TIDMCGEO

RNS Number : 7883V

Georgia Capital PLC

12 August 2022

FINANCIAL PERFORMANCE HIGHLIGHTS (IFRS) [1]

GEL '000, unless otherwise Jun-22 Mar-22 Change Dec-21 Change

noted

(Unaudited)

Georgia Capital NAV overview

NAV per share, GEL 52.71 52.62 0.2% 63.03 -16.4%

NAV per share, GBP 14.78 12.92 14.4% 15.10 -2.1%

Net Asset Value (NAV) 2,332,561 2,371,047 -1.6% 2,883,622 -19.1%

Total portfolio value 2,705,413 2,608,626 3.7% 3,616,231 -25.2%

Liquid assets and loans issued 688,741 882,574 -22.0% 426,531 61.5%

Net debt (365,914) (239,385) 52.9% (711,074) -48.5%

-1.2 -4.9

NCC ratio [2] 27.0% 28.2% ppts 31.9% ppts

Georgia Capital Performance 2Q22 2Q21 Change 1H22 1H21 Change

Total portfolio value creation (14,446) 331,912 NMF (465,266) 340,449 NMF

of which, listed and observable

businesses 18,646 70,288 -73.5% (189,061) 43,836 NMF

of which, private businesses (33,092) 261,624 NMF (276,205) 296,613 NMF

Investments 142,584 2,387 NMF 144,156 10,588 NMF

of which, conversion of

issued loans into equity 142,584 - NMF 142,584 - NMF

Divestments - - NMF (557,568) - NMF

Buybacks 27,488 1,487 NMF 53,540 3,199 NMF

Dividend income 32,226 9,691 NMF 34,421 14,430 NMF

Net (loss) / income (16,432) 368,139 NMF (501,678) 323,295 NMF

Private portfolio companies'

performance(1, [3]) 2Q22 2Q21 Change 1H22 1H21 Change

Large portfolio companies

Revenue 306,885 318,772 -3.7% 621,923 599,243 3.8%

EBITDA 35,337 44,336 -20.3% 75,113 81,334 -7.6%

Net operating cash flow 34,611 31,758 9.0% 63,276 40,709 55.4%

Investment stage portfolio

companies

Revenue 41,980 45,345 -7.4% 85,121 78,932 7.8%

EBITDA 17,307 20,982 -17.5% 30,050 31,627 -5.0%

Net operating cash flow 18,322 18,023 1.7% 24,599 21,673 13.5%

Total portfolio [4]

Revenue 470,472 449,747 4.6% 905,428 828,094 9.3%

EBITDA 62,737 78,446 -20.0% 116,558 132,634 -12.1%

Net operating cash flow 51,915 57,189 -9.2% 83,485 74,391 12.2%

KEY POINTS

Ø NAV per share (GEL) [5] flat (up 0.2%) in 2Q22 (down 16.4% in

1H22), reflecting stabilisation following 16.5% decrease in

1Q22

Ø 2Q22 NAV per share (GBP)(5) increased 14.4% (down 2.1% in

1H22), reflecting the 14.2% appreciation of GEL against GBP during

the second quarter (a 17.0% appreciation in 1H22)

Ø Net Capital Commitment (NCC) ratio decreased by 1.2 ppts to

27.0% in 2Q22, resulting from ongoing robust liquidity at the GCAP

level and the strong GEL

Ø GEL 9.4 million dividends collected from the private portfolio

companies in 2Q22, with an additional GEL 22.8 million dividends

received from BoG in July 2022

Ø US$ 46.8 million loans issued to our beverages and real estate

businesses converted into equity in 2Q22, as previously

announced

Ø c.816,000 shares repurchased in 2Q22 (total bought back and

cancelled now at c.6% of issued capital since 10-Aug-21)

Conference call: An investor/analyst conference call will be

held on 12 August 2022, at 14:00 UK / 15:00 CET / 9:00 US Eastern

Time. Please click the link to join the webinar: WEBINAR LINK ,

webinar ID: 823 2380 9213, passcode: 791297. Further details about

the webinar are available on the Group's webpage .

CHAIRMAN AND CEO'S STATEMENT

Our 2Q22 results demonstrate Georgia Capital's strong

operational and balance sheet resilience. While the uncertainties

created by the Russia-Ukraine war persist and potential

consequences can vary, our strong management teams have remained

alert to navigate the challenges and opportunities created by these

unprecedented times. This, when coupled with the recent strong

growth in the Georgian economy, has enabled us to deliver solid

operational performance in 2Q22 and 1H22, particularly reflecting

our strategy to have the majority of our capital allocated to

capital-light industries and sectors.

2Q22 NAV per share was up 0.2% (down 16.4% in 1H22). The NAV per

share performance in 2Q22 resulted from a combination of factors:

value creation across our listed and observable portfolio totalled

GEL 18.6 million with 0.8 ppts positive impact on the NAV per

share. This reflects a strong recovery in BoG's share price (up

9.9% in 2Q22) and robust value creation in the water utility

business, the latter reflecting the strong EBITDA growth supported

by the higher levels of economic activity as the impact of the

pandemic recedes. Share buybacks under our ongoing buyback

programme also supported the NAV per share growth with a 1.5 ppts

impact. The increase was offset by a GEL 33.1 million value

reduction in the private portfolio (-1.4 ppts impact), mainly

reflecting a temporary value decrease at our healthcare facilities,

as a result of their recent transition to the post-pandemic

environment, and increased discount rates used in our private

portfolio valuations. Management platform related costs had a 0.4

ppts negative impact on the 2Q22 NAV per share. In GBP terms, the

NAV per share growth in 2Q22 was particularly significant - up

14.4% - reflecting the 14.2% appreciation of GEL against GBP during

the quarter.

The decrease in the 1H22 NAV per share predominantly reflects

the first quarter impact of the Russia-Ukraine war, with a

stabilisation in the second quarter: a) a GEL 161.4 million

operating performance related value reduction of the private

portfolio companies (-5.6 ppts impact) and b) a GEL 317.5 million

negative impact on portfolio asset valuations from market movements

in BoG's share price, discount rates and listed peer multiples from

the Russia-Ukraine war (-11.0 ppts impact). The decrease was

partially offset by the accretive impact from share buybacks (+3.0

ppts impact in 1H22). In GBP terms, the NAV per share was down 2.1%

in 1H22.

Underlying operating performances across our private portfolio

remained solid. The aggregated revenue of our private portfolio

companies totalled GEL 470 million (up 4.6% y-o-y), demonstrating

modest top-line growth in 2Q22, while the aggregated EBITDA was

down by 20.0% y-o-y to GEL 63 million in 2Q22.

Ø 2Q22 revenues of our retail (pharmacy) business reflect a

recalibration of product prices due to GEL's appreciation against

foreign currencies and the termination of low-profit generating

contracts in the wholesale business line. 2Q22 EBITDA was further

impacted by inflation and increased operating expenses in line with

the continuing expansion of the retail (pharmacy) business.

Ø Our hospitals and clinics & diagnostics businesses are

currently transitioning to the post-pandemic environment. The

suspension of COVID contracts by the Government in 1Q22 and the

subsequent restructuring of the cost base of COVID facilities have

temporarily impacted the performance of the hospitals and clinics

businesses, while substantially lower COVID cases during the

quarter resulted in a significant decrease in diagnostics business

revenues. The growth is expected to rebound over the next few

quarters as the businesses complete the expected transition.

Ø The ongoing war negatively impacted the performance of our

beverages (c.60% sales exposure of our wine business to Russia and

Ukraine in 2021) and real estate businesses (significant growth in

construction materials costs). To ensure their sustainable

development, in 2Q22 we converted US$ 46.8 million loans issued to

these businesses into equity, as previously announced.

For 1H22, the aggregated revenues of our private portfolio

companies increased by 9.3% y-o-y while the aggregated y-o-y EBITDA

was down by 12.1%.

