TIDMATM

RNS Number : 5940K

AfriTin Mining Ltd

22 December 2022

22 December 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

AfriTin Mining Limited

("AfriTin" or the "Company")

Quarterly Production Update

Record Production During November 2022 Following Plant

Expansion

AfriTin Mining Limited (AIM: ATM), an African technology metals

mining company with a portfolio of mining and exploration assets in

Namibia, provides an unaudited quarterly production update for the

Uis Mine ("Uis") for the third quarter ("Q3") ending 30 November

2022 of the 2023 Financial Year ("FY2023")*.

Highlights:

-- Commissioning of the expanded crushing and tin concentrating

circuits completed during October 2022;

-- Record tin production of 88 tonnes of concentrate (53 tonnes

of tin contained) achieved during November 2022, equal to 88% of

the expanded nameplate production capacity of 100 tonnes of

concentrate per month;

-- Operating unit cost for November 2022 was 14% lower than

average monthly unit cost for H1 FY2023 ending 31 August 2022;

-- Production ramp-up on track for completion by end of January 2023; and

-- Lithium pilot plant and tantalum separation circuit under

construction and on track for commissioning in Q2 2023.

Anthony Viljoen (CEO) commented:

"We are extremely pleased with the production ramp-up

performance of the expanded Uis Mine processing plant as evidenced

by the November 2022 production which exceeded the target by 20%.

We believe the expanded production capacity will significantly

increase revenue and reduce unit costs, thereby improving the

margin and sustainability of the operation.

In addition, the Company is fast tracking the development of

separate lithium and tantalum products alongside its existing tin

production, with both a lithium pilot and a tantalum separation

circuit under construction. We look forward to realising the full

polymetallic potential of the Uis deposit."

Production Ramp-up

Commissioning of the Uis Phase 1 Expansion Project ("the

Project"), a modular expansion of the current processing plant, was

completed in October 2022 and announced on 7 November 2022. The

Project targets an increase in production at Uis from approximately

780 tonnes per annum ("tpa") to 1200 tpa tin concentrate (470 tpa

and 720 tpa tin contained in concentrate respectively). The

production ramp-up period is estimated to last for 3 months, from

November 2022 to January 2023.

During November 2022, the first month of production following

commissioning, the ramp-up target was exceeded by 20% (88 tonnes of

tin concentrate vs a target of 73 tonnes). The production of 88

tonnes of tin concentrate (containing 53 tonnes of tin) achieved

during November 2022 also represents a new monthly production

record.

Q3 Production Performance

Production during Q3 FY2023 was impacted by a planned 5-week

processing plant shutdown from 7 September 2022 to 13 October 2022,

which was required to complete the construction and commissioning

of the expanded crushing and tin concentrating circuits. This

resulted in a loss of approximately one third of the available

production time during the quarter under review. An average of 90

kt of ore was processed at an average processing rate of 107 tph

(excluding the plant shutdown period), resulting in a tin

concentrate production of 145 tonnes ( Table 1 ). The operating

unit cost for the quarter also rose concurrently with the lower

production volumes.

Management is, however, encouraged by the record production

achieved during November 2022, after commissioning of the plant

expansion ( Table 2 ). Compared to the monthly average performance

during H1 FY2023, the plant processing rate has increased by 17%,

ore processed has increased by 22%, tin concentrate production has

increased by 16%, and the operating unit cost has decreased by 14%

(unaudited). It is expected that these trends will continue as the

production ramp-up progresses.

Table 1 : QoQ (Q3 FY2023 vs Q2 FY2023) production and cost

performance of the Uis Mine.

Description Units FY2022 Actual Q1 FY2023 Q2 FY2023 Q3 FY2023 QoQ

Quarterly Actual Actual Actual Performance

Average (Mar (Mar 2022 - May (Jun 2022 - Aug (Sep 2022 - Nov (% Change)

2021 - Feb 2022) 2022) 2022)

2022)

Plant

Availability % 87 89 89 73 -18%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Plant

Utilisation % 79 78 69 63 -9%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Plant

Processing

Rate tph 92 99 100 107 7%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Ore Processed t 135,900 152,243 134,315 90,278 -33%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Feed Grade % Sn 0.147 0.149 0.145 0.140 -3%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Tin

Concentrate t 201 239 214 145 -32%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Tin Contained

in

Concentrate t 124 152 133 87 -35%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Tin Recovery % 62 67 69 68 -1%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

Operating US$/t

Cost* for contained

Uis Tin Mine tin 25,209 20,989 25,245 33,207 32%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

