TIDMASY

RNS Number : 1409N

Andrews Sykes Group PLC

28 September 2021

27 September 2021

ANDREWS SYKES GROUP PLC

("Andrews Sykes" or "the Company" or "the Group")

Half Year Results

Unaudited results for the six months ended 30 June 2021

Summary of Results

Unaudited Unaudited

six months six months

ended ended

30 June 30 June

2021 2020

GBP000 GBP000

Revenue from continuing operations 35,693 33,480

EBITDA* from continuing operations 12,402 11,781

Operating profit 7,955 7,000

Profit for the financial period 6,239 6,070

Cash and cash equivalents 24,717 32,096

Net funds 9,673 16,770

(pence) (pence)

Basic earnings per share 14.79 14.39

Special interim dividend declared per

equity share - 23.70

Interim dividend declared per equity

share 11.90 11.90

* Earnings before interest, taxation, depreciation, profit on

the sale of property, plant and equipment, amortisation and

non-recurring items

Enquiries

Andrews Sykes Group plc T: +44 (0)1902 328 700

Carl Webb, Managing Director

Ian Poole, Finance Director and

Company Secretary

GCA Altium Limited (Nominated Advisor) T: +44 (0)20 7484 4040

Tim Richardson

CHAIRMAN'S STATEMENT

Overview

Andrews Sykes' trading continues to be resilient as sectors in

which we trade show ongoing demand, despite the unprecedented

challenge in the form of the coronavirus pandemic. We continue to

be thankful and proud of our team members as they respond as

essential service providers.

The Group's revenue for the 6 months ended 30 June 2021 (the

"period") was GBP35.7 million, an increase of GBP2.2 million

compared with the same period in 2020. Operating profit for the

period was GBP8.0 million compared with GBP7.0 million in 2020, an

increase of GBP1.0 million, reflecting the increased revenue.

Overall, net funds increased by GBP2.0 million from GBP7.7m million

as at 31 December 2020 to GBP9.7 million as at 30 June 2021 .

Operations review

Our main hire and sales businesses in Europe all reported

improved revenues in the period. Revenue at Andrews Sykes Hire in

the UK improved by 6.1% compared with the same period in 2020. Our

businesses in the rest of Europe experienced a significant rebound

in revenue, improving 28.8% compared to the same period in 2020, on

the back of reduced covid restrictions and increased business

activities. Consequently, the combined operating profit for the UK

and European hire businesses in the period was GBP1.4 million above

the level achieved in 2020.

Andrews Air Conditioning and Refrigeration, our UK air

conditioning installation business, was particularly affected by

the coronavirus pandemic as our engineers were not allowed access

to certain customer sites in order to carry out their work. Whilst

revenue increased 20.5% in the period compared to the first six

months of 2020, it still remains 34.5% lower than the corresponding

period in 2019. Tight cost control has meant this business

generated a profit of GBP0.2m in the period as compared to a small

loss in the first half of 2020.

Khansaheb Sykes, our business based in the UAE, continued to

experience a difficult trading environment during the period due to

the coronavirus pandemic and reduced demand during Ramadan. Revenue

was 28.2% lower than the first half of 2020 and operating profit

decreased by GBP0.7 million compared with the first half of

2020.

Profit for the financial period and Earnings per Share

Profit before tax for the period was GBP7.6 million compared

with GBP7.2 million in the same period last year. This GBP0.4m

increase is attributable to the GBP1.0 million improvement in

operating profit, a net foreign exchange loss on inter-company

balances of GBP0.1 million (2020: gain of GBP0.4m) due to the

strengthening of Sterling compared with the Euro and the UAE

Dirham, and a net increase of GBP0.1 million in interest

charges.

The total tax charge for the period increased by GBP0.1 million

to GBP1.3 million (2020: GBP1.2 million), an effective tax rate of

17.5% (2020: 16.1%), mainly due to the lower profit generated by

Khansaheb, on which no tax is payable, increasing the overall

effective tax rate.

Profit after tax in the period was GBP6.2 million (2020: GBP6.1

million). Basic earnings per share increased by 0.40 pence, or

2.8%, to 14.79 pence (2020: 14.39 pence) reflecting this increase

in profit .

