TIDMBEM

RNS Number : 1041A

Beowulf Mining PLC

28 May 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation ("MAR") (EU) No. 596/2014, as incorporated into UK law

by the European Union (Withdrawal) Act 2018. Upon the publication

of this announcement, this inside information is now considered to

be in the public domain.

28 May 2021

Beowulf Mining plc

("Beowulf" or the "Company")

Unaudited Financial Results for the Period Ended 31 March

2021

Beowulf (AIM: BEM; Spotlight: BEO), the mineral exploration and

development company, announces its unaudited financial results for

the three months ended 31 March 2021.

Overview of Activities in the Quarter

-- On the 8 February 2021, Beowulf announced that the Company

had invested GBP200,000 in Vardar Minerals Ltd ("Vardar"),

increasing its ownership of the company from 46.1 per cent to 48.4

per cent. The funds are to be used for preparatory works in advance

of drilling across the Mitrovica licence in northern Kosovo,

lead-zinc targets at Wolf Mountain and gold targets at Majdan

Peak.

-- The Company announced the signing of a Memorandum of

Understanding ("MoU") between its 100 per cent owned graphite

subsidiary, Oy Fennoscandian Resources AB ("Fennoscandian"), and

Epsilon Advanced Materials Private Limited ("EAMPL"), a subsidiary

of Epsilon Carbon on 8 March 2021.

The MoU will enable Fennoscandian to build its downstream

capability, collaborating with a strong and innovative

technology/processing partner, as it develops its business to be a

future supplier of anode material to lithium-ion battery

manufacturers in Finland and Europe.

-- On the 12 March 2021, it was announced that a contract had

been awarded to Afry Finland Oy ("AFRY") to conduct a Scoping Study

on Fennoscandian's Aitolampi Graphite Project in Finland.

Post Period

-- On 20 April 2021, Beowulf announced that a letter had been

sent from its Chairman, Sven Otto Littorin, to Sweden's Minister of

Enterprise and Innovation, Ibrahim Baylan, concerning the status of

Beowulf's Kallak application. The Company received a brief

administrative response from the Government.

-- On 19 May 2021, the Company co-sponsored, with Eurobattery

Minerals AB, a webinar titled 'Hållbar Gruvnäring' (Sustainable

Mining) in Stockholm aimed at educating stakeholders on the rapid

increase in smart and green technologies and the demands this

creates for new supply of innovation-critical metals and

minerals.

The Swedish Government has set-up an inquiry aimed at ensuring a

sustainable supply of innovation-critical metals and minerals from

primary and secondary sources. It is recognised that sustainable

and lasting access to innovation-critical metals and minerals is of

great importance to Sweden, but at the same time, no new mine has

been established in Sweden in over a decade.

-- On 25 May 2021, the Company announced results of a Mineral

Resource Estimate ("MRE") Upgrade for the Kallak Iron Ore Project

("Kallak" or the "Project") prepared by Baker Geological Services

Ltd ("BGS"), which included an additional 19 million tonnes ("Mt")

of iron mineralisation equating to a 12.5 per cent increase in the

resource, giving a Measured and Indicated Mineral Resource of 132

Mt grading 27.8 per cent iron ("Fe") and an Inferred Mineral

Resource of 39 Mt grading 27.1 per cent Fe.

Kurt Budge, Chief Executive Officer of Beowulf, commented:

"As the Chairman wrote in the 2020 Annual Report, we are at a

tipping point where global issues are converging to drive demand

for primary raw materials. Metals are critical to achieving the

transition to a Green Economy to address the Climate Emergency;

transparent, secure, and sustainable supply chains need to be

established; and Governments are considering how to power economic

growth in a post-pandemic recovery.

"Beowulf is seeking to be a leader in sustainability, as the

Company recognises its ESG policies, procedures and performance are

essential to demonstrating the Company is well-run and fulfilling

its purpose in society.

"The results of the upgraded Mineral Resource Estimate for

Kallak and the doubling of the Exploration Target, clearly

demonstrate the potential for a mine at Kallak to supply

high-quality iron ore over several decades for fossil-free steel

production in Sweden. The potential global resource now stands at

389 million tonnes, which could support mining for 40 years.

