TIDMBKY

RNS Number : 8764S

Berkeley Energia Limited

14 March 2023

BERKELEY ENERGIA LIMITED

Interim Financial Report for the Half Year Ended 31 December

2022

Informe financiero provisional correspondiente al semestre

terminado el 31 de diciembre de 2022

abn 40 052 468 569

CORPORATE DIRECTORY | DIRECTORIO CORPORATIVO

Directors Solicitors

Mr Ian Middlemas Chairman Spain

Mr Robert Behets Acting Managing Herbert Smith Freehills, S.L.P

Director

Mr Francisco Bellón Executive United Kingdom

Director Simmons & Simmons LLP

Mr Adam Parker Non-Executive Director

Australia

Thomson Geer

Company Secretary

Mr Dylan Browne Bankers

Spain

Spanish Office Santander Bank

Berkeley Minera España, S.A.

Carretera SA-322, Km 30 Australia

37495 Retortillo National Australia Bank Ltd

Salamanca Australia and New Zealand Banking

Spain Group Ltd

Telephone: +34 923 193 903

Share Registry

London Office Spain

Unit 3C, Princes House Iberclear

38 Jermyn Street Plaza de la Lealtad, 1

London SW1Y 6DN, United Kingdom 28014 Madrid, Spain

Registered Office United Kingdom

Level 9, 28 The Esplanade Computershare Investor Services

Perth WA 6000 PLC

Australia The Pavilions, Bridgewater Road,

Telephone: +61 8 9322 6322 Bristol BS99 6ZZ

Facsimile: +61 8 9322 6558 Telephone: +44 370 702 0000

Website Australia

www.berkeleyenergia.com Computershare Investor Services

Pty Ltd

Email Level 11, 172 St Georges Terrace

info@berkeleyenergia.com Perth WA 6000

Telephone: +61 8 9323 2000

Auditor

Spain

Ernst & Young España Stock Exchange Listings

Spain

Australia Madrid, Barcelona, Bilboa and

Ernst and Young Australia - Perth Valencia Stock Exchanges (Code:

BKY)

United Kingdom

London Stock Exchange (LSE Code:

BKY)

Australia

Australian Securities Exchange

(ASX Code: BKY)

CONTENTS | CONTENIDO

Directors' Report

Directors' Declaration

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

Consolidated Statement of Financial Position

Consolidated Statement of Changes in Equity

Consolidated Statement of Cash Flows

Condensed Notes to the Financial Statements

To view the following sections as well as all illustrations and

figures, please refer to the full version of the Interim Financial

Report on our website at www.berkeleyenergia.com :

Auditor's Independence Declaration

Auditor's Review Report

DIRECTORS' REPORT

The Board of Directors of Berkeley Energia Limited present their

report on the consolidated entity of Berkeley Energia Limited ("the

Company" or "Berkeley") and the entities it controlled during the

half year ended 31 December 2022 ("Consolidated Entity" or

"Group").

DIRECTORS

The names of the Directors of Berkeley in office during the half

year and until the date of this report are:

Mr Ian Middlemas Chairman

Mr Robert Behets Non-Executive Director (Acting Managing Director)

Mr Francisco Bellón Executive Director (appointed 1 July 2022)

Mr Adam Parker Non-Executive Director

Unless otherwise disclosed, Directors were in office from the

beginning of the half year until the date of this report.

OPERATING AND FINANCIAL REVIEW

Summary

Summary for and subsequent to the half year end include:

-- Appointment of Spanish Based Director

During the period, the Company strengthened the Board's

technical capacity and Spanish operating experience with the

appointment of Mr Francisco Bellón as an Executive Director.

Mr Bellón is a Mining Engineer with more than 25 years of

experience in the resources sector, including specialisation in

mineral processing. During his career, Mr Bellón has participated

in the construction, commissioning and operation of four mines in

Spain, two in South America and two in West Africa, working at an

executive level for companies listed on either the Toronto, New

York or Madrid Stock Exchange, such as Rio Narcea Gold Mines,

Lundin Mining,ESA and Duro Felguera.

Mr Bellón who is based in Salamanca, joined Berkeley in 2011 as

General Manager of Operations, and was subsequently promoted to

Chief Operating Officer in 2017. During this period, Mr Bellón has

been responsible for the Company's day-to-day operations in Spain,

and has overseen the development of the Salamanca Project

("Salamanca" or "Project") from the Scoping Study stage through to

the completion of the Definitive Feasibility Study and Front End

Engineering Design.

Mr Bellón has a Masters Degrees in Mining Engineering and

Occupational Health and Safety, Investor Relations Certification

from the Madrid Stock Exchange, and is Member of the Australasian

Institute of Mining and Metallurgy.

-- Spanish Advisory Committee

During the period, an Advisory Committee to the Board of

Berkeley's wholly owned Spanish subsidiary, Berkeley Minera España

S.L.U. ("BME"), which holds the Salamanca Project, was

established.

The Advisory Committee is comprised of Rafael Miranda, Jaime

García-Legaz and Miguel Riaño, all prominent, highly experienced,

and well-regarded Spanish businessmen with extensive networks.

The Advisory Committee has substantially strengthened Berkeley's

position in Spain, with the committee members' collective

corporate, commercial and operating expertise plus extensive

business and government networks greatly assisting the Company as

it continues to focus on resolving the current permitting

situation, and ultimately advancing the Project towards

production.

-- Project Update

In November 2022, the Company announced that it had submitted a

written notification of an investment dispute to the Prime Minister

of Spain and the Ministry for the Ecological Transition and the

Demographic Challenge ("MITECO") informing the Kingdom of Spain of

the nature of the dispute and the Energy Charter Treaty ("ECT")

breaches, and that it proposes to seek prompt negotiations for an

amicable solution pursuant to article 26.1 of the ECT.

In February 2023, the Company received formal notification from

MITECO that it had rejected the Company's administrative appeal

against MITECO's rejection of the Authorisation for Construction

for the uranium concentrate plant as a radioactive facility ("NSC

II") for the Salamanca Project.

As previously disclosed , MITECO rejected NSC II in November

2021 following an unfavourable report for the grant of NSC II

issued by the Board of the Nuclear Safety Council ("NSC") in July

2021 .

Taking this into account, Berkeley submitted an administrative

appeal against MITECO's decision under Spanish law in December

2021. MITECO has now rejected this administrative appeal.

The Company believes that MITECO has not only infringed

regulations on administrative procedures in Spain but also under

protection afforded to Berkeley under the ECT, which would imply

that the decision on the rejection of the Company's NSC II

application is not legal.

Accordingly, the Company also submitted a written notification

of an investment dispute to the Prime Minister of Spain and MITECO

in November 2022.

