TIDMARB

RNS Number : 7040X

Argo Blockchain PLC

07 January 2022

Press Release

07 January 2022

Argo Blockchain PLC

("Argo" or "the Company")

December 2021 Operational Update

Operational Update

Argo Blockchain plc, a global leader in cryptocurrency mining

(LSE: ARB; NASDAQ: ARBK), is pleased to provide the following

operational update for December 2021.

During the month of December, Argo mined 214 Bitcoin or Bitcoin

Equivalent (together, BTC) compared to 185 BTC in November. This

brings the total amount of BTC mined in 2021 to 2,045 BTC.

Based on daily foreign exchange rates and cryptocurrency prices

during the month, mining revenue in December amounted to GBP7.82

million [$10.55 million*] (November 2021: GBP8.29 million [$11.20

million*]).

Argo generated this income at a Bitcoin and Bitcoin Equivalent

Mining Margin of approximately 83% for the month of December

(November 2021: 86%).

At the end of December, the Company owned 2,595 Bitcoin or

Bitcoin Equivalent.

Helios Mining Facility Update

The Company is also pleased to provide the following update on

the construction of its 200MW flagship cryptocurrency mining

facility, Helios, in Dickens County, Texas. The construction of

Argo's facility remains on time and the main structure, outside

facade, and roof have now been completed. The next phase of

construction and build out of essential infrastructure are ongoing,

with a projected completion date in the first half of 2022.

Peter Wall, Chief Executive of Argo and interim Chairman, said:

"2021 has been a transformational year for both Argo and the

cryptocurrency sector. We began development on our mining facility

in Texas and we took Argo to NASDAQ. Our efforts allowed us to

expand our global presence and we look forward to the year ahead

and the opening of our mining facility in Dickens County,

Texas".

Non-IFRS Measures

Bitcoin and Bitcoin Equivalent Mining Margin is a financial

measure not defined by IFRS. We believe Bitcoin and Bitcoin

Equivalent Mining Margin have limitations as an analytical tool. In

particular, Bitcoin and Bitcoin Equivalent Mining Margin excludes

the depreciation of mining equipment and so does not reflect the

full cost of our mining operations, and it also excludes the

effects of fluctuations in the value of digital currencies and

realized losses on the sale of digital assets, which affect our

IFRS gross profit. This measure should not be considered as an

alternative to gross margin determined in accordance with IFRS, or

other IFRS measures. This measure is not necessarily comparable to

similarly titled measures used by other companies. As a result, you

should not consider this measure in isolation from, or as a

substitute analysis for, our gross margin as determined in

accordance with IFRS.

The following table shows a reconciliation of Bitcoin and

Bitcoin Equivalent Mining Margin to gross margin, the most directly

comparable IFRS measure, for the months of November and December

2021.

Month Ended 30 November Month Ended 31 December

2021 2021

------------------------------------- ----------------------------

GBP $ GBP $

Gross (loss) (1,108,192) (1,108,192) (12,593,995) (17,008,110)

Gross Margin(1) (13%) (13%) (161%) (161%)

Depreciation of mining

equipment 1,203,238 1,624,965 1,444,614 1,950,942

Charge in fair value

of digital currencies 7,371,093 9,954,614 18,271,429 24,675,448

Realised loss on sale

of digital currencies 8,364 11,296 740,713 1,000,328

Crypto-currency management

fees(2) (340,561) (459,925) (1,388,635) (1,875,343)

Mining Profit 7,133,942 9,634,344 6,474,126 8,743,625

Bitcoin and Bitcoin

Equivalent Mining

Margin 86% 86% 83% 83%

---------------------------- ----------------- ------------------ ------------- -------------

(1) Due to unfavourable changes in fair value of Bitcoin and

Bitcoin Equivalents in November and December 2021 there was a

significant loss on change in fair value of digital currencies.

(2) The cryptocurrency management fees include the settlement

amount with Celsius and as such are higher than normal in December

2021.

*Dollar values translated from pound sterling into U.S. dollars

using the noon buying rate of the Federal Reserve Bank of New York

as at the applicable dates.

Forward-Looking Information

This announcement contains inside information and

forward-looking include forward-looking statements which reflect

the Company's or, as appropriate, the Directors' current views,

interpretations, beliefs or expectations with respect to the

Company's financial performance, business strategy and plans and

objectives of management for future operations. These statements

include forward-looking statements both with respect to the Company

and the sector and industry in which the Company proposes to

operate. Statements which include the words "expects", "intends",

"plans", "believes", "projects", "anticipates", "will", "targets",

"aims", "may", "would", "could", "continue", "estimate", "future",

"opportunity", "potential" or, in each case, their negatives, and

similar statements of a future or forward-looking nature identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties because they relate to

events that may or may not occur in the future. Forward-looking

statements are not guarantees of future performance. Accordingly,

there are or will be important factors that could cause the

Company's actual results, prospects and performance to differ

materially from those indicated in these statements. In addition,

even if the Company's actual results, prospects and performance are

consistent with the forward-looking statements contained in this

document, those results may not be indicative of results in

subsequent periods. These forward-looking statements speak only as

of the date of this announcement. Subject to any obligations under

the Prospectus Regulation Rules, the Market Abuse Regulation, the

Listing Rules and the Disclosure and Transparency Rules and except

as required by the FCA, the London Stock Exchange, the City Code or

applicable law and regulations, the Company undertakes no

obligation publicly to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise.For a more complete discussion of factors

that could cause our actual results to differ from those described

in this announcement, please refer to the filings that Company

makes from time to time with the United States Securities and

Exchange Commission and the United Kingdom Financial Conduct

Authority, including the section entitled "Risk Factors" in the

Company's Registration Statement on Form F-1.

For further information please contact:

Argo Blockchain

Peter Wall via Tancredi +44 203

Chief Executive 434 2334

----------------------

finnCap Ltd

----------------------

Corporate Finance

Jonny Franklin-Adams

Tim Harper

Joint Corporate Broker

Sunila de Silva +44 207 220 0500

----------------------

Tennyson Securities

----------------------

Joint Corporate Broker

Peter Krens +44 207 186 9030

----------------------

OTC Markets

----------------------

Jonathan Dickson +44 204 526 4581

jonathan@otcmarkets.com +44 7731 815 896

----------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

----------------------

Emma Valgimigli

Emma Hodges

Salamander Davoudi +44 7727 180 873

Fabio Galloni-Roversi +44 7861 995 628

Monaco +44 7957 549 906

argoblock@tancredigroup.com +44 7888 672 701

----------------------

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the Nasdaq Global Select Market in the

United States under the ticker: ARBK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMZGGMRVGGZZM

(END) Dow Jones Newswires

January 07, 2022 01:59 ET (06:59 GMT)

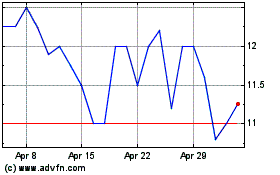

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Dec 2023 to Dec 2024