TIDMASLI

RNS Number : 4633N

Aberdeen Standard Eur Lgstc Inc PLC

30 September 2021

29 September 2021

ABERDEEN STANDARD EUROPEAN LOGISTICS INCOME PLC (the

"Company")

LEI: 213800I9IYIKKNRT3G50

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2021

Focus on high quality and structurally supported Continental

Europe mid box and urban warehouse assets delivers another period

of strong NAV and earnings growth

Aberdeen Standard European Logistics Income PLC, the Continental

European investor in modern warehouses, which is managed by abrdn,

today announces its interim results for the six months to 30 June

2021.

Continued NAV and earnings growth:

- Net asset value per ordinary share increased by 3.3% to

EUR1.24 (31 December 2020: EUR1.20)

- Share price total return of 12.0%

- NAV total return (in Euro terms) of 5.2% for the period and

14.7% for the 12 months to 30 June 2021, primarily driven by

ongoing favorable yield movement

- Loan to Value of 31.7% (all in cost of debt 1.36%, average term to maturity 5.5 years)

- Declared dividends of 2.82 Euro cents (equivalent to 2.42

pence) per share in respect of the period, in line with the target

for the financial year

- Reflecting the Company's growth ambitions, a GBP19.4 million

oversubscribed equity issuance completed in March 2021, and as

announced on 29 September 2021, a post-period end oversubscribed

GBP125 million equity issuance, with strong pipeline of

acquisitions identified

Acquisitions and focus on asset and counterparty quality take

gross assets to over EUR500 million:

- Strong rent collection with 99% of rent due for the period collected

- Portfolio valued at EUR492 million, reflecting yield

compression and new acquisitions; on a like for like basis, the

portfolio value increased by 3.4% over 31 December 2020

- Two acquisitions, totalling EUR46.8 million, taking the total

portfolio to 16 modern properties, diversified by geography and

tenant:

-- A 34,000 sqm warehouse in Lodz, Poland, for EUR28 million,

reflecting a net initial yield of 5.5%

-- Post-period end, the EUR18.8 million acquisition of a modern

urban logistics warehouse in Barcelona, Spain, reflecting a net

reversionary yield of 4.7%

- Weighted average unexpired lease term ("WAULT") of 7.4 years

Further progress delivering on ambitious sustainability

targets:

- Long-term solar panel leases at the Company's Ede and Den

Hoorn assets have delivered a capital uplift of approximately EUR1

million

- Four out of a maximum of five Green Stars with a GRESB score

of 79/100, which compares favourably with the 68/100 average score

for the Western Europe Industrial Distribution Warehouse peer

group

Tony Roper, Chairman, Aberdeen Standard European Income

Logistics, commented:

"To date we have built a diversified portfolio of 16 modern,

high quality logistics warehouses with long term, inflation linked

income characteristics. Our ambition is to increase the size of

Company, while replicating the outperformance delivered by the

Manager to date. With the support of both the new and existing

shareholders who participated in the successful equity raise and a

sizeable pipeline of acquisition opportunities, we are well placed

to achieve this ambition and can look forward to the further scale

and diversification benefits which additional investment will

afford."

Evert Castelein, Lead Fund Manager, Aberdeen Standard European

Income Logistics, added:

"The structural changes underpinning the continued growth of the

European logistics sector show little sign of abating. Supply

chains are being optimised with the demand for logistics boosted by

the rise of e-commerce as more people across Europe have adapted to

buying online. Alongside this, we are increasingly seeing the

growing trend of near-shoring overseas manufacturing closer to home

and higher inventory levels, in order to reduce operational risks.

The result is a significant demand supply imbalance of modern

Grade-A stock, in strong locations, meaning that vacancy rates are

at historically low levels.

"The Company's forensic approach to asset selection and strict

investment criteria has resulted in another period of strong

financial performance. By focusing on property fundamentals and

counterparty quality, we feel well placed to capture both rental

and capital growth, with the necessary downside protection. Despite

the weight of global capital seeking to access the sector, the

opportunity in the mid box and urban logistics space for

experienced managers with deep local market expertise remains

sizeable, underpinning our strong conviction in the Company's

prospects."

-Ends-

For further information please contact:

Aberdeen Standard Fund Managers Limited +44 (0) 20 7463 6000

Luke Mason

Gary Jones

Investec Bank plc +44 (0) 20 7597 4000

David Yovichic

Denis Flanagan

FTI Consulting +44 (0) 20 3727 1000

Dido Laurimore

Richard Gotla

James McEwan

HIGHLIGHTS AND FINANCIAL CALAR

Financial Highlights

30 June 31 December

2021 2020

====================================== ========= =============

Total assets (EUR'000) 539,992 484,104

====================================== ========= =============

Equity shareholders' funds (EUR'000) 325,018 293,596

====================================== ========= =============

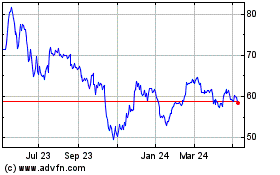

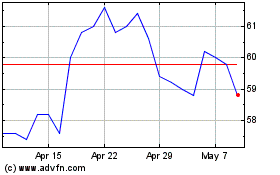

Share price - Ordinary share (pence) 119.00 108.50

====================================== ========= =============

Net asset value per Ordinary share

(EUR) 1.24 1.20

====================================== ========= =============

Share price premium to sterling net

asset value 12.2% 0.5%

====================================== ========= =============

Performance (total return)

Six months ended Year ended 31 Since Launch

30 June 2021 December 2020 return

======================== ================= =============== =============

Share Price1 12.0% 26.6% 37.1%

======================== ================= =============== =============

Net Asset Value (EUR)1 5.2% 13.6% 25.8%

======================== ================= =============== =============

1 Considered to be an Alternative Performance Measure (see

printed Half Yearly Report for more information).

Financial Calendar

24 September 2021 Payment of second interim distribution for year

ending 31 December 2021

================= ======================================================

29 September 2021 Announcement of unaudited half yearly results

================= ======================================================

October 2021 Half Yearly Report posted to Shareholders

================= ======================================================

30 December 2021 Payment of third interim distribution for year

ending 31 December 2021

================= ======================================================

25 March 2022 Payment of fourth interim distribution for year

ending 31 December 2021

================= ======================================================

April 2022 Announcement of Annual Financial Report for

the year ending 31 December 2021

================= ======================================================

May 2022 Annual Report available on line (and posted

to those registered Shareholders who have requested

hard copies)

================= ======================================================

June 2022 Annual General Meeting in London

================= ======================================================

June 2022 Payment of first interim distribution for the

year ending 31 December 2022

================= ======================================================

INTERIM BOARD REPORT - CHAIRMAN'S STATEMENT

Overview

I am pleased to be presenting the Company's half yearly report

for the six months ended 30 June 2021.

The Company is solely focussed on investing in logistics real

estate in Europe, with our strategy targeting both medium sized

"mid box" assets and smaller format "urban logistics" that will

serve 'last mile' functions for Europe's rapidly growing e-commerce

activities.

Timely share issuances, together with cautious leverage, have

enabled the Investment Manager to acquire a well-diversified

portfolio of modern logistics warehouses in established locations.

