TIDMBOIL

RNS Number : 2161R

Baron Oil PLC

28 February 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

28 February 2023

Baron Oil Plc

("Baron", or the "Company")

Competent Person's Report on the Chuditch PSC

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

and appraisal company, is pleased to announce that a copy of a

Competent Person's Report ("CPR") prepared by ERC Equipoise Pte Ltd

("ERCE") on the offshore Timor-Leste PSC TL-SO-19-16 ("Chuditch

PSC"), can be viewed

here:http://www.rns-pdf.londonstockexchange.com/rns/2161R_1-2023-2-27.pdf

and will be published in due course on the Company's website at:

www.baronoilplc.com . Baron has a 75% operated effective interest

in the Chuditch PSC, which is operated by its wholly owned

subsidiary SundaGas Banda Unipessoal Lda ("SundaGas") and contains

the Chuditch-1 gas discovery and offset analogous prospects.

The CPR has been prepared in accordance with the June 2018

Petroleum Resources Management System ("SPE PRMS") as the standard

for reporting. A summary of the gross and net Prospective and

Contingent Resources, prepared on a probabilistic basis, is given

in the tables below.

Key Points from the CPR

-- Contingent Resources assigned to Chuditch-1 discovery*

-- ERCE estimates that Chuditch-1 discovery contains 1,084 Bscf

gross Pmean Contingent gas Resources attributable to the

licence

-- Aggregated** gross Pmean Prospective gas Resources attributable to the licence of 1,562 Bscf:

o Chuditch SW prospect estimated to contain 675 Bscf gross Pmean

Prospective gas Resources when aggregated** across two segments,

Alpha and Beta, with respective Geological Chances of Success

("GCOS") of 52% and 45%;

o Chuditch NE prospect estimated to contain 744 Bscf gross Pmean

Prospective gas Resources with a GCOS of 30%; and

o Quokka prospect estimated to contain 143 Bscf gross Pmean

Prospective gas Resources with a GCOS of 26%.

-- Oil equivalent** Pmean Resources net to the Baron working

interest, including the condensate yield, calculated by the Company

to be:

o 140 MMboe Contingent for Chuditch-1; and

o 202 MMboe Prospective, when aggregated**

*A chance of development has not been estimated for the

Chudich-1 discovery.

**The CPR reports gas and condensate Contingent and Prospective

Resources separately per discovery and prospects. Aggregation and

oil equivalent calculations performed by Company. See Glossary

below for basis of calculation.

Management Commentary

The assignment of Contingent Resources to the Chuditch-1

discovery, built on the extensive technical studies completed by

the Company, sets the foundation for the next stage of the project

cycle. This phase would typically include an appraisal well,

pre-feasibility studies, Environmental Impact Assessment planning,

and preliminary work on gas sales arrangements. Management believes

that the Chuditch-1 Pmean Contingent Resources, now independently

assessed, are likely to be sufficiently large to be economically

viable to be developed standalone or in parallel with other

developments in the region.

Management's probabilistic estimates of gross gas Prospective

Resources for the Chuditch SW, NE, and Quokka prospects, as set out

below, differ from ERCE's estimates, mainly through the Company's

preferred use of the latest reprocessed seismic data velocity model

to define the extent of the prospects. Further technical discussion

regarding these differences can be found in Appendix 1 of the

CPR.

Management notes that in its previous announcements the Company

referred to both Chuditch NE and Quokka informally as "Leads", due

to parts falling outside of 3D seismic coverage, whereas ERCE

describe them as "Prospects", terminology which the Company has now

adopted. This increase in maturity towards being drillable features

is accompanied by a more conservative view on the probabilistic

Prospective Resources estimation being taken by ERCE. Further, in

the Company's announcement of 24 October 2022, the basis for in

house estimation was as "Deterministic Best Case", whereas

estimates presented in this announcement are "Probabilistic" which

introduces ranges of uncertainty on all contributing subsurface and

recovery factors, including the degree to which 3D seismic coverage

is not currently available on Chuditch NE and Quokka. Deterministic

Best Case and Probabilistic estimates are not therefore directly

comparable.

-- Baron's own Pmean estimates of gross unrisked Prospective

Resources aggregate to 2,128 Bscf***:

o Chuditch SW 855 Bscf***, with a low to high estimate range

from 420 to 1,284 Bscf*** and a GCOS of 40%;

-- Baron considers that SW represents a relatively low risk

follow on to a Chuditch-1 appraisal well;

o Chuditch NE 863 Bscf***, with a low to high estimate range

from 311 to 1,401 Bscf*** and a GCOS of 34%; and;

o Quokka 410 Bscf***, with a low to high estimate range from 110

to 733 Bscf*** and a GCOS of 26%.