"To the community in Jokkmokk, Kallak is about investment, jobs

and a sustainable economic future. When it comes to Sweden's

ambitious plans for fossil-free steel production, Kallak represents

a strategic source of high-quality iron ore for projects such as H2

Green Steel. When investors look to upstream and downstream

investment opportunities in Norrbotten, an integrated fossil-free

supply chain is a compelling investment and business case.

"The Company continues to engage with politicians in Sweden,

such that, when UNESCO has returned comments and Kallak is back on

the Government's desk, a decision on the Company's application can

be 'forthcoming'.

"During the first part of the year, we have made significant

progress in Finland with Fennoscandian Resources and we are very

pleased with our collaboration with EAMPL. In the coming weeks we

will be dispatching Aitolampi graphite concentrate to EAMPL, for

batch testing through their pilot plant with the aim of producing

pre-cursor anode material from Finnish graphite. We are also

assessing sites in Finland for a strategic processing hub, one of

the key elements for a Joint Venture Agreement with EAMPL.

"In Kosovo, we are looking forward to the commencement of

drilling in the summer. Towards the end of last year, the Company

published a sequence of announcements with results from Induced

Polarisation ("IP") and resistivity ground surveys, coupled with

'state-of-the-art' high-resolution airborne magnetic drone surveys

for lead-zinc targets at Wolf Mountain and gold at Majdan Peak in

Mitrovica, and copper-gold at Viti. With these results, the

correlation of the IP anomalies with anomalous metals in soils and

mapped alteration, the potential grows for discovering lead-zinc

and gold deposits and defining much larger mineralised systems at

both Mitrovica and Viti. There is no shortage of high priority

drill targets and we are eager to make a start.

"I look forward to providing further updates in due course."

Kurt Budge, VD för Beowulf, kommenterar:

"Som vår styrelseordförande skrev i årsredovisningen 2020

befinner vi oss vid en brytpunkt där globala frågor konvergerar för

att driva efterfrågan på primära råvaror. Metaller är avgörande för

att uppnå övergången till en grön ekonomi för att hantera

klimatnödläget; transparenta, säkra och hållbara försörjningskedjor

måste inrättas och regeringar överväger hur man ska driva ekonomisk

tillväxt i en återhämtning efter pandemin.

"Beowulf strävar efter att vara ledande inom hållbarhet,

eftersom vi vet att våra ESG-policyer, rutiner och resultat är

avgörande för att uppvisa ett välskött bolag, som uppfyller sitt

syfte i samhället.

"Resultaten från den uppgraderade uppskattningen av

mineraltillgångar för Kallak och fördubblingen av

prospekteringsmålet, visar tydligt potentialen för en gruva vid

Kallak att leverera högkvalitativ järnmalm under flera decennier

för fossilfri stålproduktion i Sverige. Den potentiella globala

resursen uppgår nu till 389 miljoner ton, vilket kan stödja

gruvdrift i nästan 40 år.

"För samhället i Jokkmokk handlar Kallak om investeringar, jobb

och en hållbar ekonomisk framtid. När det gäller Sveriges ambitiösa

planer för fossilfri stålproduktion utgör Kallak en strategisk

källa till högkvalitativ järnmalm för projekt som H2 Green Steel.

När investerare ser till investeringsmöjligheter upstream och

downstream i Norrbotten är en integrerad fossilfri

försörjningskedja ett övertygande investeringscase.

"Bolaget fortsätter att samverka med politiker i Sverige, så att

när UNESCO har svarat och Kallak är tillbaka på regeringens

skrivbord kan ett beslut vara 'förestående'.

"Under första delen av året har vi gjort betydande framsteg i

Finland med Fennoscandian Resources och vi är mycket nöjda med vårt

samarbete med EAMPL. Under de kommande veckorna skickar vi

Aitolampi-grafitkoncentrat till EAMPL för batch-testning genom

deras pilotanläggning i syfte att producera ledande anodmaterial

från finsk grafit. Vi utvärderar också platser i Finland för ett

strategiskt bearbetningsnav, ett av nyckelelementen för ett joint

venture-avtal med EAMPL.

"I Kosovo ser vi fram emot att börja borrning under sommaren.