The notification of an investment dispute submitted to the

Spanish Government is necessary to preserve the Company's rights to

initiate international arbitration should the dispute not be

satisfactorily resolved. The Company, however, has informed the

Spanish Government that it is prepared to collaborate and remains

hopeful that the dispute can be resolved amicably through prompt

negotiations.

The dispute notice is an initial step to request amicable

negotiations to overturn the rejection of NSC II. To date, the

Company has received no correspondence from the Kingdom of Spain or

MITECO in relation to the investment dispute.

-- Exploration

A drilling program, comprising five reverse circulation ("RC")

holes for a total of 282m, designed to test the tin-lithium anomaly

defined by soil sampling at the Company's Investigation Permit,

Conchas, was completed during the period.

-- Global Nuclear Power and Uranium Market :

The outlook for nuclear power and the uranium market continued

to strengthen during the period, with select recent activity and

updates including the following:

-- Spain - Spain's seven operating nuclear reactors were

reported to have generated 20.25% of the country's electricity in

2022 with average capacity factor of the units being 90%. It was

noted that "with just 7117 MWe of installed capacity, 6% of the

total, nuclear power generated over 20% of the electricity, a

consistent and consecutive figure for over a decade." Spanish

nuclear power plants produced a total of 55.9 TWh of electricity in

2022, 3.6% more than in 2021.

-- United Kingdom - A new nuclear power plant to be built in

Suffolk was approved by the UK government. The UK government has

pledged to invest GBP700 million in the project (50% stakeholder),

which also includes Electricite de France, as well as committing to

advancing additional nuclear power projects as incorporated in the

proposed Energy Bill. Great British Nuclear is being established in

order to oversee nuclear new builds.

-- Netherlands - The lower house of the Dutch Parliament adopted

a proposal to pursue the construction of two nuclear power reactors

which the Dutch Cabinet hopes to be in operation by 2035. The

Netherlands currently operate a single reactor which entered

commercial operation in 1973, located at Borssele, the likely site

for the expansion.

-- Germany - Announced it will keep all three of its nuclear

plants operating until April 2023 to ensure the country's energy

supply remains robust amid uncertainty over Russian gas supply.

-- Poland - Announced that it had selected Westinghouse Electric

to build the country's initial nuclear power plant. The Polish

government has been seeking partners to develop 6-9 GWe of nuclear

capacity by the early 2040s and may ultimately order a total of six

Westinghouse reactors.

-- Japan - Confirmed a major nuclear power policy shift in

December to tackle an energy crisis more than a decade after the

2011 Fukushima disaster prompted it to idle most of its reactors.

Quake-prone Japan, which previously said it had no plans to build

new reactors, will now seek to replace decommissioned ones and

extend the lifespan of others, with the government aiming to boost

nuclear to as much as 22% of its power mix by 2030.

-- India - The Indian government presented its road map to

attain net-zero carbon emissions by 2070 at the recent UN

Convention on Climate Change. The national plan calls for a focus

on renewable energy sources including solar, wind and hydro power

supplemented by a "three-fold rise in nuclear installed capacity by

2032."

Other developments in the uranium market during the period

included:

-- Spain's ENUSA says it and Westinghouse Electric Company has

formalised their cooperation agreement for the manufacture of

water-water energetic reactor ("VVER") fuel. The two companies have

reached an agreement that will allow operators to diversify the

supply of nuclear fuel and reduce dependence on the current

supplier, Russia, strategically complying with the will of the

European Union to provide a real alternative in the supply made out

of fuel. The ENUSA factory in Salamanca has begun the installation

of the new production line to be ready by the end of the year.

-- Finnish mining company, Terrafame, announced plans to start

recovering natural uranium as a by-product of zinc and nickel

production at its Sotkamo mine in the north-east of the country by

the summer of 2024. The state-owned company reported that it has

completed a feasibility study related to uranium recovery and has

decided to start preparing its operations for the uranium recovery

for next year.

-- Cameco reported the first packaged uranium from McArthur

River / Key Lake following the February 2022 announcement that the

production complex would be restarted after a four year shut-down.

McArthur River / Key Lake is expected to reach steady-state

production of 15 million pounds U(3) 0(8) in 2024.

-- The latest World Energy Outlook assessment published by the

International Energy Agency ("IEA"), underscores the crucial role

which nuclear power must assume over the next three decades.

Nuclear power increases under all three of the IEA government

policy-related scenarios (Stated Policies Scenario; Announced

Pledges Scenario, and; Net Zero Emissions by 2050 Scenario). The

report observes that "As markets rebalance, renewables, supported

by nuclear power, see sustained gains." Under the Net Zero

Emissions by 2050 Scenario, an average of 24 GWe/year must be added

over the 2022-2050 period, more than doubling current nuclear

capacity (compounded average annual growth rate = 2.6%).

-- Spot market activity reportedly slowed in the period with

current term prices ending at US$47.75 per pound. Longer-term

uranium price indicators continued to remain stable and closed at

the end of December at US$51.00 per pound (Long-Term); US$56.50 per

pound (3-year forward price); and US$60.00 per pound (5-year

forward price).

-- IBEX SMALL CAP(R) index

During the period, Berkeley was included in the IBEX SMALL

CAP(R) index on the Spanish Stock Exchange. The index adjustment

took effect on 19 December 2022.

Operations

Salamanca Project Summary

The Salamanca Project is being developed in an historic uranium

mining area in Western Spain about three hours west of Madrid.

The Project hosts a Mineral Resource of 89.3Mlb uranium, with

more than two thirds in the Measured and Indicated category. In

2016, Berkeley published the results of a robust Definitive

Feasibility Study ("DFS") for Salamanca confirming that the Project

may be one of the world's lowest cost producers, capable of

generating strong after-tax cash flows.

