TIDMASAI

RNS Number : 7307F

ASA International Group PLC

20 July 2021

ASA International Group plc June 2021 business update

Amsterdam, The Netherlands, 20 July 2021 - ASA International,

('ASA International', the 'Company' or the 'Group'), one of the

world's largest international microfinance institutions, today

provides the following update of the impact of COVID-19 on its

business operations as at 30 June 2021.

-- Liquidity remains high with approximately USD 108m of

unrestricted cash and cash equivalents across the Group.

-- The pipeline of funding deals under negotiation totalled approximately USD 163m.

-- With the exception of India, Sri Lanka and Myanmar, all other

operating companies achieved collection efficiency of more than

94%.

-- India collections decreased further to 55% due to lockdowns

in most states following the second wave of COVID-19 affecting the

whole country.

-- Sri Lanka collections for the month dropped to 38% following nationwide lockdowns.

-- The Philippines collections increased to 99% following

improvements in the operating environment due to fewer restrictions

on movement of people.

-- Collections in Myanmar increased to 70% despite the ongoing

disruptions following the military's takeover of the

Government.

-- Portfolio quality remained challenging, particularly in India

with benchmark PAR>30 for the Group, including off-book loans

and excluding loans overdue more than 365 days, increasing to 14.8%

from 14.0% in May 2021, and PAR>90 slightly improving to 11.1%

from 11.6% in May 2021. The Group's operating subsidiaries,

excluding India, the Philippines and Myanmar, collectively have

been able to maintain PAR>30 at 3.5%.

-- Disbursements as percentage of collections exceeded 100% in 5

countries with much lower percentages seen in India, Sri Lanka, and

Uganda, due to amongst others lockdowns.

-- The number of clients remained around 2.5m, while Gross OLP

decreased to USD 459m (11% higher than in June 2020 and 2.5% lower

compared to May 2021), due to amongst others the lockdowns in

India.

-- The moratoriums granted in June amounted to USD 48.3 m,

primarily due to loan restructuring of distressed clients in India

as per the Reserve Bank of India ('RBI') guidelines.

Health impact of COVID-19 on staff and clients

-- The immediate health impact of COVID-19 on the Company's

operations remained low with only 247 of over 12,500 staff members

confirmed as infected since March 2020 , but with no deaths . Since

March 2020, confirmed infections amongst 2.5m clients increased

from 4,977 at the end of May 2021 to 7,262 as at 30 June 2021,

resulting in 73 deaths since the start of the pandemic. Of the 73

client deaths across the Group, 32 are from India, with 9 of those

deaths occurring in June 2021.

Funding

-- Unrestricted cash and cash equivalents remained high at approximately USD 108m.

-- The Company secured approximately USD 34m of new loans from

local and international lenders in June 2021.

-- The majority of the Company's USD 163m pipeline of future

wholesale loans are supported by (agreed) term sheets and/or draft

loan documentation. The terms and conditions of the remaining loans

are being negotiated with lenders.

-- The Group is exploring the possibilities to raise some local

(Indian) equity capital to strengthen the balance sheet of ASA

India, in view of the increasing amount of ECL provisions in

India.

Collection efficiency until 30 June 2021 (1,2)

Countries Jan/21 Feb/21 Mar/21 Apr/21 May/21 Jun/21

------- ------- ------- ------- -------

India 82% 84% 87% 87% 67% 55%

Pakistan 98% 99% 99% 99% 99% 99%

Sri Lanka 97% 90% 91% 93% 57% 38%

The Philippines 75% 80% 85% 84% 89% 99%

Myanmar 89% 78% 59% 55% 67% 70%

Ghana 99% 100% 100% 100% 99% 99%

Nigeria 95% 97% 96% 95% 94% 96%

Sierra Leone 95% 89% 96% 93% 92% 94%

Kenya 97% 98% 100% 100% 99% 99%

Tanzania 99% 100% 100% 100% 100% 100%

Uganda 87% 93% 99% 100% 100% 95%

Rwanda 93% 91% 96% 95% 96% 96%

Zambia 100% 100% 100% 100% 99% 100%

----------------- ------- ------- ------- ------- ------- -------

(1) Collection efficiency refers to actual collections from

clients divided by expected collections for the period; since

any moratorium on the repayment of loans are only granted to

clients after the end of the month, the collection efficiency

is not affected by the grant of such moratorium.

