TIDMARB

RNS Number : 1200X

Argo Blockchain PLC

25 August 2022

Press Release

25 August 2022

Argo Blockchain plc

("Argo" or "the Group")

Interim Half Year Results 2022

Argo Blockchain plc, a global leader in cryptocurrency mining

(LSE: ARB; NASDAQ: ARBK), is pleased to announce its results for

the six months to 30 June 2022.

Financial Highlights

-- Total number of Bitcoin and Bitcoin Equivalent ("BTC") mined

during H1 2022 was 939, a 6% increase over the BTC mined in H1

2021

-- Revenues of GBP26.7 million ($32.5 million), a decrease of

14% from H1 2021, driven primarily by a decrease in Bitcoin price

and an increase in the global hashrate and associated network

difficulty level

-- Adjusted EBITDA of GBP17.1 million ($20.9 million), a decrease of 28% from H1 2021

-- Mining margin of 71%, down from 81% in H1 2021. Similar to

revenue, this decrease is largely attributable to the decrease in

Bitcoin price and an increase in network difficulty

-- Pre-tax loss of GBP36.9 million ($44.9 million), driven

primarily by a non-cash reduction in the fair value of digital

currencies held on the balance sheet

-- Total number of BTC held at 30 June 2022 was 1,953, a 54%

increase from 1,268 BTC held at 30 June 2021

Operational Highlights

-- Energized Phase 1 of the Helios facility in Dickens County,

Texas and commenced mining operations on 5 May 2022

-- Increased hashrate capacity by 38% from 1.6 EH/s at the end

of 2021 to 2.2 EH/s at the end of July 2022

-- Obtained $26.7 million (GBP20.2 million) of financing from

NYDIG secured by certain electrical infrastructure equipment at

Helios

-- Obtained up to $70.6 million (GBP56.3 million) of additional

financing from NYDIG secured by certain Bitmain S19J Pro machines

at Helios

-- Executed an agreement with ePIC Blockchain Technologies to

purchase custom mining machines for use with Intel's Blockscale

ASIC chip

Post Period End

-- Strengthened balance sheet by reducing exposure on BTC-backed

loan with Galaxy Digital to GBP5.5 million ($6.7 million)

-- Completed swap agreement with Core Scientific for

approximately 10,000 S19J Pro machines, which completes the

strategic pivot to a self-hosted business model in which Argo owns

and operates its own machines and infrastructure

-- Released the Group's 2021 Sustainability Report and

maintained climate positive status by producing no Scope 1

emissions and offsetting all Scope 2 and Scope 3 emissions through

renewable energy credits and verifiable emissions reductions

Update to Mining Capacity Guidance

In response to current market conditions and to reduce near-term

capital intensity, the Group is updating its year end guidance for

hashrate capacity. The Group expects to achieve 3.2 EH/s of total

hashrate capacity by the end of 2022 and to increase capacity in Q1

2023 to 4.1 EH/s.

Peter Wall, CEO of Argo, said: "The delivery and installation of

the approximately 20,000 S19J Pro machines from Bitmain continues

to progress on schedule, and we still expect to have all of these

machines installed by October 2022. The revision to our hashrate

guidance reflects our current expectations for delivery and

deployment of the custom machines we are developing with ePIC

Blockchain Technologies ("ePIC") that utilize the Intel(R)

Blockscale(TM) ASIC chips. We have worked closely with ePIC and

Intel to modify the machine design to increase total mining

efficiency, which has delayed our expected deployment schedule.

Further, we are preserving our optionality by reducing our overall

capital spending on these machines as market conditions remain

volatile. We remain confident in the performance of the custom

machines and are excited to deploy them starting in Q1 2023."

Non-IFRS Measures

The following table shows a reconciliation of gross margin to

Bitcoin and Bitcoin Equivalent Mining Margin, the most directly

comparable IFRS measure, for the periods ended 30 June 2022 and 30

June 2021.

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

GBP'000 GBP'000

-------------------------------------------- ------------- -------------

Gross (loss)/profit (34,413) 14,533

Gross margin (129%) 47%

Depreciation of mining equipment 10,852 4,758

Change in fair value of digital currencies 36,025 6,407

Realised loss/(gain) on sale of digital

currencies 6,372 (219)

Non mining revenue - (1,148)

Mining Profit 18,836 24,331

-------------------------------------------- ------------- -------------

Bitcoin and Bitcoin Equivalent Mining

Margin 71% 81%

-------------------------------------------- ------------- -------------

The following table shows a reconciliation of Adjusted EBITDA to

net income, the most directly comparable IFRS measure, for the

periods ended 30 June 2022 and 30 June 2021.

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

GBP'000 GBP'000

-------------------------------------------- ------------- -------------

(Loss) / Profit after taxation (30,504) 7,214

Interest expense 3,477 411

Income tax (credit)/expense (6,386) 3,484

Depreciation/Amortisation 11,718 4,870

Share based payment 2,816 1,568

Change in fair value of digital currencies 36,025 6,407

Adjusted EBITDA 17,146 23,954

-------------------------------------------- ------------- -------------

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's or, as

appropriate, the Directors' current views, interpretations, beliefs

or expectations with respect to the Company's financial

performance, business strategy and plans and objectives of

management for future operations. These statements include

forward-looking statements both with respect to the Company and the

sector and industry in which the Company operates. Statements which

include the words "expects", "intends", "plans", "believes",

"projects", "anticipates", "will", "targets", "aims", "may",

"would", "could", "continue", "estimate", "future", "opportunity",

"potential" or, in each case, their negatives, and similar

statements of a future or forward-looking nature identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties because they relate to

events that may or may not occur in the future. Forward-looking

statements are not guarantees of future performance. Accordingly,

there are or will be important factors that could cause the

Company's actual results, prospects and performance to differ

materially from those indicated in these statements. In addition,

even if the Company's actual results, prospects and performance are

consistent with the forward-looking statements contained in this

document, those results may not be indicative of results in

subsequent periods. These forward-looking statements speak only as

of the date of this announcement. Subject to any obligations under

the Prospectus Regulation Rules, the Market Abuse Regulation, the

Listing Rules and the Disclosure and Transparency Rules and except

as required by the FCA, the London Stock Exchange, the City Code or

applicable law and regulations, the Company undertakes no

obligation publicly to update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise. For a more complete discussion of

factors that could cause our actual results to differ from those

described in this announcement, please refer to the filings that

Company makes from time to time with the United States Securities

and Exchange Commission and the United Kingdom Financial Conduct

Authority, including the section entitled "Risk Factors" in the

Company's Registration Statement on Form F-1.

