TIDMBEM

RNS Number : 4259Q

Beowulf Mining PLC

26 February 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations ("MAR") (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

26 February 2021

Beowulf Mining plc

("Beowulf" or the "Company")

Unaudited Preliminary Financial Results for the year ended 31

December 2020

Beowulf (AIM: BEM; Spotlight: BEO), the mineral exploration and

development company, announces its unaudited preliminary financial

results for the year ended 31 December 2020.

Overview of Activities in the Period

Kosovo

-- On 17 February 2020, the Company announced that Vardar

Minerals Limited ("Vardar") had identified a copper-zinc

exploration target at Mitrovica and that the Company had invested a

further GBP50,000 in Vardar, increasing the Company's ownership

from 41.5 per cent to 42.2 per cent.

-- On 25 March 2020, the Company invested a further GBP30,000 in

Vardar, alongside founders and existing shareholders in Vardar, to

fund a soil sampling programme across the Majdan Peak gold target

at Mitrovica. The resulting investment maintained the Company's

ownership interest in Vardar at 42.2 per cent.

-- On 1 June 2020, results from the soil sampling programme were

announced. An extensive anomaly has been identified over an area

approximately 1400 metres x 700 metres, with individual soil

samples returning up to 0.36 grammes per tonne ("g/t") gold.

Furthermore, a new lead-zinc-copper-gold target has been identified

to the south of Majdan Peak, of significance given its proximity to

the Stan Terg mine.

-- On 6 July 2020, Beowulf announced results from the grab

sampling programme completed across the Majdan Peak .

-- On 13 August 2020, the Company announced that it had invested

GBP300,000 in Vardar, increasing the Company's ownership of Vardar

from 42.2 per cent to 46.1 per cent, with the funds being used for

geophysical surveys.

-- Over the period from October 2020 to December 2020, the

Company announced results from Induced Polarisation ("IP") and

resistivity surveys over the Mitrovica and Viti licences.

Sweden

-- On 4 February 2020, the Company announced that in response to

the CEO's letter sent to Minister Ibrahim Baylan, Minister for

Business, Industry and Innovation, in December 2019, the Government

stated it was not able to comment on when a decision, in respect of

the Concession for Kallak, is expected to be taken, however, the

Government had taken careful note of the information provided by

the Company.

-- The Company stated, on 13 February 2020, that contrary to

media reports, no legal action had been taken against the

Government, but that all options with regard to taking legal action

remain under active consideration.

-- On 26 May 2020, the Company announced that a Parliamentary

Question regarding Kallak had been put to Minister Baylan by Mr

Lars Hjälmered, a Moderate Party Member in the Swedish Parliament.

Mr Hjälmered had asked a similar question of Minister Baylan in

late 2019.

-- In advance of Minister Baylan's response, on 2 June 2020,

Kurt Budge, CEO sent a letter to him, informing him that Beowulf

shareholders demand that the Government be fully transparent now

and remove all uncertainty as to when a decision on Kallak will be

taken.

In addition, the CEO wrote that the Company is ready to play its

part in Sweden's post COVID-19 economic recovery, to advance Kallak

in partnership with the community in Jokkmokk, which includes Sami

reindeer herders.

-- Also on 2 June 2020, Minister Baylan provided his answer to

Mr Hjämered, explaining that the Kallak case contains extensive

data with several complex issues, such as trade-offs according to

the Environmental Code between several different national

interests, which he said obviously affects the processing time for

handling the application.

Minister Baylan continued, saying that the starting point for

the Government's process is always that it should take place

quickly, efficiently and without compromising legal certainty. He

was not prepared to comment further on when the Kallak case would

be sufficiently prepared, such that a decision could be made.

-- On 27 May 2020, the Company announced that it had a awarded a

drilling contract for Kallak to Kati Oy. The work programme,

scheduled for Autumn 2020, now postponed until later in 2021, will

determine if a 3D seismic model can be constructed, using the

established seismic characteristics of the Kallak deposit, and

whether the 3D model can be used to help define additional iron ore

resource.

-- On 17 September 2020, Beowulf released the findings of an

expert market assessment by Dr. Bo Arvidson based on the results of

laboratory and pilot plant testwork, which identified Kallak's 71.5

per cent magnetite concentrate to be market leading among known

current and planned future producers.

-- On 17 December 2020, Beowulf announced that Kurt Budge, CEO

had written to the Swedish Government regarding the Kallak and

UNESCO Consultation.

-- The CEO's letter followed an announcement on the 27 November

2020, in which the Company published the statement of The

Constitutional Committee ("KU") detailing its review findings of

the Swedish Government's handling of the Company's application for

an Exploitation Concession for Kallak.

Finland

-- On 18 May 2020, the Company provided an update on Oy

Fennoscandian Resources AB ("Fennoscandian"), the Company's

graphite business, which is pursuing a strategy to develop a

resource/production base of natural flake graphite that can provide

'security of supply' and enable Finland to achieve its ambition of

self-sufficiency in battery manufacturing. The Company is a

recipient of Business Finland funding, which is supporting

Fennoscandian to move downstream, and develop its knowledge in

processing and manufacturing value-added graphite products.

Corporate

-- On 13 August 2020, the Company announced it had secured

bridge loan financing in Sweden of SEK 12 million (approximately

GBP1.0 million) from Nordic investors, with GBP300,000 invested in

Vardar's geophysics programme.

-- On 6 November 2020, the Company announced that it would

conduct an Open Offer of up to 225,841,752 new Ordinary Shares to

Qualifying Shareholders at 3.16 pence per Share (the "Offer Price")

on a pre-emptive basis to raise up to approximately GBP7.3 million

(gross) (the "Open Offer").

-- On 10 November 2020, the Company announced that Göran Färm

was stepping down from the Board and as Non-Executive Chairman, and

that Mr Sven Otto Littorin had been appointed as Non-Executive

Chairman and a Director of the Company.

-- On 21 December 2020, the Company closed a fully subscribed

Capital Raising of approximately GBP7.4 million before expenses

(approx. SEK 83 million).

-- At 31 December 2020 there were 592,321,687 Swedish Depository

Receipts representing 71.52 per cent of the issued share capital of

the Company. The remaining issued share capital of the Company is

held in the UK.

Post Period

-- On 8 February 2021, Beowulf announced a further GBP200,000

investment in Vardar, increasing its ownership from 46.1 per cent

to 48.4 per cent.

Kurt Budge, Chief Executive Officer of Beowulf, commented:

"Despite the challenges of 2020, Beowulf finished the year with

a fully subscribed Capital Raising.

"Beowulf has started 2021 with focus and the cash to fund

investment plans across its diversified and attractive portfolio,

with growth options in all business areas.

"In Kosovo, we are finalising plans to drill the plethora of

exploration targets identified at Mitrovica and Viti, and will be

providing a more detailed update in the coming weeks.

"We have seen market values for natural flake graphite producers

increase significantly and, as batteries are centre-stage of the

Green Transition, in Finland we are accelerating development plans

for Fennoscandian Resources, focusing on both natural flake

graphite production and a Circular Economy/recycling strategy to

produce high-value graphite products.

