TIDMAV.

RNS Number : 8101V

Aviva PLC

16 December 2021

16 December 2021

Aviva plc to increase and extend ordinary share buyback

programme, taking the maximum aggregate consideration to GBP1.0

billion(1)

Aviva plc ("Aviva") announces today it will increase and extend

its ordinary share buyback programme announced on 12 August 2021

(the "Programme") from GBP750 million to a maximum aggregate

consideration of GBP1 billion(1) . The total maximum number of

shares to be acquired under the Programme is increased to 392

million(1) . The Programme commenced on 13 August 2021 and will now

complete no later than 31 March 2022.

Amanda Blanc, Group Chief Executive Officer, said:

"We are increasing our share buyback to GBP1 billion(1) as part

of our commitment to return at least GBP4 billion to ordinary

shareholders. We will update further on our capital return and

dividend plans at our full year results in March 2022."

Aviva has accordingly updated its non-discretionary agreement

with Citigroup Global Markets Ltd ("Citi") who is conducting the

Programme on Aviva's behalf and making trading decisions under the

Programme independently of Aviva (except Aviva's ability to

terminate Citi's mandate in certain limited circumstances).

Shares acquired by Citi under the agreement will be sold on to

Aviva and, to the extent permitted by law, such purchased shares

will be cancelled. The purpose of the Programme is therefore to

reduce Aviva's share capital.

As at 15 December 2021 158 million ordinary shares have been

purchased under the Programme for a total consideration of GBP635

million.

Note: Any purchase of Aviva ordinary shares contemplated by this

announcement will be executed in accordance with Aviva's general

authority to repurchase ordinary shares granted by its shareholders

on 6 May 2021, Market Abuse Regulation 596/2014 and the Commission

Delegated Regulation (EU) 2016/1052 (both as incorporated into UK

domestic law by the European Union (Withdrawal) Act 2018 and as

amended pursuant to the Market Abuse (Amendment) (EU Exit)

Regulations 2019 and the Financial Conduct Authority (FCA) Binding

Technical Standards setting out the conditions for the buy back

safe harbour), and Chapter 12 of the Financial Conduct Authority's

Listing Rules.

(1) During the Programme, Citi has discretion to notify Aviva of

a reduction in the Programme size due to a decrease in trading

liquidity of the shares. If such notification is received, a

further announcement will be made.

-ends-

Enquiries :

Analysts:

Rupert Taylor Rea +44 (0)7385 494 440

Tegan Gill +44 (0)7800 691 138

Michael O' Hara +44 (0)7387 234 388

Media:

Andrew Reid +44 (0)7800 694 276

Notes to editors :

-- For information on how Aviva is helping our people, customers

and communities impacted by COVID-19 visit:

www.aviva.com/covid-19-our-response/

-- We exist to be with people when it really matters, throughout

their lives. We have been taking care of people for 325 years, in

line with our purpose of being 'with you today, for a better

tomorrow'. In 2020, we paid GBP30.6 billion in claims and benefits

to our customers.

-- Aviva is invested in our people, our customers, our

communities and our planet. In 2021, we announced our plan to

become a Net Zero carbon emissions company by 2040, the first major

insurance company in the world to do so. This plan means Net Zero

carbon emissions from our investments by 2040; setting out a clear

pathway to get there with a cut of 25% in the carbon intensity of

our investments by 2025 and of 60% by 2030; and Net Zero carbon

emissions from our own operations and supply chain by 2030. Aviva

has been leading this agenda for decades: Aviva was the first

international insurer to go operationally carbon neutral in 2006

and we are champions of renewable energy and energy storage at our

offices, allowing us to achieve our 2030 carbon reduction target

(70% reduction on 2010 levels) 10 years early. Find out more about

our climate goals at www.aviva.com/climate-goals and our

sustainability ambition at www.aviva.com/sustainability .

-- Aviva is a Living Wage and Living Hours employer and provides

market-leading benefits for our people, including flexible working,

paid carers leave and equal parental leave. Find out more at

https://www.aviva.com/about-us/our-people/

-- We are focused on the UK, Ireland and Canada where we have

leading market positions and significant potential. We will invest

for growth in these markets. We will also transform our performance

and improve our efficiency. Our transformation will be underpinned

by managing our balance sheet prudently, reducing debt and

increasing our financial resilience. We also have strategic

investments in Singapore, China and India.

-- At 30 June 2021, total Group assets under management at Aviva

Group are GBP522 billion and our Solvency II shareholder capital

surplus is GBP12 billion. Our shares are listed on the London Stock

Exchange and we are a member of the FTSE 100 index.

-- For more details on what we do, our business and how we help

our customers, visit www.aviva.com/about-us

-- The Aviva newsroom at www.aviva.com/newsroom includes links

to our spokespeople images, podcasts, research reports and our news

release archive. Sign up to get the latest news from Aviva by

email.

-- You can follow us on:

o Twitter: www.twitter.com/avivaplc/

o LinkedIn: www.linkedin.com/company/aviva-plc

o Instagram: www.instagram.com/avivaplc

-- For the latest corporate films from around our business, subscribe to our YouTube channel: www.youtube.com/user/aviva

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDZMMZRKGGMZM

(END) Dow Jones Newswires

December 16, 2021 02:00 ET (07:00 GMT)

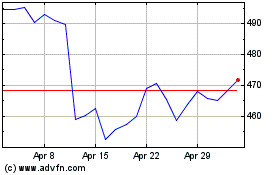

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024