TIDMANP

RNS Number : 7846L

Anpario PLC

15 September 2021

Anpario plc

("Anpario" or the "Group")

Interim results

Anpario plc (AIM:ANP), the independent manufacturer of natural

sustainable animal feed additives for animal health, nutrition and

biosecurity is pleased to announce its interim results for the six

months to 30 June 2021.

Highlights

Financial highlights

-- Sales of GBP16.0m (2020: GBP16.2m), excluding currency movements increased by 3% to GBP16.7m

-- 2% increase in adjusted EBITDA1 to GBP3.5m (2020: GBP3.4m)

-- 12% increase in profit before tax to GBP2.7m (2020: GBP2.4m)

-- Diluted adjusted earnings per share down 7% to 10.88p (2020: 11.74p)

-- 9% increase in interim dividend to 3.00p (2020: 2.75p) per share

-- Cash balances of GBP14.6m at 30 June 2021 (Dec 2020: GBP15.8m)

Operational highlights

-- Sales growth in Latin America, United States, China and Australasia, despite currency headwinds.

-- Strong demand for our unique acid-based eubiotic brand pHorce (R) to the US swine sector as an anti-viral feed

mitigant.

-- 29% sales growth in Orego-Stim (R) benefiting from our aquaculture initiatives and the reduction in use of

antibiotic growth promoters (AGP's).

-- Feed and raw material hygiene product, Salgard SW, with proven efficacy against gram negative bacteria without

safety concerns associated with formaldehyde.

-- New European stockholding hub supporting rapid service to European customers post Brexit.

Kate Allum, Chairman, commented:

"In my first statement as Chairman, I would like to thank my

predecessor, Peter Lawrence, for his 16 years of service to Anpario

and his leadership and guidance of the Board, during which time

significant shareholder value has been created.

The Board is pleased to report a good sales and improved profit

performance with sales at a similar level to last year and 3% ahead

on a constant exchange rate basis. Our strategy of offering more

sustainable and environmentally friendly products as an alternative

to anti-biotic growth promoters and some of the harsher chemical

treatments is gaining traction. This performance should be seen in

the context of a very strong comparative period and at a time when

the UK's trading relationship changed with the European Union.

It is thanks to the efforts of our staff and other stakeholders

across the globe that ensure we continue to supply and support our

customers, as well as implementing our business development

initiatives delivering organic growth. As with most industries, we

have experienced raw material price inflation and some disruption

in our supply chain and global shipping routes but our staff have

been able to manage these challenges successfully.

We are excited about the changes occurring in our markets where

Anpario's environmentally friendly and sustainable solutions are

gaining more interest from global producers. The industry is moving

away from the use of harmful applications such as formaldehyde and

zinc oxide for antimicrobial control in addition to the trend to

reduce antibiotic use. Over the past few years our developments

have been focused on products which comprise 100% natural and

sustainable ingredients which work in synergy with the animal's

natural biological processes to boost immunity.

There has been a strong start to the second half of the year and

we remain confident of continuing the profitable development of the

Group supported by a strong balance sheet and investment in our

operations, technology and global sales channels."

Kate Allum, Chairman

(1) Adjusted EBITDA represents operating profit for the year

GBP2.651m (2020: GBP2.317m) adjusted for: share based payments and

associated costs GBP0.027m (2020: GBP0.029m); foreign exchange

losses GBP0.175m (2020: GBP0.055m gain); foreign exchange hedging

gains GBP0.043m (2020: GBP0.489m loss); and depreciation,

amortisation and impairment charges of GBP0.647m (2020:

GBP0.613m)

Chief Executive Officer's statement

Overview

Group sales for the six months to 30 June 2021 declined by just

1% to GBP16.0m (2020: GBP16.2m). However, on a constant exchange

rate basis, sales for the period grew by 3% to GBP16.7m, helped by

strong performances in a number of territories and 29% sales growth

from our Orego-Stim(R) range. Latin America experienced significant

growth, notably Brazil, and in Chile where commercial trials to the

aquaculture market commenced. With the exception of China and

Australasia, which both delivered strong growth, most other regions

had similar performances to the prior period. South-East Asia

continues to be significantly impacted by the COVID-19 pandemic

experiencing 31% decline in sales compared to the same period last

year.

Gross profit decreased by 5% to GBP8.1m (2020: GBP8.5m) for the

six months to 30 June 2021 but grew by 3% to GBP8.8m on a constant

exchange rate basis. Gross margins fell from 52.5% to 50.5%, for

which there were several contributing factors including currency

movements. There has been a significant increase in logistics costs

and even though most of these costs are borne by our customers it

does impact the gross margin calculation. There has also been some

significant raw material price inflation, which we are passing on

through sales price increases and from which we expect to benefit

in the second half of the year.

