TIDMAREC

RNS Number : 4946U

Arecor Therapeutics PLC

01 August 2022

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

ARTICLE 7 OF THE EU REGULATION 596/2014 AS IT FORMS PART OF THE UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, TO U.S. PERSONS OR IN

OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH IT

WOULD BE UNLAWFUL TO DO SO.

1 August 2022

Arecor Therapeutics plc

("Arecor" or the "Company" or the "Group")

Result of Placing

Arecor Therapeutics plc (AIM: AREC), a globally focused

biopharmaceutical company advancing today's therapies to enable

healthier lives, is pleased to announce that further to the

announcement made earlier today (the "Launch Announcement"), an

aggregate of 2,000,000 Placing Shares have been successfully placed

by Panmure Gordon with institutional and other investors at a

Placing Price of 300 pence per ordinary share to raise a total of

GBP6.0 million for the Company (before expenses). This includes

participation in the Placing by certain of the Company's Directors,

who have subscribed an aggregate of GBP113,271 at the Placing Price

for 37,755 Placing Shares.

The net proceeds of the Placing will be used to support the

acquisition of Tetris Pharma which the Directors believe will help

realise Arecor's vision of becoming a significant self-sustaining

biopharmaceutical business. In particular, the proceeds will be

used to provide working capital to Tetris Pharma to accelerate the

roll-out of Ogluo (R) across the UK and Europe as set out in the

Launch Announcement, alongside payment for initial Ogluo (R)

inventory and historic one-off liabilities of Tetris Pharma.

The Acquisition is conditional, inter alia, on completion of the

Placing. The Placing in relation to the EIS/VCT Placing Shares

remains conditional on, inter alia, EIS/VCT Admission. The Placing

in relation to the General Placing Shares remains conditional on,

inter alia, General Admission. The Placing Shares will be issued

pursuant to the share authorities approved at the Company's annual

general meeting held on 23 May 2022.

Sarah Howell, CEO of Arecor, commented: " We are extremely

pleased with the results of this Placing and we thank our

shareholders for their continued support to enable Arecor's

acquisition of Tetris Pharma. We believe this deal is a strong

strategic fit for the Group, bringing a key commercial diabetes

product into our portfolio, complementing our existing specialty

hospital products franchise and offering the potential to

accelerate significant revenue growth. We believe Arecor will be

stronger as a result and better placed to achieve its vision of

becoming a significant self-sustaining biopharmaceutical company

."

Dr Shafiq Choudhary, CEO of Tetris Pharma commented: "Becoming

part of the Arecor Group provides Tetris Pharma with a robust

platform for growth and from which to deliver on the commercial

potential of Ogluo (R) in the UK and Europe. We believe Ogluo (R)

's simple two-step administration and 99% successful delivery bring

important competitive advantages and can address a significant

market in the UK and Europe. We look forward to joining the Group

and working to realise the value of our existing portfolio and

opportunities presented through Arecor's proven ability to apply

its technologies to the enhancement of specialty hospital

products."

Related Party Transaction

As part of the Placing, BGF Investment Management Limited

("BGF"), a substantial shareholder of the Company and therefore a

Related Party as defined by the AIM Rules ("Related Party"), has

subscribed for a total of 266,666 Placing Shares at the Placing

Price under the Placing. Following completion of the Placing, BGF

will have an aggregate interest in 4,026,468 Ordinary Shares,

representing 13.2 per cent. of the Enlarged Share Capital.

Certain Directors of the Company, being Sarah Howell, Susan

Lowther, Andrew Richards, Sam Fazeli, Jeremy Morgan and Christine

Soden, all of whom are deemed to be a Related Party, have

subscribed for a total of 37,755 Placing Shares at the Placing

Price under the Placing. Following completion of the Placing, the

above Directors will have an aggregate interest in 1,372,799

Ordinary Shares, representing approximately 4.5 per cent. of the

Enlarged Share Capital.

Alan Smith, a non-executive Director who is also independent of

the Placing, having consulted with Panmure Gordon, the Company's

nominated adviser, considers that the terms of the participation in

the Placing by BGF and certain Directors are fair and reasonable

insofar as the Company's shareholders are concerned.

Admission and settlement

Application will be made to the London Stock Exchange for the

admission of the Placing Shares and the Initial Consideration

Shares to trading on AIM. The Placing Shares and the Initial

Consideration Shares will be issued pursuant to the existing

authorities approved at the Company's annual general meeting held

on 23 May 2022. It is expected that: (i) EIS/VCT Admission will

occur, and that dealings in the EIS/VCT Placing Shares subscribed

for pursuant to the EIS/VCT Placing of 867,212 Ordinary Shares will

commence, at 8.00 a.m. on 3 August 2022, and (ii) General Admission

will occur, and that dealings in the General Placing Shares and the

Initial Consideration Shares of 1,784,514 Ordinary Shares will

commence, at 8.00 a.m. on 4 August 2022. Upon Admission, the

Enlarged Share Capital is expected to be 30,486,750 Ordinary

Shares. On this basis, the Placing Shares will represent

approximately 6.6 per cent. of the Enlarged Share Capital.

The capitalised terms used in this announcement have the same

meanings as in the announcement published by the Company at

approximately 7.00 a.m. today unless otherwise stated.