These assets typically benefit from durable and growing income

streams with long index-linked leases secured against a diversified

range of tenants. The prospective growth of the Company will follow

the existing investment strategy, targeting a range of logistics

real estate assets that the Investment Manager believes are well

located, close to established distribution hubs and population

centres that will provide the Company with increased asset and

tenant diversification and enable it to meet its investment

objective.

The share price ended the period under review at 119.0p, up from

108.5p at year end, and has been supported by a range of investors

seeking investment into the logistics sector through a quality,

income-producing portfolio with a low risk profile and competitive

fees.

A key uncertainty affecting the operations of the Company was

the continued impact of Covid-19 and its potential to disrupt the

suppliers of services to the Company. I am pleased to report that

these services have continued to be supplied without interruption

during the period.

In April 2021 we announced the acquisition of a modern logistics

and distribution property in Lodz, Poland for EUR28.1 million,

representing a net initial yield of 5.6%, purchased from logistics

and industrial developer Panattoni, with whom the Investment

Manager has a strong relationship.

Located at the centre of Poland's thriving industrial and

manufacturing sector, the property is situated adjacent to the

Bosch-Siemens Campus, which is a strategically important production

and distribution hub for the international manufacturer. The site

benefits from access to the Intermodal Container Terminal, created

to support the Bosch-Siemens campus and which offers direct rail

connections with China.

This purchase was followed in July 2021 with the Company

announcing that it had completed on the acquisition of a modern

urban logistics warehouse in Polinyà, Barcelona, Spain's second

most populous city. The purchase price of EUR18.8 million reflects

a net initial yield of 3.7% and, importantly, a net reversionary

yield of 4.7%.

This 13,900 square metre asset is located in the first ring of

Barcelona, which is within a 25 minute drive (27km) of the city

centre and is well positioned to benefit from the growth of

e-commerce and the scarcity of development opportunities, which

provides strong rental growth potential. The local market is

characterised by a low vacancy rate of 3%, which falls to just 1%

for the first ring, reflecting naturally occurring land

constraints, with the city surrounded by the sea and mountains.

The asset, in a strategically positioned and highly consolidated

industrial area connecting Barcelona with France and the wider

European market in the north, and to Zaragoza, Madrid and other key

cities along the Mediterranean coast of Spain, is an ideal addition

to the portfolio.

This was the Company's third investment in Spain and its first

in Barcelona, providing further diversification within the

portfolio.

Further details on the Company's portfolio are provided in the

Investment Manager's Report.

Results

The unaudited Net Asset Value ("NAV") per share as at 30 June

2021 was EUR1.24 (GBp - 106.1p), compared with the NAV per share of

EUR1.20 (GBp - 107.9p) at the end of 2020, reflecting, with the

interim dividends declared, a NAV total return of 5.2% for the six

month period under review, in euro terms. Over the 12 months ended

30 June 2021, the NAV total return was 14.7% reflecting the strong

valuation uplifts that we have witnessed.

The closing Ordinary share price at 30 June 2021 was 119.0p (31

December 2020 - 108.5p), representing a premium to the NAV per

share of 12.2%.

Rent collection

The half year ended with 99% of rents (payable in advance)

collected, with a small amount of rent due on the Meung sur Loire

property in respect of January 2021, which amounted to EUR258,000

unpaid as previously reported.

Pleasingly, for the quarter ended 30 June 2021, the Company

collected 100% of the rents due from tenants.

As previously announced it is expected that the administrator

appointed by the French courts to oversee the sale of Office

Depot's business will surrender the lease on the Meung sur Loire

warehouse. Whilst the administrator continues to pay rent, when

this ceases the Company will be able to draw on the three month

rental guarantee already held at bank while a new tenant is

actively sought through the appointed agents.

Dividend

On 24 February 2021 the Board declared a fourth interim

distribution of 1.41 euro cents (equivalent to 1.24 pence) per

Ordinary share in respect of the year ended 31 December 2020. In

aggregate a total dividend of 5.64 euro cents was paid in respect

of the 2020 financial year. The equivalent sterling rate paid was

4.96 pence.

First and second interim distributions of 1.41 euro cents

(equivalent to 1.21 pence) have been declared in respect of the

year ending 31 December 2021. Further details are shown below:

Distributions declared Dividend Interest Ex date Record date Pay date

income income

======================= ======== ======== ======== =========== =========

4th interim 2020 -

1.41c (1.24p) 0.80p 0.44p 4 Mar 21 5 Mar 21 26 Mar 21

======================= ======== ======== ======== =========== =========

1st interim 2021 -

1.41c (1.21p) 0.80p 0.41p 3 Jun 21 4 Jun 21 25 Jun 21

======================= ======== ======== ======== =========== =========

2nd interim 2021 -

1.41c (1.21p) 0.95p 0.26p 2 Sep 21 3 Sep 21 24 Sep 21

======================= ======== ======== ======== =========== =========

Interim dividends continue to be declared in respect of the

quarters ending on the following dates: 31 March, 30 June, 30

September and 31 December in each year.

In light of the demand for the Company's shares from investors

based in Europe and in order to maintain its attractiveness to

future investors, Shareholders may now elect to receive dividend

payments in Euros instead of Sterling. A currency election period

will be introduced from the record date of each dividend for

approximately 10 days to permit Shareholders to make their currency

choices.

Once a Shareholder has elected to receive dividends in Euros,

then all future dividends will be paid in Euros unless the

Shareholder elects to switch back to Sterling payments.

The default position will continue to be Sterling payments. For

CREST enabled Shareholders, this will be made available via

CRESTPay. Shareholders that hold their Ordinary shares in

certificated form will be able to elect to receive a Euro payment

via the Equiniti Shareview Portfolio. By accessing "My Investments"

and clicking on the "Dividend Election" link next to the "Aberdeen

Standard European Logistics Income" shares Shareholders will be

able to select Euro. If Shareholders have not already signed up for

a Shareview Portfolio they may register at

shareview.co.uk/register.

Fund raising and share issuance

The Investment Manager continues to review an attractive

pipeline of possible acquisitions for the Company for which

additional capital is required.

In March 2021 the Company issued 18.45m million new Ordinary

shares at a price of 105 pence per share. The shares were issued

under the remaining authority granted by Shareholders to issue up

to 10% of the issued share capital on a non pre-emptive basis and

the issue was over-subscribed. Following this issue of new Ordinary

shares, the total number of shares in issue and voting rights in

the Company was 262,950,001 shares.

Since the period end, on 8 September 2021, the Company announced

proposals to raise a target amount of GBP75 million to fund

additional acquisitions together with putting in place a share

issuance programme to enable future purchases, subject to

Shareholder approval. The proposals together comprised:

-- a target issue of GBP75 million through the issue of new

Ordinary shares pursuant to a Placing, Open Offer and Offer for

Subscription (together the "Issue"); and

-- the ability to issue up to a further 250 million Ordinary

shares and/or C Shares in aggregate on a non-pre- emptive basis

through a share issuance programme (the "Share Issuance

Programme").

On 29 September 2021 the Board confirmed the results of the

fundraising issue with gross proceeds of GBP125 million having been

raised. The very positive response to the Company's fundraising

from both existing shareholders and new investors is a clear

endorsement of the strategy and performance of the Company to date.

The issue was significantly over-subscribed and with the near-term

pipeline of acquisition opportunities growing since early

September, after careful consideration the Board increased the size

of the Issue to GBP125 million.