NCC ratio [6] decreased by 1.2 ppts to 27.0% in 2Q22. GCAP's

liquidity remained solid at GEL 686 million (US$ 234 million) in

2Q22. GEL's appreciation during the quarter positively impacted the

gross debt balance (down 4.0% in 2Q22) and as a result, the NCC

ratio was down by 1.2 ppts to 27.0% in 2Q22, demonstrating progress

towards our stated strategic priority to bring down the NCC ratio

to below 15% by Dec-25. The pro-forma NCC ratio, which reflects the

subsequent improvements in BoG's share price and foreign exchange

rates as well as the anticipated decrease in the GCAP's guarantee

towards the beer business (see page 11 for details), was down to

23.5%. Solid liquidity at the GCAP level and a robust balance sheet

and capital management framework also led to an upgrade in our

corporate credit ratings to "B1" by Moody's and "B+" by S&P

(from "B2" and "B", respectively) in 1H22.

Update on the buyback programme. During 2Q22, under the US$ 25

million share buyback and cancellation programme, we repurchased

816,054 shares for a total consideration of GEL 19.1 million (US$

6.3 million). This brings the total number of shares bought back

and cancelled to c.6% of issued capital since we launched the

programme in August 2021.

From a macroeconomic perspective , the economy has continued

double-digit growth in 2022, with real GDP expanding y-o-y by an

estimated 10. 5 % in 1H22 following a 10.4% growth in 2021. On the

external side, strong foreign demand throughout the year has been

supplemented by substantial remittance inflows, with money

transfers being up by 65% y-o-y in 1H22. Merchandise exports grew

by 35% y-o-y in 1H22, and the tourism revenues reached 79% of 2019

levels in 1H22, including 92% in May-June 2022, reflecting the

global resumption of travel as well as significant migration from

certain regional countries. On the domestic side, credit expansion

has also been robust, as the commercial bank loan portfolio grew by

18.7% y-o-y as of June 2022 (on a constant currency basis).

Additionally, while fiscal support has moderated, the fiscal stance

remains expansionary, with current expenditures growing by 9% and

capital expenditures expanding by 4% y-o-y in 1H22, facilitated by

a 34% surge in fiscal revenues. Despite USD strengthening globally,

the Georgian Lari (GEL) has sustained its appreciation trend since

mid-2021 and compared to the beginning of 2022 has appreciated by

14.1% against the US dollar as of 11 August 2022, driven by growing

demand for Georgian exports, robust remittance inflows, tight

monetary policy and accelerated foreign currency lending, as well

as the travel recovery and strong market confidence. The fiscal

deficit is projected to shrink to around 3.5% in 2022 as a result

of the higher-than-expected growth and is expected to return to

under 3% of GDP from 2023. The National Bank of Georgia (NBG) has

maintained a tight monetary stance with the refinancing rate set at

11% since March 2022, reaffirming its commitment to pursue tight

policy until inflationary pressures subside. Inflation reached

11.5% in July 2022 and 12.9% on average in January-July 2022,

although it is expected to decelerate gradually from the second

half of 2022.

Management change . In July, we announced that Nikoloz (Nick)

Gamkrelidze was to step down as Chief Executive of Georgia

Healthcare. He has been replaced as GHG's CEO by Irakli Gogia,

previously Deputy CEO, Finance of GHG. On 9 May 2022, the Board

announced the separation of the roles of Chairman and CEO, upon the

completion of my current employment contract as Chairman and CEO in

May 2023, with me continuing in the role of Board Chairman and Nick

assuming the role of Georgia Capital's CEO in May 2023. Following

Nick's departure from GHG, he will no longer take up the role of

Georgia Capital CEO in May 2023, and the Board of Georgia Capital

will announce a further update in due course with regard to the

appointment of a new CEO. I will continue in the existing combined

Chairman and CEO role until May 2023.

Outlook. Despite the ongoing regional tensions, we remain

cautiously optimistic about the emerging capital-light investment

opportunities, in line with our strategy, that lie ahead in Georgia

and beyond. We are already witnessing the formation of attractive

new markets resulting from the proven resilience of the Georgian

economy and the favourable migration to our region. While we have

increased our focus on balancing the varying risks and

opportunities by taking a relatively conservative approach to

managing our investment portfolio and balance sheet leverage, I

believe Georgia Capital is well-positioned to tap attractive

investment opportunities and deliver consistent NAV per share

growth over the medium term. At the same time, we will continue

demonstrating strong progress toward our key strategic priority of

deleveraging the Group's balance sheet.

Irakli Gilauri, Chairman and CEO

DISCUSSION OF GROUP RESULTS

The discussion below analyses the Group's unaudited net asset

value at 3 0 - Jun -22 and its income for the second quarter and

first half period then ended on an IFRS basis (see "Basis of

Presentation" on page 28 below).

Net Asset Value (NAV) Statement

NAV statement summarises the Group's IFRS equity value (which we

refer to as Net Asset Value or NAV in the NAV Statement below) at

the opening and closing dates for the second quarter (31- Mar -22

and 3 0 - Jun -22). The NAV Statement below breaks down NAV into

its components and provides a roll forward of the related changes

between the reporting periods. For the NAV Statement for the first

half of 2022 see page 27.

NAV STATEMENT 2Q 22

GEL '000, Mar-22 1. 2a. 2b. 2c. 3. 4. Jun Change

unless Value Investment Buyback Dividend Operating Liquidity/ -22 %

otherwise noted creation and expenses FX/Other

(Unaudited) ([7]) Divestments

Listed and

Observable

Portfolio

Companies

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Bank of Georgia

(BoG) 473,479 5,038 - - (22,798) - - 455,719 -3.8%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Water Utility 139,392 13,608 - - - - - 153,000 9.8%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Total Listed

and

Observable

Portfolio

Value 612,871 18,646 - - (22,798) - - 608,719 -0.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Listed and

Observable

Portfolio

value change

% 3.0% 0.0% 0.0% -3.7% 0.0% 0.0% -0.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Private

Portfolio

Companies

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Large Companies 1,410,482 (14,022) - - (7,374) - 107 1,389,193 -1.5%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Retail

(Pharmacy) 657,079 13,948 - - - - - 671,027 2.1%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Hospitals 524,296 (46,250) - - - - - 478,046 -8.8%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Insurance (P&C

and

Medical) 229,107 18,280 - - (7,374) - 107 240,120 4.8%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Of which,

P&C

Insurance 184,629 22,448 - - (7,374) - 107 199,810 8.2%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Of which,

Medical

Insurance 44,478 (4,168) - - - - - 40,310 -9.4%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Investment

Stage

Companies 447,247 (1,482) - - (2,054) - 256 443,967 -0.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Renewable

Energy 163,862 10,104 - - (2,054) - 256 172,168 5.1%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Education 135,368 16,385 - - - - - 151,753 12.1%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Clinics and

Diagnostics 148,017 (27,971) - - - - - 120,046 -18.9%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Other Companies 138,026 (17,588) 142,584 - - - 512 263,534 90.9%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Total Private

Portfolio

Value 1,995,755 (33,092) 142,584 - (9,428) - 875 2,096,694 5.1%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Private

Portfolio

value change % -1.7% 7.1% 0.0% -0.5% 0.0% 0.0% 5.1%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Total Portfolio

Value (1) 2,608,626 (14,446) 142,584 - (32,226) - 875 2,705,413 3.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Total Portfolio

value change % -0.6% 5.5% 0.0% -1.2% 0.0% 0.0% 3.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Net Debt (2) (239,385) - (136,577) (27,488) 32,226 (5,734) 11,044 (365,914) 52.9%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

of which,

Cash and

liquid funds 718,525 - - (27,488) 9,428 (5,734) (31,364) 663,367 -7.7%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

of which,

Loans

issued 164,049 - (136,577) - - - (2,098) 25,374 -84.5%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

of which,

Accrued

dividend

income - - - - 22,798 - - 22,798 0.0%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

of which,

Gross

Debt (1,121,959) - - - - - 44,506 (1,077,453) -4.0%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Net other

assets/

(liabilities)

(3) 1,806 - (6,007) - - (4,661) 1,924 (6,938) NMF

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

of which,

share-based

comp. - - - - - (4,661) 4,661 -

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Net Asset Value

(1)+(2)+(3) 2,371,047 (14,446) - (27,488) - (10,395) 13,843 2,332,561 -1.6%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

NAV change % -0.6% 0.0% -1.2% 0.0% -0.4% 0.6% -1.6%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Shares

outstanding(7) 45,063,039 - - (1,174,323) - - 361,031 44,249,747 -1.8%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

Net Asset Value

per share, GEL 52.62 (0.32) (0.00) 0.78 (0.00) (0.23) (0.12) 52.71 0.2%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

NAV per share,

GEL

change % -0.6% 0.0% 1.5% 0.0% -0.4% -0.2% 0.2%

---------------- ------------ --------- ------------ ------------ --------- ---------- ----------- ------------ -------

A 0.2% increase in NAV per share (GEL) in 2Q22 was mainly driven

by an accretive impact from share buybacks (a 1.5 ppts impact on

the NAV per share). The growth was partially offset by a GEL 14.4

million negative value creation across our portfolio companies

(-0.6 ppts impact), management platform related costs (-0.4 ppts

impact) and other expenses (-0.2 ppts impact).

