenland

Public Companies Act.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable securities legislation, which reflects

the Company's current expectations regarding future events and the

future growth of the Company's business. In this press release

there is forward-looking information based on a number of

assumptions and subject to a number of risks and uncertainties,

many of which are beyond the Company's control, that could cause

actual results and events to differ materially from those that are

disclosed in or implied by such forward-looking information. Such

risks and uncertainties include but are not limited to the factors

discussed under "Risk Factors" in the Final Prospectus available

under the Company's profile on SEDAR at www.sedar.com. Any

forward-looking information included in this press release is based

only on information currently available to the Company and speaks

only as of the date on which it is made. Except as required by

applicable securities laws, the Company assumes no obligation to

update or revise any forward-looking information to reflect new

circumstances or events. No securities regulatory authority has

either approved or disapproved of the contents of this press

release. Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Inside Information

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No. 596/2014 on

Market Abuse ("UK MAR"), as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

Qualified Person Statement

The technical information presented in this press release has

been approved by James Gilbertson CGeol, VP Exploration for Amaroq

Minerals and a Chartered Geologist with the Geological Society of

London, and as such a Qualified Person as defined by NI 43-101.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKQBBFBKDCFB

(END) Dow Jones Newswires

August 25, 2022 02:00 ET (06:00 GMT)

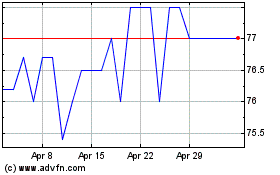

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024