"In Sweden, on Tuesday this week, Minister Baylan spoke at the

Future Mine & Mineral 2021 Conference. He acknowledged the need

for more raw materials and put Sweden at the forefront of

electrification, digitalisation and automation.

"Also, H2 Green Steel, situated in Norrbotten County, announced

a EUR2.5 billion investment and plans to produce 5 million tonnes

of green steel by 2030. It goes without saying, you need

high-quality iron ore to manufacture high-quality steel.

"Norrbotten is Sweden's powerhouse, where mining, power,

transport, manufacturing and innovation are coming together to

deliver a sustainable economic future for the region and Europe.

Kallak is part of that future.

"If you can expediently permit steel plants like H2 Green Steel

and HYBRIT, you need to treat equally the companies and investors

that are developing the mines that will feed them and ensure

security of iron ore supply.

"Kallak can produce a 'market leading' concentrate of 71.5 per

cent iron content and the Company has invested over SEK 80 million

in the project. The investment in building a mine will be billions

of SEK and Jokkmokk Municipality needs this economic stimulus.

"The Company has been in communication with UNESCO regarding its

review of Kallak and we now wait on their comments to the

Government. Since the Constitutional Committee statement last

November, political parties outside of Government are taking a

greater interest in our case and, with the support of our advisers,

we continue to inform and educate on the facts about Kallak and

dispel the perceptions that exist.

"Over the last three year, Beowulf has contributed to the OECD's

studies on the mining industry in Sweden, including the inclusion

of the Sami in regional development in Sweden. The Company is

taking the OECD's findings and incorporating them into draft

development frameworks for Kallak that we will share with

interested parties.

"Since I have been involved with Kallak, the Company has shown

nothing but respect to local reindeer herders and we remain

committed to safeguarding their traditional livelihoods. We will

continue to listen and to learn.

"Last Tuesday was a busy day. The Fraser Institute published its

Annual Mining Survey 2020 with Sweden ranked 36(th) position on

Investment Attractiveness, falling 26 places in one year.

"Sweden ranked 21(st) in 2018. The erosion of Sweden's

pre-eminent status continues unabated, despite ministerial changes,

yet the discussion about a Green Transition to tackle Climate

Emergency, achieved only with more mines, is louder than ever

before.

"The Minister suggested that, in the coming weeks, he would

present findings of reviews undertaken to develop more robust

legislation. He wants Sweden to be the role model for

sustainability. The Swedish mining sector will be anticipating his

words.

"Beowulf has a busy year ahead and our intent is to make

significant progress.

"I want to again thank our shareholders for their support in

last year's Capital Raising, many of whom are longstanding and have

stuck with the Company. The Company does not take your support for

granted.

"We look forward to updating the market on further developments

as they happen."

Kurt Budge, VD Beowulf, kommenterade:

"Trots de utmaningar som 2020 inneburit avslutade Beowulf året

med en fulltecknad kapitalanskaffning.

"Beowulf har inlett 2021 med fokus och kassa att finansiera

investeringsplaner i sin diversifierade och attraktiva portfölj,

med tillväxtalternativ inom alla affärsområden.

"I Kosovo färdigställer vi planer för att borra en rad

prospekteringsmål som identifierats vid Mitrovica och Viti, och vi

kommer att ge en mer detaljerad uppdatering under de kommande

veckorna.

"Vi har sett marknadsvärden för producenter av naturlig

flinggrafit öka avsevärt och eftersom batterier är centrala för den

gröna omställningen accelererar vi utvecklingsplanerna i Finland

genom Fennoscandian Resources, med fokus på både produktion av

naturlig flinggrafit och en strategi för cirkulär

ekonomi/återvinning, för att producera högvärdiga

grafitprodukter.

"Under tisdagen den här veckan talade näringsminister Baylan vid

konferensen Future Mine & Mineral 2021 i Sverige. Han

bekräftade behovet av mer råvaror och satte Sverige i spetsen för

elektrifiering, digitalisering och automatisering.

"H2 Green Steel, i Norrbottens län, tillkännagav också en

investering på 2,5 miljarder euro och planer på att producera 5

miljoner ton grönt stål till 2030. Det är uppenbart att det kommer

behövas järnmalm av hög kvalitet för att tillverka högkvalitativt

stål.

"Norrbotten är Sveriges kraftcentrum, där gruvdrift, energi,

transport, tillverkning och innovation samlas för att leverera en

hållbar ekonomisk framtid för regionen och Europa. Kallak är en del

av den framtiden.

"Om man på ett ändamålsenligt sätt kan tillåta stålverk som H2

Green Steel och HYBRIT måste man också säkerställa lika behandling

av de företag och investerare som utvecklar de gruvor som kommer

att mata stålverken och därmed säkra tillförlitlig leverans av

järnmalm.

"Kallak kan producera ett marknadsledande koncentrat på 71,5

procent järninnehåll och Bolaget har investerat över 80 miljoner

SEK i projektet. Investeringen för att bygga en gruva kommer att

uppgå till flera miljarder SEK och Jokkmokks kommun behöver denna

ekonomiska stimulans.

"Bolaget har varit i kontakt med UNESCO angående deras

granskning av Kallak och vi väntar nu på deras kommentarer till

regeringen. Sedan uttalandet från konstitutionskommittén i november

förra året fattar politiska partier utanför regeringen ett större

intresse för vårt ärende och med stöd av våra rådgivare fortsätter

vi att informera och utbilda om fakta kring Kallak och ändra de

uppfattningar som finns.

"Under de senaste tre åren har Beowulf deltagit i OECD:s studier

om gruvindustrin i Sverige, inklusive inkluderingen av samerna i

regional utveckling i landet. Bolaget tar OECD:s resultat och

införlivar dem i utkast till utvecklingsramar för Kallak som vi

kommer att dela med intresserade parter.

"Sedan jag har varit inblandad i Kallak har Bolaget inte visat

något annat än respekt för lokala renskötare och vi fortsätter att

vara engagerade i att skydda deras traditionella försörjning. Vi

kommer att fortsätta att lyssna och lära.

"Förra tisdagen var en hektisk dag. The Fraser Institute

publicerade sin årliga gruvundersökning för 2020 med Sverige rankat

på plats 36 för investeringsattraktivitet, ett tapp på 26 platser

på ett år."

"Sverige rankades på plats 21 år 2018. Förlusten av Sveriges

framträdande status fortsätter i oförminskad takt, trots

ministerförändringar, men diskussionen om en grön omställning för

att hantera klimatnödläget, möjligt enbart med fler gruvor, är mer

högljudd än någonsin.

"Näringsministern föreslog att han under de närmaste veckorna

skulle presentera resultaten av de granskningar som gjorts för att

utveckla mer robust lagstiftning. Han vill att Sverige ska vara

förebilden för hållbarhet. Den svenska gruvsektorn kommer att

invänta hans ord.

"Beowulf har ett hektiskt år framför oss och vi avser att göra

betydande framsteg.

