TIDMASAI

RNS Number : 7997Z

ASA International Group PLC

26 May 2021

ASA International Group plc reports FY 2020 results

Amsterdam, The Netherlands, 26 May 2021 - ASA International

Group plc, ('ASA International', the 'Company' or the 'Group'), one

of the world's largest international microfinance institutions,

today announces its full year results for the twelve-month period

from 1 January to 31 December 2020.

Key performance indicators

% Change % Change % Change

FY H1

2019 FY 2019 2020

- - FY 2020 -

(Amounts in USD FY (constant FY

thousands) FY2020 H1 2020 FY 2019 2020 currency) 2020

Number of clients

(m) 2.4 2.3 2.5 -6% 2%

Number of branches 1,965 1,956 1,895 4% 0%

Net profit -1.4 -1.5 34.5 -104% -103% 6%

OLP (1) 415.3 388.6 467.4 -11% -10% 7%

Gross OLP 445.3 411.7 471.4 -6% -4% 8%

PAR > 30 days (2) 13.1% 3.6% 1.5%

(1) Outstanding loan portfolio ('OLP') includes off-book Business

Correspondence ('BC') loans and Direct Assignment loans, excludes

interest receivable, unamortized loan processing fees, and deducts

modification losses and ECL provisions from Gross OLP.

(2) PAR>30 is the percentage of on-book OLP that has one or

more instalment of repayment of principal past due for more

than 30 days and less than 365 days, divided by the Gross OLP.

FY 2020 Highlights

-- The Company's operational and financial performance was

substantially affected by the impact of the COVID-19 pandemic,

including the associated disruption and measures taken by

government authorities, as well as the ensuing provisioning across

all operating companies.

-- As a result, the Company showed a net loss of USD 1.4m in

2020 compared to a net profit of USD 34.5m in 2019.

-- The reduction in profitability was primarily caused by (i) a

USD 27.2m expense for expected credit losses in 2020 compared to

USD 4.2m in 2019, (ii) lower interest income as the Group was not

able to charge interest in most markets on (a) the payment holidays

provided during lockdowns, moratoriums and (b) increased overdue

amounts and (iii) a modification loss of USD 3.5m at the end of the

year due to loan extensions for the payment holidays provided to

clients on account of COVID-19 related lockdowns and

moratoriums.

-- The immediate health impact on our staff and clients remained

relatively low with no deaths amongst our approximately 12.5K

employees and 25 deaths amongst our 2.4 million clients due to

COVID-19.

-- Following the end of the lockdowns in our operating

countries, the Group granted many clients a temporary moratorium of

the payment of one or more loan instalments (which, in effect,

extended the related loans for the moratorium period), which peaked

at USD 16.9m in June with 485K clients benefiting from the

moratorium.

-- PAR>30 increased to 13.1% (excluding loan instalments

under moratorium) by the end of December 2020.

-- As of 31 December 2020, the Group had approximately USD 101m

of unrestricted cash and cash equivalents, with a funding pipeline

reaching approximately USD 225m.

-- The Group successfully raised USD 163.9m in debt funding

across its operations in 2020, with total debt growing to USD

337.6m.

Outlook

In 2021, the Company expects the operating environment to remain

challenging in many countries. Assuming that the disruption caused

by COVID 19 reduces through the rest of the year, the Group's

operating and financial performance should improve meaningfully in

2021 compared with 2020, with the extent of that improvement

depending in particular on developments in India. It is expected

that in 2022 the Group's operational and financial performance will

begin to normalise, subject to the unpredictable course of the

pandemic.

Dirk Brouwer, Chief Executive Officer of ASA International,

commented:

"Considering the challenging operating circumstances in 2020, we

are pleased with the resilience of the business and its model, and

especially how local management navigated the operating

subsidiaries through the crisis. From the start of the COVID-19

pandemic our field staff stayed in close contact with our clients

and supported them throughout these difficult times, which

prevented many of our clients from doing their regular daily

business.

Our clients have shown strong resilience in rebuilding their

businesses and adjusting to the new operating circumstances. This

ability to recover from adverse circumstances together with our

support in providing more time for clients to settle their loans,

enabled many clients to increase their earnings capacity and

gradually repay in full the loans granted by the Group. In India

and the Philippines, many clients were not able to meet their

financial obligations towards the Company. In addition to the

ongoing disruption as a result of COVID-19 and the impact of

cyclone Amphan, which hit our operations in West-Bengal, political

activism against MFIs adversely affected the repayment discipline

of many clients in the State of Assam, covering 13% of our

portfolio in India at 30 April 2021. The Philippines also struggled

to increase collection efficiency to satisfactory levels, following

disruptions caused by the initial two months lockdown and the many

subsequent ongoing local restrictions imposed by local, regional

governments as well as the national government.

We considered it therefore appropriate to substantially increase

the provision for expected credit losses from USD 10.6 million in

June 2020 to USD 27.5 million by year-end 2020. As a result,

together with the lower interest income due to the lockdowns,

moratoriums and overdue, this increased the net loss of the Group

for 2020 to USD 1.4 million.