Mineral Resource at Salamanca Project

Deposit Resource Tonnes U(3) O(8) U(3) O(8)

Category

Name (Mt) (ppm) (Mlbs)

-------------------------- ------------ -------- ----------- -----------

Retortillo Measured 4.1 498 4.5

Indicated 11.3 395 9.8

Inferred 0.2 368 0.2

--------------------------------------- -------- ----------- -----------

Total 15.6 422 14.5

--------------------------------------- -------- ----------- -----------

Zona 7 Measured 5.2 674 7.8

Indicated 10.5 761 17.6

Inferred 6.0 364 4.8

--------------------------------------- -------- ----------- -----------

Total 21.7 631 30.2

--------------------------------------- -------- ----------- -----------

Alameda Indicated 20.0 455 20.1

Inferred 0.7 657 1.0

--------------------------------------- -------- ----------- -----------

Total 20.7 462 21.1

--------------------------------------- -------- ----------- -----------

Las Carbas Inferred 0.6 443 0.6

Cristina Inferred 0.8 460 0.8

Caridad Inferred 0.4 382 0.4

Villares Inferred 0.7 672 1.1

Villares North Inferred 0.3 388 0.2

-------------------------- ------------ -------- ----------- -----------

Total Retortillo

Satellites Total 2.8 492 3.0

-------------------------- ------------ -------- ----------- -----------

Villar Inferred 5.0 446 4.9

Alameda Nth Zone 2 Inferred 1.2 472 1.3

Alameda Nth Zone 19 Inferred 1.1 492 1.2

Alameda Nth Zone 21 Inferred 1.8 531 2.1

-------------------------- ------------ -------- ----------- -----------

Total Alameda Satellites Total 9.1 472 9.5

-------------------------- ------------ -------- ----------- -----------

Gambuta Inferred 12.7 394 11.1

-------------------------- ------------ -------- ----------- -----------

Salamanca Project

Total Measured 9.3 597 12.3

Indicated 41.8 516 47.5

Inferred 31.5 395 29.6

--------------------------------------- -------- ----------- -----------

Total (*) 82.6 514 89.3

======================================= ======== =========== ===========

Project Update

The Company continued with its commitment to health, safety and

the environment as a priority.

An external audit of the Company's Environmental and Sustainable

Mining Management Systems was successfully carried out by

independent consultant AENOR during the period, with no

non-compliances and numerous strengths reported.

As previously reported, Berkeley initiated a study evaluating

the design, permitting, construction and operation of a solar power

system at the Project during the period.

The Project's location has a natural abundance of sunlight which

is conducive to solar power generation, which will become a

reliable source of low cost and carbon-free energy for the Project.

In addition to making a significant contribution to reduce carbon

emissions, the solar power system will potentially contribute to

reducing the Project operating costs.

The proposed facility will have an installed power of up to 20

MW and will be able to supply up to 68% of the power requirements

at the Project.

During the period, contracts for the engineering and design, and

environmental studies were awarded to companies based in Salamanca

who are specialists on the design of solar power systems and

environmental studies.

The engineering and design, as well as preparation of all

documents required for submission to relevant authorities, will be

completed in approximately 25 weeks, after which the permitting

process can commence.

The decision to pursue a solar power system is in line with

Berkeley's ongoing commitment to environmental sustainability and

to continue to have a positive impact on the people, environment

and society surrounding the mine.

Exploration

During the period, the Company continued with its exploration

program focusing on battery and critical metals in Spain.

The exploration initiative is targeting lithium, cobalt, tin,

tungsten and rare earths, within the Company's existing tenement

package in western Spain. Further analysis of the mineral and metal

endowment across the entire mineral rich province and other

prospective regions in Spain is also being undertaken, with a view

to identifying additional targets and regional consolidation

opportunities.

Whilst Berkeley remains focused on defending its position in

relation to the adverse resolution by MITECO and ultimately

advancing the Salamanca project towards production, the planned

battery and critical metals exploration initiative also facilitates

the Company's participation in these important, rapidly evolving,

growth sectors which are integral to the global clean energy

transition.

Investigation Permit Conchas

The Investigation Permit ("I.P.") Conchas is located 10km south

of Berkeley's Alameda deposit, in the very western part of

Salamanca province, close to the Portuguese border (Figure 1).

The tenement covers an area of 31km(2) in the western part of

the Ciudad Rodrigo Basin and is largely covered by Cenozoic aged

sediments. Only the north-western part of the tenement is uncovered

and dominated by the Guarda Batholith (Vilar Formoso-Fuentes de

Oñoro sector) intrusion. The tenement hosts a number of sites where

small-scale historical tin and tungsten mining was undertaken. In

addition, several mineral occurrences (tin, tungsten, titanium,

lithium) have been identified during historical mapping or stream

sediment sampling programs.

The Company completed initial soil sampling programs in northern

and central portions of the tenement during 2021. The sampling,

which was undertaken on a 200m by 200m grid, defined a tin-lithium

anomaly covering approximately 1.1km by 0.7km which correlated with

a mapped aplo-pegmatitic leucogranite.

An infill (100m by 100m spacing) and extension soil sampling

program was undertaken to follow-up the 2021 results. The results

of the infill program confirmed the spatial location, scale and

tenor of the tin-lithium anomaly defined in 2021 but failed to

extend the anomalism to the east (Figure 2).

The Company has also obtained a report summarising exploration

work undertaken by Billiton PLC on the I.P. Conchas between 1981

and 1983. Billiton's exploration was focused on tin and tantalum

(lithium was not taken into account) and comprised regional and

detailed geological mapping, geochemistry, trenching and limited

drilling.

The results of Berkeley's soil sampling program are encouraging

and the Company has now completed the process of verifying,

evaluating and incorporating the additional historical information

contained in the Billiton report.

A drilling program, comprising five RC holes for a total of

282m, designed to test the tin-lithium anomaly, was completed

during the period. Assay results covering a suite of 51 elements

have been recently received and are currently being processed and

interpreted.

Spanish Advisory Committee

During the period, an Advisory Committee to the Board of

Berkeley's wholly owned Spanish subsidiary, BME, which holds the

Project, was established.

The Advisory Committee is comprised of Rafael Miranda, Jaime

García-Legaz and Miguel Riaño, all prominent, highly experienced,

and well-regarded Spanish businessmen with extensive networks.

The Advisory Committee has substantially strengthened Berkeley's

position in Spain, with the committee members' collective

corporate, commercial and operating expertise plus extensive

business and government networks greatly assisting the Company as

it continues to focus on resolving the current permitting

situation, and ultimately advancing the Project towards

production.

IBEX SMALL CAP(R) index

During the period, Berkeley was included in the IBEX SMALL

CAP(R) index on the Spanish Stock Exchange. The index adjustment

took effect on 19 December 2022.

The IBEX indices measure the performance of securities listed on

the Spanish Stock Market. The IBEX SMALL CAP(R) index is a market

capitalisation weighted index adjusted by free float. It is

Euro-denominated and calculated in real-time within the European

time zone.

The IBEX SMALL CAP(R) index is composed of 30 securities listed

on the Spanish Stock Exchanges that follow certain requirements in

terms of stock market capitalisation, free floating capital, and

annual rotation of the free float capitalisation.

The Technical Advisory Committee of the IBEX INDICES reviews and

adjusts the composition of SMALL CAP(R) index on a biannual

basis.