Portfolio overview

Total portfolio value increased by GEL 96.8 million (3.7%) to

GEL 2.7 billion in 2Q22:

-- The value of the listed and observable portfolio decreased by

GEL 4.2 million (-0.7%), reflecting the net impact of GEL 18.6

million value creation, driven by a robust operating performance of

the water utility business and strong recovery in BoG's share

price, offset by a GEL 22.8 million accrued dividend income from

BoG as of 30-Jun-22.

-- Private portfolio value change in 2Q22 reflects:

o A GEL 41.6 million value decrease, mainly resulting from a GEL

33.1 million negative value creation and GEL 9.4 million dividends

paid to GCAP.

o Conversion of GEL 142.6 million loans issued predominantly to

our beverages and real estate businesses into equity, due to the

adverse financial impact of the Russia-Ukraine war on these

businesses. This led to a GEL 100.9 million net increase in the

value of our private portfolio (up 5.1% in 2Q22).

Consequently, as of 30-Jun-22, the listed and observable

portfolio value totalled GEL 608.7 million (22.5% of the total

portfolio value), and the private portfolio value amounted to GEL

2.1 billion (77.5% of the total).

1) Value creation

Total portfolio value creation amounted to negative GEL 14.4

million in 2Q22.

-- A GEL 18.6 million value creation across listed and

observable portfolio supported NAV per share growth in 2Q22. This

reflects:

o A GEL 5.0 million value creation from BoG, resulting from a

9.9% increase in BoG's share price, partially offset by GEL

appreciation against GBP by 14.2% in 2Q22.

o GEL 13.6 million value creation in Water Utility, reflecting

the strong operating performance and the application of the put

option valuation to GCAP's 20% holding in the business (where GCAP

has a clear exit path through a put and call structure at

pre-agreed EBITDA multiples).

-- The negative value creation in the private portfolio amounted

to GEL 33.1 million in 2Q22, resulting from:

o GEL 117.1 million operating-performance related value

reduction, mainly driven by the developments across our retail

(pharmacy), hospitals, clinics & diagnostics and other

businesses, as described in detail on pages 6-7.

o GEL 84.0 million value creation due to GEL's appreciation

against foreign currencies and changes in valuation multiples in

2Q22.

The negative impact of the ongoing Russia-Ukraine war on the

discount rates and listed peer multiples used in our DCF and

multiple-based valuation assessments continued in 2Q22, with

discount rates being up by approximately 0.5-1.0 ppts q-o-q.

However, the resilience of the Georgian economy in almost all

economic data points and stronger than expected outlook of our

portfolio companies drove the stabilisation of value creation in

2Q22.

The table below summarises value creation drivers in our

businesses in 2 Q22:

Portfolio Businesses Operating Performance Greenfields Multiple Change Value Creation

([8]) / and FX ([10])

buy-outs

/ exits

([9])

-------------------------------------- ---------------------- ------------ ---------------- ---------------

GEL '000, unless otherwise noted

(Unaudited) (1) (2) (3) (1)+(2)+(3)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Listed and Observable 18,646

-------------------------------------- ---------------------- ------------ ---------------- ---------------

BoG 5,038

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Water Utility 13,608

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Private (117,122) - 84,030 (33,092)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Large Portfolio Companies (71,281) - 57,259 (14,022)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Retail (pharmacy) (18,667) - 32,615 13,948

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Hospitals (62,339) - 16,089 (46,250)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Insurance (P&C and Medical) 9,725 - 8,555 18,280

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, P&C Insurance 15,482 - 6,966 22,448

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, Medical Insurance (5,757) - 1,589 (4,168)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Investment Stage Portfolio Companies (15,032) - 13,550 (1,482)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Renewable Energy 11,625 - (1,521) 10,104

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Education 12,058 - 4,327 16,385

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Clinics and Diagnostics (38,715) - 10,744 (27,971)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Other (30,809) - 13,221 (17,588)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Total portfolio (117,122) - 84,030 (14,446)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Valuation overview [11]

In 2Q22, valuation assessments of our large and investment stage

portfolio companies were performed by a third-party independent

valuation firm, Kroll (formerly known as Duff & Phelps), in

line with International Private Equity Valuation ("IPEV")

guidelines. Our renewable energy and education businesses were

valued by Kroll for the first time in 2Q22 (the clinics &

diagnostics business was previously valued externally as a

component part of Healthcare Services). The independent valuation

assessments, which serve as the basis for Georgia Capital's

estimate of fair value, were performed by applying a combination of

an income approach (DCF) and a market approach (listed peer

multiples and, in some cases, precedent transactions). The

independent valuations of the large and investment stage businesses

are performed on a semi-annual basis. In line with our strategy,

from time to time we may receive offers from interested buyers for

our private portfolio companies. These would be considered in the

overall valuation assessment, where appropriate.

The enterprise value and equity value development of our

businesses in 2 Q22 are summarised in the following table:

Enterprise Value Equity Value

(EV)

-------------------------- ------------------------------- --------------------------------------------

GEL '000, unless 30-Jun-22 31-Mar-22 Change 30-Jun-22 31-Mar-22 Change % share

otherwise noted % % in total

(Unaudited) portfolio

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Listed and Observable

portfolio 608,719 612,871 -0.7% 22.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

BoG 455,719 473,479 -3.8% 16.8%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Water Utility 153,000 139,392 9.8% 5.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private portfolio 3,236,186 3,282,688 -1.4% 2,096,694 1,995,755 5.1% 77.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Large portfolio

companies 1,821,489 1,850,595 -1.6% 1,389,193 1,410,482 -1.5% 51.3%

Retail (pharmacy) 915,257 900,218 1.7% 671,027 657,079 2.1% 24.8%

Hospitals 678,687 735,626 -7.7% 478,046 524,296 -8.8% 17.7%

Insurance (P&C and

Medical) 227,545 214,751 6.0% 240,120 229,107 4.8% 8.9%

Of which, P&C Insurance 199,810 184,629 8.2% 199,810 184,629 8.2% 7.4%

Of which, Medical

Insurance 27,735 30,122 -7.9% 40,310 44,478 -9.4% 1.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Investment stage

portfolio companies 792,525 779,019 1.7% 443,967 447,247 -0.7% 16.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Renewable Energy 421,002 427,321 -1.5% 172,168 163,862 5.1% 6.4%

Education [12] 182,688 145,570 25.5% 151,753 135,368 12.1% 5.6%

Clinics and Diagnostics 188,835 206,128 -8.4% 120,046 148,017 -18.9% 4.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Other 622,172 653,074 -4.7% 263,534 138,026 90.9% 9.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Total portfolio 2,705,413 2,608,626 3.7% 100.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private large portfolio companies (51.3% of total portfolio

value)

Retail (Pharmacy) (24.8% of total portfolio value) - the

Enterprise Value (EV) of Retail (Pharmacy) increased by 1.7% to GEL

915.3 million in 2Q22, reflecting the robust outlook of the

business, driven by the expansion of the retail chain and

resilience of Georgian economy. 2Q22 revenues were down by 3.5%

y-o-y, resulting from a) the recalibration of product prices due to

GEL's appreciation against foreign currencies (the FX effect is

directly transmitted into the pricing as c.70% of the inventory

purchases are denominated in foreign currencies) and b) the

termination of low-profit generating contracts in the wholesale

business line. EBITDA (excl. IFRS 16) was down by 11.4% y-o-y in

2Q22, further reflecting inflation and the increased operating

expenses in line with the expansion of the retail (pharmacy)

business. See page 14 for details. Consequently, LTM EBITDA (incl.