Aggregate oil equivalent Pmean Prospective Resources net to the

Baron working interest, including the condensate yield, are

estimated by the Company to be 366 MMboe**, representing a

significant follow-on portfolio to be explored. Management

estimates of the Geological Chance of Success for the prospects are

in reasonable agreement with ERCE's estimates, indicating the

relatively low risk nature of the Prospective Resources

assessment.

*** Not SPE PRMS compliant. However, management believes that

its in-house estimates of Prospective Resources, although not

independently verified to SPE PRMS, are based on best industry

practice by employing the latest reprocessed seismic data velocity

model.

TIMOR GAP announcement on development of the Greater Sunrise

fields

Management notes that offshore Timor-Leste the Sunrise Joint

Venture (TIMOR GAP 56.56%; Operator, Woodside Energy 33.44%; Osaka

Gas Australia 10.0%) announced on 6 February 2023 that it will

undertake a concept select program for the development of the

Greater Sunrise fields, including the location of gas delivery,

processing and onward LNG sales, which management believes has

potential positive impacts on the export options for the

development of the Chuditch-1 gas discovery (See Section 3.5 of the

CPR - Development Plans - for more detail).

TIMOR GAP's press release can be found here:

https://www.timorgap.com/newsroom/press-releases/sunrise-joint-venture-to-undertake-concept-select-with-a-strong-focus-on-delivery-of-gas-to-timor-leste/

.

Jon Ford, Technical Director of Baron, commented:

"The independent assessment of approximately 1.1Tscf of gross

Pmean Contingent Resources for the Chuditch-1 discovery is a major

milestone, underpinning the potential commercial viability of the

asset and highlighting its attractions to potential future

participants in the Chuditch project.

"Following the recent fund-raise we have a well-funded balance

sheet for current operations, with current work commitments on both

the Timor-Leste and UK P2478 assets largely complete. Our focus now

is on assessing the viability of drilling for both a Chuditch

appraisal well in Timor-Leste and a Dunrobin West exploration well

in the UK."

Contingent and Prospective Resources

The tables below summarise ERCE's independent assessment of

Gross Contingent and Prospective Resources as at the CPR's

effective date of 31 January 2023, from which are derived the Net

Contingent and Prospective Resources attributable to Baron's 75%

net working interest, wholly within the Chuditch PSC licence area.

Totals are by arithmetic summation by the Company.

Contingent Resources

ERCE attributes the Contingent Resources associated with the

Chuditch-1 discovery to the sub-class Development Unclarified. The

Chuditch discovery Development Unclarified Contingent Resources are

contingent on the drilling and testing of an appraisal well, the

Operator finalising a commercially viable development plan and the

Operator being able to fund and execute this development plan,

including obtaining partner and regulatory consents to the

appropriate facilities.

Contingent Gross Attributable to Net Attributable to Risk Operator

Resources Licence Baron Oil Factor

(CoS)

------------ ------------------------------------------- ------------------------------------------- ------- ---------

Low Best High Mean Low Best High Mean

Estimate Estimate Estimate Estimate Estimate Estimate Estimate Estimate

------------ ------- ---------

(1C) (2C) (3C) (1C) (2C) (3C)

------------ --------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Gas (Bscf)

--------------------------------------------------------------------------------------------------------------------------

Chuditch-1

Discovery 461 929 1845 1084 346 697 1383 813 n/a SundaGas

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Condensate (MMstb)

--------------------------------------------------------------------------------------------------------------------------

Chuditch-1

Discovery 1.4 4.1 11.9 5.9 1.1 3.1 9.0 4.4 n/a "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Oil equivalent (MMboe) **

--------------------------------------------------------------------------------------------------------------------------

Chuditch-1

Discovery 78 159 319 187 59 119 240 140 n/a "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Notes:

1. Gross Contingent Resources attributable to Licence are

limited to within PSC TL-SO-19-16 and are based on percentage

on-block of the total Gross Contingent Resources.

2. Net attributable resources are based on a SundaGas working

interest of 75% of the Gross Contingent Resources attributable to

Licence following development and first gas prior to deduction of

any royalties. SundaGas are carrying the costs of the remaining 25%

interest during this phase.

3. Company net entitlement Contingent Resources require a full

economic evaluation which has not been done as part of this CPR and

hence are not presented.

4. There is no geological risk factor (CoS) for Contingent

Resources because the resource has been discovered. The Contingent

Resources have not been risked for chance of development and are

sub-classified as development unclarified.

