TIDMANG

RNS Number : 8704O

Angling Direct PLC

13 October 2021

13 October 2021

Angling Direct PLC

('Angling Direct', the 'Company' or the 'Group')

Half Year Results

Continued strong progress in H1, upgrading guidance for full

year

Angling Direct PLC (AIM: ANG), the leading omni-channel

specialist fishing tackle and equipment retailer, is pleased to

announce its unaudited financial results for the six months ended

31 July 2021.

The Group has delivered strong progress against its stated FY22

planned priorities including its plans to establish in-region

online European fulfilment which is now entering the implementation

phase. The Board is now of the view that pre IFRS 16 EBITDA for the

year ending 31 January 2022 (FY22) will be no less than GBP5.0m

(inclusive of the expected costs associated with opening its new

European distribution centre), comfortably exceeding current market

expectations. With the Group's growing omni-channel offering and

the strength of its balance sheet, the Board remains optimistic

about the growth prospects and overall success of the business.

Financial highlights:

Given the fluctuating sales patterns as a result of lockdowns

and pandemic-related restrictions in the current and previous

comparator periods, our commentary below also presents headline

financial metrics on a two year basis, showing a third column for

the six months ended 31 July 2019 (H1 2020).

GBPm H1 2022 H1 2021 H1 2020 H1 2022 Growth

------------------------ -------- -------- --------

on H1 2021 on H1 2020

------------------------ -------- -------- -------- ----------- -----------

Revenue 38.4 32.1 26.5 +19.5% +44.8%

Online sales 18.5 17.9 12.5 +3.2% +47.6%

Retail store sales 19.9 14.2 14.0 +40.1% +42.3%

Gross profit 14.4 10.8 8.5 +33.7% +68.8%

Gross margin % 37.4% 33.5% 32.1% +390bps +530bps

EBITDA (pre IFRS-16) 4.4 2.1 0.8 +111.6% +488.0%

Profit before tax 3.7 1.4 0.4 +174.2% +914.4%

Basic EPS 3.70p 2.02p 0.51p +83.2% +625.5%

------------------------ -------- -------- -------- ----------- -----------

-- Positive Operating cashflow of GBP5.8m

-- Strong balance sheet with Group net cash at 31 July 2021 of GBP19.6m

(31 July 2020: GBP21.0m)

Operational highlights:

-- Further digital investment grew UK online conversion by 80 bps to

6.3%

-- Recent investment in UK distribution centre capacity utilised to

protect supply position relative to wider market

-- 'AD+' priority delivery subscription service launched March 2021

driving customer loyalty and now accounts for 16% of all UK online

orders

-- Established business case and detailed operating model for a European

distribution centre, facilitating moving to execution phase - terms

agreed on 3,900 square metre facility in the Netherlands

-- New category management model delivered agile stocking and pricing

in short supply market supporting gross margin growth

-- Store transformation programme starting to deliver sustainable levels

of EBITDA earnings from retail stores. Stores average transaction

value up 3.8% and like for like sales up 32.2%

-- Healthy property pipeline for underserved catchments - two further

store openings planned by year end

Andy Torrance, CEO of Angling Direct, said:

"We are pleased to have delivered a robust financial performance

in the first half of the year, building on the operational and

strategic progress made last year. These results demonstrate that

the increasingly efficient, market leading omni-channel nature of

the Company's trading platform, combined with its strong balance

sheet, ensures it is well placed to serve customers across all

channels as it emerges from the challenges of the Covid 19

pandemic.

The Group has delivered strong progress against its stated key

priorities for FY22 in the first half, including its plans to

establish in-region online European fulfilment which is now

entering implementation phase. With the Group's leading customer

offering and optimised operational capabilities, combined with the

scale of the market opportunity, the Board remains optimistic about

the growth prospects and overall success of the business."

Sell-side analyst webinar and Investor Meet Company

presentation

A webinar for sell-side equity analysts will be held at 9.00

a.m. BST today, 13 October 2021, the details of which can be

obtained from FTI Consulting using the contact details below.

Management will provide a live presentation via the Investor

Meet Company platform at 11.00 a.m. BST on 18 October. The

presentation is open to all existing and potential shareholders.

Questions can be submitted pre-event via your Investor Meet Company

dashboard up until 9.00 a.m. the day before the meeting or at any

time during the live presentation. Investors can sign up to

Investor Meet Company for free to meet Angling Direct plc via:

https://www.investormeetcompany.com/angling-direct-plc/register-investor

. Investors who already follow Angling Direct on the Investor Meet

Company platform will automatically be invited.