IFRS 16) was down by 1.5% to GEL 109.7 million in 2Q22. Net debt

increased by 19.1% to GEL 159.5 million in 2Q22, as the business

paid GEL 31.2 million to complete the buyout of the 10% minority

stake (valued at GEL 41.2 million, of which GEL 10.0 million was

paid in 1Q22). As a result, the fair value of GCAP's holding

increased by 2.1% to GEL 671.0 million in 2Q22. The implied LTM

EV/EBITDA valuation multiple (incl. IFRS 16) increased to 8.3x as

at 30-Jun-22 (up from 8.1x as of 31-Mar-22).

Hospitals (17.7% of total portfolio value) - Hospitals' EV

decreased by 7.7% to GEL 678.7 million in 2Q22. The revenue was

down by 10.6% y-o-y in 2Q22, reflecting the suspension of COVID

contracts by the Government in 1Q22. Restructuring the cost base of

COVID hospitals and phasing out from Government contracts

temporarily suppressed business margins in 2Q22, which, coupled

with the absence of a state income tax subsidy for low salary range

employees that had been in effect during the entire 1H21 period,

translated into a 6.3 ppts y-o-y decrease in the 2Q22 EBITDA margin

(excl. IFRS 16). Consequently, EBITDA (excl. IFRS 16) was down

33.3% y-o-y in 2Q22. See page 16 for details. LTM EBITDA (incl.

IFRS 16) decreased by 9.3% to GEL 64.9 million in 2Q22. As a

result, the equity value of the business was assessed at GEL 478.0

million, down 8.8% q-o-q in 2Q22, translating into an implied LTM

EV/EBITDA multiple (incl. IFRS 16) of 10.5x at 30-Jun-22 (10.3x at

30-Mar-22).

Insurance (P&C and Medical) (8.9% of total portfolio value)

- The insurance business combines: a) P&C Insurance valued at

GEL 199.8 million and b) Medical Insurance valued at GEL 40.3

million.

P&C Insurance - Net premiums earned increased by 16.9% y-o-y

to GEL 24.3 million in 2Q22, mainly reflecting the growth in the

credit life and agricultural insurance lines. The combined ratio

was down 0.6 ppts y-o-y in 2Q22, reflecting a) a 3.4 ppts decrease

in loss ratio on the back of the robust revenue growth and b) a 2.8

ppts increase in expense ratio due to the increase in salaries and

other operating expenses in line with the business growth.

Consequently, 2Q22 net income was up 17.8% y-o-y to GEL 4.9

million. See page 17 for details. LTM net income [13] was up by

4.3% to GEL 18.2 million in 2Q22. The equity value of the P&C

insurance business was assessed at GEL 199.8 million at 30-Jun-22

(up 8.2% q-o-q). The implied LTM P/E valuation multiple stood at

11.0x in 2Q22 (up from 10.6x in 1Q22).

Medical Insurance - Net premiums earned increased by 0.5% y-o-y

to GEL 18.0 million in 2Q22, predominantly driven by a c.5%

increase in the price of insurance policies and related decrease in

the number of insured clients (down 4.9% y-o-y as of 30-Jun-22).

Net claims expenses were also up by 4.8% y-o-y in 2Q22, in line

with the rebounding trend of elective healthcare services, compared

to the patient footprint slowdown last year due to the pandemic .

As a result, the net income of the medical insurance business was

down by GEL 0.4 million y-o-y to negative GEL 0.2 million in 2Q22.

See page 17 for details. LTM net income [14] was down by 12.5% to

GEL 2.8 million in 2Q22, and the equity value of the business was

assessed at GEL 40.3 million at 30-Jun-22 (down 9.4% q-o-q). The

implied LTM P/E valuation multiple was at 14.5x in 2Q22, up from

14.0x in 1Q22.

Private investment stage portfolio companies (16.4% of total

portfolio value)

Renewable Energy (6.4% of total portfolio value) - The business

was valued externally for the first time in 2Q22. EV in US$ terms

was up by 4.3% to US$ 143.7 million in 2Q22 (down 1.5% to GEL 421.0

million in GEL terms, reflecting the local currency appreciation

against US$ during the quarter). In US$ terms, revenue and EBITDA

were up 2.3% and 4.4% y-o-y in 2Q22, reflecting a 12.6% y-o-y

increase in average electricity selling prices (revenue and EBITDA

in GEL terms were down by 7.6% and 5.9% y-o-y, respectively, in

2Q22). See page 20 for details. The pipeline renewable energy

projects continued to be measured at an equity investment cost of

GEL 42.0 million in aggregate. Net debt was down by GEL 14.6

million to GEL 248.8 million in 2Q22, also reflecting the currency

movements (in US$ terms, the net debt remained flat at US$ 85.0

million). The business paid GEL 2.1 million dividends to GCAP in

2Q22. As a result, the equity value of Renewable Energy was

assessed at GEL 172.2 million in 2Q22 (up by 5.1% q-o-q) (up 11.3%

q-o-q to US$ 58.8 in US$ terms). The blended EV/EBITDA valuation

multiple of the operational assets stood at 11.1x in 2Q22, up from

10.9x in 1Q22.

Education (5.6% of total portfolio value) - The business was

valued externally for the first time in 2Q22. An 80.1% increase in

total learner capacity in 2021 and higher than expected growth in

total enrolments were reflected in the 2Q22 valuation assessment of

the business, which led to a 25.5% increase in EV to GEL 182.7 [15]

million in 2Q22. See page 21 for details. Notwithstanding a 19.7%

y-o-y increase in 2Q22 EBITDA, the LTM EBITDA of the business was

down by 1.6% to GEL 11.9 million. A temporary decrease in LTM

EBITDA reflects the increased operating expenses resulting from the

addition of the new learner capacity, while additional revenue is

expected to derive in the 2023-2024 academic year, as the

utilisation rate picks up gradually. Net debt was also up by 12.7%

to GEL 8.9 million in 2Q22, reflecting an expansion. As a result,

the education business was valued at GEL 151.8 million in 2Q22 (up

12.1% q-o-q). This translated into the implied valuation multiple

of 15.3x in 2Q22, up from 12.0x in 1Q22. The forward-looking

implied valuation multiple is estimated at 11.1x for the 2023-2024

academic year.

Clinics and Diagnostics (4.4% of total portfolio value) - The EV

of the business decreased by 8.4% to GEL 188.8 million in 2Q22.

Similar to the hospitals business, our clinics business was also

impacted by the suspension of COVID contracts by the Government,

which led to an 8.6% y-o-y decrease in revenues in 2Q22. The

revenue of our diagnostics business, which apart from regular lab

tests is actively engaged in COVID-19 testing, was impacted by

substantially lower COVID cases during the quarter and was down by

48.5% y-o-y in 2Q22. This together with the expiration of the state

income tax subsidy that had been in effect in the prior period led

to a 62.1% y-o-y decrease in the combined 2Q22 EBITDA (excl. IFRS

16) of the clinics & diagnostics business. See page 22 for

details. Consequently, LTM EBITDA (incl. IFRS 16) was down by 16.0%

to GEL 19.2 million in 2Q22. As a result, the equity value of the

business was assessed at GEL 120.0 million, down 18.9% q-o-q in

2Q22, translating into an implied LTM EV/EBITDA multiple (incl.