The pandemic continues to limit the amount of international

travel and marketing events taking place across the industry,

although our local sales teams are visiting customers where

possible. As such these cost savings and our foreign exchange

hedging measures have translated into a 12% improvement in profit

before tax to GBP2.7m (2020: GBP2.4m) for the period.

Overall, we are very encouraged by the growth in some of our

market leading product brands such as Orego-Stim(R) and pHorce(R)

which are helping producers reduce antibiotic use and mitigate the

risk of virus-contaminated feed respectively. Our technical team

recently developed Salgard SW, a high strength liquid acid-based

eubiotic for feed and raw material hygiene decontamination which is

proving to be an effective replacement to formaldehyde, which was

recently banned in the European Union and certain other countries

around the World.

Operational review

Americas

Overall, the region grew sales by 5% with Latin America

delivering growth of 10%, sales in the US were flat, but there were

mixed performances across countries within Latin America.

Latin America performance was supported with key contributions

from Brazil and Chile. Chile's strong growth was due to the

commencement of commercial aquaculture trials using Orego-Stim(R)

in the feed. Brazil's 19% sales growth was driven by Orego-Stim(R)

sales following successful business development with some new

customers and an increase in sales of Prefect(R) to the aquaculture

market. Argentina, Ecuador and Mexico disappointed partly due to

the pandemic, however, we are expecting an improved second half

from Latin America following new business wins with products such

as Mastercube(R), our natural pellet binder, for aquafeed

purposes.

Additionally, we have set up a wholly owned subsidiary in Mexico

and secured third party warehousing and logistics services to stock

our products. This capability will enable us to respond more

quickly to regional distributor demand and target larger end users

directly.

US performance was flat at actual exchange rates but excluding

currency movements sales grew by 11% and volumes by 26%. Last year

our high strength acid-based eubiotic, pHorce(R), showed excellent

results in a trial undertaken by Pipestone Applied Research

(Pipestone) to evaluate the ability of feed additives in mitigating

the risk of virus-contaminated feed. Following on from this

research our US swine sales team successfully launched the product,

which has proved timely, as the industry has had to contend with

summer outbreaks of porcine reproductive and respiratory syndrome

(PPRS). Where used, pHorce(R) has managed to protect farms from

outbreaks of the virus and is viewed as being a highly effective

preventative product.

We have recently appointed a distributor for the West Coast with

first orders already received following recent sales visits, and we

are in discussions with a potential distributor for Canada. In

addition, we have had meetings with senior executives responsible

for sustainability at a leading poultry integrator to discuss how

Anpario as a company and with its technology can support their

sustainability requirements.

Asia

Overall, sales in the region declined by 2%, impacted by a

significant decline of 31% across South-East Asia as further

lockdowns and the slow rollout of the vaccine impacted economic

activity and tourism in the region. South Korea and The Philippines

experienced significant declines during the period. However, this

period should be compared to a very strong first half in the

previous year and performance has improved from the second half of

2020 which appears to have been the bottom. This weakness in

trading, however, is cushioned by strong performances in both China

and Australasia.

China delivered very strong sales with growth of 113% as

Orego-Stim(R) is adopted as a replacement for antibiotic growth

promoters (AGP's) primarily in piglet feed. We also established a

wholly owned subsidiary in New Zealand in addition to our existing

distributor channel to enable direct sales to end markets not

currently served by our distributor. The Australasia region

delivered sales growth of 26% for the period helped by an increase

in our mould control product, Mycostat(R), in the oilseed crusher

segment.

Our customers in the South-East Asian region are experiencing

some significant challenges which are also reflected around the

world to varying degrees. In addition, to low demand for meat

protein due to the COVID-19 pandemic, animal feed costs have

increased by at least one third due to raw material price inflation

and shipping and logistics issues continue to challenge our export

team. We expect these challenges to continue into next year but our

local sales teams and stock holding in the region is ensuring we

can continue to service our customers effectively.

Notwithstanding these challenges, progress continues to be made

with specific initiatives including the appointment of an

aquaculture specific distributor in Bangladesh and the adoption of

Mastercube(R), our natural pellet binder, as a replacement for

polymethylolcarbamide ( PMC ) pellet binders which contain urea

formaldehyde and are used widely in aquaculture throughout Asia.

Removing PMC from the feed allows for unrestricted export of shrimp

to markets where urea formaldehyde is banned. Our Vietnam

subsidiary was also established during the period and we have

recruited a local sales team for this important market.

The Middle East, Africa and India

Sales in the region declined by 4% compared to the same period

last year, however this represents a 26% recovery in revenue from

the second half of 2020 which was materially impacted by the

COVID-19 pandemic. We are encouraged by this recovery and have been

working on some new initiatives including the recent appointment of

another distributor in India which has already taken delivery of

their first order. There have been some good performances in

Pakistan, Yemen and Turkey and we see further growth opportunities

in Iraq but are closely managing credit terms.

