TIDMARB

RNS Number : 8357L

Argo Blockchain PLC

18 May 2022

Press Release

18 May 2022

Argo Blockchain PLC

("Argo" or "the Company")

Q1 2022 Results (Unaudited)

Argo Blockchain plc (LSE: ARB; NASDAQ: ARBK), a global leader in

cryptocurrency mining, is pleased to announce its unaudited

financial results for the quarter ended 31 March 2022. All $

amounts are in United States Dollars ("USD") and all GBP amounts

are in British Pounds ("GBP"), unless otherwise stated.

-- Revenue of $19.5 million (GBP14.9 million) (+9% Y/Y)

-- Produced net income of $2.1 million (GBP1.6 million) and

$19.1 million of Adj. EBITDA (GBP14.5 million of Adj. EBITDA) (+24%

Y/Y)

-- Mined 470 Bitcoin and Bitcoin Equivalents in Q1 2022 (+21% Y/Y)

-- "HODL" of 2,700 Bitcoin and Bitcoin Equivalents as of 31 March 2022

Peter Wall, Chief Executive of Argo, said: "During the first

quarter, our team has focused on working towards the completion of

Helios Phase 1, while continuing to deliver strong performance from

our existing fleet. To be a successful miner you need three

components - power, miners, and capital. We already have a strong

foundation for growth at Helios with our access to 800 MW of power

capacity. This quarter, we improved our access to capital by

establishing a financing relationship with NYDIG and strengthened

our access to miners through our supply agreement with Intel for

their new Blockscale ASIC chips. This will allow us to build

custom-designed mining machines specifically to Argo's

specifications and built for use in immersion-cooling

technology.

"As mining operations begin this month at Helios, we are excited

to be delivering on our commitment to shareholders to build a

best-in-class Bitcoin mining facility."

Q1 2022 Financial Performance

-- The Company generated $19.5 million (GBP14.9 million) of

revenue in the quarter, a 9% increase over the same period in 2021.

This increase was primarily driven by Argo's growth in hash rate

throughout 2021 and partially offset by lower Bitcoin prices in Q1

2022.

-- The Company produced net income of $2.1 million (GBP1.6 million).

-- Argo achieved Adj. EBITDA of $19.1 million (GBP14.5 million),

an increase of 24% over the same period in 2021.

-- Total Bitcoin mined in the quarter increased by 21% to 470

Bitcoin and Bitcoin Equivalents (together, "BTC"), compared to 387

BTC mined in the same period in 2021.

-- The Company's mining margin for the first quarter was 76%,

with an average direct cost per BTC mined of $9,779 (GBP7,448).

-- The Company ended the quarter with 2,700 BTC in its HODL;

this, combined with a cash balance of $11.9 million (GBP9.1

million), provides the Company with ample liquidity.

Q1 2022 and Recent Operational Highlights

-- The Helios facility was energized and commenced Bitcoin

mining activities on 5 May 2022. The Company held a grand opening

ceremony to commemorate the event with elected officials, partners,

suppliers, and members of the local community in attendance.

-- The Company still expects to increase its hashrate to 5.5

EH/s by the end of 2022, subject to machine deliveries.

-- In March 2022, the Company signed an agreement to swap

approximately 10,000 S19 mining machines currently hosted at Core

Scientific facilities for new S19J Pro mining machines to be

delivered to the Helios facility. To mitigate any temporary loss of

hashrate for Argo, the swap of miners will occur in stages as the

machines are delivered, which has already commenced and will

continue through July 2022. Upon completion of this mining machine

swap, Argo will no longer have any hosted machines and will have

completed its strategic pivot away from hosting to a fully

vertically-integrated model.

-- In January 2022, the Company formally launched Argo Labs, its

in-house innovation arm established to identify opportunities

within the disruptive and innovative sectors of the cryptocurrency

ecosystem while supporting the decentralization of various

blockchain protocols. Argo Labs is primarily focused on two key

areas: network participation and strategic diversification through

the efficient deployment of a portion of the Company's crypto

treasury assets. Argo has allocated approximately 10% of the

Company's crypto assets in its "HODL" to Argo Labs, which gives the

Company the opportunity to integrate cryptocurrencies into existing

financial infrastructure and gain exposure to the wider digital

asset ecosystem.

