TIDMATM

RNS Number : 8296I

AfriTin Mining Ltd

07 December 2022

7 December 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

AfriTin Mining Limited

("AfriTin" or the "Company")

Lithium and Tantalum Product Development Update

AfriTin Mining Limited (AIM: ATM), an African technology metals

mining company with a portfolio of mining and exploration assets in

Namibia, provides an update on its lithium and tantalum product

development programme.

The object of the programme is to demonstrate the potential

commercial viability of a lithium petalite concentrate co-product

from the Uis Mine ("Uis"), and provide samples for potential

offtake partners, whilst simultaneously de-risking the development

of commercial-scale processing plant for lithium. In addition, the

programme also includes the implementation of a full-scale tantalum

separation circuit to produce a tantalum concentrate by-product

from the tantalum contained in the existing tin concentrate

product.

Milestones Achieved

-- Lithium laboratory test work has produced a high-grade,

ultra-low iron lithium petalite concentrate at 4.34% Li(2) O and

low contaminants levels of 0.03% Fe(2) O(3) and 0.93% alkalis

(Na(2) O + K(2) O);

-- Test work to convert lithium petalite concentrate to

battery-grade lithium hydroxide has been initiated with Nagrom, one

of Australia's leading mineral processing companies;

-- Commercial engagements with lithium petalite concentrate offtakers have been initiated;

-- Infill exploration drilling programme for lithium and tantalum over V1/V2 orebody complete;

-- Tantalum laboratory test work produced a saleable 24%

tantalum oxide (Ta2O5) concentrate; and

-- Nicholas Rathjen appointed as Head of Business and Commercial

Development to advance the commercial aspects of AfriTin's lithium

and tantalum potential.

Anticipated News Flow

-- Larger, pilot scale lithium metallurgical testing, which will

also produce samples for potential offtakers, has commenced, with

first results expected in Q1 2023

-- First results from laboratory metallurgical test work with

Nagrom to produce battery-grade lithium hydroxide expected in Q3

2023;

-- A lithium pilot plant, intended for processing bulk ore

samples at Uis, is progressing to construction phase, with long

lead items ordered. Construction is scheduled to complete in Q2

2023;

-- Updated lithium and tantalum Mineral Resource Estimate for

lithium and tantalum expected in Q1 2023 following final infill

drilling results; and

-- A full-scale, integrated tantalum separation circuit is

progressing to construction phase, with long lead items ordered and

construction scheduled to complete in Q2 2023. First production of

tantalum concentrate is expected by Q3 2023.

Anthony Viljoen (CEO) commented:

"We are excited to see our lithium product development programme

progress on three fronts, namely updating the Mineral Resource

Estimate, commencement of lithium pilot scale metallurgical

testing, and taking the first steps to explore commercial

engagements for lithium petalite concentrate offtake.

"The excellent laboratory test result of a high-grade, ultra-low

iron petalite gives us the confidence to advance to the pilot phase

of our lithium product development programme. We look forward to

establishing production of lithium petalite concentrate and

initiating testing with potential offtakers in the glassware and

ceramics market, for whom petalite is a key raw material, as well

as with producers of lithium hydroxide and lithium carbonate for

the battery market.

"In addition to lithium, the Company is moving ahead with the

construction of a tantalum separation circuit, which will be

integrated with the existing tin concentrator plant. The new

circuit will magnetically separate tantalum minerals from the

existing tin concentrate stream into a second saleable

concentrate.

"The Company is fully focussed on unlocking early value for its

stakeholders through fast-tracking the development programme

towards production. We believe that the addition of lithium and

tantalum by-products will confirm the Company as a globally

significant, high-margin producer of technology metals.

"Lastly, we welcome Nicholas Rathjen into the role of Head of

Business and Commercial Development at AfriTin. Nicholas will focus

on advancing the commercial aspects of our lithium strategy as we

progress towards becoming a fully-fledged lithium producer."

Lithium Metallurgical Testing

The results of the first phase test work of laboratory

metallurgical test work for the beneficiation of lithium bearing

mineral petalite was announced on 24 May 2022. Geolabs Global, an

independent test facility in South Africa, produced a high-grade,

ultra-low iron petalite concentrate at 4.34% Li(2) O, with low

contaminants levels of 0.03% Fe(2) O(3) and 0.93% alkalis (Na(2) O

+ K(2) O), using a process that pre-concentrates petalite through

dense medium separation ("DMS"), followed by upgrading to a

higher-grade petalite concentrate using milling and flotation.

These qualities are typical of petalite concentrates used as

lithium feedstock in the premium glass and ceramics industry which

requires a high lithia to iron ratio. The Company also expects the

concentrate to be suitable for conversion to battery-grade lithium

carbonate or hydroxide. Laboratory flotation test work continues at

ANZAPLAN (Germany) with aim the of optimising flotation performance

and testing alternative reagent regimes.

