The FTSE 100 closed down on Tuesday as the situation in Ukraine

worsened and the price of oil rose despite speculation around the

U.S. plans to release strategic reserves. The biggest faller in the

session was steel and mining company Evraz PLC, which operates

mainly in Russia, and closed the day down 29% at 102.85 pence,

followed closely by Russian mining company Polymetal International,

which was down 26% at 258.90 pence. On the up side, BAE Systems was

the biggest riser of the day, closing up 3.7% at 746.20 pence,

buoyed by expectations of an increase in defense spending stemming

from the war in Ukraine.

Companies News:

S4 Capital Backs 2021 Guidance But Earnings to Be Delayed

S4 Capital PLC said Tuesday that it still expects to report

strong growth for 2021 but earnings will be delayed due to

Covid-related restrictions.

---

Intertek 2021 Profit Rose on Revenue Growth, Higher Margins

Intertek Group PLC on Tuesday reported a higher profit for 2021,

reflecting higher revenue and margins.

---

Croda International 2021 Pretax Profit Rose on Pandemic

Recovery

Croda International PLC said Tuesday that pretax profit for 2021

rose, with all of its businesses delivering underlying growth ahead

of pre-pandemic levels.

---

Shell Names Sinead Gorman as CFO, Replacing Jessica Uhl

Shell PLC said Tuesday that it has named Sinead Gorman as its

incoming chief financial officer, effective April 1, while current

CFO Jessica Uhl will step down on March 31.

---

Travis Perkins Swung to 2021 Pretax Profit on Coronavirus

Recovery

Travis Perkins PLC said Tuesday that it swung to a pretax profit

in 2021 as it recovered from the coronavirus pandemic, reinstating

dividends.

---

Fiske 1H Pretax Loss Narrowed on Increased Management Fees

Fiske PLC said Tuesday that its pretax loss narrowed in the

first half of fiscal 2022 as revenue rose on increased investment

management-fee income.

---

Abrdn 2021 Pretax Profit Rose; Keeps FY Dividend Unchanged

Abrdn PLC said Tuesday that pretax profit for 2021 rose on the

back of positive market movements and reduced net outflows, and

maintained its total dividend payout.

---

Revolution Bars Swung to Pretax Profit in 1H; Outlook

Positive

Revolution Bars Group PLC reported on Tuesday a swing to a

pretax profit for the first half of fiscal 2022 amid the end of

Covid-19 restrictions.

---

Polyus Reports 4Q Profit Fell, Backs 2022 Guidance

Polyus PJSC on Tuesday reported a lower profit for the fourth

quarter, and reiterated production guidance for 2022.

---

Tibergest PTE Gets Low-Level Acceptances for Photo-Me

International Offer

Tibergest PTE Ltd., a company owned by Photo-Me International

PLC Chief Executive Serge Crasnianski, said Tuesday that it has

received acceptances from shareholders owning 65,774 Photo-Me

shares.

---

Reach's 2021 Pretax Profit, Revenue Increased on Digital

Growth

Reach PLC said Tuesday that revenue and pretax profit rose for

2021 as digital growth more than offset a decline in print, though

it expects 2022 profit will be hit by print-driven cost

inflation.

---

Man Group 2021 Pretax Profit, Assets Under Management Rose on

Positive Markets Trend

Man Group PLC said Tuesday that pretax profit in 2021 rose as

assets under management increased 20%, driven by positive momentum

in markets.

---

Essensys 1H Revenue Rose Amid Higher US Recurring Revenue

Growth

Essensys PLC said Tuesday that revenue increased in the first

half of fiscal 2022, marked by continuing U.S. recurring revenue

growth and resilient global customer demand, and said the board

remains confident about the group's future growth.

---

Essensys Share Fall After Warning on FY 2022 Due to Covid-19

Hit

Shares in Essensys PLC on Tuesday fell after the company said

the board expects to miss market expectations for fiscal 2022 due

to a delay in the progress of go-to-market activities amid

Covid-19, despite also seeing revenue growth in the first half.

---

Advanced Oncotherapy Expects Tumor Treatment System to Be Fully

Operational This Summer

Advanced Oncotherapy PLC said Tuesday that it expects its LIGHT

tumor treatment system to be fully operational this summer.

---

Rotork 2021 Profit Fell as Revenue Was Hurt by Supply-Chain

Issues

Rotork PLC on Tuesday reported a profit drop for 2021, as

supply-chain constraints hurt the business.

---

Mobile Streams Says Monthly Revenue Rises Significantly;

Prepares for Huawei Users

Mobile Streams PLC said Tuesday that its monthly revenue is now

more than $150,000, nearly doubling since December, and it has

begun the process of making its content available to Huawei

Technologies Co. handset users.