For more information, please contact:

Arecor Therapeutics plc www.arecor.com

Dr Sarah Howell, Chief Executive Officer Tel: +44 (0) 1223 426060

Email: info@arecor.com

Susan Lowther, Chief Financial Officer Tel: +44 (0) 1223 426060

Email: info@arecor.com

Mo Noonan, Communications Tel: +44 (0) 7876 444977

Email: mo.noonan@arecor.com

Panmure Gordon (UK) Limited (NOMAD

and Broker)

Freddy Crossley, Emma Earl (Corporate Tel: +44 (0) 20 7886 2500

Finance)

Rupert Dearden (Corporate Broking)

Consilium Strategic Communications

Chris Gardner, David Daley, Angela Tel: +44 (0) 20 3709 5700

Gray Email: arecor@consilium-comms.com

Notes to Editors

About Arecor

Arecor Therapeutics plc is a globally focused biopharmaceutical

group transforming patient care by bringing innovative medicines to

market through the enhancement of existing therapeutic products. By

applying our innovative proprietary formulation technology

platform, Arestat(TM) , we are developing an internal portfolio of

proprietary products in diabetes and other indications, as well as

working with leading pharmaceutical and biotechnology companies to

deliver enhanced formulations of their therapeutic products. The

Arestat (TM) platform is supported by an extensive patent portfolio

.

For further details please see our website, www.arecor.com

IMPORTANT NOTICES

No action has been taken by the Company, Panmure Gordon or any

of their respective affiliates, that would, or which is intended

to, permit a public offer of the Placing Shares in any jurisdiction

or the possession or distribution of this announcement or any other

offering or publicity material relating to the Placing Shares in

any jurisdiction where action for that purpose is required. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of such jurisdictions. Persons

into whose possession this announcement comes shall inform

themselves about, and observe, such restrictions.

No prospectus will be made available in connection with the

matters contained in this announcement and no such prospectus is

required (in accordance with the Prospectus Directive) to be

published.

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED HEREIN,

IS FOR INFORMATION PURPOSES ONLY, IS NOT INTED TO AND DOES NOT

CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO PURCHASE OR

SUBSCRIBE FOR, UNDERWRITE, SELL OR ISSUE OR THE SOLICITATION OF AN

OFFER TO PURCHASE OR SUBSCRIBE, SELL, ACQUIRE, DISPOSE OF THE

PLACING SHARES OR ANY OTHER SECURITY IN THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR IN ANY JURISDICTION IN WHICH, OR TO ANY PERSONS TO

WHOM, SUCH OFFERING, SOLICITATION OR SALE WOULD BE UNLAWFUL.

Panmure Gordon, which is authorised and regulated in the United

Kingdom by the FCA, is acting as nominated adviser and joint broker

to the Company in relation to the Placing, EIS/VCT Admission and

General Admission and is not acting for any other persons in

relation to the Placing, the EIS/VCT Admission and the General

Admission. Panmure Gordon is acting exclusively for the Company and

for no one else in relation to the matters described in this

announcement and is not advising any other person and accordingly

will not be responsible to anyone other than the Company for

providing the protections afforded to clients of Panmure Gordon, or

for providing advice in relation to the contents of this

announcement or any matter referred to in it. The responsibilities

of Panmure Gordon as the Company's nominated adviser under the AIM

Rules for Companies and the AIM Rules for Nominated Advisers are

owed solely to London Stock Exchange plc and are not owed to the

Company or to any director or shareholder of the Company or any

other person, in respect of his decision to acquire shares in the

capital of the Company in reliance on any part of this

announcement, or otherwise.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Panmure Gordon or the Company or any of

their respective affiliates or any of their respective directors,

officers, employees, advisers or representatives as to or in

relation to the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefor is expressly disclaimed.

This announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decision to buy Placing Shares in the Placing must be made solely

on the basis of publicly available information, which has not been

independently verified by Panmure Gordon.

The price of Ordinary Shares and any income from them may go

down as well as up and investors may not get back the full amount

invested on disposal of the Ordinary Shares.

The Placing Shares will not be admitted to trading on any stock

exchange other than AIM, a market operated by the London Stock

Exchange.

This announcement may contain "forward-looking statements" which

includes all statements other than statements of historical fact,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates", "would,

"could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Company to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. These forward-looking statements speak

only as at the date of this announcement. None of the Company,

Panmure Gordon or their respective directors, officers, employees,

agents, affiliates and advisers, or any other party undertakes or

is under any duty to update this announcement or to correct any

inaccuracies in any such information which may become apparent or

to provide you with any additional information, other than any

requirements that the Company may have under applicable law. To the

fullest extent permissible by law, such persons disclaim all and

any responsibility or liability, whether arising in tort, contract

or otherwise, which they might otherwise have in respect of this

announcement. The information in this announcement is subject to

change without notice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIDZGGRFMDGZZM

(END) Dow Jones Newswires

August 01, 2022 09:46 ET (13:46 GMT)

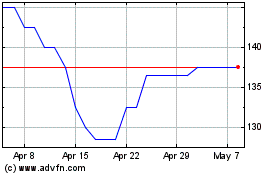

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From Apr 2023 to Apr 2024