For further information, please contact:

Argo Blockchain

Peter Wall via Tancredi +44 203 434

Chief Executive 2334

--------------------------

finnCap Ltd

--------------------------

Corporate Finance

Jonny Franklin-Adams

Tim Harper

Joint Corporate Broker

Sunila de Silva +44 207 220 0500

--------------------------

Tennyson Securities

--------------------------

Joint Corporate Broker

Peter Krens +44 207 186 9030

--------------------------

OTC Markets

--------------------------

Jonathan Dickson +44 204 526 4581

jonathan@otcmarkets.com +44 7731 815 896

--------------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

--------------------------

Emma Valgimigli

Fabio Galloni-Roversi Monaco +44 7727 180 873

Nasser Al-Sayed +44 7888 672 701

argoblock@tancredigroup.com +44 7915 033 739

--------------------------

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With its flagship mining facility in Texas, and offices in

the US, Canada, and the UK, Argo's global, sustainable operations

are predominantly powered by renewable energy. In 2021, Argo became

the first climate positive cryptocurrency mining company, and a

signatory to the Crypto Climate Accord. Argo also participates in

several Web 3.0, DeFi and GameFi projects through its Argo Labs

division, further contributing to its business operations, as well

as the development of the cryptocurrency markets. For more

information, visit www.argoblockchain.com.

Interim Management Report

Argo entered 2022 with two clear goals: to complete Phase 1 of

the Group's Helios facility in Dickens County, Texas while

continuing to optimise the performance of its existing mining

fleet.

Argo is making significant progress towards the completion of

Phase 1 of Helios; on 5 May 2022, the Group energized the facility

and commenced mining operations. Argo commemorated this important

milestone with an inauguration ceremony attended by local, state,

and federal elected officials, as well as members of the local

community. Since then, the Group has continued to install new

machines and is on track to complete the installation of its order

of 20,000 S19 J Pro machines from Bitmain by October 2022.

Additionally, in July 2022, Argo completed its machine swap

agreement with Core Scientific, which included the installation of

an additional approximately 10,000 machines at Helios.

Upon completion of the machine swap agreement, the Group now

operates 100% of its owned machines and has no third-party hosting

arrangements. This is the culmination of the strategic pivot away

from hosting to a fully vertically-integrated business model that

began with the acquisition of two data centres in Quebec in early

2021. Being vertically-integrated will allow Argo's management to

have more operational control over its mining machines and drive

increased performance. Additionally, controlling operational

expenses will be critical as the next Bitcoin halving cycle takes

place in May 2024 and the Bitcoin block reward is reduced by

50%.

On the second goal, Argo is operating with a mining margin of

70% over the period, which is among the highest of the Group's

peers.

As the Group's fleet is upgraded to the newer and more efficient

S19J Pro machines, it continues to review the profitability and

performance of the older machines in its fleet. Post period end,

the Group completed a comprehensive review of its mining fleet and

removed 460 PH/s of non-operational mining capacity from its total

hashrate. This primarily comprises S17 and T17 machines, which

despite a higher rate of failure, have been profitable for the

Group with a total aggregate ROI in excess of 260%.

Argo is also making progress on the custom mining machine it is

developing in collaboration with ePIC Blockchain that is

specifically designed to utilize the Intel Blockscale ASIC chip.

Delivery and deployment of these machines is expected to take place

in the fourth quarter of 2022.

In January, the Group formally launched Argo Labs, its in-house

innovation arm established to identify opportunities within the

broader Web3 and blockchain ecosystem while supporting the

decentralization of various blockchain protocols. Argo allocated

approximately 10% of the Group's crypto assets in its "HODL" to

Argo Labs. Argo Labs is primarily focused on two key areas: network

participation and strategic diversification through the efficient

deployment of the Group's crypto treasury assets. Network

participation consists of providing infrastructure support, running

nodes and validators, and staking innovative projects. Efficient

deployment of the Group's crypto treasury assets includes, among

other things, supporting early-stage projects and participating in

decentralized finance (DeFi), as well as the NFT & metaverse

ecosystem, in each case in furtherance of the Group's general

business operations. By gaining exposure to the broader digital

asset ecosystem, Argo Labs will allow the Group to participate in

disruptive technologies and provide long-term value to its

shareholders.

Despite the overall market drawdown and the decrease in Bitcoin

price, the Group has been able to raise significant capital via

secured debt financing. In March 2022, Argo obtained GBP20.2

million ($26.7 million) of debt financing from NYDIG, the proceeds

of which were used to continue the build out of Helios. These

borrowings are secured by certain electrical infrastructure

equipment at the Helios facility. Additionally, in May 2022, Argo

announced another debt financing agreement with NYDIG for up to

GBP56.3 million ($70.6 million); these borrowings are secured by

certain S19J Pro mining machines located at Helios.

The Group is mindful of its carbon footprint and maintains a

strong focus on environmental sustainability. The Group's mining

facilities in Quebec are powered by hydroelectricity, and

operations in Texas are located in the Texas Panhandle where 85% of

the generation capacity comes from wind power. In 2021, the Group

signed the Crypto Climate Accord, committing to achieve net-zero

carbon emissions by 2030. In 2021, Argo reached this goal,

releasing a full climate strategy and becoming the first Bitcoin

mining company to announce climate positive status through its use

of renewable energy to power mining operations, and by offsetting

more scope 2 and 3 greenhouse gas emissions than it emitted in both

2020 and 2021. Additionally, Argo was a founding member of the

Bitcoin Mining Council, which educates the public on the increasing

amount of renewable energy used for Bitcoin mining. It also seeks

to improve reporting and increase the amount of data available on

the use of renewable energy within the sector.