Both the proposed Issue and the Share Issuance Programme are

conditional upon, amongst other things, the Company obtaining

Shareholder approval at the General Meeting that has been convened

for 11:00 a.m. on 30 September 2021.

Investment policy clarity

Whilst publishing the recent prospectus in connection with the

Issue mentioned above, the Board together with its advisers and the

Manager have taken the opportunity to provide further clarity

around the Company's investment policy. There has been no material

change in respect of the policy and a copy of the new wording may

be found on the Company's website.

Revolving credit facility

At the time of the Annual Report I confirmed that the Company

had entered into a new EUR40 million Revolving Credit Facility

("RCF") at the parent Company level provided by Investec Bank.

Subsequent to the period end, the Board agreed an increase in the

size of the facility to EUR70m. The increased RCF will further

enhance the Company's ability to move quickly when acquiring new

assets and reduce the impact of cash drag on the Company's

investment returns.

Long term financing

The Investment Manager's treasury team has sourced fixed term

debt from banks which is secured on certain assets or groups of

assets within the portfolio.

Asset level gearing at the period end was 31.7%, below the

Company's target level of 35%.

The Company's non-recourse loans range in maturities between

3.75 and 7.25 years with interest rates ranging between 0.94% and

1.62% per annum.

The current average interest rate on the total fixed term debt

arrangements of EUR144.6 million (excluding the RCF) is 1.36%. The

Board continues to keep the level of borrowings under review,

calculated at the time of drawdown for a property purchase. The

actual level of gearing may fluctuate over the Company's life as

and when new assets are acquired or whilst short term asset

management initiatives are being undertaken. Banking covenants are

reviewed by the Investment Manager and the Board on a regular

basis.

ESG and Asset Management

The Company believes that comprehensive assessment of ESG

factors leads to better outcomes for shareholders and adopts the

Investment Manager's policy and approach to integrating ESG.

The Investment Manager has identified a range of key forces for

change comprising Environment & Climate, Governance &

Engagement, Demographics and Technology & Infrastructure. These

four forces naturally encompass a diverse range of topics and

concerns and our Investment Manager has translated and codified

these into its investment approach, while also aligning them to the

UN Sustainable Development Goals. It believes that these forces

will shape the future and, in turn, shape our long-term approach by

guiding how ESG factors are prioritised at the Company and asset

level.

The current portfolio has strong ESG credentials and more can be

found in the Investment Manager's report

which follows.

Asset management is essential for preserving and adding value to

the portfolio and ultimately for shareholders. Our Investment

Manager has a team of people in Europe working with tenants and

real estate experts as we see opportunities to not only improve

buildings and add a better working environment but to also extend

where the footprint allows. Meung sur Loire and Waddinxveen are two

examples where there are opportunities to add value and where the

team on the ground has been discussing options to seek to enhance

size and potential value.

Change of Company name

In order to align the Company's name with the name of the

Manager's business, which has recently changed to abrdn plc, the

Board has resolved to change the Company's name to abrdn European

Logistics Income PLC. This will take effect from the start of the

Company's new financial year on 1 January 2022. The Company's

ticker, ASLI, will remain unchanged.

Outlook

The European logistics market is large and continues to develop

rapidly; growing tenant demand is fuelled by the strong growth of

e-commerce across Europe and the consequent supply chain

reconfiguration as operators embrace this technological

advancement. Of additional note is the rapid acceleration of

interest and demand amongst logistics occupiers to adhere to higher

ESG standards and the Investment Manager both recognises and has

embraced this fundamental change in occupational demand for

suitable buildings.

As a consequence of strong occupier demand, and constrained

supply conditions, tenants have been prepared to secure favoured

assets by signing long, index-linked or fixed uplift, lease

contracts. Such indexed leases typically offer annual CPI uplifts

and can provide for a transparent and predictable inflation-proofed

cash flow to the Company.

In an increasingly uncertain world, the incontrovertible shift

in the way consumers shop and the infrastructure required to

service that demand is a source of greater certainty. The

Investment Manager believes that logistics assets are primed for

further growth, as well as being relatively defensive against any

cyclical downturn in economic activity. As such the Company's

portfolio is characterised by having long leases secured against

financially robust tenants.

To date we have built a diversified portfolio of 16 modern, high

quality logistics warehouses with long term, inflation linked

income characteristics, which has underpinned year on year

valuation gains and delivered attractive returns for Shareholders.

The Investment Manager has a strong pipeline of assets that will

sit well within the portfolio and we look forward to the further

scale and diversification benefits which these investments will

provide.

Tony Roper

Chairman

29 September 2021

INTERIM BOARD REPORT - INVESTMENT MANAGER'S REVIEW

Overview

The first half of 2021 witnessed a cautious reopening of

economies across Europe, as the vaccination roll-out programme

gathered pace. Whilst concerns over new variants are likely to make

the 'hoped for' path towards a full and sustainable recovery a

volatile one, we continue to be buoyed by the performance of the

logistics sector, which held up very well, outperforming the office

and retail segments.

Supply chains are being optimised as the demand for all aspects

of the logistics sector is boosted by the rise of e-commerce, as

more people across Europe embrace online purchasing. Together with

the increasing trend of near-shoring overseas manufacturing as

companies seek to reduce operational risks and the building of

increased inventory levels, the sector is dealing with a demand-

supply imbalance leading to vacancy rates at historically low

levels.

Strong underlying fundamentals have been driving capital into

the sector, reinforcing a strong belief that the logistics sector

will outperform, with investors benefiting from growing and

reliable income streams and capital growth.

With our local teams located across Europe, we have been able to

build a well-diversified, high quality portfolio, with 9 of our 16

buildings new at the time of purchase. This underpins our

confidence that the portfolio is liquid (in demand) and well

positioned for the future.

Rent collection held up very well in 2020 and H1 2021 reflecting

the diverse nature and overall strength of our tenant base.

Increasing property valuations in the period, reviewed by the

independent valuer, CBRE GmbH, underpinned further NAV growth and

the delivery of double digit returns.

Overall we believe that the diverse nature of the assets and

tenants, together with the long-dated inflation protected nature of

the income, with sensible gearing, offers a compelling investment

for investors.

Our ambition is to mitigate risk through further diversification

of the portfolio through the acquisition of high quality assets

which will improve the current portfolio's ESG credentials, with a

strong focus on reducing its carbon footprint. We incrementally

added to the portfolio during the period with acquisitions in Lodz,

Poland and Polinyà, Barcelona, Spain, which were completed in April

and July 2021 respectively, bringing the total number of assets now

to 16.

Logistics sector benefits from strong fundamentals

The European logistics market is sizeable and continues to

develop rapidly; growing tenant demand is fuelled by the rapid

growth of e-commerce across Europe, a trend which has accelerated

through increased smartphone ownership and the increased

technological capabilities of wireless devices. The arrival of

Amazon and other online retailers created a tipping point in 2016

in Europe which led to the growth in logistics demand rising at a

faster rate. The Covid-19 pandemic dramatically accelerated this

pre-existing trend, pushing online retail sales volumes to record

levels with unexpected growth of c.31% in 2020, and while this was

under exceptional circumstances the level is forecast to remain

structurally higher than before the pandemic due to permanent

changes in people's shopping habits.

