TIDMANII

RNS Number : 5028T

Aberdeen New India Invest Trust PLC

25 November 2021

ABERDEEN NEW INDIA INVESTMENT TRUST PLC

Legal Entity Identifier (LEI): 549300D2AW66WYEVKF02

UNAUDITED HALF-YEARLY FINANCIAL REPORT FOR THE SIX MONTHSED 30

SEPTEMBER 2021

FINANCIAL HIGHLIGHTS

Share price total Net asset value Ongoing charges

return{A} total return{A} ratio{A}

Six months ended Six months ended As at 30 September

30 September 2021 +21.8% 30 September 2021 +19.0% 2021 1.06%

Year ended 31 March Year ended 31 March As at 31 March

2021 +65.6% 2021 +52.7% 2021 1.16%

MSCI India Index Discount to Net

total return{B} asset value{A}

Six months ended As at 30 September

30 September 2021 +23.4% 2021 11.5%

Year ended 31 March

2021 +59.1% As at 31 March 2021 13.6%

{A} Considered to be an Alternative Performance

Measure.

{B} Sterling adjusted.

Source: abrdn, Morningstar & Lipper

30 September 31 March 2021 % change

2021

Total shareholders' funds

(GBP'000) 435,375 366,106 + 18.9

Share price (mid-market) 660.00p 542.00p + 21.8

Net asset value per share 745.95p 627.05p + 19.0

Discount to net asset value{A} 11.5% 13.6%

Net gearing{A} 5.6% 5.8%

Ongoing charges ratio{A} 1.06% 1.16%

Rupee to Sterling exchange

rate 100.1 100.9 + 0.8

{A} Considered to be an Alternative Performance Measure.

PERFORMANCE

Total return (in Sterling terms) for six months ended 30

September 2021 and year ended 31 March 2021

Six months ended Year ended

30 September 2021 31 March 2021

% %

Share price{A} + 21.8 + 65.6

Net asset value{A} + 19.0 + 52.7

MSCI India Index (Sterling adjusted) + 23.4 + 59.1

{A} Considered to be an Alternative Performance Measure.

Source: abrdn, Morningstar and

Lipper.

Total return (in Sterling terms) for year(s) ended 30 September

2021

1 year 3 year 5 year 10 year

% return % return % return % return

Share price {A} + 51.7 + 53.0 + 73.3 + 210.8

Net asset value per Ordinary

Share {A} + 44.1 + 48.6 + 69.5 + 212.4

MSCI India Index (Sterling adjusted) + 47.4 + 56.8 + 80.3 + 179.8

{A} Considered to be an Alternative

Performance Measure.

Source: abrdn, Morningstar and Lipper

CHAIRMAN'S STATEMENT

Dear Shareholder

Overview

Looking at the upward trajectory of Indian equities in the half

year under review, it would be easy to overlook the challenges that

the nation has endured. The MSCI India Index advanced by 23.4% and

was among the best performing markets across Asia and the rest of

the world over this period. Several factors sustained the market's

momentum, including an improving situation regarding the pandemic

and growing confidence in the country's recovery. Healthy buying

interest from retail investors, aided by better access to

technology, further propelled share prices. Additionally, India,

given the quality of its private-sector enterprises, benefited as

investors rotated away from China

over worries around regulatory tightening across multiple

sectors there.

In this environment, the Company delivered a respectable

performance. Net asset value ("NAV") rose by 19.0%, while the share

price increased by 21.8%, though both were slightly behind the

benchmark's return. The bulk of the underperformance occurred

earlier in the period, when favourable economic newsflow drove a

rally in the share prices of steel companies, which the portfolio

does not hold. Meanwhile, the portfolio's financial holdings lagged

their higher-growth peers in the broader market. Such an outcome

was not entirely unexpected, however. Amid the recent bullish

sentiment, cyclical stocks outperformed the quality names that are

favoured by your Manager. However, it is worthwhile highlighting

that investing in quality does deliver over the longer term, with

the Company strongly outperforming the MSCI India Index over the

last ten years. It remains well ahead of the benchmark since its

inception.

With effect from April 2020, the Company (in common with other

investment companies) has been subject to both short and long term

capital gains tax in India on the growth in value of its investment

portfolio. Although this additional tax only becomes payable at the

point at which the underlying investments are sold and profits

crystallised, the Company must accrue for this additional cost

which is GBP9.5m for the six months ended 30 September 2021,

equivalent to a reduction in the NAV per share of 16.3p or

2.2%.

At the start of the period, India was still struggling with a

devastating Covid-19 surge, with cases exceeding 400,000 daily at

its peak. This not only extracted a massive human toll, but also

added immense strain on the healthcare system. Thankfully, things

now seem to be under control, with a meaningful ramp up in the pace

of vaccinations countrywide underpinning a corresponding decline in

infections.

However, asset prices proved much more resilient than during the

pandemic's first wave in 2020, with investors now looking forward

to a normalising economy. This was supported by the government's

decision not to impose a full lockdown, with states opting for more

limited curbs instead. Initially, these localised restrictions did

temper consumer spending and dampen manufacturing activity. But as

larger swathes of the country began to re-open, economic conditions

and investor confidence improved swiftly. Notably, upbeat signals

in the housing cycle, recovering capital spending, higher tax

collections from goods and services and rebounding factory activity

all point to an economy in the early stages of a recovery to

pre-pandemic levels.

Sentiment also received significant support from several policy

initiatives. Perhaps the highest profile of these was the National

Monetisation Pipeline (NMP) unveiled by the Finance Minister in

August. The government will lease out state-owned infrastructure

assets, including roads, railways, airports and power plants, to

private operators for a specified period. It then plans to reinvest

the returns into new infrastructure projects under the previously

announced National Infrastructure Pipeline. The programme does seem

promising at first glance. With the central government facing a

stretched fiscal position, the NMP provides access to additional

income streams to raise the capital required for new infrastructure

investment. It could also unlock efficiencies, particularly in

areas of asset management and maintenance. While some doubts

remain, it will be in the government's interest to appear impartial

to avoid criticisms that the programme benefits only certain

favoured parties. As is so often the case with India, execution

remains key.

There were also other policy changes aimed at specific sectors.

Among these was the formation of a "bad bank" to address the

perennial problem of bad debt among public sector lenders. The

institution will take on stressed assets from these lenders and

work with another entity to try and recover their value. This is

the latest measure aimed at tackling this issue, encompassing the

2016 Insolvency and Bankruptcy Code and 2018's bank

recapitalisation plan. If all goes well, this bad bank should help

clean up lenders' balance sheets and provide fresh liquidity, which

would bolster credit growth and support economic activity. Whether

it will be effective in tackling the root issue of poor lending

practices remains to be seen. In this regard, your Manager

continues to prefer better capitalised and more conservative

private sector banks. Elsewhere, the Cabinet approved a relief

package for the telecoms sector, including deferments of unpaid

dues and the removal of foreign investment limits. This is expected

to bolster the beleaguered telecoms providers which have been

embroiled in a long running price war since Jio entered the fray in

2016.

Taken together, all these factors do appear to point to an

improving investment landscape. Crucially, these trends are

increasingly reflected at the company level. Many businesses

adapted adequately to the latest round of restrictions having

learnt from their experiences in the initial outbreak. As a result,

corporate profits continued to rebound despite the tightened curbs,

with many companies forecasting better earnings growth ahead.

