TIDMAMRQ

RNS Number : 3525Y

Amaroq Minerals Ltd

06 September 2022

(" Amaroq " or the " Corporation ")

Updated Nalunaq Mineral Resource Estimate Results in a 50%

increase in Average Grade and 30% Increase in Contained Gold.

TORONTO, ONTARIO - September 06, 2022 - Amaroq Minerals Ltd.

(AIM, TSXV: AMRQ - formerly AEX Gold), an independent mine

development company with a substantial land package of gold and

strategic mineral assets covering an area of 7,866.85 km(2) in

Southern Greenland, announces an updated Mineral Resource Estimate

(MRE) for its flagship Nalunaq Gold project, prepared by SRK

Consulting (UK) Limited (SRK). This update, termed MRE3, is

reported in accordance with the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Definition Standards on Mineral

Resources and Mineral Reserves (May 2014) as required by NI 43-101

("the CIM Definition Standards").

The update incorporates the drilling results from the 2020 and

2021 field seasons and benefits from the increased geological

understanding and historical reconciliation that the Company has

developed based on this, which has been further refined to reflect

information collected so far during the 2022 drilling programme.

The updated MRE is summarised in Table 1 below.

References to figures and tables relate to the PDF format

version of the announcement on the website by clicking the link

below:

https://www.amaroqminerals.com/investors/regulatory-news-alerts/#tsx-news

.

Highlights

-- Total Inferred Mineral Resource of 355.0Kt @ 28.0g/t Au for

320Koz gold, reported according to CIM Definition Standards by

SRK.

-- This constitutes a 30% increase in contained gold compared to

the previous estimate reported in June 2020 and a 50% increase in

average grade.

-- The Nalunaq project now sits within the top 2% in terms of

global reported gold resource grades.

-- Due to the high grade nature of the Nalunaq deposit, it is

relatively insensitive to cut-off grade and remains robust at a

range of gold prices.

Eldur Olafsson, CEO of Amaroq, commented:

"An independently assessed increase in both grade and contained

gold following two dedicated field seasons of drilling is excellent

news for Nalunaq. This update provides the project with a key

stepping stone toward the next chapter of its development. Nalunaq

now sits in the 98th percentile in terms of reported gold resource

grades globally, making it one of the highest grade gold mines in

the world.

Our new Dolerite Dyke geological model has enabled us to define

continuous high grade zones within the Main Vein, which will make

mining more efficient and profitable as lower grade tonnage can be

discounted to focus on these higher grade areas. This model

continues to be instrumental in guiding the drilling of the higher

grade zones now and in the year ahead as we aim to progressively

increase the resources at Nalunaq to provide increased scale and

optionality ahead of recommissioning this high grade gold

operation."

Table 1: Mineral Resource Statement for Nalunaq gold deposit,

Greenland, as of 3(rd) September 2022

Mineral Resource Gross Net attributable Operator

-------------------- ----------------

Tonnes Grade Contained Tonnes Grade Contained

(t) (g/t Metal (Oz) (t) (g/t Metal (Oz)

Au) Au)

-------------------- -------- ------ ------------ -------- ------ ------------ ----------------

In-Mine Inferred 140,000 31.0 140,000 140,000 31.0 140,000 Amaroq Minerals

-------- ------ ------------ -------- ------ ------------ ----------------

Extension Inferred 215,000 26.0 180,000 215,000 26.0 180,000 Amaroq Minerals

-------- ------ ------------ -------- ------ ------------ ----------------

TOTAL 355,000 28.0 320,000 355,000 28.0 320,000 Amaroq Minerals

-------- ------ ------------ -------- ------ ------------ ----------------

Mineral Resource Statement Notes

-- Mineral Resources are reported in accordance with the CIM Definition Standards.