Europe

Sales in Europe declined by 4% compared to the same period last

year affected by some distributors increasing stock in anticipation

of Brexit, although normality in order patterns is returning.

Israel showed a very strong performance delivering sales growth

of over 200% as our distributor has been able to establish

Orego-Stim(R) as the leading phytogenic brand. We are also seeing

increased interest in our products for organic production as the

European Union has committed to have 25% of agricultural land under

organic farming by 2030 . The recent appointment of a combination

of two distributors in Switzerland will give us access to both

larger customers and small farms through a farm van delivery

service, which will give Anpario full coverage of this high value

organic led market.

We have been making good progress with our raw material and feed

hygiene product, Salgard SW, which is being recognised as the best

environmentally friendly alternative to formaldehyde following its

recent ban by the European Union and is seeing customers elsewhere

look for credible alternatives. We are therefore increasing our

liquid bulk storage facilities at Manton Wood to ensure rapid

response to demand across Europe. We have also entered into a

supply agreement with a global life science ingredients distributor

to own brand our acid-based eubiotic technology for enteropathogen

control applications in the rendering sector.

Innovation and development

We are excited about the changes occurring in our markets where

Anpario's environmentally friendly and sustainable solutions are

gaining more interest from global producers. The industry is moving

away from the use of harmful applications such as formaldehyde and

zinc oxide for antimicrobial control in addition to the trend to

reduce antibiotic use. Over the past few years our developments

have been focused on products which comprise 100% natural and

sustainable ingredients which work in synergy with the animal's

natural biological processes to boost immunity. By formulating

highly concentrated products, we use less raw materials than many

competitor products yet are still able to provide better efficacy

and performance that producers value. Our product range is

typically in its early life cycle stage and as global regulatory

requirements tighten these changes should benefit our sales

growth.

It is pleasing to see products like pHorce (R) not only perform

in controlled research trials but also under tough commercial

conditions where the farmer can experience the benefits, which has

been the case in the US in preventing porcine reproductive and

respiratory syndrome virus (PRRS) break on farm through potentially

contaminated feed.

More recent trial work is underway in Chile where an aquaculture

version of Orego-Stim (R) included in the feed is being used to

control low to moderate levels of sea lice infestation in

salmonids, which is proving positive.

Outlook

There has been a strong start to the second half of the year

with most regions recovering from the low point in the second half

of 2020. Our global sales teams are focused on specific business

development initiatives and working arduously, in difficult

circumstances, to deliver beneficial solutions to both existing and

new customers. Our products are best in class and increasingly

being recognised as such.

We are mindful that challenges remain, not least the Covid-19

pandemic which is impacting some of our geographic markets, but

also raw material price inflation and global shipping issues. We

have taken early action to mitigate some of the impact and backed

by the quality and ability of our employees worldwide, we are

confident of delivering our growth plans.

Our strong balance sheet enables the Group to invest in its

growth initiatives including increasing raw material and

stockholding capacity as well as continuing our research and

development programmes. We continue to expand our multi-channel

capabilities with local subsidiaries and sales teams who have

served us exceptionally well during a period when international

travel is restricted. These areas remain a priority for investment

in addition to undertaking earnings enhancing and complementary

acquisitions to accelerate the profitable development of the

Group.

Richard Edwards

Chief Executive Officer

15 September 2021

Key performance indicators

Financial

H1 2021 H1 2020

Note GBP000 GBP000 change % change

------------------------------------ ---- ------- ------- ------ --------

Revenue 3 15,963 16,173 -210 -1%

Gross profit 8,045 8,492 -447 -5%

Gross margin 50.4% 52.5% -2.1%

Adjusted EBITDA 6 3,457 3,393 +64 +2%

Profit before tax 2,673 2,378 +295 +12%

Diluted adjusted earnings per share 12 10.88p 11.74p -0.86 -7%

Interim dividend 3.00p 2.75p +0.25p +9%

Cash and cash equivalents 14,601 13,170 +1,431 +11%

Net assets 39,468 36,539 +2,929 +8%

Financial review

Revenue and gross profits

On a constant exchange rate basis, revenue for the period grew

by 3% to GBP16.7m (2020: GBP16.2m), at actual exchange rates

revenue was down 1% to GBP16.0m. The difference primarily relating

to the increase in GBP/USD exchange rate to an average of 1.389

(2020: 1.254), the impact of which on overall profit before tax was

reduced through foreign exchange hedging. The sales performance

represented a strong recovery from the weaker, COVID impacted,

result in H2 2020 with sales 11% higher than this period.

Particularly pleasing was the continued growth in sales in

China, up 113%, as well as strong performances in LATAM and

Australasia, though market conditions in South-East Asia continued

to be difficult and sales declined 31% in the period. Detailed

commentary on the performance of the operating segments is

available in the Chief Executive Officer's Statement.