Dividends

The final dividend of 11.50 pence per ordinary share for the

year ended 31 December 2020 was approved by members at the AGM held

on 15 June 2021. Accordingly, on 18 June 2021 the Company made a

total dividend payment of GBP4.85 million which was paid to

shareholders on the register as at 28 May 2021.

The board continues to adopt the policy of returning value to

shareholders whenever possible. The Group remains profitable, cash

generative and financially strong. Accordingly, the board has

decided to declare an interim dividend of 11.90 pence per ordinary

share which in total amounts to GBP5.0 million. This will be paid

on 5 November 2021 to shareholders on the register as at 8 October

2020. The ordinary shares will go ex-dividend on 7 October 2021

.

Outlook

Whilst certain of the Group's business operations continue to be

affected by the coronavirus pandemic, for example the performance

of Khansaheb remains depressed compared to historical levels,

demand in Europe has increased and the pumps business in the UK

continues to perform in line with last year's levels and above pre

pandemic levels. Management remains optimistic that the business

will continue to improve as the economy recovers fully but are

mindful that we live in uncertain times and circumstances can

change very quickly .

JG Murray

Chairman

27 September 2021

Consolidated Income Statement

for the six months ended 30 June 2021

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

Note 2021 2020 2020

GBP000 GBP000 GBP000

Revenue 2 35,693 33,480 67,259

Cost of sales (15,064) (14,544) (28,184)

------------ ------------ -------------

Gross profit 20,629 18,936 39,075

Distribution costs (6,386) (5,541) (12,136)

Administrative expenses (6,412) (7,242) (12,183)

Other operating income 124 847 1,630

------------ ------------ -------------

Operating profit 7,955 7,000 16,386

EBITDA* 12,402 11,781 26,089

Depreciation and impairment losses (3,399) (3,785) (7,183)

Depreciation of right-of-use

assets (1,622) (1,328) (3,014)

Profit on the sale of plant and

equipment and right-of-use assets 574 332 494

--------------------------------------- ------------ ------------ -------------

Operating profit 7,955 7,000 16,386

--------------------------------------- ------------ ------------ -------------

Finance income 3 7 511 116

Finance costs 3 (401) (276) (669)

Profit before tax 7,561 7,235 15,833

Tax expense 4 (1,322) (1,165) (2,813)

------------ ------------ -------------

Profit for the period from continuing

operations attributable to equity

holders of the Parent Company 6,239 6,070 13,020

------------ ------------ -------------

Earnings per share from continuing

operations:

Basic and diluted 5 14.79p 14.39p 30.87p

Dividend per equity share paid

during the period 11.50p 10.50p 46.10p

Dividend per equity share paid - 23.70p -

after the period end

Proposed dividend per equity

share 11.90p 11.90p 11.50p

(*) Earnings before interest, taxation, depreciation, profit on

sale of property, plant and equipment, amortisation and

non-recurring items.

Consolidated Statement of Comprehensive Total Income

for the six months ended 30 June 2021

Unaudited Unaudited

six months six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

GBP000 GBP000 GBP000

Profit for the period 6,239 6,070 13,020

Other comprehensive income

Currency translation differences on

foreign currency operations (640) 1,239 527

Net other comprehensive (expense)/

income that may be reclassified to

profit and loss (640) 1,239 527

Re-measurement of defined benefit

pension assets and liabilities 2,476 (2,098) (1,980)

Related deferred tax (619) 399 376

Net other comprehensive income/(expense)

that will not be reclassified to profit

and loss 1,857 (1,699) (1,604)

------------ ------------ --------------

Other comprehensive income/ (expense)

for the period net of tax 1,217 (460) (1,077)

------------ ------------ --------------

Total comprehensive income for the

period attributable to equity holders

of the Parent Company 7,456 5,610 11,943

------------ ------------ --------------

Consolidated Balance Sheet

At 30 June 2021

Unaudited Unaudited

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 21,761 24,092 22,774

Right-of-use assets 11,594 11,506 12,463

Prepayments 42 43 42

Deferred tax assets 7 660 704

Defined benefit pension

scheme surplus 3,606 479 498

---------- ---------- ------------

37,010 36,780 36,481

Current assets

Stocks 7,821 7,353 8,048

Trade and other receivables 18,584 19,126 17,274

Current tax asset 268 187 -

Cash and cash equivalents 24,717 32,096 24,012

51,390 58,762 49,334

---------- ---------- ------------

Current liabilities

Trade and other payables (14,726) (14,882) (12,290)

