TIDMANTO

RNS Number : 3207D

Antofagasta PLC

19 October 2022

NEWS RELEASE, 19 OCTOBER 2022

Q3 2022 PRODUCTION REPORT

40% QUARTER ON QUARTER PRODUCTION INCREASE

Antofagasta plc CEO, Iván Arriagada said: "As we guided last

quarter, production has significantly improved in the third quarter

of the year due to greater water availability at Los Pelambres

increasing throughput, the movement of the concentrates that were

temporarily stockpiled in June, and the higher grades at Centinela

Concentrates. Across the Group, copper production increased by

40%.

"In the first nine months of 2022 we produced 450,600 tonnes of

copper at a net cash cost of $1.76/lb and we remain on track to

achieve the lower end of our full year production guidance of

640-660,000 tonnes.

"Following the lifting of the suspension of the marine

construction works at the Los Pelambres desalination plant project,

its completion is now expected in H1 2023 and Group copper

production in 2023 is estimated at between 670,000 and 710,000

tonnes."

HIGHLIGHTS

PRODUCTION

-- Group copper production in Q3 2022 was 181,900 tonnes , 40.1%

higher than in the previous quarter with production nearly doubling

at Los Pelambres, on improved water availability, and higher grades

at Centinela

-- Group copper production for the first nine months of the year

was 450,600 tonnes , 17.0% lower than in the same period last year

mainly due to the temporary reduction in throughput (-23.8%) at Los

Pelambres as a result of the drought and the reduced concentrate

pipeline availability in June, and expected lower grades (-21.7%)