5. There is no certainty that it will be commercially viable to

develop any portion of the Contingent Resources.

6. Contingent Resources for gas include the removal of inert

gasses.

Prospective Resources

Prospective Gross Attributable to Net Attributable to Risk Operator

Resources Licence Baron Oil Factor

(CoS)

-------------- ------------------------------------------- ------------------------------------------- ------- ---------

Low Best High Mean Low Best High Mean

Estimate Estimate Estimate Estimate Estimate Estimate Estimate Estimate

-------------- ------- ---------

(1U) (2U) (3U) (1U) (2U) (3U)

-------------- --------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Gas Prospective Resources - Gas (Bscf)

----------------------------------------------------------------------------------------------------------------------------

Chuditch

SW Alpha 139 326 729 394 105 244 547 296 52% SundaGas

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

SW Beta 107 238 505 281 80 179 379 211 45% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

NE 163 516 1556 744 122 387 1167 558 30% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Quokka 27 94 314 143 20 70 236 108 26% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Aggregate**

Gas (Bscf) 436 1174 3104 1562 327 881 2328 1172

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Condensate Prospective Resources (MMstb)

----------------------------------------------------------------------------------------------------------------------------

Chuditch

SW Alpha 0.4 1.4 4.6 2.1 0.3 1.1 3.4 1.6 52% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

SW Beta 0.3 1.1 3.2 1.5 0.3 0.8 2.4 1.1 45% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

NE 0.6 2.3 9.2 4.0 0.4 1.7 6.9 3.0 30% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Quokka 0.1 0.4 1.8 0.8 0.1 0.3 1.4 0.6 26% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Aggregate**

Condensate

(MMstb) 1.4 5.2 18.8 8.4 1.1 3.9 14.1 6.3

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Oil equivalent Prospective Resources (MMboe)

----------------------------------------------------------------------------------------------------------------------------

Chuditch

SW Alpha 24 56 126 68 18 42 95 51 52% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

SW Beta 18 41 87 48 14 31 66 36 45% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

NE 28 88 269 128 21 66 201 96 30% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Quokka 5 16 54 25 3 12 41 18 26% "

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Aggregate**

Oil

equivalent**

(MMboe) 74 201 536 269 56 151 402 202

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Notes:

1. Gross Prospective Resources attributable to Licence are

limited to within PSC TL-SO-19-16 and are based on percentage

on-block of the total Gross Prospective Resources.

2. Net attributable resources are based on a SundaGas working

interest of 75% of the Gross Prospective Resources attributable to

Licence following development and first gas prior to deduction of

any royalties. SundaGas are carrying the costs of the remaining 25%

interest during this phase.

3. Company net entitlement to Prospective Resources requires a

full economic evaluation which has not been done as part of this

CPR and hence are not presented.

4. The geological chance of success (COS) is an estimate of the

probability that drilling the prospect would result in a discovery

as defined under SPE PRMS 2018 guidelines.

5. In the case of Prospective Resources, there is no certainty

that hydrocarbons will be discovered, nor if discovered will be

commercially viable to produce any portion of the resources.

6. These are unrisked Prospective Resources that have not been

risked for chance of development.

7. Prospective Resources for gas include the removal of inert

gasses.

** Aggregation of P90, P50, and P10 values is not statistically

correct but has been shown for illustrative purposes. Aggregation

of Mean values is statistically correct. Aggregates have been

calculated by Baron and may not sum exactly due to rounding

factors. Mean is defined as the arithmetic average of all outcomes

in a probabilistic assessment of Contingent or Prospective

Resources. Oil equivalence (MMboe) calculation has been provided by

Baron for reference for the purposes of this announcement. See

Glossary below for basis of calculation.

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies ("AIM MOG"), the technical information

and resource reporting contained in this announcement has been

reviewed by Jon Ford BSc, Fellow of the Geological Society,

Technical Director of the Company. Mr Ford has more than 40 years'

experience as a petroleum geoscientist. He has compiled, read and

approved the technical disclosure in this regulatory announcement

and indicated where it does not comply with the Society of

Petroleum Engineers' SPE PRMS standard.

Basis of preparation

The Prospective and Contingent Resources estimates within this

announcement have been prepared on a probabilistic basis and unless

indicated otherwise comply with the standards set forth in the SPE

PRMS. The probabilistic Prospective and Contingent Resources

estimates within this announcement are not directly comparable to

management's provisional in-house estimates of Gas-in-Place or

Recoverable Gas Resources, as announced by the Company on 24

October 2022, which were prepared on a deterministic basis and not

to the standards set forth in the SPE PRMS or in accordance with an

appropriate Standard as set out in the AIM MOG Note.

