Antofagasta Cuts Copper Production Guidance, Warns on Costs -- Commodity Comment

20 July 2022 - 5:27PM

Dow Jones News

By Jaime Llinares Taboada

Antofagasta PLC on Wednesday downgraded copper production and

cost guidance for 2022 after operational issues at Los Pelambres

and amid cost inflation for diesel and sulphuric acid. Here's what

the FTSE 100 copper miner had to say:

On production:

"Group copper production in Q2 2022 was 129,800 tonnes, a

decrease of 6.5% compared to the previous quarter, mainly due to

the previously announced concentrate pipeline incident at Los

Pelambres which reduced reported production during the period by

approximately 23,000 tonnes. Operation of the pipeline resumed by

the end of the period and 12,000 tonnes of copper in concentrates

stockpiled at the concentrator plant will be moved to the port by

October"

"Group copper production in the first six months of the year was

268,600 tonnes, 25.7% lower than in the same period last year

mainly due to the expected temporary reduction in throughput at Los

Pelambres as a result of the drought and the concentrate pipeline

incident, and expected lower grades at Centinela Concentrates.

Throughput at Los Pelambres was 36.2% lower than in H1 2021, and

the grades at Centinela Concentrates were 25.4% lower"

"Gold production for the quarter decreased by 7.8% to 35,400

ounces compared with Q1 mainly due to the concentrate pipeline

incident, and for the first six months decreased by 38.8% to 73,800

ounces mainly due to expected lower grades at Centinela"

"Molybdenum production was 2,000 tonnes, the same as the

previous quarter. For the year to date, production was 4,000

tonnes, 31.0% lower than in the same period last year due to lower

throughput and grades at Los Pelambres"

On costs:

"Cash costs before by-product credits in the quarter were

$2.40/lb, 6c/lb higher than in the first quarter and for the first

half of the year were $2.37/lb, 37.0% higher than in the same

period last year mainly due to the temporary decrease in production

and higher input prices, particularly for diesel and sulphuric

acid. General inflation was largely offset by the weaker Chilean

peso"

"Net cash costs were $1.90/lb in Q2 2022 and $1.82/lb for the

first half of the year, compared to $1.75/lb in the previous

quarter and $1.14/lb in the first half of 2021, reflecting the

increase in cash costs before by-product credits and slightly lower

by-product credits due to lower by-product production, partially

offset by higher realised prices"

On outlook:

"Full year copper production for the Group is revised downwards

to 640-660,000 tonnes. This revision mainly reflects the impact of

the pipeline incident and the continued uncertainty arising from

the water shortage at Los Pelambres"

"The drought has continued at Los Pelambres during the period

although there has been heavier precipitation in July. The revised

guidance range incorporates a low probability negative outlook for

water availability for the rest of the year. Strict water

management protocols remain in place to optimise water usage and

mitigate the impact of low water availability"

"With increases in diesel and other input prices, net cash cost

guidance is increased to $1.65/lb, assuming market consensus

estimates of by-product prices and the Chilean Peso exchange rate

are achieved for the rest of the year"

"As announced in April, Group capital expenditure for the year

is expected to be $1.9 billion"

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 20, 2022 03:12 ET (07:12 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

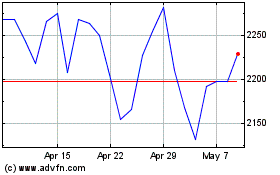

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024