On a constant exchange rate basis, gross profit for the six

months to 30 June 2021 grew by 3% to GBP8.8m (2020: GBP8.5m) and

margins were consistent between periods. At actual exchange rates

there was a 5% decrease in gross profit to GBP8.0m (2020: GBP8.5m)

and gross margins fell 210 basis points to 50.4% (2020: 52.5%),

full year margins for 2020 were 51.9%.

There are several contributing factors to the decline in

margins. The prior year sales benefited from realised foreign

exchange gains on sales receipts (GBP0.2m), whereas a loss was

experienced in the current period (GBP0.1m). As with many

businesses in the current market conditions we have experienced

challenges in logistics, though to date we have successfully

navigated these and been able to continuously supply our customers.

In terms of outbound supply, we have seen significant increases in

international shipping costs, excluding sales through our

subsidiary channels, these costs are largely passed on and invoiced

to customers. As such the impact on gross profit is small through

the period, however it does affect and reduce the gross margin

calculation. In terms of raw material supply, there has disruption

to availability which we have responded to through increased

working capital, as well as significant price inflation which is

being passed on through sales prices increases implemented at the

end of the current period.

Administrative expenses

Administrative expenses were 13% lower at GBP5.4m (2020:

GBP6.2m), most of the decline relating to administrative foreign

exchange losses which through our hedging activities were

eliminated in the current period whereas the prior period saw costs

of GBP0.5m. Underlying administrative expenses were 4% lower with

reductions across most types of expenditure.

Travel and marketing costs were lower, particularly as the first

quarter of 2020 had a relatively normal level of expenditure for

these types of activity. These costs remain at low levels but are

expected to continue to gradually normalise as restrictions due to

the pandemic are eased, the timing of which remains uncertain. In

the longer-term, overall expenditure will be lower than per-COVID

levels as we expect that we will continue to benefit from the speed

and cost-efficiencies of new communication technologies.

Legal and professional costs were GBP0.1m lower as they

normalised from higher rates of expenditure in the prior period to

support our continued expansion to support local markets .

Foreign exchange

The Group's primary foreign currency exchange rate risk relates

to both sales and related receivables denominated in US Dollars,

for which there has been significant adverse movement in the

period. However, we continue to actively take steps to mitigate the

impact of these risks and at the end of the period the Group has

recognised a GBP0.9m financial asset (2020: GBP0.1m liability) on

related hedging contracts. These protect a large portion of the

currently forecasted net US Dollar cash flows over the next three

years at an average rate of GBP/USD 1.312.

Profitability and earnings per share

Adjusted EBITDA for the period, which excludes the impact of

foreign exchange gains and losses, increased by 2% to GBP3.5m

(2020: GBP3.4m). Profit before tax increased 12% to GBP2.7m (2020:

GBP2.4m).

Adjusted earnings per share decreased by 7% to 10.88p (2020:

11.74p), this was driven by a higher effective tax rate and a

larger number of dilutive shares because of the increased share

price.

Taxation

The effective tax rate for the period was 32.4% (2020: 20.1%).

Changes to UK corporation tax rates occurred firstly in the prior

period with planned reductions to 17% being scrapped, then in the

current period on 3 March 2021 the UK government announced an

increase to 25%, from 19%, from April 2023. Deferred taxes have

been remeasured at these revised rates in both periods and resulted

in a deferred tax charge of GBP0.4m (2020: GBP0.2m). Excluding

these exceptional charges, the underlying effective tax rate for

the period was 16.9% (2020: 13.4%).

Cash flow

Operating cash flows before changes in working capital were

GBP3.5m (2020: GBP3.4m) in the period. Changes in working capital

absorbed GBP3.6m (2020: GBP2.0m), the most significant factor was

an increase in inventory of GBP1.9m. This partly relates to the

continued sales growth in our Subsidiary operations which hold

finished goods stock but also further increases in the overall

level of product held in these locations that are closer to our

customers in light of the global logistics challenges. The other

factor being a reduction in Trade and other payables, largely

related to the payment in the period of bonuses earned for the

prior year performance.

Net cash used in investing activities decreased slightly in the

period to GBP0.5m (2020: GBP0.6m). Net cash used in financing

activities was GBP0.9m lower than the prior period which saw a

GBP1.0m share buyback programme purchasing 297,346 ordinary shares

at a volume weighted average price of 336.31p per share.

Overall, cash and cash equivalents decreased by GBP1.2m in the

period to a balance of GBP14.6m (Dec 2020: GBP15.8m). The primary

purpose of holding these resources is to fund future acquisitions

and we continue to explore suitable opportunities.