Argo's operations in Quebec and Texas also promote

sustainability by helping to stabilize the electrical grid. In

Quebec, Argo participates in curtailment programs to lower

electricity usage during periods of extreme weather. In Texas, the

Helios facility will participate in demand response programs,

whereby it can reduce its electricity usage and increase

availability of power to the grid in times of peak demand. This

flexibility in electricity load has profound benefits for grid

stability and helps to ensure equilibrium between supply and

demand. This was demonstrated in July 2022 when Argo, along with

most large-scale Bitcoin miners in Texas, voluntarily shut down

operations in response to a conservation alert from ERCOT. Bitcoin

miners collectively curtailed over 1,000 MW of electricity demand,

which was then available during a time of intense heat and peak

electricity demand. This action enabled ERCOT to avoid implementing

rolling blackouts, which would have negatively impacted residential

and commercial electricity users across the state.

Having successfully energized the Helios facility and commenced

mining operations, the Group's strategic focus for the remainder of

2022 is to complete the build out of Phase 1 and lay the groundwork

for the development of future phases at Helios.

Outlook

While the first half of 2022 presented many challenges, I am

delighted with the progress that we have made in developing Helios

and positioning ourselves as a leader in the Bitcoin mining

industry. We designed and built a world-class Bitcoin mining

facility from the ground up, balancing prudent growth with a

volatile market. Furthermore, we continue to lead the industry with

our commitment to sustainability, and we were proud to publish the

Group's 2021 sustainability report which explains our climate

positive status.

As operations at Helios continue to ramp up, there are certain

milestones which will enable us to optimise our operations and

achieve greater efficiency. We are evaluating several opportunities

to execute a long-term, fixed price power purchase agreement (PPA),

which will lock in our electricity prices and reduce our exposure

to short term price fluctuations. Once the fixed price PPA is in

place, Helios will have more optionality to participate in the

demand response programs offered by ERCOT, which will further

reduce its overall electricity cost.

During the period, there has been a global macroeconomic

pullback as investors and central bankers grapple with inflation,

the war in Ukraine, and rising interest rates. These headwinds have

impacted all financial assets, including Bitcoin and the equity of

publicly traded Bitcoin miners.

Argo is well positioned to weather the current downturn with its

large and highly efficient mining infrastructure, runway for

growth, and experienced management team, which has successfully

navigated the Group through previous crypto winters. In response to

the challenging market environment, we have adjusted our treasury

management strategy. Throughout the period, we have been steadily

selling Bitcoin, utilizing derivatives to obtain a higher realized

price than simply selling into the market. In Q2 2022, we sold

Bitcoin at an average realized price of approximately $28,500,

realizing hedge gains in excess of $1,500 per Bitcoin. Proceeds

from these sales have been used for operating expenses, capital

expenditures, and to reduce exposure on our Bitcoin-backed

loan.

Despite the challenging economic environment in 2022, we

continue to focus on our strategic priority of completing Phase 1

of Helios and laying the groundwork to further scale

operations.

On behalf of the Board, I would like to thank all shareholders

and staff who share in Argo's mission of powering the world's most

innovative and sustainable blockchain infrastructure.

Onwards and upwards!

Peter Wall

CEO & Interim Executive Chairman

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting;

and

-- gives a true and fair view of the assets, liabilities,

financial position and profit/loss of the Group; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year.

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Peter Wall

CEO & Interim Executive Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

Note GBP'000 GBP'000

---------------------------------------------------------- ----- ------------- -------------

Revenues 5 26,700 31,086

Direct costs (18,716) (10,365)

Change in fair value of digital currencies 12 (42,397) (6,188)

Gross (loss) / profit (34,413) 14,533

---------------------------------------------------------- ----- ------------- -------------

Operating costs and expenses (9,846) (2,293)

Share based payment (2,816) (1,568)

Foreign exchange 10,265 437

Operating (loss) / profit (36,810) 11,109

---------------------------------------------------------- ----- ------------- -------------

Gain on settlement of contingent consideration 4,038 -

Gain on sale of investment 133 -

Fair value (loss) of investments (284) -

Finance cost (3,477) (411)

Equity accounted loss from associate (490) -

(Loss) / profit before taxation (36,890) 10,698

---------------------------------------------------------- ----- ------------- -------------

Income tax credit / (expense) 7 6,386 (3,484)

(Loss) / Profit after taxation (30,504) 7,214

---------------------------------------------------------- ----- ------------- -------------

Other comprehensive income

Items which may be subsequently reclassified

to profit or loss:

* Currency translation reserve

(4,413) (361)

* Equity accounted OCI from associate (8,318) -

(414) -

* Fair value loss on intangible digital assets

Total other comprehensive income,

net of tax (13,145) (361)

---------------------------------------------------------- ----- ------------- -------------

Total comprehensive income attributable

to the equity holders of the Company (43,649) 6,853

---------------------------------------------------------- ----- ------------- -------------

Earnings per share attributable to

equity owners (pence)

Basic earnings per share 6 (6.5p) 1.9p

Diluted earnings per share - restricted 6 (6.5p) 1.8p

The income statement has been prepared on the basis that all

operations are continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at

30 June 2022 31 December

2021

(unaudited) (audited)