For further information please contact:

Angling Direct PLC +44 (0) 1603 258 658

Andy Torrance, Chief Executive

Officer

Steven Crowe, Chief Financial Officer

Singer Capital Markets - NOMAD

and Broker +44 (0) 20 7496 3000

Peter Steel (Corporate Finance)

Alex Bond (Corporate Finance)

Tom Salvesen (Corporate Broking)

FTI Consulting - Financial PR +44 (0) 20 3727 1000

Alex Beagley anglingdirect@fticonsulting.com

James Styles

Alice Newlyn

This announcement contains information which, prior to its

disclosure, was inside information as stipulated under the UK

version of article 7 of the Market Abuse Regulation (EU) No.

596/2014.

About Angling Direct

Angling Direct is the leading omni-channel specialist fishing

tackle retailer in the UK. The Company sells fishing tackle

products and related equipment through its network of retail

stores, located strategically throughout the UK as well as through

its leading digital platform ( www.anglingdirect.co.uk , .de, .fr

and .nl) and other third-party websites.

Angling Direct is committed to supporting its active customer

base and widening access to the angling community through its

passionate colleagues, store-based qualified coaches, social media

reach and ADTV YouTube channel. The Company currently sells over

20,000 fishing tackle products, including capital items,

consumables, luggage and clothing. Angling Direct also owns and

sells fishing tackle products under its own brand 'Advanta', which

was formally launched in March 2016.

From 1986 to 2002, the Company's founders acquired interests in

a number of small independent fishing tackle shops in Norfolk and,

in 2002, they acquired a significant premise in Norwich, which was

branded Angling Direct. Since 2002, the Company has continued to

acquire or open new stores, taking the total number up to 39 retail

stores. In 2015, the Company opened a 30,000 sq. ft central

distribution centre in Rackheath, Norfolk, where the Company's head

office is also located. Angling Direct has an established, and

rapidly growing, presence in Europe with native language websites

set up in key regions to address demand.

Chief Executive Officer's Review

The Group is pleased to have delivered a strong set of results

in the period due to the increasingly efficient, market leading

omni-channel nature of the Angling Direct trading platform that

allowed our customers to flexibly access our products and content,

despite a significant period of store closures and unusual channel

mix caused by government trading restrictions. This is also a

period where the Group has delivered strong progress against all

its stated strategic priorities.

As well as continued sales growth, alongside further improved

margin growth and supply chain efficiency, the Group is now in the

implementation phase of its plan to significantly improve its

European customer offer and in-region fulfilment. We have

established a wholly owned subsidiary, ADNL BV, and agreed Heads of

Terms for a lease over a 3,900 square metre distribution centre in

the Netherlands which we anticipate will be operational ahead of

the spring 2022 fishing season. This underlines our confidence in

the significant opportunity that exists for us to grow our presence

in Europe and expand the Group's broader growth potential.

I would like to thank all my colleagues for their continued

resilience and enthusiastic commitment to the ongoing profitable

growth of the Group at this exciting time in our development.

Results

Group revenue increased by 19.5% to GBP38.4m for the six months

ended 31 July 2021 (H1 2021: GBP32.1m). The Company recorded strong

sales growth in Q1 2022 of 53.6%. Measured against unprecedented

levels of demand in the prior year following store re-openings on

15 June 2020, total sales growth in Q2 was pleasing at 3.5%.

Gross profit increased by 33.7% to GBP14.4m (H1 2021: GBP10.8m).

Pre IFRS 16 EBITDA grew by 112% to GBP4.4m (H1 2021: GBP2.1m) as

the Company's web distribution centre continued to operate during

the third lockdown period, facilitated by drawing on existing stock

levels as well as stock held in otherwise closed retail stores that

offered a Call and Collect service throughout.

Since restrictions were lifted on 12 April 2021, and all stores

safely re-opened, total sales to the end of the period returned to

a more traditional profile when compared to the prior year when

sales were skewed by the pent-up demand caused by the first

lockdown.

Due to the strength of trading, associated cash conversion and

working capital timing, the Company's net cash position at 31 July

2021 was GBP19.6m (31 July 2020: GBP21.0m).

Operational Review

Online

As part of our drive to grow market share and customer loyalty,

we continue to invest in our contemporary digital infrastructure

and customer marketing to ensure we stand apart from our

competitors.