Dividend

The Board has approved an interim dividend of 3.00 pence per

share (2020: 2.75 pence), an increase of 9%. This dividend, payable

on 12 November to shareholders on the register on 26 November,

reflects the Board's continued confidence in the Group and its

ability to generate cash.

Consolidated statement of comprehensive income

for the six months ended 30 June 2021

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

Note GBP000 GBP000 GBP000

---------------------------------------------------------------- ------ -------------- -------------- ------------

Revenue 3 15,963 16,173 30,522

Cost of sales (7,918) (7,681) (14,670)

---------------------------------------------------------------- ------ -------------- -------------- ------------

Gross profit 8,045 8,492 15,852

Administrative expenses (5,394) (6,175) (10,585)

Operating profit 2,651 2,317 5,267

Depreciation and amortisation 647 613 1,233

Adjusting items 4 159 463 104

Adjusted EBITDA 4 3,457 3,393 6,604

---------------------------------------------------------------- ------ -------------- -------------- ------------

Net finance income 5 22 61 83

---------------------------------------------------------------- ------ -------------- -------------- ------------

Profit before tax 2,673 2,378 5,350

Income tax (867) (478) (1,145)

---------------------------------------------------------------- ------ -------------- -------------- ------------

Profit for the period 1,806 1,900 4,205

---------------------------------------------------------------- ------ -------------- -------------- ------------

Items that may be subsequently reclassified to profit or loss:

Exchange difference on translating foreign operations (29) 212 (65)

Cashflow hedge movements (net of deferred tax) 68 (307) 68

Total comprehensive income for the period 1,845 1,805 4,208

---------------------------------------------------------------- ------ -------------- -------------- ------------

Basic earnings per share 6 8.84p 9.31p 20.63p

Diluted earnings per share 6 8.20p 9.08p 19.89p

Adjusted earnings per share 6 11.74p 12.04p 21.94p

Diluted adjusted earnings per share 6 10.88p 11.74p 21.15p

---------------------------------------------------------------- ------ -------------- -------------- ------------

Consolidated statement of financial position

as at 30 Jun 2021

as at as at as at

30 June 30 June 31 December

2021 2020 2020

Note GBP000 GBP000 GBP000

---------------------------------- ------ -------- -------- ------------

Intangible assets 7 11,349 11,553 11,522

Property, plant and equipment 8 4,247 4,052 4,142

Right of use assets 9 65 145 85

Deferred tax assets 1,175 1,037 987

Derivative financial instruments 489 20 641

Non-current assets 17,325 16,807 17,377

Inventories 10 6,739 5,373 4,902

Trade and other receivables 6,507 6,874 6,053

Derivative financial instruments 419 - 327

Cash and cash equivalents 14,601 13,170 15,820

---------------------------------- ------

Current assets 28,266 25,417 27,102

Total assets 45,591 42,224 44,479

---------------------------------- ------ -------- -------- ------------

Lease liabilities (42) (34) (7)

Derivative financial instruments - (152) -

Deferred tax liabilities (2,106) (1,545) (1,662)

Non-current liabilities (2,148) (1,731) (1,669)

Trade and other payables (3,709) (3,565) (5,007)

Lease liabilities (27) (116) (83)

Derivative financial instruments (10) (201) -

Current income tax liabilities (229) (72) (215)

Current liabilities (3,975) (3,954) (5,305)

Total liabilities (6,123) (5,685) (6,974)

---------------------------------- ------ -------- -------- ------------

Net assets 39,468 36,539 37,505

---------------------------------- ------ -------- -------- ------------

Called up share capital 5,433 5,411 5,426

Share premium 11,241 10,996 11,148

Other reserves (6,449) (6,729) (6,506)

Retained earnings 29,243 26,861 27,437

Total equity 39,468 36,539 37,505

---------------------------------- ------ -------- -------- ------------

Consolidated statement of changes in equity

for the six months ended 30 June 2021

Called up Share Other Retained Total

share capital premium reserves earnings equity

---------------------------------------------

GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 1 Jan 2020 5,394 10,849 (5,650) 24,961 35,554

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 1,900 1,900

Currency translation differences - - 212 - 212

Cash flow hedge reserve - - (307) - (307)

Total comprehensive income for the period - - (95) 1,900 1,805

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 17 147 - - 164

Purchase of treasury shares - - (1,004) - (1,004)

Share-based payment adjustments - - 20 - 20

Transactions with owners 17 147 (984) - (820)

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 30 Jun 2020 5,411 10,996 (6,729) 26,861 36,539

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 2,305 2,305

Currency translation differences - - (277) - (277)

Cash flow hedge reserve - - 375 - 375

Total comprehensive income for the period - - 98 2,305 2,403

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 15 152 - - 167

Share-based payment adjustments - - 26 - 26

Deferred tax regarding share-based payments - - 99 - 99

Final dividend relating to 2018 - - - (1,144) (1,144)

