TIDMANIC

RNS Number : 5311A

Agronomics Limited

03 February 2022

3 February 2022

Agronomics Limited

("Agronomics" or the "Company")

Unaudited Interim Results for the six-month period ending 31

December 2021

Agronomics Limited (AIM:ANIC), the leading listed company

focused on the field of cellular agriculture , is pleased to

announce its unaudited interim results for the six-month period

ending 31 December 2021. A copy of these Interim Results is

available on the Company's website www.agronomics.im .

Financial highlights

-- The Company's Net Asset Value per Share on 31 December 2021

was 14.32 pence (30 September 2021: 12.99 pence) - an increase of

10.24%.

-- Investment income, including loan interest and net unrealised

gains on investments, increased to GBP3,629,016 (2020: GBP510,635)

during the six-month period.

-- Operating expenses were GBP806,030 (2020: GBP441,013), and

mostly comprised of professional fees relating to the investments

acquired and the fundraise completed during the period.

-- A net profit of GBP2,523,407 (2020: loss of GBP1,447,306) was recognised during the period.

-- Invested assets at fair value increased to GBP60,878,486 (30

June 2021: GBP38,770,676), and cash and cash equivalents stood at

GBP45,281,054 (30 June 2021: GBP62,436,497).

-- Net assets increased to GBP134,340,730 at 31 December 2020

(30 June 2021: GBP100,029,816). The increase is principally due to

a successful funding round during December 2021, raising total net

funds of GBP31 million and issuing 138,368,193 new ordinary shares,

and from unrealised gains on the revaluation of investments held in

Vitrolabs (GBP1.8 million) and Galy Co (GBP1.5 million).

Investment highlights

-- 21st July 2021 - portfolio company Shiok Meats Pte. Ltd, the

world's first cell-based crustacean meat company, raised a bridge

funding round. This brought Shiok Meat's total raised capital to

US$ 30 million. Agronomics holds 2,465 Series A Preferred Shares in

Shiok Meats, representing a 1.6% equity ownership on a fully

diluted basis.

-- 13th September 2021 - The Company's shares inFormo, Europe's

first cellular agriculture company developing cultivated dairy

products, saw a 7.5x uplift on the original investment after a US$

50 million Series A financing. This represents an IRR of 225% and

Agronomics will carry this position on its balance sheet at EUR10.7

million (approximately GBP9.2 million).

-- 20th September 2021 - Agronomics led cultivated leather

company VitroLab's Series A financing, with a US$ 7.0 million

investment. Agronomics holds an equity ownership of 14.65% on a

fully diluted basis and have the right to a board seat. Agronomics

will carry this position in its accounts at a book value of US$

12.75 million including an unrealised gain on cost of US$ 2.25

million and an IRR of 40%.

-- 28th September 2021 - Portfolio company Simply Foods, Inc

closed a US$ 25 million Series A funding round. The Series A

financing represents a 5.14x uplift on the original cash investment

by Agronomics, with an IRR of 119%. Agronomics carries this

position in its accounts at a book value of US$ 3.60 million,

including an unrealised gain on cost of US$ 2.90 million.

-- 20th October 2021 - Agronomics led cultivated cocoa company

California Cultured's Seed round with a US$ 2.2 million investment.

The financing was in the form of a SAFER ("Simple Agreement for

Future Equity"). The SAFER is expected to convert into Preferred

Stock of California Cultured at a future equity financing round by

California Cultured of at least US$ 4 million, following which

Agronomics would hold an approximate equity ownership of 18.33% on

a fully diluted basis.

-- 26th October 2021 - Agronomics invested EUR3 million in Solar

Foods Oy, a company that produces protein using air-captured carbon

dioxide and electricity, in the form of a Convertible Loan Note.

The CLN is expected to give Agronomics an approximate equity

ownership of 5.80%.

-- 8th November 2021 - Agronomics invested US$ 8 million in The

EVERY Company, a commercial stage precision fermentation company

focused on the production of egg proteins, such as albumin.