Additionally, after a prolonged period of caution, the managements

of these companies appear more willing to pursue strategic plans

for expansion.

The favourable conditions are, in turn, attracting more

companies to approach the market for new capital. This has enhanced

the depth and vibrancy of the investment universe, with many of

these coming from so-called "new economy" sectors, such as the

internet and e-commerce. The quality of these listings has also

improved and your Manager has taken advantage of the rich pipeline

to invest in several interesting names operating in some niche

areas. These include online delivery services platform Zomato,

affordable housing company Aptus Value Housing Finance and medical

group Vijaya Diagnostics Centre. The Manager's Report provides

further details of these and other portfolio changes, as well as

the Company's performance.

Environmental, Social and Governance

I am pleased to note that the Company was recently rated "A"

under the MSCI ESG Rating. This reflects well on your Investment

Manager's consistent efforts to engage with the companies held

within your Company's portfolio and efforts to drive improvements

on various issues. More details on your Manager's process can be

found in the Investment Manager's Report and Case Studies.

Gearing

As at 30 September 2021, the Company had drawn down fully its

GBP30 million two-year bank loan facility, due to expire in July

2022, which resulted in net gearing of 5.6% as compared to 5.8% as

at 31 March 2021 (GBP24 million drawn down). The ability to gear is

one of the advantages of the closed ended company structure and

your Manager continues to seek opportunities to deploy this

facility.

Board

The Board was pleased to announce the appointment of David

Simpson as a Director of the Company with effect from 1 November

2021 following a search conducted by an independent recruitment

consultancy.

David initially qualified as a solicitor before following a

career in corporate finance, which included seven years with

Barclays de Zoete Wedd and 15 years with KPMG, latterly as global

head of mergers and acquisitions.

David's interest in India derives from his previous career and

from his current role as a non-executive director of ITC Limited

("ITC"), a major listed Indian company capitalised at around GBP29

billion. ITC has a diversified presence in FMCG, hotels, packaging,

specialty paper and agri-business. ITC represented 2.9% of the

Company's total assets at 30 September 2021 and David has agreed

that he will recuse himself from all discussions regarding ITC to

avoid any potential conflict of interest.

Shareholder Communications

The Board encourages shareholders to visit the Company's website

(www.aberdeen-newindia.co.uk) or other virtual channels for the

latest information and access to podcasts and monthly

factsheets.

Discount

The Board continues to monitor actively the discount of the

Ordinary share price to the NAV per Ordinary share (including

income) and pursues a policy of selective buybacks of shares where

to do so, in the opinion of the Board, is in the best interests of

shareholders, whilst also having regard to the overall size of the

Company.

During the period under review, the discount to NAV narrowed

from 13.6% to 11.5% as at 30 September 2021 following the Company

buying back into treasury 20,000 Ordinary shares, resulting in

58,365,328 Ordinary shares with voting rights and an additional

704,812 shares in treasury. Between the period end and the date of

this Report a further 81,961 shares were bought back into treasury

resulting in 58,283,367 shares in issue with voting shares and

786,773 shares held in treasury.

The Board believes that a combination of strong long-term

performance and effective marketing should increase demand for the

Company's shares and reduce the discount to NAV at which they

trade, over time.

Reduction in Investment Management Fee

As set out in the Chairman's Statement for the year ended 31

March 2021, the Board reached agreement with abrdn that, with

effect from 1 April 2021, the management fee was reduced to 0.85%

of the Company's net assets up to GBP350m and 0.70% above net

assets of GBP350m. Previously, the fee was based on the Company's

total assets less current liabilities and was charged at 0.9% on

the first GBP350m and at 0.75% above GBP350m. This reduction

contributed to a fall in the ongoing charges ratio from 1.16% to

1.06% over the reporting period.

Outlook

India's prospects appear brighter given the tailwinds of a

stabilising pandemic situation amid a widening vaccine rollout and

the continued economic reopening. Nonetheless, some caution is

warranted in view of prevailing risks. A key issue that merits

monitoring is inflation. There are growing fears that rising food,

energy and raw material costs could amplify price pressures. This

could, in turn, thwart the demand recovery, weigh on companies'

profit margins and hamper the country's growth trajectory. Another

concern is that the central bank could begin to normalise its loose

monetary policy soon in line with other global peers. For now,

though, policymakers have given assurance that any moves will be

gradual. Of course, Covid-19 is still a concern, with experiences

of other regional countries showing how swiftly the virus can undo

previous successes in managing the virus. That said, businesses and

the government are much better equipped now to respond to further

sudden outbreaks.

On the whole, India's outlook appears promising. Apart from a

conducive macroeconomic backdrop, the long term attractions of the

market remain intact. Favourable demographics, with a young

population and rising income levels, should drive demand across

various segments. Government policy appears committed towards

addressing the nation's extensive infrastructure needs and

expanding opportunities in emerging areas, such as renewable

energy. Meanwhile, the recent infusion of high-tech "new economy"

businesses has injected excitement into the investment universe. As

always, the key is to identify the best of these opportunities that

will deliver sustainable long term returns. In this regard, your

Manager's eye for quality remains critical in ensuring that the

portfolio is exposed to these appealing themes through

fundamentally sound, well managed businesses. This should stand the

Company in good stead, enabling it to remain resilient in the face

of challenges while positioning it well for the future.

Hasan Askari

Chairman

24 November 2021

INTERIM BOARD REPORT

Investment Objective

The investment objective of the Company is to provide

shareholders with long term capital appreciation by investment in

companies which are incorporated in India, or which derive

significant revenue or profit from India, with dividend yield from

the Company being of secondary importance.

Investment Policy

The Company primarily invests in Indian equity securities.

Principal Risks and Uncertainties

The principal risks and uncertainties associated with the

Company are set out in detail on pages 14 to 16 of the Annual

Report for the year ended 31 March 2021, which is published on the

Company's website. These are not expected to change materially for

the remaining six months of the Company's financial year ending 31

March 2022 as they have not done for the period under review.

The risks may be summarised under the following headings:

-- Market risk

-- Foreign Exchange risk

-- Discount risk

-- Depositary risk

-- Financial and Regulatory risk

-- Gearing risk

-- Covid-19

The Board continued to assess the ongoing implications for the

Company of the spread of Covid-19, including the resilience of the

reporting and control systems in place for both the Manager and

other key service providers.

Going Concern

In accordance with the Financial Reporting Council's guidance on

Going Concern and Liquidity Risk, the Directors have reviewed the

Company's ability to continue as a going concern. The Company's

assets consist of a diverse portfolio of listed equity shares which

in most circumstances are realisable within a short timescale.

The Directors are conscious of the principal risks and

uncertainties disclosed on pages 14 to 16 and in Note 17 to the

financial statements for the year ended 31 March 2021.

The Company has a two year, GBP30 million revolving credit

facility with Natwest Markets Plc (the "Facility") which was fully

drawn down at 30 September 2021. The Board has set limits for

borrowing and regularly reviews the level of any gearing and

compliance with banking covenants.

In advance of expiry of the Facility in July 2022, the Company

will enter into negotiations with its bankers. If acceptable terms

are available from the existing bankers, or any alternative, the

Company would expect to continue to access a facility. However,

should these terms not be forthcoming, any outstanding borrowing

would be repaid through the proceeds of equity sales.