In addition, laboratory test work for the production of lithium

hydroxide from the Uis petalite concentrate has been initiated at

Nagrom one of Australia's leading mineral processing companies,

with results expected in Q3 2023 . Lithium hydroxide serves as a

key raw material for the manufacturing of lithium-ion

batteries.

Larger, pilot scale metallurgical testing has commenced, which

involves the processing of bulk samples ranging from 1 to 100

tonnes of mineralised material. By scaling up the test work the

Company intends to achieve the following improvements:

-- Increase the confidence of the lithium beneficiation parameters and process flow design;

-- Improve variability modelling for the mineralised material

and its beneficiation characteristics;

-- Generate enough concentrate to initiate downstream test work with potential offtakers.

The pilot scale testing programme includes the following work

streams in progress:

-- DMS test work on a large bulk ore sample at Bond Equipment (South Africa);

-- Pilot scale milling and flotation test work at Nagrom (Australia);

-- Hyperspectral ore sorting test work with Steinert (Germany)

and Tomra (Germany) to investigate alternative or supplementary

methods of petalite pre-concentration. The hyperspectral ore

sorting test work runs in parallel to x-ray transmission ore

sorting test work for tin.

The results of the second phase of metallurgical test work are

expected during Q1 2023 and will inform the process flow design

("PFD") of the full-scale, integrated lithium beneficiation circuit

at the current Uis Mine processing plant. A preliminary process

flow design for an integrated lithium, tin and tantalum processing

facility is presented in Figure 2.

Early-stage metallurgical test work has also been initiated on

mineralised material from ML133 to establish the lithium

beneficiation potential of these pegmatites.

Lithium Pilot Plant

As part of the pilot phase of metallurgical testing the Company

has set out to construct a lithium pilot plant adjacent to the

current tin processing plant of the Uis Mine on the licence ML134.

Basic engineering design for a lithium pilot plant has been

completed and long lead items have been ordered. The project has

now entered the construction phase with commissioning projected for

Q2 2023.

The pilot plant comprises a crushing and screening section,

followed by a DMS and gravity separation circuit, and will be built

at a total capital cost of US$5 million. A milling and flotation

section for petalite may be added as the next stage of the pilot

plant, although pilot test campaigns for flotation will first be

conducted at off-site testing facilities. The commercial viability

of lithium petalite extraction via DMS technology is sufficiently

well established to warrant its inclusion in this stage of the

pilot plant, with the intention of fast-tracking its production and

marketing.

The lithium pilot plant is intended to process bulk sample

discard material from the current tin processing plant and

run-of-mine ore from the current mining pit, as well as mineralised

material from ML133 and ML129. The plant will have a processing

capacity of approximately 20 tph. Pilot campaigns will test various

processing configurations, with the aim of refining the process

flow design. It is also intended that the pilot plant will produce

lithium concentrate, both for further offtake testing and

development.

Tantalum By-Product Development

The results of the laboratory metallurgical test work for

tantalum were announced on 18 November 2021. Tantalum bearing

columbite-group minerals was separated from the tin bearing

cassiterite using dry electromagnetic separation, producing a

concentrate containing 24% Ta(2) O(5) . As a result of this

successful test, a tantalum separation will be constructed as an

integrated circuit to the existing tin concentrating plant. Basic

engineering has been completed and long lead items have been

ordered. Commissioning of the circuit is scheduled for Q2 2023,

with first tantalum product is expected in Q3 2023.

The tantalum separation circuit comprises a dryer, vibrating

screen, and over-belt electromagnetic separators. The total

estimated capital cost of the circuit is US$1 million. The circuit

will be fed with concentrate exiting the wet concentration

circuits. The moist concentrate will be dried, classified, and each

size fraction treated by a separate magnetic separator, after which

the non-magnetic fractions will be combined into a tin concentrate,

whereas the magnetic fractions (excluding the low-intensity

iron-rich fraction) will be combined into a saleable tantalum

concentrate.

Lithium & Tantalum Mineral Resources

The Company owns three mining licences with lithium occurrences:

ML134, ML129 and ML133 (Figure 1). The lithium occurs in pegmatites

that are also enriched in tin and tantalum. ML134 holds the

Company's flagship asset, the Uis Mine which includes an inferred

JORC (2012) compliant lithium resource of 450,000 tonnes of Li(2) O

at the V1/V2 pegmatite. An infill drilling programme of 7,600 m

over this pegmatite has been concluded with the aim of increasing

the Mineral Resource Estimate ("MRE") classification for the

lithium resource to the indicated and measured categories. The

final assay results are expected in December 2022. An updated MRE

for lithium and tantalum is expected during Q1 2023.

