TIDMBT.A

RNS Number : 9964T

BT Group PLC

28 July 2022

Trading update for the three months to 30 June 2022

BT Group plc

28 July 2022

Philip Jansen, Chief Executive, commenting on the results, said

"BT Group has made a good start to the year; we're accelerating our network

investments and performing well operationally. Despite ongoing challenges

in our enterprise businesses, we returned to revenue and EBITDA growth

in the quarter.

"We continued to grow the number of BT and EE customers connected to

our next generation networks. We're building our full fibre broadband

network faster than ever and we're seeing record customer connections

- both ahead of our own expectations. Openreach's full fibre network

now reaches over 8 million homes and businesses across the UK and we

anticipate increasing our annual build from 2.6 million premises last

year to around 3.5 million this year. EE's 5G network covers more than

55% of the country's population. We're achieving continued high customer

satisfaction scores thanks to our much improved customer service and

the value for money that our products and services represent.

"The modernisation of BT Group remains on track. We are delivering and

notwithstanding the current economic uncertainty we remain confident

in our outlook for this financial year."

Key strategic developments:

-- Fibre build and connection continues at pace, beyond our

expectations, with record quarterly FTTP build of 763k and net adds

of 302k

-- Finalised our FTTP co-provisioning agreement with Sky

-- EE was voted best network by RootMetrics for the ninth year

running and came top in every category measured; our 5G ready base

is now at 7.7m

-- Price rises to support investment in the network and offset

cost inflation; we have continued to raise awareness of our Home

Essentials social tariff with prices frozen this year

-- Consumer churn and complaints remain low with high levels of service

-- BT Sport remains home of UEFA club competitions, including

the UEFA Champions League, until 2027

-- The CMA(1) approved the BT Group plc agreement with Warner

Bros. Discovery, Inc. to form a 50:50 sports broadcasting joint

venture

-- Contingency plans in place to minimise disruption and keep

customers connected during CWU(2) strike action

Revenue and EBITDA growth, no change to full year outlook:

-- Revenue GBP5.1bn, up 1% due to improved pricing and trading

in Consumer and Openreach, offset by the migration of a wholesale

MVNO customer which concluded in FY22 and by continued legacy

product declines and challenging market conditions impacting large

corporate customers in Enterprise and Global.

-- Adjusted(3) EBITDA GBP1.9bn, up 2% primarily due to flow

through from revenue and continued strong cost control

-- Reported profit before tax GBP0.5bn, down 10% due to

increased depreciation offsetting EBITDA growth

-- Reported capital expenditure down 17% to GBP1.3bn, due to

prior year investment in spectrum; capital expenditure excluding

spectrum payments up 24% to GBP1.3bn, primarily due to increased

investments on FTTP build and provision, and cost inflation

-- Normalised free cash flow(3) GBP(0.2)bn, down GBP162m

primarily reflecting increased cash capital expenditure

-- Net financial debt (which excludes lease liabilities) was

GBP13.2bn and net debt(3) was GBP18.9bn at 30 June 2022, both

GBP0.9bn higher than at 31 March 2022 driven by pensions

contributions and lower cash flows

-- No change to FY23 outlook: Revenue growth, at least GBP7.9bn

EBITDA, around GBP4.8bn capital expenditure and between

GBP1.3bn-GBP1.5bn normalised free cash flow

Three months to 30 June 2022 2021 Change

----------------------------- --------------------------------

Reported measures GBPm GBPm %

Revenue 5,130 5,071 1

Profit before tax 482 536 (10)

Profit after tax 422 2 n/m

Capital expenditure 1,251 1,507 (17)

------------------------------ ----------------------------- -------------------------------- -------

Adjusted measures

Adjusted(3) Revenue 5,133 5,070 1

Adjusted(3) EBITDA 1,903 1,866 2

Capital expenditure excluding

spectrum 1,251 1,011 24

Normalised free cash flow(3) (205) (43) (377)

Net debt(3,4) 18,891 18,566 GBP325m

------------------------------ ----------------------------- -------------------------------- -------

n/m = not meaningful

(1) Competition and Markets Authority

(2) Communications Workers Union

(3) See Glossary on page 3

(4) Net debt was GBP18,009m at 31 March 2022

Overview of the three months to 30 June 2022

Customer-facing unit updates

Adjusted(1) revenue Adjusted(1) EBITDA

-----------------------

First quarter to

30 June 2022 2021 Change 2022 2021 Change

GBPm GBPm % GBPm GBPm%

------------------ ------ ------ ------- ------ ------ -----

Consumer 2,502 2,382 5 625 523 20

Enterprise 1,200 1,287 (7) 315 429 (27)