Mot slutet av förra året publicerade Bolaget en rad

tillkännagivanden med resultat från Induced Polarisation ("IP") och

resistivitetsundersökningar, i kombination med toppmoderna

högupplösta luftburna magnetiska drönarundersökningar för

bly-zinkmål vid Wolf Mountain och guld vid Majdan Peak i Mitrovica

samt kopparguld vid Viti. Med dessa resultat, korrelationen mellan

IP-anomalier och avvikande metaller i jord och kartlagda

förändringar, växer potentialen för att upptäcka bly-zink och

guldavlagringar och definiera mycket större mineraliserade system

vid både Mitrovica och Viti. Det finns ingen brist på borrmål med

hög prioritet och vi är angelägna att börja.

"Jag ser fram emot att tillhandahålla ytterligare uppdateringar

i sinom tid."

Financials

-- The consolidated loss increased in the quarter ended 31 March

2021 to GBP526,578 (Q1 2020: GBP217,342). This increase is largely

attributable to a translation loss of GBP265,985 on the revaluation

of the Swedish Krona bank account. Further contributing to the loss

was an increase in consultants and legal costs of GBP28,679, and

staff training costs of GBP13,449.

-- Consolidated basic and diluted loss per share for the quarter

ended 31 March 2021 was 0.06 pence (Q1 2020: loss of 0.03

pence).

-- GBP4,724,385 in cash held at the period end (Q1 2020: GBP789,310).

-- The cumulative translation losses held in equity increased by

GBP625,752 in the quarter ended 31 March 2021 to GBP1,083,024 (31

December 2020: loss of GBP457,272). Much of the Company's

exploration costs are in Swedish Krona and Euro which have weakened

against the pound since 31 December 2020.

-- At 30 April 2021 there were 595,950,484 Swedish Depository

Receipts representing 71.96 per cent of the issued share capital of

the Company. The remaining issued share capital of the Company is

held in the UK.

Operational

Vardar Minerals, Kosovo

-- On 8 February 2021, Beowulf announced that the Company

invested a further GBP200,000 in Vardar, increasing its ownership

of the company from 46.1 to 48.4 per cent. The funds being used for

preparatory works, building access roads and drilling platforms,

across the Mitrovica licence in northern Kosovo, lead-zinc targets

at Wolf Mountain and gold targets at Majdan Peak.

Finland

-- The Company announced the signing of a MoU with EAMPL on 8 March 2021. The MoU enables Fennoscandian to build its downstream capability, collaborating with a strong and innovative technology/processing partner. The purpose of the MoU is to:

o Develop the concept of a strategic processing hub for both

natural flake and recycled graphite to be located in Finland;

o Target the market for pre-cursor anode material for the

lithium-ion batteries in the Nordics and Europe; and

o Establish a Joint Venture between Fennoscandian and EAMPL.

-- On 12 March 2021, Beowulf announced that a contract had been

awarded to AFRY to conduct a Scoping Study on the Fennoscandian

owned Aitolampi Graphite Project.

The purpose of the Scoping Study is to verify the robustness of

the work completed by Fennoscandian, and to provide a roadmap for

the next project development stage, most likely a Pre-feasibility

Study. The output of the Scoping Study will enable Fennoscandian to

better explain the Aitolampi project to the local community and

other important stakeholders.

Sweden

-- On 20 April 2021, Beowulf announced that it had sent a letter

from its Chairman, Sven Otto Littorin, to Sweden's Minister of

Enterprise and Innovation, Ibrahim Baylan, concerning the status of

Beowulf's Kallak application. In the letter the Chairman cited.

o A statement in 2019 from the Minister regarding a

'forthcoming' decision on the Kallak application and the need for

upstream availability of sustainably mined high-quality iron ore,

following announced investments in downstream fossil-free steel

manufacturing in Norrbotten;

o Jokkmokk's need for economic stimulus, even more so given the

Municipality's budget cuts over the last two years regarding public

services and infrastructure, and how Kallak would go a long way in

providing this much needed stimulus; and

o The lack of any timeline for UNESCO to return comments to the

Government.

The Company received a brief administrative response from the

Government:

"Thank you for your message to Minister of Trade and Industry

Ibrahim Baylan. I answer because I am the administrator of the case

to which the communication relates.