(2) As of December 2020, the definition of collection efficiency

has been amended in view of the increased amount of overdue

collection and advance payments in various countries to: the

sum of actual regular collections, actual overdue collections

and actual advance payments divided by the sum of expected regular

collections, actual overdue collections and actual advance payments.

This also means that collection efficiency no longer can exceed

100%.

-- Collection efficiency across the Group increased or remained

broadly stable compared to the previous month in all countries,

with the exception of India and Sri Lanka .

-- Collections in India decreased to 55 % compared to the

previous month, due to the increased disruptions to operations

following lockdowns in most States, as a result of the severe

second wave of COVID-19, which affected disbursements and also

caused the Group to explore the possibilities to raise some equity

capital for ASA India (see the Funding paragraph).

-- Collections in Sri Lanka reduced to 38% due to the implementation of new lockdowns.

-- In the Philippines collections improved significantly to 99%,

as some local and regional restrictions on movement of people were

partially lifted.

-- Collections in Myanmar increased to 70% compared to the previous month, despite disruptions to the ordinary life

of citizens caused by the military's takeover of the Government and ongoing nation-wide protests.

Loan portfolio quality up to and including June 2021(3,4)

Gross OLP (in USDm) Non-overdue loans PAR>30

------------------------------------- ------------------------- -------------------------

Apr/21 May/21 Jun/21 Apr/21 May/21 Jun/21 Apr/21 May/21 Jun/21

India

(total) 177 167 155 70.0% 47.3% 57.5% 24.3% 27.8% 31.4%

Pakistan 76 76 75 96.9% 97.0% 98.4% 2.3% 1.8% 1.5%

Sri Lanka 9 9 8 89.0% 36.3% 62.7% 6.0% 7.7% 12.1%

Philippines 54 54 55 75.7% 76.8% 76.6% 21.7% 20.8% 20.0%

Myanmar 26 24 24 48.8% 58.2% 64.7% 3.1% 0.9% 0.7%

Ghana 47 46 46 99.4% 99.3% 99.2% 0.3% 0.3% 0.3%

Nigeria 34 32 33 91.3% 90.5% 90.8% 5.3% 5.3% 5.1%

Sierra

Leone 5 6 6 91.9% 92.2% 93.5% 4.6% 4.5% 4.3%

Kenya 16 17 17 86.0% 86.9% 87.6% 13.0% 12.1% 11.4%

Uganda 9 9 9 84.9% 87.4% 69.7% 14.9% 12.4% 12.7%

Tanzania 25 27 28 97.9% 98.1% 98.1% 1.9% 1.7% 1.6%

Rwanda 3 3 3 87.4% 89.0% 89.5% 9.7% 8.9% 8.4%

Zambia 1 1 1 98.6% 98.4% 98.9% 1.4% 0.7% 1.1%

Group 482 470 459 81.1% 73.1% 78.0% 13.3% 14.0% 14.8%

PAR>90 PAR>180

------------------------- -------------------------

Apr/21 May/21 Jun/21 Apr/21 May/21 Jun/21

India (total) 18.4% 21.9% 21.8% 8.4% 12.5% 17.1%

Pakistan 2.1% 1.7% 1.3% 1.8% 1.4% 1.1%

Sri Lanka 3.6% 4.0% 4.0% 3.0% 3.1% 2.8%

Philippines 19.1% 20.1% 19.4% 2.2% 2.5% 2.6%

Myanmar 2.3% 0.6% 0.5% 1.7% 0.3% 0.2%

Ghana 0.3% 0.3% 0.2% 0.3% 0.2% 0.2%

Nigeria 3.9% 3.7% 3.4% 3.1% 2.8% 2.3%

Sierra

Leone 3.2% 3.2% 3.2% 1.9% 1.8% 1.7%

Kenya 12.7% 11.8% 11.1% 11.5% 11.3% 10.8%

Uganda 14.9% 12.4% 12.6% 7.3% 10.1% 12.1%

Tanzania 1.7% 1.6% 1.5% 1.5% 1.4% 1.3%

Rwanda 7.8% 7.1% 7.1% 5.0% 5.4% 5.6%

Zambia 1.3% 0.4% 1.1% 1.0% 0.2% 0.8%

Group 10.6% 11.6% 11.1% 4.6% 6.0% 7.3%

(3) PAR>x is the percentage of outstanding customer loans with at

least one instalment payment overdue x days, excluding loans more

than 365 days overdue, to gross outstanding loan portfolio including

off-book loans.