At the same time, long distance supply chains have proven to be

vulnerable due not only to Covid-19, but also to global events like

the recent Suez Canal blockage. This helps explain the growing

near-shoring trend with manufacturers considering bringing

production closer to home or keeping higher inventory levels at

warehouses in order to make the supply chain more resilient to such

shocks. The Covid-19 pandemic re-opened the debate about the merits

and drawbacks of highly coordinated global supply chains.

However, an increasingly uncertain political environment and the

looming effects of climate change had already prompted concerns

about robustness, resilience and the very structure of such 'just

in time' global supply models. These trends together are driving

the demand for modern logistics space to higher levels each year,

with warehouse supply unable to keep up, resulting in a heavily

undersupplied market and vacancy rates at c.4%.

As a consequence, tenants are increasingly prepared to sign

long, CPI index-linked lease contracts to secure the most sought

after assets. The requirement for what the industry terms 'last

mile' warehouses to be close to or within the major centres of

population also coincides with rapid urbanisation across Europe,

where city populations are growing rapidly and logistics assets

competing with other land uses, driving land prices and rents

upwards. These factors are why we will continue to focus on urban

logistics.

Building a well-diversified portfolio with 'liquid' or saleable

assets

Diversification and liquidity are key considerations for us when

considering any purchase, with the portfolio's risk currently

spread across 16 logistics warehouses located in five European

countries and leased to 44 tenants. During the first six months of

2021, two buildings were added to the portfolio. In April, the

Manager exchanged contracts on a brand new warehouse in Lodz,

Poland, for EUR28.1 million, reflecting a net initial yield of

5.6%. This cross-dock warehouse is leased to seven tenants with

strong links to the location thanks to the presence of the

Bosch-Siemens Campus and direct access to the Silk Road, the

railway connection between Asia and Europe.

In July the Company exchanged contracts on an urban logistics

warehouse in Barcelona, Spain, for a net purchase price of EUR18.8

million, reflecting a net initial yield of 3.7% on current rent. As

a city, Barcelona is supply constrained by nature due to the close

presence of the sea and the mountains. With the city expanding, it

is extremely difficult to find new logistics locations, thus

creating upside potential for the Company in terms of rental

income, resulting in an expected reversionary yield of 4.7%

following the first break. The asset is located on the Polinyà

Logistic Park, a strategically positioned and highly consolidated

industrial area just off the AP-7 motorway that connects Barcelona

with France and the wider European market in the north, and to the

south to Zaragoza, Madrid and other key cities along the

Mediterranean coast of Spain.

At the end of June 2021, the portfolio was valued at EUR492.3

million. Excluding the Lodz asset, this shows a solid increase of

3.4% over the first half of the year despite a short term reduction

of EUR6.5 million in respect of the Meung sur Loire valuation

whilst we seek a new tenant for the building. With Lodz showing an

increase of 4.0% over the initial purchase price to 30 June and

including our Barcelona asset at cost which was purchased in July

the total portfolio gross asset value is c.EUR510 million.

At 30 June 2021, the Netherlands, considered one of the most

attractive logistics markets in Europe by the Investment Manager,

had the largest allocation in the portfolio by value at 46.0%,

followed by Poland 18.3%, France 15.3%, Germany 14.2% and Spain

6.2%. The allocation to Spain increased to almost 10% with the

addition of the warehouse in Barcelona in July, with exposure to

the other countries decreasing proportionally.

More than any other sector, real estate logistics is looking

beyond national borders and is driven by international trade flows.

For an operator, the quality of a location will depend on a

combination of several factors. For example, the quality of the

local infrastructure, population density, spending power,

e-commerce adoption and the availability of labour and labour

costs. Over the last decade, the most active markets in Europe were

ranked (in order): the Netherlands, Germany and Poland measured by

square metres of transactions per capita. This is exactly where the

Company has been focussed and active with 11 of its 16

acquisitions, or 76% of the total portfolio value. Liquidity or

saleability is always a key focus for us. This will depend not only

on the quality of the location but also on the asset specifications

which need to be modern and when combined together will give the

building a 'second-life', thus making it attractive to other

potential tenants. In addition, with our on the ground resources in

many of these European countries, we are able to manage and work

closely with developers and other contractors to add value to

assets that may require modernisation or re-formatting.

The Netherlands is our largest country exposure, reflecting its

position as a gateway to the European market, thanks to its

strategic location and the presence of Rotterdam, the largest

seaport in Europe. Logistics density in stock per capita is the

second highest in Europe with many European Distribution Centres

found alongside the main transport corridors leading to Belgium and

Germany. Land for new developments in this densely populated

country is scarce, explaining our overweight exposure, with six

Dutch assets in the portfolio.

The logistics market in Poland is also expanding rapidly,

clearly benefiting from the dominant manufacturing Sector, in

combination with the low labour costs and it being the first stop

for the Silk Road and giving it a competitive edge in Europe. For

these reasons, Poland is now our second largest country allocation,

with three warehouses, providing the Company with a yield pick-up

over certain other regions. The manufacturing sector is most

dominant in Germany, the largest economy in Europe, where we have

two multi-tenanted warehouses in the densely populated Frankfurt

Rhine-Main region. The remainder of the portfolio comprises two

warehouses on established logistics hubs in France and three in

Spain, of which two are urban logistics warehouses with especially

strong rental growth expectations.

Property portfolio as at 30 June 2021

WAULT incl WAULT excluding % of Fund

Country Location Built breaks breaks in

in yrs yrs

============ ================ ============ ========== =============== =========

France Avignon 2018 6.1 10.2 10.4

============ ================ ============ ========== =============== =========

France Meung sur Loire 2004 - - 4.3

============ ================ ============ ========== =============== =========

Germany Erlensee 2018 4.7 6.9 8.4

============ ================ ============ ========== =============== =========

Germany Flörsheim 2015 3.6 7.3 5.3

============ ================ ============ ========== =============== =========

Netherlands Den Hoorn 2020 8.9 8.9 11.7

============ ================ ============ ========== =============== =========

Netherlands Ede 1999/2005 6.5 6.5 3.4

============ ================ ============ ========== =============== =========

Netherlands Oss 2019 13.0 13.0 6.5

============ ================ ============ ========== =============== =========

Netherlands s Heerenberg 2009/ 2011 10.5 10.5 6.4

============ ================ ============ ========== =============== =========

Netherlands Waddinxveen 1983 - 2018 12.4 12.4 9.1

============ ================ ============ ========== =============== =========

Netherlands Zeewolde 2019 13.0 13.0 7.3

============ ================ ============ ========== =============== =========

Poland Krakow 2018 3.4 3.4 5.7

============ ================ ============ ========== =============== =========

Poland Lodz 2020 7.6 7.6 5.9

============ ================ ============ ========== =============== =========

Poland Warsaw 2019 6.4 6.4 5.9

============ ================ ============ ========== =============== =========

Spain Leon 2019 7.7 7.7 3.6

============ ================ ============ ========== =============== =========

Spain Madrid 1999 8.5 8.5 2.4

============ ================ ============ ========== =============== =========

Total Q2 2021 (1) 7.4 8.2 96.2

============================== ============ ========== =============== =========

Spain, Jul

2021 (2) Barcelona 2019 5.0 8.0 3.8

============ ================ ============ ========== =============== =========

Total (1+2) 7.3 8.2 100.0

============================== ============ ========== =============== =========

Loan portfolio as at 30 June 2021

Existing Remaining Interest

Country Property Bank loan End date Years (incl margin)