Note GBP'000 GBP'000

------------------------------------- ----- ------------- ------------

ASSETS

Non-current assets

Investments at fair value through

income and loss 135 403

Investments accounted for using the

equity method 8 5,009 13,817

Intangible fixed assets 9 3,602 5,604

Property, plant and equipment 10 157,795 111,604

Right of use assets 10 374 350

Total non-current assets 166,915 131,778

------------------------------------- ----- ------------- ------------

Current assets

Trade and other receivables 11 99,448 63,359

Digital assets 12 28,092 80,759

Cash and cash equivalents 9,210 11,803

Total current assets 136,750 155,921

------------------------------------- ----- ------------- ------------

Total assets 303,665 287,699

------------------------------------- ----- ------------- ------------

EQUITY AND LIABILITIES

Equity

Share capital 13 478 468

Share premium 13 143,752 139,581

Share based payment reserve 14 4,689 1,905

Currency translation reserve 14 (4,380) 33

Fair value reserve - 414

Other comprehensive (loss)/income

of equity accounted associate (1,747) 6,571

Accumulated surplus 14 22,366 52,838

------------------------------------- ----- ------------- ------------

Total equity 165,158 201,810

------------------------------------- ----- ------------- ------------

Current liabilities

Trade and other payables 15 17,633 15,245

Contingent consideration - 8,071

Loans and borrowings 16 44,716 23,391

Income tax 2,439 7,679

Deferred tax - 286

Lease liability 11 7

------------------------------------- ----- ------------- ------------

Total current liabilities 64,799 54,679

------------------------------------- ----- ------------- ------------

Non-current liabilities

Deferred tax 442 541

Issued debt - bond 16 32,892 26,908

Loans and borrowings 16 39,989 3,391

Lease liability 385 370

Total liabilities 138,507 85,889

------------------------------------- ----- ------------- ------------

Total equity and liabilities 303,665 287,699

------------------------------------- ----- ------------- ------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Currency Share Fair Other Accumulated Total

capital premium translation based value comprehensive surplus/

reserve payment reserve income of (deficit)

reserve associates

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

Balance at

1 January

2022 468 139,581 33 1,905 414 6,571 52,838 201,810

Total

comprehensive

profit for

the period:

Loss for the

period - - - - - - (30,504) (30,504)

Other

comprehensive

income - - (4,413) - (414) (8,318) - (13,145)

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

Total

comprehensive

income for

the period - - (4,413) - (414) (8,318) (30,504) (43,649)

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

Transactions

with equity

owners:

Stock based

compensation

charge - - - 2,816 - - - 2,816

Common stock

options/warrants

exercised 10 4,171 - (32) - - 32 4,181

Balance at

30 June 2022 478 143,752 (4,380) 4,689 - (1,747) 22,366 165,158

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Currency Share Accumulated Total

capital premium translation based payment surplus/

reserve reserve (deficit)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- --------- --------- ------------- --------------- ------------ --------

Balance at

1 January 2021 304 1,540 443 75 21,965 24,327

Total comprehensive

income for the

period:

Profit for the

period - - - - 7,214 7,214

Other comprehensive

income - - (361) - - (361)

--------------------- --------- --------- ------------- --------------- ------------ --------

Total comprehensive

income for the

period - - (361) - 7,214 6,853

--------------------- --------- --------- ------------- --------------- ------------ --------

Transactions

with equity

owners:

Common stock

to be issued* - 11 - - - 11

Issue of common

stock net of

issue costs 78 53,766 - - - 53,844

Stock based

compensation

charge - - - 1,568 - 1,568

Common stock

options/warrants

exercised - - - (568) 568 -

Common stock

options/warrants

lapsed/expired - - - (83) 83 -

--------------------- --------- --------- ------------- --------------- ------------ --------

Total transactions

with equity

owners 78 53,777 - 917 651 55,423

--------------------- --------- --------- ------------- --------------- ------------ --------

Balance at

30 June 2021 382 55,317 82 992 29,830 86,603

--------------------- --------- --------- ------------- --------------- ------------ --------

*Shares to be issued relate to share options exercised and paid

up pre period end, however the shares were formally issued post

period end.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

Note GBP'000 GBP'000

------------------------------------------------ ----- ------------- -------------

Cash flows from operating activities

(Loss) / profit before taxation (36,890) 10,698

Adjustments for:

Depreciation/Amortisation 11,718 4,870

Foreign exchange movements (10,266) 25

Finance cost 3,477 411

Fair value change in digital assets 36,025 -

through profit or loss

Investment fair value movement 284 -

Gain on investment (133) -

Impairment of intangible digital assets 3,009 -

Share of loss from associate 490 -

Gain on settlement of contingent consideration (4,038) -

Share based payment expense 2,816 1,568

Working capital changes:

(Increase) in trade and other receivables 11 (928) (2,095)

Increase in trade and other payables 15 2,388 15,246

Decrease/(increase) in digital assets 12 16,642 (28,351)

Net cash flow from operating activities 24,594 2,372

------------------------------------------------ ----- ------------- -------------

Investing activities

Acquisition of subsidiaries, net of

cash acquired - (272)

Proceeds from sale of investment 133 -

Investment in associate 8 - (7,353)

Other investments - (219)

Purchase of tangible fixed assets* 9 (49,243) (6,883)

Mining equipment prepayments (35,431) (35,471)

------------------------------------------------ ----- ------------- -------------

Net cash used in investing activities (84,541) (50,198)

------------------------------------------------ ----- ------------- -------------

Financing activities

Proceeds from borrowings 16 66,331 14,375

Lease payments (13) (1,734)

Loan repayments (8,393) -

Interest paid (3,477) (411)

Proceeds from shares issued 116 49,593

------------------------------------------------ ----- ------------- -------------

Net cash generated from financing

activities 54,564 61,823

------------------------------------------------ ----- ------------- -------------

Net (decrease)/increase in cash and

cash equivalents (5,383) 13,997

------------------------------------------------ ----- ------------- -------------

Effect of foreign exchange changes 2,790 -

in cash

Cash and cash equivalents at beginning

of period 11,803 2,051

Cash and cash equivalents at end of

period 9,210 16,048

------------------------------------------------ ----- ------------- -------------

Material non-cash movements:

*GBP7,277k of the machine additions were funded by the sale of

machines, as part of the Core Scientific swap deal arrangement

GBP1,648k purchase of intangible assets were acquired using

Bitcoin

GBP4,362k payment to Bitmain in respect of machine prepayments

paid in Bitcoin

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. COMPANY INFORMATION

Argo Blockchain PLC ("the company") is a public company, limited

by shares, and incorporated in England and Wales. The registered

office is 9th Floor, 16th Great Queen Street, London, England, WC2B

5DG. The company was incorporated on 5 December 2017 as GoSun

Blockchain Limited and changed its name to Argo Blockchain Limited

on 21 December 2017. Also on 21 December 2017, the company

re-registered as a public company, Argo Blockchain plc. Argo

Blockchain plc acquired a 100% subsidiary, Argo Innovation Labs

Inc. (together "the Group"), incorporated in Canada, on 12 January

2018.

