TIDMBHP

RNS Number : 1005Z

BHP Group PLC

20 January 2022

20 January 2022

To: London Stock Exchange cc: New York Stock Exchange

JSE Limited

CHAIRMAN'S SPEECHES FOR BHP GROUP PLC SHAREHOLDER MEETINGS

Please find attached the addresses to shareholders to be

delivered by the Chairman at the BHP Group Plc scheme and general

meetings that will be held today.

A poll will be conducted on each of the resolutions to be

proposed at the BHP Group Plc scheme and general meetings. The poll

results on these resolutions will be released to the market shortly

after conclusion of the BHP Group Plc general meeting.

A live webcast of both of the BHP Group Plc meetings will be

available at https://web.lumiagm.com/123-885-895 .

Further information on BHP can be found at bhp.com.

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

BHP Group plc

Registration number 3196209

LEI 549300C116EOWV835768

Registered in England and Wales

Registered Office: Nova South, 160 Victoria Street

London SW1E 5LB United Kingdom

A member of the BHP Group which is headquartered in

Australia

BHP Group Plc Scheme Meeting

Speech by Ken MacKenzie, Chair

20 January 2022

BHP Group Plc Scheme Meeting

20 January 2022

Ken MacKenzie, Chair

We believe BHP is in a strong position.

Our people have proven their resilience during challenging

times, our balance sheet is strong, as is our performance culture,

and we have a clear strategy in place focused on shaping the

company to meet the world's needs and deliver long-term shareholder

value.

In August last year, we announced our intention to make a number

of strategic changes that will ensure BHP is in the best position

to capture the opportunities presented as our world evolves.

At the centre of these changes was the announcement of our

intention to unify BHP's corporate structure under BHP Group

Limited.

Since that announcement, we have worked through that process and

the Board approved the proposal in December.

And now it is up to you as our shareholders to decide whether

BHP unifies.

We are here today to discuss this proposal with you, take your

questions and put the proposal to a shareholder vote.

First, I think it is important to set out some background

regarding our current Dual Listing Company structure - better known

as our DLC.

This structure was established with the BHP and Billiton merger

in 2001.

The DLC structure comprises two parent companies - BHP Group Plc

and BHP Group Limited - operating as a single economic entity.

While shareholders in both Plc and Limited have equivalent

shareholder and economic rights, there are two share registries and

two share prices - BHP Group Plc has its primary listing on the

London Stock Exchange, while BHP Group Limited has its listing on

the Australian Securities Exchange.

This structure has served us well for a number of years.

However, the Board and Management believe that its suitability for

us has diminished over time.

So why unify now?

As we have stated previously, we have kept our DLC structure

under review because as an organisation, we value simplicity and

having two parent companies listed in two locations is complex and

managing them requires significant management time and focus.

In addition, over time, the makeup of our organisation has

changed. We are not the same Group we were in 2001.

When the DLC was first established in 2001, about 40 per cent of

the earnings were generated through the UK Plc entity.

Due to changes to our portfolio over the years, this is now down

below 5 per cent today.

Put simply, the DLC structure is no longer the optimal

configuration for BHP.

However, even though this reality has emerged over time, the

business case for unwinding the DLC has not been compelling enough

to make the change - until now.

A key driver is cost.

Today, one-off unification costs have come down substantially -

by approximately 1.2 billion US dollars since

2017. These are now expected to range between 350 to 450 million US dollars.

Under the proposed structure, a significant part of these

unification costs relate to stamp duties to be paid by BHP for the

purchase of Plc shares.

As a result, our most recent review of the DLC concluded that

now was the right time to unify - facilitating a corporate

structure that better supports the BHP of today and the BHP of

tomorrow, and the value that will be delivered for our shareholders

and stakeholders as a result.

So what does this mean for shareholders?

From an overarching standpoint, it will mean shareholders will

have a company with a corporate structure that is 'fit-for-purpose'

- to support the BHP we are today and our exciting future.

In addition, shareholders will be able to buy the same BHP

shares around the world via BHP Group Limited's listings on the

Australian, London and Johannesburg stock exchanges as well as our

NYSE listed ADR program.

We believe these benefits are significant for our future,

underpin our strategy and support long-term shareholder value

creation.

Now turning to the proposal in more detail.

A unified BHP will, through BHP Group Limited, have a primary

listing on the Australian Securities Exchange, a standard listing

on the London Stock Exchange, a secondary listing on the

Johannesburg Stock Exchange, and a Level 2 ADR program on the New

York Stock Exchange. This means that shareholders can continue to

invest in BHP in the same markets as they do now.