We are pleased to report overall online sales in the period grew

by 3.2% to GBP18.5m (H1 2021: GBP17.9m) partially reflecting the

year-on-year lockdown driven change in channel mix. Our UK website

achieved strong online sales growth of 15.8%. In Europe, Brexit

driven customs disruption significantly impacted delivery lead

times and coupled with restrictions on the export of bait, meant

that sales via the Company's three native language websites (which,

during the period, comprised less than 5% of Group revenue)

declined by 34.2%.

Lead-times to customers in Europe have started to improve as new

customs and border practices slowly start to stabilise. We have now

also partnered with one of Germany's leading bait manufacturers to

supply direct to our customers via Angling Direct websites. The

Board anticipates the new European fulfilment facility will, in the

medium term, greatly facilitate trading and the scale of the

Company's online opportunity in Mainland Europe.

As the Company seeks to exit unprofitable online activity, sales

via eBay and non-core international territories combined reduced by

GBP0.9m, or 5.0% of H1 21 total online sales.

Continued investment and development of our UK search

functionality meant that despite decreased browsing, driven by the

wider economy re-opening, UK conversion increased by 80bps to 6.3%

and average online transaction value grew by 11.2% to GBP77.19. As

we expected, Brexit trading restrictions impacted conversion on the

Group's native language websites with a reduction of 90bps to 1.6%:

(H1 2021 2.5%).

During the first half, the Company invested in the development

of a mobile web App, believed to be the first of its kind in our

sector in the UK. The App is now in the final stage of testing,

with launch date scheduled pre-Christmas, and will provide our

customers with further choice, convenience and inspiration on the

move, as well as the opportunity for us to improve online marketing

efficiency. AD+, our priority delivery subscription service

designed to build ongoing customer loyalty, was launched in March

2021 and now accounts for 16% of all UK online orders.

Retail Stores

We are really encouraged to see customers enthusiastically

returning to our stores. Our store colleagues are the vital touch

point between Angling Direct and our customers. They are crucial

for driving conversion, creating loyal customers and prompting

recommendation.

Total store sales in the period increased 40.1% to GBP19.9m (H1

2021: GBP14.2m). Like-for-like ('LFL') store sales grew by 32.2%.

All retail stores were closed at the beginning of the period from 1

February to 12 April 2021 due to government restrictions during the

third lockdown. This compares to stores being originally closed in

the prior period from 24 March to 14 June 2020.

In line with our strategic commitment to being the first choice

omni-channel retailer in all our markets, we opened one new store

in the period: Redditch (February 2021, restricted until April

2021), re-sited a further store: Sittingbourne (April 2021 with a

considerably improved shopping environment) and re-fitted another:

(Hull with improved layout and ranging).

We have a healthy new store pipeline focused on unserved

catchments, with two further stores planned before the FY22 year

end.

We have established a two-year Retail Transformation plan which

is now well underway. The plan is focused on radically improving

our store shopping environment through improved layouts and

merchandising, promotional messaging and, crucially, colleague

interaction focused on customer satisfaction.

Trading

We are committed to providing the most comprehensive range of

products for major fishing disciplines, always delivering choice,

value, quality and stock availability.

The Company's newly implemented category management process,

along with continued focus on pricing and promotional discipline,

has resulted in gross margin growing by 390bps to 37.4%.

Higher margin own brand sales in the period grew by 10.1%,

whilst its proportion of total sales slipped modestly by 40 bps to

5.2%. The slightly higher proportion of own brand sales in H1 2021

reflects the scarcity of branded equivalent products towards the

end of that period. Current Q3 own brand sales as a proportion of

total sales have improved to 6.8% following a refresh of our

promotional activity. New own brand SKUs and ranges have been

developed which, along with new packaging, are due to be launched

by summer 2022.

The Board has been following a strategy of prudently using the

Company's balance sheet strength to ensure the Group is well

invested in key stock lines as they become available from product

suppliers. We believe this provides a significant competitive

advantage given ongoing global supply chain disruption and

suppliers forecasting upward cost price pressure. Our Category

Management team continues to maintain a key focus on cost price

inflation with the objective of maintaining strong stock

availability for customers, whilst at the same time actively

investing to protect our price competitiveness.

This relative depth of stock has facilitated a degree of pricing

stability in the period beyond traditional levels, however, the

Company remains committed to protecting its competitive customer

offering, and will, where considered necessary, invest gross margin

in its pricing proposition.