The Directors' assessment of going concern also assumes that the

Ordinary resolution for the Company's continuation is passed by

shareholders at the next AGM of the Company in September 2022, as

it has been in the years since it was put in place. The Directors

consult annually with major shareholders and, as at the date of

approval of this Report, had no reason to believe that this

assumption was incorrect.

After making enquiries, including a review of revenue forecasts,

the Directors have a reasonable expectation that the Company

possesses adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis of accounting in preparing the financial

statements.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Half Yearly

Financial Report, in accordance with applicable law and

regulations. The Directors confirm that, to the best of their

knowledge:

-- the condensed set of Financial Statements has been prepared

in accordance with Financial Reporting Standard 104 (Interim

Financial Reporting);

-- the Half Yearly Board Report includes a fair review of the

information required by rule 4.2.7R of the Disclosure Guidance and

Transparency Rules (being an indication of important events that

have occurred during the first six months of the financial year and

their impact on the condensed set of Financial Statements and a

description of the principal risks and uncertainties for the

remaining six months of the financial year); and

-- the Half Yearly Board Report includes a fair review of the

information required by 4.2.8R of the Disclosure Guidance and

Transparency Rules (being related party transactions that have

taken place during the first six months of the financial year and

that have materially affected the financial position of the Company

during that period; and any changes in the related party

transactions described in the last Annual Report that could do

so).

The Half Yearly Financial Report for the six months ended 30

September 2021 comprises the Interim Board Report, including the

Statement of Directors' Responsibilities, and a condensed set of

Financial Statements.

For and on behalf of the Board

Hasan Askari

Chairman

24 November 2021

INVESTMENT MANAGER'S REPORT

Performance

The Company's NAV rose by 19.0% in sterling terms over the 6

months ended 30 September 2021, compared to the 23.4% gain by the

MSCI India benchmark. Meanwhile, the Company's share price advanced

by 21.8% and its discount to NAV narrowed from 13.6% to 11.5%.

Overview

Indian equities displayed remarkable resilience during the six

months to September despite the continued spectre of the pandemic

and rose even faster than most of their emerging and developed

market peers. The stock market built on the steep rally last year,

pausing only when the second wave of the coronavirus swept the

country. Sentiment also found support in steady corporate earnings,

as companies adapted better to the resurgence of infection

caseloads. Impact from the second wave was softened by having

targeted mobility restrictions instead of the blanket lockdown in

the first Covid-19 crisis that hobbled the economy last year.

Market gains were across the board, led by a buoyant real estate

sector that led to property stocks rising by almost 50% over the

review period. The housing turnaround came after a sharp decline in

home sales and residential construction in the past few years. With

the central bank retaining an accommodative policy stance and

leading lenders cutting mortgage rates, homes turned more

affordable owing to lower interest rates, rising incomes and

smaller unit sizes. Stamp-duty rebates in some states also

propelled a wider housing recovery. This, plus the

larger-than-expected stimulus to infrastructure spending, was

positive for both materials companies and lenders.

Communications services stocks also did well, as foreign

ownership limits were relaxed. In addition, network operators were

allowed to defer payment of telecommunications spectrum fees and

other liabilities by four years. Elsewhere, technology services

providers continued to be buoyed by healthy demand for cloud

migration and business transformation needs, with the shift to

work-from-home and advancements in high-performance computing

accelerating this trend.

Portfolio review

The Company's holdings in real estate, technology and consumer

discretionary sectors supported returns, though the portfolio

overall lagged the benchmark due to a lack of exposure to steel and

energy.

Property stocks were supported by still-low interest rates and

hopes of a faster economic recovery in the post-pandemic world.

Among the top contributors were property developers, Godrej

Properties and Prestige Estates, as well as Piramal Enterprises'

housing-finance business. Piramal Enterprise's share price also

reacted well to the de-merger and separate listing of its

pharmaceutical business as this created value for all shareholders.

In the technology services sector, Mphasis contributed on the back

of record deal wins and bumper earnings. In the consumer

discretionary sector, Zomato, which we recently initiated,

contributed to performance after a strong initial public offer

(IPO) debut. Zomato is an online food market featuring restaurant

menus and reviews from countries around the world. The food

delivery company has been gaining market share in a fast-growing

sector. The Company benefited from less exposure to the automobile

sector that was impacted by the semiconductor shortage.

The Company tends to avoid businesses that are cyclical,

dependent on government policies and with balance sheets that are

highly leveraged. During this period, China's removal of steel

export rebates and steady global demand supported price hikes,

leading to a strong rally in steel stocks. Cement, instead, remains

our preferred exposure to infrastructure spending. Although

Ultratech Cement detracted during the period, it has contributed

positively to the Company's year-to-date returns as it has

demonstrated strong pricing power amid rising demand from housing

and infrastructure investments. We are also encouraged by the

company's initiatives to tackle carbon emissions, using

science-based targets to align with global efforts towards carbon

neutrality. Elsewhere in the energy sector, Aegis Logistics' share

price retreated following a good run when its liquefied petroleum

gas (LPG) terminalling business was hampered by cyclones and

Covid-19 disruptions delayed its growth projects. We believe these

are one-off events that do not affect longer-term demand

trends.

Separately, the Company's bank holdings lagged the lenders that

delivered faster growth. We believe that our holdings

HDFC, HDFC Bank and Kotak Mahindra are well-positioned with

their strong, low-cost deposit franchise and digital capabilities

to accelerate growth as confidence in the economic outlook

improves.

In key portfolio changes, we participated in several IPOs as the

number of companies seeking a public listing accelerated in 2021.

The record-breaking local stock indices enticed a slew of

promising, good quality companies to tap the market for funds and

the IPO pipeline remains exciting for the year ahead. This also

reflects the growing breadth and depth of Indian businesses as well

as the burgeoning start-up ecosystem. Besides Zomato, we also

participated in Aptus Value Housing Finance's share float. Aptus

has a firm foothold in South India and provides exposure to the

country's underpenetrated affordable housing sector.

Elsewhere, we initiated ReNew Energy Global, Vijaya Diagnostic

Centre and IndiaMart InterMesh. ReNew generates electricity from a

mix of wind, solar, and more recently hydropower. Our research

concluded that it has both scale and clarity around its pipeline.

More importantly, the power producer is funded fully for its

capacity build-out. We also like that its management has shown

discipline in bidding at renewable energy auctions. Vijaya is the

market-leading healthcare diagnostics player in South India,

focused on the consumer segment. IndiaMart is the dominant,

subscription-based online business-to-business platform for

industrial and office supplies.

Against these, we sold Bandhan Bank on concerns over stress

faced by the micro-financing segment if the pandemic continued to

drag on. We also participated in the IPO of Clean Science &

Technology but exited the specialty chemicals player following its

stellar debut.

Outlook

Confidence appears to be returning across industries. As

vaccinations cross the billion mark, there is less fear of

super-spreader events spoiling a surge in consumption in the

upcoming festive season. Policy reform is also picking up pace,

helped by an improving fiscal position. With better job creation

and government schemes to attract more manufacturing, the economy

could be in the early stages of a capital expenditure investment

cycle. Meanwhile, we are keeping an eye on inflation, particularly

in view of the recent spike in the oil price. We are confident that

the portfolio holdings' pricing power and ability to sustain

margins provide a measure of comfort.