Plc shareholders will be entitled to receive Limited shares in

exchange for each Plc share held by them at the relevant time on a

one-for-one basis.

Importantly, the dividend policy and ability to distribute

franking credits will remain the same. And BHP's considerable

franking credit balance means that dividends paid to non-Australian

shareholders will not be subject to Australian withholding tax for

the foreseeable future.

It will also not change BHP's strong fundamentals - it will not

change BHP's underlying assets nor operations, workforce, executive

leadership team, Board or cash flow generation, or our commitment

to strong governance and social value.

As a result, the Board is strongly supportive of the move to

unification and the benefits it will bring.

To conclude, the DLC has served us well for many years. However,

its suitability for our organisation has diminished over time.

Today BHP's portfolio is simpler and focused on growing

long-term value from future-facing commodities.

And we require a corporate structure that supports this - that

is fit-for-purpose.

We believe now is the right time to take this step.

Unification will only proceed if it is supported by both Plc and

Limited shareholders.

Your Directors consider that unification is in the best

interests of BHP Shareholders as a whole, and each of your

Directors intends to vote all BHP Shares that they own or control

in favour of the resolutions at each of the shareholder meetings

today. As is customary in Australia, an Independent Expert, Grant

Samuel, has also concluded that unification is in the best

interests of BHP Shareholders.

The Board unanimously recommends that you vote in favour of

unification and we ask for your consideration and support for the

unification of BHP.

The Chair then conducted the formal item of business.

BHP Group Plc General Meeting

Speech by Ken MacKenzie, Chair

20 January 2022

BHP Group Plc General Meeting

20 January 2022

Ken MacKenzie, Chair

Many of you will have heard the discussion at the earlier scheme

meeting regarding the benefits of unification, but for those who

have just joined us, I will provide some background to the

rationale for and the benefits of unification.

The DLC structure was established with the BHP and Billiton

merger in 2001 and comprises two parent companies - BHP Group Plc

and BHP Group Limited - operating as a single economic entity.

This structure has served us well for a number of years,

however, the Board and Management believe that its suitability has

diminished over time as the company evolved.

Unification will result in a corporate structure that's simpler

and more efficient, with improved flexibility to shape our

portfolio for the future.

However, for a long time, the business case for unwinding the

DLC has not been compelling enough to make the change - until

now.

A key driver is cost.

Today, one-off unification costs have come down substantially -

by approximately 1.2 billion US dollars since 2017.

These are now expected to range between 350 to 450 million US

dollars - with a significant part of these costs relating to stamp

duties to be paid by BHP for the purchase of Plc shares.

So what does this mean for you as Plc shareholders if BHP

unifies?

You will have a company with a corporate structure that is

'fit-for-purpose' - to support the BHP we are today and for our

exciting future.

A unified BHP will, through BHP Group Limited, have a primary

listing on the Australian Securities Exchange, a standard listing

on the London Stock Exchange, a secondary listing on the

Johannesburg Stock Exchange, and a Level 2 ADR program on the New

York Stock Exchange, and investors will be able to buy the same BHP

shares around the world.

You will be entitled to receive Limited shares in exchange for

each Plc share held by you at the relevant time on a one-for-one

basis.

BHP's Board, management team, underlying assets and operations,

workforce, cash flow generation will not change as a result of

unification. Neither will our dividend policy or our commitment to

strong governance and social value.

To conclude, we require a corporate structure that is

fit-for-purpose and that better supports the BHP of today and the

BHP of tomorrow.

Unification will provide this, but will only proceed if it is

supported by both Limited and Plc shareholders.

Your Directors consider that unification is in the best

interests of BHP Shareholders as a whole, and intend to vote all

BHP Shares that they own or control in favour of the resolutions at

each of the shareholder meetings today. As is customary in

Australia, an Independent Expert, Grant Samuel, has also concluded

that unification is in the best interests of BHP Shareholders.

The Board unanimously recommends that you vote in favour of

unification and we ask for your support for the unification of

BHP.

The Chair then conducted the formal items of business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

GMSKBLBLLFLLBBE

(END) Dow Jones Newswires

January 20, 2022 04:33 ET (09:33 GMT)

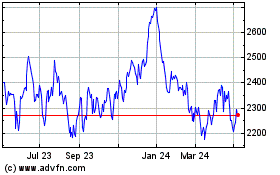

Bhp (LSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

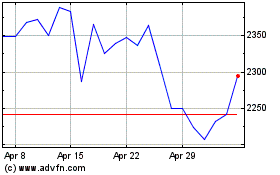

Bhp (LSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024