On 4 March 2021 the Group acquired 100% of the share capital of

DPN LLC and was merged into new US entity Argo Innovation

Facilities (US) Inc (also 100% owned by Argo Blockchain plc).

On 11 May 2021 the Group acquired 100% of the share capital of

9377-2556 Quebec Inc and 9366-5230 Quebec Inc. These are held by

Argo Innovation Labs Inc. (Canada).

The principal activities of the group are that of crypto asset

mining and investing in crypto assets and non-fungible tokens.

The ordinary shares of the Group are listed under the trading

symbol ARB on the London Stock Exchange. The American Depositary

Receipt of the Group are listed under the trading symbol ARBK on

Nasdaq. The Group bond is listed on the Nasdaq Global Select Market

under the trading symbol ARBKL.

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements for the

six months ended 30 June 2022 have been prepared in accordance with

IAS 34 'Interim Financial Reporting' and presented in sterling.

They do not include all of the information required in annual

financial statements in accordance with IFRS, and should be read in

conjunction with the consolidated financial statements for the year

ended 31 December 2021, which have been prepared in accordance with

UK-adopted international accounting standards and International

Financial Reporting Standards as issued by the IASB. The report of

the auditors on those financial statements was unqualified.

The financial statements have been prepared under the historical

cost convention, except for the measurement to fair value certain

financial and digital assets and financial instruments.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates. In preparing these

condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the year ended 31 December 2021.

3. ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these condensed consolidated interim financial statements are

consistent with those of the previous financial year except as set

out below.

Segmental reporting

The directors consider that the Group has only one significant

reporting segment being crypto mining which is fully earned by a

Canadian subsidiary.

Derivative financial instruments

The Group uses derivative financial instruments to hedge its

exposure to commodity risks (namely the price of Bitcoin) arising

from operating, financing and investing activities. The Group does

not hold or issue derivative financial instruments for trading

purposes.

Derivative financial instruments are recognised and stated at

fair value.

4. ADOPTION OF NEW AND REVISED STANDARDS AND INTERPRETATIONS

The Group has adopted all recognition, measurement and

disclosure requirements of IFRS, including any new and revised

standards and Interpretations of IFRS, in effect for annual periods

commencing on or after 1 January 2022. The adoption of these

standards and amendments did not have any material impact on the

financial result of position of the Group.

Standards which are in issue but not yet effective:

At the date of authorisation of these financial statements, the

following Standards and Interpretation, which have not yet been

applied in these financial statements, were in issue but not yet

effective.

Standard Description Effective date for

or Interpretation annual accounting period

beginning on or after

------------------ -------------------------------------------- -------------------------

IAS 1 Amendments - Presentation and Classification 1 January 2023

of Liabilities as Current or Non-current

IAS 8 Amendments - Definition of Accounting 1 January 2023

Estimates

The Group has not early adopted any of the above standards and

intends to adopt them when they become effective.

5. REVENUES

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

GBP'000 GBP'000

------------------------------------ -------------- --------------

Crypto currency mining - worldwide 26,700 29,937

Crypto currency management fees -

United States - 1,148

Total revenue 26,700 31,085

------------------------------------ -------------- --------------

Due to the nature of Crypto currency mining, it is not possible

to provide a geographical split of the revenue stream.

Crypto currency mining revenues are recognised at a point in

time.

Crypto currency management fees are services recognised over

time.

6. EARNINGS PER SHARE

The basic earnings per share is calculated by dividing the

profit attributable to equity shareholders by the weighted average

number of shares in issue.

Period Period

ended ended

30 June 30 June

2022 (unaudited) 2021 (unaudited)

Net (loss)/profit for the period attributable

to ordinary equity holders from continuing

operations (GBP000) (30,504) 7,214

Weighted average number of ordinary shares

in issue 469,182,463 381,832,335

Basic earnings per share for continuing operations

(pence) (6.5) 1.9

---------------------------------------------------- ------------------ ------------------

Net (loss)/profit for the period attributable

to ordinary equity holders for continuing

operations (GBP000) (30,504) 7,214

Diluted number of ordinary shares in issue 475,067,159 393,091,232

---------------------------------------------------- ------------------ ------------------

Diluted earnings per share for continuing

operations (pence) - restricted (6.5) 1.8

---------------------------------------------------- ------------------ ------------------

The Group has in issue 18,396,397 warrants and options at 30 June

2022 (2021: 11,258,897).

7. TAXATION

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

GBP'000 GBP'000

--------------------------------------- -------------- --------------

Income tax (credit)/expense - foreign

tax (6,000) 3,484

Deferred tax (credit)/expense (386) -

--------------------------------------- -------------- --------------

Taxation charge in the financial

statements (6,386) 3,484

--------------------------------------- -------------- --------------

No deferred tax asset has been recognised in respect of UK tax

losses carried forward on the basis that there is insufficient

certainty over the level of future profits to utilise against this

amount.