US$/t

AISC** for contained

Uis Tin Mine tin 27,515 23,526 29,282 38,570 32%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

US$/t

Tin Price contained

Achieved tin 38,604 34,367 22,975 22,625 -2%

-------------- ---------------- ---------------- ---------------- ---------------- --------------

* Operating Cost (excludes sustaining capital expenditure

associated with developing and maintaining the Uis operation;

unaudited)

** AISC = All-In Sustaining Cost (incorporates all costs related

to sustaining production and in particular recognising the capital

expenditure associated with developing and maintaining the Uis

operation, including pre-stripping waste mining costs;

unaudited)

Production period includes a 5-week shutdown of the processing

plant from 7 September 2022 to 13 October 2022, which was required

to complete the construction and commissioning of the expanded

crushing and tin concentrating circuits.

Table 2 : Production and cost performance for November 2022

compared to the average monthly performance for the Uis Mine for H1

FY2023 ending 31 August 2022.

Description Units H1 FY2023 Actual Nov 2022 Actual Change in Monthly

Monthly Average Performance

(Mar 2022 - Aug 2022) (%)

Plant Availability % 89 91 2%

--------------------- ------------------------ ---------------- ------------------------

Plant Utilisation % 74 81 9%

--------------------- ------------------------ ---------------- ------------------------

Plant Processing Rate tph 100 117 17%

--------------------- ------------------------ ---------------- ------------------------

Ore Processed t 47,760 58,333 22%

--------------------- ------------------------ ---------------- ------------------------

Feed Grade % Sn 0.147 0.140 -5%

--------------------- ------------------------ ---------------- ------------------------

Tin Concentrate t 76 88 16%

--------------------- ------------------------ ---------------- ------------------------

Tin Contained in

Concentrate t 48 53 10%

--------------------- ------------------------ ---------------- ------------------------

Tin Recovery % 68 67 -1%

--------------------- ------------------------ ---------------- ------------------------

Operating Cost for Uis

Tin Mine US$/t contained tin 23,117 19,883 -14%

--------------------- ------------------------ ---------------- ------------------------

AISC for Uis Tin Mine US$/t contained tin 26,404 22,763 -14%

--------------------- ------------------------ ---------------- ------------------------

Lithium Pilot Plant and Tantalum Separation Circuit

As announced on 7 December 2022, a lithium pilot plant and

tantalum separation circuit are currently under construction. The

lithium pilot plant is intended to process bulk samples into a

lithium concentrate, with the aim of refining the process flow

design for lithium, as well as for offtake testing and development.

The tantalum separation circuit will be integrated with the

existing tin concentrating plant to produce a separate saleable

tantalum concentrate. Commissioning of both projects is scheduled

for Q2 2023.

Glossary of abbreviations

AISC All-in sustaining costs

FY Financial year

------------------------

k t K ilo tonnes

------------------------

M t M illion tonnes

------------------------

Q oQ Q uarter-on-quarter

------------------------

t Tonnes

------------------------

t ph T onnes per hour

------------------------

Glossary of Terms

Operating Costs Excludes sustaining capital expenditure associated with developing and maintaining

the Uis

operation (unaudited)

AISC = All-In Sustaining Cost Incorporates all costs related to sustaining production and in particular recognising

the

sustaining capital expenditure associated with developing and maintaining the Uis

operation,

including pre-stripping waste mining costs (unaudited)

--------------------------------------------------------------------------------------

* The Company's Financial Year runs from March to February. All

reference to quarters applies to the financial year reporting

period, unless stated otherwise.

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United Kingdom) +44 (0) 207 920 3150

Emily Moss

Catherine Drummond

Adam Baynes

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed technology metals

mining company with a vision to create a portfolio of globally

significant, conflict-free, producing and exploration assets. The

Company's flagship asset is the Uis Tin Mine in Namibia, formerly

the world's largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Mine in Namibia to more than 10,000 tonnes of tin

concentrate and 350,000 tonnes of lithium concentrate in a Phase 2

expansion, having reached Phase 1 commercial production in 2020.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin and lithium by developing a critical mass of

resource inventory, achieving production in the near term and

further scaling production by consolidating assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQLLBLLLLFFBL

(END) Dow Jones Newswires

December 22, 2022 02:00 ET (07:00 GMT)

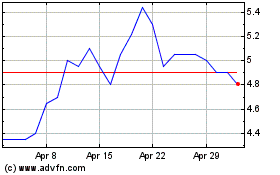

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024