At 30 April 2021, despite ongoing COVID-19 related disruptions

in the Philippines and India, and political unrest in Myanmar, the

Group's other operating subsidiaries, where traditionally more than

two-thirds of our customary operating profits are generated,

achieved a collection efficiency of more than 90% and 9 out of 13

countries achieved a collection efficiency of more than 95%. As a

result, the PAR>30 of the Group's operating subsidiaries,

excluding India, the Philippines and Myanmar, came down to

3.8%.

We are grateful for the solid and consistent financial support

we received from almost all our lenders since the start of the

pandemic. The Group secured in excess of USD 219 million of new

credit facilities since the start of the pandemic in March 2020. As

of 30 April 2021, liquidity remains high. The Group had a pipeline

of wholesale loans of 164 million from a large variety of local and

international lenders."

CHIEF EXECUTIVE OFFICER'S REVIEW

Business Review FY 2020

2020 was one of the most challenging years for our Company with

lockdowns, curfews and many other measures taken by Governments to

reduce the spread of COVID-19. We have been fortunate that up until

now none of our 12,535 staff and few of our clients have died from

COVID-19. Nevertheless, it has been difficult for many of our

clients to run their businesses and for our staff to service them

under these difficult and continuously changing circumstances.

As result of the disruption to our clients' businesses, we

focused more on collection of outstanding installments rather than

disbursement of new loans during the first 6-8 weeks after the end

of the lockdowns in order to re-assess the earning capacity of each

of our clients. This resulted in a 6% reduction of the gross

outstanding loan portfolio from USD 471.4 million by year-end 2019

to USD 445.3 million as of 31 December 2020. From July 2020, the

Group started to increase its loan disbursements across all

markets, which led to renewed growth of the Group's loan

portfolio.

We opened 70 branches from 1,895 to 1,965 (+4%) in Q1 2020, but

halted further branch expansion during the remainder of the year.

The number of clients went down from 2.5m to 2.4m (-6%) in 2020.

The number of clients per branch decreased from 1,337 to 1,212 and

Gross OLP per Client increased from USD 186 to USD 187.

In India and the Philippines, two of our larger markets in terms

of number of clients, the disruption caused by COVID-19 caused our

clients to struggle in meeting their financial obligations to our

Company. Besides the ongoing disruption in the market places where

many of our Indian clients usually trade, political activism in the

State of Assam (India) against microfinance institutions with the

threat of local government intervention as well as the long-term

impact of cyclone Amphan, adversely affected the repayment

discipline and capacity of many of our clients in Assam and various

districts in West Bengal.

We have seen positive developments on the regulatory front with

(i) ASA Pakistan securing an in-principal approval in January 2020

from the Central Bank of Pakistan ('SBP') to transform into a

microfinance bank. Throughout the year ASA Pakistan completed the

requirements for transforming into a microfinance bank. It is

expected that the SBP will complete the inspection of its head

office and operations during 2021, after which it is expected that

the license will be granted, (ii) ASA Myanmar received approval for

taking savings from its clients; and (iii) completing the transfer

of the net assets of ASIEA NGO to ASHA Microfinance Bank, our

nationwide microfinance bank in Nigeria on 1 April 2020.

The Company successfully completed the roll-out and

implementation of the real-time version of its proprietary ASA

Microfinance Banking System ('AMBS') in all of its operating

countries, which will be essential for the gradual introduction of

doorstep banking and other digital financial services in the next

few years. In 2021 we are making a substantial investment in the

development of our DFS platform with the intention to first launch

a broad range of digital financial services to our clients in Ghana

in 2022.

The competitive environment has not appeared to have changed

much last year as a result of the crisis. Competition remains

highest in India and the Philippines where our strongest

competitors are three microfinance institutions which also follow

the ASA model of microfinance as taught to them by ASA NGO

Bangladesh more than 15 years ago. In most other markets, we face

less competition by traditional microfinance institutions. We

expect that many of our competitors face similar problems in terms

of collections and overdue as we do. However, the messages we

receive from the field, appear to indicate that many of our smaller

competitors face more hardship than we do in terms of portfolio

quality as well as funding. To date, we have experienced limited

competition of digital lenders in any of our markets, as the loans

and services offered are not particularly targeted to our client

base as of yet. Digital lenders are often perceived by our clients

as lenders of last resort who employ aggressive debt collectors,

charge high interest rates and have little or no connection to the

local communities.

During 2020, we maintained a minimum foreign currency mismatch,

and benefited from the shorter duration of our assets vis-à-vis our

liabilities, which enabled us to draw some liquidity from the field

at the height of the COVID-19 crisis.

Compared to 2018 and 2019, our operating currencies remained

relatively stable vis-à-vis the US dollar during 2020, with the

exceptions of Kenya, Nigeria, and Zambia which have seen

significant depreciation of their currencies.