Income tax expense

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the weighted average tax

rate applicable to profits of the consolidated entities as

follows:

Period ended Period ended

30 June 2022 30 June 2021

(unaudited) (unaudited)

GBP'000 GBP'000

(Loss)/Profit before taxation (36,890) 10,698

---------------------------------------- -------------- --------------

Expected tax (credit)/charge based

on a weighted average of 25% (2020

- 24%) (UK, US and Canada) (16,404) 2,568

Effect of expenses not deductible

in determining taxable profit 40 32

Capital allowances in excess of

depreciation (5,589) 323

Other tax adjustments 11,588 1,838

Losses utilised re prior years* (7,005) (1,790)

Origination and reversal of temporary

differences 3,936 256

Unutilised tax losses carried forward 7,048 257

Taxation (credit)/charge in the

financial statements (6,386) 3,484

---------------------------------------- -------------- --------------

*During the period the tax charge in respect of the year ended

31 December 2021 in respect of the taxable charge for Argo

Innovation Labs Inc was finalised and it was agreed losses

previously not accepted as deductible were deductible and as a

result the liability for that year was reduced.

8. INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Period ended Year ended

30 June 2022 31 December

(unaudited) 2021 (audited)

GBP'000 GBP'000

------------------------------------------------ -------------- ----------------

Opening balance 13,817 -

Acquired during the period - 8,444

Share of loss (490) (1,198)

Share of fair value (loss) /gain on

intangible assets through other comprehensive

income (8,318) 6,571

------------------------------------------------ -------------- ----------------

Total Associates 5,009 13,817

------------------------------------------------ -------------- ----------------

Set out below are the associates of the Group as at 30 June

2022, which, in the opinion of the Directors, significant influence

is held. The associate as listed below has share capital consisting

solely of ordinary shares, which are held directly by the Group.

The country of incorporation or registration is also their

principal place of business.

Nature of investment in associates 2022 and 2021:

Name of entity Address of the % of ownership Nature of Measurement

registered office interest relationship method

Pluto Digital Hill Dickinson 24.65% Refer below Equity

PLC LLP, 8th Floor

The Broadgate

Tower, 20 Primrose

Street, London,

United Kingdom,

EC2A 2EW

On 3 February 2021 Argo invested in Pluto Digital PLC ("Pluto"),

a crypto venture capital and technology company. The investment was

satisfied with 75,000 Polkadot with a fair value at that date of

GBP1,091,850. Further to this in a second round of funding the

Group invested an additional GBP7,352,970 on 8 March 2021.

Argo owns 24.65% of the total share capital and voting rights of

the business and is entitled to nominate one director to the Pluto

Board of Directors.

Pluto is a crypto technology company that connects Web 3.0

decentralised technologies to the global economy. Pluto identifies

key emerging areas and projects in the crypto sphere, then deploys

its business, networks and technical expertise to create value for

crypto partners, projects and Pluto shareholders.

Pluto incubates and advises digital asset projects based on

decentralised technologies, decentralised finance and networks such

as Ethereum and Polkadot. Additionally, Pluto supports the

operation of proof-of-stake networks by staking and operating

validator nodes. Pluto represents a strategic partnership for the

Group as it diversifies its activities in the crypto space.

Pluto Digital PLC is an unlisted company and there is no quoted

market price available for its shares.

There are no contingent liabilities relating to the Group's

interest in the associates.

Summarised financial information for associates

Set out below is the summarised financial information for Pluto

Digital plc which is accounted for using the equity method.

Pluto Digital plc

As at 30 June

2022

GBP000's

------------ ------------------

Net assets 18,033

-------------- ------------------

Summarised Statement of Comprehensive Income, Pluto Digital

plc

Period ended June 2022

GBP000's

--------------------------------- -----------------------

Loss from continuing operations (3,046)

Interest expense, net of

income (179)

Income tax expense 1,240

----------------------------------- -----------------------

Post-tax loss from continuing

operations (1,985)

Other comprehensive loss (33,736)

Total comprehensive Income (35,721)

----------------------------------- -----------------------

The information above reflects the amounts presented in the

management accounts of the associate (and not Argo Blockchain Plc's

share of those amounts) adjusted for differences in accounting

policies between the Group and the associate.

9. INTANGIBLE FIXED ASSETS NOTE

Group Goodwill Digital Website 2022 Total

assets

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------- ----------------- ------------- ----------- -----------

Cost

At 1 January

2022 80 5,424 671 6,175

Additions - 5,841 - 5,841

Disposals - (4,087) - (4,087)

At 30 June 2022 80 7,178 671 7,929

------------------------------------------------ ----------------- ------------- ----------- -----------

Amortisation

and impairment

At 1 January - 121 450 571

Foreign exchange movement 35 204 23 262

Impairment - 3,009 - 3,009

Fair value loss/(gain) - 413 - 413

Amortisation charged during

the period - - 72 72

At 30 June 2022 35 3,747 545 4,327

------------------------------------------------ ----------------- ------------- ----------- -----------

Balance At 30 June 2022 45 3,431 126 3,602

Digital assets are cryptocurrencies not mined by the Group. The

Group held crypto assets during the year, which are recorded

at cost on the day of acquisition. Movements in fair value between

acquisition (date mined) and disposal (date sold), and the movement

in fair value in crypto assets held at the year end, impairment

of the intangible assets and any increase in fair value are recorded

in the fair value reserve.

The digital assets held below are held in Argo Labs (a division

of the Group) as discussed above. The assets are all held in

secure custodian wallets controlled by the Group team and not

by individuals within the Argo Labs team.

The assets detailed below are all accessible and liquid in nature.

Those assets (immaterial in total) held longer term are inaccessible

for a period of time have been valued either at cost or GBPnil

depending upon the information available as at the year end.