Over the longer term, India remains alluring to investors. The

domestic market benefits from a rapidly growing middle-class that

is increasingly affluent. Digital adoption has accelerated and we

expect to see more listed investment opportunities in the

new-economy space. India is home to many of Asia's most successful

companies that have been tested by prior economic crises. We remain

highly selective in our portfolio positioning, preferring

high-quality companies with robust balance sheets and led by good

management that helps them weather storms better than most. We

remain focused on identifying companies with clear prospects for

earnings growth, a secure competitive position, and prudent capital

management. These companies should deliver sustainable returns over

time.

Kristy Fong, Senior Investment Director

James Thom, Senior Investment Director

abrdn Asia Limited

24 November 2021

INVESTMENT CASE STUDIES

Azure Power - tapping solar to meet India's growing need for

renewable energy

Founded in 2008, Azure Power started its journey in 2009 by

building India's first private utility-scale solar plant. This was

a 2 megawatt (MW) plant in a small village in Awan, Punjab. The

solar farm operator has since chalked up other firsts along the

way. In 2016, Azure became the first Indian energy company to be

listed on the New York Stock Exchange. A year later, it issued

India's first solar green bond.

Today, Azure is one of India's largest renewable power

companies, selling affordable and reliable solar power on long-term

fixed price contracts to its customers. It has a solar asset base

of over 2 gigawatt (GW) of operational capacity and about 5GW of

capacity under construction and in the pipeline, which will

transform the scale of the business and drive significant growth

over the medium term.

The company is backed by blue chip institutional and

multilateral shareholders and has a high quality management team,

which gives us confidence that it will successfully execute its

business plan. It also has first-comer advantage, having developed

significant operational expertise and regional knowledge. This is

reflected in its good track record of delivering high quality

projects.

The Investment Manager sees Azure benefiting from India's

growing economy and demand for electricity. Its business is also

aligned with the policy push for green energy. Solar is the

cheapest form of electricity and there is significant untapped

potential as solar accounts for less than 10% of India's installed

electricity generation capacity. Azure sells solar electricity

generated by its plants to the grid. With the overall power

consumption growing in India, Azure is helping meet the incremental

energy demand with green energy, as the growing penetration of

renewables would reduce the need for new coal plants. With several

gigawatts of solar projects in the pipeline, Azure will contribute

towards reducing carbon emissions and thus mitigating climate

change.

More broadly, India still relies heavily on fossil fuels for its

energy generation, with fossil fuels accounting for around three

quarters of primary energy demand. It is the world's third largest

carbon emitter, accounting for about 7% of global CO2 emissions

with the coal heavy power sector being a major contributor to

India's carbon footprint (source: India Renewables - A Primer, 27

July 2021, Bernstein). However, there has been a ramp-up in the

installation of renewable energy in recent years. India is now the

world's fourth largest renewable energy market with 80GW of wind

and solar capacity, after China, the US and Germany (source:

Bernstein). The government is going even further, unveiling

aggressive targets to increase the renewable capacity by five

times, through adding 450GW of non-hydro renewable electricity

capacity by 2030.

Aptus Value Housing Finance - helping the lower paid own their

dream home

In India, about three homes are built for every 1,000 people

every year, falling below the required rate of five homes per 1,000

people (source: India Brand Equity Foundation) to adequately meet

housing needs. As a result, the country faces a housing shortage

that is set to increase to 100 million homes by 2022. This crunch

is more pronounced in rural areas, with the economically weaker

sections and low income groups making up 95% of the housing

shortage (source: Aptus Value Housing Finance Annual Report

2020-2021). With brisk population growth, especially in urban

areas, the

situation could worsen.

The central government is addressing this. It aims to build 20

million affordable houses by 2022, launching various initiatives

including the Housing for All scheme and the Smart Cities programme

to support ownership via interest subsidies and other measures.

Ensuring adequate housing remains a daunting challenge, with a

stark shortage in Uttar Pradesh, Andhra Pradesh and

Maharashtra.

Given the strong policy support for affordable housing,

increasing urbanisation along with rising incomes, demand for

housing is expected to rise, and along with that home financing.

The Investment Manager regards the Company's holding in Aptus Value

Housing Finance as being among those well positioned to be a key

beneficiary, while helping to mitigate the overall housing

shortage, especially in the rural areas.

Aptus is a housing finance company that focuses entirely on

serving low and middle income self-employed customers in the rural

and semi-urban parts of India, with a strong foothold in South

India. Of its overall loans, home loans make up 52%, while business

loans to small business entrepreneurs and non-housing loans, such

as insurance loans, account for the rest.

The company's services help the lower income group realise their

dream of owning a home, improve the standard of living of its

customers and bring them into the financial mainstream. Aptus

operates mostly in rural and semi-urban markets where bigger

players have less presence. The low income group are usually

excluded by banks or large financial institutions because they do

not have the credit history or formal income proof to assess their

creditworthiness.

The Investment Manager is bullish on Aptus' prospects. The

industry has ample opportunity for growth and Aptus has superior

metrics relative to its peers in terms of asset quality, loan

yields and return ratios. Management is conservative and has kept a

robust balance sheet throughout its history.

The Investment Manager also likes that the company is clear

about where it wants to go, with its mission being "to be a leader

in the affordable housing finance segment and make an impact in the

lives of a million people by 2025".

INVESTMENT PORTFOLIO

As at 30 September 2021

Valuation Total assets

Company Sector GBP'000 %

----------------------------------------- ------------------------ ---------- -------------------

Housing Development Finance Corporation Financials 45,783 9.8

Infosys Information Technology 45,754 9.8

Tata Consultancy Services Information Technology 39,954 8.6

Hindustan Unilever Consumer Staples 31,016 6.7

Kotak Mahindra Bank Financials 21,483 4.6

UltraTech Cement Materials 19,667 4.2

HDFC Bank Financials 17,102 3.7

Asian Paints Materials 15,912 3.4

SBI Life Insurance Financials 14,672 3.2

Godrej Properties Real Estate 14,540 3.1

----------------------------------------- -------------------

Top ten investments 265,883 57.1

------------------------------------------------------------------- ---------- -------------------

Axis Bank Financials 13,609 2.9

ITC Consumer Staples 13,387 2.9

Communications

Bharti Airtel Services 13,178 2.8

MphasiS Information Technology 12,523 2.7

Container Corporation of India Industrials 11,869 2.6

Prestige Estates Projects Real Estate 9,915 2.1

Fortis Healthcare Healthcare 9,051 2.0

Power Grid Corporation of India Utilities 9,009 1.9

Maruti Suzuki India Consumer Discretionary 8,912 1.9

Larsen & Toubro Industrials 8,819 1.9

----------------------------------------- -------------------

Top twenty investments 376,155 80.8

------------------------------------------------------------------- ---------- -------------------

Nestlé India Consumer Staples 8,523 1.8

Gujarat Gas Utilities 7,755 1.7

Communications

Affle India Services 7,703 1.7

Piramal Enterprises Financials 7,300 1.6

Crompton Greaves Consumer Electricals Consumer Discretionary 7,175 1.5

Syngene International Health Care 6,389 1.4

Godrej Consumer Products Consumer Staples 6,072 1.3

Sanofi India Health Care 5,299 1.1

Aegis Logistics Energy 5,171 1.1

Jyothy Laboratories Consumer Staples 5,127 1.1

----------------------------------------- -------------------

Top thirty investments 442,669 95.1

------------------------------------------------------------------- ---------- -------------------

