TIDMCTEC

RNS Number : 6483Q

ConvaTec Group PLC

29 October 2021

29 October 2021

ConvaTec Group Plc

Trading update for the three months ended 30 September 2021

Q3 performance in line with expectations

& continued strategic progress

Key Points:

-- Q3 Group reported revenue of $511 million was 3.7% higher

year on year; up 2.7%(1) in constant currency and 2.2%(2) on an

organic basis.

o Continued momentum in Advanced Wound Care, modest growth in

Ostomy Care and Continence Care, with declines, as expected, in

Infusion Care and Critical Care against tough prior year

comparatives.

-- Group revenue for the 9 months to 30 September 2021 was up

5.4% on an organic and constant currency basis.

-- Further good progress on our FISBE (Focus, Innovate,

Simplify, Build, Execute) strategy to pivot to sustainable and

profitable growth:

o In Continence Care we improved the quality of our HSG business

by disposing of the non-core incontinence activities while also

signing an agreement to acquire a quality US service provider

focused on existing catheter users.

o To further advance our new product pipeline we have rolled out

a consistent new product development and launch process across all

business units. We have conducted investment, development, and

scale-up gate reviews for new products such as MioAdvance Extended

Wear Infusion Sets and the GentleCath(TM) Air male catheters

launching in 2022.

o We have continued to improve our regulatory processes

including optimising the phasing of MDR implementation over an

extended timetable.

o Continuing to make progress and planning further investments

in key initiatives such as digital interactions with healthcare

professionals and consumers. We are also progressing plans to

expand our Global Business Services centre beyond finance to

include HR and IT.

-- Strengthened the balance sheet with the successful issuance

of $500 million 2029 senior unsecured notes - diversifying Group

debt and extending its maturity profile.

-- 2021 full year guidance - We now expect organic(2) revenue

growth to be towards the upper end of our 3.5-5.0% guidance range

with a constant currency adjusted EBIT margin of 18.0-19.0%. Based

on current FX this equates to guidance of 17.4-18.4% for the

published adjusted EBIT margin.

Karim Bitar, Chief Executive Officer, commented:

"During Q3, we continued to drive good momentum in the business

and made further strategic progress implementing key transformation

initiatives and improving execution. As expected, the growth in the

third quarter slowed from Q2 given the relatively tougher

comparatives. Notwithstanding the continuing uncertainties in the

market, particularly around logistics and raw material inflation,

for the full year we expect to be towards the upper end of our

organic revenue guidance and to meet our EBIT margin guidance.

"We remain focused on pivoting to sustainable and profitable

growth and are making good progress - I am confident in ConvaTec's

long-term growth prospects."

Revenue summary

Q3 2021 Q3 2020 Reported CC growth(1) Organic 9 months

growth % growth(2) CC growth(1)

%

Reported Reported % %

$'m $'m

----------------------- ---------- ---------- --------- ----------- --------------

Advanced Wound

Care 152 149 2.1 0.6 5.3 6.9

Ostomy Care 136 132 2.9 1.6 1.6 3.0

Continence & Critical

Care 136 124 9.7 9.2 1.7 7.7

Infusion Care 87 88 (1.2) (1.4) (1.4) 3.7

Total revenue 511 493 3.7 2.7 2.2 5.4

---------

Organic growth(2) Q1 2021 Q2 2021 Q3 2021 9 months

% 2021

----------------------- -------- -------- --------

Advanced Wound Care 9.4 23.8 5.3 12.1

Ostomy Care 3.0 4.4 1.6 3.0

Continence & Critical

Care 4.5 1.5 1.7 2.6

Infusion Care 11.7 1.2 (1.4) 3.7

Group 6.7 8.0 2.2 5.4

Advanced Wound Care r evenue of $152 million increased 2.1% on a

reported basis and 0.6%(1) in constant currency. Adjusting for the

disposal of the US Skincare products, which contributed $6.7

million of revenue in Q3'20, organic growth was 5.3%. As expected,

there was a slow-down in growth from Q2 given relatively tougher

comparatives in Q3; however, the business achieved continued strong

growth in the Global Emerging Markets, and improved commercial

execution in the US and Europe.

Ostomy Care revenue of $136 million increased 2.9% on a reported

basis and 1.6%(1) on organic and constant currency bases. The

business saw continued strong growth in Global Emerging Markets

partially offset by the impact of product rationalization and

pressure in some established markets.

Continence & Critical Care revenue of $136 million increased

9.7% on a reported basis and 9.2%(1) in constant currency.

Adjusting for the Cure Medical acquisition and the disposal of

HSG's non-core incontinence business revenues rose 1.7% on an

organic basis. Modest organic growth in Continence was partially

offset by an anticipated reduction in demand for Critical Care

products in all regions except the Global Emerging Markets. Our

GentleCath and Cure Medical brands continued to achieve strong

growth.

Infusion Care revenue of $87 million decreased 1.2% on a

reported basis or 1.4%(1) on organic and constant bases. This

performance, which was slightly better than anticipated, reflects

the order phasing against a tough Q3'20 comparative when the

category grew by 27%.