Global 774 785 (1) 96 102 (6)

Openreach 1,417 1,347 5 851 773 10

Other 7 8 (13) 16 39 (59)

Intra-group items (767) (739) (4) - --

------------------ ------ ------ ------- ------ ------ -----

Total 5,133 5,070 1 1,903 1,8662

------------------ ------ ------ ------- ------ ------ -----

Consumer: Strong financial performance and FTTP growth; churn

remains near record lows

-- Revenue growth with improved fixed and mobile service

revenues, now returning close to levels in the quarter before the

start of the pandemic; this was helped by the annual contractual

price rise in April and

strong Sport revenues including the Fury-Whyte event

-- EBITDA increased with revenue growth, tight cost management

and lower indirect mobile commissions

-- Churn remains near record lows with continued low complaints

to Ofcom and high levels of service

-- Highest ever quarterly growth in FTTP base with increase of 118k, 5G ready base now at 7.7m

-- The CMA approved the BT Group plc agreement with Warner Bros.

Discovery, Inc. to form a 50:50 sports broadcasting joint

venture

Enterprise: Challenging market conditions continue in large

corporates offsetting growth in other segments

-- Revenue decrease primarily due to challenging market

conditions in large corporates, ongoing legacy product declines and

the migration of a wholesale MVNO customer which concluded in

FY22

-- EBITDA decrease as a result of reduction in revenue, with the

mix of revenue driving a further downside; Q1 FY22 also saw an

asset disposal along with strong performance in ESN

-- SoHo and SME segments saw revenue and EBITDA growth

-- Retail order intake was GBP2.6bn on a 12-month rolling basis,

down 8% with growth in new business offset by decline in contract

re-signs; wholesale order intake was GBP1.0bn, up 8%

-- Concluded an agreement to extend the existing MVNO agreement

with Telecom Plus (UW), and Sellafield Ltd has awarded a major new

contract to BT for managed network services

Global: Challenging market conditions and impact of prior year

divestments partly offset by strong cost transformation

-- Revenue decline due to impact of prior year divestments and

challenging market conditions partly offset by GBP18m foreign

exchange movement; revenue excluding divestments, one-offs and

foreign exchange was down 1%

-- EBITDA decline reflected lower revenues, the impact of

divestments and inflationary pressures offset by lower operating

costs from ongoing modernisation, cost control and one-offs; EBITDA

excluding divestments,

one-offs and foreign exchange was down 8%

-- Order intake was GBP3.7bn on a 12-month rolling basis, up 6%

with our growth product portfolio

representing over half of total orders won in the quarter

-- Announced a strategic alliance with MTN to enhance

communications services in Africa, in which cloud-based security

and consultancy, managed connectivity and voice services will be

delivered seamlessly as part of MTN's Enterprise portfolio. We also

launched Connect Cloud Edge in partnership with Equinix, a

next-generation cloud connectivity solution designed to accelerate

our customers' digital transformation

Openreach: Revenue and EBITDA growth; FTTP build

accelerating

-- Revenue growth driven by price increases and increased sales

in fibre-enabled products and Ethernet, partially offset by decline

in physical lines and decrease in chargeable repairs due to lower

repair volumes;

in FY22 price increases started in Q2

-- EBITDA growth from revenue flow through and lower operating

costs driven by lower repair and efficiency programmes, partially

offset by higher FTTP provisioning activity and pay inflation

-- Record FTTP build of 763k premises passed in the quarter at

an average build rate of 59k per week, around a third of the way

through our 25m build; we now have a footprint of over 8m including

2.5m in rural locations

-- Record growth in FTTP take up with base of c.2.1m, weekly net

adds of 23k and a take up rate of 26%

-- Achieved all 30 of the Ofcom Quality of Service measures for

Q1, with higher standards set for FY23;

delivered improved year on year performance for on time copper and FTTP provision of 94%

-- Finalised our FTTP co-provisioning agreement with Sky in a long-term deal

(1) See Glossary on page 3. Commentary on revenue and EBITDA is

based on adjusted measures.

Glossary

Adjusted Before specific items. Adjusted results are consistent

with the way that financial performance is measured

by management and assist in providing an additional

analysis of the reporting trading results of the group.