EUR million

============ ======================== =========== ============ ============ ========= ==============

February

Germany Erlensee DZ Hyp 17.8 2029 7.7 1.62%

============ ======================== =========== ============ ============ ========= ==============

February

Germany Flörsheim DZ Hyp 12.4 2026 4.7 1.54%

============ ======================== =========== ============ ============ ========= ==============

Avignon + Meung February

France sur Loire BayernLB 33.0 2026 4.6 1.57%

============ ======================== =========== ============ ============ ========= ==============

Netherlands Ede + Oss + Waddinxveen Berlin Hyp 37.7 June 2025 3.9 1.18%

============ ======================== =========== ============ ============ ========= ==============

Netherlands s Heerenberg Berlin Hyp 8.0 June 2025 4.0 0.94%

============ ======================== =========== ============ ============ ========= ==============

Netherlands Den Hoorn + Zeewolde Berlin Hyp 35.7 January 2028 6.5 1.25%

============ ======================== =========== ============ ============ ========= ==============

Total 144.6 5.2 1.36%

=================================================== ============ ============ ========= ==============

Long indexed leases and historic strong rent collection

Rent collection has remained strong.. A total of 99% of rent was

collected in respect of H1 2021, following a pleasing 97% of rent

being collected for the full calendar year of 2020, despite the

pandemic and its obvious impact through various lockdowns. In 2020

we received several requests for rent deferrals and granted seven

rent-free periods in exchange for material lease extensions. No new

requests have been received through the first half of 2021.

A rent deferral for one quarter of rent was also agreed with our

tenant, Office Depot, at our French asset in Meung sur Loire. The

tenant paid two-thirds of the deferred rent but sought court

protection in February 2021 with an administrator appointed to seek

buyers for the business. Since then, a decision has been made to

sell part of the retail business, but the warehouse will not be

required. We are now actively seeking a new tenant with leasing

agents already appointed. We are confident that we will find a

solution for this attractive asset, which is located in an

established central location in France, making this an ideal

location for national distribution. The building has the potential

to be multi-tenanted whilst the low site density offers future

development potential, which we previously explored with Office

Depot. This upside potential remains and can still be achieved with

any new tenant. Furthermore, the logistics market in France is

extremely tight with very little modern stock available.

At the end of June 2021, the portfolio average lease length was

7.4 years including break options and 8.2 years excluding break

options, all with indexed leases creating an effective inflation

hedge on our future cashflows.

ESG and the Investment Manager's strategy to reach Zero Carbon

emissions

Environmental, Social and Governance (ESG) is another key area

of focus for the Investment Manager. Since the signing of the Paris

Treaty on climate change in 2015, we have recognised an increased

ESG awareness amongst governments, investors and also tenants in

the logistics sector. Together with our dedicated ESG team we

remain very proactive in driving our ESG agenda, in order to

protect the property values of our buildings by ensuring their

current and future appeal. Our current rating is strong and

reflected in the four Green Stars awarded, out of a maximum of

five, in the 2019 submission for the Global Real Estate

Sustainability Benchmark assessment (GRESB), where we achieved a

score of 79/100 points for the portfolio against 68/100 points for

the larger peer group. Results from the 2020 submission are

expected to be announced in October 2021 when we hope to improve

our rating even further.

We are also making good progress with our appointed adviser,

Verco, helping to define a pathway to a Net Zero Carbon emissions

target and which we hope to update investors on in the future. This

will help to define asset-level strategies. Other ESG projects that

we are concentrating on are BREEAM-in-use certification, a pilot

for advanced smart metering and the installation of solar panels.

In Q2 2021, the Company completed the signing of two roof leases

for solar panel projects in the Netherlands, at Den Hoorn and Ede,

both with a 20 year duration. These will generate a total income

stream of c.EUR100,000 per year and a c.EUR1.0 million capital

uplift. The reviews of options for assets that do not have such

panels are ongoing. With our local teams we are building on our

close relationships with our tenants and seeking to understand how

we can service them best.

Increasing capital values and our capacity to add value

In the first half of 2021, the portfolio value increased by

3.4%. This included the EUR6.5 million fall in value in relation to

Meung sur Loire after the tenant, Office Depot, went into

liquidation. Marketing of the building has commenced and there is

built-in upside once a new tenant has been found. The property

benefits from low site coverage with expansion potential of c.

8,000 square metres, or over 25%, which will broaden our offer in

the re-letting of this asset. A EUR1.0 million uplift in valuation

was added with the signing of two roof leases with solar panels on

our two Dutch warehouses in Ede and Den Hoorn and we continue to

evaluate further options in the portfolio, within the parameters of

local planning laws. The Investment Manager is in advanced

discussions on a building extension in Waddinxveen of c. 5,000

square metres. In addition, the most recent purchase in Barcelona

is heavily under-rented by 22%, giving an expectation of further

upside potential at the first break option in 2026, allowing for

further negotiations which could enhance capital values

further.

Strong fundamentals support a positive outlook

We believe the Covid-19 pandemic has further accentuated and

accelerated many of the positive demand drivers that were already

in place before the crisis began. Important considerations around

sustainability and social responsibility have also been brought to

the forefront of the sector and there will be greater scrutiny of

these areas in the future.

We expect the logistics industry to continue to be a beneficiary

of structural trends. Demographics trends, notably urbanisation and

suburbanisation, alongside technological changes, are expected to

boost overall demand for the movement of goods. Occupiers and

investors will become increasingly focused on the social and

environmental footprint of their properties with carbon net-zero

set to be a minimum requirement.

Technology and mechanisation are evolving processes and

operating models are changing quicker than ever before. The speed

of change is significant and while this presents a risk to many

companies (and often additional costs), it also provides

significant opportunities.

E-commerce and the automation of processes are the clear

supportive drivers for the sector. However, the digitalisation of

logistics platforms is often one of the least talked of changes,

but potentially yields some of the biggest benefits in

communication, efficiency and therefore profitability. Robotics is

increasingly adopted in warehouse management systems and this will

further influence the nature of demand and space requirements.

In the wake of Covid-19, there will be increased awareness of

public health issues. This is likely to accelerate the development

and implementation of legislation safeguarding public health from

environmentally and socially harmful activities. As seen in

Amsterdam, this could lead to re-zoning of logistics areas, the

development of "consolidation centres" and restrictions on delivery

times. Furthermore, it will ramp up the speed of adoption of

electric vehicles, which has large implications for warehouse

design and yard space to accommodate charging points and the

necessity to be located closer to key nodes on electricity grids.

Interestingly, the 15 minute city concept being adopted in Paris is

prioritising parcel deliveries over other car movements in the

recognition that supplying cities and their citizens with goods and

services is critical for enabling economic and social prosperity.

Restricting less important vehicle movements could cut congestion

and reduce delivery times further.

As a result of the abovementioned factors and the strength of

our pan-European teams, we believe that the portfolio and our

strategy is exposed to a compelling sector and we are ideally

placed to capture not only increasingly valuable index linked

income, but also further valuation uplifts. This in turn will allow

us to continue rewarding our supportive and growing shareholder

base.