(4) Gross loan portfolio includes the off-book BC and DA model, excluding

interest receivable and before deducting ECL provisions and modification

loss.

-- PAR>30 for the Group increased to 14.8%, primarily due to

the decreased collections in India and following restructuring of

loans for clients by offering moratoriums to clients impacted by

the recent lockdowns.

-- Credit exposure of the India off-book BC portfolio of USD

38.7m is capped at 5%. The included off-book DA portfolio of USD

2.3m has no credit exposure.

Disbursements vs collections of loans until 30 June 2021(5)

Countries Jan/21 Feb/21 Mar/21 Apr/21 May/21 Jun/21

--------- --------- -------- -------- ---------

India 90% 104% 131% 71% 3% 5%

Pakistan 97% 99% 99% 102% 89% (6) 102%

Sri Lanka 95% 116% 92% 43% 17% 0%

The Philippines 113% 101% 96% 88% 91% 88%

Myanmar 144% 55% 71% 30% 76% 87%

Ghana 94% 112% 118% 99% 91% (6) 99%

Nigeria 68% 105% 109% 109% 108% 109%

Sierra Leone 89% 109% 110% 95% 101% 118%

Kenya 97% 113% 107% 100% 100% 93%

Uganda 46% 99% 99% 105% 99% 53%

Tanzania 78% 97% 102% 107% 109% 96%

Rwanda 60% 73% 86% 95% 106% 81%

Zambia 137% 140% 115% 107% 142% 170%

--------------------- --------- --------- -------- -------- --------- --------

(5) Disbursements vs collections refers to actual loan disbursements

made to clients divided by total loans collected from clients in

the period.

(6) Slowdown in disbursements due to official EID holidays in

second week of May.

-- With the business environment continuing to gradually improve

in many countries, disbursements of new loans continued to

stabilise or increase in amount and as a percentage of weekly

collections, with the exception of India, Sri Lanka and Uganda, due

to amongst others the lockdowns.

Development of Clients and Outstanding Loan Portfolio until 30

June 2021

Gross OLP (in

Clients (in thousands) Delta USDm) Delta

Jun/20- May/21

May/21 Jun/20- Jun/21 -

Jun/20- - Jun/21 CC Jun/21

Countries Jun/20 May/21 Jun/21 Jun/21 Jun/21 Jun/20 May/21 Jun/21 USD (7) USD

India 727 735 721 -1% -2% 171 167 155 -9% -11% -7%

Pakistan 409 462 468 14% 1% 54 76 75 39% 31% -1%

Sri Lanka 56 56 54 -2% -3% 9 9 8 -4% 3% -3%

The

Philippines 308 331 335 9% 1% 48 54 55 15% 13% 1%

Myanmar 140 120 119 -15% -1% 30 24 24 -20% -5% 0%

Ghana 134 158 157 17% -1% 34 46 46 36% 38% -2%

Nigeria 225 253 251 12% -1% 24 32 33 38% 46% 3%

Sierra

Leone 30 40 40 31% 0% 3 6 6 93% 103% 5%

Kenya 78 109 113 44% 3% 12 17 17 35% 37% 1%

Uganda 96 86 85 -11% -1% 9 9 9 -5% -10% -9%

Tanzania 104 141 147 42% 4% 15 27 28 82% 82% 3%

Rwanda 20 18 17 -13% -2% 3 3 3 9% 13% 0%

Zambia 3 9 10 182% 10% 0 1 1 246% 332% 21%

Total 2,332 2,518 2,517 8% 0% 412 470 459 11% 12% -2.5%

(7) Constant currency ('CC') implies conversion of local

currency results to USD with the exchange rate from the beginning

of the period.

-- With disbursements decreasing mainly in India , Gross OLP

decreased 2.5% to USD 459m in June 2021 compared to the previous

month.

