TIDMBOOM TIDMTTM

RNS Number : 6640I

Audioboom Group PLC

16 August 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATIONS (EU) NO. 596/2014 AS

RETAINED IN UK LAW ("MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN ANNOUNCEMENT OF A FIRM

INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE CITY CODE ON

TAKEOVERS AND MERGERS (THE "CODE") AND THERE CAN BE NO CERTAINTY

THAT ANY FIRM OFFER WILL BE MADE .

16 August 2021

Audioboom Group plc

("Audioboom", the "Group" or the "Company")

Possible offer update - extension to PUSU deadline

On 19 July 2021, All Active Asset Capital Limited ("AAA")

announced a possible offer for the entire issued and to be issued

share capital of Audioboom (the "Possible Offer"). This

announcement stated that, in accordance with Rule 2.6(a) of the

Code, AAA was required, by not later than 5.00 p.m. (London time)

on 16 August 2021 to do one of the following: (i) announce a firm

intention to make an offer for Audioboom in accordance with Rule

2.7 of the Code; or (ii) announce that it does not intend to make

an offer for Audioboom, in which case the announcement will be

treated as a statement to which Rule 2.8 of the Code applies.

On 22 July 2021, Audioboom published an initial response

rejecting the Possible Offer as a result of the concerns of the

Independent Directors of Audioboom* in relation to the valuation of

Audioboom implied by the Possible Offer, its structure, including

the majority of consideration being in the form of unlisted

ordinary shares of AAA, and the limited information on which to

assess the strategic rationale for such a combination.

On 12 August 2021, a meeting was held between Audioboom, AAA and

their respective advisers during which Audioboom was informed that

a number of substantial initiatives were being pursued by AAA,

which its board expects to be in a position to announce by 10

September 2021 at the latest. Based on the information provided to

it, the Independent Directors of Audioboom have concluded that AAA

is actively seeking to address their concerns and that it is

currently in the best interests of Audioboom shareholders to allow

discussions to continue.

The Board of Audioboom therefore requested and the Panel on

Takeovers and Mergers (the "Panel") consented to an extension to

the deadline by which AAA must either announce a firm intention to

make an offer for Audioboom in accordance with Rule 2.7 of the Code

or announce that it does not intend to make an offer. The revised

deadline, which will be further extended only with the consent of

the Takeover Panel in accordance with Rule 2.6(c) of the Code,

expires at 5.00 p.m. UK time on 13 September 2021.

There can be no certainty that any offer will be made or as to

its terms.

This announcement is being made with the consent of AAA.

Disclosure of shareholdings and dealings

The attention of shareholders is drawn to the disclosure

requirements of Rule 8 of the Code, which are summarised below.

A further announcement will be made as and when appropriate.

* The independent directors of Audioboom are deemed to comprise

Mike Tobin, Roger Maddock, Stuart Last and Brad Clarke. Steven

Smith is not considered independent for the purposes of the

Possible Offer due to his relationship with Candy Ventures SARL

which has signed an irrevocable undertaking in relation to the

Possible Offer.

For further information, please contact:

Audioboom Group plc

Stuart Last, Chief Executive Officer

Brad Clarke, Chief Financial Officer

Tel: +44(0)300 303 3765

Allenby Capital Limited (Nominated Adviser, Financial Adviser

and Broker to Audioboom)

David Hart / Alex Brearley (Corporate Finance)

Amrit Nahal (Sales and Corporate Broking)

Tel: +44(0)20 3328 5656

Additional information

Allenby Capital Limited ('Allenby'), which is authorised and

regulated by the Financial Conduct Authority in the United Kingdom,

is acting exclusively for Audioboom and no one else in connection

with the Possible Offer and will not be responsible to any person

other than Audioboom for providing the protections afforded to

clients of Allenby or for providing advice in relation to the

Possible Offer or any matter referred to herein.

This announcement is for information purposes only and is not an

invitation, inducement or the solicitation of an offer to purchase,

or otherwise acquire, subscribe for or sell or otherwise dispose of

or exercise rights in respect of any securities. Any offer will be

made solely through the offer document and any accompanying

forms.

Publication on website

A copy of this announcement will be made available (subject to

certain restrictions relating to persons resident in restricted

jurisdictions) at https://audioboomplc.com/regulatory-news/ no

later than 12.00 noon (London time) on the business day following

the release of this announcement in accordance with Rule 26.1 of

the Code. The content of the website referred to in this

announcement is not incorporated into and does not form part of

this announcement.

Disclosure requirements of the Takeover Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.2

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OFDEAKPDFLLFEFA

(END) Dow Jones Newswires

August 16, 2021 02:00 ET (06:00 GMT)

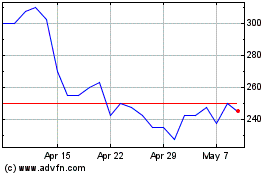

Audioboom (LSE:BOOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Audioboom (LSE:BOOM)

Historical Stock Chart

From Apr 2023 to Apr 2024