"Jag vill än en gång tacka våra aktieägare för deras stöd i

förra årets kapitalanskaffning, varav många varit med länge och

stått fast vid Bolaget. Bolaget tar inte ert stöd för givet.

"Vi ser fram emot att löpande uppdatera marknaden om den

fortsatta utvecklingen."

Financial

-- On 13 August 2020, further investment was made in Vardar

which increased the holding in Vardar to approximately 46.1 per

cent. On the 8 February 2021, another investment was made in Vardar

for GBP200,000 to increase the holding in Vardar to 48.4 per

cent.

-- The consolidated loss increased in the year from GBP428,707

in 2019 to GBP1,294,691 in 2020. This increase is in part

attributable to a higher impairment charge on Ågåsjiegge,

Joutsijärvi, Polvela and Tammijärvi (GBP98,799) compared to the

impairment charge in the prior year on Sala (GBP10,270). Further

contributions to the increase include a GBP563,431 fair value gain

on further investments in Vardar in the prior year compared to no

fair value gain in the current year now the entity is considered a

subsidiary for accounts purposes and a finance charge of GBP203,321

in relation to the Bridging Loan which was issued in the year.

-- The administration expenses increased in the year from

GBP904,667 to GBP1,005,547, due mostly to more corporate time being

devoted to the Capital Raising and less time being spent on

projects, the result of which was that a lower level of underlying

exploration cost was capitalised.

-- Consolidated basic and diluted loss per share for the 12

months ended 31 December 2020 was 0.19 pence (2019: loss of 0.04

pence).

-- GBP4,329,414 in cash was held at the year end (2019: GBP1,124,062).

-- At 31 December 2020 trade and other receivables of the Group

included an amount of GBP1,392,081 relating to proceeds received in

January 2021 from issues of shares before the year end (2019:

GBPnil).

-- The translation reserve losses attributable to the owners of

the parent decreased from GBP1,291,068 at 31 December 2019 to

GBP457,813 at 31 December 2020. Much of the Company's exploration

costs are in Swedish Krona which has strengthened against the pound

since 31 December 2019.

-- At 31 December 2020, there were 592,321,687 Swedish

Depository Receipts representing 71.52 per cent of the issued share

capital of the Company. The remaining issued share capital of the

Company is held in the UK.

Operational

Kosovo

Overview

-- Vardar gives Beowulf strategic investment exposure to the

highly prospective Tethyan Belt. Vardar has two exploration licence

areas, Mitrovica and Viti.

-- During 2020, Vardar made significant progress, with

exploration results developing the Company's understanding of the

porphyry potential at both projects.

-- Porphyry deposits are exceptionally large, low grade,

polymetallic systems, that typically contain copper along with

other metals, such as gold, silver, zinc and lead. Examples in the

region include the Kiseljak deposit in Serbia (Inferred Mineral

Resource: 459 million tonnes at 0.22 per cent. copper, 0.2 grammes

per tonne gold. Source: Dunav Resources' announcement, June 2014)

and the Skouries high grade gold-copper deposit in Greece (Measured

and Indicated Mineral Resource: 289 million tonnes at 0.43 per

cent. copper and 0.58 grammes per tonne gold. Inferred Mineral

Resource: 170 million tonnes at 0.34 per cent. copper and 0.31

grammes per tonne gold. Source: Eldorado Gold).

Investments during the period

-- On 13 August 2020, the Company announced that it had secured

bridge loan financing in Sweden of SEK 12 million (approximately

GBP1.0 million) from Nordic investors, with GBP300,000 invested in

Vardar increasing the Company's ownership of Vardar from 42.2 per

cent to 46.1 per cent.

Mitrovica Licence

The Mitrovica licence is located immediately to the west and

north west of the world class Stan Terg former lead-zinc-silver

mine, which dates back to the 1930s. With current reserves of 29

million tonnes ("Mt") of ore at 3.45 per cent Pb, 2.30 per cent Zn,

and 80 g/t Ag (ITT/UNMIK 2001 report), together with the past

production of approximately 34 Mt of ore, the deposit represents an

important source of metals in the south eastern part of Europe

(Source: Strmić Palinkaš S., Palinkaš L.A et al, 2013. Metallogenic

Model of the Trepča Pb-Zn-Ag Skarn Deposit, Kosovo: Evidence from

Fluid Inclusions, Rare Earth Elements, and Stable Isotope Data.

Economic Geology, 108, 135-162).

The licence is showing its potential for a range of porphyry

related mineralisation types, including the Majdan Peak

high-sulphidation epithermal gold target, the Wolf Mountain

low-sulphidation lead-zinc-silver target and the Mitrovica South

base and precious metal target in the southern part of the licence

area. Vardar believes all the targets are related to a potentially

much larger porphyry style mineralised system.

Majdan Peak - Gold Target - Overview

An extensive gold anomaly has been identified over an area

approximately 1,400 m x 700 m, with individual soil samples

returning up to 0.36 g/t gold. A number of grab samples returned

high grade gold results, which correlated well with gold in soils

and alteration intensity and confirmed the significant scale of the

anomaly, which remains open to the east.

The scale and size of the anomaly, together with coincidental

multi-element anomalies and extensive hydrothermal alteration, are

comparable to significant high-sulphidation epithermal gold

deposits within the region. The gold anomaly correlates well with

anomalous arsenic, copper, lead, mercury, strontium and antimony

and geological mapping has shown the presence of advanced argillic

alteration.

Mitrovica South - Lead-Zinc-Copper-Gold - Overview

A new lead-zinc-copper-gold target has been identified to the

south of Majdan Peak, of particular significance given its

situation, approximately 4 km from Stan Terg. Vardar has mapped

zinc mineralisation associated with trachyte dykes.

Soil sampling results indicate the potential for a large

mineralised system, having identified distinctive zinc, copper,

lead, silver, and gold anomalies in the southern part of the

licence, extending laterally from known mineralisation, suggesting

that the system may be larger than indicated by initial geological

mapping.

Drill testing was designed to test the extent and type of

alteration associated with an extensive 3 km gossanous outcrop,

which had previously returned anomalous copper and gold

concentrations in rock grab samples. In addition, soil samples were

collected to determine the extent of possible anomalous metal

concentrations over the target area.

1 June 2020 - Majdan Peak Shows Epithermal Gold Potential

-- Extensive gold anomaly identified over an area approximately

1400 metres x 700 metres, with individual soil samples returning up

to 0.36 g/t.

-- The gold anomaly correlates well with anomalous Arsenic,

Copper, Lead, Mercury, Strontium and Antimony, and geological

mapping has shown the presence of extensive argillic

alteration.

-- The scale and size of the anomaly, together with coincidental

multi-element anomalies and extensive hydrothermal alteration, are

comparable to significant high-sulphidation epithermal gold

deposits within the region.

-- Furthermore, a new lead-zinc-copper-gold target has been

identified to the south of Majdan Peak, of particular significance

given its situation, approximately 3 kilometres from Stan Terg.

