Diageo Fiscal Year 2022 Pretax Profit Rose on Robust Sales Growth; Raises Dividend

28 July 2022 - 5:21PM

Dow Jones News

By Michael Susin

Diageo PLC on Thursday reported a rise in pretax profit for

fiscal 2022 on robust sales growth, although the print missed

expectations, and said it has raised its dividend payout.

The liquor maker--which owns Johnnie Walker whisky and Tanqueray

gin--made a pretax profit of 4.39 billion pounds ($5.34 billion)

for the year ended June 30, compared with GBP3.71 billion the

previous year.

A consensus estimate, taken from FactSet and based on 17

analysts' projections, forecast Diageo's pretax profit at GBP4.51

billion.

Net sales rose to GBP15.45 billion from GBP12.73 billion a year

earlier. A consensus estimate, taken from FactSet and based on 17

analysts' projections, expected net sales to come in at GBP14.83

billion.

Diageo reported organic net sales growth of 21.4%, up from the

consensus forecast of 17.4% taken from the company's website.

The board declared a final dividend of 46.82 pence a share. This

compares with a final dividend of 44.59 pence a share and a

full-year dividend of 72.55 pence in fiscal 2021.

The company reiterated its 2023-2025 guidance for organic net

sales growth of 5% to 7% a year and organic operating profit growth

of 6% to 9% a year.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

July 28, 2022 03:06 ET (07:06 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

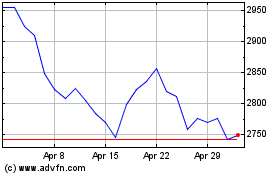

Diageo (LSE:DGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

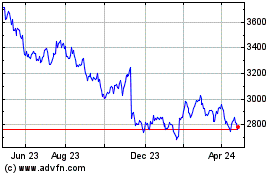

Diageo (LSE:DGE)

Historical Stock Chart

From Apr 2023 to Apr 2024