Results of Operations

The net loss of the Consolidated Entity for the half year ended

31 December 2022 was $849,000 (31 December 2021 restated gain:

$63,804,000). Significant items contributing to the current half

year loss and the substantial differences from the previous half

year include the following:

(i) Exploration and evaluation expenses of $1,494,000 (31

December 2021: $2,177,000), which are attributable to the Group's

accounting policy of expensing exploration and evaluation

expenditure incurred subsequent to the acquisition of the rights to

explore and up to and until a decision to develop or mine is

made;

(ii) Non-cash fair value movement gain of $633,000 (31 December

2021 restated: gain of $64,078,000) on the unlisted options issued

to Singapore Mining Acquisition Co Pte Ltd (a subsidiary of the

Oman Investment Fund, formerly the State General Reserve Fund of

Oman ("SGRF")) (the "SGRF Options"). These financial liabilities

increase or decrease in size as the share price of the Company

fluctuates. During the period, 10,088,625 SGRF Options expired.

During the prior period, the fair value of the Convertible Note was

calculated using a probability-weighted payout approach on the

basis that the Convertible Note converted at 30 November 2021 at

the floor price of GBP0.27. At the date the Convertible Note

automatically converted, the valuation date share price was

GBP0.105, which resulted in a gain of $59,907,000 being recognised.

Further, during the prior period, the Company issued 186,814,815

fully paid ordinary shares in the capital of the Company to SGRF

following the automatic conversion of the convertible note in

accordance with the terms of the investment agreement and

convertible note entered into with SGRF in 2017. This resulted in

the convertible note liability being derecognised with the

Company's share capital increasing;

(iii) One off expense of $393,000 ( 31 December 2021: nil) for

the publication of a prospectus in October 2022 for the admission

of 186,814,815 fully paid ordinary shares to the London and Spanish

stock exchanges;

(iv) Foreign exchange gain of $1,220,000 (31 December 2021

restated: gain of $2,522,000) largely attributable on the US$53

million held in cash by the Group following the weakening of the

AUD against the USD by some 2% during the half year period; and

(v) Non-cash share-based payment expense of $374,000 (31

December 2021: reversal of $110,000) was recognised in respect of

incentive securities granted to directors, employees and key

consultants of the Group as part of the long-term incentive plan to

reward directors, employees and key consultants for the long-term

incentive of the Group. The Company's policy is to expense the

incentive securities over the vesting period. During the period the

Company issued 2,000,000 incentive options ("Incentive Options")

which relates to the current period expense.

Financial Position

At 31 December 2022, the Group is in an extremely strong

financial position with cash reserves of $78,860,000 (30 June 2022:

$79,943,000).

The Group had net assets of $87,545,000 at 31 December 2022 (30

June 2022: net assets of $87,633,000), a decrease of 0.1% compared

with 30 June 2022. The decrease is consistent with the decrease in

cash which has been offset by the decrease in total

liabilities.

Business Strategies and Prospects for Future Financial Years

Berkeley's strategic objective is to create long-term

shareholder value with the Company's primary focus continuing to be

on progressing the approvals required to commence construction of

the Salamanca mine and bring it into production.

To achieve its strategic objective, the Company currently has

the following business strategies and prospects:

-- Continue in the defence of the Company's rights with respect

to the Salamanca Project;

-- Continue to assess other business, development and investment

opportunities at the Salamanca Project;

-- Continue to assess other business and development

opportunities in the resources sector; and

-- Continue its exploration initiative focusing on battery and

critical metals in Spain.

All of these activities are inherently risky and the Board is

unable to provide certainty that any or all of these activities

will be able to be achieved. The material business risks faced by

the Company that are likely to have an effect on the Company's

future prospects, and how the Company manages these risks, include

but are not limited to the following:

-- Litigation risk - All industries, including the mining

industry, are subject to legal and arbitration claims.

Specifically, in November 2022, the Company submitted a written

notification of an investment dispute to the Prime Minister of

Spain and the MITECO informing the Kingdom of Spain of the nature

of a dispute and the ECT breaches relating to the Company's

rejection of NSCII, and that it proposes to seek prompt

negotiations for an amicable solution pursuant to article 26.1 of

the ECT. Berkeley will strongly defend its position and continue to

take relevant actions to pursue its legal rights regarding the

Salamanca Project. However, there is no certainty that any claim,

should it be made in the future, will be successful.

-- Mining licences and government approvals required - With the

mining licence, environmental licence and the Urbanism Licence

("UL") already obtained at the Salamanca Project, the only major

approval to commence construction at the Salamanca Project is NSC

II.

During the year ended 30 June 2021, Berkeley reported that the

NSC had issued an unfavourable report for the grant of the NSC II.

In November 2021, the Company received formal notification from

MITECO that it had rejected the NSC II application at the Company's

Salamanca Project. This decision followed the unfavourable NSC II

report issued by the NSC in July 2021.

In this regard, in December 2021, the Company submitted an

administrative appeal against MITECO's decision under Spanish law.

In the appeal, the Company refutes the NSC's assessment on the

basis that the NSC has adopted an arbitrary decision with the

technical issues used as justification to issue the unfavourable

report lacking in both technical and legal support. Furthermore,

the Company states in the appeal that MITECO has rejected the

Company's NSC II application without following a legally

established procedure, and that MITECO has infringed the Company's

right of defence, which would imply that the decision on the

rejection of the Company's NSC II application is not legal.

Berkeley also submitted further documentation to MITECO in which

the Company, with strongly supported arguments, dismantles all of

the technical issues used by the NSC as justification to issue the

unfavourable report.

Berkeley strongly refutes the NSC's assessment and notes that

all documentation submitted by the Company in relation to NCS II

has been prepared following advice from independent, nationally and

internationally recognised advisors and consultants who are experts

in their field.

However, In February 2023, the Company received formal

notification from MITECO that it had rejected the Company's

administrative appeal against MITECO's rejection of NSC II for the

Salamanca Project.

It should also be noted that more than 120 previous permits and

favourable reports have been granted by the relevant authorities at

the local, regional, federal and European Union levels in relation

to the Salamanca Project, among which nine have been from the

NSC.

The Company believes that MITECO has not only infringed

regulations on administrative procedures in Spain but also under

protection afforded to Berkeley under the ECT, which would imply

that the decision on the rejection of the Company's NSC II

application is not legal.

The Company will continue to strongly defend its position in

relation to the adverse decision by the NSC however as discussed in

the litigation risk section above.

Further, various appeals have also been made against other

permits and approvals the Company has received for the Salamanca

Project, as allowed for under Spanish law, and the Company expects

that further appeals will be made against these and future

authorisations and approvals in the ordinary course of events.

Whilst none of these appeals have been finally determined, no

precautionary or interim measures have been granted in relation to

the appeals regarding the award of licences and authorisations at

the Salamanca Project to date.