-- 19th November 2021 - Agronomics led cultivated beef company

Ohayo Valley's Pre-Seed round with a US$ 1.5 million

subscription

Richard Reed, Chairman of Agronomics, commented: -

"The first half of the financial year has been both busy and

very exciting. Our current investment portfolio shows considerable

promise for future growth, given the scale of opportunity to invest

in the nascent alternative foods sector. We are expecting

significant developments in a number of our portfolio companies

that should positively impact their valuation in the coming months.

The Board continue to seek new opportunities in line with its

Investing Policy, thereby creating value for shareholders."

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

For further information please contact:

Agronomics Beaumont Cenkos Peterhouse TB Cardew

Limited Cornish Limited Securities Capital

Plc Limited

The Company Nomad Joint Broker Joint Broker Public Relations

------------------ ------------------ --------------------- ------------------------

Richard Reed Roland Cornish Giles Balleny Lucy Williams Ed Orlebar

Denham Eke James Biddle Michael Johnson Charles Goodfellow Joe McGregor

------------------ ------------------ --------------------- ------------------------

+44 (0) 20 7930

0777

+44 (0) 1624 +44 (0) 7738 724

639396 +44 (0) 207 +44 (0) 207 +44 (0) 207 630

info@agronomics.im 628 3396 397 8900 469 0936 agronomics@tbcardew.com

------------------ ------------------ --------------------- ------------------------

Chairman's statement

Introduction

I am pleased to present the Unaudited Interim Results for

Agronomics Limited (the "Company" or "Agronomics") for the

six-month period ending 31 December 2021.

This half-year saw Agronomics focus on selective opportunities

to deploy capital within the field of cellular agriculture, which

saw three new names added to the portfolio. Agronomics now has 18

companies in its portfolio, with broad diversification across the

world's largest protein categories.

We define cellular agriculture as the direct production of

agricultural commodities without animals, but from living cells or

single-celled organisms completely disconnected from conventional

agriculture. This encompasses cell culture, including cultivated

meat and seafood, precision fermentation - including biomass and

precision fermentation, and enabling technologies, such as novel

bioreactor designs and low-cost growth factor methodologies to

support the first two categories. These technologies aim to provide

more sustainable methods for the development of such products,

reducing greenhouse gas emissions, antibiotic requirements, land

use, water use, energy use, improving animal welfare and mitigating

climate change. Agronomics now has exposure across cultivated meat

- chicken, beef, pork, cultivated leather, cultivated cocoa and

cotton, precision fermentation derived dairy and egg proteins.

During the period, Agronomics led three deals in cellular

agriculture: cultivated leather company VitroLab's Series A

financing, cultivated cocoa company California Cultured's Seed

round and cultivated beef company Ohayo Valley's Pre-Seed round. It

also saw The EVERY Company, a commercial stage precision

fermentation company focused on the production of egg proteins,

such as albumin, be added to the portfolio.

With the December 2021 financing completed, Agronomics has a

very strong balance sheet with approximately GBP74 million cash on

hand to deploy into new and existing opportunities. During 2021,

US$ 2.4 billion was invested into the sector, which was a

significant increase from prior years. Last year, US$ 1 billion was

raised by cultivated meat companies alone, and US$ 1.4 billion by

fermentation companies, seeing the largest amount of capital raised

in any single year. We are witnessing and supporting the sector's

evolution to focus on commercial scale-up, with many companies

looking to establish their first pilot facilities and seek

regulatory approvals. It is now anticipated that the next 12 months

will be pivotal, with the first regulatory approvals for the sale

of its cultivated meat products in the US. Looking further out,

China also recently announced its five-year agricultural plan,

referencing cultivated meat for the first time.

In the last 6 months, the largest financing of a cultivated meat

company was achieved, with Israel based Future Meat Technologies

raising a substantial US$ 347 million Series B led by ADM Ventures.

We also witnessed Upside Foods unveil its 53,000 square ft facility

in California, as well as recently announcing the acquisition of a

cultivated seafood company in the field, Cultured Decadence. There

have been three acquisitions in the sector to date. JBS, the

largest meat processing company in the world, also acquired Spanish

cultivated meat company Biotech Foods. Though this is the first

acquisition by a major conventional meat producer, we anticipate

many more similar acquisitions or collaborations with other giants

in the protein supply chain.