In your message, you wonder when the government will make a

decision in the matter. The case is being prepared. The application

contains an extensive document that reflects the complex issues

that the case includes. In order for the matter to be investigated

to the extent required by its nature, UNESCO has been given the

opportunity to comment. Documentation has therefore been translated

and sent to the organization on 3 November 2020 and 17 December

2020. We currently have no further information on when UNESCO's

response can be expected."

-- On 25 May 2021, the Company announced results of a Mineral

Resource Estimate Upgrade for the Kallak Iron Ore Project prepared

by Baker Geological Services Ltd, which included an additional 19

million tonnes of iron mineralisation equating to a 12.5 per cent

increase in the resource, giving a Measured and Indicated Mineral

Resource of 132 Mt grading 27.8 per cent iron and an Inferred

Mineral Resource of 39 Mt grading 27.1 per cent Fe.

In addition to the MRE, BGS has updated the Exploration Target

for the Project with inclusion of the Parkijaure permit area. In

total, BGS has reported an Exploration Target of between 73 Mt and

218 Mt grading between 20 per cent Fe to 30 per cent Fe. The

potential quantity and grade are conceptual in nature as there has

been insufficient exploration to estimate a Mineral Resource; and

that it is uncertain if further exploration will result in the

estimation of a Mineral Resource.

ESG

-- Beowulf is a strong supporter of the Sustainable Development

Goals ("SDGs") and is currently reviewing how the Company can best

proactively support their implementation in our areas of

influence.

-- The Company has adopted the following Disclosure Topics

listed by the Sustainability Accounting Standards Board for the

Metals and Mining sector ( https://www.sasb.org/standards/ ) as

material to the Company's stakeholders:

o Energy Management including Green House Gas Emissions;

o Water Management;

o Biodiversity Impacts;

o Rights of Indigenous Peoples;

o Community Relations; and

o Business Ethics and Transparency.

-- As at this time Beowulf has no active mining operations,

these Disclosure Topics will be integrated into the Company's

policies, corporate strategy, project development plans and

management systems.

-- As the Company moves forward with its ESG agenda, it will be

transparent in its communications, the progress it is making, and

sustainability results.

Enquiries:

Beowulf Mining plc

Kurt Budge, Chief Executive Tel: +44 (0) 20 7583

Officer 8304

SP Angel

(Nominated Adviser & Broker)

Ewan Leggat / Stuart Gledhill Tel: +44 (0) 20 3470

/ Adam Cowl 0470

Blytheweigh

Tim Blythe / Megan Ray Tel: +44 (0) 20 7138

3204

Cautionary Statement

Statements and assumptions made in this document with respect to

the Company's current plans, estimates, strategies and beliefs, and

other statements that are not historical facts, are forward-looking

statements about the future performance of Beowulf. Forward-looking

statements include, but are not limited to, those using words such

as "may", "might", "seeks", "expects", "anticipates", "estimates",

"believes", "projects", "plans", strategy", "forecast" and similar

expressions. These statements reflect management's expectations and

assumptions in light of currently available information. They are

subject to a number of risks and uncertainties, including, but not

limited to , (i) changes in the economic, regulatory and political

environments in the countries where Beowulf operates; (ii) changes

relating to the geological information available in respect of the

various projects undertaken; (iii) Beowulf's continued ability to

secure enough financing to carry on its operations as a going

concern; (iv) the success of its potential joint ventures and

alliances, if any; (v) metal prices, particularly as regards iron

ore. In the light of the many risks and uncertainties surrounding

any mineral project at an early stage of its development, the

actual results could differ materially from those presented and

forecast in this document. Beowulf assumes no unconditional

obligation to immediately update any such statements and/or

forecast .

About Beowulf Mining plc

Beowulf Mining plc ("Beowulf" or the "Company") is an

exploration and development company, listed on the AIM market of

the London Stock Exchange and the Spotlight Exchange in Sweden.

Beowulf's purpose to be a responsible and innovative company

that creates value for our shareholders, wider society and the

environment, through sustainably producing critical raw materials,

which includes iron ore, graphite and base metals, needed for the

transition to a Green Economy and to address the Climate

Emergency.

The Company's asset portfolio is diversified by commodity,

geography and the development stage of its various projects.