Communications

Info Edge Services 5,095 1.1

ICICI Prudential Life Insurance Financials 4,908 1.1

Azure Power Global Utilities 3,981 0.9

Biocon Health Care 3,851 0.8

Zomato Consumer Discretionary 3,613 0.8

Godrej Agrovet Consumer Staples 3,486 0.7

Bosch Consumer Discretionary 3,425 0.7

Shree Cement Materials 3,393 0.7

Vijaya Diagnostic Centre Health Care 2,598 0.6

IndiaMart Consumer Discretionary 2,378 0.5

----------------------------------------- -------------------

Top forty investments 479,397 103.0

Aptus Value Housing Finance Financials 1,818 0.4

ReNew Power Utilities 904 0.2

Total portfolio investments 482,119 103.6

------------------------------------------------------------------- ---------- -------------------

Net current assets (before deducting

prior charges){A} (16,744) (3.6)

------------------------------------------------------------------- -------------------

Total assets{A} 465,375 100.0

------------------------------------------------------------------- ---------- -------------------

{A} Excluding loan balances.

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Six months ended

30 September 2021 30 September 2020

(unaudited) (unaudited)

------------------------------- -------------------------------

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------ --------- --------- --------- --------- --------- ---------

Income

Income from investments

and other income 3 2,936 - 2,936 2,946 - 2,946

Gains on investments

held at fair value through

profit or loss - 78,990 78,990 - 66,671 66,671

Currency losses - (64) (64) - (236) (236)

------------------------------ ------ --------- --------- --------- --------- --------- ---------

2,936 78,926 81,862 2,946 66,435 69,381

------------------------------ ------ --------- --------- --------- --------- --------- ---------

Expenses

Investment management

fees (1,637) - (1,637) (1,275) - (1,275)

Administrative expenses (441) - (441) (439) - (439)

------------------------------ ------ --------- --------- --------- --------- --------- ---------

Profit before finance

costs and taxation 858 78,926 79,784 1,232 66,435 67,667

Finance costs (134) - (134) (215) - (215)

------------------------------

Profit before taxation 724 78,926 79,650 1,017 66,435 67,452

Taxation 4 (303) (9,966) (10,269) (295) (4,900) (5,195)

------------------------------ ------ --------- --------- --------- --------- --------- ---------

Profit for the period 421 68,960 69,381 722 61,535 62,257

------------------------------ ------ --------- --------- --------- --------- --------- ---------

Return per Ordinary

share (pence) 5 0.72 118.13 118.85 1.23 104.86 106.09

------------------------------ ------ --------- --------- --------- --------- --------- ---------

The Company does not have any income or expense that is not included

in profit/(loss) for the period, and therefore the "Profit/(loss) for

the period" is also the "Total comprehensive income for the period".

The total columns of this statement represent the Condensed Statement

of Comprehensive Income, prepared in accordance with IFRS. The revenue

and capital columns are supplementary to this and are prepared under

guidance published by the Association of Investment Companies. All items

in the above statement derive from continuing operations.

All of the profit/(loss) and total comprehensive income is attributable

to the equity holders of Aberdeen New India Investment Trust PLC. There

are no non-controlling interests.

The accompanying notes are an integral part of these financial statements.

CONDENSED STATEMENT OF COMPREHENSIVE INCOME (Cont'd)

Year ended

31 March 2021

(audited)

Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000

------------------------------------------- ------ --------- --------- ---------

Income

Income from investments and other

income 3 4,517 - 4,517

Gains on investments held at fair

value through profit or loss - 140,538 140,538

Currency losses - (404) (404)

------------------------------------------- ------ --------- --------- ---------

4,517 140,134 144,651

------------------------------------------- ------ --------- --------- ---------

Expenses

Investment management fees (2,801) - (2,801)

Administrative expenses (821) - (821)

------------------------------------------- ------ --------- --------- ---------

Profit before finance costs and taxation 895 140,134 141,029

Finance costs (334) - (334)

------------------------------------------- ---------

Profit before taxation 561 140,134 140,695

Taxation 4 (452) (13,624) (14,076)

------------------------------------------- ------ --------- --------- ---------

Profit for the period 109 126,510 126,619

------------------------------------------- ------ --------- --------- ---------

Return per Ordinary share (pence) 5 0.19 216.06 216.25

------------------------------------------- ------ --------- --------- ---------

The Company does not have any income or expense that is not included

in profit/(loss) for the period, and therefore the "Profit/(loss) for

the period" is also the "Total comprehensive income for the period".

The total columns of this statement represent the Condensed Statement

of Comprehensive Income, prepared in accordance with IFRS. The revenue

and capital columns are supplementary to this and are prepared under

guidance published by the Association of Investment Companies. All

items in the above statement derive from continuing operations.

All of the profit/(loss) and total comprehensive income is attributable

to the equity holders of Aberdeen New India Investment Trust PLC. There

are no non-controlling interests.

The accompanying notes are an integral part of these financial statements.

CONDENSED BALANCE SHEET

As at As at As at

30 September 30 September 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Investments held at fair value

through profit or loss 482,119 328,969 401,669

---------------------------------- ------ ------------- ------------- ----------

Current assets

Cash at bank 5,655 3,948 2,588

Receivables 1,297 557 530

---------------------------------- ------------- ------------- ----------

Total current assets 6,952 4,505 3,118

---------------------------------- ------ ------------- ------------- ----------

Current liabilities

Bank loan 8 (30,000) (24,000) (24,000)

Other payables (564) (1,384) (1,038)

---------------------------------- ------ ------------- ------------- ----------

Total current liabilities (30,564) (25,384) (25,038)

---------------------------------- ------ ------------- ------------- ----------

Net current liabilities (23,612) (20,879) (21,920)

---------------------------------- ------ ------------- ------------- ----------

Non-current liabilities

Deferred tax liability on Indian

capital gains 4 (23,132) (4,919) (13,643)

---------------------------------- ----------

Net assets 435,375 303,171 366,106

---------------------------------- ------ ------------- ------------- ----------

Share capital and reserves

Ordinary share capital 9 14,768 14,768 14,768

Share premium account 25,406 25,406 25,406

Special reserve 12,516 13,470 12,628

Capital redemption reserve 4,484 4,484 4,484

Capital reserve 377,671 244,191 308,711

Revenue reserve 530 852 109

---------------------------------- ------------- ------------- ----------

Equity shareholders' funds 435,375 303,171 366,106

---------------------------------- ------ ------------- ------------- ----------

Net asset value per Ordinary

share (pence) 11 745.95 517.73 627.05

---------------------------------- ------ ------------- ------------- ----------

The accompanying notes are an integral part of

these financial statements.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Six months ended 30 September

2021 (unaudited)

Share Capital

Share premium Special redemption Capital Revenue

capital account reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ----------- --------- --------- ---------

Balance at 31 March 2021 14,768 25,406 12,628 4,484 308,711 109 366,106

Profit for the period - - - - 68,960 421 69,381

Buyback of share capital

to treasury - - (112) - - - (112)