As at 30 June 2022 Coins/tokens Fair value

Crypto asset name GBP'000

------------------------------------------------------------------- ------------- -----------

Polkadot - DOT 120,886 693

Ethereum - ETH 605 526

Solana - SOL 9,365 256

Cosmos Hub - ATOM 27,938 183

ASTRA - 112

Alternative coins - 1,661

At 30 June 2022 3,431

------------------------------------------------------------------- ------------- -----------

10. TANGIBLE FIXED ASSETS

Group Right Office Mining Assets Under Leasehold Data Motor Total

of use Equipment and Construction Improvements centres vehicles

Assets Computer

Equipment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

Cost

At 1 January

2022 358 49 58,499 61,306 85 10,466 - 130,763

Foreign

exchange

movement 32 - 2,476 6,805 8 975 - 10,296

Additions - 27 41,353 6,344 1 8,742 53 56,520

Disposals - - (12,340) - - - - (12,340)

Transfer to

another

class - - - (74,455) - 74,455 - -

At 30 June

2022 390 76 89,988 - 94 94,638 53 185,239

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

Depreciation

and

impairment

At 1 January

2022 8 - 18,507 - 65 229 18,809

Foreign

exchange

movement - - 1,612 - 6 59 - 1,677

On disposals - - (5,063) - - - - (5,063)

Depreciation

charged

during

the period 8 5 10,839 - 10 782 2 11,646

At 30 June

2022 16 5 25,895 - 81 1,070 2 27,069

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

Carrying

amount

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

At 1 January

2022 350 49 39,992 61,306 20 10,237 111,954

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

At 30 June

2022 374 71 64,093 - 13 93,568 51 158,170

-------------- -------- ---------- ---------- ----------------- ------------- --------- ---------- ---------

Note: on the face of the balance sheet the Right of Use assets

are disclosed as a separate line but have been aggregated with

other fixed assets above.

11. TRADE AND OTHER RECEIVABLES

As at As at 31 December

30 June 2022 2021 (audited)

(unaudited)

GBP'000 GBP'000

------------------------------------ -------------- ------------------

Mining equipment prepayments 82,587 47,426

Hedging instrument 1,608 -

Prepayments and other receivables 12,233 13,194

Other taxation and social security 3,020 2,739

Total trade and other receivables 99,448 63,359

------------------------------------ -------------- ------------------

Mining equipment prepayments consist of payments made and due on

mining equipment due to arrive by the end of 2022. Payments to ePIC

ASIC Asia Limited ("ePIC") comprise GBP4.1m, Intel of GBP15.1m and

the balance of GBP63.4m was paid to Bitmain in advance of machine

purchases to be received after the period end.

Other taxation and social security consist of purchase tax

recoverable in the UK and Canada. GST and QST debtors are greater

than 90 days as at 30 June 2022.

The directors consider that the carrying amount of trade and

other receivables is equal to their fair value.

12. DIGITAL ASSETS

Group Period ended Year ended

31 December

2021

30 June 2022 (audited)

(unaudited) GBP'000

GBP'000

---------------------------------------- --------------- ---------------

At 1 January 2022 and 2021 80,759 4.637

Additions

Crypto assets mined 26,700 70,325

Crypto asset purchased and received - 16,569

---------------------------------------- --------------- ---------------

Total additions 26,700 86.894

Disposals

Crypto assets sold (34,069) (12,400)

---------------------------------------- --------------- ---------------

Total disposals (34,069) (12,400)

Fair value movements

Foreign exchange (2,901) -

Gain/(loss) on crypto asset sales (6,372) 437

Movements on crypto assets held at

the period end (36,025) 1,191

---------------------------------------- --------------- ---------------

Total fair value movements (45,298) 1,628

At 30 June 2022 & 31 December 2021 28,092 80,759

---------------------------------------- --------------- ---------------

The Group mined crypto assets during the period, which are

recorded at fair value on the day of acquisition. Movements in fair

value between acquisition (date mined) and disposal (date sold),

and the movement in fair value in crypto assets held at the year

end, are recorded in profit or loss. The Group has used 1,178 as at

30 June 2022 and 1,504 Bitcoin as at 31 December 2021 as collateral

for a loan.

As at 30 June 2022 and 31 December 2021 the above digital assets

solely comprised 1,742 and 2,441 Bitcoin respectively.

13. ORDINARY SHARES

As at As at

30 June 2022 31 December

(unaudited) 2021 (audited)

GBP'000 GBP'000

-------------------------------------------------------- ------------------- ----------------

Ordinary share capital

Issued and fully paid

468,082,335 Ordinary Shares of GBP0.001

each 468 303

Issued in the period

9,742,831 Ordinary Shares of GBP0.001

each 10 165

477,825,166 Ordinary Shares of GBP0.001

each 478 468

--------------------------------------------------------- ------------------- ----------------

Share premium

-------------------------------------------------------- ------------------- ----------------

At beginning of the period 139,581 1,540

Issued in the period 4,171 150,977

Issue Costs - (12,936)

At the end of period 143,752 139,581

--------------------------------------------------------- ------------------- ----------------

Acquisition of DPN LLC

The acquisition of DPN LLC, effectively comprising the land acquisition

in west Texas, has been treated as an asset acquisition in these

condensed consolidated financial statements. In June 2022, the

Company settled the contingent consideration by issuing 8,147,831

new Ordinary Shares credited as fully paid at a price per share

of GBP0.495.

14. RESERVES

The following describes the nature and purpose of each

reserve:

Reserve Description

---------------------- -------------------------------------------------------

Ordinary shares Represents the nominal value of equity shares

Share premium Amount subscribed for share capital in excess

of nominal value

Share based payment Represents the fair value of options and warrants

granted less amounts transferred on exercise,

lapse or expiry

Foreign currency Cumulative effects of translation of opening

translation reserve balances on non-monetary assets between subsidiary

functional currency (Canadian dollars) and Group

functional and presentational currency (Sterling).

Fair value reserve Cumulative net gains on the fair value of intangible

assets

Other comprehensive The other comprehensive income of any associates

income of equity is recognised in this reserve

accounted associates

Accumulated surplus Cumulative net gains and losses and other transactions

with equity holders not recognised elsewhere.

15. TRADE AND OTHER PAYABLES

As at As at

30 June 2022 31 December 2021

(unaudited) (audited)

GBP'000 GBP'000

--------------------------------- -------------- ------------------

Trade payables 12,531 10,259

Accruals and other payables 5,102 4,986

Total trade and other creditors 17,633 15,245

--------------------------------- -------------- ------------------

Within trade payables is GBP2.2m (2021: GBP10.8m) for amounts

due for mining machines not yet received.