We will also take the opportunity in the coming months to

further tailor ranges more closely to our customer needs.

International

The opportunity for profitable growth within Europe remains

clear and as outlined in the Group's Annual Results, considerable

management resource has been focused upon realising our plans to

become Europe's first choice omni-channel destination.

The Board has confidence in the business case for establishing

in-region fulfilment which will allow the Group to improve customer

order fulfilment, broaden the appeal of our ranges locally and

facilitate the further development of our full omni-channel

proposition. Working with expert partners we have defined a clear

view of our business requirements in terms of optimal location and

operating model, providing a strong platform for future growth

As a result, we have incorporated a new wholly owned Dutch

subsidiary, ADNL B.V., engaged in-country commercial management and

agreed terms for the lease of a 3,900 square metre distribution

facility in the Netherlands, with a targeted opening date of Spring

2022. We have also received strong support from both existing and

potentially new supply partners to support range extensions for

Europe.

Management's current financial projections show that this new

facility is expected to provide the Company with European growth

capacity to 2027, with the Board anticipating that it will be

earnings positive by 2025. All costs associated with this phase of

expansion will be funded from existing cash resources.

Given our increased confidence in the robustness of the European

business case we have subsequently commenced investment into

stimulating customer engagement ahead of the new facility going

online in Spring 2022.

Organisational Development

We remain fully committed to acting responsibly and sustainably

within our environment and communities. We continue to supplement

and upskill key capabilities within our category management,

digital and operational teams. We have appointed a new Commercial

Director, a new Head of Product Development and a new European

Commercial Manager. As well as human resource, we continue to

invest in digital technologies and customer acquisition marketing

to further differentiate our competitive position.

Current trading and Outlook

Sales in Q3 are anticipated to decline relative to the

unprecedented levels in Q3 in the prior year (post lock down 1). It

is not yet clear the extent to which the Company will track sales

levels during Q4 against the comparative period, which included the

second lockdown (all stores closed November 2020) and the beginning

of the third lockdown (all stores closed January 2021). Post

period-end, we have not experienced any material impact from supply

chain disruption and continue to hold good levels of stock in

mitigation. As with other retailers, we are not immune to increased

raw material and freight costs, however, these will be offset by

our margin growth and we are well placed to continue mitigating any

impact.

Whilst some uncertainty persists, the Company's overall

performance in the current year to date means that the Board is now

of the view that pre IFRS-16 EBITDA for the year ending 31 January

2022 will be no less than GBP5.0m, inclusive of the expected costs

associated with opening the Group's new European distribution

centre and comfortably exceeding current market expectations.

Looking ahead, our strong balance sheet means we have the

firepower to continue investing in both online and in-store growth

along with particular focus on accelerating penetration into our

five key European mainland territories of Germany, France, The

Netherlands, Austria and Belgium. The Board believes that with

Angling Direct's profitable growth and established competitive

advantage, combined with the increasing resonance of its refreshed

purpose to Get Everyone Fishing, the Group is well placed to

benefit from the clear opportunities within its markets both within

the UK and Mainland Europe. With the Group's growing multi-channel

offering and the strength of the balance sheet, the Board remains

optimistic about the growth prospects and overall success of the

business.

Andy Torrance

Chief Executive Officer

12 October 2021

Consolidated statements of profit or loss and other

comprehensive income

For the period ended 31 July 2021

Audited

Unaudited six months year ended

ended 31 July 31 January

Note 2021 2020 2021

GBP'000 GBP'000 GBP'000

Revenue from contracts with customers 4 38,404 32,128 67,581

Cost of sales of goods (24,022) (21,369) (44,458)

Gross profit 14,382 10,759 23,123

-------- -------- --------

Other income 5932 1,503 1,540

Interest revenue calculated using the effective

interest method 19 12 24

Expenses

Administrative expenses (9,608) (8,971) (18,183)

Distribution expenses (1,787) (1,734) (3,424)

Finance costs (215) (211) (434)

------- ------- --------

Profit before income tax expense 3,723 1,358 2,646

Income tax expense 7(863) (2) (241)

----- --- -----

Profit after income tax expense for the period

attributable to the owners of Angling Direct

PLC 2,860 1,356 2,405

Other comprehensive income for the period,

net of tax - - -

----- ----- -----

Total comprehensive income for the period

attributable to the owners of Angling Direct

PLC 2,860 1,356 2,405

===== ===== =====

Earnings per share (Pence)