Q1 2022 and Recent Financing Highlights

-- Argo entered into two significant non-dilutive debt financing

arrangements with New York Digital Investment Group LLC

("NYDIG").

-- In March 2022, Argo signed loan agreements to borrow $26.7

million (GBP20.2 million at the 3 March 2022 exchange rate), with

the proceeds to be used for the continued build out of Helios Phase

1. Under these loan agreements, the borrowings are secured against

certain electrical infrastructure at Helios.

-- In May 2022, Argo signed additional loan agreements to borrow

up to $70.6 million (GBP56.3 million at the 3 May 2022 exchange

rate), subject to customary drawdown conditions, with the proceeds

to be used for the continued build out of Helios Phase 1. Under

these loan agreements, the borrowings are secured against certain

Bitcoin mining machines installed at Helios.

Q1 2022 and Recent Personnel Updates

-- The Company strengthened its executive team by appointing

Seif El-Bakly as Chief Operating Officer and Alana Marks as Vice

President of People and Culture.

-- Justin Nolan, who previously held the role of Vice President

of Business Development, was promoted to the role of Chief Growth

Officer.

-- The Company appointed Raghav Chopra, a seasoned finance and

investing professional, as a non-executive director.

Earnings Conference Call

Argo will host a conference call to discuss its results at 08:00

ET/12:00 BST tomorrow, Wednesday 18 May 2022. The live webcast of

the call can be accessed via the Investor Meet Company

platform.

Investors can sign up to Investor Meet Company and add Argo

Blockchain via the following link:

https://www.investormeetcompany.com/argo-blockchain-plc/register-investor

Investors already following Argo Blockchain on the Investor Meet

Company platform will be invited automatically.

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's or, as

appropriate, the Directors' current views, interpretations, beliefs

or expectations with respect to the Company's financial

performance, business strategy and plans and objectives of

management for future operations. These statements include

forward-looking statements both with respect to the Company and the

sector and industry in which the Company operates. Statements which

include the words "expects", "intends", "plans", "believes",

"projects", "anticipates", "will", "targets", "aims", "may",

"would", "could", "continue", "estimate", "future", "opportunity",

"potential" or, in each case, their negatives, and similar

statements of a future or forward-looking nature identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties because they relate to

events that may or may not occur in the future. Forward-looking

statements are not guarantees of future performance. Accordingly,

there are or will be important factors that could cause the

Company's actual results, prospects and performance to differ

materially from those indicated in these statements. In addition,

even if the Company's actual results, prospects and performance are

consistent with the forward-looking statements contained in this

document, those results may not be indicative of results in

subsequent periods. These forward-looking statements speak only as

of the date of this announcement. Subject to any obligations under

the Prospectus Regulation Rules, the Market Abuse Regulation, the

Listing Rules and the Disclosure and Transparency Rules and except

as required by the FCA, the London Stock Exchange, the City Code or

applicable law and regulations, the Company undertakes no

obligation publicly to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise. For a more complete discussion of

factors that could cause our actual results to differ from those

described in this announcement, please refer to the filings that

Company makes from time to time with the United States Securities

and Exchange Commission and the United Kingdom Financial Conduct

Authority, including the section entitled "Risk Factors" in the

Company's Annual Report on Form 20-F.

Non-IFRS Measures

Bitcoin and Bitcoin Equivalent Mining Margin and Adjusted EBITDA

are financial measures not defined by IFRS. We believe Bitcoin and

Bitcoin Equivalent Mining Margin and Adjusted EBITDA have

limitations as analytical tools. In particular, Bitcoin and Bitcoin

Equivalent Mining Margin excludes the depreciation of mining

equipment and so does not reflect the full cost of our mining

operations, and it also excludes the effects of fluctuations in the

value of digital currencies and realized losses on the sale of

digital assets, which affect our IFRS gross profit. Further,

Adjusted EBITDA excludes interest income (expense), taxes,

depreciation and amortization, change in fair value of digital

currencies, and share based payments, which are important

components of our IFRS net income/(loss). These measures should not

be considered as an alternative to gross margin or net

income/(loss), as applicable, determined in accordance with IFRS,

or other IFRS measures. These measures are not necessarily

comparable to similarly titled measures used by other companies. As

a result, you should not consider these measures in isolation from,

or as a substitute analysis for, our gross margin or net

income/(loss), as applicable, as determined in accordance with

IFRS.