at Centinela Concentrates

-- Gold production for the quarter was 46,900 ounces, 32.5%

higher than in the previous quarter mainly due to higher throughput

at Los Pelambres and higher grades at Centinela. The year-to-date

production decreased by 35.6% to 120,700 ounces as a result of the

expected lower grades at Centinela

-- Molybdenum production in the quarter was 2,600 tonnes , 30.0%

higher than the previous quarter on increased throughput at Los

Pelambres. For the year-to-date, production was 6,600 tonnes, 1,800

tonnes lower than in the same period last year due to lower

throughput and grades at Los Pelambres

CASH COSTS

-- Cash costs before by-product credits in Q3 2022 were $2.12/lb

, 28c/lb lower than in the second quarter reflecting the improved

production during the period

-- Cash costs before by-product credits in the first nine months

of the year were $2.27/lb , 29.7% higher than in the same period

last year mainly due to the temporary decrease in production in H1

and higher input prices during the period, particularly for diesel

and sulphuric acid. Other inflationary pressures were largely

offset by the weaker Chilean peso

-- Net cash costs were $1.66/lb in Q3 2022 and $1.76/lb for the

year-to-date, a 12.6% decrease compared with the previous quarter

and 53.0% higher than the same period last year, respectively. This

increase reflects the increase in cash costs before by-product

credits and lower by-product credits due to lower by-product

production

GROWTH PROJECTS UPDATE

-- As at the end of Q3 the Los Pelambres Desalination Plant and

Expansion projects, including design, procurement and construction,

were 88% complete

-- As previously reported, on 15 August unusually high sea

swells overturned a construction platform working on the marine

works of the desalination plant project and work was temporarily

halted pending recovery of lost equipment and materials. This

suspension was lifted on 3 October and as a result of this and

adjusted working conditions for assumed continuing swells, it is

now expected that completion of the desalination plant will be in

H1 2023

-- Expected completion of the Los Pelambres concentrator plant

expansion in Q1 2023 remains unchanged, as is the estimated total

capital cost of the Los Pelambres Expansion project

-- Progress continues on the engineering and remaining project

studies for the Centinela Second Concentrator project. I n line

with our disciplined approach to capital allocation, the decision

on when to submit the project to the Board for approval during 2023

will c onsider the completion date of the Los Pelambres Expansion

project as well as ongoing discussions on the tax reform and mining

royalty bills

GUIDANCE

-- Copper production guidance for 2022 is unchanged at the lower

end of the 640-660,000 tonnes range

-- The Cost and Competitiveness Programme is on track to achieve

the targeted savings of over $50 million during the year

-- In 2023 copper production is expected to be between 670,000

and 710,000 tonnes, with completion of the Los Pelambres

desalination and concentrator plants, and lower production at

Centinela Cathodes

-- Sustaining and mine development capital expenditure are

expected to average approximately $1 billion per year for the

coming years with some larger projects being advanced such as the

expansion of the Los Pelambres desalination plant and the

replacement of its concentrate pipeline. Development expenditure in

2023 will include the residual expenditure on the Los Pelambres

Expansion project and any expenditure of the Second Concentrator at

Centinela if it is approved during the year. Capital expenditure

guidance will be given in January 2023

SUSTAINABILITY

-- As previously announced, Antucoya has obtained the Copper

Mark, for compliance with this independently verified responsible

production standard, joining Centinela and Zaldívar who received it

in 2021. In turn, Los Pelambres is in the final phase of

verification following successfully completion of the site

review

OTHER

-- Zaldívar submitted an Environmental Impact Assessment (EIA)

in 2018 which included an application to extend its water

extraction permit from 2025 to 2029 (with decreasing extraction

levels in 2030-2031) together with the extension of the permit to

mine, which expires in 2024. This application is still pending

approval.

During the period, the company (as well as other named

defendants) submitted a response contradicting the allegations made

by the Consejo de Defensa del Estado (CDE), an independent

governmental agency tasked with the defence of the interests of the

State of Chile before the courts, who previously filed a claim

against Minera Escondida, Albemarle and Zaldívar, alleging that

their extraction of water from the Monturaqui-Negrillar-Tilopozo

aquifer over the years has impacted the underground water level.

Since the EIA remains unresolved and the litigation by the CDE is

outstanding the company has been in discussions with the local

environmental authority and is planning to submit a DIA(1) , a

limited scope and less detailed procedure than an EIA, requesting

that the permit to mine be extended to 2025 in line with current

water permit to achieve continuity while the water extraction

permit is under review

-- On 4 September the proposed new Chilean constitution was

rejected in a national referendum. Congress is now considering how

to proceed, but is expected to propose an alternative plan for

drafting a new constitution for the country

-- The Government presented a draft mining royalty bill to

Congress in July. Following representations from the mining

industry, academics, trade unions and other interested parties, the

bill is expected to be simplified. The bill will then be debated in

the Senate before being passed to the lower house for its

consideration, which is expected to be before the end of the

year

-- Labour agreements were successfully concluded during the period with the supervisors' union at Zaldívar, and in October with the supervisors' union at Los Pelambres and the workers' union at Antucoya. Together with the earlier agreement with the supervisors' union at Antucoya, this completes the labour negotiations scheduled for 2022

GROUP PRODUCTION AND CASH COSTS Year to Date Q3 Q2

----------------------- ------ ------

2022 2021 % 2022 2022 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Copper production kt 450.6 542.6 (17.0) 181.9 129.8 40.1

Copper sales kt 441.0 528.4 (16.5) 178.0 147.1 21.0

Gold production koz 120.7 187.3 (35.6) 46.9 35.4 32.5

Molybdenum production kt 6.6 8.4 (21.4) 2.6 2.0 30.0

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits (2) $/lb 2.27 1.75 29.7 2.12 2.40 (11.7)

Net cash costs (2) $/lb 1.76 1.15 53.0 1.66 1.90 (12.6)

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Declaración de Impacto Ambiental (Environmental Impact

Declaration)

(2) Cash cost is a non-GAAP measure used by the mining industry

to express the cost of production in US dollars per pound of copper

produced.

There will be a Q&A video conference call today at 1:00pm

BST hosted by Iván Arriagada - Chief Executive Officer and Mauricio

Ortiz - Chief Financial Officer. Participants can join the

conference call here .

Investors Media - London

- London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988 Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Register on our website to receive our email alerts

http://www.antofagasta.co.uk/investors/email-alerts/

Twitter LinkedIn

MINING OPERATIONS

Los Pelambres

In the first nine months of 2022, copper production at Los

Pelambres was 186,200 tonnes, 25.6% lower than in the same period

last year. This decrease includes the impact of the reduced

availability of the concentrate pipeline in June, but was mainly

driven by the expected reduced throughput, which was down 23.8%

compared with the prior year due to the lack of water due to the

water scarcity in H1. The precipitation in recent months has

allowed for a progressive increase in throughput.