IFRS 16) of 9.8x at 30-Jun-22, up from 9.0x at 31-Mar-22.

Other businesses (9.7% of total portfolio value) - The "other"

private portfolio (Auto Service, Beverages, IT Outsourcing, Housing

Development and Hospitality businesses) is valued based on LTM

EV/EBITDA except the housing development (DCF), wine business (DCF)

and hospitality businesses (NAV). See performance highlights of

other businesses on page 25. The portfolio had a combined value of

GEL 263.5 million at 30-Jun-22, up by 90.9% q-o-q. The increase

reflects the conversion of GEL 142.6 million loans issued

predominantly to our beverages and real estate businesses into

equity, due to the adverse financial impact of the Russia-Ukraine

war on these businesses. In 2Q22, the negative value creation

amounted to GEL 17.6 million.

Listed and observable portfolio companies (22.5% of total

portfolio value)

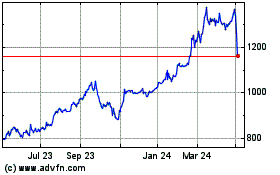

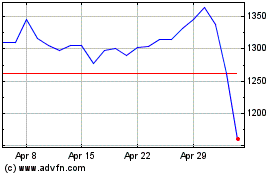

BOG ( 16.8% of total portfolio value) [16] - In 1Q22, BoG

delivered an annualised ROAE of 30.7% and strong 11.6% loan book

growth y-o-y. The loan book growth was largely driven by continued

strong loan origination levels in all segments, but predominantly

in the consumer, micro and SME portfolios. In 2Q22, BoG's share

price demonstrated a strong recovery and was up by 9.9 % q-o-q to

GBP 13.06 at 30-Jun-22. The positive impact of BOG's share price

performance on our valuations was partially offset by GEL's

appreciation against GBP by 14.2% in 2Q22. In 2Q22, the Bank

declared a final dividend for 2021 of GEL 2.33 per ordinary share.

Consequently, the accrued dividend income for GCAP amounted to GEL

22.8 million as of 30-Jun-22. The final dividends were received on

14-Jul-22. In 2Q22, the Bank also announced the commencement of the

GEL 72.7 million share buyback and cancellation programme,

effective until 31 December 2022. The programme is in line with

BoG's capital and distribution policy, which targets a

dividend/share buyback payout ratio in the range of 30-50% of the

Bank's annual profits. As a result of the developments described

above, the market value of our equity stake in BoG decreased by

3.8% to GEL 455.7 million. BoG's public announcement of their 2Q22

results, when published, will be available on BoG's website .

Water Utility ( 5.7% of total portfolio value) - 2Q22 valuation

of the Water Utility, where GCAP has a clear exit path through a

put and call structure at pre-agreed EBITDA multiples) [17] ,

reflects the strong operating performance of the business. Positive

developments in the normalised [18] LTM EBITDA and the application

of the put option valuation led to GEL 13.6 million value creation

in 2Q22. As a result, the fair value of GCAP's 20% holding in the

business was assessed at GEL 153.0 million, up 9.8% q-o-q.

2) Investments [19]

GCAP's investments of GEL 142.6 million in 2Q22 represent the

non-cash conversion of the loans issued mainly to our real estate

and beverages business into equity.

3) Share buybacks

During 2Q22, 1,174,323 shares were bought back for a total

consideration of GEL 27.5 million.

-- 358,269 shares were repurchased for the management trust.

-- 816,054 shares were repurchased under the ongoing US$ 25

million share buyback and cancellation programme. The total value

of shares repurchased under the programme amounted to GEL 19.1

million (US$ 6.3 million) in 2Q22.

-- As of 11-Aug-22 a total of 2,777,234 shares with the value of

GEL 69.4 million (US$ 22.7 million) have been repurchased under the

buyback programme, since 10 August 2021. The share buyback and

cancellation programme is extended until 31 December 2022, as set

out on page 27 of this report.

4) Dividends(19)

In 2Q22, Georgia Capital received GEL 9.4 million regular

dividends from the private portfolio companies, of which, GEL 7.4

million was collected from the P&C insurance and GEL 2.1

million from the renewable energy businesses. GEL 22.8 dividends,

receivable from BOG as of 30-Jun-22, were collected on

14-Jul-22.

1H22 NAV STATEMENT HIGHLIGHTS

GEL '000, unless Dec-21 1. 2a. 2b. 2c. 3. 4. Jun Change

otherwise noted Value Investment Buyback Dividend Operating Liquidity/ -22 %

(Unaudited) creation and expenses FX/Other

([20]) divestments

Total Listed and

Observable

Portfolio

Value 681,186 (189,061) 139,392 - (22,798) - - 608,719 -10.6%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Listed and

Observable

Portfolio value

change

% -27.8% 20.5% 0.0% -3.3% 0.0% 0.0% -10.6%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Private

Portfolio

Companies 2,935,045 (276,205) (552,804) - (11,623) - 2,281 2,096,694 -28.6%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which, Large

Companies 2,249,260 (156,554) (696,960) - (7,374) - 821 1,389,193 -38.2%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which,

Investment

Stage

Companies 461,140 (14,970) 1,559 - (4,249) - 487 443,967 -3.7%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Of which,

Other

Companies 224,645 (104,681) 142,597 - - - 973 263,534 17.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Private

Portfolio

value change % -9.4% -18.8% 0.0% -0.4% 0.0% 0.1% -28.6%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Portfolio

Value (1) 3,616,231 (465,266) (413,412) - (34,421) - 2,281 2,705,413 -25.2%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Total Portfolio

value change % -12.9% -11.4% 0.0% -1.0% 0.0% 0.1% -25.2%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Debt (2) (711,074) - 419,419 (53,540) 34,421 (10,951) (44,189) (365,914) -48.5%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Asset Value

(1)+(2)+(3) 2,883,622 (465,266) - (53,540) - (19,700) (12,555) 2,332,561 -19.1%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV change % -16.1% 0.0% -1.9% 0.0% -0.7% -0.4% -19.1%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Shares

outstanding(20) 45,752,362 - - (2,166,578) - - 663,963 44,249,747 -3.3%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

Net Asset Value

per share, GEL 63.03 (10.17) (0.00) 1.90 (0.00) (0.43) (1.61) 52.71 -16.4%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV per share,

GEL

change % -16.1% 0.0% 3.0% 0.0% -0.7% -2.5% -16.4%

----------------- ----------- ---------- ------------ ------------ --------- ---------- ----------- ----------- -------

NAV per share (GEL) decreased by 16.4% in 1H22, reflecting a)

value reduction of BoG and private portfolio companies with a 7.0

ppts and 9.6 ppts negative impact on the NAV per share,

respectively, and b) management platform related costs (-0.7 ppts

impact) and net interest expenses (-0.7 ppts impact). The NAV per

share decrease was partially offset by share buybacks (+3.0 ppts

impact).

Portfolio overview

The total portfolio value decreased by GEL 910.8 million (25.2%)

to GEL 2,705.4 million in 1H22:

-- The value of the water utility business decreased by GEL

544.0, reflecting the disposal of an 80% equity interest in the

business.

-- The value of BoG and our private portfolio companies

decreased by GEL 225.5 million and GEL 141.4 million, respectively,

reflecting the impact of market movements on portfolio asset

valuations resulting from the Russia-Ukraine war.

1) Value creation

BoG's share price decreased by 21.7%, which coupled with a 17.0%

appreciation of GEL against GBP in 1H22, translated into a GEL

202.7 million negative value creation. The negative value creation

across our private portfolio amounted to GEL 276.2 million and

reflect a) GEL 161.4 million operating performance related value

decrease and b) GEL 114. 8 million value reduction due to changes

in valuation multiples and foreign exchange rates in 1H22.

a) Operating performance related value decrease reflects the

developments across our healthcare facilities as described earlier

in this report and the spillover effect of the Russia-Ukraine war

on our wine (c. 60% sales exposure to Russia and Ukraine in 2021)

and housing businesses (significant growth in construction

materials costs).

b) The value reduction due to changes in valuation multiples and

FX reflect the uncertainties surrounding the geopolitical tensions,

which translated into approximately a 2.0-3.0 ppts increase in

discount rates and reduced listed peer multiples as reflected in

the private portfolio companies' valuations in 1H22.