ECL provision

During 2020 the Company increased its provision for expected

credit losses ('ECL') from USD 4.3m to USD 27.5m for the combined

OLP including the off-book BC portfolio. The related ECL expense in

the P&L amounts to USD 27.2m in total in 2020 compared to USD

4.2m in 2019. This increase mainly relates to an additional

management overlay as part of the ECL policy under IFRS 9 due to

the impact on our clients of government and regulatory actions

related to COVID-19, such as lockdowns and moratoriums, and

political uncertainty related to developments observed in Assam

(India). Management has applied its previous experiences from

natural calamities and other disruptive events like the Andhra

Pradesh crisis and demonetisation in India, as well as the current

developments in each of its operating companies, to determine the

assumptions for the ECL calculation. The USD 27.5m ECL provisions

concentrated in India 60% and the Philippines 17%, with the

remainder spread more evenly across the other countries as

percentage of each countries outstanding loan portfolio or as

aggregate amount. Following the removal or relaxation of

restrictions in certain countries, collections only gradually

improved as regional restrictions continued in the Philippines, and

political events in the Assam region of India created reticence of

some clients to pay instalments. The assumptions for the ECL

provision include significant uncertainty. As such, the resulting

outcome of losses on the loan portfolio may be materially

different. Further details on the ECL calculation are provided in

note [2.5.2] of the unaudited preliminary consolidated financial

statements (Appendix 1).

Modification loss

The Group booked a modification loss of USD 3.5m in 2020 which

relates to the extension of the term of the Company's loans to

clients during lockdowns and individual moratoriums granted after

the lockdowns. In most of the markets, the Group was not able to

accrue interest for such extensions. We have estimated the

modification loss through performing sample testing of borrowers

across each country and extrapolating the difference across the

remainder of the affected population. As such there is a degree of

estimation uncertainty in the recording of income as the sample

selected may not be indicative of the untested population. We have

further explained the modification loss in notes 2.5.4, 13 and 29.4

of the unaudited preliminary financial statements (Appendix 1).

Dividend

Due to the impact of COVID-19 on the Group's financial

performance during 2020 and the resulting uncertainty, the Board

decided not to declare a dividend on earnings for the year 2020.

The Company will review its dividend policy during the course of

the year.

Webcast and Conference call

Management will be hosting an audio webcast and conference call,

with Q&A today at 14:00 (BST).

To access the audio webcast, please go to

www.asa-international.com or use the following link:

https://webcasting.brrmedia.co.uk/broadcast/60a686666a1e1c4d685c066d

. The 2020 results presentation can be downloaded from the Investor

section of the Company's website Investors | Asa

(asa-international.com) .

In order to ask questions, analysts and investors are invited to

submit questions via the webcast or dial into the conference call.

Please use the dial-in details below. You will be asked to provide

the following information:

Confirmation code: 6297353

Title of the conference: ASA International Full Year Results

2020

Speaker name: Dirk Brouwer

Location Phone Number

United Kingdom +44 (0)330 336 9125

--------------- -------------------

Netherlands +31 (0)20 703 8211

--------------- -------------------

South Africa +27 11 844 6054

--------------- -------------------

India +91 11 6310 0156

--------------- -------------------

Singapore +65 6320 9026

--------------- -------------------

United States +1 323-794-2588

--------------- -------------------

Statutory accounts

The financial information in this document do not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006 ("the Act"). A copy of the accounts for the year

ended 31 December 2019 was delivered to the Registrar of Companies.

The auditors' report on those accounts was not qualified but made

reference to a material uncertainty in respect of going concern and

did not contain statements under section 498 (2) or 498 (3) of the

Companies Act 2006.

The audit of the statutory accounts for the year ended 31

December 2020 is not yet complete. The Directors expect the

auditors' report to be unqualified and to make reference to a

material uncertainty in respect of going concern due to the impact

of COVID-19 and expect not to contain a statement under section 498

(2) or (3) of the Act. These accounts will be finalized on the

basis of the financial information presented by the Directors in

these preliminary results and will be delivered to the Registrar of

Companies following the Company's annual general meeting.

2020 Full Year Annual Report and Accounts

On 1 June 2021, the Company will publish the Full Year Annual

Report and Accounts for the 12 months period ended 31 December 2020

on: Home | Asa (asa-international.com) .

Annual General Meeting

The Annual General Meeting will be held on 30 June 2021.

Change of registered office

The Company has changed its registered office to: Highdown

House, Yeoman Way, Worthing, West Sussex, BN99 3HH, United

Kingdom.

Enquiries:

ASA International Group plc

Investor Relations

Véronique Schyns

+31 6 2030 0139

vschyns@asa-international.com

GROUP FINANCIAL PERFORMANCE

% Change % Change % Change

FY H1

2019 FY 2019 2020

- - FY 2020 -

FY (constant FY

(Amounts in USD thousands) FY2020 H1 2020 FY 2019 2020 currency) 2020

Net profit -1,395 -1,487 34,497 -104% -103% 6%

Cost/income ratio 98% 108% 60%

Return on average

assets -0.2% -0.5% 6.7%

Return on average

equity -1.3% -2.8% 34.5%

Earnings growth -104% -109% 6%

OLP (1) 415,304 388,649 467,429 -11% -10% 7%

Gross OLP 445,257 411,700 471,420 -6% -4% 8%

Total assets 579,260 530,984 559,958 3% 9%

Client deposits (2) 80,174 74,488 78,080 3% 8%

Interest-bearing

debt (2) 337,632 301,094 317,810 6% 12%

Share capital and

reserves 107,073 104,131 111,169 -4% 3%

Number of clients 2,380,685 2,331,563 2,534,015 -6% 2%

Number of branches 1,965 1,956 1,895 4% 0%

Average Gross OLP

per client (USD) 187 177 186 1% 2% 6%

PAR > 30 days 13.1% 3.6% 1.5%

Client deposits as

% of loan portfolio 19% 19% 17%

(1) Outstanding loan portfolio ('OLP') includes off-book Business

Correspondence ('BC') loans and Direct Assignment loans, excludes

interest receivable, unamortized loan processing fees, and deducts

modification losses and ECL provisions from Gross OLP.

(2) Excludes interest payable

Regional performance

South Asia

% Change % Change % Change

FY H1

2019 FY 2019 2020

- - FY 2020 -

FY (constant FY

(Amounts in USD thousands) FY2020 H1 2020 FY 2019 2020 currency) 2020

Net profit -4,360 594 14,098 -131% -131% -834%

Cost/income ratio 134% 99% 50%

Return on average

assets -1.7% 0.5% 6.1%

Return on average

equity -7.8% 2.0% 26.6%

Earnings growth -131% -92% -5%

OLP 217,843 226,401 254,361 -14% -12% -4%

Gross OLP 238,738 234,139 256,578 -7% -4% 2%

Total assets 253,360 229,747 252,034 1% 10%

Client deposits 2,610 2,363 2,082 25% 10%

Interest-bearing

debt 183,756 159,136 177,257 4% 15%

Share capital and

reserves 53,232 57,777 58,703 -9% -8%

Number of clients 1,185,656 1,191,888 1,234,638 -4% -1%

Number of branches 758 766 751 1% -1%

Average Gross OLP

per client (USD) 201 196 208 -3% -0.5% 3%

PAR > 30 days 21.3% 4.7% 2.0%

Client deposits as

% of loan portfolio 1% 1% 1%

Due to the impact of COVID-19 and associated lockdowns in each

country, operations were substantially disrupted in the South Asia

region. A shrinking OLP along with increased provisions for

expected credit losses as well as currency depreciation in Pakistan

(PKR down 4% YoY against USD) led to South Asia's USD net profits

going down 131% YoY (131% YoY down on a constant currency

basis).

-- The quality of the loan portfolio declined with PAR>30 increasing from 2.0% to 21.3%

-- Cost/Income ratio increased by 8,363 bps to 134% due to

reduced income caused by the COVID-19 disruptions compared to an

increased cost base YoY

-- Return on average assets was down 778 bps to -1.7% due to

lower profits caused by a declining OLP, and increase in expected

credit loss expenses

-- Return on average equity was down by 3,439 bps to -7.8%

India

ASA India shrank its operations over the twelve-month

period:

-- Number of clients down from 732 k to 714 k (down 3 % YoY)

-- Number of branches up from 399 to 400 (up 0.3% YoY)

-- OLP declined from INR 9.0bn (USD 127m) to INR 7.3bn (USD 101m) (down 19% YoY in INR)

-- Off-book portfolio declined from INR 4.0bn (USD 55.9m) to INR

3.4bn (USD 46.4m) (down 15% in INR). This now includes INR 270.0m

(USD 3.7m) of the portfolio transferred under a direct assignment

(DA) agreement to State Bank of India

-- Gross OLP/Client down from INR 18K to INR 17K (down 5% YoY in INR)

-- PAR>30 increased from 1.5% to 31.9%

-- USD 15m in moratoriums granted to 530k clients in 2020

Pakistan

ASA Pakistan saw its operations shrink due to COVID-19 impact in

H1 2020 but recover in H2 2020:

-- Number of clients declined from 439 k to 4 16 k (down 5% YoY)

-- Number of branches up from 281 to 292 (up 4 % YoY)

-- OLP up from PKR 9.7bn (USD 62.5m) to PKR 10.0bn (USD 62.5m) (up 3 % in PKR)

-- Gross OLP/Client up from PKR 22 .2 K (USD 143) to PKR 24.8K (USD 1 55 ) ( up 12% YoY in PKR)

-- PAR>30 increased from 1.9% to 4.0%

-- No moratoriums granted to clients

Sri Lanka

Lak Jaya continued to feel the negative impact of COVID-19:

-- Number of clients down from 63 k to 56 k ( do wn 11% YoY)

-- Number of branches down from 71 to 66 (down 7% YoY)

-- OLP down from LKR 1.7bn (USD 9.4m) to LKR 1.6bn (USD 8.4m) (down 9% YoY in LKR)

-- Gross OLP/Client up from LKR 29.2K (USD 161) to LKR 30.3K (USD 163) (up 4% Y oY in LKR)

-- PAR>30 improved from 9.7% to 7.6%

-- Up to USD 1.9m in moratoriums granted to 81k clients between March and December 2020