Strategic progress

Good progress with the implementation of our FISBE strategy has

continued. During the period we disposed of HSG's non-core

incontinence activities and also signed an agreement to acquire

Patient Care Medical for $30 million, expected to complete in

December. The business is a quality service provider based in

Austin, Texas .

Our focus on innovation has continued and we have introduced a

common product development and launch process to further advance

our new product pipeline. We have conducted investment,

development, and scale-up gate reviews for new products such as

MioAdvance Extended Wear Infusion Sets and the GentleCath(TM) Air

male catheters launching in 2022.

We have also continued to improve our regulatory processes

including optimising the phasing of MDR implementation over an

extended timetable thereby enhancing the efficiency and

effectiveness of the roll out.

We continued to make progress planning further investments in

key initiatives such as digital interactions with healthcare

professionals and consumers. We are progressing plans to expand our

Global Business Services centre beyond finance to include HR and

IT.

During the period we successfully issued $500 million of senior

unsecured 3.875% notes due October 2029. The full proceeds from the

issuance were used to prepay a portion of the existing bank debt.

This has further strengthened our balance sheet, diversified Group

debt and extends the weighted average maturity profile by c.2 years

to 4.3 years. The impact will be an extra c.$5 million of finance

expense in 2021, including the write-off of unamortised bank debt

fees, and c.$10 million of additional finance expense in 2022.

2021 Full Year Guidance

We now expect to be towards the upper end of our organic revenue

growth of guidance of 3.5-5.0% for the full year. We continue to

expect our constant currency adjusted EBIT margin to be between

18.0-19.0% and based on current FX this equates to guidance of

17.4-18.4% for the published adjusted EBIT margin.

Footnotes

(1) Constant currency growth is calculated by applying the

applicable prior period average exchange rates to the Group's

actual performance in the respective period.

(2) Organic growth presents period over period growth at

constant currency, excluding M&A activities.

Foreign exchange rates

Q3 2021 Average Q3 2020 Average

--------- ---------------- ----------------

USD/GBP 1.38 1.31

USD/EUR 1.18 1.18

****

Investor and analyst audio webcast

There will be an audio webcast hosted by CFO, Frank Schulkes,

for investors and analysts at 8:30am BST, details of which can be

found below and on the ConvaTec website,

www.convatecgroup.com/investors/reports.

Dial-in details:

United Kingdom - 020 3936 2999

United States - 1 646 664 1960

All other locations - +44 20 3936 2999

Access code - 439387

Enquiries:

Analysts and Investors

Kate Postans, Vice President, Investor Relations +44 (0)7826 447

807

ir@convatec.com

Media

Buchanan: Charles Ryland / Chris Lane / Hannah Ratcliff

+44 (0)207 466 5000

About ConvaTec

ConvaTec is a global medical products and technologies company

focused on therapies for the management of chronic conditions, with

leading market positions in advanced wound care, ostomy care,

continence and critical care, and infusion care. Our vision, which

encompasses our purpose, is: Pioneering trusted medical solutions

to improve the lives we touch. Our products provide a range of

clinical and economic benefits including infection prevention,

protection of at-risk skin, improved patient outcomes and reduced

total cost of care. To learn more about ConvaTec, please visit

www.convatecgroup.com

Forward Looking Statements

This document includes statements that are, or may be deemed to

be, "forward looking statements". These forward-looking statements

involve known and unknown risks and uncertainties, many of which

are beyond the Group's control. "Forward-looking statements" are

sometimes identified by the use of forward-looking terminology,

including the terms "believes", "estimates", "aims" "anticipates",

"expects", "intends", "plans", "predicts", "may", "will", "could",

"shall", "risk", "targets", forecasts", "should", "guidance",

"continues", "assumes" or "positioned" or, in each case, their

negative or other variations or comparable terminology. These

forward-looking statements include all matters that are not

historical facts. They appear in a number of places and include,

but are not limited to, statements regarding the Group's

intentions, beliefs or current expectations concerning, amongst

other things, results of operations, financial condition,

liquidity, prospects, growth, strategies and dividend policy of the

Group and the industry in which it operates.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. These

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. As such, no assurance

can be given that such future results, including guidance provided

by the Group, will be achieved; actual events or results may differ

materially as a result of risks and uncertainties facing the Group.

Such risks and uncertainties could cause actual results to vary

materially from the future results indicated, expressed, or implied

in such forward-looking statements. Forward-looking statements are

not guarantees of future performance and the actual results of

operations, financial condition and liquidity, and the development

of the industry in which the Group operates, may differ materially

from those made in or suggested by the forward-looking statements

set out in this Presentation. Past performance of the Group cannot

be relied on as a guide to future performance. Forward-looking

statements speak only as at the date of this document and the

Company and its directors, officers, employees, agents, affiliates

and advisers expressly disclaim any obligations or undertaking to

release any update of, or revisions to, any forward-looking

statements in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIBDGLUDDGBI

(END) Dow Jones Newswires

October 29, 2021 02:00 ET (06:00 GMT)

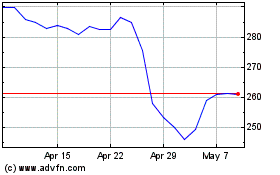

Convatec (LSE:CTEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Convatec (LSE:CTEC)

Historical Stock Chart

From Apr 2023 to Apr 2024