Current tax liabilities - (630) (1,161)

Bank loans (2,995) (493) (493)

Right-of-use lease obligations (2,539) (2,411) (2,656)

(20,260) (18,416) (16,600)

---------- ---------- ------------

Net current assets 31,130 40,346 32,734

---------- ---------- ------------

Total assets less current

liabilities 68,140 77,126 69,215

Non-current liabilities

Bank loans - (2,994) (2,998)

Right-of-use lease obligations (9,510) (9,427) (10,193)

(9,510) (12,421) (13,191)

Net assets 58,630 64,705 56,024

---------- ---------- ------------

Equity

Called up share capital 422 422 422

Share premium 13 13 13

Retained earnings 54,667 59,390 51,421

Translation reserve 3,282 4,634 3,922

Other reserve 246 246 246

---------- ---------- ------------

Total equity 58,630 64,705 56,024

---------- ---------- ------------

Consolidated Cash Flow Statement

for the six months ended 30 June 2021

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Operating activities

Profit for the period 6,239 6,070 13,020

Adjustments for:

Tax charge 1,322 1,165 2,813

Finance costs 401 276 669

Finance income (7) (511) (116)

Profit on disposal of property,

plant and equipment and

right-of-use assets (574) (332) (494)

Depreciation of property,

plant and equipment 3,399 3,785 7,183

Depreciation of right-of-use

assets 1,621 1,328 3,014

Difference between pension

contributions paid and

amounts recognised in the

Income Statement (625) (591) (470)

Decrease/ (increase) in

inventories 65 (1,355) (2,690)

(Increase)/ decrease in

receivables (1,500) 2,942 4,099

Increase/ (decrease) in

payables 2,534 1,671 (762)

Cash generated from continuing

operations 12,875 14,448 26,266

Interest paid (284) (274) (592)

Corporation tax paid (2,694) (2,433) (3,419)

Net cash inflow from operating

activities 9,897 11,741 22,255

Investing activities

Disposal of property,

plant and equipment 722 382 619

Purchase of property,

plant and equipment (2,794) (2,128) (4,157)

Interest received - 57 79

Net cash outflow from investing

activities (2,072) (1,689) (3,459)

Financing activities

Loan repayments (500) (500) (500)

Capital repayments for

right-of-use lease

obligations (1,547) (1,245) (2,832)

Equity dividends paid (4,850) (4,428) (19,442)

Net cash outflow from financing

activities (6,897) (6,173) (22,774)

------------ ------------ -------------

Net increase/ (decrease)

in cash and cash equivalents 928 3,879 (3,978)

Cash and cash equivalents

at the start of the period 24,012 27,880 27,880

Effect of foreign exchange

rate changes (223) 337 110

------------ ------------ -------------

Cash and cash equivalents

at the end of the period 24,717 32,096 24,012

------------ ------------ -------------

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2021

Attributable

Capital to equity

Share Translation redemption UAE Netherlands holders

Share premium reserve reserve legal capital Retained of the

capital reserve reserve earnings parent

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 31 December

2019 422 13 3,395 158 79 9 59,447 63,523

Profit for the

period - - - - - - 6,070 6,070

Other

comprehensive

income/

(expense)

for the

period

net of tax - - 1,239 - - - (1,699) (460)

-------- --------- ------------- ------------ --------- ------------ ---------- --------------

Total

comprehensive

income - - 1,239 - - - 4,371 5,610

Dividends paid - - - - - - (4,428) (4,428)

Total of

transactions

with

shareholders - - - - - - (4,428) (4,428)

At 30 June

2020 422 13 4,634 158 79 9 59,390 64,705

Profit for the

period - - - - - - 6,950 6,950

Other

comprehensive

(expense)/

income

for the

period

net of tax - - (712) - - - 95 (617)

-------- --------- ------------- ------------ --------- ------------ ---------- --------------

Total

comprehensive

(expense)/

income - - (712) - - - 7,045 6,333

Dividends paid - - - - - - (15,014) (15,014)

-------- --------- ------------- ------------ --------- ------------ ---------- --------------

Total of

transactions

with

shareholders - - - - - - (15,014) (15,014)