Evert Castelein

Fund Manager

Aberdeen Standard Investments Ireland Limited

29 September 2021

PROPERTY PORTFOLIO

Property Tenure Principal Tenant

============================== ========= ====================

1 France, Avignon (Noves) Freehold Biocoop

============================== ========= ====================

2 France, Meung sur Loire Freehold Office Depot

============================== ========= ====================

3 Germany, Erlensee Freehold Bergler

============================== ========= ====================

4 Germany, Flörsheim Freehold DS Smith

============================== ========= ====================

5 Poland, Krakow Freehold Lynka

============================== ========= ====================

6 Poland, Warsaw Freehold DHL

============================== ========= ====================

7 Poland, Lodz Freehold Compal

============================== ========= ====================

8 Spain, Leon Freehold Decathlon

============================== ========= ====================

9 Spain, Madrid Freehold DHL

============================== ========= ====================

10 the Netherlands, Ede Freehold AS Watson (Kruidvat)

============================== ========= ====================

11 the Netherlands, Oss Freehold Orangeworks

============================== ========= ====================

12 the Netherlands, 's Heerenberg Freehold JCL Logistics

============================== ========= ====================

13 the Netherlands, Waddinxveeen Freehold Combilo

============================== ========= ====================

14 the Netherlands, Zeewolde Freehold VSH Fittings

============================== ========= ====================

15 the Netherlands, Den Hoorn Leasehold Van der Helm

============================== ========= ====================

Acquired after 30 June 2021

============================== ========= ====================

16 Spain, Barcelona Freehold Mediapost

============================== ========= ====================

INTERIM BOARD REPORT - DISCLOSURES

Principal Risks and Uncertainties

The principal risks and uncertainties affecting the Company are

set out on pages 11 to 14 of the Annual Report and Financial

Statements for the year ended December 2020 (the "2020 Annual

Report") together with details of the management of the risks and

the Company's internal controls. These risks have not changed and

can be summarised as follows:

- Strategic Risk: Strategic Objectives and Performance;

- Investment and Asset Management Risk: Investment Strategy;

- Investment and Asset Management Risk: Developing and Refurbishing Property;

- Investment and Asset Management Risk: Health and Safety;

- Investment and Asset Management Risk: Environment;

- Financial Risk: Macroeconomic;

- Financial Risk: Gearing;

- Financial Risk: Liquidity and FX Risk;

- Financial Risk: Credit Risk;

- Financial Risk: Insufficient Income Generation;

- Regulatory Risk: Compliance;

- Operational Risk: Service Providers; and

- Operational risk: Business Continuity.

The Board also has a process in place to identify emerging

risks. If any of these are deemed to be significant, these risks

are categorised, rated and added to the Company's risk matrix.

The Board has reviewed the risks related to the Covid-19

pandemic. Covid-19 is continuing to impact the underlying tenants

in the Company's warehouse portfolio in varying degrees due to the

disruption of supply chains and demand for products and services,

increased costs and potential issues around changes in cash flow

forecasts.

However, the Board notes the Investment Manager's robust and

disciplined investment process which continues to focus on high

quality warehouses located across Europe and prudent cash flow

management. The pandemic has impacted the Company's third party

service providers, with business continuity and home working plans

having been implemented. The Board, through the Manager, has been

closely monitoring all third party service arrangements and is

pleased to report that it has not seen any reduction in the level

of service provided to the Company to date.

Following the expiry at the end of 2020 of the transitional

arrangements relating to Brexit, some issues remain including the

potential or actual impacts on trading and supply chains for

tenants. The Board will continue to monitor developments.

Related party transactions

ASFML acts as Alternative Investment Fund Manager, Aberdeen

Standard Investments Ireland Limited acts as Investment Manager and

Aberdeen Asset Management PLC acts as Company Secretary to the

Company; details of the service and fee arrangements can be found

in the 2020 Annual Report, a copy of which is available on the

Company's website. Details of the transactions with the Manager

including the fees payable to abrdn plc group companies are

disclosed in note 16 of this Half Yearly Report.

Going concern

In accordance with the Financial Reporting Council's Guidance on

Risk Management, Internal Control and Related Financial and

Business Reporting, the Directors have undertaken a rigorous review

and consider that there are no material uncertainties and that the

adoption of the going concern basis of accounting is appropriate.

This review included the additional risks relating to the ongoing

Covid-19 pandemic and, where appropriate, action taken by the

Manager and Company's service providers in relation to those risks.

An analysis of the level of rental payments from tenants together

with operational and other Company costs has been modelled covering

a range of potential Covid-19 scenarios. In addition, the Company

maintains an overdraft facility which allows the Company to draw

down additional funds if unexpected short term liquidity issues

were to arise. The Board notes that the Investment Manager remains

in regular contact with tenants and third party suppliers and

continues to have a constructive dialogue with all parties.

Accordingly, the Directors believe that the Company has adequate

financial resources to continue in operational existence for the

foreseeable future and at least 12 months from the date of this

Half Yearly Report. Accordingly, the Directors continue to adopt

the going concern basis in preparing these financial

statements.

Directors' responsibility statement

The Directors are responsible for preparing this half-yearly

financial report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements contained within

the half-yearly financial report has been prepared in accordance

with International Accounting Standard 34 'Interim Financial

Reporting' and gives a true and fair view of the assets,

liabilities, financial position and net return of the Company as at

30 June 2021; and

-- the Interim Board Report (constituting the interim management

report) includes a fair review of the information required by rule

4.2.7R of the UK Listing Authority Disclosure Guidance and

Transparency Rules (being an indication of important events that

have occurred during the first six months of the financial year and

their impact on the condensed set of financial statements and a

description of the principal risks and uncertainties for the

remaining six months of the financial year) and 4.2.8R (being

related party transactions that have taken place during the first

six months of the financial year and that have materially affected

the financial position of the Company during that period).

Tony Roper

Chairman

29 September 2021

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

For the period ended 30 June 2021

1 January to 1 January to 1 January to

30 June 2021 30 June 2020 31 December 2020

==================

Unaudited Unaudited Audited

=============================== =============================== ===============================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

REVENUE

Rental Income 11,121 - 11,121 9,896 - 9,896 20,257 - 20,257

Property service

charge

income 1,648 - 1,648 1,492 - 1,492 3,096 - 3,096

Other operating

income 201 - 201 88 - 88 47 - 47

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Total Revenue 2 12,970 - 12,970 11,476 - 11,476 23,400 - 23,400

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

GAINS/(LOSSES)

ON INVESTMENTS

Gains on

Revaluation

of investment

properties 8 - 15,290 15,290 - 7,218 7,218 - 32,878 32,878

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Total Income and

gains on

investments 12,970 15,290 28,260 11,476 7,218 18,694 23,400 32,878 56,278

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

EXPITURE

Investment

management

fee (1,201) - (1,201) (993) - (993) (2,066) - (2,066)

Direct property

expenses (1,123) - (1,123) (597) - (597) (1,305) - (1,305)

Property service

charge

exposure (1,648) - (1,648) (1,492) - (1,492) (3,096) - (3,096)

SPV property

management

fee (93) - (93) (63) - (63) (139) - (139)

Other expenses (882) - (882) (481) - (481) (1,290) - (1,290)