-- Management implemented a strategy to focus on cost control

and improving the portfolio quality by consolidating some branches

and making a larger write-off of its bad loans

South East Asia

% Change % Change % Change

FY H1

2019 FY 2019 2020

- - FY 2020 -

FY (constant FY

(Amounts in USD thousands) FY2020 H1 2020 FY 2019 2020 currency) 2020

Net profit -3,366 -3,969 5,349 -163% -154% 15%

Cost/income ratio 135% 464% 74%

Return on average

assets -2.7% -6.7% 4.8%

Return on average

equity -16.1% -38.3% 29.1%

Earnings growth -163% -274% 38%

OLP 74,214 68,847 84,205 -12% -18% 8%

Gross OLP 80,832 77,714 84,886 -5% -12% 4%

Total assets 119,152 111,870 125,750 -5% 7%

Client deposits 24,000 23,726 22,995 4% 1%

Interest-bearing

debt 66,412 59,140 72,419 -8% 12%

Share capital and

reserves 20,259 19,964 21,453 -6% 1%

Number of clients 428,645 448,707 491,813 -13% -4%

Number of branches 415 416 405 2% 0%

Average Gross OLP

per client (USD) 189 173 173 9% 1% 9%

PAR > 30 days 4.1% 1.1% 1.0%

Client deposits as

% of loan portfolio 32% 34% 27%

In South East Asia, client and OLP growth declined due in large

part to disruptions brought on by COVID-19 in especially the

Philippines. The extended 10-week lockdown period (and partial lock

downs in the second half of 2020) and the ongoing disruption

afterwards in the Philippines led to a reduction in OLP and higher

expected credit losses resulting in lower earnings. Also,

additional 8 weeks of compulsory moratorium in Yangon and Bago

regions in Myanmar, where 60% of ASA Myanmar's branches are based,

led to lower revenues.

The Philippines

Pagasa Philippines operations contracted due to the impact from

COVID-19:

-- Number of clients down from 340k to 299k (down 12% YoY)

-- Number of branches up from 315 to 322 (up 2% YoY)

-- OLP down from PHP 2.7bn (USD 52.7m) to PHP 2.2bn (USD 45.3m) (down 19% YoY in PHP)

-- Gross OLP/Client increased from PHP 7.9K (USD 156) to PHP 8.1

K (USD 1 68 ) (up 2% YoY in PHP)

-- PAR>30 increased from 1.3% to 6.4%

-- Up to USD 26.8m in moratoriums granted to 663k clients between March and December 2020

Myanmar

ASA Myanmar saw a decline in clients and OLP which stabilised in

H2 2020:

-- Number of clients down from 152k to 1 29 k (down 15% YoY)

-- Number of branches increased from 90 to 93 (up 3 % YoY)

-- OLP down from to MMK 46.8bn (USD 31.5m) to MMK 38.4bn (USD 28.9m) (down 18% YoY in MMK)

-- Gross OLP/Client up from MMK 310K (USD 209) to MMK 316K (USD 237) (up 2% YoY in MMK)

-- PAR>30 increased from 0.4% to 0.5%

-- Up to USD 9.0m in moratoriums granted to 267k clients between March and December 2020

West Africa

% Change % Change % Change

FY 2019 FY 2019 H1 2020

- - FY 2020 -

(constant

(Amounts in USD thousands) FY2020 H1 2020 FY 2019 FY 2020 currency) FY 2020

Net profit 13,443 5,297 15,935 -16% -15% 154%

Cost/income ratio 49% 55% 45%

Return on average

assets 13.2% 11.2% 17.3%

Return on average

equity 31.1% 28.5% 45.7%

Earnings growth -16% -25% -6%

OLP 77,835 56,647 77,200 1% 5% 37%

Gross OLP 79,499 60,237 78,078 2% 6% 32%

Total assets 107,748 93,962 95,240 13% 15%

Client deposits 39,788 34,809 38,195 4% 14%

Interest-bearing debt 10,255 11,212 11,919 -14% -9%

Share capital and

reserves 49,033 37,003 37,452 31% 33%

Number of clients 447,122 389,453 459,022 -3% 15%

Number of branches 433 431 423 2% 0%

Average Gross OLP

per client (USD) 178 155 170 5% 9% 15%

PAR > 30 days 2.7% 4.0% 1.5%

Client deposits as

% of loan portfolio 51% 61% 49%

West Africa's operational and financial performance declined,

however, it performed well compared to any of the other regions.

Ghana saw a quick recovery of its operations following the end of

the 2-week lockdowns with collections back to pre-COVID levels,

while Nigeria faced a longer recovery from lockdowns due to prior

challenging market conditions further impacted by COVID-19,

including a depreciation of NGN (6% down against USD in 2020).