Investment Review

During the period, the Company completed a number of

acquisitions and a number of investments had positive revaluations,

as detailed below.

On 21st July 2021, portfolio company Shiok Meats Pte. Ltd

("Shiok Meats") raised a bridge funding round from South Korean

strategic investors Woowa Brothers Asia Holdings and CJ CheilJedang

Corporation, as well as Vietnamese seafood exporter Vinh Hoan

Corporation. Agronomics holds 2,465 Series A Preferred Shares in

Shiok Meats, representing a 1.6% equity ownership on a fully

diluted basis (excluding any shares to be issued pursuant to this

debt financing). This increased Shiok Meat's total raised capital

to US$ 30 million.

On 13 September 2021, the Company participated in the US$ 50

million Series A financing of Formo Bio GmbH ("Formo" formerly

LegenDairy Foods GmbH), led by EQT Ventures . Agronomics

participated in the round, subscribing for 1,186 Series A Preferred

Shares, with a EUR3.15 million investment. Agronomics now holds a

total of 3,575 shares in Formo, representing an equity ownership of

5.94% on a fully diluted basis. Agronomics co-led Formo's EUR4

million Seed round in December 2019 , with a EUR1 million

investment for 2,389 Series Seed Preferred Shares, which will see a

7.5x uplift on the original investment. This represents an IRR of

225% and, subject to audit, Agronomics will carry this position on

its balance sheet at EUR10.7 million (approximately GBP9.2

million), inclusive of the Series A participation. This equates to

an estimated portfolio weighting based on the Company's last

reported Net Asset Value of 9.1%.

Agronomics led VitroLabs Inc. ("VitroLabs") Series A funding

round on 20th September 2021, with a US$ 7.0 million investment,

with the proceeds being used to build and scale the world's first

pilot production facility of cultivated leather. Agronomics

previously invested US$ 3.5 million in VitroLabs via SAFEs and

CLNs, which converted on completion of this funding round.

Agronomics holds an equity ownership of 14.65% on a fully diluted

basis and have the right to a board seat. Agronomics will carry

this position in its accounts at a book value of US$ 12.75 million,

subject to audit, including an unrealised gain on cost of US$ 2.25

million and an IRR of 40%. VitroLabs is the Bay-Area-based

biotechnology company focused on producing leather via its

innovative and unique cell culture process. Its technology

encompasses utilising a tissue engineering process to create

genuine hides directly from animal cells for leather products.

The global luxury leather goods market is a US$ 48 billion

opportunity, and VitroLabs is set to become the world's first

company to commercialise cultivated leather.

On the 28th September 2021, portfolio company Simply Foods,

Inc., (trading as "New Age Meats"), closed a US$ 25 million Series

A funding round led by Hanwha Solutions Corporation, a South Korean

conglomerate. Agronomics first invested in New Age Meats in July

2019 , with a US$ 699,999 investment. The Series A financing

represents a 5.14x uplift on the original cash investment by

Agronomics, with an IRR of 119%. Subject to audit, Agronomics

carries this position in its accounts at a book value of US$ 3.60

million, including an unrealised gain on cost of US$ 2.90

million.

Agronomics led California Cultured Inc's ("California Cultured")

Seed funding round on the 20th October 2021, with a US$ 2.2 million

investment. The financing was in the form of a SAFER ("Simple

Agreement for Future Equity"). Joining the round included global

venture firm SOSV's IndieBio. The SAFER is expected to convert into

Preferred Stock of California Cultured at a future equity financing

round by California Cultured of at least US$ 4 million, following

which Agronomics would hold an approximate equity ownership of

18.33% on a fully diluted basis. Following the close of the round,

Agronomics has the right to a directorship in California Cultured.

Should California Cultured not complete a qualifying financing

within 12 months the SAFER will automatically convert into equity.

California Cultured is a food-tech company based in Davis,

California, U.S., which harnesses cell culture technology to

produce cocoa products. The application of cellular agriculture for

the production of plants or plant-derived ingredients has to date

not been extensively commercialised. Using cocoa cell cultures to

produce valuable cocoa products, such as cocoa powder, chocolate,

cocoa butter and flavanols is considered an exciting

opportunity.