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Total expenditure (4,947) - (4,947) (3,626) - (3,626) (7,896) - (7,896)

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

Net operating return

before

finance costs 8,023 15,290 23,313 7,850 7,218 15,068 15,504 32,878 48,382

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

FINANCE COSTS

======================= =============================== ================================================================

Finance costs 3 (1,373) - (1,373) (1,226) - (1,226) (2,545) - (2,545)

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Effect of foreign

exchange

differences 53 (507) (454) - - - (829) 301 (591)

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

Net return before

taxation 6,703 14,783 21,486 6,624 7,218 13,842 12,067 33,179 45,246

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

Taxation 4 (391) (4,832) (5,223) (124) (2,024) (2,148) (228) (9,629) (9,857)

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Net return for the

period 6,312 9,951 16,263 6,500 5,194 11,694 11,839 23,550 35,389

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

OTHER

COMPREHENSIVE

INCOME

TO BE

RECLASSIFIED TO

PROFIT OR LOSS

Currency

translation

differences on

initial

capital

proceeds - - - - 190 190 - - -

Currency

translation

on conversion

of distribution

payments - - - (783) 7 (776) - - -

Effect of

foreign

exchange

differences - - - (243) - (243) - - -

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

Other comprehensive

income - - - (1,026) 197 (829)

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

Total comprehensive

return

for the period 6,312 9,951 16,263 5,474 5,391 10,865 11,839 23,550 35,389

======================= ========= ========= ========= ========= ========= ========= ========= ========= =========

Basic and

diluted

earnings

per share 6 2.47c 3.90c 6.37c 2.77c 2.21c 4.98c 4.95c 9.84c 14.79c

================== === ========= ========= ========= ========= ========= ========= ========= ========= =========

The accompanying notes are an integral part of the Financial

Statements.

The total column of the Condensed Consolidated Statement of

Comprehensive Income is the profit and loss account of the Company.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

during the period

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

30 June 2021 30 June 2020 31 December 2020

=================================

Unaudited Unaudited Audited

Notes EUR'000 EUR'000 EUR'000

============================================ ============ ============ ================

NON-CURRENT ASSETS

Investment properties 8 492,280 423,509 448,418

Deferred tax asset 4 1,081 1,323 1,425

================================= ========= ============ ============ ================

Total non-current assets 493,361 424,832 449,843

============================================ ============ ============ ================

CURRENT ASSETS

Trade and other receivables 9 15,522 11,193 9,286

Cash and cash equivalents 10 30,832 18,705 24,874

Other Assets 200 203 75

Derivative financial instruments 15 77 - 26

================================= ========= ============ ============ ================

Total current assets 46,631 30,101 34,261

============================================ ============ ============ ================

Total assets 539,992 454,933 484,104

============================================ ============ ============ ==================

CURRENT LIABILITIES

Lease liability 11 550 550 550

Bank Loans 13 19,500 - -

Trade and other payables 12 8,780 9,689 8,291

Derivative financial instruments 15 - 243 -

================================= ========= ============ ============ ==================

Total current liabilities 28,830 10,482 8,841

============================================ ============ ============ ==================

NON-CURRENT LIABILITIES

Bank Loans 13 143,453 143,425 143,331

Lease liability 11 22,487 22,751 22,620

Deferred tax liability 4 20,204 8,009 15,716

================================= ========= ============ ============ ==================

Total non-current liabilities 186,144 174,185 181,667

============================================ ============ ============ ==================

Total liabilities 214,974 184,667 190,508

============================================ ============ ============ ==================

Net assets 325,018 270,266 293,596

============================================ ============ ============ ==================

SHARE CAPITAL AND RESERVES

Share capital 14 2,970 2,700 2,756

Share premium 83,791 56,047 61,691

Special distributable reserve 182,368 187,707 185,661

Capital reserve 41,719 13,609 31,768

Revenue reserve 14,170 10,203 11,720

================================= ========= ============ ============ ==================

Equity shareholders' funds 325,018 270,266 293,596

============================================ ============ ============ ==================

Net asset value per share 7 EUR 1.24 EUR 1.13 EUR 1.20

================================= ========= ============ ============ ==================

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

For the period ended 30 June 2021

Special

Notes Share Share distributable Capital Revenue

capital premium reserve reserve reserve Total

Six months ended 30 June 2021

(unaudited) EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

================================ ========= ========= ============== ========= ========= ========

Balance at 31 December 2020 2,756 61,691 185,661 31,768 11,720 293,596

Share Issue 14 214 22,325 - - - 22,539

Share Issue costs - (225) - - - (225)

Total Comprehensive return for

the period - - - 9,951 6,312 16,263

Interim Distributions paid 5 - - (3,293) - (3,862) (7,155)

================================ ========= ========= ============== ========= ========= ========

Balance at 30 June 2021 2,970 83,791 182,368 41,719 14,170 325,018

==================================== ========= ========= ============== ========= ========= ========

Six months ended 30 June 2020

(unaudited)

Balance at 31 December 2019 2,645 50,364 191,579 8,218 7,471 260,277

Share Issue 14 55 5,741 - - - 5,796

Share Issue costs - (58) - - - (58)

Total Comprehensive return for

the period - - - 5,391 5,474 10,865

Interim Distributions paid - - (3,872) - (2,742) (6,614)

================================ ========= ========= ============== ========= ========= ========

Balance at 30 June 2020 2,700 56,047 187,707 13,609 10,203 270,266

================================ ========= ========= ============== ========= ========= ========

Year ended 31 December 2020

(audited)

Balance at 31 December 2019 2,645 50,364 191,579 8,218 7,471 260,277

Share Issue 14 111 11,442 - - - 11,553

Share Issue costs - (115) - - - (115)

Total Comprehensive return for

the year - - - 23,550 11,839 35,389

Distributions paid - - (5,918) - (7,590) (13,508)

================================ ========= ========= ============== ========= ========= ========

Balance at 31 December 2020 2,756 61,691 185,661 31,768 11,720 293,596

-------------------------------- --------- --------- -------------- --------- --------- --------

UNAUDITED CONDENSED CONSOLIDATED CASH FLOW STATEMENT

As at 30 June 2021

1 January 1 January to 1 January to

to 30 June 2020 31 December

30 June 2021 Unaudited 2020

Unaudited Audited

=========================================

Notes EUR'000 EUR'000 EUR'000

============================================= ============= ============= ============

CASH FLOWS FROM OPERATING ACTIVITIES

Net gain for the period before

taxation 21,486 13,842 45,246

Adjustments for:

Amortisation of tenant incentives and

leasing costs - (1,512) -

Gains on investment properties 8 (15,290) (7,218) (32,878)

Land Leasehold Liability decreases 132 126 257

(Increase)/Decrease in operating trade

and other

receivables (6,534) 983 1,215

(Decrease)/Increase in operating

trade and other payables (207) 799 (1,270)

Decrease in other operating

assets - (156) -

Finance costs 3 1,373 1,226 2,545

Tax paid (314) - (106)

========================================= ============= ============= ============

Cash generated by operations (20,840) (5,752) (30,237)

============================================= ============= ============= ============

Net cash inflow from operating activities 646 8,090 15,009

============================================= ============= ============= ============

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of investment properties (28,490) (46,972) (46,223)

