TIDMANGS

RNS Number : 8985A

Angus Energy PLC

30 May 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 6/2014 AS IT FORMS

PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR"), AND IS DISCLOSED IN ACCORDANCE WITH

THE COMPANY'S OBLIGATIONS UNDER ARTICLE 17 OF MAR.

30 May 2023

Angus Energy Plc

("Angus Energy", "Angus" or the "Company")

Saltfleetby Field: Production and Pricing Update and future

Drilling Plans

Further to the announcement of 15 May 2023, Angus Energy (AIM:

ANGS) is pleased to announce that production at the Saltfleetby

Field has reached a steady operating state from the 3 producing

wells in the field, B2, A4 and the new B7T.

After a short duration plant outage, we are now exporting gas to

the National Grid at a combined average daily rate of 9.5 mmscfd,

reaching peak flows of over 10 mmscf. The new B7T well continues to

clean-up and the Company anticipates exceeding a combined average

daily rate of 10 mmscfd, on a sustainable basis.

We have seen gas prices falling back to lower summer levels over

recent weeks, but winter 2023-2024 pricing is strong, with

forecasted prices at GBP1.24 per therm on Heren NBP pubished

trading data. On the basis of continued production at this level,

known hedge prices and published market forward prices we should be

generating approximately GBP2.5 million of revenues on average each

month for winter 2023 from Saltfleetby.

Potential Future Drilling and Gas Storage

Angus continues to evaluate storage opportunities at Saltfleetby

variously for natural gas, hydrogen and CO2. To advance this, the

Company has also engaged planning consultants to submit a further

planning permission for an expanded site at Saltfleetby to

encompass a number of new wells and process plant.

The drilling will initially address the Namurian reservoir,

below the presently exploited Westphalian, as a commercial source

of natural gas but wells will also be designed to be repurposed as

potential injection wells for gas storage, whether in the Namurian

or Westphalian, and for which further planning permissions at

national level would be sought if deemed appropriate.

Furthermore, following on from the pioneering use of hydrogen

tight Soluforce pipe in the first commercial transmission grid

connection at Theddlethorpe Entry Point, Angus will be exploring

the design parameters around the management of hydrogen or CO2 at

high pressures, alongside traditional storage of natural gas.

The Namurian reservoir, which sits below the Westphalian from

which the Company currently extracts natural gas, has produced 1.5

bcf to date but a very wide variation of gas in place exists

between our own recent CPRs and internal estimates by previous

Operators, Gazprom-Wintershall and Roc Oil. To date no detailed

interpretation of the Namurian, independent from the Westphalian,

has been undertaken and accordingly a full third party

re-interpretation of both reservoirs is presently underway,

expected to complete in October.

In 2006 Gazprom-Wintershall estimated the storage capacity of

the overall field to be between 700 and 800 million cubic metres,

making it easily the largest onshore storage facility in the UK.

Estimates by Angus of storage capacity are somewhat higher and do

not include the Namurian.

Richard Herbert, CEO, writes: "The Company is pleased to have

reached this production milestone and to be able to turn attention

to both organic and inorganic growth opportunities. Gas storage is

an obvious and topical one. Properly engineered to manage H2 or CO2

as well as natural gas, storage at Saltfleetby has the potential to

meet the twin demands of present and future administrations for

clean energy and energy security and we are pleased to be able to

align shareholder interests with those longer term goals whilst

offering the possibility of enhanced gas recoveries in the medium

term."

.

END.

Enquiries:

Angus Energy Plc www.angusenergy.co.uk

George Lucan Tel: +44 (0) 208 899

6380

Beaumont Cornish (Nomad) www.beaumontcornish.com

James Biddle/ Roland Tel: +44 (0) 207 628

Cornish 3396

WH Ireland Limited

(Broker)

Katy Mitchell/ Harry Tel: +44 (0) 113 394

Ansell 6600

Flagstaff PR/IR angus@flagstaffcomms.com

Tim Thompson Tel: +44 (0) 207 129

1474

Fergus Mellon

Aleph Commodities info@alephcommodities.com

Qualified Person's Statement: Andrew Hollis, the Technical

Director of the Company, who has over 40 years of relevant

experience in the oil and gas industry, has approved the

information contained in this announcement. Mr Hollis is a Fellow

of the Geological Society and member of the Society of Petroleum

Engineers.

Notes

About Angus Energy plc

Angus Energy plc is a UK AIM quoted independent onshore Energy

Transition company with a complementary portfolio of clean gas

development assets, onshore geothermal projects, and legacy oil

producing fields. Angus is focused on becoming a leading player in

the aggregation, production and storage of energy. Angus Energy has

a 100% interest in the Saltfleetby Gas Field (PEDL005), majority

owns and operates conventional oil production fields at Brockham

(PL 235) and Lidsey (PL 241) and has a 25% interest in the Balcombe

Licence (PEDL244). Angus Energy operates all fields in which it has

an interest.

Important Notices

This announcement contains 'forward-looking statements'

concerning the Company that are subject to risks and uncertainties.

Generally, the words 'will', 'may', 'should', 'continue',

'believes', 'targets', 'plans', 'expects', 'aims', 'intends',

'anticipates' or similar expressions or negatives thereof identify

forward-looking statements. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond the Company's ability to control or estimate

precisely. The Company cannot give any assurance that such

forward-looking statements will prove to have been correct. The

reader is cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

announcement. The Company does not undertake any obligation to

update or revise publicly any of the forward-looking statements set

out herein, whether as a result of new information, future events

or otherwise, except to the extent legally required.

Nothing contained herein shall be deemed to be a forecast,

projection or estimate of the future financial performance of the

Company.

Explanation of Terminology:

scm (standard cubic metre) mscm (thousand standard cubic metre)

and mmscf (million standard cubic feet) are traditional measures of

volumes of gas. As producers we tend to observe volume flow from

wells and through process plant but we are paid on the energy

content which is metered and analysed at point of sale. Mmscfd

represents mmscfd per day.

These two types of measurement, energy and volume, are related

by the calorific or higher heating value which is the number of MJ

per standard cubic metre. Very intense processing, i.e. lower

temperatures, will tend to remove more higher hydrocarbon fractions

such as propane, butane and pentane, which will lower the calorific

value but improve the margin of safety in terms of meeting

transmission grid specification.

55,000 Therms, given a calorific value of about 41MJ per

standard cubic metres is approximately equal to 5mmscf or 141,584

scm, 1,612,486 kwhrs, 5,804,948 MJ.

FWHP- Flowing Well Head Pressure

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLDGGDUBSDDGXC

(END) Dow Jones Newswires

May 30, 2023 02:00 ET (06:00 GMT)

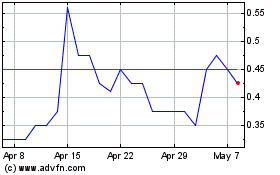

Angus Energy (LSE:ANGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Angus Energy (LSE:ANGS)

Historical Stock Chart

From Apr 2023 to Apr 2024