On the 26th October 2021, Agronomics invested EUR3 million in

Solar Foods Oy ("Solar Foods") in the form of a Convertible Loan

Note ("CLN"). Also joining the round were existing investors CPT

Capital and Happiness Capital Limited and new investor, LOSA Group.

The CLN is expected to give Agronomics an approximate equity

ownership of 5.80%, inclusive of its prior investment announced in

September 2020 . In the past year, Solar Foods has made strong

R&D progress and is now focused on building its new

demonstration facility that is set to be operational early 2023.

Solar Foods' novel technology has recently been recognised by NASA

as part of their Deep Space Food Challenge - looking for new

solutions to feed astronauts.

Agronomics invested US$ 8 million in The EVERY Company ("EVERY",

formerly Clara Foods Co.) on the 4th November 2021 for an equity

stake on a fully diluted basis of 1.39%. This was part of an

oversubscribed US$ 127.5 million Series C Round by raising a total

of US$ 175 million. Based on this revised Series C Round its

investment will equate to an interest of 1.28%. EVERY is a leading

precision fermentation company with a key focus on the

commercialisation of proteins traditionally derived from animals.

Recently, EVERY launched the world's first animal-free egg protein

and collaborated with the juice brand Pressed to produce smoothies

containing their protein. This recent fundraise will help drive the

scale up of its animal-free protein platform, so that EVERY's

sustainable ingredients can have a worldwide reach.

On the 19th November 2021, Agronomics led Ohayo Valley Inc's

("Ohayo Valley") Pre-Seed funding round with a US$ 1.5 million

subscription in the form of a Simple Agreement for Future Equity

("SAFE"). Ohayo Valley is a cultivated meat company, initially

focused on producing cultivated Wagyu ribeye steak, before

expanding to other beef products. Ohayo Valley was co-founded in

2020 by Dr Jess Krieger. Combined, the co-founding team brings 20

years of experience in the cultivated meat sector, including Jess'

previous position as CSO for Artemys Foods, where she led the

development of the Artemys Burger prototype. The SAFE is expected

to convert into preferred shares in Ohayo Valley at a future equity

financing round of at least US$ 1.5 million, giving Agronomics an

approximate equity ownership of 18.75%. Agronomics will have the

right to a board seat.

Agronomics also disposed of two assets during the period. On the

29th September 2021, Agronomics sold its entire holding of 23,147

shares in Insilico Medicine, Inc for US$ 523,477 (GBP378,561),

thereby representing an IRR of 45%.

Agronomics also sold its entire holding of 40,000 shares in

Oritain Global Limited for NZ$ 1.36 million (approximately GBP0.7

million), representing an IRR of 74%. The proceeds from these

disposals will be used to provide further funding for opportunities

within the field of cellular agriculture, inclusive of supporting

existing companies, as well as identifying new opportunities.

Financial Review

The Company recorded a net profit for the period of GBP2,523,407

(2020: loss of GBP1,447,306). During the six months, our investment

income, including loan interest and net unrealised gains, increased

to GBP3,629,016 (2020: GBP510,635). Operating expenses were

GBP769,365 (2020: GBP430,180), with the increase due to

professional fees relating to the investments acquired and the

fundraise completed during the period. Following the fundraise,

share issue commissions of GBP43,600 were paid, which under IFRS

have been capitalised to equity. No performance fees were payable

or accrued for the current period. The basic profit per share was

0.33 pence (2020: loss of 0.62 pence), and the diluted profit per

share was 0.21 pence (2020: loss of 0.61 pence).

Our invested assets at fair value increased to GBP60,878,486 (30

June 2021: GBP38,770,676), and cash and cash equivalents stood at

GBP45,281,054 (30 June 2021: GBP62,436,497). Our net assets

increased to GBP134,340,730 at 31 December 2021 (30 June 2021:

GBP100,029,816). The increase is due to a fundraise completed on 21

December 2021, issuing 138,368,193 new ordinary shares for gross

proceeds of GBP31,824,684, and unrealised gains on investments of

GBP3,492,270 recognised during the period. As a result, the net

asset value per share at 31 December 2021 is 14.32 pence, being 14%

higher than at 30 June 2021 (12.51 pence).