The Company's most advanced project is the Kallak iron ore asset

in northern Sweden. A potential 389 million tonne global resource

which has produced a 'market leading' concentrate of 71.5 per cent

iron content and could supply Sweden's rapidly developing

fossil-free steel sector for decades to come.

Fennoscandian Resources ("Fennoscandian"), a wholly-owned

subsidiary, is pursuing a strategy to develop a resource and

production base of graphite that can provide security of supply and

contribute to Finland's ambitions of achieving battery

manufacturing self-sufficiency, focusing on both natural flake

graphite production and a Circular Economy/recycling strategy to

produce high-value graphite products. The Company is also

developing its knowledge in processing and manufacturing

value-added graphite products, including anode material for

lithium-ion batteries.

Since Fennoscandian was acquired by Beowulf in January 2016, the

Company has invested approximately EUR2.2 million in graphite

exploration, resource development, metallurgical testwork and the

assessment of market applications for graphite supplied from its

Aitolampi project, including lithium-ion battery applications.

Fennoscandian has recently signed a Memorandum of Understanding

("MoU") with Epsilon Advance Materials Limited ("EAMPL"). The MoU

enables Fennoscandian to build its downstream capability,

collaborating with a strong and innovative technology/processing

partner, and for EAMPL to firmly establish itself in Finland, as a

market-entry point for supplying pre-cursor anode material into

Europe. The MoU addresses the development of a strategic processing

hub for both natural flake and recycled graphite to be located in

Finland.

In addition, a Scoping Study contract for the Aitolampi graphite

project has been awarded to AFRY Finland Oy. The purpose of the

Scoping Study is to verify the robustness of the work completed by

Fennoscandian, and to provide a roadmap for the next project

development stage, most likely a Pre-feasibility Study. The output

of the Scoping Study will enable Fennoscandian to share information

on the Aitolampi project and communicate with the local community

and other important stakeholders.

In Kosovo, the Company owns approximately 48.4 per cent of

Vardar Minerals Limited, which is focus on exploration in the

Tethyan Belt, a major orogenic metallogenic province for gold and

base metals. Vardar is delivering exciting results for its

Mitrovica licence which has several exploration targets, including

lead, zinc, copper and gold. It also has the Viti licence which is

showing potential for copper-gold porphyry mineralisation. With

Beowulf's support, Vardar is focused on making a discovery.

Kallak is the foundation asset of the Company, but with Vardar

and Fennoscandian, the Company has many opportunities to grow, each

business area displaying strong prospects.

BEOWULF MINING PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE THREE MONTHS TO 31 MARCH 2021

(Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months

ended 31 ended 31 ended 31

March March December

2020

2021 2020

GBP

Notes GBP GBP

Continuing operations

Administrative expenses (527,883) (217,651) (1,005,547)

Impairment of exploration

costs - - (98,799)

Operating (Loss) (527,833) (217,651) (1,104,346)

Finance costs (18) (88) (203,576)

Finance income 26 397 594

Grant Income 1,247 - 12,637

------------ ------------ ------------

(Loss) before and after

taxation (526,578) (217,342) (1,294,691)

============ ============ ============

Loss attributable to:

Owners of the parent (497,635) (191,543) (1,128,512)

Non-controlling interests (28,943) (25,799) (166,179)

(526,578) (217,342) (1,294,691)

============ ============ ============

Loss per share attributable

to the owners of the

parent:

Basic and diluted (pence) 3 (0.06) (0.03) (0.19)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE THREE MONTHS TO 31 MARCH 2021

(Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months

ended ended

31 March 31 March ended

2021 2020 31 December

2020

GBP GBP GBP

(Loss) for the period

/ year (526,578) (217,342) (1,294,691)

Other comprehensive (loss)

/ income

Items that may be reclassified

subsequently to profit

or loss:

Exchange (losses)/gain

arising on translation

of foreign operations (645,923) 124,676 854,020

------------ ------------ -------------

Total comprehensive (loss) (1,172,501) (92,666) (440,671)

============ ============ =============

Total comprehensive (loss)

attributable to:

Owners of the parent (1,123,388) (70,725) (294,716)

Non-controlling interests (49,113) (21,941) (145,955)

(1,172,501) (92,666) (440,671)

============ ============ =============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF COMPREHENSIVE INCOME

