Athelney Trust PLC Net Asset Value(s) (2567K)

04 May 2022 - 4:56PM

UK Regulatory

TIDMATY

RNS Number : 2567K

Athelney Trust PLC

04 May 2022

Athelney Trust PLC

Legal Entity Identifier:

213800ON67TJC7F4DL05

The unaudited net asset value of Athelney Trust was 260.0p at 30

April 2022.

Fund Manager's comment for April 2022

Our portfolio declined by 1.38% over the month which was in line

with the overall decline in the UK market. After providing for the

expenses the NAV declined by 1.48% as compared to the FTSE 100

which was up by 0.38% and the broader FTSE 250 Index which declined

by 2.13%. The AIM All Share Index declined by 1.93%, the Small Cap

Index performed slightly better declining by only 1.54% while t he

Fledgling Index was up by 0.71%. As mentioned in previous monthly

comments, the FTSE 100 Index contains many larger, older and more

traditional commodity and energy-related stocks including BP and

Royal Dutch Shell which have been benefiting from soaring global

oil and metal prices as a result of the war in Ukraine.

By comparison, the Global markets were under huge pressure with

the MSCI declining by 8.43% over the month, mirroring the 8.8%

decline in the S&P500 index. This decline in the broad global

index was largely driven by a massive decline in the Mega Cap

companies in the US with the tech heavy NASDAQ down by a massive

13.26% during the month.

Recent UK economic data for February reflected the global trend

of higher inflation and slowing growth. GDP grew by 0.1%

month-on-month, following a 0.8% gain in January which reflected

weakness in industrial and manufacturing production as well as in

construction and services. The UK's March CPI headline rate was up

by 7% and now sits at a 30-year-high which is the primary cause of

the current tightening by the Bank of England with its policy rate

now at 0.5% .

The contraction in the US GDP at an annualised rate of 1.4% in

the first quarter was a surprise and due to a substantial decline

in net exports and inventories. However, personal consumption

expenditure and fixed investment remained positive contributors. In

the business sector, equipment investment increased by an

annualised 15.3% against the backdrop of limited labour

availability and strong wage growth as businesses continue to

invest in automation to overcome the labour shortage and rising

labour costs.

During the month we sold our holding in Lok 'n Store and added

further to our holding in Target Healthcare, Tritax Big Box, LXI

Reit and AEW UK Reit, thereby increasing the yield from our

property exposure. We received the cash from the takeover of

Clinigen with cash currently comprising 10.5% of the portfolio at

month end .

Fact Sheet

An accompanying fact sheet which includes the information above

as well as wider details on the portfolio can be found on the

Fund's website www.athelneytrust.co.uk under "About" then select

"Latest Monthly Fact Sheet".

Background Information

Dr. Emmanuel (Manny) Pohl AM

Manny is Chairman and Chief Investment Officer of E C Pohl &

Co ("ECP"), an investment management company and has been a major

shareholder in Athelney trust for many years.

E C Pohl & co is licensed by the Australian Financial

services (licence no.421704).

www.ecpohl.com

www.ecpam.com

Manny Pohl and the ECP group has AUD2.7bn (GBP1.5 billion) under

its management including four listed investment companies, three

listed in Australia and one in the UK:

-- Flagship Investments (ASX code:FSI)

AUD95m https://flagshipinvestments.com.au

-- Barrack St Investments (ASX code: BST)

AUD37m www.barrackst.com

-- Global Masters Fund Limited (ASX code: GFL)

AUD33m www.globalmastersfund.com.au

-- Athelney Trust plc (LSE code: ATY)

GBP6m www.athelneytrust.co.uk

Athelney Trust plc Investment Policy

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

The assets of the Trust are allocated predominantly to companies

with either a full listing on the London Stock Exchange or a

trading facility on AIM or ISDX. The assets of the Trust have been

allocated in two main ways: first, to the shares of those companies

which have grown steadily over the years in terms of profits and

dividends but, despite this progress, the market rating is

favourable when compared to future earnings and dividends; second,

to those companies whose shares are standing at a favourable level

compared with the value of land, buildings or cash in the balance

sheet.

Athelney Trust was founded in 1994. In 1996 it was one of the

ten pioneer members of the Alternative Investment Market ("AIM").

In 2008 the shares became fully listed on the main market of the

London Stock Exchange. Athelney Trust has a successful progressive

dividend growth record and the dividend has grown every year since

2004. According to the Association of Investment Companies (AIC)

Athelney Trust is one of only "22 investment companies that have

increased their dividend every year between 10 and 20 years - the

next generation of dividend heroes" (as at 20/03/2018). See

link

https://www.theaic.co.uk/income-finder/dividend-heroes

Website

www.athelneytrust.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVGLGDUUUGDGDS

(END) Dow Jones Newswires

May 04, 2022 02:56 ET (06:56 GMT)

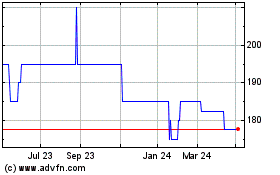

Athelney (LSE:ATY)

Historical Stock Chart

From Mar 2024 to Apr 2024

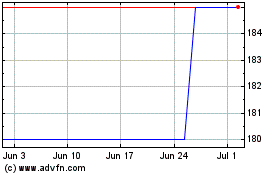

Athelney (LSE:ATY)

Historical Stock Chart

From Apr 2023 to Apr 2024