Basic earnings 15 3.70 2.02 3.33

Diluted earnings 15 3.65 2.02 3.28

Consolidated statements of financial position

As at 31 July 2021

Audited

Unaudited six months year ended

ended 31 July 31 January

Note 2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 8 6,218 6,252 6,251

Property, plant and equipment 9 5,831 5,784 6,019

Right-of-use assets 10 10,385 10,389 10,910

Total non-current assets 22,434 22,425 23,180

-------------------- ------- ------------

Current assets

Inventories 15,724 11,081 12,481

Trade and other receivables 474 674 623

Prepayments 324 108 245

Cash and cash equivalents 19,584 20,983 14,996

Total current assets 36,106 32,846 28,345

-------------------- ------- ------------

Current liabilities

Trade and other payables 11 10,400 12,478 6,741

Lease liabilities 1,421 1,251 1,358

Income tax 503 - -

Total current liabilities 12,324 13,729 8,099

------ ------ ------

Net current assets 23,782 19,117 20,246

------ ------ ------

Total assets less current liabilities 46,216 41,542 43,426

------ ------ ------

Non-current liabilities

Lease liabilities 9,249 9,264 9,773

Provision 289 265 277

Deferred tax 618 19 258

Total non-current liabilities 10,156 9,548 10,308

------ ------ ------

Net assets 36,060 31,994 33,118

====== ====== ======

Equity

Share capital 12 773 773 773

Share premium 31,037 31,037 31,037

Reserves 157 - 75

Retained profits/(accumulated losses) 4,093 184 1,233

Total equity 36,060 31,994 33,118

==================== ======= ============

Consolidated statements of changes in equity

For the period ended 31 July 2021

Share Share-based

Share premium payment Retained

capital account reserve profits Total equity

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February

2021 773 31,037 75 1,233 33,118

Profit after income

tax expense

for the period - - - 2,860 2,860

Other comprehensive

income for

the period, net of

tax - - - - -

Total comprehensive

income for

the period - - - 2,860 2,860

Transactions with

owners in

their capacity as

owners:

Share-based payments - - 82 - 82

Balance at 31 July

2021 773 31,037 157 4,093 36,060

======= ======== =========== ======== ============

Share-based

Share Share premium payment Retained

capital account reserve profits Total equity

Audited year

ended 31 January GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

February 2020 646 26,017 - (1,172) 25,491

Profit after

income tax

expense

for the period - - - 2,405 2,405

Other

comprehensive

income for

the period, net

of tax - - - - -

Total

comprehensive

income for

the period - - - 2,405 2,405

Transactions

with owners in

their capacity

as owners:

Contributions of

equity, net

of transaction

costs 127 - - - 127

Share premium,

net of

transaction

costs - 5,020 - - 5,020

Share-based

payments - - 75 - 75

Balance at 31

January 2021 773 31,037 75 1,233 33,118

======= ============= =========== ======== ============

Consolidated statements of cash flows

For the period ended 31 July 2021

Audited

year

Unaudited six months ended 31

ended 31 July January

Note 2021 2020 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit/(loss) before income tax expense for

the period 3,723 1,358 2,646

Adjustments for:

Depreciation and amortisation 1,452 1,314 2,662

Share-based payments 82 - 75

Net movement in provisions 7 16 18

Interest received (19) (12) (24)

Interest and other finance costs 215 211 434

5,460 2,887 5,811

Change in operating assets and liabilities:

Decrease/(increase) in trade and other receivables 149 (165) (114)

Decrease/(increase) in inventories (3,243) 2,372 972

Decrease/(increase) in prepayments (79) 366 229

Increase in trade and other payables 3,697 6,008 407

5,984 11,468 7,305

Interest received 19 12 24

Interest and other finance costs (210) (211) (424)

Net cash from operating activities 5,793 11,269 6,905

---------- ---------- --------

Cash flows from investing activities

Payments for property, plant and equipment 9 (342) (614) (1,382)

Payments for intangibles 8 (170) (179) (338)

Payment of contingent consideration - - (48)

Net cash used in investing activities (512) (793) (1,768)

---------- ---------- --------

Cash flows from financing activities

Proceeds from issue of shares and premium - 5,147 5,147

Repayment of lease liabilities (693) (618) (1,266)

Net cash from/(used in) financing activities (693) 4,529 3,881

---------- ---------- --------

Net increase in cash and cash equivalents 4,588 15,005 9,018

Cash and cash equivalents at the beginning

of the financial period 14,996 5,978 5,978

Cash and cash equivalents at the end of the

financial period 19,584 20,983 14,996

========== ========== ========

Notes to the consolidated financial statements

Note 1. General information

The financial statements cover Angling Direct PLC as a Group consisting

of Angling Direct PLC ('Company' or 'parent entity') and the entities it

controlled at the end of, or during, the half-year (collectively referred

to in these financial statements as the 'Group'). The financial statements

are presented in British Pound Sterling ('GBP'), which is Angling Direct

PLC's functional and presentation currency.