Selected moratoriums(8) on loan repayments until 30 June

2021

Clients under moratorium

(in thousands) As % of

Countries Apr/21 May/21 Jun/21 Total clients

India 0 0 226 31%

Pakistan 0 0 0 0%

Sri Lanka 1 0 11 20%

The Philippines 0 0 0 0%

Myanmar 60 56 0 0%

Ghana 0 0 0 0%

Nigeria 0 0 0 0%

Sierra Leone 0 0 0 0%

Kenya 0 0 0 0%

Uganda 0 0 0 0%

Tanzania 0 0 0 0%

Rwanda 0 0 0 0%

Zambia 0 0 0 0%

Total 61 56 237 9.4%

Moratorium amounts

(USD thousands)

Total June moratoriums

since as % of As % of

Countries Apr/21 May/21 Jun/21 Mar/20 OLP total moratoriums

India 0 0 48,201 63,018 31% 55%

Pakistan 0 0 0 0 0% 0%

Sri Lanka 16 0 134 2,168 2% 2%

The Philippines 0 0 0 26,404 0% 23%

Myanmar 1,315 1,290 0 12,354 0% 11%

Ghana 0 0 0 0 0% 0%

Nigeria 0 0 0 957 0% 1%

Sierra Leone 0 0 0 50 0% 0%

Kenya 0 0 0 4,830 0% 4%

Uganda 0 0 0 4,857 0% 4%

Tanzania 0 0 0 266 0% 0%

Rwanda 0 0 0 578 0% 1%

Zambia 0 0 0 0 0% 0%

Total 1,331 1,290 48,334 115,482 10.5% 100.0%

(8) Moratoriums relate to clients who have received an extension

for the payment of one or more loan instalments during the

month.

-- Moratoriums on loan repayments relate primarily to

approximately 30% of the clients in India, who were offered to

benefit from the one-time debt restructuring scheme established by

the RBI. See RBI COVID-19 Restructuring Guidelines .

-- Moratoriums granted in Sri Lanka were due to disruption in

operations following national lockdowns.

-- The moratorium amount across the Group was USD 48.3m, which

represents 10.5 % of the Group's Gross OLP.

Key events in June 2021

-- In India, RBI released a Consultative Document on Regulation

of Microfinance on 14 June 2021. RBI proposes a harmonisation of

regulations for all entities operating in the microfinance sector.

If adopted, the new regulations would create the same operating

environment for NBFC-MFIs, Small Finance Banks, NBFC and Universal

Banks operating in the microfinance sector. The Consultative

Document proposes amongst others the removal of existing caps for

NBFC-MFIs on the number of total lenders (two NBFC-MFIs, three in

total), ticket sizes, tenures, and loan pricing (10% margin cap),

which were up until now only applicable to NBFC-MFIs.

Please note that, while the Company's operational performance

appears to gradually normalize in most countries except for India

and Sri Lanka, the risk of additional challenges to our operations

should not be underestimated due to (i) the still relatively high

infection rates, (ii) the current lack of available vaccines in

most of our operating countries, (iii) the risk of the introduction

of more infectious COVID-19 variants in our operating countries as

have been observed in the United Kingdom, South Africa, Brazil, the

Philippines and India, and (iv) the associated disruption this may

cause to the businesses of our clients.

---

Enquiries:

ASA International Group plc

Investor Relations +31 6 2030 0139

Véronique Schyns vschyns@asa-international.com

About ASA International Group plc

ASA International is one of the world's largest international

microfinance institutions, with a strong commitment to financial

inclusion and socioeconomic progress. The company provides small,

socially responsible loans to low-income, financially underserved

entrepreneurs, predominantly women, across South Asia, South East

Asia, West and East Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFFFMUEFSESW

(END) Dow Jones Newswires

July 20, 2021 02:00 ET (06:00 GMT)

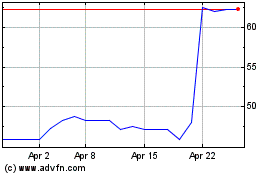

Asa (LSE:ASAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asa (LSE:ASAI)

Historical Stock Chart

From Apr 2023 to Apr 2024