Ghana

ASA Savings & Loans operations declined but managed to

recover and maintain excellent portfolio quality:

-- Number of clients down from 165k to 158k (down 4% YoY)

-- Number of branches up from 123 to 129 (up 5% YoY)

-- OLP up from GHS 237.4m (USD 41.6m) to GHS 248.3 m (USD 42.3m) (up 5% YoY in GHS)

-- Gross OLP/Client up to GHS 1.6k (USD 269) (up 9% YoY in GHS)

-- PAR>30 increased from 0.2% to 0.4%

-- No moratoriums granted to clients in the period

Nigeria

ASA Nigeria saw a contraction of operations in H1 2020 which

gradually recovered in H2 2020:

-- Number of clients down from 260k to 253k (down 3% YoY)

-- Number of branches maintained at 263

-- OLP up from NGN 11.9bn (USD 32.7m) to NGN 12.0bn (USD 31.2m) (up 1% YoY in NGN)

-- Gross OLP/Client up from NGN 47k (USD 129) to NGN 50k (USD 129) (up 6% YoY in NGN)

-- PAR>30 increased from 2.7% to 5.5%

-- Up to USD 1.0m in moratoriums granted to 24k clients between March and December 2020

Sierra Leone

ASA Sierra Leone continued to successfully expand with client,

branch and OLP growth:

-- Number of clients up from 34k to 36k (up 6% YoY)

-- Number of branches up from 37 to 41 (up 11% YoY)

-- OLP up from SLL 28.1bn (USD 2.9m) to SLL 43.6bn (USD 4.3m) (up 55% YoY in SLL)

-- Gross OLP/Client up from SLL 0.8m (USD 85) to SLL 1.2m (USD 123) (up 51% YoY in SLL)

-- PAR>30 declined from 5.1% to 4.4%

-- Up to USD 50k in moratoriums granted to 3.8k clients between March and December 2020

East Africa

% Change % Change % Change

FY H1

2019 FY 2019 2020

- - FY 2020 -

FY (constant FY

(Amounts in USD thousands) FY2020 H1 2020 FY 2019 2020 currency) 2020

Net profit 1,069 333 6,160 -83% -84% 221%

Cost/income ratio 90% 97% 62%

Return on average

assets 1.8% 1.2% 12.6%

Return on average

equity 6.7% 4.3% 51.0%

Earnings growth -83% -87% 69%

OLP 45,413 36,753 51,664 -12% -9% 24%

Gross OLP 46,188 39,607 51,878 -11% -8% 17%

Total assets 59,802 55,856 59,356 1% 7%

Client deposits 13,776 13,591 14,808 -7% 1%

Interest-bearing debt 26,292 24,245 25,835 2% 8%

Share capital and

reserves 16,313 15,408 15,476 5% 6%

Number of clients 319,262 301,515 348,542 -8% 6%

Number of branches 359 343 316 14% 5%

Average Gross OLP

per client (USD) 145 131 149 -3% 0.3% 10%

PAR > 30 days 13.2% 1.9% 0.6%

Client deposits as

% of loan portfolio 30% 37% 29%

East Africa saw a decline in operational performance and

profitability attributable to extended lockdown due to COVID 19 in

Uganda and Kenya. Only ASA Tanzania and ASA Zambia managed to

expand in number of branches and OLP.

Kenya

ASA Kenya decreased its operations:

-- Number of clients down from 101k to 92k (down 9% YoY)

-- Number of branches up from 90 to 100 (up 11% YoY)

-- OLP down from KES 1.8bn (USD 17.6m) to KES 1.4bn (USD 12.7m) (down 23% YoY in KES)

-- Gross OLP/Client down from KES 18K (USD 175) to KES 15K (USD 142) (down 13% YoY in KES)

-- PAR>30 increased from 1.3% to 21.9%

-- Up to USD 4.8m in moratoriums granted to 82k clients between March and December 2020

Tanzania

ASA Tanzania managed to expand its operations:

-- Number of clients down from 123k to 121k (down 1% YoY)

-- Number of branches up from 102 to 121 (up 19% YoY)

-- OLP up from TZS 47.1bn (USD 20.5m) to TZS 49.6bn (USD 21.4m) (up 5% YoY in TZS)

-- Gross OLP/Client up from TZS 384k (USD 167) to TZS 413k (USD 178) (up 7% YoY in TZS)

-- PAR>30 increased from 0.1% to 2.5%

-- Up to USD 267k in moratoriums granted to up to 10k clients between March and December 2020

Uganda

ASA Uganda saw a reduction in operations:

-- Number of clients down from 101k to 81k (down 20% YoY)

-- Number of branches up from 88 to 98 (up 11% YoY)

-- OLP down from UGX 38.0bn (USD 10.4m) to UGX 29.3bn (USD 8.0m) (down 23% YoY in UGX)

-- Gross OLP/Client down from UGX 377K (USD 103) to UGX 366K

(USD 100) (down 3% YoY in UGX), which is expected to remain lower

than in Kenya and Tanzania due to generally lower income levels in

Uganda

-- PAR>30 increased from 0.1% to 29.1%

-- Up to USD 4.7m in moratoriums granted between March and December 2020 to up to 197k clients

Rwanda

ASA Rwanda saw its operations shrink in H1 2020 and gradually

recover in H2:

-- Number of clients declined from 21k to 19k (down 9% YoY)

-- Number of branches maintained at 30

-- OLP slightly up from RWF 2.8bn (USD 3.0m) to RWF 2.9bn (USD 3.0m) (up 2% YoY in RWF)

-- Gross OLP/Client up from RWF 133K (USD 141) to RWF 151K (USD 153) (up 13% YoY in RWF)