For further information, please contact:

Baron Oil Plc +44 (0) 20 7117 2849

Andy Yeo, Chief Executive

Allenby Capital Limited +44 (0) 20 3328 5656

Nominated Adviser and Broker

Alex Brearley, Nick Harriss, George Payne (Corporate

Finance)

Kelly Gardiner (Sales and Corporate Broking)

IFC Advisory Limited +44 (0) 20 3934 6630

Financial PR and IR baronoil@investor-focus.co.uk

Tim Metcalfe, Florence Chandler

Glossary

Bscf Billion standard cubic feet of gas.

Best Estimate ( 2U) Denotes the mid estimate qualifying as Prospective Resources.

Reflects a volume estimate that

there is a 50% probability that the quantities actually recovered

will equal or exceed the

estimate.

Best Estimate ( 2C) Denotes the mid estimate qualifying as Contingent Resources.

Reflects a volume estimate that

there is a 50% probability that the quantities actually recovered

will equal or exceed the

estimate.

Contingent Resources Those quantities of petroleum estimated, as of a given date, to be

potentially recoverable

from known accumulations by application of development projects,

but which are not currently

considered to be commercially recoverable owing to one or more

contingencies.

Gas-in-Place Volume of natural gas estimated to exist originally in naturally

occurring reservoirs.

Geological Chance of Success , CoS or Risk factor The geological chance of success (COS) is an estimate of the

probability that drilling the

prospect would result in a discovery as defined under SPE PRMS 2018

guidelines.

High Estimate (3U) Denotes the high estimate qualifying as Prospective Resources.

Reflects a volume estimate

that there is a 10% probability that the quantities actually

recovered will equal or exceed

the estimate.

High Estimate ( 3C) Denotes the high estimate qualifying as Contingent Resources.

Reflects a volume estimate that

there is a 10% probability that the quantities actually recovered

will equal or exceed the

estimate.

LNG Liquefied natural gas

Low Estimate (1U) Denotes the low estimate qualifying as Prospective Resources.

Reflects a volume estimate that

there is a 90% probability that the quantities actually recovered

will equal or exceed the

estimate.

Low Estimate (1C) Denotes the low estimate qualifying as Contingent Resources.

Reflects a volume estimate that

there is a 90% probability that the quantities actually recovered

will equal or exceed the

estimate.

Mean or Pmean Reflects a mid-case volume estimate of resource derived using

probabilistic methodology. This

is the mean of the probability distribution for the resource

estimates and may be skewed by

resource numbers with relatively low probabilities.

MMboe Million barrels of oil equivalent. Volume derived by dividing the

estimate of the volume of

natural gas in billion cubic feet by six in order to convert it to

an equivalent in million

barrels of oil and, where relevant, adding this to an estimate of

the volume of oil in millions

of barrels.

MMstb Millions stock tank barrel

Prospective Resources Quantities of petroleum that are estimated to exist originally in

naturally occurring reservoirs,

as of a given date. Crude oil in-place, natural gas in-place, and

natural bitumen in-place

are defined in the same manner.

Recoverable Gas Resource Quantities of gas which are estimated to be potentially recoverable

from discoveries, prospects

and leads

SPE PRMS The Society of Petroleum Engineers' ("SPE") Petroleum Resources

Management System ("PRMS"):

a system developed for consistent and reliable definition,

classification, and estimation

of hydrocarbon resources prepared by the Oil and Gas Reserves

Committee of SPE and approved

by the SPE Board in June 2018 following input from six sponsoring

societies: the World Petroleum

Council, the American Association of Petroleum Geologists, the

Society of Petroleum Evaluation

Engineers, the Society of Exploration Geophysicists, the European

Association of Geoscientists

and Engineers, and the Society of Petrophysicists and Well Log

Analysts.

Tscf Trillion standard cubic feet of gas.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUBWPUPWPUM

(END) Dow Jones Newswires

February 28, 2023 02:00 ET (07:00 GMT)

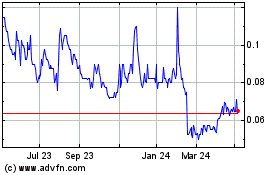

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

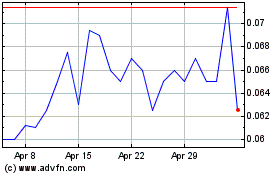

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Apr 2023 to Apr 2024