Derivative financial instruments (51) (8) (34)

Currency translation differences - (564) -

========================================= ============= ============= ============

Net cash outflow from investing activities (28,541) (47,544) (46,257)

============================================= ============= ============= ============

CASH FLOWS FROM FINANCING ACTIVITIES

Dividends paid (7,155) (6,614) (13,508)

Finance costs (806) (1,226) (1,588)

Bank loans drawn 19,500 35,682 35,201

Proceeds from share issue 22,539 5,796 11,553

Issue costs relating to share

issue (225) (58) (115)

========================================= ============= ============= ============

Net cash inflow from financing activities 33,853 33,580 31,543

============================================= ============= ============= ============

Net increase/(decrease) in cash and

cash equivalents 5,958 (5,874) 295

============================================= ============= ============= ============

Opening balance 24,874 24,579 24,579

============================================= ============= ============= ============

Closing cash and cash equivalents 10 30,832 18,705 24,874

========================================= ============= ============= ============

REPRESENTED BY

============================================= ============= ===========================

Cash at bank 30,832 18,705 24,874

============================================= ============= ============= ============

NOTES TO THE FINANCIAL STATEMENTS

1 Accounting Policies

The Consolidated Financial Statements have been prepared in

accordance with International Financial Reporting Standard ("IFRS")

IAS 34 'Interim Financial Reporting' and are consistent with the

accounting policies set out in the statutory accounts of the Group

for the year ended 31 December 2020.

The condensed Unaudited Consolidated Financial Statements for

the six months ended 30 June 2021 do not include all of the

information required for a complete set of IFRS financial

statements and should be read in conjunction with the Consolidated

Financial Statements of the Group for the year ended 31 December

2020, which were prepared under full IFRS requirements as adopted

by the EU. The financial information in this Report does not

comprise statutory accounts within the meaning of Section 434 - 436

of the Companies Act 2006. Those financial statements have been

delivered to the Registrar of Companies and included the report of

the auditor which was unqualified and did not contain a statement

under either section 498(2) or 498(3) of the Companies Act 2006.

The financial information for the six months ended 30 June 2021 and

30 June 2020 has not been audited or reviewed by the Company's

auditor.

2 Revenue

Half year ended Half year ended Year ended

30 June 2021 30 June 2020 31 December

2020

========================

Unaudited Unaudited Audited

========================

EUR'000 EUR'000 EUR'000

======================== =============== =============== ============

Rental income 11,121 9,896 20,257

Property service charge

income 1,648 1,492 3,096

Other income 201 88 47

======================== =============== =============== ============

Total revenue 12,970 11,476 23,400

======================== =============== =============== ============

Included within rental income is amortisation of rent free

periods granted.

3 Finance costs

Half year ended Half year ended Year ended

30 June 2021 30 June 2020 31 December

2020

=======================

Unaudited Unaudited Audited

=======================

EUR'000 EUR'000 EUR'000

======================= =============== =============== ============

Interest on bank loans 1,046 968 1,998

Bank interest 205 158 335

Amortisation of loan

costs 122 100 212

======================= =============== =============== ============

Total finance costs 1,373 1,226 2,545

======================= =============== =============== ============

4 Taxation

(a) Tax charge in the Group Statement of Comprehensive

Income

Half year ended Half year ended 30 Year ended

30 June 2021 June 2020 31 December 2020

===================

Unaudited Unaudited Audited

===================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

Current taxation:

Overseas taxation 391 - 391 124 - 124 228 - 228

Deferred taxation:

Overseas taxation - 4,832 4,832 - 2,024 2,024 - 9,629 9,629

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

Total taxation 391 4,832 5,223 124 2,024 2,148 228 9,629 9,857

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

(b) Tax in the Group Balance Sheet

As at 30 June 2021 As at 30 June 2020 As at 31 December

2020

===================

Unaudited Unaudited Audited

===================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

Deferred tax

assets:

On tax losses - 712 712 - 1,323 1,323 - 1,084 1,084

On other temporary

differences - 369 369 - - - - 341 341

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

- 1,081 1,081 - 1,323 1,323 - 1,425 1,425

=================== ======= ======= ======= ======= ======= ======= ======= ======= =======

As at 30 June 2021 As at 30 June 2020 As at 31 December

2020

====================

Unaudited Unaudited Audited

====================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

==================== ======= ======= ======= ======= ======= ======= ======= ======= =======

Deferred tax

liabilities:

Differences between

tax and property

revaluation - 20,204 20,204 - 8,009 8,009 - 15,716 15,716

==================== ======= ======= ======= ======= ======= ======= ======= ======= =======

Total taxation

on return - 20,204 20,204 - 8,009 8,009 - 15,716 15,716

==================== ======= ======= ======= ======= ======= ======= ======= ======= =======

5 Distributions 30 June 2021

====================================================

Unaudited

====================================================

EUR'000

==================================================== ============

2020 Fourth Interim dividend of 1.24p per Share

paid 26 March 2021 3,447

==================================================== ============

2021 First Interim dividend of 1.21p per Share paid

25 June 2021 3,708

==================================================== ============

Total Dividends Paid 7,155

==================================================== ============

A fourth quarterly interim dividend for 2020 of 1.24p per Share

was paid on 26 March 2021 to shareholders on the register on 5

March 2021. The distribution was split 0.80p dividend income and

0.44p qualifying interest income.

A first quarterly interim dividend for 2021 of 1.21p per Share

was paid on 25 June 2021 to shareholders on the register on 4 June

2021. The distribution was split 0.80p dividend income and 0.41p

qualifying interest income.

6 Earnings per share (basic and 30 June 30 June 31 December

diluted) 2021 2020 2020

=====================================

Unaudited Unaudited Audited

===================================== =========== =========== ===========

Revenue net return attributable

to Ordinary shareholders (EUR'000) 6,312 6,500 11,839

Weighted average number of shares

in issue during the period 255,406,907 234,692,309 239,213,116

===================================== =========== =========== ===========

Total revenue return per ordinary

share 2.47c 2.77c 4.95c

===================================== =========== =========== ===========

Capital return attributable to

Ordinary shareholders (EUR'000) 9,951 5,194 23,550

Weighted average number of shares

in issue during the period 255,406,907 234,692,309 239,213,116

===================================== =========== =========== ===========

Total capital return per ordinary

share 3.90c 2.21c 9.84c

===================================== =========== =========== ===========

Total return per ordinary share 6.37c 4.98c 14.79c

===================================== =========== =========== ===========

Earnings per Share is calculated on the revenue and capital loss

for the period (before other comprehensive income) and is

calculated using the weighted average number of Shares in the

period of 255,406,907 Shares.

7 Net asset value per share 30 June 30 June 31 December

2021 2020 2020

========================================

Unaudited Unaudited Audited

======================================== =========== =========== ===========

Net assets attributable to shareholders

(EUR'000) 325,018 270,266 293,596

Number of shares in issue 262,950,001 239,500,001 244,500,001

======================================== =========== =========== ===========

Net asset value per share (EUR) 1.24 1.13 1.20

======================================== =========== =========== ===========

8 Investment properties 30 June 30 June 31 December

2021 2020 2020

=============================

Unaudited Unaudited Audited

=============================

EUR'000 EUR'000 EUR'000

============================= ========= ========= ===========