-- PAR>30 increased from 0.8% to 10.1%

-- Up to USD 578k in moratoriums granted to 23.6k clients between March and December 2020

Zambia

ASA Zambia managed to expand its operations:

-- Number of clients increased from 2k to reach 5k

-- Number of branches increased from 6 to 10

-- OLP up from ZMW 2.5m (USD 179k) to ZMW 7.9m (USD 372k)

-- Gross OLP/Client up from ZMW 1.2k (USD 86) to ZMW 1.6k (USD 76)

-- PAR>30 declined to 5.8%

-- No moratoriums granted to clients

Regulatory Environment

The Company operates in a wide range of jurisdictions each with

their own regulatory regimes applicable to microfinance

institutions. At this time, the Company continues to pursue a

deposit-taking license in Pakistan and a non-deposit taking license

in Tanzania.

In all our operating countries the Governments instituted

lengthy lockdowns, ranging from two to eight weeks, and other

security measures to contain the infection rate of COVID-19, which

adversely affected the ability of many of our clients to conduct

their customary business. Most restrictions were gradually lifted

during the second half of 2020, which enabled the Group to re-open

branches and resume field activities. India started collections

after the end of the lockdown by the end of May 2020, but clients

were entitled to request a moratorium instituted by the Government

of India until 30 August 2020, which up to 484k clients availed of.

Uganda only fully resumed operations by mid-June 2020. As of 31

December 2020 , collection efficiency across the Group continued to

strengthen with 10 out of thirteen countries reporting collections

in the mid to high nineties. Temporary local and regional lock

downs or limitations on movement occurred in Sri Lanka, the

Philippines and Myanmar on the second half of the year.

Key Events 2020 and 2021

Pakistan

-- 2020: ASA Pakistan received in principle approval (via a No

Objection Certificate or 'NOC') from State Bank of Pakistan ('SBP')

to transform into a microfinance bank. ASA Pakistan made good

progress in completing all pre-licensing requirements set by the

central bank.

-- 2021: In January 2021, ASA Pakistan received extension in the

validity of the No Objection Certificate till 30 April 2021 for

completion of the MFB license requirements. It is expected that SBP

will complete the inspection of its head office and operations

during 2021 after which it is expected that the license will be

granted.

Sri Lanka

-- 2020: The microfinance sector has not yet fully recovered

from three major events that occurred during the past two years,

including (i) the introduction of the government backed debt relief

programme for microfinance loans in drought affected districts of

Sri Lanka in 2018, that eroded the repayment discipline of clients

across the country, which after-effects still persisted in 2019,

(ii) the 2019 Easter Sunday bomb attack and the knock-on effect on

the economy, and (iii) the spread of COVID-19 in 2020.

-- 2021: In addition, due to overall interest rate cuts by the

government in the financial sector following the economic downturn

due to COVID-19, there is concern that the interest rate cap of 35%

introduced 2020 may be further reduced.

Ghana

-- 2020: Bank of Ghana suspended all dividend payments for a

period of two years and pursuant to measures taken due to

COVID-19.

-- 2021: the suspension on dividends was removed by the Bank of

Ghana. Dividends can be declared subject to certain requirements

and approval by the Bank of Ghana.

Nigeria

-- 2020: The Central Bank approved the transfer of the net

assets from ASIEA to ASHA Microfinance Bank (the nationwide

microfinance bank) , which was completed by 1 April 2020.

-- 2021: New Banking & Other Financial Institutions Act 2020

passed in Nigeria to regulate the banking industry. The

implications hereof are yet to be analysed.

Tanzania

-- 2020: ASA Tanzania progressed in securing the non-deposit

taking license by the Central bank of Tanzania ('BoT'), which, once

received, will allow it to proceed with applying for a full deposit

taking license.

-- 2021: BoT is of the view that interest rates charged to

clients should not exceed 3.5% per month (42% p.a.). BoT inspection

of ASA Tanzania was completed in Q1 of 2021 in view of the ongoing

license application.

Myanmar

-- 2020: ASA Myanmar received the license to take savings from its clients.

-- 2021: Disruptions and civil unrest in Myanmar following the

military's takeover of the government in February 2021 with

nationwide protests and any related governmental measures are

expected to impact the operations.

India

-- 2021: The Reserve Bank of India proposed new uniform

regulations for all lenders in microfinance, including banks, which

had fewer restrictions so far compared to NBFC-MFIs. This may have

a positive impact on NBFC-MFIs, including ASA India. There is a

threat of government intervention, including possible loan and/or

interest waivers, in the microfinance sector in the State of Assam

following aggressive lending practices in the certain districts of

the State.

Regulatory Capital

Many of the Group's operating subsidiaries are regulated and

subject to minimum regulatory capital requirements. As of 31

December 2020, the Group and its subsidiaries were in full

compliance with minimum regulatory capital requirements.