6 July 2020 - Majdan Peak Gold Target - Grab Sample Results

-- 42 samples have assayed in excess of 0.1 g/t out of a total

of 96 samples collected from available outcrop and subcrop.

-- Anomalous results correlate well with gold in soils and

alteration intensity and confirm the significant scale of the

Majdan Peak gold anomaly, an area 1400 x 700 metres, which remains

open to the east.

-- Sample results over 1 g/t gold include: 7.2 g/t; 4.6 g/t; 2.8

g/t; 2.0 g/t; 1.5 g/t; 1.3 g/t; 1.3 g/t; and 1.1 g/t.

-- In addition to the primary gold target, a new multi-element

anomaly has been delineated to the south of the main peak. This

anomaly correlates well with anomalous rock grab samples (including

individual samples with 0.79 g/t gold), with galena (lead sulphide)

veins apparent in some of the outcropping gossans.

5 November 2020 - Majdan Peak Gold Target Shows IP Anomalies For

Drill Testing

-- Highly anomalous IP chargeability targets have been mapped

for both Majdan Peak and the target area directly south, Majdan

Peak South.

-- Chargeability targets correlate well with anomalous rock and

soil samples, mapped alteration and zones of demagnetisation

identified in the recent high-resolution drone magnetic survey.

-- Importantly, the IP anomalies demonstrate depth extent

suggesting that the mapped surficial gold mineralisation is related

to a potentially large underlying source (over 700 metres in strike

length with significant width and thickness).

-- Zones of high resistivity correlate well with mapped

silicification and advanced argillic alteration which appear to

overlay the main IP chargeability target, as would be expected in a

typical high-sulphidation gold deposit.

-- Shallow IP anomalies follow structural trends mapped in the

magnetic data suggesting a structural control to the distribution

of mineralisation which may link up to the carbonate replacement

lead-zinc ore bodies of the neighbouring Stan Terg deposit.

Wolf Mountain - Lead/Zinc/Silver Target - Overview

The Wolf Mountain target forms a prominent outcropping feature,

with strike length of more than 4 km and width ranging from almost

20 m to greater than 300 m. It represents a hydrothermal breccia

zone with stockworks, which outcrop as a gossan, with

iron-manganese oxides and hydroxides. The peripheral parts of the

zone are characterised by intense silicification corresponding to

fold structures which control the development of the hydrothermal

breccia.

The mineralisation is structurally controlled, and for most of

the target mineralisation is developed in the basement, broadly

following a tectonic contact between ultramafic rocks and phyllite,

with the bulk of mineralisation developed within the ultramafic

units. Mineralisation is likely vein/replacement-type related to

Oligocene magmatic activity responsible for the hydrothermal

systems mapped in the southern portion of the licence area.

Vardar has completed 1,609 m of drilling and a total of 278.5 m

of trenching, carried out over outcropping stockwork and

hydrothermal breccia mineralisation. Drilling and trenching results

have confirmed extensive lead-zinc-silver mineralisation over an

area of 800 m in length and 400 m in width in its northern part,

with significant potential for high grade feeder structures.

23 October 2020 - Geophysics Results Define High Priority Drill

Targets

-- Highly anomalous IP chargeability zones, considered high

priority targets for drill testing, have been defined beneath areas

of laterally extensive Pb-Zn gossans and hydrothermal

alteration.

-- The IP anomalies are located below, often straddling, the

contact between younger Oligo-Miocene ("O-M") volcanoclastic rocks

and ultramafic ("UM") basement, in agreement with mapped and drill

tested mineralisation, adding further support for a source of the

observed mineralisation.

-- Importantly, anomalies follow established regional structural trends suggesting they may be representative of high-grade Pb-Zn-Ag feeder structures, often a characteristic of the deposit type.

-- Resistivity results correlate very well with geological

mapping, drilling and trenching, delineating the lateral and

vertical extent of the low resistivity volcanoclastic units over

the higher resistivity UM basement.

1 December 2020 - Geophysical Anomaly Identified at Wolf

Mountain East Provides More Drill Targets

-- An exceptional high chargeability anomaly identified to the

east of the main Wolf Mountain prospect, correlating with anomalous

soil samples (up to 1.0 per cent zinc ("Zn") and 0.5 per cent lead

("Pb")) and rock samples from gossans (including 3.5 per cent Zn,

1.8 per cent Pb, 93 grammes per tonne ("g/t") silver ("Ag");

-- The chargeable source follows a prominent northwest trending

structure which connects to the Zijaca deposit (non-JORC compliant

5.2 million tonnes ("Mt") containing 2.83 per cent Zn, 2.83 per

cent Pb and 16 g/t Ag) located just two kilometres ("km") to the

southeast and it remains open ended to the northwest; and

-- Results to date suggest that the Wolf Mountain prospect

consists of several structurally controlled targets, often

occurring along geological contacts in the basement rocks and

covering a larger area than previously considered.

Viti Licence

The Viti project is situated in south-eastern Kosovo and

encompasses an interpreted circular intrusive, indicated by

regional airborne magnetic data. There is evidence of intense

alteration typically associated with porphyry systems, with several

copper occurrences and stream sample anomalies in proximity to, and

within the project area. In the south-east of the project area,

reconnaissance mapping has identified several zones of intense

argillic alteration, hydrothermal breccias and iron oxide

stockworks.

In addition, Viti is prospective for lithium-boron

mineralisation, with a geological setting similar to Rio Tinto's

Jadar deposit in Serbia.

Orientation drilling at Viti has intersected the upper part of a

copper-gold porphyry system. Two stratigraphic holes, totalling 439

m , drilled to test for alteration type and potential associated

mineralisation in the gossanous zone, identified highly altered

trachyte porphyry dykes with associated copper and gold

mineralisation, including down the hole intersections of 1 m at 0.5

g/t and 10 m at 0.12 g/t.

26 November 2020 - Geophysical Anomalies Identified at Viti

Project Present Compelling Drill Targets

-- A detailed 3D IP-DC survey has delineated high chargeability

anomalies associated with an extensive NNW trending zone of

alteration and anomalous multi-element soil sample and rock grab

sample results.

-- The newly defined high chargeability anomalies sit in close

proximity to gold and copper mineralisation, associated with

altered porphyritic trachyte dykes, intersected by stratigraphic

drilling in 2019.

-- The anomalies could represent higher grade mineralised zones

and Vardar is now planning to drill two short holes to test

chargeability 'hot spots'.

Plans for 2021

-- Beowulf announced on 8 February 2021, that the Company had

invested GBP200,000 to fund preparatory works, building access

roads and drilling platforms, across the Mitrovica licence in

northern Kosovo, lead-zinc targets at Wolf Mountain and gold

targets at Majdan Peak. It is hoped that drilling can commence in

early Spring 2021.

-- For Viti, a plan is being worked to drill two diamond holes

into Viti SE, for drone magnetics at Viti North and to carry out

geophysical surveys. This work would follow drilling at Mitrovica

and be carried out later in 2021.