Financing

During the 6 months to 31st December 2021, the Company

successfully completed a funding round, raising gross proceeds of

GBP31,824,684 and issuing 138,368,193 new Ordinary Shares.

Following share issue commissions and professional fees, net cash

proceeds of approximately GBP31 million were retained by the

Company. These funds, together with existing cash resources, will

be utilised to provide funding for opportunities within the field

of cellular agriculture, inclusive of supporting existing

companies, as well as identifying new opportunities.

Approach to Risk and Corporate Governance

"The Company's general risk appetite is a moderate, balanced one

that allows it to maintain appropriate growth, profitability and

scalability, whilst ensuring full corporate compliance."

The Group's primary risk drivers include: -

Strategic, Reputational, Credit, Operational, Market, Liquidity,

Foreign Exchange, Capital and Funding, Compliance and Conduct.

Our risk appetite has been classified as high under an "impact"

matrix defined as Zero, Low, Medium and High. Appropriate steps

have been taken and adequate controls implemented to monitor the

risks of the Company, and the appropriate committees and reporting

structures have been established, which under the Chairmanship of

the Chairman, will monitor risks facing the Company. Further

details of the Corporate Governance Statement, including the role

and responsibilities of the Chairman and an explanation as to how

the QCA Code has been applied, will be found on pages 7 to 10 of

the audited 30 June 2021 Financial Statements, which are on the

Company's website at www.agronomics.im .

At the General Meeting of the Company on 16 April 2019,

shareholders adopted a new Investing Policy, which includes the

following:

"The Company will invest in opportunities within the Life

Sciences sector, concentrating on, but not being limited to,

environmentally friendly alternatives to the traditional production

of meat and plant-based nutrition sources ("Clean Food"). The

Company will focus on investments that provide scalable and

commercially viable opportunities."

Under our valuation policy, it is not possible to reflect

significant uplifts between valuation events such as a new third

party funding, and therefore the Board believes that the stated NAV

per share may not fully represent the current intrinsic value of

the portfolio companies given their continuing progress and the

comparable valuations we see for these types of companies in this

rapidly growing sector.

Further details of the new Investing Policy can found on the

Company's website at www.agronomics.im .

Strategy and Outlook

The first half of the financial year has been both busy and very

exciting. Our current investment portfolio shows considerable

promise for future growth, given the scale of opportunity to invest

in the nascent alternative foods sector. We are expecting

significant developments in a number of our portfolio companies

that should positively impact their valuation in the coming months.

The Board continue to seek new opportunities in line with its

Investing Policy, thereby creating value for shareholders.

Richard Reed

Chairman

2 February 2022

Condensed statement of comprehensive income

For the period ended 31 December 2021

Period Period

ended ended

31/12/2021 31/12/2020

Notes (unaudited) (unaudited)

GBP GBP

Income

Net income from financial instruments at fair value through profit and

loss 2 3,492,270 479,010

---------------- ----------------

3,492,270 479,010

Operating expenses

Directors' fees (36,667) (10,833)

Other operating costs 4 (769,363) (430,180)

Unrealised foreign exchange losses (299,579) (1,516,928)

---------------- ----------------

Profit/(loss) from operating activities 2,386,661 (1,478,931)

Interest received 2 136,746 31,625

---------------- ----------------

Profit/(loss) before taxation 2,523,407 (1,447,306)

Taxation - -

---------------- ----------------

Profit/(loss) for the period 2,523,407 (1,447,306)

Other comprehensive income - -

---------------- ----------------

Total comprehensive profit/(loss) for the period 2,523,407 (1,447,306)

Basic profit/(loss) per share (pence) 5 0.33 (0.62)

Diluted profit/(loss) per share (pence) 5 0.21 (0.61)

The Directors consider that the Company's activities are

continuing.