Statement of Income Three Months Ended Three Months Ended 31

31 March, 2022 March, 2021

Figures in '000 except per share $ GBP $ GBP

and BTC mined

------------------------------------------ ---------- --------- ----------- -----------

Revenues 19,515 14,862 17,836 13,583

Direct costs (4,596) (3,500) (2,562) (1,951)

Depreciation of mining equipment (6,961) (5,301) (2,869) (2,185)

Change in fair value of digital

currencies (6,080) (4,630) 13,248 10,090

Realized gain on sale of digital

currencies 41 30 1,472 1,121

------------------------------------------ ---------- --------- ----------- -----------

Gross profit 1,919 1,461 27,125 20,657

------------------------------------------ ---------- --------- ----------- -----------

Consulting fees (208) (159) (467) (356)

Professional fees (1,262) (961) (259) (197)

General and administrative (2,908) (2,215) (633) (482)

Share based payment charge (1,423) (1,084) (123) (94)

Foreign exchange 5,705 4,346 (54) (41)

Operating profit 1,823 1,388 25,589 19,488

------------------------------------------ ---------- --------- ----------- -----------

Fair value gain (loss) of investments (174) (132) - -

Fair value revaluation of contingent

consideration 2,742 2,088 - -

Finance costs (2,442) (1,860) (289) (221)

Profit before taxation 1,949 1,484 25,300 19,267

------------------------------------------ ---------- --------- ----------- -----------

Tax credit 117 89 - -

Profit after taxation 2,066 1,573 25,300 19,268

------------------------------------------ ---------- --------- ----------- -----------

Other comprehensive loss

Items which may be subsequently

reclassified to profit or loss:

* Currency translation reserve (17,170) (13,076) - -

Total other comprehensive (loss),

net of tax (17,170) (13,076) - -

------------------------------------------ ---------- --------- ----------- -----------

Total comprehensive (loss) income

attributable to the equity holders

of the Company (15,104) (11,503) 25,300 19,268

------------------------------------------ ---------- --------- ----------- -----------

Earnings per share attributable

to equity owners (pence)

Basic earnings (loss) per share $0.004c 0.003p $0.080c 0.060p

Diluted earnings per share $0.004c 0.003p $0.070c 0.050p

Balance Sheet As at 31 As at 31

March 2022 December 2021

Figures in '000 $ GBP $ GBP

----------------------------------------------------------- --------- --------- -------- --------

ASSETS

Non-current assets

Investments at fair value through profit or loss 355 271 529 403

Investments accounted for using the equity method 18,143 13,817 18,143 13,817

Intangible fixed assets 11,655 8,876 7,359 5,604

Property, plant and equipment 156,765 119,386 146,546 111,604

Right of use assets 484 368 460 350

Total non-current assets 187,402 142,718 173,037 131,778

----------------------------------------------------------- --------- --------- -------- --------

Current assets

Trade and other receivables 111,500 84,914 83,196 63,359

Digital assets 104,835 79,839 106,044 80,759

Cash and cash equivalents 11,904 9,066 15,498 11,803

Total current assets 228,239 173,819 204,738 155,921

----------------------------------------------------------- --------- --------- -------- --------

Total assets 415,641 316,537 377,775 287,699

----------------------------------------------------------- --------- --------- -------- --------

EQUITY AND LIABILITIES

Equity

Share Capital 614 468 614 468

Share Premium 183,282 139,581 183,282 139,581

Share based payment reserve 3,925 2,989 2,501 1,905

Fair value reserve 545 414 545 414

Currency translation reserve (16,588) (12,633) 44 33

Other comprehensive income of equity accounted associates 8,628 6,571 8,628 6,571

Accumulated surplus 80,075 60,982 69,381 52,838

----------------------------------------------------------- --------- --------- -------- --------

Total equity 260,481 198,372 264,995 201,810

----------------------------------------------------------- --------- --------- -------- --------