The developments described above led to negative GEL 465.3

million value creation in 1H22.

The table below summarises value creation drivers in our

businesses in 1H 22:

Portfolio Businesses Operating Performance Greenfields Multiple Change Value Creation

([21]) / and FX ([23])

buy-outs

/ exits

([22])

-------------------------------------- ---------------------- ------------ ---------------- ---------------

GEL '000, unless otherwise noted

(Unaudited) (1) (2) (3) (1)+(2)+(3)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Listed and Observable (189,061)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

BoG (202,669)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Water Utility 13,608

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Private (161,351) (13) (114,841) (276,205)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Large Portfolio Companies (45,048) - (111,506) (156,554)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Retail (pharmacy) 50,859 - (90,217) (39,358)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Hospitals (93,993) - (1,776) (95,769)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Insurance (P&C and Medical) (1,914) - (19,513) (21,427)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, P&C Insurance 12,484 - (17,626) (5,142)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Of which, Medical Insurance (14,398) - (1,887) (16,285)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Investment Stage Portfolio Companies (2,159) - (12,811) (14,970)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Renewable Energy 8,739 - (6,492) 2,247

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Education 27,074 - (6,333) 20,741

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Clinics and Diagnostics (37,972) - 14 (37,958)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Other (114,144) (13) 9,476 (104,681)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

Total portfolio (161,351) (13) (114,841) (465,266)

-------------------------------------- ---------------------- ------------ ---------------- ---------------

The enterprise value and equity value development of our

businesses in 1H 22 are summarised in the following table:

Enterprise Value Equity Value

(EV)

-------------------------- ------------------------------- --------------------------------------------

GEL '000, unless 30-Jun-22 31-Dec-21 Change 30-Jun-22 31-Dec-21 Change % share

otherwise noted % % in total

(Unaudited) portfolio

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Listed and Observable

portfolio 608,719 681,186 -10.6% 22.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

BoG 455,719 681,186 -33.1% 16.8%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Water Utility 153,000 - NMF 5.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Private portfolio 3,236,186 4,633,145 -30.2% 2,096,694 2,935,045 -28.6% 77.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Large portfolio

companies 1,821,489 3,126,186 -41.7% 1,389,193 2,249,260 -38.2% 51.3%

Retail (pharmacy) 915,257 952,269 -3.9% 671,027 710,385 -5.5% 24.8%

Hospitals 678,687 791,756 -14.3% 478,046 573,815 -16.7% 17.7%

Water Utility - 1,129,902 NMF - 696,960 NMF NMF

Insurance (P&C and

Medical) 227,545 252,259 -9.8% 240,120 268,100 -10.4% 8.9%

Of which, P&C Insurance 199,810 211,505 -5.5% 199,810 211,505 -5.5% 7.4%

Of which, Medical

Insurance 27,735 40,754 -31.9% 40,310 56,595 -28.8% 1.5%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Investment stage

portfolio companies 792,525 779,824 1.6% 443,967 461,140 -3.7% 16.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Renewable Energy 421,002 428,248 -1.7% 172,168 173,288 -0.6% 6.4%

Education [24] 182,688 139,947 30.5% 151,753 129,848 16.9% 5.6%

Clinics and Diagnostics 188,835 211,629 -10.8% 120,046 158,004 -24.0% 4.4%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Other 622,172 727,135 -14.4% 263,534 224,645 17.3% 9.7%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

Total portfolio 2,705,413 3,616,231 -25.2% 100.0%

-------------------------- ---------- ---------- ------- ---------- ---------- ------- -----------

2) Investments [25]

In 1H22, GCAP's cash investments amounted to GEL 1.6 million, of

which GEL 1.2 million was allocated to our education business,

predominantly for the capacity expansion of the existing campus of

Buckswood (mid-scale segment) and the development of land and

building of the new campus of Green School (affordable segment).

The investments presented in the 1H22 NAV statement also reflect

the following non-cash operations: a) the transfer of the remaining

20% equity interest in the water utility business to the listed and

observable portfolio (GEL 139.4 million) and b) the conversion of

loans issued predominantly to our beverages and real estate

businesses into equity (GEL 142.6 million).

3) Share buybacks

During 1H22, 2,166,578 shares were bought back for a total

consideration of GEL 53.5 million.

-- 1,689,480 shares were repurchased under the ongoing share

buyback and cancellation programme. The total value of shares

repurchased under the programme amounted to GEL 42.0 million (US$

13.7 million) in 1H22.

-- 477,098 shares were repurchased for the management trust.

4) Dividends [26]

In 1H22, Georgia Capital received GEL 11.6 million regular

dividends from the private portfolio companies, of which, GEL 7.4

million was collected from P&C insurance and GEL 4.3 million

from the renewable energy businesses. The balance also reflects a

GEL 22.8 million accrued dividend income from BoG.

Net Capital Commitment (NCC) overview

Below we describe the components of Net Capital Commitment (NCC)

as of 30 June 2022 and as of 31 March 2022. NCC represents an

aggregated view of all confirmed, agreed and expected capital

outflows at the GCAP HoldCo level.

Components of NCC 30-Jun-22 31-Mar-22 Change 31-Dec-21 Change

GEL '000, unless otherwise

noted (unaudited)

Cash at banks 359,262 425,911 -15.6% 132,580 NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Liquid funds 304,105 292,614 3.9% 139,737 NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Of which, Internationally

listed debt securities 300,967 289,551 3.9% 137,215 NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Of which, Locally listed

debt securities 3,138 3,063 2.4% 2,522 24.4%

-------------------------------- ------------ ------------ ------- ------------ -------

Total cash and liquid

funds 663,367 718,525 -7.7% 272,317 NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Loans issued [27] 25,374 21,206 19.7% 21,540 17.8%

-------------------------------- ------------ ------------ ------- ------------ -------

Accrued dividend income 22,798 - NMF - NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Gross debt (1,077,453) (1,121,959) -4.0% (1,137,605) -5.3%

-------------------------------- ------------ ------------ ------- ------------ -------

Net debt (1) (365,914) (382,228) -4.3% (843,748) -56.6%

-------------------------------- ------------ ------------ ------- ------------ -------

Guarantees issued (2) (45,615) (53,836) -15.3% (55,297) -17.5%

-------------------------------- ------------ ------------ ------- ------------ -------

Net debt and guarantees

issued (3)=(1)+(2) (411,529) (436,064) -5.6% (899,045) -54.2%

-------------------------------- ------------ ------------ ------- ------------ -------

Planned investments (5) (158,675) (168,015) -5.6% (131,933) 20.3%

-------------------------------- ------------ ------------ ------- ------------ -------

of which, planned investments

in Renewable Energy (88,024) (93,205) -5.6% (101,834) -13.6%

-------------------------------- ------------ ------------ ------- ------------ -------

of which, planned investments

in Education (70,651) (74,810) -5.6% (30,099) NMF

-------------------------------- ------------ ------------ ------- ------------ -------

Announced Buybacks (6) (12,597) (17,463) -27.9% (9,330) 35.0%

-------------------------------- ------------ ------------ ------- ------------ -------

Contingency/liquidity

buffer (7) (146,444) (155,065) -5.6% (154,880) -5.4%

-------------------------------- ------------ ------------ ------- ------------ -------

Total planned investments,

announced buybacks and

contingency/liquidity buffer

(8)=(5)+(6)+(7) (317,716) (340,543) -6.7% (296,143) 7.3%

-------------------------------- ------------ ------------ ------- ------------ -------

Net capital commitment

(3)+(8) (729,245) (776,607) -6.1% (1,195,188) -39.0%

-1.2 -4.9

NCC ratio 27.0% 28.2% ppts 31.9% ppts

-------------------------------- ------------ ------------ ------- ------------ -------

Cash and liquid funds . Total cash and liquid funds' balance was

down by 7.7% to GEL 663.4 million (US$ 226.5 million) in 2Q22. The

decrease was mainly driven by a) GEL's appreciation in 2Q22, as

more than 90% of the cash and liquid funds were denominated in

foreign currencies and b) a GEL 26.6 million cash outflow for

buybacks. The decrease was partially offset by the dividend and

interest receipts of GEL 9.4 and GEL 8.0 million in 2Q22,

respectively. A 3.9% increase in internationally listed debt

securities' balance was attributable to the temporary investments

in dollar-denominated Eurobonds issued by Georgian corporates to

generate yield on GCAP's liquid funds.