-- With continued exploration success, the Company will continue

to fund work at Mitrovica and Viti, the goal being to focus on

discovering a deposit(s) and thereafter define a mineral

resource(s).

Sweden

-- During the year, the Company's focus remained on Kallak and

the application for an Exploitation Concession (the "Concession")

for Kallak North. Beowulf continued to engage with the authorities

in Sweden, but progress was hampered by the COVID-19 and the

Swedish Government's focus diverted to fighting the pandemic.

-- The Company's application remained with the Government

through 2020, and as such, Swedish authorities other than the

Government were not actively engaged in the permitting process.

-- The Constitutional Committee ("KU"), which has been reviewing

the Swedish Government's handling of the Company's application for

an Exploitation Concession for Kallak North met 26 November 2020

and made the following statement (translation):

"KU has examined the application for a processing concession for

Kallak. In the Government case, no visible administrative measures

were implemented for almost three years. This means a delay that is

not acceptable, according to KU.

It also appears that the applicant has on several occasions

asked the Ministry of Trade and Industry for a meeting. The

Ministry has then stated that this is not possible because the

issue concerns a forthcoming Government decision and is a matter

under consideration.

KU notes that the Ministry management's statement does not seem

to be in line with what the Prime Minister has stated. The

Government Offices thus seem to lack a common approach to the

possibility for parties in administrative matters to have a meeting

with the responsible ministry."

While the KU's statement will have no bearing on the final

decision, the Company now hopes that a decision will be

'forthcoming' as previously stated by the Government.

-- The Company announced, on 17 September 2020, the findings of

an expert market assessment by Dr. Bo Arvidson, which investigated

the market potential of future products from the Kallak, based on

the results of laboratory and pilot plant testwork conducted to

date.

Highlights included:

o Exceptionally high-grade magnetite concentrate at 71.5 per

cent iron content with minimal detrimental components, which would

make Kallak the market leading high-grade product among known

current and planned future producers, as demand for high-quality

feedstock and therefore magnetite increases as producers look to

protect the environment by improving energy efficiency, minimising

waste and the impact of waste disposal.

o The next best magnetite product was shown to be LKAB's (the

state-owned Swedish iron ore company), whose production of

magnetite fines with a target specification of 70.7 per cent iron

had been regarded as unique, until now, due to its exceptionally

high iron content.

o Kallak magnetite concentrate was shown to be able to reduce

the carbon footprint of traditional steel making, improve energy

efficiency in any downstream process and reduce waste, due to

magnetite's inherent energy content, resulting in lower energy

demand for steel manufacturing than current common practice using

feedstock of 80 per cent hematite and 20 per cent magnetite.

Finland

-- On 18 May 2020, the Company provided an update on the

activities of Fennoscandian. Since Fennoscandian was acquired in

January 2016, Beowulf has invested over Euros 1.56 million in

graphite exploration, resource development, metallurgical testwork

and the assessment of market applications for graphite from its

Aitolampi project, including Lithium Ion Battery ("LIB")

applications.

-- Fennoscandian continues to develop a 'resource footprint' of

natural flake graphite to provide 'security of supply' to Finland's

emerging battery sector and to benefit from Business Finland

funding, as the Company seeks to move downstream and develop its

knowledge in processing and manufacturing battery grade and

value-added graphite products.

-- Test work on a composite sample for Karhunmäki, a new

graphite prospect, was found by Fennoscandian to produce a

concentrate grade of 96.4 per cent Total Graphitic Carbon ("TGC"),

with 51.3 per cent large/jumbo flakes (+180 micron). The company

has applied for an Exploration Permit for the project.

Competent Person Review

The information in this announcement has been reviewed by Mr.

Chris Davies, a Competent Person ("CP"), who is a Fellow of the

Australasian Institute of Mining and Metallurgy. Mr. Davies has

conducted a desktop review of source documents and data which

underpin the technical statements disclosed herein and approves the

disclosure of technical information in the form and context in

which it appears in this announcement, in his capacity as a CP as

required under the AIM rules. Mr. Davies has visited Vardar's

Mitrovica and Viti projects in Kosovo.

Mr. Davies has sufficient experience, that is relevant to the

content of this announcement, to qualify as a CP as defined in the

2012 Edition of the "Australasian Code of Reporting of Exploration

Results, Mineral Resources and Ore Reserves".

Mr. Davies BSc (Hons) Geology, MSc DIC Mineral Exploration,

FAusIMM, is a Non-executive Director of Beowulf and is an

exploration/economic geologist with more than 35 years' experience

in the mining sector.

About Beowulf Mining plc

Beowulf Mining plc ("Beowulf" or the "Company") is an

exploration and development company, listed on the AIM of the

London Stock Exchange and the Spotlight Exchange in Sweden. The

Company listed in Sweden in 2008 and is approximately 71.5 per cent

owned by Swedish shareholders.

Beowulf's vision is to build a sustainable and innovative mining

company, which creates value by developing mining assets in

partnership with communities, delivering production and generating

cash flow, and in so doing meets society's ongoing need for

metals.

The Company's most advanced project is the Kallak iron ore asset

in northern Sweden. A potential 250 million tonne resource which

can produce a 'market leading' concentrate of 71.5 per cent iron

content and is a potential source of supply for Sweden's

fossil-free mining and steel making industries.

Fennoscandian Resources ("Fennoscandian"), the Company's

graphite business, is pursuing a strategy to develop a

resource/production base of natural flake graphite that can provide

'security of supply' and enable Finland to achieve its ambition of

self-sufficiency in battery manufacturing. The Company is a

recipient of Business Finland funding, which is supporting

Fennoscandian to move downstream, and develop its knowledge in

processing and manufacturing value-added graphite products.

The Company is developing the Aitolampi graphite asset, which

has a contained graphite resource of 1,275,000 million tonnes,

possessing almost perfect crystallinity, an important prerequisite

for high tech applications, such as lithium ion batteries.

In Kosovo, the Company owns approximately 48.4 per cent of

Vardar Minerals (as at 31 December 2020 - 46.1%) ("Vardar"), which

is focussed on exploration in the Tethyan Belt, a major orogenic

metallogenic province for gold and base metals. Vardar is

delivering exciting results for its Mitrovica licence which has

several exploration targets, including lead, zinc, copper and gold.

It also has the Viti licence which is showing potential for

copper-gold porphyry mineralisation. With Beowulf's support, Vardar

is focused on making a discovery.

The Company's asset portfolio is diversified by commodity,

geography and the development stage of its various projects, and

features metals and minerals in demand to facilitate an economic

'Green Transition' and for addressing the climate emergency.

Kallak is the foundation asset of the Company, but with Vardar

and Fennoscandian, the Company has many opportunities to grow, each

business area displaying strong prospects.