EBITDA Earnings before interest, tax, depreciation and amortisation.

Adjusted EBITDA EBITDA before specific items, share of post tax profits/losses

of associates and joint ventures and net non-interest

related finance expense.

Free cash flow Net cash inflow from operating activities after net

capital expenditure.

Capital expenditure Additions to property, plant and equipment and intangible

assets in the period.

Normalised Free cash flow (net cash inflow from operating activities

free cash flow after net capital expenditure) after net interest

paid and payment of lease liabilities, before pension

deficit payments (including cash tax benefit), payments

relating to spectrum, and specific items. For non-tax

related items the adjustments are made on a pre-tax

basis. It excludes cash flows that are determined

at a corporate level independently of ongoing trading

operations such as dividends, share buybacks, acquisitions

and disposals, and repayment and raising of debt.

Net debt Loans and other borrowings and lease liabilities (both

current and non-current), less current asset investments

and cash and cash equivalents, including items which

have been classified as held for sale on the balance

sheet. Currency denominated balances within net debt

are translated into sterling at swapped rates where

hedged. Fair value adjustments and accrued interest

applied to reflect the effective interest method are

removed.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

In the current period these relate to changes to our

assessment of our provision for historic regulatory

matters, restructuring charges, divestment-related

items and net interest expense on pensions.

------------------- --------------------------------------------------------------

Our commentary focuses on the trading results on an adjusted

basis, which is a non-GAAP measure, being before specific items.

The directors believe that presentation of the group's results in

this way is relevant to an understanding of the group's financial

performance as specific items are those that in management's

judgement need to be disclosed by virtue of their size, nature or

incidence. This is consistent with the way that financial

performance is measured by management and reported to the Board and

the Executive Committee and assists in providing a meaningful

analysis of the trading results of the group. In determining

whether an event or transaction is specific, management considers

quantitative as well as qualitative factors such as the frequency

or predictability of occurrence. Reported revenue, reported

operating costs, reported operating profit and reported profit

before tax are the equivalent unadjusted or statutory measures.

Enquiries

Press office: Tom Engel Tel: 07947 711 959

Richard Farnsworth Tel: 07734 776 317

Investor relations: Mark Lidiard Tel: 0800 389 4909

We will hold a conference call for analysts and investors in

London at 10am today and a simultaneous webcast will be available

at www.bt.com/results .

We are scheduled to announce the half year results for FY23 on 3

November 2022.

Forward-looking statements - caution advised

Certain information included in this announcement is forward

looking and involves risks, assumptions and uncertainties that

could cause actual results to differ materially from those

expressed or implied by forward looking statements. Forward looking

statements cover all matters which are not historical facts and

include, without limitation, projections relating to results of

operations and financial conditions and the Company's plans and

objectives for future operations. Forward looking statements can be

identified by the use of forward looking terminology, including

terms such as 'believes', 'estimates', 'anticipates', 'expects',

'forecasts', 'intends', 'plans', 'projects', 'goal', 'target',

'aim', 'may', 'will', 'would', 'could' or 'should' or, in each

case, their negative or other variations or comparable terminology.

Forward looking statements in this announcement are not guarantees

of future performance. All forward looking statements in this

announcement are based upon information known to the Company on the

date of this announcement. Accordingly, no assurance can be given

that any particular expectation will be met and readers are

cautioned not to place undue reliance on forward looking

statements, which speak only at their respective dates.

Additionally, forward looking statements regarding past trends or

activities should not be taken as a representation that such trends

or activities will continue in the future. Other than in accordance

with its legal or regulatory obligations (including under the UK

Listing Rules and the Disclosure Guidance and Transparency Rules of

the Financial Conduct Authority), the Company undertakes no

obligation to publicly update or revise any forward looking

statement, whether as a result of new information, future events or

otherwise. Nothing in this announcement shall exclude any liability

under applicable laws that cannot be excluded in accordance with

such laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUBUWRUBUBUAR

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

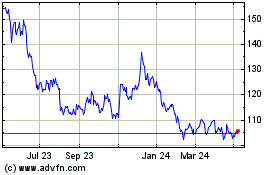

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

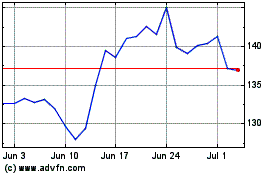

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024