-- Mineral Resources have an effective date of 3 September 2022,

and have been depleted to reflect the current understanding of the

mining completed up to the date of production ceasing in 2013;

-- Mineral Resources are reported as in-situ and undiluted. The

Mineral Resources are reported above a cut-off grade of 5.0 g/t,

generated using a gold price of 1,800 USD/ozAu. Given these

parameters, SRK considers there to be reasonable prospects for

eventual economic extraction, and as such, fulfil the requirements

for reporting a Mineral Resource;

-- The In-Mine Mineral Resource is accessible from existing

underground development while the Extension Mineral Resource

requires development to be put in place for it to be accessed;

-- Mineral Resources are not Ore Reserves and have not

demonstrated economic viability, nor have any mining modifying

factors been applied;

-- The Competent Person for the declaration of Mineral Resources

is Dr Lucy Roberts, MAusIMM(CP), of SRK Consulting. The Mineral

Resource estimates and accompanying Statements were produced and

reviewed by a team of consultants from SRK.

-- SRK notes that a site visit to Nalunaq was conducted by the QP in September 2021;

-- Tonnages are reported in metric units, with metal grades in

grammes per tonne (g/t). Tonnages and grades are rounded. Rounding,

as required by reporting guidelines, may result in apparent

summation differences between tonnes, grade and contained metal

content. Where these occur, SRK does not consider these to be

material.

MRE3 Estimation Methodology

MRE3 was produced by SRK and supersedes MRE2 dated 19 June 2020,

which was produced by SRK Exploration Services Ltd. MRE3 has been

reported in accordance to CIM Definition Standards and incorporates

several updates to the project most notably the inclusion of data

obtained from 61 new core drillholes totalling 13,065m completed

during the 2020 and 2021 seasons centred on the newly defined

Valley Block and benefits from significant improvements in

geological understanding gained through the incorporation of the

Dolerite Dyke Model.

The Company believes that this, along with detailed

reconciliation and geostatistical studies performed by SRK, has

resulted in an updated estimation methodology that better reflects

the nature of the orebody and produces a more robust and defendable

estimate with respect to past production records.

Other updates to MRE2 include:

-- A change from a 1.2m minimum mining width to the reporting of

an undiluted model which contributes to the change in grade;

-- Improvement in the estimates of past mining tonnages through

the use of more robust underground surveys;

-- The use of a two tier approach to cap the influence of high

and ultra-high grade values in the interpolation process in which

the former were given distance restrictions and the latter were

both capped as well as being given distance restrictions; and

-- A change in rock density from 3.00 to 2.96 t/m(3) to reflect new measurements.

MRE3 Cut-off Grade

MRE3 has been reported using a cut-off grade of 5.0 g/t Au which

was determined by SRK based on assumptions regarding the likely

mining and processing methods, estimates of operating costs and a

gold price of USD1,800/oz which is based on a long term gold price

+30% in order to capture mineralisation that has Reasonable

Prospects for Eventual Economic Extraction (RPEEE). The high grade

nature of the project, however, means it is relatively insensitive

to cut-off grade and operating costs as illustrated in Table 2 and

3 below.

Table 2: Mineral Resource Sensitivity to Cut-off Grade

Cut-off Grade Effective Gold price Change in Gold Content

(g/t Au) (USD/oz) (%)

--------------------- -----------------------

6.0 1,500 -1.1%

--------------------- -----------------------

5.5 1,650 -0.5%

--------------------- -----------------------

5.0 1,800

--------------------- -----------------------

4.5 1,900 0.8%

--------------------- -----------------------

4.0 2,000 1.6%

--------------------- -----------------------

Table 3: Mineral Resource Sensitivity to Operating Costs

Change in Operating Effective Cut-off Change in Gold Content

Costs Grade

(g/t Au) (g/t Au) (%)

------------------ -----------------------

+15% 6.0 -1.1%

------------------ -----------------------

+10% 5.4 -0.5%

------------------ -----------------------

+5% 5.2 -0.3%

------------------ -----------------------

0 5.0 0%

------------------ -----------------------

-5% 4.7 0.4%

------------------ -----------------------

-10% 4.4 0.8%

------------------ -----------------------

-15% 4.2 1.2%

------------------ -----------------------

Qualified Person Statement

The Mineral Resource Estimate was prepared by Dr Lucy Roberts,

MAusIMM(CP), Principal Consultant (Resource Geology), SRK

Consulting (UK) Limited., an independent Qualified Person in

accordance with the requirements of National Instrument 43-101 ("NI

43-101"). Dr Roberts has approved the disclosure herein.