Enquiries

Beowulf Mining plc

Kurt Budge, Chief Executive Tel: +44 (0) 20 3771

Officer 6993

SP Angel

(Nominated Adviser & Broker)

Ewan Leggat / Stuart Gledhill Tel: +44 (0) 20 3470

/ Adam Cowl 0470

Blytheweigh

Tim Blythe / Megan Ray Tel: +44 (0) 20 7138

3204

Cautionary Statement

Statements and assumptions made in this document with respect to

the Company's current plans, estimates, strategies and beliefs, and

other statements that are not historical facts, are forward-looking

statements about the future performance of Beowulf. Forward-looking

statements include, but are not limited to, those using words such

as "may", "might", "seeks", "expects", "anticipates", "estimates",

"believes", "projects", "plans", strategy", "forecast" and similar

expressions. These statements reflect management's expectations and

assumptions in light of currently available information. They are

subject to a number of risks and uncertainties, including, but not

limited to , (i) changes in the economic, regulatory and political

environments in the countries where Beowulf operates; (ii) changes

relating to the geological information available in respect of the

various projects undertaken; (iii) Beowulf's continued ability to

secure enough financing to carry on its operations as a going

concern; (iv) the success of its potential joint ventures and

alliances, if any; (v) metal prices, particularly as regards iron

ore. In the light of the many risks and uncertainties surrounding

any mineral project at an early stage of its development, the

actual results could differ materially from those presented and

forecast in this document. Beowulf assumes no unconditional

obligation to immediately update any such statements and/or

forecast.

BEOWULF MINING PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020 AND THE THREE MONTHS

TO 31 DECEMBER 2020

(Unaudited) (Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months 12 months

ended ended ended ended

31 December 31 December 31 December 31 December

2019

2020 2019 2020

GBP

Notes GBP GBP GBP

Continuing operations

Administrative expenses (349,873) (167,585) (1,005,547) (904,666)

Impairment of exploration

costs (80,149) (10,720) (98,799) (10,720)

Share based payment

expense - (26,566) - (119,720)

Gain on step acquisition - - - 563,431

------------- ------------- ------------- -------------

Operating loss (430,022) (204,871) (1,104,346) (471,675)

Finance costs (163,236) (410) (203,576) (410)

Finance income 3 583 594 6,298

Grant income 4,938 37,080 12,637 37,080

------------- ------------- ------------- -------------

Loss before and after

taxation (588,317) (167,618) (1,294,691) (428,707)

============= ============= ============= =============

Loss attributable

to:

Owners of the parent (505,448) (113,025) (1,128,512) (267,000)

Non-controlling interests (82,869) (54,593) (166,179) (161,707)

(588,317) (167,618) (1,294,691) (428,707)

============= ============= ============= =============

Loss per share attributable

to the owners of the

parent:

Basic and diluted

(pence) 3 (0.08) (0.02) (0.19) (0.04)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020 AND THE THREE MONTHS

TO 31 DECEMBER 2020

(Unaudited) (Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months 12 months

ended ended ended ended

31 December 31 December 31 December 31 December

2019

2020 2019 2020

GBP

GBP GBP GBP

Loss for the year (588,317) (167,618) (1,294,691) (428,707)

Other comprehensive income

Items that may be reclassified

subsequently to profit

or loss:

Exchange gains/(losses)

arising on translation

of foreign operations 233,660 (203,018) 854,020 (794,299)

------------- ------------- ------------- -------------

Total comprehensive loss (354,657) (370,636) (440,671) (1,223,006)

============= ============= ============= =============

Total comprehensive income

loss attributable to:

Owners of the parent (222,242) (321,323) (295,258) (1,037,811)

Non-controlling interests (132,415) (49,313) (145,413) (185,195)

(354,657) (370,636) (440,671) (1,223,006)

============= ============= ============= =============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF COMPREHENSIVE LOSS

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020 AND THE THREE MONTHS

TO 31 DECEMBER 2020

(Unaudited) (Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months 12 months

ended ended ended ended

31 December 31 December 31 December 31 December

2019

2020 2019 2020

GBP

Notes GBP GBP GBP

Continuing operations

Administrative expenses (355,053) (87,573) (869,853) (651,434)

Share based payment

expense - (26,566) - (119,719)

Operating Loss (355,053) (114,139) (869,853) (771,153)

Finance income 3 583 594 6,298

Grant income - 1,425 - 1,425

------------- ------------- ------------- -------------

Loss before and after

taxation and total

comprehensive loss (355,050) (112,131) (869,259) (763,430)

============= ============= ============= =============

Loss per share attributable

to the owners of the

parent:

Basic and diluted (pence) 3 (0.06) (0.02) (0.14) (0.13)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

(Unaudited) (Audited)

As at As at

31 December 31 December

2020 2019

GBP GBP

ASSETS Notes

Non-current assets

Intangible assets 5 11,371,916 10,011,494

Property, plant and equipment 145,094 86,998

Loans and other financial assets 5,468 5,212

Right of use asset 1,937 7,324

------------- -------------

11,524,415 10,111,028

------------- -------------

Current assets

Trade and other receivables 1,566,848 167,261

Cash and cash equivalents 4,329,414 1,124,062

------------- -------------

5,896,262 1,291,323

------------- -------------

TOTAL ASSETS 17,420,677 11,402,351

============= =============

EQUITY

Shareholders' equity

Share capital 4 8,281,751 6,022,446

Share premium 24,722,362 20,824,009

Capital contribution reserve 46,451 46,451

Share based payment reserve 732,185 732,185

Merger reserve 137,700 137,700

Translation reserve (457,813) (1,291,068)

Accumulated losses (17,083,185) (15,781,161)

------------- -------------

Total Equity 16,379,451 10,690,562

------------- -------------

Non-controlling interests 394,654 326,555

------------- -------------

TOTAL EQUITY 16,774,105 11,017,117

------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 501,147 242,885

Grant income 143,399 134,877

Lease liability 2,026 7,472

TOTAL LIABILITIES 646,572 385,234

------------- -------------

TOTAL EQUITY AND LIABILITIES 17,420,677 11,402,351

============= =============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

(Unaudited) (Audited)

As at As at

31 December 31 December

2020 2019

Notes GBP GBP

ASSETS

Non-current assets

Investments 2,077,988 1,697,988

Loans and other financial assets 9,341,315 8,989,451

Property, plant and equipment 1,483 -

11,420,786 10,687,439

------------- -------------

Current assets

Trade and other receivables 1,476,755 23,260

Cash and cash equivalents 4,241,426 978,514

-------------

5,718,181 1,001,774

------------- -------------

TOTAL ASSETS 17,138,967 11,689,213

============= =============

EQUITY

Shareholders' equity

Share capital 4 8,281,751 6,022,446

Share premium 24,722,362 20,824,009

Capital contribution reserve 46,451 46,451

Share option reserve 732,185 732,185

Merger reserve 137,700 137,700

Accumulated losses (17,168,118) (16,298,859)

------------- -------------

TOTAL EQUITY 16,752,331 11,463,932

------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 243,237 90,404

Grant income 143,399 134,877

TOTAL LIABILITIES 386,636 225,281

------------- -------------

TOTAL EQUITY AND LIABILITIES 17,138,967 11,689,213

============= =============

BEOWULF MINING PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020

Share Share Capital Share-based Merger Translation Accumulated Total Non- Total

capital premium contribution payment reserve reserve losses controlling equity

reserve reserve interest

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2019 5,663,072 19,266,271 46,451 612,465 137,700 (520,257) (15,311,933) 9,893,769 (160,587) 9,733,182