FOR THE THREE MONTHS TO 31 MARCH 2021

(Unaudited) (Unaudited) (Audited)

3 months 3 months 12 months

ended ended ended

31 March 31 March 31 December

2020

2021 2020

GBP

Notes GBP GBP

Continuing operations

Administrative expenses (483,751) (157,336) (869,853)

Operating Loss (483,751) (157,336) (869,853)

Finance income 26 396 594

Loss before and after

taxation and total comprehensive

loss (483,725) (156,940) (869,259)

============ ============ =============

Loss per share attributable

to the owners of the

parent:

Basic and diluted (pence) 3 (0.06) (0.03) (0.14)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2021

(Unaudited) (Unaudited) (Audited)

As at As at As at

31 March 31 March 31 December

2021 2020 2020

GBP GBP GBP

ASSETS Notes

Non-current assets

Intangible assets 5 10,917,186 10,427,186 11,371,916

Property, plant and

equipment 132,045 126,637 145,094

Loans and other financial

assets 5,291 5,234 5,468

Right of use asset 460 6,018 1,937

------------- ------------- -------------

11,054,982 10,565,075 11,524,415

------------- ------------- -------------

Current assets

Trade and other receivables 118,983 201,572 1,566,848

Cash and cash equivalents 4,724,385 789,310 4,329,414

------------- ------------- -------------

4,843,368 990,882 5,896,262

------------- ------------- -------------

TOTAL ASSETS 15,898,350 11,555,957 17,420,677

============= ============= =============

EQUITY

Shareholders' equity

Share capital 4 8,281,751 6,022,446 8,281,751

Share premium 24,665,977 20,824,009 24,684,737

Merger Reserve 137,700 137,700 137,700

Capital contribution

reserve 46,451 46,451 46,451

Share-based payment

reserve 732,185 732,185 732,185

Translation reserve (1,083,024) (1,170,250) (457,272)

Accumulated losses (17,647,927) (15,770,476) (17,083,185)

------------- ------------- -------------

Total Equity 15,133,113 10,822,065 16,342,367

------------- ------------- -------------

Non-controlling interests 412,106 365,469 394,113

------------- ------------- -------------

TOTAL EQUITY 15,545,219 11,187,534 16,736,480

------------- ------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 217,142 229,412 538,772

Grant income 135,505 132,833 143,399

Lease Liability 484 6,178 2,026

------------- ------------- -------------

TOTAL LIABILITIES 353,131 368,423 684,197

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 15,898,350 11,555,957 17,420,677

============= ============= =============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2020

(Unaudited) (Unaudited) (Audited)

As at As at As at

31 March 31 March 31 December

2021 2020 2020

GBP GBP GBP

ASSETS

Non-current assets

Investments 2,277,988 1,777,988 2,077,988

Loans and other financial

assets 9,526,244 9,078,455 9,341,315

Property, plant and

equipment 1,390 - 1,483

11,805,622 10,856,443 11,420,786

------------- ------------- -------------

Current assets

Trade and other receivables 40,897 32,278 1,476,755

Cash and cash equivalents 4,574,079 679,445 4,241,426

------------- -------------

4,614,976 711,723 5,718,181

------------- ------------- -------------

TOTAL ASSETS 16,420,598 11,568,166 17,138,967

============= ============= =============

EQUITY

Shareholders' equity

Share capital 8,281,751 6,022,446 8,281,751

Share premium 24,665,977 20,824,009 24,684,737

Merger Reserve 137,700 137,700 137,700

Capital contribution

reserve 46,451 46,451 46,451

Share-based payment

reserve 732,185 732,185 732,185

Accumulated losses (17,651,843) (16,455,799) (17,168,118)

------------- ------------- -------------

TOTAL EQUITY 16,212,221 11,306,992 16,714,706

------------- ------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 72,872 128,341 280,862

Grant income 135,505 132,833 143,399

------------- -------------

TOTAL LIABILITIES 208,377 261,174 424,261

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 16,420,598 11,568,166 17,138,967

============= ============= =============

BEOWULF MINING PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE THREE MONTHS TO 31 MARCH 2020

Share Share Merger Capital Share-based Translation Accumulated Total Non- Total

capital premium reserve contribution payment reserve losses controlling equity

reserve reserve interest

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2020 6,022,446 20,824,009 137,700 46,451 732,185 (1,291,068) (15,781,161) 10,690,562 326,555 11,017,117