At 31 December

2020 422 13 3,922 158 79 9 51,421 56,024

Profit for the

period - - - - - - 6,239 6,239

Other

comprehensive

(expense)/

income

for the

period

net of tax - - (640) - - - 1,857 1,217

Total

comprehensive

(expense)/

income - - (640) - - - 8,096 7,456

Dividends paid - - - - - - (4,850) (4,850)

Total of

transactions

with

shareholders - - - - - - (4,850) (4,850)

At 30 June

2021 422 13 3,282 158 79 9 54,667 58,630

-------- --------- ------------- ------------ --------- ------------ ---------- --------------

Notes to the Interim Financial statements

1 General information and accounting policies

These interim financial statements have been prepared in

accordance with the recognition and measurement principles of

international accounting standards in conformity with the

requirements of the Companies Act 2006 .

The information for the 12 months ended 31 December 2020 does

not constitute the Group's statutory accounts for 2020 as defined

in Section 434 of the Companies Act 2006. Statutory accounts for

2020 have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified and did not

contain statements under Section 498(2) or (3) of the Companies Act

2006. These interim financial statements, which were approved by

the Board of Directors on 27 September 2021, have not been audited

or reviewed by the auditors .

Basis of preparation

The interim financial statement has been prepared using the

historical cost basis of accounting except for:

(i) Properties held at the date of transition to IFRS which are stated at deemed cost;

(ii) Assets held for sale which are stated at the lower of (i)

fair value less anticipated disposal costs and (ii) carrying

value;

(iii) Derivative financial instruments (including embedded

derivatives) which are valued at fair value; and

(iv) Pension scheme assets and liabilities calculated at fair

value in accordance with IAS 19

The annual financial statements of the Group are prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 . The condensed set

of financial statements included in this half-yearly financial

report has been prepared in accordance with the AIM Rules issued by

the London Stock Exchange.

Accounting policies

The principal accounting policies applied in preparing the

interim Financial Statements comply with international accounting

standards in conformity with the requirements of the Companies Act

2006 and are consistent with the policies set out in the Annual

Report and Accounts for the year ended 31 December 2020.

No new standards or interpretations issued since 31 December

2020 have had a material impact on the accounting of the Group.

Functional and presentational currency

The financial statements are presented in pounds Sterling

because that is the functional currency of the primary economic

environment in which the group operates.

2 Revenue

An analysis of the group's revenue is as follows:

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Continuing operations

Revenue outside the scope of IFRS

15 and recognised as lease income

in accordance with IFRS 16:

Hire 31,627 29,185 59,598

Revenue recognised at a point in time

in accordance with IFRS 15:

Sales 2,709 3,161 5,162

Maintenance 752 560 1,348

Installation and sale

of units 605 574 1,151

------------ ------------ --------------

Group consolidated revenue from the

sale of goods and provision of services 35,693 33,480 67,259

------------ ------------ --------------

The geographical analysis of the Group's revenue by origination

is:

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

United Kingdom 22,743 20,903 40,882

Rest of Europe 8,874 6,891 16,077

Middle East and Africa 4,076 5,686 10,300

35,693 33,480 67,259

------------ ------------ --------------

The geographical analysis of the Group's revenue by destination

is not materially different to that by origination.

3 Finance income and costs

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Finance income GBP000 GBP000 GBP000

Net interest on net defined benefit

pension surplus 7 23 45

Intertest receivable on bank deposit

accounts - 61 71

Inter-company foreign exchange gains - 427 -

7 511 116

------------ ------------ -------------

Finance costs

Interest charge on bank loans and

overdrafts (20) (38) (64)

Interest charge on right-of-use lease

obligations (264) (238) (530)

Inter-company foreign exchange losses (117) - (75)

(401) (276) (669)

------------ ------------ -------------

4 Income tax expense

The total effective tax charge for the financial period

represents the best estimate of the weighted average annual

effective tax rate expected for the full financial year applying

tax rates that have been substantively enacted by the balance sheet

date. UK corporation tax has been provided at 19%. In the UK budget

on 15 March 2021, the chancellor announced that the rate of

corporation tax in the UK will increase from 19% to 25% with effect

from 1 April 2023. This increase will increase the amount of

corporation tax payable in the UK. Deferred tax has been calculated

based on the rates that the directors anticipate will apply when

the temporary timing differences are expected to reverse .