Loss for the

year - - - - - - (267,000) (267,000) (161,707) (428,707)

Foreign

exchange

translation - - - - - (770,811) - (770,811) (23,488) (794,299)

---------- ------------ ------------- ------------ -------- ------------ ------------- ------------ ------------ ------------

Total

comprehensive

loss - - - - - (770,811) (267,000) (1,037,811) (185,195) (1,223,006)

Transactions

with

owners

Issue of share

capital 357,707 1,642,293 - - - - - 2,000,000 - 2,000,000

Costs

associated

with the issue

of

new shares - (93,305) - - - - - (93,305) - (93,305)

Equity-settled

share-based

payment

transactions 1,667 8,750 - 119,720 - - - 130,137 - 130,137

Acquisition of

subsidiary - - - - - - (202,228) (202,228) 672,337 470,109

At 31

December 2019

(Audited) 6,022,446 20,824,009 46,451 732,185 137,700 (1,291,068) (15,781,161) 10,690,562 326,555 11,017,117

---------- ------------ ------------- ------------ -------- ------------ ------------- ------------ ------------ ------------

Loss for the

year - - - - - - (1,128,512) (1,128,512) (166,179) (1,294,691)

Foreign

exchange

translation - - - - - 833,255 - 833,255 20,765 854,020

---------- ------------ ------------- ------------ -------- ------------ ------------- ------------ ------------ ------------

Total

comprehensive

income - - - - - 833,255 (1,128,512) (295,257) (145,414) (440,671)

Transactions

with

owners

Issue of share

capital 2,259,305 5,165,060 - - - - - 7,424,365 - 7,424,365

Costs

associated

with the issue

of

new shares - (1,266,707) - - - - - (1,266,707) - (1,266,707)

Step up

interest

in subsidiary - - - - - - (173,512) (173,512) 213,513 40,001

At 31 December

2020

(Unaudited) 8,281,751 24,722,362 46,451 732,185 137,700 (457,813) (17,083,185) 16,379,451 394,654 16,774,105

========== ============ ============= ============ ======== ============ ============= ============ ============ ============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020

Share Share Merger Capital Share-based Accumulated Total

capital premium reserve contribution payment losses

reserve reserve

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2019 5,663,072 19,266,271 137,700 46,451 612,465 (15,535,429) 10,190,530

Loss for the

year - - - - - (763,430) (763,430)

Total

comprehensive

loss - - - - - (763,430) (763,430)

Transactions

with owners

Issue of share

capital 357,707 1,642,293 - - - - 2,000,000

Costs

associated

with

the issue of

new shares - (93,305) - - - - (93,305)

Equity-settled

share-based

payment

transactions 1,667 8,750 - - 119,720 - 130,137

------------- ------------ ------------ ------------- ------------

At 31

December 2019

(Audited) 6,022,446 20,824,009 137,700 46,451 732,185 (16,298,859) 11,463,932

------------- ------------- ------------- ------------ ------------ ------------- ------------

Loss for the

year - - - - - (869,259) (869,259)

Total

comprehensive

loss

- - - - - (869,259) (869,259)

------------- ------------- ------------- ------------ ------------ ------------- ------------

Transactions

with owners

Issue of share

capital 2,259,305 5,165,060 - - - - 7,424,365

Costs

associated

with

the issue of

new shares - (1,266,707) - - - - (1,266,707)

At 31 December

2020

(Unaudited) 8,281,751 24,722,362 137,700 46,451 732,185 (17,168,118) 16,752,331

============= ============= ============= ============ ============ ============= ============

BEOWULF MINING PLC

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

AS AT 31 DECEMBER 2020

(Unaudited) (Audited)

31 December 31 December

2020

2019

GBP GBP

Cash flows from operating activities

Loss before income tax (1,294,691) (428,707)

Depreciation charges 35,608 20,971

Equity-settled share-based transactions - 130,137

Impairment of exploration costs 98,799 10,720

Finance income (594) (6,298)

Finance expense 203,576 410

Grant income (12,637) (37,080)

Fair value gain - (563,431)

Amortisation 5,777 4,615

Unrealised foreign exchange (gains)/losses (12,590) 2,121

(976,752) (866,542)

Decrease/(increase) in trade and

other receivables (2,203) (106,009)

Decrease/(increase) in trade and

other payables 97,623 14,930

Net cash used in operating activities (881,332) (957,621)

------------- -------------

Cash flows from investing activities

Purchase of intangible assets (622,501) (1,304,896)

Purchase of property, plant and

equipment (89,436) (77,615)

Acquisition of associate - (500,000)

Investment by minority interest 40,000 -

Cash acquired with subsidiary - 530,031

Sale of investments - 7

Interest received 594 6,298

Grant receipt 25,796 -

Net cash used in investing activities (645,547) (1,346,175)

------------- -------------

Cash flows from financing activities

Proceeds from issue of shares 6,006,368 2,000,000

Payment of share issue costs (1,113,348) (93,305)

Lease principal paid (5,840) (4,467)

Lease interest paid (255) (410)

Interest paid (203,321) -

Proceeds from borrowings 932,309 -

Repayment of borrowings (953,111) -

Net cash from financing activities 4,662,802 1,901,818

------------- -------------

Increase/(decrease) in cash and

cash equivalents 3,135,923 (401,978)

Cash and cash equivalents at beginning

of year 1,124,062 1,533,232

Effect of foreign exchange rate

changes 69,429 (7,192)

Cash and cash equivalents at end

of year 4,329,414 1,124,062

============= =============

BEOWULF MINING PLC

CONDENSED COMPANY CASH FLOW STATEMENT

AS AT 31 DECEMBER 2020

(Unaudited) (Audited)

31 December 31 December

2020

2019

GBP GBP

Cash flows from operating activities

Loss before income tax (869,259) (763,430)

Expected credit loss 72,069 158,005

Equity-settled share-based transactions - 130,137

Finance income (594) (6,298)

Finance costs 203,321 -

Grant income - (1,425)

Unrealised foreign exchange (gains)/losses (16,865) 2,121

(611,328) (480,890)

(Increase)/decrease in trade and

other receivables (61,415) 1,141

Decrease in trade and other payables (524) 23,443

Net cash used in operating activities (673,267) (456,306)

------------- ----------------

Cash flows from investing activities

Loans to subsidiaries (448,151) (989,434)

Interest received 594 6,298

Acquisition of subsidiary - (500,000)

Grant receipt 25,796 -

Purchase of property, plant and (1,483)

equipment -

Net cash used in investing activities (803,244) (1,483,146)

------------- ----------------

Cash flows from financing activities

Proceeds from issue of shares 6,006,368 2,000,000

Payment of share issue costs (1,113,348) (93,305)

Financing of subsidiary (380,000) (465,000)

Proceeds from borrowings 932,309 -

Repayment of loan principal (953,111) -

Interest paid (203,321) -

Net cash from financing activities 4,668,897 1,441,695

------------- ----------------

Increase/(decrease) in cash and

cash equivalents 3,192,386 (497,747)

Cash and cash equivalents at beginning

of year 978,514 1,470,087

Effect of foreign exchange rate

changes 70,526 6,174

Cash and cash equivalents at end

of year 4,241,426 978,514

============= ================

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM

FOR THE TWELVE MONTHS TO 31 DECEMBER 2020

1 . Nature of Operations

Beowulf Mining plc (the "Company") is domiciled in England and

Wales. The Company's registered office is 201 Temple Chambers, 3-7

Temple Avenue, London, EC4Y 0DT. This consolidated financial

information comprises that of the Company and its subsidiaries

(collectively the 'Group' and individually 'Group companies'). The

Group is engaged in the acquisition, exploration and evaluation of

natural resources assets and has not yet generated revenues.