Loss for the

period - - - - - - (191,543) (191,543) (25,799) (217,342)

Foreign

exchange

translation - - - - - 120,818 - 120,818 3,858 124,676

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

Total

comprehensive

loss - 120,818 (191,543) (70,725) (21,941) (92,666)

At 31 March

2020

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (1,170,250) (15,972,704) 10,619,837 304,614 10,924,451

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

Loss for the

period - - - - - - (936,969) (936,969) (140,380) (1,077,349)

Foreign

exchange

translation - - - - - 712,978 - 712,978 16,366 729,344

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

Total

comprehensive

loss - - - - - 712,978 (936,969) (223,991) (124,014) (348,005)

Transactions

with

owners

Issue of share

capital 2,259,305 5,165,060 - - - - - 7,424,365 - 7,424,365

Issue costs - (1,304,332) - - - - - (1,304,332) - (1,304,332)

Issue of

shares - - - - - - (173,512) (173,512) 213,513 40,001

At 31 December

2020

(Audited) 8,281,751 24,684,737 137,700 46,451 732,185 (457,272) (17,083,185) 16,342,367 394,113 16,736,480

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

Loss for the

period - - - - - - (497,635) (497,635) (28,943) (526,578)

Foreign

exchange

translation - - - - - (625,752) - (625,752) (20,171) (645,923)

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

Total

comprehensive

loss - (625,752) (497,635) (1,123,387) (49,114) (1,172,501)

Transactions

with

owners

Issue costs - (18,760) - - - - - (18,760) - (18,760)

Issue of

shares - - - - - - (67,107) (67,107) 67,107 -

At 31 March

2021

(Unaudited) 8,281,751 24,665,977 137,700 46,451 732,185 (1,083,024) (17,647,927) 15,133,113 412,106 15,545,219

---------- ------------ -------- ------------- ------------ ------------ ------------- ------------ ------------ ------------

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE THREE MONTHS TO 31 MARCH 2020

Share Share Merger Capital Share-based Accumulated Total

capital premium reserve contribution payment losses

reserve reserve

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2020 6,022,446 20,824,009 137,700 46,451 732,185 (16,298,859) 11,463,932

Loss for the

period - - - - - (156,940) (156,940)

Total

comprehensive

loss - - - - - (156,940) (156,940)

At 31 March

2020

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (16,455,799) 11,306,992

------------- ------------- ---------- ------------- ------------ --------------- -------------

Loss for the

period - - (712,319) (712,319)

Total

comprehensive

loss - - (712,319) (712,319)

Transactions

with owners

Issue of share

capital 2,259,305 5,165,060 - - - - 7,424,365

Issue costs - (1,304,332) - - - - (1,304,332)

At 31 December

2020

(Audited)

(Unaudited) 8,281,751 24,684,737 137,700 46,451 732,185 (17,168,118) 16,714,706

------------- ------------- ---------- ------------- ------------ --------------- -------------

Loss for the

period - - - - - (483,725) (483,725)

Total

comprehensive

loss - - - - - (483,725) (483,725)

Transactions

with owners

Issue costs - (18,760) - - - - (18,760)

------------- ------------- ---------- ------------- ------------ --------------- -------------

At 31 March

2020

(Unaudited) 8,281,751 24,665,977 137,700 46,451 732,185 (17,651,843) 16,212,221

------------- ------------- ---------- ------------- ------------ --------------- -------------

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FOR THE

THREE MONTHS TO 31 MARCH 2020

1 . Nature of Operations

Beowulf Mining plc (the "Company") is domiciled in England and

Wales. The Company's registered office is 201 Temple Chambers, 3-7

Temple Avenue, London, EC4Y 0DT. This consolidated financial

information comprises that of the Company and its subsidiaries

(collectively the 'Group' and individually 'Group companies'). The

Group is engaged in the acquisition, exploration and evaluation of

natural resources assets and has not yet generated revenues.