Unaudited Unaudited

six months six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

GBP000 GBP000 GBP000

Current tax

UK corporation tax at 19% (June and

December 2020: 19%) 736 901 2,068

Adjustments in respect of prior periods (21) (92) (207)

------------ ------------ --------------

715 809 1,861

Overseas tax 530 382 1,023

Adjustments in respect of prior periods - (20) 2

------------ ------------ --------------

Total current tax charge 1,245 1,171 2,886

------------ ------------ --------------

Deferred tax

Origination and reversal of timing

differences 386 (6) (44)

Effect of tax rate change (309) - -

Adjustments in respect of prior periods - - (29)

------------ ------------ --------------

Total deferred tax charge/ (credit) 77 (6) (73)

------------ ------------ --------------

Total tax charge for the financial

period 1,322 1,165 2,813

------------ ------------ --------------

5 Earnings per share

Basic earnings per share

The basic figures have been calculated by reference to the

weighted average number of ordinary shares in issue and the

earnings as set out below. There are no discontinued operations in

any period .

Unaudited Unaudited

six months six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

Weighted average number of ordinary

shares 42,174,359 42,174,359 42,174,359

------------ ------------ --------------

GBP000 GBP000 GBP000

Basic earnings 6,239 6,070 13,020

------------ ------------ --------------

pence pence pence

Basic earnings per ordinary share 14.79 14.39 30.87

------------ ------------ --------------

Diluted earnings per share

There were no dilutive instruments outstanding as at 30 June

2021 or either of the comparative periods and therefore there is no

difference in the basic and diluted earnings per share for any of

these periods. There were no discontinued operations in any period

.

6 Dividend payments

Dividends declared and paid on ordinary one pence shares during

the 6 months ended 30 June 2021 were as follows:

Paid during the six

months ended 30 June

2021

Total dividend

paid

Pence per GBP000

share

Final dividend for the year ended

31 December 2020 paid on 18 June 2021

to members on the register as at 28

May 2021 11.50p 4,850

The above dividend was charged against reserves during the 6

months ended 30 June 2021.

On 27 September 2021 the directors declared an interim dividend

of 11.90 pence per ordinary share which in total amounts to

GBP5,019,000. This will be paid on 5 November 2021 to shareholders

on the register as at 8 October 2021 and will be charged against

reserves in the second half of 2021.

Dividends declared and paid on ordinary one pence shares during

the 6 months ended 30 June 2020 were as follows:

Paid during the six

months ended 30 June

2020

Total dividend

paid

Pence per GBP000

share

Final dividend for the year ended

31 December 2019 paid on 19 June 2020

to members on the register as at 29

May 2020 10.50p 4,428

The above dividend was charged against reserves during the 6

months ended 30 June 2020.

On 23 July 2020 the directors declared a special interim

dividend of 23.7 pence per ordinary share which in total amounts to

GBP9,995,000. This was paid on 28 August 2020 to shareholders on

the register as at 7 August 2020 and was charged against reserves

in the second half of 2020.

Dividends declared and paid on ordinary one pence shares during

the 12 months ended 31 December 2020 were as follows:

Paid during the year ended

31 December 2020

Total dividend

paid

Pence per share GBP000

Final dividend for the year ended

31 December 2019 paid on 19 June 2020

to members on the register as at 29

May 2020 10.50p 4,428

First interim dividend declared on

23 July 2020 and paid on 28 August

2020 to members on the register as

at 7 August 2020 23.70p 9,995

Second interim dividend declared on

29 September 2020 and paid on 6 November

2020 to members on the register as

at 9 October 2020 11.90p 5,019

------------------ -----------------

46.10p 19,442

------------------ -----------------

The above dividends were charged against reserves during the 12

months ended 31 December 2020.

7 Pensions

The Group closed the UK Group defined benefit pension scheme to

future accrual as at 29 December 2002. The assets of the defined

benefit pension scheme continue to be held in a separate trustee

administered fund. Over recent years the Group has taken steps to

manage the ongoing risks associated with its defined benefit

liabilities.

As at 30 June 2021 the Group had a net defined benefit pension

scheme surplus, calculated in accordance with IAS 19 using the

assumptions as set out below, of GBP3,606,000 (30 June 2020:

GBP479,000; 31 December 2020: GBP498,000). The asset has been

recognised in the financial statements as the directors are

satisfied that it is recoverable in accordance with IFRIC 14.

