AfriTin Mining Ltd Uis Phase 1 Expansion Lending Facility Completion (6700T)

26 November 2021 - 6:00PM

UK Regulatory

TIDMATM

RNS Number : 6700T

AfriTin Mining Ltd

26 November 2021

26 November 2021

AfriTin Mining Limited

("AfriTin" or the "Company")

Uis Phase 1 Expansion Lending Facility Completion

AfriTin Mining Limited (AIM: ATM), an African tech-metals mining

company with a portfolio of mining and exploration assets in

Namibia in tin, lithium and tantalum, with its flagship asset, the

Uis Tin Mine ("Uis") in Namibia, is pleased to announce that the

lending facility with Standard Bank Namibia Ltd ("Standard Bank"),

to fund the expansion of the Uis Phase 1 processing plant ("Lending

Facility"), and detailed in the announcement of 21 September 2021,

has now been executed.

Highlights:

-- Financial close of the NAD 90 million (approximately GBP 4.5

million) Senior Secured Term Loan ("Term Loan") with Standard Bank

Namibia Ltd;

-- Immediate drawdown of the total amount available under Term

Loan marks the beginning of a long-term financing partnership with

Standard Bank; and

-- The monies from the Term Loan will be used to fund the

expansion of the Phase 1 pilot processing plant.

Anthony Viljoen (CEO) commented:

"We are pleased to announce the financial close and drawdown of

the term loan facility with Standard Bank in Namibia. This marks

the start of a long-term financing partnership to continue the

rapid development of the Uis Tin mine to its full potential and

growing our tech-metal revenue profile."

The Company has today executed a NAD 90 million (approximately

GBP 4.5 million) Term Loan with Standard Bank and has immediately

drawn down the full NAD90 million available to it. The headline

terms include the following:

-- Loan term of 5 years from the date of drawdown

-- Ranked as senior secured debt

-- Interest rate of 3-month JIBAR (currently 3.85%) plus 4.5% (currently equal to 8.35%)

In addition to the Term Loan, Standard Bank has taken over the

Company's existing short-term banking facilities (working capital

facilities) with Nedbank Namibia totalling NAD 43 million

(approximately GBP 2.2 million). These facilities will incur an

interest rate of Namibian prime lending rate (currently 7.50%)

minus 1.00%. Furthermore, Standard Bank has provided AfriTin Mining

(Namibia) Pty Limited with a NAD 5 million guarantee to Namibia

Power Corporation Pty Limited in relation to a deposit for the

supply of electrical power.

Project Summary

On 14 June 2021, the Board approved a Definitive Feasibility

Study for an expansion of the Uis Phase 1 pilot processing plant,

projected to increase tin concentrate production by 67%, from 720

tonnes per annum to 1,200 tonnes per annum.

The project scope consists of a modular expansion of the current

plant, leveraging existing bulk infrastructure services and

installed processing configurations. Approximately 70% of the

project capital will be applied towards the expansion of the dry

crushing and screening circuits, consisting mainly of an additional

secondary crusher and vibrating screen, and a fines ore stockpile

to decouple the comminution circuit from the concentrator. The

balance of the project capital relates to addressing potential

throughput constraints in the concentrator that may result from the

increased feed rate, as well as improvements to the concentrate

cleaning circuit to enhance tin recovery.

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 20 7220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart +44 (0) 20 7710 7600

Tavistock Financial PR (United

Kingdom) +44 (0) 20 7920 3150

Jos Simson

Nick Elwes

Oliver Lamb

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is the first pure tin company listed in

London and its vision is to create a portfolio of globally

significant, conflict-free, tin-producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to 10,000 tonnes of concentrate in a

Phase 2 expansion, having reached Phase 1 commercial production in

2020. The Company strives to capitalise on the solid supply/demand

fundamentals of tin by developing a critical mass of tin resource

inventory, achieving production in the near term and further

scaling production by consolidating tin assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZMZMGVMGMZG

(END) Dow Jones Newswires

November 26, 2021 02:00 ET (07:00 GMT)

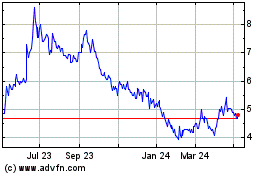

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

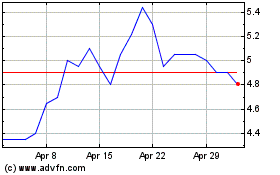

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024