Interim dividend relating to 2019 - - - (585) (585)

Transactions with owners 15 152 125 (1,729) (1,437)

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 31 Dec 2020 5,426 11,148 (6,506) 27,437 37,505

--------------------------------------------- --------------- --------- ---------- ---------- --------

Profit for the period - - - 1,806 1,806

Currency translation differences - - (29) - (29)

Cash flow hedge reserve - - 68 - 68

Total comprehensive income for the year - - 39 1,806 1,845

--------------------------------------------- --------------- --------- ---------- ---------- --------

Issue of share capital 7 93 - - 100

Share-based payment adjustments - - 18 - 18

Transactions with owners 7 93 18 - 118

--------------------------------------------- --------------- --------- ---------- ---------- --------

Balance at 30 Jun 2021 5,433 11,241 (6,449) 29,243 39,468

--------------------------------------------- --------------- --------- ---------- ---------- --------

Consolidated statement of cash flows

for the six months ended 30 June 2021

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

Note GBP000 GBP000 GBP000

---------------------------------------------------------- ------ -------------- -------------- ------------

Operating profit for the period 2,651 2,317 5,267

Depreciation, amortisation and impairment 4 647 613 1,233

Loss on disposal of property, plant and equipment 8 - - 3

Share-based payments 18 20 46

Fair value adjustment to derivatives 156 433 (406)

Operating cash flows before changes in working capital 3,472 3,383 6,143

Increase in inventories (1,921) (1,186) (1,000)

(Increase)/decrease in trade and other receivables (488) (1,571) (636)

(Decrease)/increase in trade and other payables (1,141) 724 2,233

Changes in working capital (3,550) (2,033) 597

Cash generated by operations (78) 1,350 6,740

---------------------------------------------------------- ------ -------------- -------------- ------------

Income tax paid (619) (529) (910)

Net cash from operating activities (697) 821 5,830

---------------------------------------------------------- ------ -------------- -------------- ------------

Purchases of property, plant and equipment 8 (336) (270) (593)

Proceeds from disposal of property, plant and equipment 4 - -

Payments to acquire intangible assets 7 (191) (361) (663)

Interest received 5 24 64 88

Net cash used in investing activities (499) (567) (1,168)

Purchase of treasury shares - (1,004) (1,004)

Proceeds from issuance of shares 100 164 331

Cash payments in relation to lease liabilities (60) (60) (117)

Operating lease interest paid 5 (2) (3) (5)

Dividend paid to Company's shareholders - - (1,729)

Net cash from financing activities 38 (903) (2,524)

Net (decrease)/increase in cash and cash equivalents (1,158) (649) 2,138

---------------------------------------------------------- ------ -------------- -------------- ------------

Effect of exchange rate changes (61) (23) (160)

Cash and cash equivalents at the beginning of the period 15,820 13,842 13,842

Cash and cash equivalents at the end of the period 14,601 13,170 15,820

---------------------------------------------------------- ------ -------------- -------------- ------------

1. General information

Anpario plc ("the Company") and its Subsidiaries (together "the

Group") produce and distribute natural feed additives for animal

health, hygiene and nutrition. Anpario plc is a public company

traded on the Alternative Investment Market ("AIM") of the London

Stock Exchange and is incorporated in the United Kingdom and

registered in England and Wales. The address of its registered

office is Unit 5 Manton Wood Enterprise Park, Worksop,

Nottinghamshire, S80 2RS. The presentation currency of the Group is

pounds sterling.

2. Basis of preparation

The consolidated financial statements comprise the accounts of

the Company and its subsidiaries drawn up to 30 June 2021.

The Group has presented its financial statements in accordance

with International Financial Reporting Standards ("IFRSs") in

conformity with the Companies Act 2006 applicable to companies

reporting under IFRS.

Full details on the basis of the accounting policies used are

set out in the Group's financial statements for the year ended 31

December 2020, which are available on the Company's website at

www.anpario.com.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2020 were approved by the Board of Directors on 17 March

2021 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 (2) or (3) of the Companies Act 2006.

The consolidated interim financial information for the period

ended 30 June 2021 is neither audited nor reviewed.

3. Operating segments

Management has determined the operating segments based on the

information that is reported internally to the Chief Operating

Decision Maker, the Board of Directors, to make strategic

decisions. The Board considers the business from a geographic

perspective and is organised into four geographical operating

divisions: Americas, Asia, Europe, Middle-East and Africa (MEA) and

Head Office.

All revenues from external customers are derived from the sale

of goods and services in the ordinary course of business to the

agricultural markets and are measured in a manner consistent with

that in the income statement. Inter-segment revenue is charged at

prevailing market prices or in accordance with local transfer

pricing regulations.