2. Basis of preparation

The condensed consolidated financial information has been

prepared on the basis of the recognition and measurement

requirements of International Financial Reporting Standards (IFRS)

as adopted in accordance with the provisions of the Companies Act

2006 . The accounting policies, methods of computation and

presentation used in the preparation of the interim financial

information are the same as those used in the Group's audited

financial statements for the year ended 31 December 2020.

The financial information in this statement does not constitute

full statutory accounts within the meaning of Section 434 of the UK

Companies Act 2006. The financial information for the quarter ended

31 March 2020 is unaudited and has not been reviewed by the

auditors. The financial information for the twelve months ended 31

December 2020 is an extract from the audited financial statements

of the Group and Company. The auditor's report on the statutory

financial statements for the year ended 31 December 2020 was

unqualified and did not contain any statement under sections 498

(2) or (3) of the Companies Act 2006.

The financial statements are presented in GB Pounds Sterling.

They are prepared on the historical cost basis or the fair value

basis where the fair valuing of relevant assets and liabilities has

been applied.

3. Share Capital

(Unaudited) (Unaudited) (Unaudited)

31 March 31 March

2021 2020 31 Dec 2020

GBP GBP GBP

Allotted, issued and fully paid

Ordinary shares of 1p each 8,281,751 6,022,446 6,022,446

----------- ----------- --------------

The number of shares in issue was as follows:

Number

of shares

Balance at 1 January 2020 602,244,672

Issued during the period -

------------

Balance at 31 March 2020 602,244,672

Issued during the period 225,930,552

------------

Balance at 31 December 2020 828,175,224

Issued during the period -

------------

Balance at 31 March 2021 828,175,224

------------

4 . Intangible Assets: Group

Exploration costs As at 31 As at 31

March December

2021 2020

(Unaudited) (Audited)

GBP GBP

Cost

At 1 January 11,371,916 10,011,494

Additions for the year 186,828 612,062

Foreign exchange movements (641,558) 847,159

Impairment - (98,799)

10,917,186 11,371,916

============ ===========

The net book value of exploration costs is comprised of

expenditure on the following projects:

As at As at

31 31

March December

2021 2020

(Unaudited) (Audited)

GBP GBP

Project Country

Kallak Sweden 7,099,530 7,533,388

Åtvidaberg Sweden 369,170 393,303

Pitkäjärvi Finland 1,352,126 1,333,114

Rääpysjärvi Finland 46,623 47,053

Karhunmäki Finland 40,501 41,017

Merivaara Finland 36,479 36,965

Mitrovica Kosovo 1,338,299 1,387,030

Viti Kosovo 634,458 600,046

10,917,186 11,371,916

=============== ===========

Total Group exploration costs of GBP 10,917,186 are currently

carried at cost in the financial statements. No impairment has been

recognised during the period, (2020: Ågåsjiegge, Joutsijärvi,

Polvela and Tammijärvi GBP 98,799 ).

Accounting estimates and judgements are continually evaluated

and are based on a number of factors, including expectations of

future events that are believed to be reasonable under the

circumstances. Management are required to consider whether there

are events or changes in circumstances that indicate that the

carrying value of this asset may not be recoverable.

The most significant risk currently facing the Group is that it

does not receive an Exploitation Concession for Kallak. The Company

originally applied for the Exploitation Concession in April 2013

and throughout 2017, and since the year-end, management have

actively sought to progress the application, engaging with the

various government bodies and other stakeholders. These activities

are summarised above.

Kallak is included in the condensed financial statements as at

31 March 2021 as an intangible exploration licence with a carrying

value of GBP7,099,529. Management have considered the status of the

application for the Exploitation Concession and in their judgement,

they believe it is appropriate to be optimistic about the chances

of being awarded the Exploitation Concession and thus have not

impaired the project.

5. Availability of interim report

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 207 Temple Chambers,

3-7 Temple Avenue, London, EC4Y 0DT. A copy can also be downloaded

from the Company's website at www.beowulfmining.com. Beowulf Mining

plc is registered in England and Wales with registered number

02330496.

** Ends **

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFARMFTMTITBBB

(END) Dow Jones Newswires

May 28, 2021 02:00 ET (06:00 GMT)

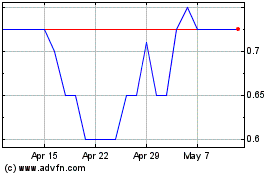

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Apr 2023 to Apr 2024