TIDMATM

RNS Number : 7468S

AfriTin Mining Ltd

18 November 2021

18 November 2021

AfriTin Mining Limited

("AfriTin" or the "Company")

By-product and Metallurgical Process Development Programme

AfriTin Mining Limited (AIM: ATM), an African tech-metals mining

company with a portfolio of mining and exploration assets in

Namibia in tin, lithium and tantalum, with its flagship asset, the

Uis Tin Mine ("Uis") in Namibia, is pleased to provide an update on

its by-product and metallurgical process development programme.

Highlights

-- Density-based lithium beneficiation test work has achieved

petalite concentrate grades in excess of 4% Li(2) O and within

contaminant specifications for a typical saleable technical grade

petalite product;

-- The Company will proceed with the design and procurement of

pilot lithium beneficiation facility;

-- Test work successful in producing a high-grade, saleable

specification tantalum concentrate (>24% Ta(2) O(5) ); and

-- The Company to proceed with the implementation of tantalum concentrating circuit.

Anthony Viljoen (CEO) Commented:

"The metallurgical test work results confirm the production

potential of separate saleable lithium and tantalum concentrates.

Implementation of these by-product streams could substantially

transform the overall economics and unit cost of production for the

current Phase 1 facility. More importantly, it provides an

outstanding platform for the future large-scale Phase 2 facility

with a planned production capacity of more than 8 times the current

facility. By implementing the pilot phase development of these

separate elements, the Company aims to take advantage of the

burgeoning technology metals market by fast tracking the by-product

streams into production.

We are encouraged by the rapid progress on our metallurgical

test work programme in support of our goal of becoming a major

player in the tech-metal mining sector."

The Company has embarked on an aggressive strategy to maximise

returns by producing by-products and maximising processing

throughput. The programmes to develop separate tantalum and lithium

concentrate by-products are advancing to the piloting phase.

Lithium By-product Development:

Lithium oxide at Uis occurs primarily as the mineral petalite in

the ore which is treated by the current processing facility. The

occurrence of petalite is consistent throughout the mineral

resource. The Company aims to produce a premium technical grade

petalite concentrate. Although petalite contains comparatively less

lithium than the more common spodumene (petalite has a theoretical

limit of 4.9% Li(2) O), the low contaminant levels of technical

grade petalite makes it suitable for the glass and ceramics market,

therefore attracting a premium to the typical chemical grade

spodumene concentrate. A technical grade petalite concentrate

typically contains a minimum of 4.0% Li(2) O, a maximum of 0.05%

Fe(2) O(3) and alkali metal compounds (Na(2) O + K(2) O) of less

than 1.0%. The Company is also investigating possible offtake

routes in the battery materials market.

Test work to date focussed on processing several samples from

the current plant feed and discard streams to produce petalite

concentrates. Dense Medium Separation (DMS) test work on laboratory

scale as well as piloting scale has achieved an upgrade in Li(2) O

of 4 times and higher, with several samples producing grades above

4.0% Li(2) O and contaminant levels within technical grade

specifications. The test work has been expanded to include milling

and flotation as a method of further upgrade and maximising

recovery of Li(2) O.

The Company will proceed with the design and procurement for a

pilot petalite concentration plant. The process flow design of a

petalite concentration circuit is planned as a combination of

density separation, flotation and magnetic separation methods. The

circuit will be fed with coarse discard material from the first

stage of DMS in the current processing plant on a batch basis. The

facility will have a processing capacity of 20 tonnes per hour and

is intended as a pilot for an integrated full-scale petalite

concentrate circuit (120 tonnes per hour).

The pilot plant is expected to cost GBP2.2 million, consisting

of CAPEX and operating costs over the course of the pilot campaign.

The plant will be funded from existing cash reserves. The Company

plans to operate the plant for an initial period of 6 months,

generating bulk product sales for the purpose of establishing a

long-term offtake agreement. Results from this pilot will inform a

bankable feasibility study for the integrated full-scale circuit.

AfriTin is engaging with possible EPCM partners for the

implementation of the pilot plant by Q2 of 2022, to be followed by

the implementation of the full-scale petalite concentrate

circuit.

Tantalum By-Product Development:

Tantalum at Uis occurs primarily within Columbite Group Minerals

(CGM) which have a similar density to the tin bearing mineral

cassiterite and is currently recovered as part of the tin

concentrate. At present, the Company does not receive a credit for

the contained tantalum within the tin concentrate. Therefore, the

aim is to separate the tantalum bearing minerals from the tin

concentrate and create a by-product at a typical saleable grade of

20% Ta(2) O(5) .

Magnetic separation is a proven technology for the separation of

Ta-bearing CGM from non-magnetic minerals such as Cassiterite.

Following the initial focus on wet magnetic separation techniques,

recent work investigated dry magnetic separation techniques.

Production of concentrates containing in excess of 24% Ta(2) O(5)

was achieved from separate samples submitted to two independent

service providers using similar processing strategies and

equipment.

Based on the above results, the Company will proceed with the

implementation of a pilot beneficiation circuit to further process

the currently produced tin concentrate employing dry screening and

a high intensity dry electromagnetic separation to produce a

separate tantalum concentrate. The circuit has an estimated capital

cost of GBP0.3 million and will be funded from existing cash

reserves. Construction of the circuit will be managed by AfriTin's

in-house engineering team.

The pilot tantalum separation circuit will treat the entire

stream of currently produced tin concentrate. The Company expects

to progress seamlessly from the pilot phase to the final circuit

configuration through process optimisation over a period of 6

months.

Glossary of abbreviations

Cassiterite Tin bearing mineral

DMS Dense Medium Separation

CGM Columbite Group Minerals, which is tantalum bearing

Li Elemental symbol for Lithium

Li(2) O Lithium oxide

Li -> Li(2) Conversion factor of 2.153

O

Petalite Low iron lithium bearing silicate

NIR Near Infrared

QA/QC Quality Assurance Quality Control

Sn Elemental symbol for Tin

Ta Elemental symbol for Tantalum

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 20 7220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Tavistock Financial PR (United

Kingdom) +44 (0) 20 7920 3150

Jos Simson

Nick Elwes

Oliver Lamb

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is the first pure tin company listed in

London and its vision is to create a portfolio of globally

significant, conflict-free, tin-producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to 10,000 tonnes of concentrate in a

Phase 2 expansion, having reached Phase 1 commercial production in

2020. The Company strives to capitalise on the solid supply/demand

fundamentals of tin by developing a critical mass of tin resource

inventory, achieving production in the near term and further

scaling production by consolidating tin assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIBDBGXBDGBR

(END) Dow Jones Newswires

November 18, 2021 02:00 ET (07:00 GMT)

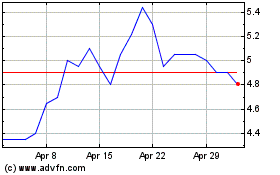

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024