Angling Direct PLC is a public limited company incorporated under the Companies

Act 2006, listed on the AIM (Alternative Investment Market), a sub-market

of the London Stock Exchange. The Company is incorporated and domiciled

in the United Kingdom. The registered number of the Company is 05151321.

Its registered office and principal place of business is:

2d Wendover Road,

Rackheath Industrial Estate

Rackheath

Norwich, Norfolk

NR13 6LH

The principal activity of the Group is the sale of fishing tackle through

its websites and stores. The Group's business model is designed to generate

growth by providing excellent customer service, expert advice and ensuring

product lines include a complete range of premium equipment. Customers range

from the casual hobbyist through to the professional angler.

The financial statements were authorised for issue, in accordance with a

resolution of Directors, on 12 October 2021. The Directors have the power

to amend and reissue the financial statements.

Note 2. Significant accounting policies

These financial statements for the interim half-year reporting period ended

31 July 2021 have been prepared in accordance with the AIM Rules for Companies,

International Accounting Standard IAS 34 'Interim Financial Reporting' and

the Companies Act for for-profit oriented entities.

These interim financial statements do not include all the notes of the type

normally included in annual financial statements. Accordingly, these financial

statements are to be read in conjunction with the annual report for the

year ended 31 January 2021 and any public announcements made by the Company

during the interim reporting period.

The interim consolidated financial information has been prepared on a going-concern

basis.

The principal accounting policies adopted are consistent with those set

out on pages 78 to 87 of the consolidated financial statements of Angling

Direct PLC for the year ending 31 January 2021, except for taxation which

has been accounted for as described in note 7.

New or amended Accounting Standards and Interpretations adopted

The Group has adopted all of the new or amended Accounting Standards and

Interpretations issued by the International Accounting Standards Board that

are mandatory for the current reporting period. There was no impact on the

adoption of these new or amended Accounting Standards and Interpretations

Any new or amended Accounting Standards or Interpretations that are not

yet mandatory have not been early adopted.

Note 3. Segmental reporting

Segmental information is presented in respect of the Group's operating segments,

based on the Group's management and internal reporting structure, and monitored

by the Group's Chief Operating Decision Maker (CODM).

Segment results, assets and liabilities include items directly attributable

to a segment as well as those that can be allocated on a reasonable basis.

Unallocated items comprise mainly own brand stock in transit from the manufacturers,

group cash and cash equivalents, taxation related assets and liabilities,

centralised support functions salary and premises costs, and government

grant income.

Geographical segments

The business operated predominantly in the UK. As at 31 July 2021, it has

three native language web sites for Germany, France and the Netherlands.

In accordance with IFRS 8 'Operating segments' no segmental results are

presented for trade with European customers as these are not reported separately

for management purposes and are not considered material for separate disclosure,

save for disaggregation of revenue in note 4.

Operating segments

The Group is split into two operating segments (Stores and Online) and a

centralised support function (Head Office) for business segment analysis.

In identifying these operating segments, management follows the route to

market for the generation of the customer order for its products. Due to

the growth in the Group's online sales, management has made a judgement

that there are now two operating segments. In the comparative period, management

considered there to be only one segment, therefore comparative information

is not available to be restated.

Each of these operating segments is managed separately as each segment requires

different specialisms, marketing approaches and resources. Head Office includes

costs relating to the employees, property and other overhead costs associated

with the centralised support functions.

The CODM reviews EBITDA (earnings before interest, tax, depreciation and

amortisation) pre IFRS 16. The accounting policies adopted for internal

reporting to the CODM are consistent with those adopted in the financial

statements, save for IFRS 16. A full reconciliation of pre IFRS 16 EBITDA

to post IFRS 16 EBITDA performance is provided to the CODM.

The information reported to the CODM is on a monthly basis.

All non-current assets are located in the UK.