However, the successful development of the Salamanca mine will

be dependent on the granting of all permits and licences necessary

for the construction and production phases, in particular the award

NSC II which will allow for the construction of the plant as a

radioactive facility.

However, with any development project, there is no guarantee

that the Company will be successful in applying for and maintaining

all required permits and licences to complete construction and

subsequently enter into production. If the required permits and

licences are not obtained, then this could have a material adverse

effect on the Group's financial performance, which has led to a

reduction in the carrying value of assets and may materially

jeopardise the viability of the Salamanca Project and the price of

its Ordinary Shares.

Further, the Company's exploration and any future mining

activities are dependent upon the maintenance and renewal from time

to time of the appropriate title interests, licences, concessions,

leases, claims, permits, environmental decisions, planning consents

and other regulatory consents which may be withdrawn or made

subject to new limitations. The maintaining or obtaining of

renewals or attainment and grant of title interests often depends

on the Company being successful in obtaining and maintaining

required statutory approvals for its proposed activities. The

Company closely monitors the status of its mining permits and

licences and works closely with the relevant Government departments

in Spain to ensure the various licences are maintained and renewed

when required. However, there is no assurance that such title

interests, licenses, concessions, leases, claims, permits,

decisions or consents will not be revoked, significantly altered or

not renewed to the detriment of the Company or that the renewals

and new applications will be successful;

-- The Company may not successfully acquire new projects - In

conjunction with seeking to overturn the negative MITECO decision,

the Company is also searching for and assessing other new business

opportunities at the Salamanca Project but also for new business

opportunities in the resources sector which could have the

potential to build shareholder value. These new business

opportunities may take the form of direct project acquisitions,

joint ventures, farm-ins, acquisition of tenements/permits, or

direct equity participation.

The Company's success in its acquisition activities depends on

its ability to identify suitable projects, acquire them on

acceptable terms, and integrate the projects successfully, which

the Company's Board is experienced in doing. However, there can be

no guarantee that any proposed acquisition will be completed or be

successful and the Directors are not able to assess the likelihood

or timing of a successful acquisition. If a proposed acquisition is

completed the usual risks associated with a new project and/or

business activities will remain. Further, any new acquisition may

require the establishment of a new business. The Company's ability

to generate revenue from a new business will depend on the Company

being successful in exploring, identifying mineral resources and

establishing mining operations in relation to a new project. Whilst

the Directors have extensive industry experience, there is no

guarantee that the Company will be successful in exploring and

developing a new project;

-- The Company's activities are subject to Government

regulations and approvals - The Company's exploration and any

future mining activities are dependent upon the maintenance and

renewal from time to time of the appropriate title interests,

licences, concessions, leases, claims, permits, environmental

decisions, planning consents and other regulatory consents which

may be withdrawn or made subject to new limitations. The

maintaining or obtaining of renewals or attainment and grant of

title interests often depends on the Company being successful in

obtaining and maintaining required statutory approvals for its

proposed activities. The mining licence for the Salamanca Project

was granted in April 2014 and is valid until April 2044 (and

renewable for two further periods of 30 years each).

The Company closely monitors the status of its mining and

exploration permits and licences and works closely with the

relevant government departments in Spain to ensure the various

licences are maintained and renewed when required. However, there

is no assurance that such title interests, licenses, concessions,

leases, claims, permits, decisions or consents will not be revoked,

significantly altered or not renewed to the detriment of the

Company or that the renewals and new applications will be

successful.

If such title interests, licences, concessions, leases, claims,

permits, environmental decisions, planning consents and other

regulatory consents are not maintained or renewed then this could

have a material adverse effect on the Company's financial

performance and the price of its Ordinary Shares.

There can also be no assurances that the Company's interests in

its properties and licences are free from defects. The Company has

investigated its rights and believes that these rights are in good

standing. There is no assurance, however, that such rights and

title interests will not be revoked or significantly altered to the

detriment of the Company.

In April 2021, the parliament in Spain (the "Spanish

Parliament") approved an amendment to the draft climate change and

energy transition bill relating to the investigation and

exploitation of radioactive minerals (e.g. uranium). The Spanish

Parliament reviewed and approved the amendment to Article 10 under

which: (i) new applications for exploration, investigation and

direct exploitation concessions for radioactive materials, and

their extensions, would not be accepted following the entry into

force of this law; and (ii) existing concessions, and open

proceedings and applications related to these, would continue as

per normal based on the previous legislation. The new law was

published in the Official Spanish State Gazette and came into

effect in May 2021.

The Company currently holds legal, valid and consolidated rights

for the investigation and exploitation of its mining projects,

including the 30-year mining licence (renewable for two further

periods of 30 years) for the Salamanca Project, however any new

proceedings opened by the Company is now not allowed under the

aforementioned new law. This could create uncertainty and pose a

risk on future applications, renewals or proceedings the Company

may have to make in the future at the Salamanca Project or

elsewhere, which if unfavourable could have a detrimental effect on

the viability of the Salamanca Project or the Company's pursuit of

other development opportunities.

Therefore, there can be no assurances that the Company's rights

and title interests will not be challenged or impugned by third

parties or governments in the future. To the extent that any such

rights or title interests are revoked or significantly altered to

the detriment of the Company, then this could have a material

adverse effect on the Group's financial performance and the price

of its Ordinary Shares;

-- Additional requirements for capital - the ability to finance

a mining project is dependent on the Company's existing financial

position, the availability and cost of project funding and other

debt markets, the availability and cost of leasing and similar

finance packages for project infrastructure and mobile equipment,

the availability of mezzanine and offtake financing and the ability

to access equity markets to raise new capital. There can be no

guarantees that when the Company seeks to implement further

financing strategies to pursue the development of its projects that

suitable financing alternatives will be available and at a cost

acceptable to the Company;

-- The Company may be adversely affected by fluctuations in

commodity prices - The price of uranium has fluctuated widely since

the Fukushima nuclear power plant disaster in March 2011 and is

affected by further numerous factors beyond the control of the

Company. Future production, if any, from the Salamanca Project will

be dependent upon the price of uranium being adequate to make these

properties economic. The Company currently does not engage in any

hedging or derivative transactions to manage commodity price risk,

but as the Company's Salamanca Project advances, this policy will

be reviewed periodically;

-- The Group's projects are not yet in production - As a result

of the substantial expenditures involved in mine development

projects, mine developments are prone to material cost overruns

versus budget. The capital expenditures and time required to

develop new mines are considerable and changes in cost or

construction schedules can significantly increase both the time and

capital required to build the mine; and

-- Global financial conditions may adversely affect the

Company's growth and profitability - Many industries, including the

mineral resource industry, are impacted by these market conditions.