The directors consider that the carrying value of trade and

other payables is equal to their fair value.

16. LOANS AND BORROWINGS

Non-current liabilities As at As at

30 June 2022 31 December

(unaudited) 2021 (audited)

GBP'000 GBP'000

--------------------------------- -------------- ----------------

Issued debt - bond 32,892 26,908

Long term loans 37,081 -

Assumed mortgage on acquisition 2,908 3,391

Total 72,881 30,299

--------------------------------- -------------- ----------------

Current liabilities

--------------------------------- -------------- ----------------

Short term loans 43,876 22,239

Assumed mortgage on acquisition 840 1,152

--------------------------------- -------------- ----------------

Total 44,716 23,391

--------------------------------- -------------- ----------------

The mortgages are secured against the two buildings at Mirabel

and Baie Comeau and are repayable over periods from 52 months to 58

months at an interest rate of lender prime + 0.6%.

The Company entered into several loans to acquire mining

equipment for the Helios facility in Texas. The loans are secured

by the financed mining equipment. The loans have terms from 2 years

to 4 years and interest rates from 8.25% to 12%.

17. FINANCIAL INSTRUMENTS

As at As at

30 June 2022 31 December 2021

(unaudited) (audited)

GBP'000 GBP'000

------------------------------------------ -------------- ------------------

Carrying amount of financial assets

Measured at amortised cost

82,587 47,426

* Mining equipment prepayments 5,496 13,194

* Trade and other receivables

* Cash and cash equivalents 9,210 11,803

Measured at fair value through profit

or loss 1,608 403

Total carrying amount of financial

assets 98,901 72,826

------------------------------------------ -------------- ------------------

Carrying amount of financial liabilities

Measured at amortised cost

* Trade and other payables 17,633 10,259

* Short term loans 44,716 23,391

39,989 3,391

* Long term loans 32,892 26,908

* Issued Debt - bonds

* Lease liabilities 398 377

Measured at fair value through profit

or loss - 8,071

Total carrying amount of financial

liabilities 135,628 72,397

------------------------------------------ -------------- ------------------

Fair Value Estimation

Fair value measurements are disclosed according to the following

fair value measurement hierarchy:

- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1)

- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices), or indirectly (that is, derived from prices) (Level

2)

- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level 3).

This is the case for unlisted equity securities.

The following table presents the Group's assets and liabilities

that are measured at fair value at 30 June 2022 and 31 December

2021.

Level 1 Level 2 Level 3 Total

Assets GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- -------- -------- --------

Financial assets at fair - - - -

value through profit or

loss

Equity holdings 60 - 74 134

Hedging instruments 1,608 - - 1,608

Intangible assets - crypto

assets - 3,431 - 3,431

Digital assets - 28,092 26,092

Total at 30 June 2022 1,668 31,523 74 33,265

------------------------------------ -------- -------- -------- --------

Level 1 Level 2 Level 3 Total

Assets GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- -------- -------- --------

Financial assets at fair - - - -

value through profit or

loss

Equity holdings 329 - 73 402

Hedging instruments - - - -

Intangible assets - crypto

assets - 5,424 - 5,424

Digital assets - 80,759 80,759

Total at 31 December 2021 329 86,183 73 86,585

------------------------------------ -------- -------- -------- --------

Liabilities

------------------------------------ -------- -------- -------- --------

Financial liabilities at

fair value through profit

or loss

-Deferred contingent consideration 8,071 8,071

Total at 31 December 2021 8,071 8,071

------------------------------------ -------- -------- -------- --------

All financial assets are in listed/unlisted securities and

digital assets.

There were no transfers between levels during the period.

The Group recognises the fair value of financial assets at fair

value through profit or loss relating to unlisted investments at

the cost of investment unless:

- There has been a specific change in the circumstances which,

in the Group's opinion, has permanently impaired the value of the

financial asset. The asset will be written down to the impaired

value;

- There has been a significant change in the performance of the

investee compared with budgets, plans or milestones;

- There has been a change in expectation that the investee's

technical product milestones will be achieved or a change in the

economic environment in which the investee operates;

- There has been an equity transaction, subsequent to the

Group's investment, which crystallises a valuation for the

financial asset which is different to the valuation at which the

Group invested. The asset's value will be adjusted to reflect this

revised valuation; or

- An independently prepared valuation report exists for the

investee within close proximity to the reporting date.

18. COMMITMENTS

The Group's material contractual commitments relate to the

master services agreement with Core Scientific, which provides

hosting, power and support services. This terminates shortly after

the period end once the machine swap deal is complete.

19. RELATED PARTY TRANSACTIONS

Key management compensation - all amounts in GBP000's

Key management includes Directors (executive and non-executive)

and senior management. The compensation paid to related parties in

respect of key management for employee services during the period

was made only from Argo Innovation Labs Inc, amounting to: GBP20k

(2021 - GBP18k) paid to POMA Enterprises Limited in respect of fees

of Matthew Shaw (Non-executive director); GBP142k (2021 - GBP106k)

paid to Vernon Blockchain Inc in respect of fees of Peter Wall

(CEO); GBPnil (2021 - GBP68k) paid to Tenuous Holdings Ltd in

respect of fees of Ian MacLeod (ex Executive chairman). During the

period, James Savage (ex NED) was remunerated a gross salary of

GBPnil (2021 - GBP15k), Marco D'Attanasio was remunerated gross

fees of GBPnil (2021 - GBP15k) and Alex Appleton (CFO) through

Appleton Business Advisors Limited was paid GBP97k (2021 - GBP60k)

during the period.

Total director fees and remuneration, paid directly and

indirectly, totalled GBP313k (2021: GBP221k).

20. CONTROLLING PARTY

There is no controlling party of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EALPLAAEAEFA

(END) Dow Jones Newswires

August 25, 2022 02:00 ET (06:00 GMT)

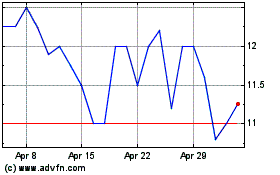

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024