---------

Balance at 30 September

2021 14,768 25,406 12,516 4,484 377,671 530 435,375

--------- --------- --------- ----------- --------- --------- ---------

Six months ended 30 September

2020 (unaudited)

Share Capital

Share premium Special redemption Capital Revenue

capital account reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ----------- --------- --------- ---------

Balance at 31 March 2020 14,768 25,406 14,139 4,484 182,656 130 241,583

Profit for the period - - - - 61,535 722 62,257

Buyback of share capital

to treasury - - (669) - - - (669)

---------

Balance at 30 September

2020 14,768 25,406 13,470 4,484 244,191 852 303,171

--------- --------- --------- ----------- --------- --------- ---------

Year ended 31 March 2021

(audited)

Share Capital

Share premium Special redemption Capital Revenue

capital account reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ----------- --------- --------- ---------

Balance at 31 March 2020 14,768 25,406 14,139 4,484 182,656 130 241,583

Profit for the year - - - - 126,510 109 126,619

Buyback of share capital

to treasury - - (1,511) - - - (1,511)

Equity dividend paid - - - - (455) (130) (585)

---------

Balance at 31 March 2021 14,768 25,406 12,628 4,484 308,711 109 366,106

--------- --------- --------- ----------- --------- --------- ---------

The Special reserve and the Revenue reserve represent the amount of the

Company's distributable reserves.

CONDENSED CASH FLOW STATEMENT

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------------- ------------- ------------- -----------

Cash flows from operating activities

Dividend income received 2,515 2,772 4,517

Investment management fee paid (2,119) (1,013) (2,427)

Overseas withholding tax (646) (295) (937)

Other cash expenses (420) (707) (812)

-------------------------------------------- ------------- ------------- -----------

Cash (outflow)/inflow from operations (670) 757 341

Interest paid (149) (190) (302)

-------------------------------------------- ------------- ------------- -----------

Net cash (outflow)/inflow from operating

activities (819) 567 39

Cash flows from investing activities

Purchase of investments (35,968) (36,055) (69,103)

Sales of investments 34,507 37,744 71,555

Indian capital gains tax on sales (477) - -

Indian capital gains tax on sales refunded - 19 19

-------------------------------------------- -----------

Net cash (outflow)/inflow from investing

activities (1,938) 1,708 2,471

-------------------------------------------- ------------- ------------- -----------

Cash flows from financing activities

Equity dividend paid - - (585)

Buyback of shares (112) (669) (1,511)

Drawdown/(repayment) of loan 6,000 (6,000) (6,000)

-------------------------------------------- -----------

Net cash inflow/(outflow) from financing

activities 5,888 (6,669) (8,096)

-------------------------------------------- ------------- ------------- -----------

Net increase/(decrease) in cash and

cash equivalents 3,131 (4,394) (5,586)

Cash and cash equivalents at the start

of the period 2,588 8,578 8,578

Effect of foreign exchange rate changes (64) (236) (404)

-------------------------------------------- ------------- -----------

Cash and cash equivalents at the end

of the period 5,655 3,948 2,588

-------------------------------------------- ------------- ------------- -----------

There were no non-cash transactions during the period (six months ended

30 September 2021 - GBPnil; year ended 31 March 2021 - GBPnil).

NOTES TO THE FINANCIAL STATEMENTS

1. Principal activity. The principal activity of the Company is that

of an investment trust company within the meaning of Section 1158

of the Corporation Tax Act 2010.

2. Accounting policies. The Company's financial statements have been

prepared in accordance with International Accounting Standard ('IAS')

34 - 'Interim Financial Reporting', as adopted by the International

Accounting Standards Board (IASB), and interpretations issued by

the International Reporting Interpretations Committee of the IASB

(IFRIC). The Company's financial statements have been prepared using

the same accounting policies applied for the year ended 31 March

2021 financial statements, which received an unqualified audit report.

The financial statements have been prepared on a going concern basis.

In accordance with the Financial Reporting Council's guidance on

'Going Concern and Liquidity Risk' the Directors have undertaken

a review of the Company's assets which primarily consist of a diverse

portfolio of listed equity shares which, in most circumstances, are

realisable within a short timescale.

3. Income

Six months ended Six months ended Year ended

30 September 30 September

2021 2020 31 March 2021

GBP'000 GBP'000 GBP'000

--------------------- ------------------------------- ------------------------------- -----------------------

Income from

investments

Overseas dividends 2,936 2,946 4,517

-------------------------- ------------------------------- ------------------------------- -----------------------

Total income 2,936 2,946 4,517

-------------------------- ------------------------------- ------------------------------- -----------------------

4. Taxation

Six months ended Six months ended Year ended

30 September 2021 30 September 31 March 2021

2020

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(a) Analysis of

charge for

the period

Indian capital

gains tax charge

on sales - 477 477 - - - - - -

Indian capital

gains tax charge

refunded on

sales - - - - (19) (19) - (19) (19)

Overseas taxation 303 - 303 295 - 295 452 - 452

Total current

tax charge

for the period 303 477 780 295 (19) 276 452 (19) 433

Movement in

deferred tax

liability on

Indian capital

gains - 9,489 9,489 - 4,919 4,919 - 13,643 13,643

--------------

Total tax

charge for

the period 303 9,966 10,269 295 4,900 5,195 452 13,624 14,076

------------------------------- --------- --------- --------- --------- ----------- ----------- ----------- ------------ --------------

The Company is liable to Indian capital gains tax under Section 115

AD of the Indian Income Taxes Act 1961.

On 1 April 2018, the Indian Government withdrew an exemption from

capital gains tax on investments held for twelve months or longer.

The Company has recognised a deferred tax liability of GBP9,489,000

(30 September 2020 - GBP4,919,000; 31 March 2021 - GBP13,643,000)

on capital gains which may arise if Indian investments are sold.

On 1 April 2020, the Indian Government withdrew an exemption from

withholding tax on dividend income. Dividends are received net of

20% withholding tax and an additional charge of 4%. A further surcharge

of either 2% or 5% is applied if the receipt exceeds a certain threshold.

Of this total charge, 10% of the withholding tax is irrecoverable

with the remainder being shown in the Condensed Statement of Financial

Position as an asset due for reclaim.

(b) Factors affecting the tax charge for the year or period. The tax

charged for the period can be reconciled to the profit per the Statement

of Comprehensive Income as follows:

Six months ended Six months ended Year ended

30 September 2021 30 September 2020 31 March 2021

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profit before

tax 724 78,926 79,650 1,017 66,435 67,452 561 140,134 140,695

------------------------------- --------- --------- --------- -------------- ----------- ----------- ------------ ----------- ---------

UK corporation

tax on profit

at the standard

rate of 19% 138 14,996 15,134 193 12,623 12,816 107 26,625 26,732

Effects of:

Gains on investments

held at fair

value through

profit or loss

not taxable - (15,008) (15,008) - (12,667) (12,667) - (26,702) (26,702)

Currency losses

not taxable - 12 12 - 44 44 - 77 77

Deferred tax

not recognised

in respect

of tax losses 419 - 419 362 - 362 750 - 750

Expenses not

deductible

for tax purposes 1 - 1 5 - 5 1 - 1

Indian capital

gains tax charged/(refunded)

on sales - 477 477 - (19) (19) - (19) (19)

Movement in

deferred tax

liability on

Indian capital

gains - 9,489 9,489 - 4,919 4,919 - 13,643 13,643

Irrecoverable

overseas withholding

tax 303 - 303 295 - 295 452 - 452

Non-taxable

dividend income (558) - (558) (560) - (560) (858) - (858)

---------

Total tax charge 303 9,966 10,269 295 4,900 5,195 452 13,624 14,076

------------------------------- --------- --------- --------- -------------- ----------- ----------- ------------ ----------- ---------

At 30 September 2021, the Company has surplus management expenses

and loan relationship debits with a tax value of GBP6,375,000 (30

September 2020 - GBP4,035,000; 31 March 2021 - GBP4,424,000) based

on enacted tax rates, in respect of which a deferred tax asset has

not been recognised. No deferred tax asset has been recognised because

the Company is not expected to generate taxable income in the future

in excess of the deductible expenses of those future periods. Therefore,

it is unlikely that the Company will generate future taxable revenue

that would enable the existing tax losses to be utilised.