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the six months ended 30 Jun 2021 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 4,033 6,111 11,045 1,446 - 22,635

Inter-segment revenue - - (6,672) - - (6,672)

Revenue from external customers 4,033 6,111 4,373 1,446 - 15,963

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (1) (30) (5) (2) (609) (647)

Net finance income - - - - 22 22

Profit before tax 1,616 1,703 1,654 505 (2,805) 2,673

-------------------------------------- --------- ------- -------- ------- ------------ --------

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the six months ended 30 Jun 2020 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 3,841 6,242 9,311 1,519 - 20,913

Inter-segment revenue - - (4,740) - - (4,740)

Revenue from external customers 3,841 6,242 4,571 1,519 - 16,173

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (2) (31) (2) (2) (576) (613)

Net finance income - (1) - 1 61 61

Profit before tax 823 2,413 2,011 422 (3,291) 2,378

-------------------------------------- --------- ------- -------- ------- ------------ --------

Americas Asia Europe MEA Head Office Total

--------------------------------------

for the year ended 31 Dec 2020 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------- --------- ------- -------- ------- ------------ --------

Total segmental revenue 7,384 11,664 16,567 2,668 - 38,283

Inter-segment revenue - - (7,761) - - (7,761)

Revenue from external customers 7,384 11,664 8,806 2,668 - 30,522

-------------------------------------- --------- ------- -------- ------- ------------ --------

Depreciation and amortisation (3) (63) (3) (4) (1,160) (1,233)

Net finance income - (1) - 1 83 83

Profit before tax 1,473 4,100 3,906 828 (4,957) 5,350

-------------------------------------- --------- ------- -------- ------- ------------ --------

4. Alternative performance measures

In reporting financial information, the Group presents

alternative performance measures (APMs), which are not defined or

specified under the requirements of IFRS. The Group believes that

these APMs, which are not considered to be a subsitute for or

superior to IFRS measures, provide depth and understanding to the

users of the financial statements to allow for further assessment

of the underlying performance of the Group.

The Board considers that adjusted EBITDA is the most appropriate

profit measure by which users of the financial statements can

assess the ongoing performance of the Group. EBITDA is a commonly

used measure in which earnings are stated before net finance

income, amortisation and depreciation. The Group makes further

adjustments to remove items that are non-recurring or are not

reflective of the underlying operational performance either due to

their nature or the level of volatility.

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------------------------- -------------- -------------- ------------

Operating profit 2,651 2,317 5,267

------------------------------------------------- -------------- -------------- ------------

Share-based payments 27 29 67

Loss on disposal of property - - -

Foreign exchange losses/(gains) 175 (55) 442

Foreign exchange hedging - Fair value movements (43) 489 (405)

------------------------------------------------- -------------- -------------- ------------

Total adjustments 159 463 104

Adjusted operating profit 2,810 2,780 5,371

------------------------------------------------- -------------- -------------- ------------

Depreciation and amortisation 647 613 1,233

Adjusted EBITDA 3,457 3,393 6,604

------------------------------------------------- -------------- -------------- ------------

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------------------------- -------------- -------------- ------------

Adjusted operating profit 2,810 2,780 5,371

------------------------------------------------- -------------- -------------- ------------

Income tax expense (867) (478) (1,145)

Effect of changes to future tax rates 416 159 158

Income tax impact of adjustments 38 (5) 88

Adjusted profit after tax 2,397 2,456 4,472

------------------------------------------------- -------------- -------------- ------------

5. Net finance income

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------------------------- -------------- -------------- ------------

Interest receivable on short-term bank deposits 24 64 88

------------------------------------------------- -------------- -------------- ------------

Finance income 24 64 88

Lease interest paid (2) (3) (5)

------------------------------------------------- -------------- -------------- ------------

Finance costs (2) (3) (5)

Net finance income 22 61 83

------------------------------------------------- -------------- -------------- ------------

6. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

-------------------------------------------------------- -------------- -------------- ------------

Profit for the year (GBP000's) 1,806 1,900 4,205

--------------------------------------------------------- -------------- -------------- ------------

Weighted average number of shares in issue 20,423,732 20,399,790 20,387,477

--------------------------------------------------------- -------------- -------------- ------------

Number of dilutive shares 1,611,463 522,281 755,047

Weighted average number for diluted earnings per share 22,035,195 20,922,071 21,142,524

--------------------------------------------------------- -------------- -------------- ------------

Basic earnings per share 8.84p 9.31p 20.63p

Diluted earnings per share 8.20p 9.08p 19.89p

--------------------------------------------------------- -------------- -------------- ------------

The calculation of the adjusted and diluted adjusted earnings

per share is based on the following data:

six months to six months to year ended

30 June 30 June 31 December

Note 2021 2020 2020

---------------------------------------------------------------- ------ -------------- -------------- ------------