As throughput increased by 46.0% during the quarter, copper

production nearly doubled to 87,800 tonnes; including approximately

10,000 tonnes from copper in concentrates stockpiled at the plant

in June.

Molybdenum production was 2,100 tonnes in Q3 2022, 700 tonnes

higher than in the previous quarter. Production for the

year-to-date decreased to 4,800 tonnes from 7,500 tonnes in the

same period in 2021, due to lower throughput and grades.

Gold production for the first nine months of 2022 was 29,300

ounces, 12,100 ounces lower than in the same period last year due

to expected lower throughput and grades.

Cash costs before by-product credits in Q3 were $1.75/lb, 15.0%

lower than in previous quarter mainly due to higher production, and

for the first nine months of 2022 were $1.89/lb, 22.7% higher than

the same period last year. This increase was due to the lower

copper production, higher input prices (mainly diesel and

explosives) and general inflation, partially offset by the weaker

Chilean peso.

Net cash costs in Q3 2022 of $1.19/lb decreased by 18c/lb

compared to Q2 2022 reflecting the lower cash costs before

by-product credits, partially offset by lower by-product credits.

For the year to date, net cash cost increased by 53.7% to $1.26/lb

due to the higher cash costs before by-product credits and lower

by-product credits.

As at the end of Q3 the Los Pelambres Expansion project was 88%

complete, and completion of the desalination plant is expected in

H1 2023 and the concentrator expansion in Q1 2023.

The labour agreement with the supervisors' union was

successfully concluded this month.

LOS PELAMBRES Year to Date Q3 Q2

----------------------- ------ ------

2022 2021 % 2022 2022 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 123.4 161.9 (23.8) 160.7 110.1 46.0

Copper grade % 0.64 0.65 (1.5) 0.61 0.64 (4.7)

Copper recovery % 89.7 89.9 (0.2) 88.4 89.3 (1.0)

Copper production kt 186.2 250.4 (25.6) 87.8 44.3 98.2

Copper sales kt 176.6 234.7 (24.8) 80.4 54.4 47.8

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.017 0.020 (15.0) 0.016 0.018 (11.1)

Molybdenum recovery % 84.9 84.4 0.6 84.8 83.9 1.1

Molybdenum production kt 4.8 7.5 (36.0) 2.1 1.4 50.0

Molybdenum sales kt 4.5 7.0 (35.7) 1.8 1.5 20.0

Gold grade g/t 0.042 0.045 (6.7) 0.040 0.042 (4.8)

Gold recovery % 70.5 71.0 (0.7) 67.2 72.4 (7.2)

Gold production koz 29.3 41.4 (29.2) 13.9 6.8 104.4

Gold sales koz 28.0 36.9 (24.1) 12.8 8.8 45.5

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits (1) $/lb 1.89 1.54 22.7 1.75 2.06 (15.0)

Net cash costs (1) $/lb 1.26 0.82 53.7 1.19 1.37 (13.1)

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.17/lb in Q3 2022, $0.18/lb in

Q2 2022, $0.17/lb YTD 2022 and $0.16/lb YTD 2021

Centinela

Centinela produced 62,500 tonnes of copper during the quarter,

12.4% higher than in the previous quarter on higher copper grades,

slightly offset by lower throughput. Production for the

year-to-date was 173,800 tonnes, 14.3% lower than in the same

period last year, due to expected lower ore grades at Centinela

Concentrates.

Production of copper in concentrate was 37,600 tonnes in Q3

2022, 12.9% higher than in the previous quarter on higher grades,

partially offset by lower throughput due to a major maintenance

completed during the quarter. For the first nine months of the

year, copper in concentrate production was 103,800 tonnes, 24.8%

lower than in the same period last year, mainly due to expected

lower copper grades which were 0.47% compared to 0.60%.