The technical information presented in this press release has

been approved by James Gilbertson CGeol, VP Exploration for Amaroq

Minerals and a Chartered Geologist with the Geological Society of

London , and as such a Qualified Person as defined by NI

43-101.

Use of a Standard

The resource information included within this announcement is

reported in accordance with the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Definition Standards on Mineral

Resources and Mineral Reserves (May 2014) as required by CIM

Definition Standards.

Analyst presentation

There will be a video conference call for analysts at 14:00

(BST) today (06 September 2022) hosted by CEO Eldur Olafsson and

Vice President Exploration James Gilbertson.

Please contact amaroq@camarco.co.uk to register your

attendance.

Enquiries:

Amaroq Minerals Ltd.

Eldur Olafsson, Executive Director and CEO

+354 665 2003

eo@amaroqminerals.com

Eddie Wyvill, Investor Relations

+44 (0)7713 126727

ew@amaroqminerals.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Broker)

Callum Stewart

Simon Mensley

Ashton Clanfield

+44 (0) 20 7710 7600

Panmure Gordon (UK) Limited (Joint Broker)

John Prior

Hugh Rich

Dougie Mcleod

+44 (0) 20 7886 2500

SI Capital Limited (Joint Broker)

Nick Emerson

Charlie Stephenson

+44 (0) 1483 413500

Camarco (Financial PR)

Billy Clegg

Elfie Kent

Charlie Dingwall

+44 (0) 20 3757 4980

For Company updates:

Follow @Amaroq_minerals on Twitter

Follow Amaroq Minerals Inc. on LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business objectives are the

identification, acquisition, exploration, and development of gold

and strategic metal properties in Greenland. The Company's

principal asset is a 100% interest in the Nalunaq Project, an

advanced exploration stage property with an exploitation license

including the previously operating Nalunaq gold mine. The

Corporation has a portfolio of gold and strategic metal assets

covering 7,866.85km(2) , the largest mineral portfolio in Southern

Greenland covering the two known gold belts in the region. Amaroq

Minerals is incorporated under the Canada Business Corporations Act

and wholly owns Nalunaq A/S, incorporated under the Greenland

Public Companies Act.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable securities legislation, which reflects

the Company's current expectations regarding future events and the

future growth of the Company's business. In this press release

there is forward-looking information based on a number of

assumptions and subject to a number of risks and uncertainties,

many of which are beyond the Company's control, that could cause

actual results and events to differ materially from those that are

disclosed in or implied by such forward-looking information. Such

risks and uncertainties include but are not limited to the factors

discussed under "Risk Factors" in the Final Prospectus available

under the Company's profile on SEDAR at www.sedar.com. Any

forward-looking information included in this press release is based

only on information currently available to the Company and speaks

only as of the date on which it is made. Except as required by

applicable securities laws, the Company assumes no obligation to

update or revise any forward-looking information to reflect new

circumstances or events. No securities regulatory authority has

either approved or disapproved of the contents of this press

release. Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Glossary

Au gold

g grams

g/t grams per tonne

km kilometers

Koz thousand ounces

m meters

MRE2 Mineral Resource Estimate 2020

MRE3 Mineral Resource Estimate 2022

oz ounces

t tonnes

t/m(3) tonne per cubic meter

USD/ozAu US Dollar per ounce of gold

Inside Information

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No. 596/2014 on

Market Abuse ("UK MAR"), as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLAMTTMTTMTAT

(END) Dow Jones Newswires

September 06, 2022 02:00 ET (06:00 GMT)

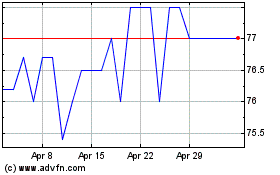

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024