Following the triennial recalculation of the funding deficit as

at 31 December 2019, a revised schedule of contributions and

recovery plan was agreed with the pension scheme trustees in March

2021 and was effective from 1 January 2021. In accordance with this

schedule of contributions and recovery plan, the Group will be

making regular contributions of GBP110,000 per month for the period

1 January 2021 to 31 December 2022, and GBP10,000 per month for the

period 1 January 2023 to 31 December 2025 or until a revised

schedule of contributions is agreed, if earlier. Consequently the

Group expects to make total contributions to the defined benefit

pension scheme of GBP1,320,000 during 2021.

Assumptions used to calculate the scheme surplus

The IAS 19 figures are based on a number of actuarial

assumptions as set out below, which the actuaries have confirmed

they consider appropriate.

30 June 30 June 31 December

2021 2020 2020

Rate of increase in pensionable salaries n/a n/a n/a

Rate of increase in pensions in payment 3.3% 2.9% 2.9%

Discount rate 1.8% 1.4% 1.3%

Inflation assumption - RPI 3.3% 2.9% 2.9%

Inflation assumption - CPI 2.7% 1.9% 2.3%

Percentage of members taking maximum

tax-free lump sum on retirement 75% 75% 75%

The demographic assumptions used for 30 June 2021, were the same

as used in 31 December 2020, 30 June 2020 and the last full

actuarial valuation performed as at 1 April 2020.

Assumptions regarding future mortality experience are set based

on advice in accordance with published statistics. The mortality

table used at 30 June 2021, 30 June 2020 and 31 December 2020 is

100% S3PA CMI2018 with a 1.25% per annum long term improvement for

both males and females, heavy tables for males and medium tables

for females.

Valuation

The defined benefit scheme funding has changed under IAS 19 as

follows:

Unaudited Unaudited

six months six months Year to

Funding status to to 31 December

30 June 30 June 2020

2021 2020 GBP000

GBP000 GBP000

Scheme assets at end of period 46,958 43,769 45,018

Benefit obligations at end of period (43,352) (43,290) (44,520)

---------------------- ------------------------ --------------

Surplus in scheme 3,606 479 498

The increase in the pension surplus since December 2020 is

mainly due to a decrease in the value of liabilities as a

consequence of an increase in bond yields increasing the discount

rate and an increase in the scheme assets due to a positive return

on scheme assets.

8 Net funds and movement in financing liabilities

Unaudited Unaudited

six months six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

GBP000 GBP000 GBP000

Cash and cash equivalents per consolidated

cashflow statement 24,717 32,096 24,012

Bank loans at the beginning of the

period (3,491) (3,983) (3,983)

Loans repaid 500 500 500

Other non-cash changes (4) (4) (8)

Bank loans at the end of the period (2,995) (3,487) (3,491)

------------ ------------ --------------

Right-of-use lease obligations at

the beginning of the period (12,849) (11,761) (11,761)

Capital repayments for right-of-use

lease obligations 1,547 1,245 2,832

New right-of-use leases entered into

during the period (963) (1,171) (3,943)

Non-cash movements re: termination

of right-of-use lease obligations 36 160 249

Foreign exchange 180 (312) (226)

------------ ------------ --------------

Right-of-use lease obligations at

the end of the period (12,049) (11,839) (12,849)

------------ ------------ --------------

Gross debt (15,044) (15,326) (16,340)

------------ ------------ --------------

Net funds 9,673 16,770 7,672

------------ ------------ --------------

9 Distribution of interim financial statements

Following a change in regulations in 2008, the Company is no

longer required to circulate this half year report to shareholders.

This enables us to reduce costs associated with printing and

mailing and to minimise the impact of these activities on the

environment. A copy of the interim financial statements is

available on the Company's website, www.andrews-sykes.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBGDCRDDDGBR

(END) Dow Jones Newswires

September 28, 2021 02:00 ET (06:00 GMT)

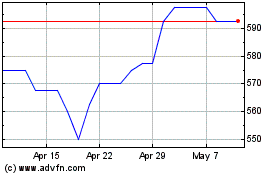

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Apr 2023 to Apr 2024