Adjusted profit attributable to owners of the Parent (GBP000's) 4 2,397 2,456 4,472

---------------------------------------------------------------- ------ -------------- -------------- ------------

Weighted average number of shares in issue 20,423,732 20,399,790 20,387,477

---------------------------------------------------------------- ------ -------------- -------------- ------------

Number of dilutive shares 1,611,463 522,281 755,047

Weighted average number for diluted earnings per share 22,035,195 20,922,071 21,142,524

---------------------------------------------------------------- ------ -------------- -------------- ------------

Adjusted earnings per share 11.74p 12.04p 21.94p

Diluted adjusted earnings per share 10.88p 11.74p 21.15p

---------------------------------------------------------------- ------ -------------- -------------- ------------

7. Intangible assets

Patents,

trademarks

Customer and Development Software

Goodwill Brands relationships registrations costs and Licenses Total

-----------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- --------- ------- ---------------- ----------------- ----------------- -------------- -------

Cost

As at 1 January

2021 5,960 4,440 786 1,773 559 784 14,302

Additions - - - 63 127 1 191

As at 30 June

2021 5,960 4,440 786 1,836 686 785 14,493

----------------- --------- ------- ---------------- ----------------- ----------------- -------------- -------

Accumulated

amortisation

As at 1 January

2021 - 731 661 890 - 498 2,780

Charge for the

year - 130 30 137 - 67 364

As at 30 June

2021 - 861 691 1,027 - 565 3,144

----------------- --------- ------- ---------------- ----------------- ----------------- -------------- -------

Net book value

As at 1 January

2021 5,960 3,709 125 883 559 286 11,522

As at 30 June

2021 5,960 3,579 95 809 686 220 11,349

----------------- --------- ------- ---------------- ----------------- ----------------- -------------- -------

8. Property, plant and equipment

Land and Fixtures, fittings Assets in the course

buildings Plant and machinery and equipment of construction Total

------------------------------

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Cost

As at 1 January 2021 1,854 3,355 635 479 6,323

Additions - 78 14 244 336

Transfer of assets in

construction - 284 - (284) -

Disposals - - (8) - (8)

Foreign exchange - - (1) - (1)

As at 30 June 2021 1,854 3,717 640 439 6,650

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Accumulated depreciation

As at 1 January 2021 283 1,473 425 - 2,181

Charge for the year 14 170 41 - 225

Disposals - - (3) - (3)

As at 30 June 2021 297 1,643 463 - 2,403

------------------------------ ----------- -------------------- ------------------- --------------------- -------

Net book value

As at 1 January 2021 1,571 1,882 210 479 4,142

As at 30 June 2021 1,557 2,074 177 439 4,247

------------------------------ ----------- -------------------- ------------------- --------------------- -------

9. Right-of-use assets

Land and Plant and Fixtures, fittings

buildings machinery and equipment Total

-----------------------------

GBP000 GBP000 GBP000 GBP000

----------------------------- ----------- ----------- ------------------- -------

Cost

As at 1 January 2021 321 26 7 354

Additions 28 - - 28

Modification to lease terms 11 - - 11

Disposals - (26) (5) (31)

Foreign exchange 1 - - 1

As at 30 June 2021 361 - 2 363

----------------------------- ----------- ----------- ------------------- -------

Accumulated depreciation

As at 1 January 2021 239 25 5 269

Charge for the year 56 1 1 58

Modification to lease terms 1 - - 1

Disposals - (26) (5) (31)

Foreign exchange 1 - - 1

As at 30 June 2021 297 - 1 298

----------------------------- ----------- ----------- ------------------- -------

Net book value

As at 1 January 2021 82 1 2 85

As at 30 June 2021 64 - 1 65

----------------------------- ----------- ----------- ------------------- -------

10. Inventories

six months to six months to year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- ------------

Raw materials and consumables 1,979 2,178 1,932

Finished goods and goods for resale 4,760 3,195 2,970

Inventory 6,739 5,373 4,902

------------------------------------- -------------- -------------- ------------

Enquiries:

Anpario plc

Richard Edwards, CEO +44(0) 777 6417 129

Marc Wilson, Group Finance Director +44(0) 1909 537380

Peel Hunt LLP (NOMAD) +44 (0)20 7418 8900

Adrian Trimmings

Andrew Clark

Will Bell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZGMLGDRGMZZ

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

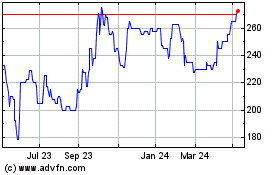

Anpario (LSE:ANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

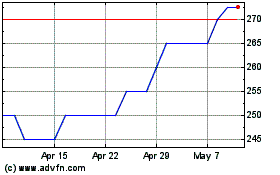

Anpario (LSE:ANP)

Historical Stock Chart

From Apr 2023 to Apr 2024