5. Return per

Ordinary

share

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

----------------------------- ------------------------------------------- ---------------------------

Based on

the

following

figures:

Revenue return 421 722 109

Capital return 68,960 61,535 126,510

---------------------------

Total return 69,381 62,257 126,619

---------------- ----------------------------- ------------------------------------------- ---------------------------

Weighted 58,373,678 58,680,999 58,551,911

average number

of

Ordinary

shares in

issue

6. Dividends on equity shares. In the prior period, the Board of Aberdeen

New India Investment Trust PLC (the "Company") announced an interim

dividend in respect of the year ended 31 March 2020 of 1.0 pence per

share on the Company's Ordinary shares. This interim dividend, which

was paid on 30 October 2020 to shareholders on the register on 2 October

2020 (ex-dividend date 1 October 2020), was declared, on an exceptional

basis, to enable the Company to maintain its investment trust status

in accordance with HMRC requirements. The minimum required net revenue

distribution of approximately 0.22 pence per Ordinary share was supplemented

by capital reserves in accordance with the Company's revised Articles

of Association, which were approved by shareholders at the Annual

General Meeting on 23 September 2020.

7. Transaction costs. During the year, expenses were incurred in acquiring

or disposing of investments classified as fair value through profit

or loss. These have been expensed through the capital column of the

Statement of Comprehensive Income, and are included within gains

on investments at fair value through profit or loss in the Statement

of Comprehensive Income. The total costs were as follows:

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Purchases 41 61 109

Sales 52 64 120

---------------------------------- -------------- ------------

93 125 229

---------------------------------- -------------- ------------

The above transaction costs are calculated in line with the AIC SORP.

The transaction costs in the Company's Key Information Document,

provided by the Manager, are calculated on a different basis and

in line with the Packaged Retail Investment and Insurance Products

("PRIIPs") regulations.

8. Bank loan. In July 2020, the Company entered into a two year GBP30

million multi-currency revolving credit facility with Natwest Markets

Plc. At 30 September 2021 GBP30 million (30 September 2020 - GBP24

million; 31 March 2021 - GBP24 million) had been drawn down at an

all-in interest rate of 0.95488% on GBP28 million and 0.95268% on

GBP2 million, which rolled over on 10 November 2021. At the date

of this report the Company had drawn down GBP30 million at an all-in

interest rate of 1.0135%.

9. Ordinary share capital. During the period 20,000 Ordinary shares

were bought back by the Company for holding in treasury (period to

30 September 2020 - 163,277; year to 31 March 2021 - 335,653), at

a cost of GBP112,000 (30 September 2020 - GBP669,000; 31 March 2021

- GBP1,511,000). As at 30 September 2021 there were 58,365,328 (30

September 2020 - 58,557,704; 31 March 2021 - 58,385,328) Ordinary

shares in issue, excluding 704,812 (30 September 2020 - 512,436;

31 March 2021 - 684,812) Ordinary shares held in treasury.

Following the period end a further 81,961 Ordinary shares were bought

back for treasury by the Company at a cost of GBP526,000 resulting

in there being 58,283,367 Ordinary shares in issue, excluding 786,773

Ordinary shares held in treasury at the date this Report was approved.

10. Analysis of changes in net

debt

At At

31 March Currency Cash 30 September

2021 differences flows 2021

GBP'000 GBP'000 GBP'000 GBP'000

Cash and short term

deposits 2,588 (64) 3,131 5,655

Debt due within one year (24,000) - (6,000) (30,000)

-------------------

(21,412) (64) (2,869) (24,345)

------------------ ------------------------- ---------------- -------------------

At At

31 March Currency Cash 31 March

2020 differences flows 2021

GBP'000 GBP'000 GBP'000 GBP'000

Cash and short term

deposits 8,578 (404) (5,586) 2,588

Debt due within one year (30,000) - 6,000 (24,000)

-------------------

(21,422) (404) 414 (21,412)

------------------ ------------------------- ---------------- -------------------

A statement reconciling the movement in net funds to the net cash

flow has not been presented as there are no differences from the

above analysis.

11. Net asset value per Ordinary share. The net asset value per Ordinary

share is based on a net asset value of GBP435,375,000 (30 September

2020 - GBP303,171,000; 31 March 2021 - GBP366,106,000) and on 58,365,328

(30 September 2020 - 58,557,704 and 31 March 2021 - 58,385,328) Ordinary

shares, being the number of Ordinary shares in issue at the period

end.

12. Fair value hierarchy. IFRS 13 'Fair Value Measurement' requires an

entity to classify fair value measurements using a fair value hierarchy

that reflects the subjectivity of the inputs used in making measurements.

The fair value hierarchy has the following levels:

Level 1: quoted (unadjusted) market prices in active markets for identical

assets or liabilities;

Level 2: valuation techniques for which the lowest level input that

is significant to the fair value measurement is directly or indirectly

observable; and

Level 3: valuation techniques for which the lowest level input that

is significant to the fair value measurement is unobservable.

The financial assets and liabilities measured at fair value in the

Statement of Financial Position are grouped into the fair value hierarchy

at the Statement of Financial Position date are as follows:

Level 1 Level 2 Level 3 Total

As at 30 September 2021 Note GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair

value through profit or loss

Quoted equities a) 482,119 - - 482,119

---------

Net fair value 482,119 - - 482,119

---------- ----------------------- -------------------- ---------

Level 1 Level 2 Level 3 Total

As at 30 September 2020 Note GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair

value through profit or loss

Quoted equities a) 328,969 - - 328,969

---------

Net fair value 328,969 - - 328,969

---------- ----------------------- -------------------- ---------

Level 1 Level 2 Level 3 Total

As at 31 March 2021 Note GBP'000 GBP'000 GBP'000 Total

Financial assets at fair

value through profit or loss

Quoted equities a) 401,669 - - 401,669

---------

Net fair value 401,669 - - 401,669

---------- ----------------------- -------------------- ---------

a) Quoted equities. The fair value of the Company's investments in

quoted equities has been determined by reference to their quoted

bid prices at the reporting date. Quoted equities included in Fair

Value Level 1 are actively traded on recognised stock exchanges.

13. Related party transactions. The Company has an agreement with Aberdeen

Standard Fund Managers Limited (the "Manager") for the provision

of management, secretarial, accounting and administration services

and for carrying out promotional activity services in relation to

the Company.

