AfriTin Mining Ltd Result of AGM (3150B)

30 September 2022 - 5:00PM

UK Regulatory

TIDMATM

RNS Number : 3150B

AfriTin Mining Ltd

30 September 2022

30 September 2022

AfriTin Mining Limited

("AfriTin" or the "Company")

Result of AGM

AfriTin Mining Limited (AIM: ATM), an African technology-metals

mining company with a portfolio of mining and exploration assets in

Namibia, announces that, at its Annual General Meeting ("AGM") held

yesterday, all resolutions were duly passed with the exception of

resolution nine. Resolution nine is a special resolution pertaining

to the approval for the issue of certain share options to directors

and employees of the Company, was not passed.

Full details of the results of the voting are available on the

Company's website:

https://afritinmining.com/investor-centre/company-reports/

In accordance with the QCA Corporate Governance Code, the Board

confirms that it will consult and engage with the relevant

shareholders to understand and discuss their concerns with respect

to resolution nine.

For further information, please visit www.afritinmining.com or

contact :

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart +44 (0) 20 7710 7600

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Emily Moss

Cath Drummond

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed tech-metals mining

company with a vision to create a portfolio of globally

significant, conflict-free, producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to more than 10,000 tonnes of tin

concentrate and 350,000 tonnes of lithium concentrate in a Phase 2

expansion, having reached Phase 1 commercial production in 2020.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin and lithium by developing a critical mass of

resource inventory, achieving production in the near term and

further scaling production by consolidating assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGURANRUAUKORR

(END) Dow Jones Newswires

September 30, 2022 03:00 ET (07:00 GMT)

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

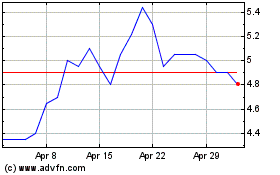

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024