Copper cathode production during the quarter was 24,900 tonnes,

12.2% higher than in Q2 2022 primarily as grades increased by

17.7%. For the year-to-date, copper cathode production was 70,000

tonnes, 8.0% higher than in the same period last year primarily due

to expected higher grades.

Gold production was 33,000 ounces in the quarter, 15.4% higher

than the previous quarter on higher grades, and for the first nine

months was 91,300 ounces, 37.4% lower than the same period last

year as grades, which are correlated to copper grades, and

recoveries decreased.

Cash costs before by-product credits were $2.47/lb, 7.1% lower

than in the previous quarter. Cash costs before by-product credits

for the first nine months of the year were $2.60/lb, 42.9% higher

than the same period in 2021 primarily due to lower copper

production and higher input costs, particularly for diesel,

sulphuric acid and explosives. Other inflationary pressures were

largely offset by the weaker Chilean peso.

By-product credits in Q3 were $0.55/lb compared with $0.63/lb in

Q2. For the first nine months, by-product credits decreased from

$0.72/lb in 2021 to $0.64/lb in 2022 due to lower gold

production.

Net cash costs in Q3 2022 were $1.92/lb, 5.4% lower than the

previous quarter. During the first nine months of the year net cash

costs were $1.96/lb, 86c/lb higher than in the same period in 2021

reflecting the increase in cash costs before by-product credits and

the slightly lower by-product credits.

CENTINELA Year to Date Q3 Q2

----------------------- ------ ------

2022 2021 % 2022 2022 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

CONCENTRATES

Daily ore throughput kt 106.5 103.2 3.2 105.1 110.6 (5.0)

Copper grade % 0.47 0.60 (21.7) 0.52 0.45 15.6

Copper recovery % 79.9 84.8 (5.8) 79.7 78.8 1.1

Copper production kt 103.8 138.0 (24.8) 37.6 33.3 12.9

Copper sales kt 103.5 137.1 (24.5) 39.0 42.0 (7.1)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.013 0.009 44.4 0.012 0.013 (7.7)

Molybdenum recovery % 59.9 48.5 23.5 58.1 61.7 (5.8)

Molybdenum production kt 1.7 0.9 88.9 0.5 0.6 (16.7)

Molybdenum sales kt 1.8 0.9 100.0 0.7 0.7 0.0

Gold grade g/t 0.16 0.24 (33.3) 0.17 0.15 13.3

Gold recovery % 64.8 71.2 (9.0) 64.0 64.0 0.0

Gold production koz 91.3 145.9 (37.4) 33.0 28.6 15.4

Gold sales koz 92.5 139.4 (33.6) 34.1 36.1 (5.5)

------ ------ ------- ------ ------ -------

CATHODES

Daily ore throughput kt 55.9 57.8 (3.3) 55.0 57.3 (4.0)

Copper grade % 0.67 0.61 9.8 0.73 0.62 17.7

Copper recovery % 65.4 65.0 0.6 64.0 64.5 (0.8)

Copper production - heap

leach kt 67.2 62.0 8.4 23.8 21.3 11.7

Copper production - total

(1) kt 70.0 64.8 8.0 24.9 22.2 12.2

Copper sales kt 69.2 63.6 8.8 26.7 20.0 33.5

------------------------------ ------ ------ ------ ------- ------ ------ -------

Total copper production kt 173.8 202.8 (14.3) 62.5 55.6 12.4

Cash costs before by-product

credits (2) $/lb 2.60 1.82 42.9 2.47 2.66 (7.1)

Net cash costs (2) $/lb 1.96 1.10 78.2 1.92 2.03 (5.4)

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes production from ROM material

(2) Includes tolling charges of $0.15/lb in Q3 2022, $0.14/lb in

Q2 2022, $0.14/lb YTD 2022 and $0.11/lb YTD 2021

Antucoya

Total copper production at Antucoya during the quarter was

21,000 tonnes, 11.1% higher than in the previous quarter reflecting

higher grades, slightly offset by lower throughput due to major

scheduled maintenance. Production in the first nine months of 2022

was 57,400 tonnes was very similar to the same period last

year.