Operating segment information

Stores Online Head office Total

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 19,938 18,466 - 38,404

Profit/(loss) before income tax 2,832 2,809 (1,918) 3,723

EBITDA post IFRS 16 3,965 3,140 (1,734) 5,371

Total assets 23,669 8,418 26,453 58,540

Total liabilities (13,249) (6,061) (3,170) (22,480)

EBITDA Reconciliation

Profit/(loss) before income tax 2,832 2,809 (1,918) 3,723

Less: Interest income - - (19) (19)

Add: Interest expense 176 25 14 215

Add: Depreciation and amortisation 956 306 190 1,452

EBITDA post IFRS 16 3,964 3,140 (1,733) 5,371

Less: Costs relating to IFRS 16 lease

liabilities (816) (79) (48) (943)

EBITDA pre IFRS 16 3,148 3,061 (1,781) 4,428

===== ===== ======= =====

Note 4. Revenue from contracts with customers

Disaggregation of revenue

The disaggregation of revenue from contracts with customers is

as follows:

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Route to market

Retail store sales 19,938 14,232 32,259

Online sales 18,466 17,896 35,322

38,404 32,128 67,581

Geographical regions

United Kingdom 37,144 29,690 63,206

Germany, France and Netherlands 1,033 1,569 2,868

Other countries 227 869 1,507

38,404 32,128 67,581

Timing of revenue recognition

Goods transferred at a point in time 38,404 32,128 67,581

=========== ========= ===============

Note 5. Other income

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Net foreign exchange gain - - 13

Government grants 932 1,503 1,527

Other income 932 1,503 1,540

========== ========== ===========

As a result of the economic impacts of the Covid-19 pandemic, a number of

government programmes have been put into place to support businesses and

consumers. Examples of such initiatives include the UK's Coronavirus Job

Retention Scheme. In accounting for the impacts of these measures, the Group

has applied IAS 20: 'Government Grants'.

During the six months to 31 July 2021, the Group recognised an amount totalling

GBP216,000 (2020: GBP893,000) receivable under the UK Government's Coronavirus

Job Retention Scheme and an amount totalling GBP716,000 (2020: GBPnil) receivable

under the UK Government's Restart Grant Scheme. There was an amount of GBP610,000

receivable under the UK Government's Retail Hospitality and Leisure Grant

Fund as at 31 July 2020.

Note 6. EBITDA reconciliation (earnings before interest, taxation, depreciation

and amortisation)

The Directors believe that adjusted profit provides additional useful information

for shareholders on performance. This is used for internal performance analysis.

This measure is not defined by IFRS and is not intended to be a substitute

for, or superior to, IFRS measurements of profit. The following table is

provided to show the comparative earnings before interest, tax, depreciation

and amortisation ('EBITDA') after adjusting for costs relating to IFRS 16

lease liabilities.

Unaudited Unaudited

six six Audited

months months year

ended ended ended 31

31 July 31 July January

2021 2020 2021

GBP'000 GBP'000 GBP'000

EBITDA reconciliation

Profit before income tax expense post IFRS 16 3,723 1,358 2,646

Less: Interest income (19) (12) (24)

Add: Interest expense 215 211 434

Add: Depreciation and amortisation 1,452 1,314 2,662

EBITDA post IFRS 16 5,371 2,871 5,718

Less: costs relating to IFRS 16 lease liabilities (943) (778) (1,737)

EBITDA pre IFRS 16 4,428 2,093 3,981

========= ========= =========

Note 7. Income tax expense

The tax charge for the six months ended 31 July 2021 is

recognised based on management's estimate of the weighted average

annual effective tax rate expected for the full financial year,

adjusted for the tax impact of any discrete items arising in the

period. Deferred tax balances are calculated using tax rates that

have been enacted or substantively enacted by the balance sheet

date and that are expected to apply in the period when the

liability is settled or the asset realised.

In the March 2021 budget, the Chancellor of the Exchequer

announced an increase to the standard rate of UK corporation tax

from 19% to 25% from 1 April 2023. The impact on the half year due

to the enacted change in the taxation rate is an increase in the

opening deferred taxation liability by GBP82,000. This increases

the effective taxation rate for the period by approximately 2%.