Asset/Liability and Risk Management

ASA International has strict policies and procedures for the

management of its assets and liabilities as well as various

non-operational risks to ensure that:

-- The average tenor of loans to customers is substantially

shorter than the average tenor of debt provided by third party

banks and other third-party lenders to the Group and any of its

subsidiaries

-- Foreign exchange losses are minimized by having all loans to

any of the Group's operating subsidiaries denominated or duly

hedged in the local operating currency and all loans to any of the

Group's subsidiaries denominated in local currency are hedged in US

dollars

-- Foreign translation losses affecting the Group's balance sheet are minimised by preventing over-capitalisation of any of the Group's subsidiaries by distributing dividends and/or repaying capital as soon as reasonably possible

Nevertheless, the Group will always remain exposed to currency

movements in both (i) the profit & loss statement, which will

be affected by the translation of profits in local currencies into

USD, and (ii) the balance sheet, due to the erosion of capital of

each of its operating subsidiaries in local currency when

translated in USD, in case the US dollar strengthens against the

currency of any of its operating subsidiaries.

Funding

The funding profile of the Group has not materially changed

during 2020:

In USD millions

31 Dec

31 Dec 20 31 Dec 19 18

Local Deposits 80.2 78.1 64.0

Loans from Financial Institutions 274.1 260.6 221.2

Microfinance Loan Funds 23.5 27.2 17.8

Loans from Dev. Banks & Foundations 40.0 30.0 40.0

Equity 107.1 111.2 88.4

Total Funding 524.9 507.1 431.4

The Group maintains a favourable maturity profile with the

average tenor of all funding from third parties being substantially

longer than the average tenor at issuance of loans to customers

which ranges from 6-12 months for the bulk of the loans.

The Group and its subsidiaries have existing credit

relationships with more than 50 lenders throughout the world, which

has provided reliable access to competitively-priced funding for

the growth of its loan portfolio.

Some subsidiaries did not fulfil some of the ratios as required

in contracts for credit lines amounting to USD 172.7 million in

2020. Due to these breaches of covenant clauses, the lenders are

contractually entitled to request for immediate repayment of the

outstanding loan amounts. The Group already received waivers from

its lenders against all breaches except for loans amounting to a

total of USD 14.5 million, which are still in process. The balance

is presented as on demand as at 31 December 2020. The lenders have

not requested any early repayment of these loans as of this

date.

In expectation of additional potential temporary portfolio

quality covenant breaches in 2021 from increased overdue by some of

the Company's operating subsidiaries due to ongoing disruption

caused by COVID-19, the Company is in discussions to further extend

temporary waivers, no action and/or comfort letters from almost all

its major lenders for the remainder of 2021. The impact of these

potential covenant breaches was further assessed in the evaluation

of the Company's going concern as disclosed in note 2.1.

Impact of foreign exchange rates

As a USD reporting company with operations in thirteen different

currencies, currency movements can have a major effect on the

Group's USD financial performance and reporting.

The effect of this is that (i) existing and future local

currency earnings translate into less US dollar earnings, and (ii)

local currency capital of any of the operating subsidiaries will

translate into less US dollar capital.

Countries FY2020 FY2019 <DELTA> FY2019

- FY2020

Pakistan (PKR) 160.3 154.8 (4%)

India (INR) 73.0 71.3 (2%)

Sri Lanka (LKR) 185.3 181.4 (2%)

The Philippines

(PHP) 48.0 50.7 5%

Myanmar (MMK) 1330.7 1487.0 11%

Nigeria (NGN) 384.6 362.5 (6%)

Ghana (GHS) 5.9 5.7 (3%)

Sierra Leone

(SLL) 10107.0 9782.7 (3%)

Kenya (KES) 109.0 101.4 (8%)

Uganda (UGX) 3647.7 3665.4 0%

Tanzania (TZS) 2317.2 2298.0 (1%)

Rwanda (RWF) 986.4 943.2 (5%)

Zambia (ZMW) 21.1 14.1 (50%)

During 2020, the US dollar particularly strengthened against ZMW

+50%, KES +8% and NGN +6% as a result of the impact of COVID-19 on

the individual countries and global economy. This had an additional

negative impact on the USD earnings contribution of these

subsidiaries to the Group and also contributed to an increase in

foreign exchange translation losses. The total contribution to the

foreign exchange translation loss reserve during 2020 amounted to

USD 2.0m of which USD 1.2m related to the depreciation of the NGN

and USD 0.8m to depreciation of the PKR.

Forward Looking Statement and Disclaimers

This announcement does not constitute or form part of any offer

or invitation to purchase, otherwise acquire, issue, subscribe for,

sell or otherwise dispose of any securities, nor any solicitation

of any offer to purchase, otherwise acquire, issue, subscribe for,

sell, or otherwise dispose of any securities. The release,

publication or distribution of this announcement in certain

jurisdictions may be restricted by law and therefore persons in

such jurisdictions into which this announcement is released,

published or distributed should inform themselves about and observe

such restrictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFSTEFIEFIL

(END) Dow Jones Newswires

May 26, 2021 02:00 ET (06:00 GMT)

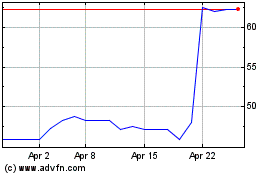

Asa (LSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024