Some of the key impacts of the current financial market turmoil

include contraction in credit markets resulting in a widening of

credit risk, devaluations and high volatility in global equity,

commodity, foreign exchange and energy markets, and a lack of

market liquidity. A slowdown in the financial markets or other

economic conditions may adversely affect the Company's growth and

ability to finance its activities.

SIGNIFICANT EVENTS AFTER THE REPORTING PERIOD

(i) On 7 February 2023, the Company received formal notification

from MITECO that it had rejected the Company's administrative

appeal against MITECO's rejection of NSC II for the Salamanca

Project.

Other than as disclosed above, there were no significant events

occurring after balance date requiring disclosure.

ROUNDING

The amounts contained in the half year financial report have

been rounded to the nearest $1,000 (where rounding is applicable)

where noted ($000) under the option available to the Company under

ASIC Corporations (Rounding in Financial/Directors' Reports)

Instrument 2016/191. The Company is an entity to which this

legislative instrument applies.

AUDITOR'S INDEPENCE DECLARATION

Section 307C of the Corporations Act 2001 requires our auditors,

Ernst & Young, to provide the Directors of Berkeley Energia

Limited with an Independence Declaration in relation to the review

of the half year financial report. This Independence Declaration is

on page 23 and forms part of this Directors' Report.

Signed in accordance with a resolution of Directors .

Robert Behets

Acting Managing Director

13 March 2023

DIRECTORS' DECLARATION

In accordance with a resolution of the Directors of Berkeley

Energia Limited, I state that:

In the opinion of the Directors:

(a) the financial statements and notes are in accordance with

the Corporations Act 2001, including:

(i) complying with Accounting Standard AASB 134 Interim

Financial Reporting and the Corporations Regulations 2001; and

(ii) giving a true and fair view of the Consolidated Entity's

financial position as at 31 December 2022 and of its performance

for the half year ended on that date.

(b) the Directors Report, which includes the Operating and

Financial Review, provides a fair review of:

(i) important events during the first six months of the current

financial year and their impact on the half year financial

statements, and a description of the principal risks and

uncertainties for the remaining six months of the year; and

(ii) related party transactions that have taken place in the

first six months of the current financial year and that have

materially affected the financial position or performance of the

Group during that period, and any changes in the related party

transactions described in the last annual report that could have

such a material effect; and

(c) there are reasonable grounds to believe that the Company

will be able to pay its debts as and when they become due and

payable.

On behalf of the Board

Robert Behets

Acting Managing Director

13 March 2023

Competent Persons Statement

The information in this report that relates to the Mineral

Resource Estimate is extracted from the announcement entitled

'Annual Report 2022' dated 31 August 2022, which is available to

view on Berkeley's website at www.berkeleyenergia.com. Berkeley

confirms that: a) it is not aware of any new information or data

that materially affects the information included in the original

announcement; b) all material assumptions and technical parameters

underpinning the Mineral Resource Estimate in the original

announcement continue to apply and have not materially changed; and

c) the form and context in which the relevant Competent Persons'

findings are presented in this announcement have not been

materially modified from the original announcement.

The information in this report that relates to Exploration

Results is extracted from the announcement entitled 'Quarterly

Report June 2022' dated 29 July 2022, which is available to view on

Berkeley's website at www.berkeleyenergia.com. Berkeley confirms

that: a) it is not aware of any new information or data that

materially affects the information included in the original

announcement; b) all material assumptions and technical parameters

underpinning the Exploration Results in the original announcement

continue to apply and have not materially changed; and c) the form

and context in which the relevant Competent Persons' findings are

presented in this announcement have not been materially modified

from the original announcement.

Forward Looking Statement

Statements regarding plans with respect to Berkeley's mineral

properties are forward-looking statements. There can be no

assurance that Berkeley's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that Berkeley will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

Berkeley's mineral properties.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE HALF YEARED 31 DECEMBER 2022

Half Year Half Year

Ended Ended

31 December 31 December

2022 2021 Restated

(Note 4)

Note $000 $000

--------------------------------------------- ------- -------------- ----------------

Interest income 268 15

Exploration and evaluation costs (1,494) (2,177)

Corporate and administration costs (582) (707)

Prospectus preparation costs (393) -

Business development expenses (127) (37)

Share based payments (expense)/reversal 10 (a) (374) 110

Fair value movements on financial

liabilities 6 633 64,078

Foreign exchange movements 1,220 2,522

Profit/(loss) before income tax (849) 63,804

Income tax expense - -

--------------------------------------------- ------- -------------- ----------------

Profit/(loss) after income tax (849) 63,804

--------------------------------------------- ------- -------------- ----------------

Other comprehensive income, net

of income tax:

Items that may be reclassified subsequently

to profit or loss:

Exchange differences arising on translation

of foreign operations 387 11

Other comprehensive income, net

of income tax 387 11

--------------------------------------------- ------- -------------- ----------------

Total comprehensive income/(loss)

for the half year attributable to

Members of Berkeley Energia Limited (462) 63,815

============================================= ======= ============== ================

Basic and diluted earning/(loss)

per share (cents per share) (0.19) 14.31

The above Consolidated Statement of Profit or Loss and Other

Comprehensive Income should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Note 31 December 2022 30 June 2022

$000 $000

------------------------------- ------ ------------------ --------------

ASSETS

Current Assets

Cash and cash equivalents 78,860 79,943

Other receivables 747 977

--------------

Total Current Assets 79,607 80,920

------------------------------- ------ ------------------ --------------

Non-current Assets

Property, plant and equipment 7 9,202 8,872

Other financial assets 91 97

------------------------------- ------ ------------------ --------------

Total Non-Current Assets 9,293 8,969

------------------------------- ------ ------------------ --------------

TOTAL ASSETS 88,900 89,889

------------------------------- ------ ------------------ --------------

LIABILITIES

Current Liabilities

Trade and other payables 774 1,005

Financial liabilities 8 33 669

Other liabilities 548 582

Total Current Liabilities 1,355 2,256

------------------------------- ------ ------------------ --------------

TOTAL LIABILITIES 1,355 2,256

------------------------------- ------ ------------------ --------------

NET ASSETS 87,545 87,633

=============================== ====== ================== ==============

EQUITY

Issued capital 9 206,404 206,404

Reserves 10 (1,563) (2,187)

Accumulated losses (117,296) (116,584)

------------------------------- ------ ------------------

TOTAL EQUITY 87,545 87,633

=============================== ====== ================== ==============

The above Consolidated Statement of Financial Position should be

read in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF YEARED 31 DECEMBER 2022

Foreign

Share Currency

Issued Based Payments Translation Accumulated

Capital Reserve Reserve Losses Total

$000 $000 $000 $000 $000

As at 1 July 2022 206,404 341 (2,528) (116,584) 87,633

Total comprehensive

income for the period:

Net loss for the period - - - (849) (849)

Other comprehensive

income/(loss):

Exchange differences

arising on translation

of foreign operations - - 387 - 387

------------------------------- --------- ---------------- ------------- ------------ ---------

Total comprehensive

income/(loss) - - 387 (849) (462)

------------------------------- --------- ---------------- ------------- ------------ ---------

Expiry of Incentive Options - (137) - 137 -

Recognition of share-based

payment expense - 374 - - 374

As at 31 December 2022 206,404 578 (2,141) (117,296) 87,545

=============================== ========= ================ ============= ============ =========

Restated as at 1 July

2021 169,862 442 (2,014) (181,622) (13,332)

Total comprehensive

income for the period:

Restated net profit for

the period - - - 63,804 63,804

Other comprehensive

income

Exchange differences

arising on translation

of foreign operations - - 11 - 11

------------------------------- --------- ---------------- ------------- ------------ ---------

Restated total comprehensive

income - - 11 63,804 63,815

------------------------------- --------- ---------------- ------------- ------------ ---------

Issue of ordinary shares

restated 36,635 - - - 36,635

Share issue costs (93) - - - (93)

Lapse of unvested Performance

Rights - (148) - - (148)

Share-based payment expense - 38 - - 38

------------------------------- --------- ---------------- ------------- ------------ ---------

As at 31 December 2021

(restated) 206,404 332 (2,003) (117,818) 86,915

=============================== ========= ================ ============= ============ =========

The above Consolidated Statement of Changes in Equity should be

read in conjunction with the accompanying notes.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 31 DECEMBER 2022

Half Year

Half Year Ended Ended

31 December 31 December

2022 2021

$000 $000

------------------------------------------- ---------------- -------------

Cash flows from operating activities

Payments to suppliers and employees (2,666) (2,937)

Interest received 268 15

Net cash outflow from operating activities (2,398) (2,922)

------------------------------------------- ---------------- -------------

Cash flows from financing activities

Transaction costs from issue of securities - (93)

Net cash outflow from financing activities - (93)

------------------------------------------- ---------------- -------------

Net decrease in cash and cash equivalents

held (2,398) (3,015)

Cash and cash equivalents at the beginning

of the period 79,943 79,066

Effects of exchange rate changes on cash

and cash equivalents 1,315 2,572

------------------------------------------- ---------------- -------------

Cash and cash equivalents at the end of

the period 78,860 78,623

=========================================== ================ =============

The above Consolidated Statement of Cash Flows should be read in

conjunction with the accompanying notes.

CONDENSED NOTES TO THE FINANCIAL STATEMENTS

FOR THE HALF YEARED 31 DECEMBER 2022

1. REPORTING ENTITY

Berkeley Energia Limited is a company domiciled in Australia.

The interim financial report of the Company is as at and for the

six months ended 31 December 2022.

The annual financial report of the Company as at and for the

year ended 30 June 2022 is available upon request from the

Company's registered office or is available to download from the

Company's website at www.berkeleyenergia.com .

2. STATEMENT OF COMPLIANCE

The interim financial report is a general purpose financial

report which has been prepared in accordance with Accounting

Standard AASB 134: Interim Financial Reporting and the Corporations

Act 2001.

This interim financial report does not include all the

information of the type normally included in an annual financial

report. Accordingly, this report is to be read in conjunction with

the annual report of Berkeley Energia Limited for the year ended 30

June 2022 and any public announcements made by Berkeley Energia

Limited during the interim reporting period in accordance with the

continuous disclosure requirements of the Corporations Act

2001.

(a) Basis of Preparation of Half Year Financial Report

The amounts contained in the half year financial report have

been rounded to the nearest $1,000 (where rounding is applicable)

under the option available to the Company under ASIC Corporations

(Rounding in Financial/Directors' Reports) Instrument 2016/191.

The financial statements have been prepared on the going concern

basis, which contemplates the continuity of normal business

activity and the realisation of assets and the settlement of

liabilities in the normal course of business.

(b) Historical cost convention

These financial statements have been prepared under the

historical cost convention, as modified where applicable by the

revaluation of certain financial assets and liabilities at fair

value through profit or loss.

3. SIGNIFICANT ACCOUNTING POLICIES

Accounting policies applied by the Consolidated Entity in this

consolidated interim financial report are the same as those applied

by the Consolidated Entity in its consolidated financial report for

the year ended 30 June 2022.

In the current period, the Group has adopted all of the new and

revised Accounting Standards and Interpretations issued by the

Australian Accounting Standards Board (the AASB) that are relevant

to its operations and effective for annual reporting periods

beginning on or after 1 July 2022.

New and revised Standards and amendments thereof and

Interpretations effective for the current half year that are

relevant to the Group include:

-- AASB 2020-3 Amendment to AASB 9 - Test for Derecognition of Financial Liabilities

-- Conceptual Framework and Financial Reporting

The adoption of the aforementioned standards has resulted in no

impact on interim financial statements of the Group as at 31

December 2022.

(a) Issued standards and interpretations not early adopted

Australian Accounting Standards and Interpretations that have

recently been issued or amended but are not yet effective have not

been adopted by the Group for the reporting period ended 31

December 2022. Those which may be relevant to the Group are set out

in the table below, but these are not expected to have any

significant impact on the Group's financial statements:

Standard/Interpretation Application Application

Date of Date for

Standard Company

AASB 2020-6 Amendments to Australian Accounting 1 January 1 July 2023

Standards - Classification of Liabilities as 2023

Current or Non-Current - Deferral of Effective

Date

------------ ------------

AASB 2021-2 Amendments to Australian Accounting 1 January 1 July 2023

Standards - Disclosure of Accounting Policies 2023

and Definition of Accounting Estimates

------------ ------------

AASB 2020-1 Amendments to Australian Accounting 1 January 1 July 2024

Standards - Classification of Liabilities as 2024

Current or Non-Current

------------ ------------

AASB 2021-7(a-c) Amendments to Australian 1 January 1 July 2025

Accounting Standards - Effective Date of Amendments 2025

to AASB 10 and AASB 128 and Editorial Corrections

------------ ------------

4. ADJUSTMENTS TO THE COMPARATIVE PERIOD

The Group reassessed the valuation of the Convertible Note in

2021. Details of the change in fair value measurement of the

Convertible Note liability are included in the 2022 Annual Report.

The 31 December 2021 comparatives have been restated in these

financial statements.