Total cash and liquid funds' balance was up 2.4x in 1H22,

reflecting a) the receipt of GEL 526.7 million (US$ 173 million)

cash proceeds (net of transaction fees) in 1Q22 from the disposal

of an 80% equity interest in the water utility business, following

the successful completion of the first stage of the transaction, b)

dividend and interest receipts of GEL 11.6 million and GEL 13.6

million, respectively. The increase was partially offset by a) GEL

38.0 million Eurobond coupon payment, and b) GEL 58.1 million cash

outflow for buybacks. The internationally listed debt securities'

balance also more than doubled in 1H22. The increase was

attributable to the temporary investments in dollar-denominated

Eurobonds issued by Georgian corporates.

Loans issued(27) . Issued loans' balance, which primarily refers

to loans issued to our private portfolio companies, was up by GEL

4.2 million in 2Q22 (up by GEL 3.8 million in 1H22). Loans are lent

at market terms.

Gross debt. At 30-Jun-22, the outstanding balance of US$ 365

million six-year Eurobonds due in March 2024 was GEL 1,077.5

million (down 4.0% q-o-q). The decrease in gross debt reflects the

GEL's appreciation against US$, which was partially offset by a GEL

17.8 million coupon accrual [28] during the quarter.

A 5.3% decrease in the gross debt balance in 1H22 reflects the

impact of GEL's appreciation against US$ by 5.8% and a GEL 38.0

million coupon payment in 1Q22, partially offset by a GEL 37.7

million coupon accrual in 1H22.

Guarantees issued. The balance reflects GCAP's guarantee on the

borrowing of the beer business. Due to the recent developments in

the business' operating performance, GCAP's guarantee decreased by

EUR 1.0 million to EUR 14.8 million.

Planned investments. Planned investments' balance represents US$

c.54 million expected investments in renewable energy (US$ c.30

million) and education (US$ c.24 million) businesses. The balance

in US$ terms remained unchanged as at 30-Jun-22 (down by 5.6% in

GEL terms due to the local currency appreciation in 2Q22). The

balance was up 20.3% in 1H22, in line with our capital allocation

outlook.

Announced buybacks . A 27.9% decrease in the announced buybacks'

balance reflects the developments in the share buyback programme as

described on pages 8 and 10. A 35.0% increase in the balance in

1H22 reflects a US$ 15 million increase in the programme in

1H22.

Contingency/liquidity buffer. The balance reflects the cash and

liquid assets in the amount of US$ 50 million, held by GCAP at all

times, for contingency/liquidity purposes. The balance remained

unchanged in US$ terms as at 30-Jun-22.

As a result of the movements described above, NCC was down by

6.1% to GEL 729.2 million (US$ 249.0 million), translating into a

27.0% NCC ratio as at 30-Jun-22 (down by 1.2 ppts q-o-q).

Subsequent to 30-Jun-22, the beer business engaged in

discussions with local lenders to reduce the required amount of

GCAP's guarantee on their borrowing. As of today, local lenders

have agreed in principle to reduce GCAP's guarantee to EUR 8.5

million, pending approvals from their risk/various committees,

which are expected to be finalised in 3Q22. Following the

reduction, the guarantee amount will be down by EUR 6.3 million to

EUR 8.5 million (from EUR 14.8 million), bringing the pro-forma NCC

ratio down to 23.5% as of 30 June 2022.

INCOME STATEMENT (ADJUSTED IFRS / APM)

Net loss under IFRS was GEL 19.6 million in 2Q22 (GEL 371.3

million net income in 2Q21) and GEL 509.1 million in 1H22 (GEL

325.2 million net income in 1H21). The IFRS income statement is

prepared on the Georgia Capital PLC level and the results of all

operations of the Georgian holding company JSC Georgia Capital are

presented as one line item. As we conduct almost all of our

operations through JSC Georgia Capital, through which we hold all

of our portfolio companies, the IFRS results provide little

transparency on the underlying trends.

Accordingly, to enable a more granular analysis of those trends,

the following adjusted income statement presents the Group's

results of operations for the period ending June 30 as an

aggregation of (i) the results of GCAP (the two holding companies

Georgia Capital PLC and JSC Georgia Capital, taken together) and

(ii) the fair value change in the value of portfolio companies

during the reporting period. For details on the methodology

underlying the preparation of the adjusted income statement, please

refer to page 98 in Georgia Capital PLC 2021 Annual report.

INCOME STATEMENT (Adjusted IFRS/APM)

GEL '000, unless otherwise

noted

(Unaudited) 2 Q22 2 Q21 Change 1H 22 1H 21 Change

================================ ========= ========= ======= ========== ========= =======

Dividend income 32,226 9,691 NMF 34,421 14,430 NMF

================================ ========= ========= ======= ========== ========= =======

Interest income 9,364 6,120 53.0% 18,150 10,617 71.0%

================================ ========= ========= ======= ========== ========= =======

Realised / unrealised

loss on liquid funds (1,197) 1,687 NMF (11,435) 1,516 NMF

================================ ========= ========= ======= ========== ========= =======

Interest expense (17,826) (20,302) -12.2% (37,679) (37,520) 0.4%

================================ ========= ========= ======= ========== ========= =======

Gross operating income/(loss) 22,567 (2,804) NMF 3,457 (10,957) NMF

================================ ========= ========= ======= ========== ========= =======

Operating expenses (10,395) (9,225) 12.7% (19,700) (18,096) 8.9%

================================ ========= ========= ======= ========== ========= =======

GCAP net operating

income/(loss) 12,172 (12,029) NMF (16,243) (29,053) -44.1%

================================ ========= ========= ======= ========== ========= =======

Fair value changes

of portfolio companies

================================ ========= ========= ======= ========== ========= =======

Listed and Observable

Portfolio Companies (4,152) 70,288 NMF (211,859) 43,836 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Bank of

Georgia Group PLC (17,760) 70,288 NMF (225,467) 43,836 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Water Utility 13,608 - NMF 13,608 - NMF

================================ ========= ========= ======= ========== ========= =======

Private Portfolio

companies (42,520) 251,933 NMF (287,828) 282,183 NMF

================================ ========= ========= ======= ========== ========= =======

Large Portfolio Companies (21,396) 197,356 NMF (163,928) 201,855 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Retail (pharmacy) 13,948 44,816 -68.9% (39,358) 27,657 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Hospitals (46,250) 64,276 NMF (95,769) 90,889 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Water Utility - 91,100 NMF - 76,097 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Insurance

(P&C and Medical) 10,906 (2,836) NMF (28,801) 7,212 NMF

================================ ========= ========= ======= ========== ========= =======

Investment Stage Portfolio

Companies (3,536) 48,976 NMF (19,219) 54,115 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Renewable

energy 8,050 13,072 -38.4% (2,002) 7,632 NMF

================================ ========= ========= ======= ========== ========= =======

Of which, Education 16,385 19,443 -15.7% 20,741 23,207 -10.6%

================================ ========= ========= ======= ========== ========= =======

Of which, Clinics

and Diagnostics (27,971) 16,461 NMF (37,958) 23,276 NMF

================================ ========= ========= ======= ========== ========= =======

Other businesses (17,588) 5,601 NMF (104,681) 26,213 NMF

================================ ========= ========= ======= ========== ========= =======

Total investment return (46,672) 322,221 NMF (499,687) 326,019 NMF

================================ ========= ========= ======= ========== ========= =======