During the quarter, cash costs were $2.40/lb compared to

$2.59/lb in Q2. For the year-to-date, cash costs were $2.47/lb,

20.5% higher than the same period last year due to increased input

costs, particularly for sulphuric acid, diesel and explosives.

Other inflationary pressures were largely offset by the weaker

Chilean peso.

The labour agreement with the workers' union was successfully

concluded this month.

ANTUCOYA Year to Date Q3 Q2

-------------------- ----- -----

2022 2021 % 2022 2022 %

---------------------- ------ ----- ----- ------ ----- ----- ------

Daily ore throughput kt 88.1 83.6 5.4 89.8 92.1 (2.5)

Copper grade % 0.33 0.34 (2.9) 0.36 0.32 12.5

Copper recovery % 69.1 68.3 1.2 69.4 68.6 1.2

Copper production kt 57.4 57.7 (0.5) 21.0 18.9 11.1

Copper sales kt 58.2 60.5 (3.8) 21.1 19.7 7.1

---------------------- ------ ----- ----- ------ ----- ----- ------

Cash costs $/lb 2.47 2.05 20.5 2.40 2.59 (7.3)

---------------------- ------ ----- ----- ------ ----- ----- ------

Zaldívar

Copper production for the quarter was 10,600 tonnes, 3.6% lower

than in the previous quarter due to lower grades and recoveries,

partially offset by higher throughput. Production for the

year-to-date was 33,100 tonnes, 4.7% higher than the same period

last year due to higher grades, partially offset by lower

throughput.

Cash costs during the quarter were $2.55/lb, $0.37/lb higher

than Q2 2022 primarily due to lower production, higher sulphuric

acid consumption and the payment of a one-off signing bonus

following the successful completion of a new 3-year labour

agreement.

Cash costs for the first nine months of the year were $2.27/lb,

compared with $2.42/lb in the same period in 2021, mainly due to

higher production partially offset by higher input prices.

ZALDÍVAR Year to Date Q3 Q2

-------------------- ----- -----

2022 2021 % 2022 2022 %

--------------------------- ------ ----- ----- ------ ----- ----- ------

Daily ore throughput kt 40.9 42.9 (4.7) 44.3 39.0 13.6

Copper grade % 0.80 0.73 9.6 0.77 0.78 (1.3)

Copper recovery (1) % 52.3 52.8 (0.9) 49.7 54.2 (8.3)

Copper production - heap

leach (2) kt 23.6 23.0 2.6 7.8 7.6 2.6

Copper production - total

(2,3) kt 33.1 31.6 4.7 10.6 11.0 (3.6)

Copper sales (2) kt 33.5 32.7 2.4 10.8 11.1 (2.7)

Cash costs $/lb 2.27 2.42 (6.2) 2.55 2.18 17.0

----- ----- ----- -----

(1) Metallurgical recoveries during the period. Prior periods

have been restated

(2) Group's 50% share

(3) Includes production from secondary leaching

Transport Division

Total transport volumes in Q3 2022 were 1.7 million tonnes, 6.5%

lower than the previous quarter, mainly due to customers'

maintenance and lower demand for transport services.

For the first nine months of the year, transport volumes

increased by 7.2% compared to the same period in 2021 as new rail

transport contracts have ramped up during the period.

TRANSPORT Year to Date Q3 Q2

--------------------- ------ ------

2022 2021 % 2022 2022 %

--------------------------- ---- ------ ------ ----- ------ ------ ------

Rail kt 4,018 3,883 3.5 1,310 1,398 (6.3)

Road kt 1,279 1,059 20.8 418 451 (7.3)

Total tonnage transported kt 5,297 4,942 7.2 1,728 1,849 (6.5)

------ ------ ------ ------

Commodity prices and exchange rates

Year to Date Q3 Q2

----------------------- ------ ------

2022 2021 % 2022 2022 %

------ ------ ------- ------ ------

Copper

Market price $/lb 4.12 4.17 (1.2) 3.51 4.32 (18.8)

Realised price $/lb 3.78 4.27 (11.5) 3.28 3.42 (4.1)