ML134 contains an additional 14 historically mined pegmatites

along a 7 km strike, where exploration work to date has

demonstrated that the mineralogy of all these pegmatites is similar

to the V1/V2 pegmatite. This substantiates historical mining

practices which sourced material from all these pegmatites and

processed the material through a single plant. These pegmatites

occur within 4 km of the current Uis processing plant. Exploration

drilling is planned to continue over these pegmatite bodies with

the goal of expanding the lithium, tin and tantalum mineral

resource estimates on this licence.

Lithium mineralisation has also been reported on the proximal

ML129 and ML133 licences (announced on 2 March 2023 and 24 November

2022 respectively) and geological sampling confirms the presence of

lithium mineralisation over more than 70 pegmatites. The main

lithium bearing mineral on ML134 and ML133 has been identified as

petalite. On ML129, however, surface sampling has identified the

presence of spodumene, whose distribution will be further

investigated during future exploration drilling programmes.

Appointment of Head of Business and Commercial Development

The Company is pleased to announce the appointment of Nicholas

Rathjen as Head of Business and Commercial Development. He will

focus on advancing the commercial aspects of our lithium and

tantalum strategy. Nicholas brings a strong commercial capability

having led early-stage lithium projects through development,

definitive feasibility studies, execution of offtake agreements

with global counter parties through to execution of commercial

transactions. His most recent role was head of corporate

development at Prospect Resources (ASX:PSC), where he led the

strategic process to advance the Arcadia Project, featuring

petalite and spodumene, which culminated in the sale of this

significant asset to leading new energy company, Huayou Cobalt, for

US$422 million.

Figures

Figure 1 : AfriTin's Uis Mine and mineral licence locality map

showing the position of ML134, ML129 and ML133.

Figure 2 : Simplified process flow design for an integrated

lithium, tin and tantalum processing plant (subject to further

process flow optimisation). The parts of the process flow design

enclosed by the red dashed lines indicate possible future additions

to the processing plant.

Glossary of abbreviations

DMS Dense medium separation

ILiA International Tin Association

------------------------------------------------

km Kilometre

------------------------------------------------

Li Symbol for lithium

------------------------------------------------

Li -> Li (2) O Metal to metal-oxide conversion factor of 2.153

------------------------------------------------

Li (2) O Lithium oxide

------------------------------------------------

m Metre

------------------------------------------------

MRE Mineral Resource Estimate

------------------------------------------------

PPM Parts per million

------------------------------------------------

Sn Symbol for tin

------------------------------------------------

Ta Symbol for tantalum

------------------------------------------------

tpa Tonnes per annum

------------------------------------------------

tph Tonnes per hour

------------------------------------------------

Glossary of Technical Terms

Dense Medium Separation An ore beneficiation method in which minerals of relatively high or low specific gravity

are

separated from gangue using a hydro cyclone and a dense medium.

Pegmatite An igneous rock typically of granitic composition, which is distinguished from other

igneous

rocks by the extremely coarse and systematically variable size of its crystals, or by an

abundance

of crystals with skeletal, graphic, or other strongly directional growth habits, or by a

prominent

spatial zonation of mineral assemblages, including monomineralic zones

--------------------------------------------------------------------------------------------

Petalite A lithium aluminium phyllosilicate mineral LiAlSi(4) O(10) , occurring in lithium-bearing

pegmatites, often with other lithium minerals such as spodumene and lepidolite.

--------------------------------------------------------------------------------------------

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

+44 (0) 207 220

Nominated Adviser 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield +44 (0) 20 7907

Nilesh Patel 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart +44 (0) 20 7710

Varun Talwar 7600

Tavistock Financial PR (United +44 (0) 207 920

Kingdom) 3150

Emily Moss

Catherine Drummond

Adam Baynes

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed technology metals

mining company with a vision to create a portfolio of globally

significant, conflict-free, producing and exploration assets. The

Company's flagship asset is the Uis Tin Mine in Namibia, formerly

the world's largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Mine in Namibia to more than 10,000 tonnes of tin

concentrate and 350,000 tonnes of lithium concentrate in a Phase 2

expansion, having reached Phase 1 commercial production in 2020.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin and lithium by developing a critical mass of

resource inventory, achieving production in the near term and

further scaling production by consolidating assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDXQLLBLLLFFBL

(END) Dow Jones Newswires

December 07, 2022 02:00 ET (07:00 GMT)

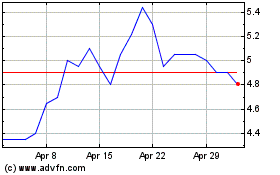

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024