AfriTin Mining Ltd Quarterly Production Update (4715L)

13 September 2021 - 4:00PM

UK Regulatory

TIDMATM

RNS Number : 4715L

AfriTin Mining Ltd

13 September 2021

13 September 2021

AfriTin Mining Limited

("AfriTin" or the "Company")

Quarterly Production Update

AfriTin Mining Limited (AIM: ATM), an African tin mining company

with its flagship asset, the Uis Tin Mine ("Uis") in Namibia, is

pleased to provide a quarterly production update for Q2 of the 2022

Financial Year ("FY2022"), for the three-month period ended 31

August 2021.

Highlights:

-- Tin concentrate production for Q2 totalled 185 tonnes,

exceeding the target of 180 tonnes for the third consecutive

quarter;

-- Strong operational performance supported by a 9.9% increase

in processing plant throughput and a 10.2% improvement in tin

recovery; and

-- Implementation of Uis Phase 1 expansion project, which is

projected to increase tin concentrate production by 67%, has

commenced.

Anthony Viljoen (CEO) commented:

"We are pleased to release our Q2 numbers from our flagship Uis

Tin Mine which has exceeded production targets and nameplate for

the third consecutive quarter. During the quarter we commenced the

early implementation work and long lead item ordering for the Uis

expansion programme which will see the processing plant produce 67%

more tin concentrate."

The Company is pleased to report that Uis maintained a

production level above its steady state target during Q2 of FY2022.

During the quarter under review, Uis surpassed the target of 180

tonnes of tin concentrate to produce 185 tonnes (containing 113

tonnes of tin metal). The quarter-on-quarter ("QoQ") performance

for Q1 and Q2 of FY2022 is tabulated below:

Table 1 : Quarterly performance of the Uis Phase 1 pilot plant

during the 2022 financial year.

Description Units 2022 Financial Year

Q1 Actual Q2 Actual Q2 vs Q1

(Mar - May) (Jun - Aug) (% change)

------------- ------------- ------------

Plant Availability % 75 78 4%

------- ------------- ------------- ------------

Plant Utilisation % 83 85 2.4%

------- ------------- ------------- ------------

Plant Processing

Rate tph 84 87 3.6%

------- ------------- ------------- ------------

Ore Processed t 115 751 127 263 9.9%

------- ------------- ------------- ------------

Feed Grade % Sn 0.167 0.137 -18%

------- ------------- ------------- ------------

Tin Concentrate t 183 185 1.1%

------- ------------- ------------- ------------

Tin Contained in

Concentrate t 114 113 -0.9%

------- ------------- ------------- ------------

Tin Recovery % 59 65 10.2%

------- ------------- ------------- ------------

Increased processing plant throughput of 127,263 tonnes of ore

for Q2 was obtained by improvements in plant availability,

utilisation and processing rate, resulting in a QoQ throughput

increase of 9.9%.

The feed grade for Q2 of FY2022 was lower than the preceding

quarter due to natural grade variations in the mining area.

However, the feed grade is still in line with the Company's mine

plan estimates and the average projected life-of-mine feed grade of

0.138% Sn.

The lower QoQ plant feed grade was countered, to a large extent,

by a 10.2% improvement in overall tin recovery. Q2 of FY2022

displayed a 65% recovery, well above the design target of 60%

recovery.

The Company also announced on 14 June 2021 that the Directors

approved a Definitive Feasibility Study for the expansion of the

Uis Phase 1 processing plant through a modular addition to the

current plant, projected to increase tin concentrate production by

67%.. The project has commenced with the placing of orders for long

lead items, the appointment of a project implementation team, and

establishment of infrastructure to facilitate procurement and

fabrication. The Company expects to provide a detailed project

progress update in a few weeks time.

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Turner Pope Investments

Andy Thacker

James Pope +44 (0) 20 3657 0050

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Jos Simson

Nick Elwes

Oliver Lamb

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is the first pure tin company listed in

London and its vision is to create a portfolio of globally

significant, conflict-free, tin-producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to 10,000 tonnes of concentrate in a

Phase 2 expansion, having reached optimal Phase 1 commercial

production in 2021. The Company strives to capitalise on the solid

supply/demand fundamentals of tin by developing a critical mass of

tin resource inventory, achieving production in the near term and

further scaling production by consolidating tin assets in

Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLQBLFFFKLLBBZ

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

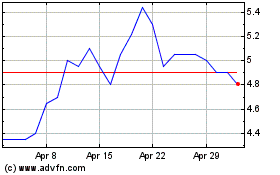

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024