Impact on consolidated statement of profit or loss and other

comprehensive income

----------------------------------------------------------------------------------------------

31 December

2021 31 December

as previously 31 December 2021

disclosed 2021 adjustments Restated

$000 $000 $000

------------------------------------------- --------------- ------------------ ------------

Fair value movement on financial

liabilities 4,171 59,907 64,078

Foreign exchange movements 1,640 882 2,522

Profit/(loss) before income tax 3,015 60,789 63,804

Profit/(loss) after income tax 3,015 60,789 63,804

Other comprehensive income, net of

income tax 11 - 11

------------------------------------------- --------------- ------------------ ------------

Total comprehensive income for the

year attributable to Members of Berkeley

Energia Limited 3,026 60,789 63,815

=========================================== =============== ================== ============

5. SEGMENT INFORMATION

AASB 8 requires operating segments to be identified on the basis

of internal reports about components of the Consolidated Entity

that are regularly reviewed by the chief operating decision maker

in order to allocate resources to the segment and to assess its

performance.

The Consolidated Entity operates in one operating segment, being

exploration for mineral resources within Spain. This is the basis

on which internal reports are provided to the Directors for

assessing performance and determining the allocation of resources

within the Consolidated Entity. All material non-current assets

excluding financial instruments are located in Spain.

6. FAIR VALUE MOVEMENTS

Consolidated

31 December

Consolidated 2021

31 December Restated

2022

$000 $000

---------------------------------------------- -------------- --------------

Fair value movement on financial liabilities

through profit and loss 633 64,078

---------------------------------------------- -------------- --------------

Please refer to note 8 for further disclosure.

7. NON-CURRENT ASSETS - PROPERTY, PLANT AND EQUIPMENT

Land

$000

Carrying amount at 1 July 2022 8,872

Foreign exchange differences 330

Carrying amount at 31 December 2022 9,202

========================================================= =====

- at cost 9,202

- accumulated depreciation, amortisation and impairment -

8. FINANCIAL LIABILITIES

Consolidated Consolidated

31 December 30 June 2022

2022

$000 $000

------------------------------------ -------------- ---------------

(a) Financial liabilities at fair

value through profit and loss:

SGRF Options 33 669

------------------------------------ -------------- ---------------

33 669

==================================== ============== ===============

Consolidated Consolidated

30 June 31 December

2022 2022

---------------------- ---------------- ----------- ---------- -------------

Foreign

Fair Value Exchange

Opening Balance Change Loss Total

$000 $000 $000 $000

---------------------- ---------------- ----------- ---------- -------------

(b) Reconciliation:

SGRF Options 669 (633) (3) 33

---------------------- ---------------- ----------- ---------- -------------

Total fair value 669 (633) (3) 33

====================== ================ =========== ========== =============

(c) Fair Value Estimation

The fair value of the SGRF Options was determined using a

binomial option pricing model. The fair value movement of the SGRF

Options has been recognised in the Statement of Profit and Loss.

Fair value measurements are a Level 2 valuation in the fair value

hierarchy.

The reporting date fair values of the SGRF Options were

estimated using the following assumptions:

31 December 2022 Tranche 2 Tranche 3

---------------------------- ------------ ------------

Exercise price GBP0.750 GBP1.000

Valuation date share price GBP0.153 GBP0.153

Dividend yield(1) - -

Volatility(2) 80% 80%

Risk-free interest rate 3.45% 3.45%

Number of SGRF Options 15,132,973 25,221,562

Issue date 30 Nov 2017 30 Nov 2017

Estimated Expiry date 31 May 2023 30 Nov 2023

Fair value (GBP) GBP0.0001 GBP0.0007

Fair value ($) $0.0001 $0.0012

---------------------------- ------------ ------------

(1) The dividend yield reflects the assumption that the current

dividend payout will remain unchanged.

(2) The expected volatility reflects the assumption that the

historical volatility is indicative of future trends, which may not

necessarily be the actual outcome.

9. CONTRIBUTED EQUITY

(a) Issued and Paid Up Capital

Consolidated Consolidated

31 December 30 June 2022

2022

$000 $000

----------------------------------------- -------------- ---------------

445,797,000 (30 June 2022: 445,797,000)

fully paid ordinary shares 206,404 206,404

----------------------------------------- -------------- ---------------

(b) Movements in Ordinary Share Capital during the Six Month Period ended 31 December 2022:

There were no movements in fully paid ordinary shares during the

past six months.

10. RESERVES

Consolidated Consolidated

31 December 30 June 2022

2022

$000 $000

-------------------------------------- -------------- ---------------

Share based payments reserve (Note

10 (a)) 578 341

Foreign currency translation reserve (2,141) (2,528)

(1,563) (2,187)

====================================== ============== ===============

(a) Movements in Options during the Six Month Period ended 31 December 2022:

Number of Options

Date Details '000 $000

------------------ -------------------------------------- ------------------ ------

1 Jul 22 Opening Balance 6,600 341

23 Nov 22 Issue of Incentive Options 2,000 -

31 Dec 22 Expiry of unvested Incentive Options (2,900) (137)

Jul 22 to Dec 22 Share based payment expense - 374

31 Dec 22 Closing Balance 5,700 578

================== ====================================== ================== ======

11. DIVIDENDS PAID OR PROVIDED FOR

No dividend has been paid or provided for during the half year

(2021: nil).

12. FAIR VALUE OF FINANCIAL INSTRUMENTS

The majority of the Group's financial instruments consist of

those which are measured at amortised cost including trade and

other receivables, security bonds, trade and other payables and

other financial liabilities. The carrying amount of these financial

assets and liabilities approximate their fair value. Please refer

to notes 6 and 8 for details on the fair value of non-cash settled

financial liabilities classified as fair value through profit and

loss.

13. CONTINGENT LIABILITIES

There have been no changes to contingent liabilities since the

date of the last annual report.

14. RELATED PARTY DISCLOSURE

Balances and transactions between the Company and its

subsidiaries, which are related parties to the Company, have been

eliminated on consolidation. There have been no other transactions

with related parties during the half-year ended 31 December 2022,

other than remuneration with Key Management Personnel.

15. SUBSEQUENT EVENTS AFTER BALANCE DATE

(i) On 7 February 2023, the Company received formal notification

from MITECO that it had rejected the Company's administrative

appeal against MITECO's rejection of NSC II for the Salamanca

Project.

Other than as disclosed above, there were no significant events

occurring after balance date requiring disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKQBBQBKKDND

(END) Dow Jones Newswires

March 14, 2023 03:00 ET (07:00 GMT)

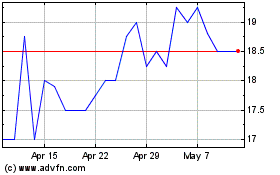

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Berkeley Energia (LSE:BKY)

Historical Stock Chart

From Apr 2023 to Apr 2024