Condensed statement of financial position

As at 31 December 2021

31/12/2021 30/06/2021

Notes (unaudited) (audited)

GBP GBP

Current assets

Financial assets at fair value through profit or loss 6 60,878,486 38,770,676

Trade and other receivables 7 29,892,027 445,667

Cash and cash equivalents 45,281,054 62,436,497

---------------- ----------------

Total assets 136,051,567 101,652,840

Equity

Share capital 937 799

Share premium 123,065,776 91,278,407

Share reserve 7,394,360 7,394,360

Accumulated earnings 3,879,657 1,356,250

---------------- ----------------

Total equity 134,340,730 100,029,816

Current liabilities

Trade and other payables 8 1,710,837 1,623,024

---------------- ----------------

Total liabilities 1,710,837 1,623,024

---------------- ----------------

Total equity and liabilities 136,051,567 101,652,840

These interim financial statements were approved by the Board of

Directors on 2 February 2022 and were signed on their behalf

by:

Denham Eke

Director

Condensed statement of changes in equity

For the period ended 31 December 2021

Share Share Retained (loss)/earnings

capital premium GBP Total

GBP GBP GBP

Balance at 01 July 2020 331 19,080,138 336,409 19,416,878

(audited)

Total comprehensive loss for the

period - - (1,447,306) (1,447,306)

Issue of shares 168 10,050,474 - 10,050,642

Share issue costs capitalised - (265,635) - (265,635)

---------------- ---------------- ---------------- ----------------

Balance at 31 December 2020

(unaudited) 499 28,864,977 (1,110,897) 27,754,579

Share Share Share reserve Retained

capital premium GBP earnings Total

GBP GBP GBP GBP

Balance at 01 July 2021

(audited) 799 91,278,407 7,394,360 1,356,250 100,029,816

Total comprehensive profit

for the period - - - 2,523,407 2,523,407

Issue of shares 138 31,830,969 - - 31,831,107

Share issue costs capitalised - (43,600) - - (43,600)

------------ ---------------- -------------- ---------------- ----------------

Balance at 31 December 2021

(unaudited) 937 123,065,776 7,394,360 3,879,657 134,340,730

Condensed statement of cash flows

For the period ended 31 December 2021

Period Period

ended ended

Notes 31/12/2021 31/12/2020

(unaudited) (unaudited)

GBP GBP

Cash flows from operating activities

Profit/(loss) for the period 2,523,407 (1,447,306)

Purchase of investments (19,423,481) (9,647,469)

Proceeds from sale of investments 696,456 91,092

Interest received - non-cash (134,052) (31,625)

Unrealised gains on investments 2 (3,492,270) (479,010)

Unrealised foreign exchange losses on investments 245,537 1,469,538

-------------- --------------

Operating loss before changes in working capital (19,584,403) (10,044,780)

Change in trade and other receivables 378,324 (4,065)

Change in trade and other payables 87,813 176,439

-------------- --------------

Net cash flows from operating activities (19,118,266) (9,872,406)

Cash flows from financing activities

Proceeds from issue of shares 2,006,423 9,855,460

Share issue commissions paid (43,600) (265,635)

-------------- --------------

Net cash flows from financing activities 1,962,823 9,589,825

Decrease in cash and cash equivalents (17,155,443) (282,581)

Cash and cash equivalents at beginning of period 62,436,497 2,789,097

-------------- --------------

Cash and cash equivalents at the end of period 45,281,054 2,506,516

1 Significant accounting policies

Agronomics Limited (the "Company") is a company domiciled in the

Isle of Man. The address of the Company's registered office is 18

Athol Street, Douglas, Isle of Man, IM1 1JA.

The unaudited condensed financial statements of the Company (the

"Financial Information") are prepared in accordance with Isle of

Man law and International Financial Reporting Standards ("IFRS")

and their interpretations issued by the International Accounting

Standards Board ("IASB") and adopted by the European Union ("EU").

The financial information in this report has been prepared in

accordance with the Company's accounting policies. Full details of

the accounting policies adopted by the Company are contained in the

financial statements included in the Company's annual report for

the year ended 30 June 2021 which is available on the Group's

website: www.agronomics.im

The accounting policies and methods of computation and

presentation adopted in the preparation of the Financial

Information are consistent with those described and applied in the

financial statements for the year ended 30 June 2021. There are no

new IFRSs or interpretations effective from 1 July 2020 which have

had a material effect on the financial information included in this

report.

