Atalaya Mining PLC Approval of inaugural dividend (3544Q)

27 October 2021 - 5:00PM

UK Regulatory

TIDMATYM

RNS Number : 3544Q

Atalaya Mining PLC

27 October 2021

27 October 2021

Atalaya Mining Plc.

("Atalaya" or the "Company")

Approval of inaugural dividend and future dividend policy

Atalaya Mining Plc (AIM: ATYM, TSX: AYM) is pleased to announce

that the Company's Board of Directors has approved its inaugural

dividend (the "Inaugural Dividend") as well as the adoption of a

future dividend policy ("Dividend Policy") that will take effect

from 2022.

Background

Following the expansion of Proyecto Riotinto's processing

capacity to 15 Mtpa, Atalaya has been generating robust cash flow

as a result of the plant consistently operating above nameplate

capacity, coupled with the strong copper price environment.

Accordingly, Atalaya is now in a position to reward its

shareholders by initiating a sustainable dividend policy while

still investing in its portfolio of low capital intensity growth

projects, such as the San Dionisio deposit, Proyecto Masa Valverde

and Proyecto Touro.

Dividend Policy

Consistent with its strategy to create and deliver shareholder

value, the Company has approved a Dividend Policy that will make an

annual payout of between 30% and 50% of free cash flow generated

during the applicable financial year ("Ordinary Dividend").

The Dividend Policy will take effect in financial year 2022. The

annual Ordinary Dividend will be paid in two half-yearly

instalments and announced in conjunction with future interim and

full year results.

The declaration and payment of all future dividends under the

new policy will remain subject to approval by the Board of

Directors.

Inaugural Dividend

The Board of Directors has elected to declare an Inaugural

Dividend of US$0.395 per ordinary share (approximately US$54.6

million), which is equivalent to approximately 29 pence per share.

The Inaugural Dividend is for the nine months ended 30 September

2021 and represents a yield of approximately 7.3% based on the

current share price.

The record date for the Inaugural Dividend will be 5 November

2021 and the shares will become ex-dividend on 4 November 2021.

The Inaugural Dividend will be paid on 1 December 2021 in US

Dollars, with an option for shareholders to elect to receive the

dividend in Sterling or Euros (the "Foreign Designated

Currencies"). Shareholders are requested to communicate their

currency election to the Company by no later than 11 November 2021.

The exchange rates for payments in Sterling and Euros will be fixed

by Atalaya on 15 November 2021 and subsequently announced.

Shareholders are also requested to complete the requisite tax

forms by no later than 11 November 2021, which are available on the

Company's website.

Inaugural Dividend Timetable:

Event Date

Ex-Dividend date 4 November 2021

-----------------

Record date 5 November 2021

-----------------

Last day for currency election 11 November 2021

-----------------

Last date for tax form 11 November 2021

-----------------

Date of exchange rate used for Foreign Designated 15 November 2021

Currencies

-----------------

Announcement of exchange rate in Foreign 16 November 2021

Designated Currencies

-----------------

Payment date 1 December 2021

-----------------

Alberto Lavandeira, CEO, commented:

"I am proud that Atalaya is announcing its inaugural dividend

for 2021 along with a future dividend policy. This represents a

major milestone for the Company and validates the strength and

sustainability of our business. Atalaya's shareholders will be

rewarded for having consistently supported the Company as it

restarted Proyecto Riotinto and expanded it into a world class

operation. Today, we are in a strong net cash position and continue

to grow our cash balance, allowing the Company to begin returning

capital to shareholders whilst continuing to advance our exciting

growth pipeline."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) no 596/2014.

Contacts:

Elisabeth Cowell / Adam Lloyd / + 44 20 3757

Newgate Communications Tom Carnegie 6880

+44 20 3170

4C Communications Carina Corbett 7973

----------------------------------- -------------

Canaccord Genuity

(NOMAD and Joint Henry Fitzgerald-O'Connor / James +44 20 7523

Broker) Asensio 8000

----------------------------------- -------------

BMO Capital Markets +44 20 7236

(Joint Broker) Tom Rider / Andrew Cameron 1010

----------------------------------- -------------

Peel Hunt LLP +44 20 7418

(Joint Broker) Ross Allister / David McKeown 8900

----------------------------------- -------------

About Atalaya Mining Plc

Atalaya is an AIM and TSX-listed mining and development group

which produces copper concentrates and silver by-product at its

wholly owned Proyecto Riotinto site in southwest Spain. Atalaya's

current operations include the Cerro Colorado open pit mine and a

modern 15 Mtpa processing plant, which has the potential to become

a centralised processing hub for ore sourced from its wholly owned

regional projects around Riotinto that include Proyecto Masa

Valverde and Proyecto Riotinto East. In addition, the Group has a

phased, earn-in agreement for up to 80% ownership of Proyecto

Touro, a brownfield copper project in the northwest of Spain. For

further information, visit www.atalayamining.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVPPGWAUUPGPUQ

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

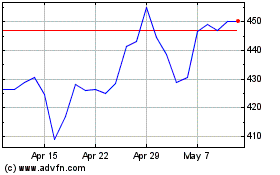

Atalaya Mining (LSE:ATYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

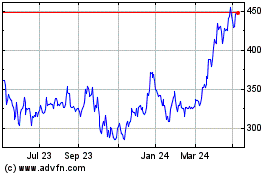

Atalaya Mining (LSE:ATYM)

Historical Stock Chart

From Apr 2023 to Apr 2024