Ashmore Group PLC Trading Statement (0089P)

14 October 2021 - 5:00PM

UK Regulatory

TIDMASHM

RNS Number : 0089P

Ashmore Group PLC

14 October 2021

Ashmore Group plc

14 October 2021

FIRST QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces the following update to

its assets under management ("AuM") in respect of the quarter ended

30 September 2021.

Assets under management

Actual Estimated

30 September

30 June 2021 2021 Movement

Theme (US$ billion) (US$ billion) (%)

- External debt 18.7 18.8 +0.5%

--------------- --------------- ---------

- Local currency 31.9 30.5 -4.4%

--------------- --------------- ---------

- Corporate debt 11.3 10.3 -8.8%

--------------- --------------- ---------

- Blended debt 23.4 22.4 -4.3%

--------------- --------------- ---------

Fixed income 85.3 82.0 -3.9%

--------------- --------------- ---------

Equities 7.7 7.8 +1.3%

--------------- --------------- ---------

Alternatives 1.4 1.5 +7.1%

--------------- --------------- ---------

Total 94.4 91.3 -3.3%

--------------- --------------- ---------

Assets under management declined by US$3.1 billion over the

period, comprising net outflows of US$1.0 billion and negative

investment performance of US$2.1 billion.

There were net inflows in the external debt and equities themes

and net outflows in the local currency, corporate debt and blended

debt themes over the quarter. The net outflows were influenced by a

small number of large institutional redemptions and there was a

small net outflow from intermediary retail clients. New mandates

were won in external debt, blended debt, local currency and

equities, and there continues to be good demand for investment

grade strategies.

Market sentiment, prompted by the macro environment,

deteriorated as the quarter progressed, and the consequent

reduction in investor risk appetite in September meant that returns

were negative for the period overall. While certain of Ashmore's

strategies underperformed, as is typical in such a market

environment, equity and investment grade strategies outperformed.

Relative performance over one, three and five years remains broadly

consistent with the position in June.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Investors have focused increasingly on the global growth

outlook, including the impact of higher commodity prices, supply

chain challenges and China's ongoing reforms. Meanwhile,

vaccination rates are increasing and restrictions are easing across

a wide range of Emerging Markets, delivering a pickup in leading

indicators and a broadening of economic growth. Further, central

banks in emerging countries are raising interest rates, reinforcing

the attractive yields available. This positive fundamental backdrop

is not reflected in current valuations, presenting an opportunity

for Ashmore's active investment processes to exploit and enabling

investors to benefit from increasing their allocations to Emerging

Markets."

Notes

Local currency AuM includes US$12.1 billion of AuM managed in

overlay/liquidity strategies (30 June 2021: US$12.3 billion).

Ashmore's Legal Entity Identifier (LEI) is

549300U3L59WB4YI2X12.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Neil Doyle +44 (0)20 3727 1141

Kit Dunford +44 (0)20 3727 1143

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFERITLVLIL

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

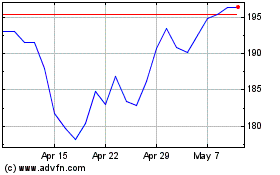

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

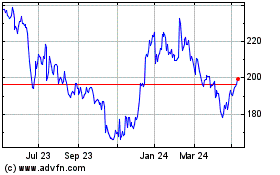

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024