(Loss)/income before

foreign exchange movements

and non-recurring expenses (34,500) 310,192 NMF (515,930) 296,966 NMF

================================ ========= ========= ======= ========== ========= =======

Net foreign currency

gain 18,172 57,988 -68.7% 14,448 26,547 -45.6%

================================ ========= ========= ======= ========== ========= =======

Non-recurring expenses (104) (41) NMF (196) (218) -10.1%

================================ ========= ========= ======= ========== ========= =======

Net (loss)/income (16,432) 368,139 NMF (501,678) 323,295 NMF

================================ ========= ========= ======= ========== ========= =======

Gross operating income of GEL 22.6 million in 2Q22 reflects a

3.3x and 53.0% increase in dividend and interest income,

respectively, which was further supported by a decrease in interest

expenses due to GEL's y-o-y appreciation against US$. Gross

operating income of GEL 3.5 million in 1H22 also reflects increased

dividend and interest inflows, which was partially offset by GEL

11.4 million realised and unrealised loss on liquid funds held by

GCAP - which was mostly unrealised due to the market volatility

driven by the regional geopolitical instability. The significant

interest income growth in 2Q22 and 1H22 was mainly due to the

increased liquid funds balance and related investments in

internationally listed debt securities.

GCAP earned an average yield of 3.9% on the average balance of

liquid assets of GEL 471.7 million in 1H22 (3.1% on GEL 240.9

million in 1H21).

The components of GCAP's operating expenses are shown in the

table below.

GCAP Operating Expenses Components

GEL '000, unless otherwise

noted

(Unaudited) 2Q22 2Q21 Change 1H22 1H21 Change

Administrative expenses

([29]) (3,323) (3,031) 9.6% (6,087) (5,840) 4.2%

Management expenses

- cash-based ([30]) (2,411) (2,402) 0.4% (4,864) (4,997) -2.7%

Management expenses

- share-based ([31]) (4,661) (3,792) 22.9% (8,749) (7,259) 20.5%

Total operating expenses (10,395) (9,225) 12.7% (19,700) (18,096) 8.9%

Of which, fund type

expense ([32]) (3,091) (3,278) -5.7% (6,084) (6,384) -4.7%

Of which, management

fee type expenses ([33]) (7,304) (5,947) 22.8% (13,616) (11,712) 16.3%

GCAP management fee expenses have a self-targeted cap of 2% of

Georgia Capital's market capitalisation. The LTM management fee

expense ratio was 2.6% at 30-Jun-22 (1.5% [34] as of 30-Jun-21).

The total LTM operating expense ratio (which includes fund type

expenses) was 3.9% at 30-Jun-22 (2.4%(34) at 30-Jun-21). The

increase in the LTM management fee expense ratio and the total LTM

operating expense ratio mainly reflect the movements in GCAP's

market capitalisation.

Total investment return represents the increase (decrease) in

the fair value of our portfolio. Total investment return was

negative GEL 46.7 million in 2Q22 and GEL 499.7 million in 1H22,

reflecting the decrease in the value of listed and observable and

private businesses, as described earlier in this report. We discuss

valuation drivers for our businesses on pages 5-7. The performance

of each of our private large and investment stage portfolio

companies is discussed on pages 14-24.

GCAP's net foreign currency liability balance amounted to c.US$

152 million (GEL 445 million) at 30-Jun-22. Net foreign currency

gain was GEL 18.2 million in 2 Q22 and GEL 14.4 million in 1H22. As

a result of the movements described above, GCAP's adjusted IFRS net

loss was GEL 16.4 million in 2Q22 and GEL 501.7 million in

1H22.

DISCUSSION OF PORTFOLIO COMPANIES' RESULTS (STAND-ALONE

IFRS)

The following sections present the IFRS results and business

development extracted from the individual portfolio company's IFRS

accounts for large and investment stage entities, where 2Q22, 1H22,

2Q21 and 1H21 portfolio company's accounts and respective IFRS

numbers are unaudited. We present key IFRS financial highlights,

operating metrics and ratios along with the commentary explaining

the developments behind the numbers. For the majority of our

portfolio companies the fair value of our equity investment is

determined by the application of an income approach (DCF) and a

market approach (listed peer multiples and precedent transactions).

Under the discounted cash flow (DCF) valuation method, fair value

is estimated by deriving the present value of the business using

reasonable assumptions of expected future cash flows and the

terminal value, and the appropriate risk-adjusted discount rate

that quantifies the risk inherent to the business. Under the market

approach, listed peer group earnings multiples are applied to the

trailing twelve months (LTM) stand-alone IFRS earnings of the

relevant business. As such, the stand-alone IFRS results and

developments driving the IFRS earnings of our portfolio companies

are key drivers of their valuations within GCAP's financial

statements. See "Basis of Presentation" on page 28 for more

background.

LARGE PORTFOLIO COMPANIES

Discussion of Retail (pharmacy) Business Results

The retail (pharmacy) business, where GCAP owns a 77% equity

interest through GHG [35] , is the largest pharmaceuticals retailer

and wholesaler in Georgia, with a 35 % market share by revenue. The

business consists of a retail pharmacy chain and a wholesale

business that sells pharmaceuticals and medical supplies to

hospitals and other pharmacies. The pharmacy chain operates a total

of 366 pharmacies, of which 358 are in Georgia, and 8 are in

Armenia.

2Q22 & 1H22 performance (GEL '000), Retail (pharmacy)

[36]

Unaudited

INCOME STATEMENT HIGHLIGHTS 2Q22 2Q21 Change 1H22 1H21 Change

Revenue, net 192,100 199,020 -3.5% 390,902 372,817 4.9%

Of which, retail 149,739 142,923 4.8% 304,617 270,452 12.6%

Of which, wholesale 42,361 56,097 -24.5% 86,285 102,365 -15.7%

Gross Profit 55,745 49,927 11.7% 114,842 90,172 27.4%

3.9 5.2

Gross profit margin 29.0% 25.1% ppts 29.4% 24.2% ppts

Operating expenses (ex.

IFRS 16) (37,896) (29,780) 27.3% (76,376) (56,935) 34.1%

EBITDA (ex. IFRS 16) 17,849 20,147 -11.4% 38,466 33,237 15.7%

EBITDA margin, (ex. -0.8 0.9

IFRS 16) 9.3% 10.1% ppts 9.8% 8.9% ppts

Net profit (ex. IFRS

16) 19,477 21,242 -8.3% 36,522 29,550 23.6%

CASH FLOW HIGHLIGHTS

Cash flow from operating

activities (ex. IFRS

16) 18,406 16,075 14.5% 35,212 13,553 NMF

23.3 50.7

EBITDA to cash conversion 103.1% 79.8% ppts 91.5% 40.8% ppts

Cash flow used in investing

activities [37] (25,278) (3,806) NMF (45,672) (5,627) NMF

Free cash flow, (ex.

IFRS 16) [38] (17,780) 11,808 NMF (19,744) 6,671 NMF

Cash flow used in financing

activities (ex. IFRS

16) 24,863 (12,639) NMF 15,166 (16,321) NMF

BALANCE SHEET HIGHLIGHTS 30-Jun-22 31-Mar-22 Change 31-Dec-21 Change

Total assets 532,014 516,303 3.0% 522,814 1.8%

Of which, cash and bank

deposits 58,230 41,007 42.0% 54,616 6.6%

Of which, securities

and loans issued 14,464 24,037 -39.8% 20,922 -30.9%

Total liabilities 480,294 475,523 1.0% 497,954 -3.5%

Of which, borrowings 116,126 85,769 35.4% 89,844 29.3%

Of which, lease liabilities 111,051 112,012 -0.9% 104,613 6.2%

Total equity 51,720 40,780 26.8% 24,860 NMF

INCOME STATEMENT HIGHLIGHTS

Ø 2 Q22 total revenue (down 3.5%) reflects the recalibration of

product prices due to the GEL's appreciation against the basket of

foreign currencies (the FX effect is directly transmitted into the

pricing as c.70% of the inventory purchases are denominated in

foreign currencies).