During the period, the management fee was payable monthly in arrears

and was based on 0.85% per annum up to GBP350m and 0.7% thereafter

of the net assets of the Company (period ended 30 September 2020

and year ended 31 March 2021 the management fee payable was based

on 0.9% per annum up to GBP350m and 0.75% per annum thereafter of

the net assets of the Company). The management agreement is terminable

by either the Company or the Manager on six months' notice. The amount

payable in respect of the Company for the period was GBP1,637,000

(six months ended 30 September 2020 - GBP1,275,000; year ended 31

March 2021 - GBP2,801,000) and the balance due to the Manager at

the period end was GBP294,000 (period end 30 September 2020 - GBP664,000;

year end 31 March 2021 - GBP775,000). All investment management fees

are charged 100% to the revenue column of the Statement of Comprehensive

Income.

The Company has an agreement with the Manager for the provision of

promotional activities in relation to the Company's participation

in the abrdn Investment Trust Share Plan and ISA. The total fees

paid and payable under the agreement during the period were GBP83,000

(six months ended 30 September 2020 - GBP83,000; year ended 31 March

2021 - GBP166,000) and the balance due to the Manager at the period

end was GBP83,000 (period ended 30 September 2020 - GBP83,000; year

ended 31 March 2021 - GBP42,000).

14. Segmental information. For management purposes, the Company is organised

into one main operating segment, which invests in equity securities.

All of the Company's activities are interrelated, and each activity

is dependent on the others. Accordingly, all significant operating

decisions are based upon analysis of the Company as one segment. The

financial results from this segment are equivalent to the financial

statements of the Company as a whole.

15. Half-Yearly Report. The financial information contained in this Half-Yearly

Report does not constitute statutory accounts as defined in Sections

434 - 436 of the Companies Act 2006. The financial information for

the six months ended 30 September 2021 and 30 September 2020 has not

been audited.

The information for the year ended 31 March 2021 has been extracted

from the latest published audited financial statements which have

been filed with the Registrar of Companies. The report of the Independent

Auditor on those accounts contained no qualification or statement

under Section 237 (2), (3) or (4) of the Companies Act 2006.

The Half-Yearly Report has not been reviewed or audited by the Company's

Independent Auditor.

16. Approval. This Half-Yearly Report was approved by the Board on

24 November 2021.

ALTERNATIVE PERFORMANCE MEASURES

Alternative performance measures are numerical measures of the Company's

current, historical or future performance, financial position or cash

flows, other than financial measures defined or specified in the applicable

financial framework. The Company's applicable financial framework includes

International Financial Reporting Standards ("IFRS") and the Statement

of Recommended Practice issued by the Association of Investment Companies

("AIC"). The Directors assess the Company's performance against a range

of criteria which are viewed as particularly relevant for closed-end

investment companies.

Total return . NAV and share price total returns show how the NAV and

share price have performed over a period of time in percentage terms,

taking into account both capital returns and dividends paid to shareholders.

NAV total return assumes that dividends are reinvested at NAV when the

shares are quoted ex-dividend. Share price total return assumes that

dividends are reinvested at the mid-market price when the shares are

quoted ex-dividend.

The tables below provide information relating to the NAVs and share prices

of the Company on the dividend reinvestment dates during the six months

ended 30 September 2021 and the year ended 31 March 2021. A dividend

of 1.0p was paid during the year ended 31 March 2021.

Share

Six months ended 30 September 2021 NAV price

-------------------------------------------- ---------- -------------------------------- --------------------------

31 March 2021 627.05p 542.00p

30 September 2021 745.95p 660.00p

-------------------------------------------- ---------- -------------------------------- --------------------------

Total return +19.0% +21.8%

-------------------------------------------- ---------- -------------------------------- --------------------------

Share

Year ended 31 March 2021 Dividend NAV price

rate

-------------------------------------------- ---------- -------------------------------- --------------------------

31 March 2020 411.41p 328.00p

1 October 2020 1.00p 533.62p 435.00p

31 March 2021 627.05p 542.00p

-------------------------------------------- ---------- -------------------------------- --------------------------

Total return +52.7% +65.6%

-------------------------------------------- ---------- -------------------------------- --------------------------

Discount to net asset value per Ordinary share . The discount is the

amount by which the share price is lower than the net asset value per

share with debt at fair value, expressed as a percentage of the net asset

value.

30 September 31 March 2021

2021

-------------------------------------------- ---------- -------------------------------- --------------------------

NAV per Ordinary share a 745.95p 627.05p

Share price b 660.00p 542.00p

-------------------------------------------- ---------- -------------------------------- --------------------------

Discount (a-b)/a 11.5% 13.6%

-------------------------------------------- ---------- -------------------------------- --------------------------

Net gearing . Net gearing measures the total borrowings less cash and

cash equivalents divided by shareholders' funds, expressed as a percentage.

Under AIC reporting guidance cash and cash equivalents includes amounts

due to and from brokers at the period end.

30 September 31 March

2021 2021

-------------------------------------------- -------------- ------------------------------------ ------------------

Borrowings (GBP'000) a 30,000 24,000

Cash (GBP'000) b 5,655 2,588

Shareholders' funds (GBP'000) c 435,375 366,106

-------------------------------------------- ------------------

Net gearing (a-b)/c 5.6% 5.8%

-------------------------------------------- -------------- ------------------------------------ ------------------

Ongoing charges . The ongoing charges ratio has been calculated in accordance

with guidance issued by the AIC as the total of annualised investment

management fees and administrative expenses and expressed as a percentage

of the average net asset values with debt at fair value throughout the

year. The ratio for 30 September 2021 is based on forecast ongoing charges

for the year ending 31 March 2022.

30 September 31 March

2021 2021

-------------------------------------------- ------------------- ------------------------------- -----------

Investment management fees (GBP'000) 3,437 2,801

Administrative expenses (GBP'000) 938 821

Less: non-recurring charges (GBP'000){A} (18) -

-------------------------------------------- -----------

Ongoing charges (GBP'000) 4,357 3,622

-------------------------------------------- ------------------- ------------------------------- -----------

Average net assets (GBP'000) 410,429 312,355

-------------------------------------------- ------------------- ------------------------------- -----------

Ongoing charges ratio 1.06% 1.16%

-------------------------------------------- ------------------- ------------------------------- ----------- -----

{A} Professional fees unlikely to recur.

The ongoing charges ratio provided in the Company's Key Information Document

is calculated in line with the PRIIPs regulations which amongst other

things, includes the cost of borrowings and transaction costs.

Stuart Reid

Aberdeen Asset Management PLC

Secretaries

Tel. 0131 372 2200

24 November 2021

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRLRLSFIL

(END) Dow Jones Newswires

November 25, 2021 01:59 ET (06:59 GMT)

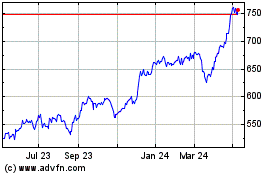

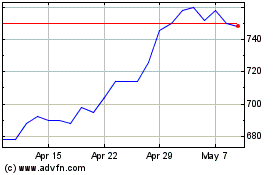

Abrdn New India Investment (LSE:ANII)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn New India Investment (LSE:ANII)

Historical Stock Chart

From Apr 2023 to Apr 2024