Current liabilities

Trade and other payables 18,122 13,803 20,018 15,245

Contingent consideration 7,856 5,983 10,598 8,071

Loans and borrowings 58,618 44,641 30,715 23,391

Income tax 10,568 8,048 10,083 7,679

Deferred tax 259 197 375 286

Lease liability 10 7 9 7

----------------------------------------------------------- --------- --------- -------- --------

Total current liabilities 95,433 72,679 71,798 54,679

----------------------------------------------------------- --------- --------- -------- --------

Non-current liabilities

Deferred tax 710 541 710 541

Issued debt - bond 35,322 26,900 35,333 26,908

Loans 23,188 17,659 4,453 3,391

Lease liability 507 386 486 370

Total liabilities 155,160 118,165 112,780 85,889

----------------------------------------------------------- --------- --------- -------- --------

Total equity and liabilities 415,641 316,537 377,775 287,699

----------------------------------------------------------- --------- --------- -------- --------

The following table shows a reconciliation of Bitcoin and

Bitcoin Equivalent Mining Margin to gross margin, the most directly

comparable IFRS measure, for the three months ended 31 March 2022

and the three months ended 31 March 2021.

2022 2021

---------------- --------------------

Figures in '000 $ GBP $ GBP

-------------------------------------------- ------- ------- --------- ---------

Gross profit 1,919 1,461 27,125 20,658

-------------------------------------------- ------- ------- --------- ---------

Depreciation of mining equipment 6,961 5,301 2,869 2,185

Change in fair value of digital currencies 6,080 4,630 (13,248) (10,090)

Realized gain (loss) on sale of digital

currencies (41) (30) (1,472) (1,121)

Cryptocurrency management fees - - (434) (330)

Mining profit 14,919 11,362 14,840 11,302

-------------------------------------------- ------- ------- --------- ---------

Bitcoin and Bitcoin Equivalent Mining

Margin 76% 76% 83% 83%

The following table shows a reconciliation of Adjusted EBITDA to

net income, the most directly comparable IFRS measure, for the

three months ended 31 March 2022 and the three months ended 31

March 2021.

2022 2021

---------------- --------------------

Figures in '000 $ GBP $ GBP

--------------------------------- ------- ------- --------- ---------

Net income 2,066 1,573 25,300 19,267

--------------------------------- ------- ------- --------- ---------

Depreciation/amortization 7,166 5,457 2,914 2,219

Interest expense 2,442 1,860 289 220

Income tax credit (117) (89) - -

Share based payment 1,423 1,084 123 94

Change in fair value of digital

currencies 6,080 4,630 (13,248) (10,090)

Adjusted EBITDA 19,060 14,515 15,378 11,710

--------------------------------- ------- ------- --------- ---------

Adjusted EBITDA Margin 98% 98% 86% 86%

*Dollar values translated from pound sterling into U.S. dollars

at the rate of GBP1.00 to $1.31 unless otherwise specified.

For further information please contact:

Argo Blockchain

Peter Wall via Tancredi +44 203 434

Chief Executive 2334

--------------------------

finnCap Ltd

--------------------------

Corporate Finance

Jonny Franklin-Adams

Tim Harper

Joint Corporate Broker

Sunila de Silva +44 207 220 0500

--------------------------

Tennyson Securities

--------------------------

Joint Corporate Broker

Peter Krens +44 207 186 9030

--------------------------

OTC Markets

--------------------------

Jonathan Dickson +44 204 526 4581

jonathan@otcmarkets.com +44 7731 815 896

--------------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

--------------------------

Emma Valgimigli

Fabio Galloni-Roversi Monaco +44 7727 180 873

Nasser Al-Sayed +44 7888 672 701

argoblock@tancredigroup.com +44 7915 033 739

--------------------------

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the Nasdaq Global Select Market in the

United States under the ticker: ARBK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFSFWFIWEESEDI

(END) Dow Jones Newswires

May 18, 2022 02:00 ET (06:00 GMT)

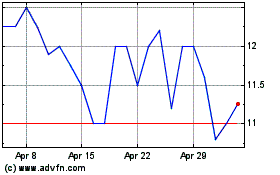

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024