The unaudited condensed financial statements do not constitute

statutory financial statements. The statutory financial statements

for the year ended 30 June 2021, extracts of which are included in

these unaudited condensed financial statements, were prepared under

IFRS as adopted by the EU. The auditors' report on those financial

statements was unmodified.

The preparation of the Financial Information requires management

to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and

liabilities, income and expenses. Actual results could differ

materially from these estimates. In preparing the Financial

Information, the critical judgements made by management in applying

the Company's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the financial

statements as at and for the year ended 30 June 2021 as set out in

those financial statements.

The Financial Information is presented in Great British Pounds,

rounded to the nearest pound, which is the functional currency and

also the presentation currency of the Company.

2 Net income from financial instruments at fair value through profit and loss

31/12/2021 31/12/2020 31/12/2019

(unaudited) (unaudited) (unaudited)

GBP GBP GBP

Net unrealised gains on investments 3,492,270 479,010 84,262

Other income 136,746 31,625 -

-------------- -------------- --------------

Total investment income 3,629,016 510,635 84,262

3 Performance fee

31/12/2021 31/12/2020

(unaudited) (unaudited)

GBP GBP

Performance fee - -

Shellbay Investments Limited ("Shellbay") receives performance

fees for the provision of Jim Mellon as Director of the Company.

Shellbay shall be entitled to an annual fee equal to the value of

15% of any increase between the Company's net asset value ("NAV")

on a per issued share basis at the start of a reporting period and

30 June ("Closing NAV Date") each year during the term of the New

Shellbay Agreement, with the first reporting period being from 1

July 2020 to 30 June 2021, and annually thereafter. The opening and

closing NAV for each period will be based on the audited financial

statements of the Company for the relevant financial year, with the

opening NAV for each reporting period being the higher of (i) 5.86

pence per share (the highest annual audited NAV per share since the

Company adopted its current investment policy and reported NAV per

share in September 2019), and (ii) the highest NAV per share

reported at a Closing Date for the previous reporting periods

during the term of the agreement (establishing a rolling

high-watermark for Shellbay to qualify for such fee). Any increase

in NAV per share will then be applied to the total issued share

capital at the end of the relevant period for the purposes of

determining the 15% fee. Any change in NAV per share that arises

from funds raised at a premium or discount to the existing NAV per

share will therefore be considered for the purposes of calculating

Shellbay's fee by reference to the annual audited accounts (for

clarity being an increase in respect of a premium and a decrease in

respect of a discount).

At the election of the Company, the Shellbay fee shall be

payable either in whole or in part by the issue of new shares at a

price equal to the mid-price on the last day of the relevant

Qualifying Period (being the Company's accounting year from 1 July

to 30 June) or grant of nil price warrants over shares; or in cash;

or (with the agreement of Shellbay), in cash-equivalents (such as

shares), and other assets held by the Company

No fees were payable or accrued for the current period (31

December 2020: GBPnil). See note 9 for further details.

4 Other operating costs

31/12/2021 31/12/2020 31/12/2019

(unaudited) (unaudited) (unaudited)

GBP GBP GBP

Auditors' remuneration 51,149 17,500 9,500

Insurance 9,031 4,158 3,544

Professional fees 577,849 360,136 518,388

Sundry expenses 131,334 48,386 31,350

-------------- -------------- --------------

Total other costs 769,363 441,013 577,782

The Company has no employees other than the Directors.

5 Basic and diluted profit per share

The calculation of basic profit per share of the Company is

based on the profit for the period of GBP 2,523,407 (31 December

2020: loss of GBP1,447,306) and the weighted average number of

shares of 763,671,848 (31 December 2020: 231,939,864) in issue

during the period.

Diluted profit per share is calculated by adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares such as warrants and

options. The calculation of diluted profit per share of the Company

is based on the profit for the period of GBP 2,523,407 (31 December

2020: loss of GBP1,447,306) and the diluted weighted average number

of shares of 1,199,151,684 (31 December 2020: 234,466,498) in issue

during the period.