---------------- ------ ------ ------ ------- ------ ------ -------

Gold

Market price $/oz 1,825 1,801 1.3 1,730 1,873 (7.6)

Realised price $/oz 1,795 1,778 1.0 1,633 1,821 (10.3)

---------------- ------ ------ ------ ------- ------ ------ -------

Molybdenum

Market price $/lb 17.8 14.9 19.5 16.1 18.4 (12.5)

Realised price $/lb 17.2 17.2 0.0 16.0 16.4 (2.4)

---------------- ------ ------ ------ ------- ------ ------ -------

Exchange rates

per

Chilean peso $ 859 738 16.4 927 843 10.0

---------------- ------ ------ ------ ------- ------ ------ -------

Spot commodity prices for copper, gold and molybdenum as at 30

September 2022 were $3.47/lb, $1,672/oz and $18.3/lb respectively,

compared with $3.74/lb, $1,815/oz and $17.1/lb as at 30 June 2022

and $4.40/lb, $1,820/oz and $18.7/lb as at 31 December 2021.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were negative $97.5 million, negative

$3.2 million and positive $0.5 million respectively.

The provisional pricing adjustments for copper, gold and

molybdenum for the year to date were negative $304.4 million,

positive $0.5 million and negative $12.7 million respectively.

_____________________________________________________________________________________________

Cautionary Statement

This announcement contains certain forward-looking statements.

All statements other than historical facts are forward-looking

statements. Examples of forward-looking statements include, without

limitation, those regarding the Group's strategy, plans, objectives

or future operating or financial performance, reserve and resource

estimates, commodity demand and trends in commodity prices, growth

opportunities, and any assumptions underlying or relating to any of

the foregoing. Words such as "intend", "aim", "project",

"anticipate", "estimate", "plan", "believe", "expect", "may",

"should", "will", "continue" and similar expressions identify

forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors that are beyond the

Group's control. Given these risks, uncertainties and assumptions,

actual results, performance or achievements could differ materially

from any future results, performance or achievements expressed or

implied by these forward-looking statements, which apply only as at

the date of this report. These forward-looking statements are based

on numerous assumptions regarding the Group's present and future

business strategies and the environment in which the Group will

operate in the future. Important factors that could cause actual

results, performance or achievements to differ from those in the

forward-looking statements include, but are not limited to: natural

events, global economic and financial conditions (which may affect

our business, results of operations or financial condition);

various political, economic, legal, regulatory, social and other

risks and uncertainties across jurisdictions in which the Group

operates; changes to mining concessions or the imposition of new

mining royalties, or changes to existing mining royalties in the

jurisdictions in which the Group operates; the Group's ability to

comply with the extensive body of regulations governing the mining

industry, as well as the need to manage relationships with local

communities; the ongoing effects of the global COVID-19 pandemic;

demand, supply and prices for copper and other long-term commodity

price assumptions (as they materially affect the timing and

feasibility of future projects and developments); trends in the

copper mining industry and conditions of the international copper

markets; the effect of currency exchange rates on commodity prices

and operating costs; the availability and costs associated with

mining inputs and labour; operating or technical difficulties in

connection with mining or development activities; risks, hazards

and/or events and conditions inherent to the mining industry, which

may affect our operations or facilities; employee relations;

climate change as well as the effects of extreme weather

conditions; the outcome of any litigation arbitration, regulatory

or administrative proceedings to which the Group is and may be

subject in the future; and actions and activities of governmental

authorities, including changes to laws, regulations or

taxation.

Except as required by applicable law, rule or regulation, the

Group does not undertake any obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Past performance cannot be

relied on as a guide to future performance.

No statement in this announcement is intended as a profit

forecast or estimate for any period. No statement in this

announcement should be interpreted to indicate a particular level

of profit and, as a consequence, it should not be possible to

derive a profit figure for any future period from this report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLMPBFTMTJBBJT

(END) Dow Jones Newswires

October 19, 2022 02:00 ET (06:00 GMT)

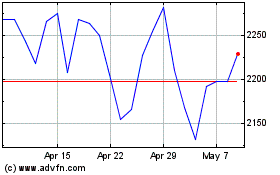

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024