Note 8. Intangibles

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill - at cost 5,802 5,802 5,802

Less: Impairment (182) (182) (182)

5,620 5,620 5,620

Software - at cost 1,274 945 1,104

Less: Accumulated amortisation (676) (313) (473)

598 632 631

6,218 6,252 6,251

========== ========== ===========

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Goodwill Software Total

Unaudited six months ended 31 July GBP'000 GBP'000 GBP'000

Balance at 1 February 2021 5,620 631 6,251

Additions - 170 170

Amortisation expense - (203) (203)

Balance at 31 July 2021 5,620 598 6,218

======== ======== =======

Note 9. Property, plant and equipment

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Land and buildings improvements - at cost 1,002 1,002 1,002

Less: Accumulated depreciation (295) (313) (287)

707 689 715

Plant and equipment - at cost 6,660 5,910 6,411

Less: Accumulated depreciation (2,041) (1,326) (1,685)

4,619 4,584 4,726

Motor vehicles - at cost 15 15 15

Less: Accumulated depreciation (9) (6) (8)

6 9 7

Computer equipment - at cost 1,326 1,093 1,271

Less: Accumulated depreciation (827) (591) (700)

499 502 571

5,831 5,784 6,019

========== ========== ===========

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Land and

buildings Plant and Motor Computer

improvements equipment vehicles equipment Total

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February

2021 715 4,726 7 571 6,019

Additions - 249 - 55 304

Depreciation expense (8) (356) (1) (127) (492)

Balance at 31 July 2021 707 4,619 6 499 5,831

============ ========= ======== ========= =======

Note 10. Right-of-use assets

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Land and buildings - right-of-use 15,235 13,752 15,003

Less: Accumulated depreciation (5,305) (3,937) (4,610)

9,930 9,815 10,393

Plant and equipment - right-of-use 575 575 575

Less: Accumulated depreciation (194) (137) (166)

381 438 409

Motor vehicles - right-of-use 269 254 269

Less: Accumulated depreciation (218) (146) (187)

51 108 82

Computer equipment - right-of-use 59 59 59

Less: Accumulated depreciation (36) (31) (33)

23 28 26

10,385 10,389 10,910

========== ========== ===========

Reconciliations

Reconciliations of the written down values at the beginning and end of the

current financial period are set out below:

Land and Plant and Motor Computer

buildings equipment vehicles equipment Total

Unaudited six months

ended 31

July GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 February 2021 10,393 409 82 26 10,910

Additions 232 - - - 232

Depreciation expense (695) (28) (31) (3) (757)

Balance at 31 July 2021 9,930 381 51 23 10,385

========= ========= ======== ========= =======

Note 11. Trade and other payables

Audited

Unaudited six months year ended

ended 31 July 31 January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Current liabilities

Trade payables 6,334 8,444 3,287

Accrued expenses 1,894 1,030 1,462

Refund liabilities 96 35 102

Social security and other taxes 1,097 2,240 537

Contingent consideration - 50 -

Other payables 979 679 1,353

10,400 12,478 6,741

========== ========== ===========

Note 12. Share capital

Unaudited six months ended 31 July

2021 2020 2021 2020

Shares Shares GBP'000 GBP'000

Ordinary shares of GBP0.01 each - fully

paid 77,267,304 77,267,304 773 773

========== ========== ======= =======

Note 13. Dividends

There were no dividends paid, recommended or declared during the

current or previous financial period.

Note 14. Contingent liabilities

The Group had no material contingent liabilities as at 31 July

2021, 31 January 2021 and 31 July 2020.

Note 15. Earnings per share

Unaudited Unaudited Audited

six months six months year

ended 31 ended 31 ended 31

July July January

2021 2020 2021

GBP'000 GBP'000 GBP'000

Profit after income tax attributable to the

owners

of Angling Direct PLC 2,860 1,356 2,405

----------- ----------- ---------

Number Number Number

Weighted average number of ordinary shares

used

in calculating basic earnings per share 77,267,304 67,172,185 72,226,957

Adjustments for calculation of diluted

earnings

per share:

Options over ordinary shares 970,610 - 1,049,867

Weighted average number of ordinary shares

used

in calculating diluted earnings per share 78,237,914 67,172,185 73,276,824

---------- ---------- ----------

Pence Pence Pence

Basic earnings per share 3.70 2.02 3.33

Diluted earnings per share 3.65 2.02 3.28

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DXBDGRDBDGBD

(END) Dow Jones Newswires

October 13, 2021 02:00 ET (06:00 GMT)

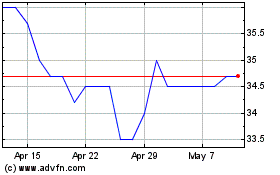

Angling Direct (LSE:ANG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Angling Direct (LSE:ANG)

Historical Stock Chart

From Apr 2023 to Apr 2024