---

PCI-PAL 1H Pretax Loss Narrows; Sees FY in Line With Market

Views

PCI-PAL PLC said Tuesday that pretax loss narrowed in the first

half of fiscal 2022 on a rise in revenue, and that it remains on

track to meet its market forecasts for the current financial

year.

---

XP Power Chairman James Peters to Retire in 2023

XP Power Ltd. said Tuesday that Chairman James Peters intends to

retire after the general meeting in April 2023.

Market Talk:

Reach's Positive Management Not Seen Protecting It From

Inflation

1105 GMT - Reach's management has performed well in a difficult

environment, but the U.K. media group's pretax profit for 2022

should be hit by inflation on news print, energy, salaries and

distribution, Peel Hunt says. The share price has declined to a

level well below its 280 pence target price, Peel Hunt adds. While

this should open the door to a more positive recommendation than

its hold, it stops short of an upgrade owing to uncertainty

relating to the U.K. consumer environment and over Western European

security, with its implications for economic growth, the U.K.

brokerage says. Shares trade down 25% at 171.40 pence.

---

Revolution Bars 1H Earnings Should Drive Upgrades to

Forecasts

1047 GMT - Revolution Bars' earnings for the first half of

fiscal 2022 were strong and will likely drive full-year upgrades to

consensus, Peel Hunt says. The U.K. brokerage raises its full-year

Ebitda consensus for the bar operator--which owns the Revolution

and Revolution de Cuba brands--by 12% to GBP9 million. "We believe

incremental sales from refurbishments could drive more forecast

upgrades, hence we view the shares as attractive," it adds. Peel

Hunt has a buy recommendation on the stock and a target price of 35

pence a share. Shares are up 6.3% at 21.25 pence.

---

UK Households Credit Growth Likely to Remain Weak in the

Short-Term

1026 GMT - The muted rise in U.K. consumer credit in January

suggests that households were cautious at the beginning of the

year, while the outlook for borrowing in the short-term is

darkening, Capital Economics says. Consumer credit rose by GBP0.6

billion in January, smaller than the GBP0.8 billion in December and

well below the GBP1.2 billion average monthly increase in the two

years prior to the pandemic, the economic-research firm says. "With

higher interest rates on the horizon and the cost of living crisis

only set to worsen, we wouldn't be surprised after a rebound in

February to see credit growth remain weak in the months ahead," CE

says.

---

Flutter Entertainment Shares Are Seen as Good Value

1020 GMT - Flutter Entertainment's 2021 Ebitda excluding the

U.S. was down 10%, but Peel Hunt reiterates its buy recommendation

as it says the shares represent good value following a period of

decline. The recommendation is based on the Sisal deal in Italy,

which is due to complete, and strong market leadership in the U.S.,

the U.K. brokerage says. Revenue growth is seen accelerating in the

second half as the first six months present tough comparatives, it

says. The revenue contribution from Russia and Ukraine is in

jeopardy, but its exposure to the countries has been falling, with

the GBP60 million contribution in 2021 being 4% of group Ebitda

excluding the U.S. Peel Hunt reiterates its target price of 14,500

pence. Shares trade down 15% at 9,228 pence.

---

UK's Factory Sector Growth Accelerates on Strong Demand,

Improving Supply Chains

0952 GMT - Factory activity in the U.K. gained momentum in

February due to strong domestic demand, fewer input shortages and

easing global supply-chain pressures, according to a purchasing

managers survey. The IHS Markit/CIPS manufacturing PMI increased to

58.0 in February from 57.3 in January, a three-month high. Faster

growth in output, new orders and inventories lifted the index,

offsetting the effect of slower job creation and lessening

supply-chain disruptions, the report says. Input price inflation

remained high, but the survey points to moderating cost increases.

"Although this easing may have provided some temporary respite,

signs that energy and oil prices may stay high is a further cause

for concern," IHS Markit director Rob Dobson says.

Contact: London NewsPlus, Dow Jones Newswires; Write to Sarka

Halas at sarka.halas@wsj.com

(END) Dow Jones Newswires

March 01, 2022 12:38 ET (17:38 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

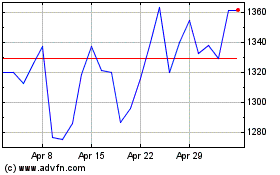

Bae Systems (LSE:BA.)

Historical Stock Chart

From Mar 2024 to Apr 2024

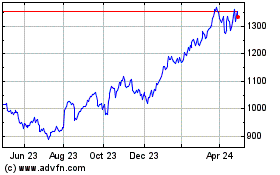

Bae Systems (LSE:BA.)

Historical Stock Chart

From Apr 2023 to Apr 2024