6 Financial assets at fair value through profit or loss

During the previous financial year, the Company established a

new wholly owned subsidiary entity, Agronomics Investment Holdings

Limited ("the Subsidiary" or "AIHL"), which now holds the majority

of the portfolio of unquoted investments previously held directly

by the Company. Unquoted investments were transferred by the

Company into AIHL at their respective carrying amounts. The

investment in subsidiary is stated at fair value through profit or

loss in accordance with the IFRS 10 Investment Entity Consolidation

Exception. The fair value of the investment in Subsidiary is based

on the period-end net asset value of the Subsidiary. Additions and

disposals regarding the investment in subsidiary are recognised on

trade date.

31/12/2021 30/06/2021

(unaudited) (audited)

GBP GBP

Quoted 360,442 656,502

Unquoted 2,646,684 59,704

Investment in subsidiary 57,871,360 38,054,470

-------------- --------------

60,878,486 38,770,676

The composition of the investments held, both directly and

indirectly through the Subsidiary in the underlying portfolio, is

as follows:

31/12/2021 30/06/2021

(unaudited) (audited)

GBP GBP

Equities 50,282,538 28,349,567

Convertible loan notes and SAFEs* 10,595,948 10,421,109

-------------- --------------

60,878,486 38,770,676

* A SAFE is a Simple Agreement for Future Equity. SAFE

Agreements have similar characteristics to Convertible Loans and

are designed to provide an early investor with an "edge" ahead of a

larger planned funding. The edge is typically conversion of funds

advanced for new equity at a discount to the subsequent raise.

7 Trade and other receivables

31/12/2021 30/06/2021

(unaudited) (audited)

GBP GBP

Trade and other receivables 29,892,027 445,667

As stated in the Chairman's statement, the Company completed a

fundraise on 21 December 2021, issuing 138,368,193 new ordinary

shares for gross proceeds of GBP31,824,684. As at 31 December 2021,

GBP29,824,546 of the fundraise proceeds were due to be received by

the Company.

8 Trade and other payables

31/12/2021 30/06/2021

(unaudited) (audited)

GBP GBP

Provision for audit fee 25,000 37,797

Other provisions - 2,203

Trade creditors 206,965 104,152

Provision for irrecoverable VAT 1,478,872 1,478,872

------------ ------------

1,710,837 1,623,024

9 Related party transactions

Under an agreement dated 1 December 2011, Burnbrae Limited, a

company related to both Jim Mellon and Denham Eke, provide certain

services, principally accounting and administration, to the

Company. This agreement may be terminated by either party on three

months' notice. The Company incurred a total cost of GBP18,000 (31

December 2020: GBP18,000) during the period under this agreement of

which GBP6,000 was outstanding as at the period end (30 June 2021:

GBP68).

Under an updated agreement dated May 2021, Shellbay Investments

Limited, a Company related to both Jim Mellon and Denham Eke,

provide the services of Jim Mellon as Director of the Company. No

fees were payable or accrued for the current period (31 December

2020: GBPnil). See note 3 for further details.

In accordance with the Company's published investment strategy,

Jim Mellon may co-invest alongside the Company in certain

investments and, accordingly, he has direct and indirect interests

in other investments held by the Company.

10 Commitments and contingent liabilities

There are no known commitments or contingent liabilities as at

the period end.

11 Events after the reporting date

To the knowledge of the Directors, there have been no material

events since the end of the reporting period that require

disclosure in the condensed interim financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIAFLIFIIF

(END) Dow Jones Newswires

February 03, 2022 01:59 ET (06:59 GMT)

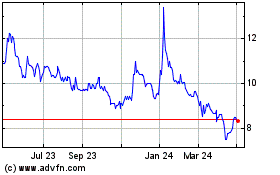

Agronomics (LSE:ANIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

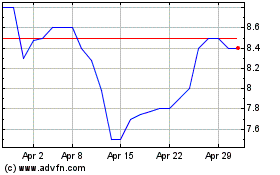

Agronomics (LSE:ANIC)

Historical Stock Chart

From Apr 2023 to Apr 2024