2. Basis of preparation

The condensed consolidated financial information has been

prepared on the basis of the recognition and measurement

requirements of international accounting standards in conformity

with the requirements of the Companies Act 2006. The accounting

policies, methods of computation and presentation used in the

preparation of the interim financial information are the same as

those used in the Group's audited financial statements for the year

ended 31 December 2019 except as noted below.

The financial information in this statement does not constitute

full statutory accounts within the meaning of Section 434 of the UK

Companies Act 2006. The financial information for the twelve months

ended 31 December 2019 is audited. The audit of the financial

information for the year ended 31 December 2019 has been completed.

The auditor's report on the statutory financial statements for the

year ended 31 December 2019 was unqualified and did not contain any

statement under sections 498 (2) or (3) of the Companies Act 2006.

The audit report did contain a material uncertainty with respect of

going concern, however following additional audit procedures and

noting it as key audit matter, it was concluded the going concern

basis was appropriate.

The going concern assumption has been assessed by the Directors

in light of the impact of COVID-19, taking into consideration the

entities current financial position, ability to raise new funds and

carry out its operations for the year. The Directors are confident

that there is no immediate need for funding following a round of

successful capital raisings that generated GBP7.4m before

expenses.

The financial statements are presented in GB Pounds Sterling.

They are prepared on the historical cost basis or the fair value

basis where the fair valuing of relevant assets and liabilities has

been applied.

3 . Group and Company loss per share

(Unaudited) (Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months 12 months

ended ended ended ended

Group 31 December 31 December 31 December 31 December

2020 2019 2020 2019

Loss for the period/year

attributable to shareholders

of the Company (GBP's) (505,448) (113,025) (1,128,512) (267,000)

Weighted average number

of ordinary shares 624,589,452 591,944,747 607,815,562 585,102,740

Diluted weighted average

number of ordinary shares 624,589,452 591,944,747 607,815,562 585,102,740

------------ ------------ ------------ ------------

Loss per share (p) (0.08) (0.02) (0.19) (0.04)

------------ ------------ ------------ ------------

Parent

Loss for the period/year

attributable to shareholders

of the Company (GBP's) (335,050) (112,131) (869,259) (763,430)

Weighted average number

of ordinary shares 624,589,542 597,824,737 607,815,562 585,102,740

Diluted weighted average

number of ordinary shares 624,589,542 597,824,737 607,815,562 585,102,740

------------ ------------ ------------ ------------

Loss per share (p) (0.06) (0.02) (0.14) (0.13)

------------ ------------ ------------ ------------

4. Share Capital

(Unaudited) (Audited)

31 December 31 December

2020 2019

GBP GBP

Allotted, issued and fully paid

Ordinary shares of 1p each 8,281,752 6,022,446

----------- --------------

The number of shares in issue was as follows:

Number

of shares

Balance at 1 January 2019 566,307,254

Issued during the year 35,937,418

------------

Balance at 31 December 2019 602,244,672

Issued during the year 225,930,552

------------

Balance at 31 December 2020 828,175,224

------------

5 . Intangible Assets: Group

Exploration costs As at As at

31 December 31 December

2020 2019

(Unaudited) (Audited)

GBP GBP

Cost

At 1 January 10,011,256 8,285,547

Additions for the year 612,062 1,304,896

Additions arising from the step-up in

interest in Vardar - 1,203,685

Foreign exchange movements 847,397 (771,914)

Impairment (98,799) (10,720)

11,371,916 10,011,494

============= =============

The net book value of exploration costs is comprised of

expenditure on the following projects:

As at As at

31 December 31 December

2020 2019

(Unaudited) (Audited)

GBP GBP

Project Country

Kallak Sweden 7,533,388 6,675,124

Åtvidaberg Sweden 393,303 345,978

Ågåsjiegge Sweden - 15,568

Pitkäjärvi Finland 1,333,114 1,058,078

Joutsijärvi Finland - 19,095

Rääpysjärvi Finland 47,053 39,905

Karhunmäki Finland 41,017 24,078

Merivaara Finland 36,965 17,846

Polvela Finland - 31,316

Tammijärvi Finland - 24,278

Mitrovica Kosovo 1,387,030 1,243,194

Viti Kosovo 600,046 517,034

-------------

11,371,916 10,011,494

============= =============

Total Group exploration costs of GBP11,371,916 are currently

carried at cost in the financial statements. During the period

Ågåsjiegge, Joutsijärvi, Polvela and Tammijärvi were identified as

projects to be discontinued. The impairment charge arising from the

impairment of the projects was GBP98,799 (31 December 2019: Sala

GBP10,270).

Accounting estimates and judgements are continually evaluated

and are based on a number of factors, including expectations of

future events that are believed to be reasonable under the

circumstances. Management are required to consider whether there

are events or changes in circumstances that indicate that the

carrying value of this asset may not be recoverable.

The most significant risk currently facing the Group is that it

does not receive an Exploitation Concession for Kallak. The Company

originally applied for the Exploitation Concession in April 2013

and throughout 2017, and since the year-end, management have

actively sought to progress the application, engaging with the

various government bodies and other stakeholders. These activities

are summarised above.

Kallak is included in the condensed financial statements as at

31 December 2020 as an intangible exploration licence with a

carrying value of GBP7,533,388. Management have considered the

status of the application for the Exploitation Concession and in

their judgement, they believe it is appropriate to be optimistic

about the chances of being awarded the Exploitation Concession and

thus have not impaired the project.

6. Availability of interim report

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 207 Temple Chambers,

3-7 Temple Avenue, London, EC4Y 0DT. A copy can also be downloaded

from the Company's website at www.beowulfmining.com. Beowulf Mining

plc is registered in England and Wales with registered number

02330496.

** Ends **

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUWPPUPGGBA

(END) Dow Jones Newswires

February 26, 2021 02:00 ET (07:00 GMT)

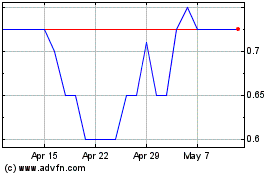

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Apr 2023 to Apr 2024